Europe Europe CNC Machine Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Lathe Machines, Milling Machines, Laser Machines), End-use (Automotive, Aerospace & Defense ,Construction Equipment, Power & Energy) and Country (Germany, UK, France, Italy, Spain) – Industry Analysis from 2025 to 2033.

Europe CNC Machine Market Size

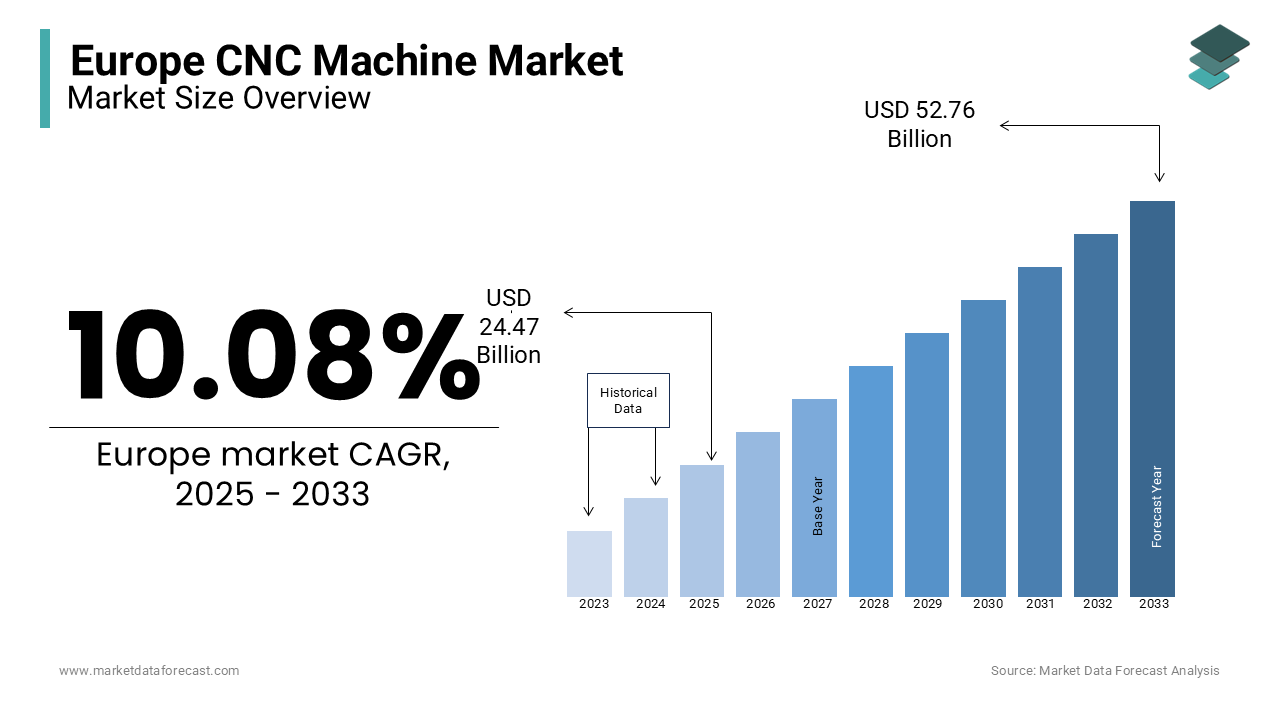

The Europe CNC Machine Market was valued at USD 22.23 billion in 2024. The Europe CNC Machine Market is expected to have 10.08% CAGR from 2025 to 2033 and be worth USD 52.76 billion by 2033 from USD 24.47 billion in 2025.

The Europe CNC machine market encompasses a broad range of computer numerical control (CNC) equipment used for precision manufacturing across industries such as automotive, aerospace, industrial machinery, and electronics. These machines are essential for automating complex machining tasks with high accuracy and efficiency. The European region has long been recognized for its strong industrial base and advanced manufacturing capabilities, particularly in countries like Germany, Italy, France, and Spain. Germany remains the largest market for CNC machines in Europe due to its robust automotive and mechanical engineering sectors. As per VDMA, the German Mechanical Engineering Industry Association, domestic demand for metalworking machinery increased by 4.7% in 2023 compared to the previous year. Apart from these, the growing adoption of Industry 4.0 technologies is reshaping production lines, further integrating smart CNC systems that support real-time monitoring and adaptive processing. This evolution reflects the ongoing digital transformation within the continent’s manufacturing landscape.

