Europe Circuit Breaker Market Size, Share, Trends & Growth Forecast Report Segmented Insulation Type, Voltage, Installation, End-User By And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Circuit Breaker Market Size

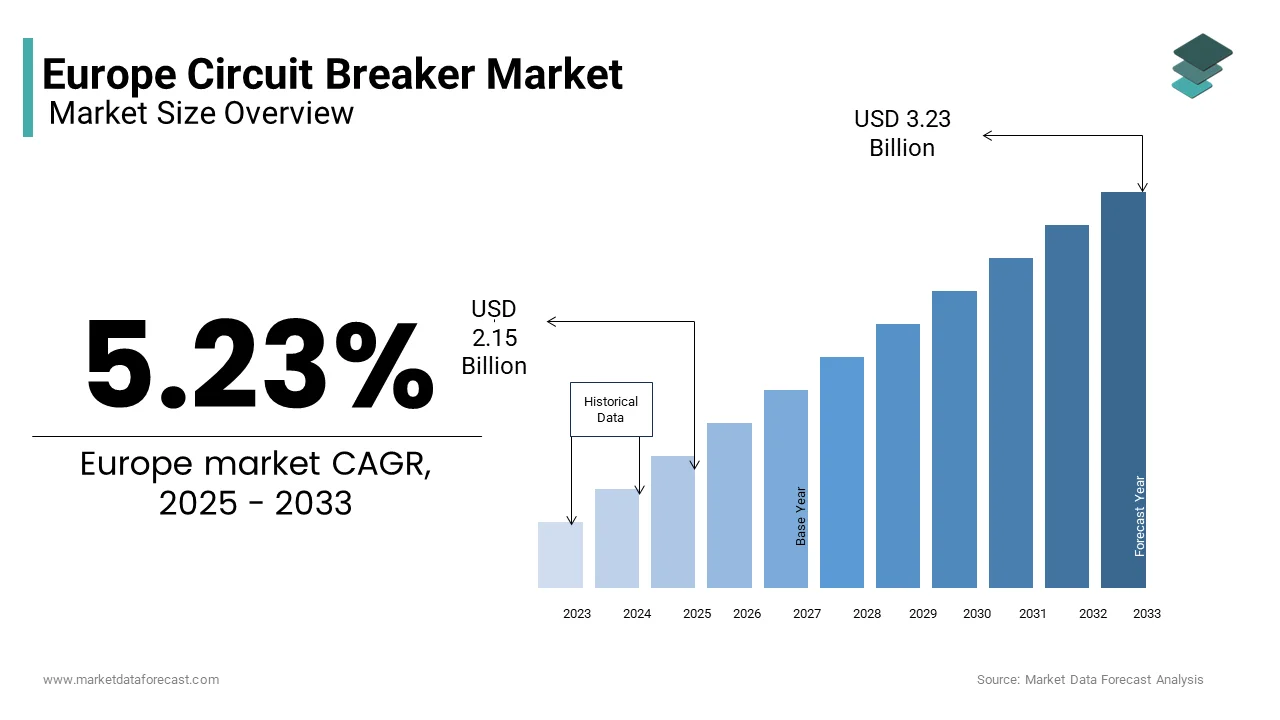

The Europe Circuit Breaker market was valued at USD 2.04 billion in 2024 and is anticipated to reach USD 2.15 billion in 2025 from USD 3.23 billion by 2033, growing at a CAGR of 5.23% during the forecast period from 2025 to 2033.

The Europe circuit breaker market covers electrical protection devices designed to automatically interrupt electric circuits under abnormal conditions such as overloads or short circuits. These breakers are essential components in residential, commercial, industrial, and utility applications, ensuring safety, reliability, and continuity of power systems across the continent. The market includes a wide range of products—miniature circuit breakers (MCBs), molded case circuit breakers (MCCBs), and air circuit breakers (ACBs)—catering to low, medium, and high voltage applications.

As per the European Commission, a significant portion of Europe’s electricity generation capacity now comes from renewable sources, necessitating advanced grid management technologies—including intelligent circuit breakers—to ensure system stability and fault tolerance. Moreover, the EU’s Green Deal initiative has prompted significant investments in smart buildings, electric vehicle charging stations, and industrial decarbonization projects, all of which require robust electrical protection systems.

