Europe Chemical Distribution Market Size, Share, Trends & Growth Forecast Report By Product, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Chemical Distribution Market Size

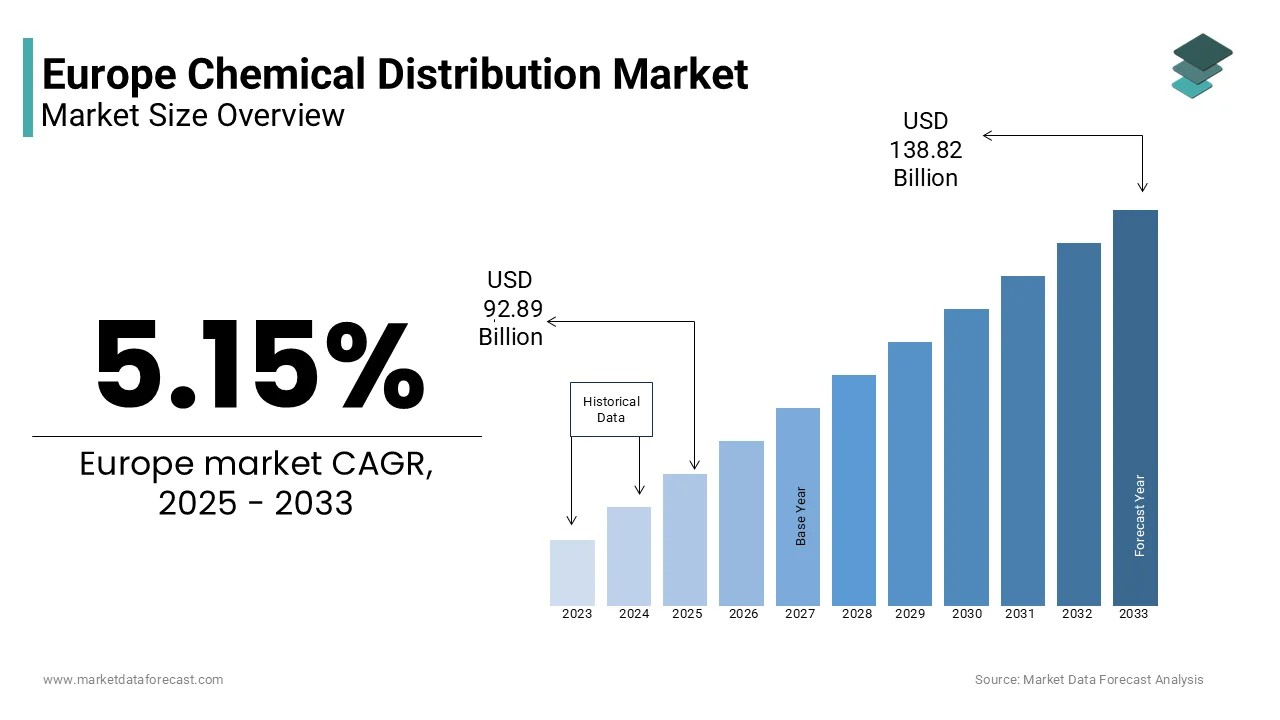

The chemical distribution market size in Europe was valued at USD 88.34 billion in 2024. The European market is anticipated to be worth USD 138.82 billion by 2033 from USD 92.89 billion in 2025, growing at a CAGR of 5.15% from 2025 to 2033.

Chemical distribution forms the backbone of industrial supply chains across the continent, enabling the seamless flow of chemicals from manufacturers to end-users. This sector plays a crucial role in ensuring that industries such as construction, automotive, healthcare, agriculture, and consumer goods receive the chemicals they need for production and innovation. These services are essential in a region like Europe, characterized by diverse industries, stringent environmental regulations, and a focus on sustainability. The European market has evolved significantly due to increasing demand for specialty chemicals that are tailored to meet the specific needs of industries such as pharmaceuticals and electronics. Furthermore, sustainability has become a pivotal theme, with distributors adopting environmentally friendly practices, such as reducing carbon emissions during transport and offering green-certified products.

MARKET DRIVERS

Rising Demand for Specialty Chemicals

Specialty chemicals are increasingly driving the European chemical distribution market due to their essential role in enhancing industrial applications. These chemicals, such as adhesives, coatings, and biocides, are widely used in pharmaceuticals, agriculture, and electronics, where they provide specific functional benefits like improved efficiency or durability. As industries focus on innovation and sustainability, specialty chemicals are becoming integral to product development, including eco-friendly solutions. This growing demand aligns with Europe’s industrial shift toward value-added products, ensuring that chemical distributors play a crucial role in bridging the gap between producers and end-users by offering tailored logistics and compliance solutions.