MARKET DRIVERS

Growth of the Automotive Industry in Europe

One of the primary drivers of the Europe CNC machine market is the steady expansion and technological advancement of the automotive industry. CNC machines play a pivotal role in the production of engine components, transmission parts, and intricate body elements that require high levels of precision. Moreover, the shift toward electric vehicles (EVs) is influencing the design and manufacturing processes of automotive components. EV powertrains require more precise machining than traditional internal combustion engines, thereby increasing reliance on advanced CNC equipment. BMW and Volkswagen have both announced significant investments in electrification, with plans to increase their EV production capacity across multiple facilities in Germany and Eastern Europe. This investment directly correlates with increased demand for high-performance CNC machines capable of handling new materials and tighter tolerances.

Expansion of Aerospace Manufacturing Across Europe

Another significant driver of the Europe CNC machine market is the sustained growth of the aerospace manufacturing sector, especially in countries like France, the UK, and Spain. Aerospace components—such as turbine blades, landing gear, and structural frames—require extreme precision and durability, which can only be achieved through advanced CNC machining. According to ADS Group, the UK aerospace and defense trade organization, the sector generated £36.4 billion in turnover during 2022, with exports accounting for over 80% of this revenue. France, home to major players like Airbus and Safran, also saw continued investment in next-generation aircraft production, contributing to heightened demand for CNC-based solutions. This escalation necessitates a parallel increase in machining capacity, especially for composite and titanium components that are integral to modern aircraft construction. Such programs are encouraging innovation in lightweight materials and hybrid propulsion systems, which in turn require specialized CNC machining techniques.

MARKET RESTRAINTS

High Initial Investment and Operational Costs

A key restraint impeding the growth of the Europe CNC machine market is the substantial initial investment and ongoing operational costs associated with advanced CNC systems. These machines, particularly those equipped with multi-axis capabilities or integrated with Industry 4.0 technologies, often come with price tags in high. For small and medium-sized enterprises (SMEs), which form a considerable portion of Europe’s manufacturing base, acquiring such machinery represents a significant financial burden. Additionally, beyond the upfront cost, maintenance, software licensing, and skilled labor expenses further elevate the total cost of ownership. Training technicians to operate and program sophisticated CNC machines requires time and resources, often leading to delays in implementation. Moreover, fluctuations in raw material prices, especially for metals like aluminum and steel, add another layer of unpredictability to operational budgets.

Supply Chain Disruptions and Component Shortages

Another major restraint affecting the Europe CNC machine market is the persistent issue of supply chain disruptions and component shortages, particularly in the aftermath of the global semiconductor crisis. CNC machines rely heavily on programmable logic controllers (PLCs), servo drives, and embedded processors, many of which depend on microchips that have faced extended lead times since 2021. Germany’s VDMA highlighted in its 2023 mid-year report that approximately 60% of machine tool producers in the country faced delays due to unavailability of critical electronic components. This bottleneck not only affects the timely delivery of CNC machines but also increases project costs due to expedited shipping fees and sourcing alternatives. Furthermore, geopolitical tensions, including trade restrictions and energy crises, have compounded these challenges.

MARKET OPPORTUNITIES

Integration of IoT and Smart Manufacturing

The integration of IoT (Internet of Things) and smart manufacturing presents a transformative opportunity for the European CNC machine market. By incorporating IoT capabilities, CNC machines can enable real-time data exchange, predictive maintenance, and remote monitoring, significantly enhancing operational efficiency. The European Commission reports that IoT-enabled manufacturing could increase productivity by 25% in the next decade. For instance, Germany’s "Industrie 4.0" initiative is driving the adoption of smart CNC technologies, enabling manufacturers to achieve higher precision and efficiency. These advancements align with Europe’s focus on digitalization and sustainability, paving the way for innovative CNC applications in diverse industries.