MARKET DRIVERS

Expansion of Renewable Energy Infrastructure Across Europe

One of the primary drivers of the Europe circuit breaker market is the rapid expansion of renewable energy infrastructure, particularly in wind and solar power generation. As governments strive to meet the European Union’s target of achieving climate neutrality by 2050, investment in clean energy has surged. Renewable energy installations require extensive electrical protection due to their intermittent nature and complex grid integration requirements. Circuit breakers play a crucial role in managing surges, fluctuations, and faults in these systems, ensuring safe and continuous operation. For example, offshore wind farms in the North Sea rely heavily on high-capacity air circuit breakers to protect turbines and substation transformers from electrical anomalies.

As reported by BloombergNEF, cumulative installed solar photovoltaic (PV) capacity in Europe reached 380 GW in 2023, up from 220 GW in 2020. Similarly, wind capacity expanded by over 25 GW during the same period. These developments have significantly boosted demand for both low-voltage and medium-voltage circuit breakers tailored for renewable energy applications.

Growth in Smart Building and Electrified Urban Infrastructure Projects

Another key driver fueling the Europe circuit breaker market is the rising adoption of smart building technologies and the development of electrified urban infrastructure. Cities across Europe are increasingly investing in energy-efficient buildings, automated electrical systems, and intelligent grid-connected facilities, all of which require advanced circuit protection mechanisms to ensure operational safety and efficiency. These buildings integrate smart meters, IoT-enabled lighting, HVAC systems, and EV charging points, all of which depend on miniature and molded case circuit breakers to manage load distribution and prevent electrical failures. Like, cities like Copenhagen, Amsterdam, and Vienna have mandated the use of intelligent electrical panels equipped with programmable circuit breakers in new construction and retrofitting projects. Furthermore, the rollout of electric vehicle (EV) charging networks has spurred demand for specialized circuit breakers capable of handling high currents and variable loads.

MARKET RESTRAINTS

Supply Chain Disruptions Affecting Component Availability

A major restraint affecting the Europe circuit breaker market is the persistent disruption in global supply chains, particularly concerning semiconductor shortages and raw material scarcity. The automotive and electronics industries’ heavy reliance on just-in-time manufacturing practices has made them highly susceptible to delays, impacting production schedules and product availability.

According to the European Commission, the shortage of microchips and essential components such as copper, aluminum, and magnetic materials led to a key drop in electrical equipment production in 2022 compared to pre-pandemic levels. Furthermore, geopolitical tensions and export restrictions have compounded the problem. Also, foundries supplying copper castings and coil components faced increased input costs due to energy price surges and raw material bottlenecks. These factors have forced manufacturers to delay new model launches and revise production forecasts, creating uncertainty for distributors and end-users alike.

Rising Manufacturing and Compliance Costs Due to Stringent Regulations

An ongoing challenge impeding the growth of the Europe circuit breaker market is the rising cost of compliance with increasingly stringent safety, environmental, and performance standards. Regulatory bodies such as the International Electrotechnical Commission (IEC) and the European Committee for Electrotechnical Standardization (CENELEC) have introduced updated certification protocols that mandate higher testing, documentation, and quality assurance requirements. These expenses include investments in precision testing equipment, upgraded production lines, and enhanced product traceability systems—all necessary to meet evolving regulatory expectations. Moreover, as noted by McKinsey & Company, small and mid-sized enterprises (SMEs) face disproportionate challenges in adapting to these changes due to limited financial resources and access to advanced R&D capabilities. Larger firms can absorb these costs through economies of scale, but smaller players struggle to maintain profitability while adhering to compliance mandates. Additionally, as per the European Environment Agency, directives such as the Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) regulations have imposed further constraints on material selection and end-of-life disposal processes.

MARKET OPPORTUNITY

Integration of Digital Technologies in Smart Grid Applications

A significant opportunity shaping the future of the Europe circuit breaker market is the growing integration of digital technologies in smart grid applications. As part of the European Union’s broader digitalization strategy, utilities and grid operators are adopting intelligent electrical systems that combine real-time monitoring, predictive maintenance, and remote control capabilities, transforming traditional power networks into adaptive, self-regulating infrastructures. These smart breakers allow for dynamic load balancing, automatic isolation of faulty segments, and improved outage response times, enhancing overall grid reliability.

