Europe Coconut Water Market Size, Share, Trends & Growth Forecast Report By Type (Sweetened, Unsweetened), Form, Packaging, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Coconut Water Market Size

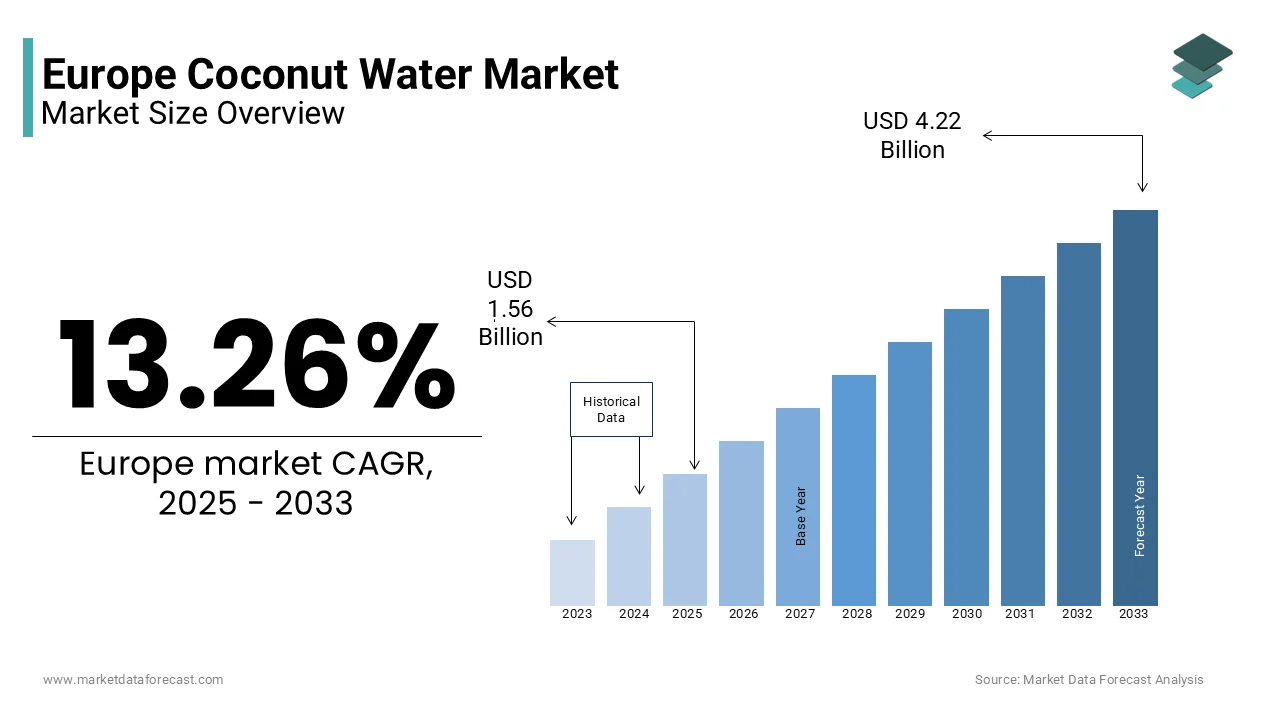

The Europe Coconut Water market size was valued at USD 1.38 billion in 2024. The European market is estimated to be worth USD 4.22 billion by 2033 from USD 1.56 billion in 2025, growing at a CAGR of 13.26% from 2025 to 2033.

The Europe coconut water market has experienced remarkable growth, driven by shifting consumer preferences toward healthier beverage options. This surge is attributed to the rising awareness of coconut water’s natural hydration properties and its status as a low-calorie, nutrient-rich alternative to sugary drinks. Key cities like London, Paris, and Berlin have emerged as major consumption hubs, supported by robust retail networks and growing demand for organic and plant-based products. According to a study by Mintel, 60% of European consumers now prioritize beverages with functional health benefits, positioning coconut water as a preferred choice. Additionally, the proliferation of fitness trends and wellness culture has further amplified its appeal among millennials and Gen Z demographics. These factors collectively underscore a thriving market poised for sustained expansion.

MARKET DRIVERS

Rising Health Consciousness

The increasing emphasis on health and wellness is a key driving factor for the Europe coconut water market to grow. According to Nielsen, over 70% of European consumers actively seek out natural and minimally processed beverages, creating a fertile ground for coconut water adoption. This trend is particularly evident in countries like Germany and the UK, where health-conscious lifestyles dominate consumer behavior. The perception of coconut water as a functional drink. As per a report by the European Food Safety Authority (EFSA), coconut water contains essential electrolytes such as potassium and magnesium by making it an ideal post-workout hydration solution. Additionally, the rise of veganism and plant-based diets has positioned coconut water as a staple in health-focused households. For instance, a study by ProVeg International reveals that 40% of Europeans now incorporate plant-based beverages into their daily routines that further promote the growth rate of the market in the coming years.

Expansion of Retail Channels

The expansion of retail channels, supermarkets and online platforms, has significantly bolstered the Europe coconut water market. According to IRI Worldwide, supermarket sales of coconut water grew by 25% in 2023 with the strategic product placements and promotional campaigns. Online retail has emerged as a game-changer. Subscription-based models offered by platforms like Amazon and HelloFresh have further streamlined access for consumers. Additionally, partnerships between brands and retailers have enhanced product visibility, ensuring widespread availability. These developments collectively drive the market’s upward trajectory.