Expansion of Aerospace and Medical Manufacturing

The growing demand for precision components in aerospace and medical manufacturing offers substantial opportunities for CNC machine adoption. Europe’s aerospace sector, which produces over 20% of global components, requires advanced CNC machines for fabricating complex and high-tolerance parts, as highlighted by the European Aerospace Industry Association. Similarly, the medical industry’s increasing need for custom implants and surgical instruments drives the demand for CNC machining solutions. The European Commission notes that medical manufacturing is expected to grow by over 10% annually, fueled by advancements in healthcare technology. This expansion presents significant potential for CNC machine manufacturers to cater to niche, high-value markets.

MARKET CHALLENGES

Environmental Regulations and Energy Consumption

Strict environmental regulations in Europe pose a challenge to the CNC machine market. CNC machines, particularly older models, consume significant energy during operations, contributing to higher carbon emissions. The European Commission’s climate goals mandate a 55% reduction in greenhouse gas emissions by 2030, pressuring manufacturers to adopt energy-efficient technologies. However, retrofitting or replacing existing systems with eco-friendly alternatives involves considerable costs and operational adjustments. Additionally, compliance with environmental standards, such as the EU’s Energy Efficiency Directive, requires continuous monitoring and optimization, increasing the burden on manufacturers to balance productivity with sustainability.

Dependency on Raw Material Supply Chains

The CNC machine market in Europe faces challenges due to dependency on raw material imports for components like precision alloys, electronics, and semiconductors. The European Commission highlights that over 90% of rare earth materials, essential for CNC machine parts, are sourced from non-European countries, primarily China. This reliance creates vulnerabilities to global supply chain disruptions, trade restrictions, and fluctuating material prices. For example, the COVID-19 pandemic exposed supply chain fragilities, leading to delays in production schedules and increased costs. Addressing these challenges requires strategic investments in local manufacturing and raw material sourcing to reduce dependency and ensure supply chain resilience.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.08 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

AMADA MACHINERY CO., LTD.,AMERA.SEIKI,DMG MORI CO., LTD. |

SEGMENTAL ANALYSIS

By Type Insights

The milling machines dominated the Europe CNC machine market, accounting for a 32.4% of total market share in 2024. These machines are extensively used across industries requiring high-precision component manufacturing, particularly in automotive, aerospace, and industrial machinery sectors. As per VDMA, German metalworking machinery sales alone showed a major growth in milling equipment demand in 2023, driven largely by increased production requirements in high-tech components. A key factor behind this dominance is the versatility of CNC milling machines in handling complex geometries and multi-axis operations. The shift toward 5-axis milling systems has been significant, with companies like DMG MORI and INDEX reporting rising order volumes from European manufacturers seeking improved efficiency and reduced setup times. Additionally, the growing demand for lightweight materials in aerospace and automotive applications is pushing the need for advanced milling capabilities.

The laser machines are experiencing the fastest growth, projected to expand at a CAGR of 9.4% between 2025 and 2033. This rapid expansion is primarily fueled by the increasing adoption of laser cutting and engraving technologies in the automotive, electronics, and medical device sectors. One major driver is the rising preference for non-contact, high-speed precision cutting in sheet metal processing. TRUMPF, a leading German manufacturer of industrial lasers, recorded a major year-on-year increase in laser machine orders in 2023, citing strong demand from automotive suppliers producing battery enclosures and structural components for electric vehicles. Besides, the integration of fiber laser technology—known for its energy efficiency and superior beam quality—is gaining traction across small-to-medium enterprises (SMEs). Moreover, advancements in hybrid laser-CNC systems that combine cutting, welding, and additive functions are enabling more flexible production lines. In response to these developments, the European Commission has included laser-based manufacturing under its Horizon Europe funding program, allocating €80 million for R&D initiatives through 2025.

By Application Insights

The automotive sector remained the largest application segment in the Europe CNC machine market by holding an estimated 28.2% market share in 2024. This dominance is due to the region's deep-rooted presence in vehicle manufacturing, especially in Germany, France, and Spain. CNC machines play a crucial role in the production of engine blocks, transmission components, brake rotors, and chassis elements, all of which require tight tolerances and high repeatability. Furthermore, the transition to electric drivetrains is altering machining requirements. Components such as motor housings and battery casings demand precise milling and turning operations, boosting demand for high-performance CNC systems. This sustained capital expenditure ensures the automotive sector remains the dominant application area in the Europe CNC machine market.