Also, as reported by the European Network of Transmission System Operators for Electricity (ENTSO-E), the deployment of smart substations and decentralized energy resources (DER) integration requires advanced circuit protection solutions capable of handling bidirectional power flows from renewable sources. This shift is driving demand for digitally enhanced MCCBs and ACBs equipped with communication interfaces and embedded sensors. Moreover, partnerships between circuit breaker manufacturers and software providers are accelerating the development of cloud-based asset management platforms that enable remote monitoring and diagnostics.

Surge in Demand for Electric Vehicle Charging Infrastructure

An emerging opportunity within the Europe circuit breaker market lies in the rapid expansion of electric vehicle (EV) charging infrastructure. As governments and private entities invest heavily in nationwide EV ecosystems, there is a corresponding need for high-performance circuit breakers to protect charging stations, battery storage units, and associated electrical systems.

According to ACEA – The European Automobile Manufacturers’ Association, over 2.8 million EVs were registered in Europe in 2023, representing a 22% increase from the previous year. To support this growing fleet, the European Commission estimates that approximately 1 million public EV charging points will be needed by 2025. Each of these stations requires multiple layers of circuit protection, including MCBs and RCCBs, to manage varying voltage levels and ensure user safety. This requirement is prompting manufacturers to develop compact, high-interrupting-capacity breakers specifically designed for EV charging applications.

MARKET CHALLENGES

Intensifying Competition from Low-Cost Asian Suppliers

One of the most pressing challenges facing the Europe circuit breaker market is the intensifying competition from low-cost suppliers based in Asia, particularly China, India, and Vietnam. These countries offer significantly lower production costs, supported by government subsidies, abundant raw materials, and favorable labor conditions. As a result, European manufacturers must contend with aggressive pricing strategies that erode profit margins and threaten market share. This cost disparity has enabled Chinese and Indian exporters to penetrate European markets through large-scale tenders and contract bids, particularly in public infrastructure and industrial automation projects. While European companies maintain an advantage in high-end, customized, and smart circuit breaker solutions, they face increasing pressure in the mid-tier and commodity segments where price sensitivity dominates purchasing decisions. To counteract this challenge, local manufacturers are focusing on differentiation through superior product quality, localized service support, and advanced digital features.

Rapid Technological Obsolescence and Innovation Pressure

Another critical challenge affecting the Europe circuit breaker market is the rapid pace of technological change and the resulting pressure to continuously innovate. As electrical systems become more digitized, interconnected, and responsive, traditional circuit breakers are being replaced or augmented by smart, connected alternatives that integrate data analytics, remote monitoring, and predictive maintenance capabilities.

According to McKinsey & Company, nearly 40% of circuit breaker manufacturers in Europe reported difficulty in keeping up with the speed of innovation required to meet evolving customer expectations and industry standards. This challenge is particularly pronounced among smaller firms that lack the financial resources and technical expertise to invest in embedded intelligence, IoT compatibility, and cybersecurity enhancements.

Moreover, the shift toward modular and configurable electrical architectures in smart buildings and renewable energy systems is redefining product specifications. Manufacturers must now design circuit breakers that can communicate with building management systems, adapt to variable loads, and comply with interoperability standards—a significant departure from conventional designs.

Additionally, as noted by the European Committee for Electrotechnical Standardization (CENELEC), regulatory updates are occurring more frequently, requiring faster adaptation cycles and greater investment in compliance testing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.23% |

|

Segments Covered |

By Type, Voltage, Installation, End-Us,er And By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

ABB, Schneider Electric, Siemens, Mitsubishi Electric, Eaton, Mitsubishi Electric, CG Power and Industrial Solutions, TE Connectivity, LS ELECTRIC, Hyundai Electric, Secheron, Chint Electric, TE Connectivity, Tavrida Electric, Toshiba, Powell Industries, and others |