Stringent Environmental Regulations

Environmental regulations in Europe are a significant factor shaping the chemical distribution market, influencing how chemicals are transported, stored, and managed. Regulations such as the European Union’s REACH initiative enforce strict guidelines on chemical safety, evaluation, and usage, increasing the demand for distributors adept at regulatory compliance. These distributors facilitate end-user compliance while maintaining seamless supply chain operations. The focus on sustainability is further evident in the push for green logistics and environmentally friendly packaging practices, making regulatory adherence both a challenge and a growth opportunity for the sector. This compliance-driven landscape underscores the importance of expertise and innovation in distribution practices.

MARKET RESTRAINTS

High Energy Costs

The chemical distribution market in Europe faces significant pressure from rising energy costs, which directly impact the transportation, storage, and processing of chemicals. The dependency of Europe on energy imports and fluctuating energy prices creates challenges for distributors striving to maintain competitive pricing. According to the European Commission’s energy price monitoring data, wholesale electricity prices in Europe rose by over 50% in 2022 due to geopolitical tensions and increased demand. These costs disproportionately affect smaller distributors that lack the economies of scale to offset these expenses. As energy costs remain volatile, they pose a persistent restraint, forcing distributors to optimize logistics, adopt energy-efficient technologies, or pass on costs to end-users, potentially reducing market competitiveness.

Stringent Regulatory Environment

While regulations enhance safety and sustainability, the complexity and cost of compliance are substantial barriers for the chemical distribution market. Initiatives such as REACH require extensive data collection, testing, and documentation for chemical substances. The European Chemicals Agency (ECHA) reports that the average cost of registering a single substance under REACH ranges between €50,000 and €200,000, depending on its hazard profile and volume. These expenses create financial strain, particularly for small and medium-sized distributors, limiting their ability to expand or diversify. The continuous introduction of new regulatory updates further exacerbates this burden, requiring ongoing investments in compliance infrastructure and training, ultimately constraining the sector's growth potential.

MARKET OPPORTUNITIES

Growth in Sustainable and Green Chemicals

The rising emphasis on sustainability presents a substantial opportunity for the European chemical distribution market. Green chemicals, including biodegradable solvents and bio-based polymers, are increasingly in demand as industries shift toward environmentally friendly practices. According to the European Environment Agency, the EU has committed to reducing greenhouse gas emissions by 55% by 2030, driving innovation in sustainable products. This transition encourages distributors to expand their portfolios with green-certified chemicals and offer services that align with clients' sustainability goals. Additionally, distributors specializing in eco-friendly products can capitalize on government incentives and emerging green initiatives, positioning themselves as leaders in a rapidly evolving market segment.

Digitalization and Supply Chain Optimization

Digital transformation offers immense growth opportunities for the European chemical distribution sector by enhancing supply chain efficiency. Advanced digital platforms allow distributors to track inventory, optimize logistics, and improve customer engagement through real-time data. The European Commission’s Digital Economy and Society Index (DESI) highlights that over 70% of businesses in the EU are adopting digital solutions, underscoring the market’s readiness for technological innovation. By leveraging digital tools like blockchain for transparency and AI-driven analytics for demand forecasting, distributors can reduce costs, improve service reliability, and strengthen customer relationships. This integration of technology not only boosts operational efficiency but also positions companies to meet the evolving needs of a highly competitive market.

MARKET CHALLENGES

Geopolitical Instabilities

Geopolitical tensions pose a significant challenge to the European chemical distribution market, disrupting supply chains and increasing operational risks. Recent conflicts, such as the Russia-Ukraine war, have severely impacted energy supplies and raw material imports. According to the European Commission, natural gas imports from Russia decreased by over 50% in 2022, causing a sharp rise in energy costs and affecting chemical production and distribution. Such disruptions force distributors to seek alternative suppliers, often at higher costs, while also managing delays and logistical inefficiencies. The unpredictability of geopolitical events continues to threaten supply chain stability, compelling market players to implement contingency plans and diversify sourcing strategies to mitigate risks.