The aerospace and defense sector is emerging as the fastest-growing application segment for CNC machines in Europe, registering a CAGR of 8.7%. This surge is primarily attributed to the increasing complexity of aircraft components and the growing reliance on precision-engineered parts made from exotic materials like titanium and Inconel. Each unit requires hundreds of machined components, including turbine blades, landing gear, and fuselage frames, all of which depend heavily on multi-axis CNC machining. Rolls-Royce, another major player based in the UK, has also ramped up production of next-generation jet engines, incorporating more additive-integrated CNC machining workflows. This includes lightweight structures and hybrid propulsion systems that necessitate highly specialized CNC equipment.

COUNTRY LEVEL ANALYSIS

Germany held the top position in the Europe CNC machine market, capturing a 31.3% of total regional demand in 2024. As Europe’s largest economy and a global hub for mechanical engineering and automotive manufacturing, Germany continues to drive CNC adoption across various industrial segments. The country’s prowess is underpinned by its robust industrial base, particularly in the automotive and machinery sectors. BMW and Mercedes-Benz have both integrated advanced CNC systems into their smart factories, enhancing automation and reducing cycle times. Furthermore, Germany’s commitment to Industry 4.0 has accelerated the deployment of digitally connected CNC machines.

.

Italy maintains a strong foothold in the global manufacturing ecosystem, particularly in machinery, automotive components, and aerospace sub-assemblies. Italian manufacturing is characterized by a dense network of SMEs, many of which specialize in precision machining. Companies like FCA (now Stellantis) and Ducati rely on high-speed CNC lathes and milling centers to maintain competitiveness in global markets. In addition, Italy plays a vital role in the European aerospace supply chain. Leonardo S.p.A., one of the continent’s leading defense and aerospace firms, sources numerous machined components domestically, driving CNC demand. The government-backed “Piano Nazionale Impresa 4.0” initiative has also provided tax incentives for companies investing in automation, further stimulating CNC machine adoption across the country

France is driven by a combination of traditional manufacturing strength and emerging digital transformation initiatives. The country’s industrial sector, particularly in aerospace, automotive, and heavy machinery, remains a key consumer of CNC equipment. Besides, the French government has supported automation through the “Usine du Futur” initiative, encouraging manufacturers to adopt intelligent CNC systems equipped with IoT-enabled sensors and predictive maintenance features. These factors collectively contribute to France’s strong presence in the European CNC machine market

The United Kingdom has resilient manufacturing base. The country maintains a resilient manufacturing ecosystem, particularly in aerospace, defense, and high-precision engineering. Companies like Rolls-Royce and BAE Systems depend on advanced CNC machining for turbine blades, landing gear, and avionics components. Apart from these, the UK government has backed several initiatives aimed at revitalizing domestic manufacturing. Despite economic headwinds, the UK remains a notable contributor to the European CNC machine landscape, with continued emphasis on innovation and technical excellence.

Spain captured a notable share of the Europe CNC machine market in 2024 and is driven by growing automation adoption in the automotive and industrial sectors. The country’s manufacturing base has seen steady investment in CNC infrastructure, particularly in regions like Catalonia and Valencia, which host major automotive assembly plants. Seat, Renault, and Volkswagen all operate large-scale facilities in the country, relying on CNC machines for precision machining of engine and chassis components. Moreover, Spain’s participation in the European Union’s Digital Europe Programme has facilitated access to funding for smart manufacturing upgrades.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe CNC Machine Market are AMADA MACHINERY CO., LTD.,AMERA.SEIKI,DMG MORI CO., LTD.,General Technology Group Dalian Machine Tool Co., Ltd.,FANUC CORPORATION,Haas Automation, Inc.,Hurco Companies, Inc.,Okuma Corporation.,Shenyang Machine Tool Part Co., Ltd.,Yamazaki Mazak Corporation.

The competition in the Europe CNC machine market is marked by a blend of established global leaders and specialized regional manufacturers vying for dominance through innovation and strategic positioning. German firms like DMG MORI, TRUMPF, and INDEX dominate due to their deep-rooted engineering expertise and extensive product portfolios. However, international players from Japan and the United States have also made significant inroads, leveraging their advanced technologies and strong brand reputations. In addition to technological prowess, competitive differentiation increasingly hinges on digital integration, energy efficiency, and after-sales service capabilities. Smaller European manufacturers often focus on niche applications or custom-built machines to carve out a space in the market. As demand for smart manufacturing and automation continues to rise, companies are intensifying R&D efforts, expanding service footprints, and forming strategic alliances to maintain relevance and capture new opportunities. This dynamic environment fosters continuous evolution, ensuring that competition remains fierce yet innovation-driven across the region.