SEGMENTAL ANALYSIS

By Type Insights

Vacuum circuit breakers had the largest share in the Europe circuit breaker market by accounting for 42.7% of total demand in 2024. This dominance is primarily attributed to their superior arc-quenching properties, compact design, and suitability for medium voltage applications across power distribution networks. Like, vacuum technology has become the preferred choice for new electrical infrastructure projects due to its high reliability, low maintenance requirements, and longer service life compared to traditional oil or air-based systems. These advantages are particularly relevant in urban power grids where space constraints and safety considerations drive preference toward more efficient solutions. The shift toward smart grid modernization and digital substations further supports this trend, as vacuum breakers integrate seamlessly with automation and remote monitoring systems.

Additionally, environmental concerns surrounding insulating oils and sulfur hexafluoride (SF₆) gas have prompted regulatory scrutiny on conventional breaker types.

Gas-insulated circuit breakers are emerging as the fastest-growing segment in the Europe circuit breaker market, expanding at a CAGR of 9.8%. This rapid expansion is driven by increasing deployment in high-voltage transmission systems and compact urban substations where space efficiency and performance are critical. Sulfur hexafluoride (SF₆)-based gas circuit breakers are widely used in extra-high voltage (EHV) applications due to their excellent dielectric strength and fast arc quenching capabilities. Furthermore, as reported by the International Energy Agency (IEA), Europe’s push for grid densification and integration of renewable energy sources has led to increased investment in gas-insulated switchgear (GIS) systems, which rely heavily on gas circuit breakers. Despite environmental concerns regarding SF₆—a potent greenhouse gas—manufacturers such as Siemens and ABB have introduced advanced gas recovery and recycling technologies to comply with EU F-gas regulations.

By Voltage Insights

Medium voltage circuit breakers commanded the Europe circuit breaker market with 61.6% of total market share in 2024. This is associated with their extensive use in industrial facilities, commercial buildings, and distribution networks that operate within the 1 kV to 36 kV range. Countries like Germany, Italy, and Spain rely heavily on MV circuit breakers for industrial automation, data centers, and EV charging infrastructure, all of which require a stable and secure power supply. Additionally, the proliferation of decentralized energy resources—such as rooftop solar, battery storage, and microgrids—has intensified the need for reliable medium voltage protection systems. These distributed generation units often interface with the grid at MV levels, necessitating robust fault detection and isolation mechanisms.

Moreover, the construction boom in smart cities and industrial parks across Central and Eastern Europe has significantly boosted demand for molded case and vacuum-type medium voltage breakers.

High voltage circuit breakers are the fastest-growing segment in the Europe circuit breaker market, registering a compound annual growth rate (CAGR) of 8.4% between 2020 and 2023, as per Mordor Intelligence. This surge is fueled by large-scale investments in cross-border transmission infrastructure and the integration of renewable energy into national grids. As reported by the International Renewable Energy Agency (IRENA), Europe added over 45 GW of new wind and solar capacity in 2023, much of which required connection to extra-high voltage (EHV) transmission lines operating above 60 kV. High-voltage breakers play a crucial role in managing long-distance power flows, ensuring grid stability, and isolating faults in these complex networks. Projects such as the North Sea Link interconnector between the UK and Norway and the Baltic Synchronization Project emphasize the growing reliance on high-performance circuit breakers to support grid resilience. Furthermore, advancements in hybrid circuit breaker technologies—combining mechanical and solid-state components—are enabling faster fault response times and greater system flexibility.

By Installation Insights

The indoor circuit breakers segment prevailed in the Europe circuit breaker market by capturing 68.5% of total demand in 2024. This overwhelming performance is largely due to the widespread deployment of indoor-rated breakers in commercial buildings, industrial plants, and utility substations, where controlled environments ensure optimal performance and longevity. These breakers are extensively used in switchgear rooms, data centers, and manufacturing facilities where dust, moisture, and extreme temperatures are minimized. Moreover, as reported by the European Environment Agency, indoor installations are preferred for safety and compliance reasons, particularly in densely populated urban areas where exposure to weather elements can compromise operational integrity. Indoor-rated breakers also align well with fire safety regulations, reducing the risk of arc flash incidents in enclosed spaces. With ongoing investments in intelligent electrical infrastructure and indoor substation modernization, this segment continues to maintain its leading position in the regional market.