Labor Shortages and Skill Gaps

Labor shortages and skill gaps are critical challenges for the chemical distribution market in Europe, affecting efficiency and service quality. The European Labour Authority reports that industries reliant on skilled labor, including chemical distribution, have faced workforce shortages due to demographic shifts and a lack of specialized training. This shortage is particularly evident in logistics and regulatory compliance roles, where expertise is crucial for maintaining smooth operations. For example, the European Skills Index (2022) indicates a gap in vocational training for logistics and supply chain management, which directly impacts chemical distribution. Addressing this issue requires investments in workforce development programs, apprenticeships, and upskilling initiatives to ensure that the sector remains competitive and resilient in the face of growing demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.15% |

|

Segments Covered |

By Product, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Univar AG, Helm AG, Brenntag AG, Azelis Holdings SA, IMCD Group, BASF SE, and Biesterfeld AG, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The specialty chemicals segment is expected to be the fastest-growing segment in the European market over the forecast period. The rising need for application-specific compounds in many sectors, combined with technological developments in production, will likely increase demand in the future. The specialty chemicals industry refers to high-performance and tailored chemical solutions that satisfy the needs of application-specific consumers. Coatings, adhesives, sealants, elastomers (CASE), construction materials, cosmetic additives, polymers, lubricant additives, and others such as surfactants, industrial gases, and textile auxiliaries are examples of Specialty compounds.

By End-User Insights

In 2024, the construction segment dominated the market in Europe and is expected to be the dominating segment in the European market throughout the forecast period owing to the growing construction spending in developing economies across Asia is likely to fuel specialized chemical demand in various applications.

REGIONAL ANALYSIS

Germany accounted for the leading share of the European chemical distribution market in 2024. Germany is the leading chemical distribution market in Europe, and the growth of the German market is majorly driven by its robust chemical manufacturing sector and advanced infrastructure. As per the German Chemical Industry Association (VCI), the chemical and pharmaceutical sector contributed approximately €220 billion in sales in 2022, representing 27% of total EU chemical sales. The country’s well-developed logistics network, including ports like Hamburg, enhances distribution efficiency. Germany also prioritizes sustainability, with a strong focus on green chemicals and compliance with stringent EU regulations. The presence of major chemical producers, such as BASF and Bayer, strengthens the demand for distribution services, solidifying Germany’s position as a market leader.

France ranks among the top players in the European chemical distribution market. The significant focus of France on specialty chemicals and innovative solutions is driving the French market. The French chemical industry generated €100 billion in 2022, according to the French Chemical Industry Association (UIC), emphasizing the market's importance. Key industries, including cosmetics, automotive, and agriculture, drive demand for customized chemical solutions. The country’s commitment to environmental sustainability, supported by government policies, further accelerates the adoption of green chemicals. France’s strategic location and well-connected transportation infrastructure, such as the port of Marseille, facilitate efficient distribution, making it a critical hub for chemical trade in Europe.

The Netherlands is playing an important role in the European chemical distribution market and is likely to account for a notable share of the market over the forecast period due to its strategic location and world-class logistics capabilities. The Port of Rotterdam, Europe’s largest port, handles over 450 million metric tons of goods annually, with chemicals accounting for a significant share, according to the Netherlands Statistics Bureau (CBS). The Dutch chemical industry contributes €70 billion annually, with exports playing a key role. Advanced digitalization in supply chain management and proximity to major European markets ensure efficient distribution processes. The Netherlands’ emphasis on sustainability and innovation, including investments in renewable energy for chemical manufacturing, reinforces its position as a leader in the European chemical distribution market.

KEY MARKET PLAYERS

Univar AG, Helm AG, Brenntag AG, Azelis Holdings SA, IMCD Group, BASF SE, and Biesterfeld AG are some of the notable companies in the Europe Chemical Distribution market.

MARKET SEGMENTATION

This research report on the Europe chemical distribution market is segmented and sub-segmented based on the following categories.

By Product

- Specialty Chemicals

- Commodity Chemicals

By End-User

- Automotive & Transportation

- Construction

- Agriculture

- Industrial Manufacturing

- Consumer Goods

- Textiles

- Pharmaceuticals

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the major opportunities driving growth in the Europe chemical distribution market?

The market is being driven by the rise in specialty chemical demand, increasing outsourcing of distribution by manufacturers, and the growth of end-use industries like pharmaceuticals, food & beverages, and personal care across Europe.

2. What challenges does the Europe chemical distribution market face?

Key challenges include stringent environmental and safety regulations, fluctuating raw material prices, and supply chain disruptions, particularly for cross-border transportation.

3. Who are the key players in the Europe chemical distribution market?

Major players in the market include Brenntag AG, IMCD N.V., Univar Solutions Inc., Nexeo Solutions, and Azelis, each holding strong networks and diverse product portfolios across Europe.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]