Top Players in the Market

One of the leading players in the Europe CNC machine market is DMG MORI AG . Headquartered in Germany, the company has a strong global footprint and is known for its high-precision machining solutions. DMG MORI offers a wide range of CNC machines including milling, turning, and additive manufacturing systems. The company plays a pivotal role in driving Industry 4.0 adoption by integrating digital technologies into its machines, enhancing automation and connectivity across production lines.

Another major contributor to the European CNC machine landscape is TRUMPF GmbH + Co. KG . Based in Ditzingen, Germany, TRUMPF is a global leader in laser technology and sheet metal processing machines. The company’s CNC laser cutting systems are widely used across automotive, electronics, and aerospace sectors. TRUMPF emphasizes innovation and sustainability, offering smart manufacturing solutions that improve efficiency and reduce material waste in industrial settings.

A third key player shaping the market is Mazak Corporation (Europe) . With a strong presence in the UK and across continental Europe, Mazak delivers advanced CNC lathes, milling machines, and multi-tasking systems. Known for its robust engineering and reliability, Mazak supports diverse industries with tailored machining solutions. The company also focuses on training and after-sales service, ensuring long-term customer support and integration of its CNC equipment into modern production environments.

Top Strategies Used by Key Market Participants

A primary strategy employed by key players in the Europe CNC machine market is product innovation and technological advancement. Companies are continuously developing high-precision, multi-axis CNC machines integrated with digital technologies such as IoT, AI, and cloud-based monitoring systems. These innovations enhance productivity, reduce downtime, and support smart factory initiatives across industrial sectors.

Another crucial approach is strategic partnerships and collaborations . Leading manufacturers are forming alliances with software developers, automation providers, and research institutions to accelerate the development of intelligent machining solutions. These collaborations enable companies to offer more comprehensive, end-to-end manufacturing ecosystems that align with Industry 4.0 requirements.

Lastly, expansion of service networks and localized support is a growing focus. To strengthen their foothold in Europe, CNC machine providers are investing in regional service centers, training facilities, and customer support infrastructure. This ensures timely maintenance, operator training, and faster response to client needs, thereby improving customer retention and market competitiveness.

RECENT HAPPENINGS IN THE MARKET

In January 2024, DMG MORI launched a new line of hybrid CNC machines combining additive and subtractive manufacturing capabilities, aimed at supporting aerospace and medical device manufacturers in Europe seeking greater design flexibility and reduced material waste.

In March 2024, TRUMPF introduced an updated version of its TruTops Laser software suite across its European operations, enhancing laser machine programming efficiency and enabling seamless integration with CAD/CAM systems used by automotive and electronics manufacturers.

In May 2024, Mazak expanded its technical center in Worcester, UK, adding dedicated demonstration zones for multi-axis machining and automation solutions, reinforcing its commitment to customer engagement and hands-on training for European clients.

In July 2024, EMAG opened a new service hub in northern Italy to provide faster technical support and spare parts availability for its CNC vertical machines, strengthening its position in the Italian automotive components manufacturing sector.

In September 2024, GF Machining Solutions partnered with Siemens to co-develop a digital twin platform tailored for precision mold and die makers across Europe, enhancing simulation accuracy and reducing setup times for complex machining operations.

MARKET SEGMENTATION

This europe cnc machine market research report has been segmented and sub-segmented into the following categories.

By Type

- Milling Machines

- Laser Machines

By Application

- Automotive

- Aerospace & Defense

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which industries are the major consumers of Europe CNC Machine Market

Key industries include automotive, aerospace, healthcare, electronics, and industrial manufacturing.

What are the future trends in the European CNC machine market

Increasing adoption of AI-powered CNC machines, robotics integration, 3D printing hybrid machines, and advancements in automation technology.

What is the current size of the Europe CNC Machine Market

The European CNC machine market is growing, driven by increasing industrial automation and demand for precision manufacturing.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com