The outdoor circuit breakers are the fastest growing segment in the Europe circuit breaker market, expanding at a CAGR of 7.2%. This progress is mainly driven by the expansion of open-air substations, renewable energy integration, and rural electrification initiatives. According to the International Energy Agency (IEA), over 25 GW of new wind and solar capacity connected to the grid in 2023, many of which were located in remote regions requiring outdoor-rated circuit breakers. Offshore wind farms in the North Sea and photovoltaic farms in Southern Europe depend on durable, weather-resistant breakers to manage power flow and protect equipment from lightning strikes and surges. Moreover, several countries, including Poland, Romania, and Greece, have launched rural electrification programs aimed at improving grid access in less-developed regions. These efforts involve deploying outdoor breakers in overhead line networks, which are more cost-effective and easier to install than underground alternatives. Apart from these, outdoor circuit breakers are increasingly being equipped with smart sensors and predictive maintenance capabilities to enhance reliability in harsh conditions.

By End-User Insights

The Transmission & Distribution (T&D) utilities represented the largest end-user segment in the Europe circuit breaker market by commanding 45.8% of total demand in 2024. This control is due to the aging power infrastructure across the region and the urgent need for grid modernization to accommodate renewable energy sources and electric vehicle loads. As part of the EU’s Clean Energy Package, member states are investing in smart grid technologies, including intelligent circuit breakers that enable real-time fault detection and automatic load balancing.

Moreover, over €25 billion was allocated to grid infrastructure improvements across Europe in 2023, with a major portion directed toward circuit breaker replacements and digital protection relays. Countries such as Germany, France, and the Netherlands have prioritized grid resilience, driving procurement of high-capacity vacuum and gas-insulated breakers for substations and overhead lines.

Additionally, the decentralization of energy production, driven by rooftop solar, biomass, and microgrid projects, is placing additional stress on T&D networks, further increasing demand for adaptive and scalable circuit protection solutions.

The renewables segment is the fastest-growing end-user category in the Europe circuit breaker market, expanding at a CAGR of 11.6% between 2025 and 2033. This rapid expansion is fueled by the accelerated deployment of wind, solar, and hydroelectric power generation across the continent. Each megawatt of renewable generation requires multiple layers of circuit protection—from inverters and transformers to grid interconnection points—boosting demand for both medium and high voltage breakers. Wind turbines, especially offshore ones, operate under demanding conditions and rely on specialized circuit breakers to manage fluctuating power output and transient voltages. Additionally, governments are mandating advanced protection systems for renewable assets to prevent backfeeding and ensure grid stability. This requirement has led to increased adoption of vacuum and SF₆-insulated breakers tailored for variable frequency and bidirectional power flows.

COUNTRY-LEVEL ANALYSIS

Germany had the top position in the Europe circuit breaker market, commanding 23.9% of total regional revenue in 2024. As Europe’s largest economy and a global leader in industrial automation, Germany maintains a strong demand for circuit breakers across the manufacturing, energy, and transportation sectors. The country’s ongoing Energiewende initiative has spurred massive investments in grid modernization, renewable energy integration, and smart building infrastructure, all of which rely heavily on advanced circuit protection solutions. With strong R&D capabilities and government-backed electrification strategies, Germany remains at the forefront of the European circuit breaker ecosystem.

France has strong grid modernization initiatives. The country benefits from a well-established electrical infrastructure and a strategic focus on nuclear and renewable energy, both of which require sophisticated circuit protection systems. These initiatives included the rollout of smart substations and the enhancement of cross-border interconnection capacities, driving demand for high-voltage and vacuum circuit breakers. Additionally, the French government’s “Renewable Energy Roadmap” has spurred the development of offshore wind and solar parks, each requiring dedicated circuit protection to manage intermittent generation and ensure grid compatibility.

The United Kingdom saw robust growth in the market. The country’s growing emphasis on smart grid development, offshore wind expansion, and EV charging infrastructure has significantly boosted demand for advanced circuit protection solutions. According to National Grid ESO, the UK added over 5 GW of offshore wind capacity in 2023, necessitating high-voltage circuit breakers capable of handling fluctuating power flows and fault currents. Moreover, the proliferation of EV charging hubs and heat pump installations has increased reliance on indoor circuit breakers designed for dynamic load management.

Italy occupies a prominent position in the Europe circuit breaker market. The country’s strong industrial base and growing adoption of decentralized energy systems have been key drivers behind this growth. Companies in the automotive, food processing, and pharmaceutical sectors are increasingly adopting smart circuit breakers with remote diagnostics and energy monitoring capabilities. With continued investment in digital substations and sustainable manufacturing, Italy remains a key contributor to the European circuit breaker market.

Spain holds a comparatively smaller share of the Europe circuit breaker market. The country’s aggressive renewable energy expansion, particularly in solar power, has significantly boosted demand for circuit breakers in utility-scale and distributed generation applications. These installations require extensive protection infrastructure, including molded case and vacuum circuit breakers, to ensure safe and efficient operation. Additionally, Spain’s commitment to hydrogen production and industrial electrification has increased the need for high-interruptible-capacity breakers in electrolysis plants and e-mobility hubs.

KEY MARKET PLAYERS

ABB, Schneider Electric, Siemens, Mitsubishi Electric, Eaton, Mitsubishi Electric, CG Power and Industrial Solutions, TE Connectivity, LS ELECTRIC, Hyundai Electric, Secheron, Chint Electric, TE Connectivity, Tavrida Electric, Toshiba, Powell Industries, and others. These are the market players that are dominating the circuit breaker market.

Top Players in the Market

Siemens Energy

Siemens Energy is a leading global player in the circuit breaker industry, with a strong presence across Europe’s power generation, transmission, and industrial automation sectors. The company offers a comprehensive portfolio of vacuum, gas-insulated, and molded case circuit breakers tailored for high-voltage grids, smart substations, and renewable energy systems.

Known for its innovation and engineering excellence, Siemens has been instrumental in advancing digitalized electrical infrastructure through smart circuit breakers equipped with real-time monitoring and predictive maintenance capabilities. Its solutions support grid stability, decarbonization, and electrification initiatives across European markets.

With a focus on sustainability and grid modernization, Siemens continues to drive technological advancements that influence both product development and industry standards globally.

ABB Ltd.

ABB is a major contributor to the Europe circuit breaker market, offering a wide range of medium and high voltage protection solutions designed for utility networks, industrial applications, and renewable energy integration. The company is recognized for its pioneering work in hybrid and digital circuit breaker technologies that enhance system reliability and efficiency.

ABB plays a crucial role in enabling smart grid deployments by integrating intelligent protection systems into electrical infrastructure. Its modular breaker designs and eco-efficient insulation technologies align with Europe’s environmental regulations and energy transition goals.

Through continuous R&D investments and strategic partnerships, ABB remains at the forefront of shaping next-generation circuit protection systems, reinforcing its leadership position in the European and global markets.

Schneider Electric SE

Schneider Electric is a key player in the Europe circuit breaker market, particularly in low and medium voltage segments used across commercial buildings, data centers, and industrial facilities. The company emphasizes sustainable and connected electrical systems, offering EcoStruxure-enabled circuit breakers that integrate IoT-based monitoring and remote diagnostics.

Its commitment to energy efficiency and digital transformation has made Schneider a preferred partner for smart city and green building projects throughout the region. The company's localized manufacturing and service networks ensure rapid deployment and customer support.

By focusing on decarbonization, electrification, and digital resilience, Schneider Electric continues to expand its footprint and influence within Europe’s evolving power infrastructure ecosystem.

Top Strategies Used by Key Market Participants

One of the primary strategies employed by leading players in the Europe circuit breaker market is technological innovation, particularly in the development of smart, digitally integrated circuit breakers. Companies are investing heavily in IoT-enabled protection devices that offer real-time diagnostics, remote monitoring, and predictive maintenance capabilities. This approach enhances system reliability while aligning with broader trends in smart grid and industrial automation.

Another critical strategy is strategic acquisitions and partnerships, where established firms acquire niche technology providers or collaborate with software developers to expand their offerings. These moves allow companies to integrate advanced analytics, cybersecurity features, and AI-driven fault detection into their products, ensuring they remain competitive in an increasingly digitized power landscape.

Lastly, sustainability-focused product development has become a core strategy among market leaders. Manufacturers are prioritizing eco-friendly materials, SF₆-free gas insulation, and recyclable components to comply with EU environmental regulations and meet growing demand for green electrical infrastructure across the region.

COMPETITION OVERVIEW

The competition in the Europe circuit breaker market is marked by a blend of global conglomerates, regional specialists, and emerging technology-driven firms vying for dominance in an evolving power infrastructure landscape. Established players such as Siemens, ABB, and Schneider Electric leverage their extensive R&D capabilities, brand reputation, and broad distribution networks to maintain leadership positions. These firms continuously innovate by integrating digital intelligence, enhancing energy efficiency, and adapting to regulatory shifts toward sustainability and smart grid integration.

At the same time, mid-sized manufacturers and local suppliers are carving out niches by offering cost-competitive alternatives tailored for specific industrial and utility applications. Their agility allows them to respond quickly to regional demand fluctuations and customize solutions for smaller-scale operations. Additionally, new entrants from Asia are exerting pressure through aggressive pricing and scalable production models, prompting European firms to differentiate through superior quality, localization, and value-added services.

This dynamic environment fosters ongoing innovation but also intensifies the need for differentiation beyond product specifications, such as lifecycle support, digital integration, and compliance with stringent safety and environmental standards. As electrification and renewable integration accelerate, competition will likely shift further toward smart, adaptive, and environmentally responsible circuit protection solutions.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Siemens Energy launched a new line of digital circuit breakers featuring built-in sensors and cloud connectivity, aimed at supporting smart grid implementations across Germany and Scandinavia. This move reinforces Siemens' leadership in grid modernization and digital substation solutions.

- In July 2023, ABB announced a strategic partnership with a Finnish software firm specializing in predictive maintenance for electrical assets. This collaboration enables ABB to enhance its circuit breaker offerings with AI-powered diagnostics, improving uptime and operational efficiency for European utilities and industries.

- In November 2023, Schneider Electric expanded its factory in France to increase production capacity for EcoStruxure-enabled circuit breakers, responding to rising demand for smart electrical infrastructure in commercial and residential sectors.

- In January 2024, Eaton Corporation introduced a new series of SF₆-free gas-insulated circuit breakers designed to reduce environmental impact while maintaining high performance in high-voltage applications across the UK and Benelux countries.

- In May 2024, GE Vernova unveiled an advanced vacuum circuit breaker specifically engineered for offshore wind farms, addressing the growing need for durable, high-performance protection systems in Europe’s expanding renewable energy sector.

MARKET SEGMENTATION

This research report on the Europe circuit breaker market is segmented and sub-segmented into the following categories.

By Insulation Type

- Vacuum Circuit Breaker

- Air Circuit Breaker

- Gas Circuit Breaker

- Oil Circuit Breaker

By Voltage

- Medium Voltage

- High Voltage

By Installation

- Indoor

- Outdoor

By End user

- T&D Utilities

- Power Generation

- Renewables

- Railways

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What’s driving the demand for circuit breakers in Europe?

The shift toward renewable energy integration, electrification of transport, and grid modernization are significantly boosting demand for advanced circuit protection systems across the EU.

Which types of circuit breakers are most in demand in Europe?

Vacuum and SF₆-free breakers are seeing increased adoption due to EU environmental regulations and the need for sustainable medium-voltage switchgear solutions.

How are European energy policies influencing circuit breaker technology?

Regulations like the EU Green Deal and Clean Energy Package are pushing utilities to adopt smart, eco-friendly circuit breakers that support grid stability and remote monitoring.

What industries are leading circuit breaker adoption across Europe?

Utilities, railways, and data centers are major buyers, with high reliability and arc flash protection becoming essential in high-load environments like Germany, France, and the Nordics.

What role is digitalization playing in circuit breaker advancements?

Smart circuit breakers with IoT-enabled diagnostics, predictive maintenance, and integration with energy management systems are transforming asset management in modern electrical infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com