MARKET RESTRAINTS

High Production and Import Costs

One of the primary barriers impeding the growth of the Europe coconut water market is the high cost associated with production and imports. According to the Food and Agriculture Organization (FAO), nearly 90% of coconut water consumed in Europe is imported from tropical regions like Southeast Asia and South America. These logistical challenges contribute to elevated prices is making coconut water less accessible to budget-conscious consumers.

Additionally, fluctuations in global supply chains exacerbate the issue. A study by Rabobank reveals that shipping costs for coconut water increased by 15% in 2023 due to geopolitical tensions and port congestion. These expenses are often passed on to consumers, resulting in higher retail prices. While premium brands can absorb these costs, smaller players struggle to compete are creating a fragmented market landscape.

Limited Consumer Awareness in Rural Areas

Limited consumer awareness in rural and semi-urban areas poses another significant restraint for the Europe coconut water market. According to Kantar, only 40% of consumers in these regions are familiar with the health benefits of coconut water when compared to 70% in urban centers. This knowledge gap hinders market penetration and slows adoption rates. Moreover, the lack of aggressive marketing campaigns in underserved regions compounds the challenge. As per a report by Nielsen, rural consumers are more likely to opt for traditional beverages like soda and juice due to familiarity and affordability. Addressing this issue requires significant investments in educational initiatives and localized advertising, which may not be feasible for all stakeholders. This disparity undermines equitable market growth.

MARKET OPPORTUNITIES

Innovation in Flavored Variants

The development of innovative flavored variants presents a transformative opportunity for the Europe coconut water market. According to Innova Market Insights, flavored coconut water sales grew by 30% in 2023, driven by consumer demand for unique taste experiences. Brands are experimenting with infusions such as mango, passion fruit, and ginger to cater to diverse palates. For instance, a study by Mintel, 50% of European consumers prefer flavored beverages over plain options in France and Italy. Additionally, collaborations with local flavor experts have enabled brands to introduce region-specific variants by enhancing cultural relevance. These innovations not only attract new customers but also position coconut water as a versatile and trendy beverage choice.

Growing Popularity of Coconut Water Powder

The growing popularity of coconut water powder offers another promising avenue for growth in the Europe coconut water market. European consumers prefer portable beverage options for outdoor activities and travel. Coconut water powder, which can be easily reconstituted with water, meets this demand while reducing packaging waste. Additionally, partnerships with fitness brands and gyms have amplified its appeal among health enthusiasts. These factors collectively propel the segment’s rapid expansion.

MARKET CHALLENGES

Competition from Alternative Beverages

Intense competition from alternative beverages poses a significant challenge to the Europe coconut water market. According to Zenith Global, the functional beverage category, which includes kombucha, cold-pressed juices, and sparkling waters in Europe. These alternatives often offer similar health benefits at competitive prices by making it difficult for coconut water to stand out. According to a study by McKinsey, 60% of European consumers are willing to experiment with new beverage options, particularly those perceived as trendy or exotic. This preference creates a crowded marketplace, forcing coconut water brands to invest heavily in differentiation strategies.

Environmental Concerns Over Packaging

Environmental concerns over packaging represent another pressing challenge for the Europe coconut water market. According to a report by Greenpeace, plastic bottles account for 45% of the total packaging used in the beverage industry, raising fears about their environmental impact. This issue has led to increased scrutiny from both consumers and regulatory bodies. For instance, a study by the Ellen MacArthur Foundation reveals that 55% of European consumers prioritize eco-friendly packaging when making purchasing decisions. While some brands have introduced biodegradable and recyclable options, these alternatives often come at a higher cost is limiting accessibility.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.26% |

|

Segments Covered |

By Type, Form, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

The Coca Cola Co., The Green Coconut Foods Co. Ltd., Chi, Cocofina Ltd., Cocos Pure Beverage Corp., First Grade International, FORCE BIO SAS, Goya Foods Inc., Gracekennedy Ltd., Happy Coco BV, Helios Ingredients Ltd., MightyBee Ltd., NATURE INNOVATION, PepsiCo Inc., The Vita Coco Co. Inc., TIANA Fairtrade Organics Ltd, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The unsweetened coconut water segment dominated the Europe coconut water market by capturing 59.1% of the total share in 202. The growth of the segment is attributed by the growing demand for natural and minimally processed beverages among health-conscious consumers. A key factor fueling this dominance is the perception of unsweetened variants as a purer and healthier option. As per a study by the European Nutrition Society, 70% of consumers prefer beverages without added sugars is aligning with the trend toward clean eating. Additionally, the rise of keto and low-carb diets has amplified demand for unsweetened coconut water that is likely to fuel the growth of the market.

The sweetened coconut water segment is deemed to register a CAGR of 8.5% from 20225 to 2033. This growth is fueled by the increasing popularity of flavored variants infused with natural sweeteners like agave and stevia. According to a report by Mintel, sweetened coconut water appeals to younger demographics, who prioritize taste over nutritional content. Additionally, partnerships with cafes and dessert shops have expanded its reach is creating new consumption occasions. These factors collectively propel the segment’s rapid expansion.

By Flavor Insights

The plain coconut water segment was accounted in holding 55.4% of the Europe coconut water market share in 2024. This dominance is driven by its reputation as a natural and unadulterated beverage by appealing to health-conscious consumers who prioritize purity and simplicity. The growing demand for hydration solutions without artificial additives is greatly influencing the growth of the market. According to the European Hydration Institute, plain coconut water is perceived as an ideal isotonic drink due to its electrolyte-rich composition by making it popular among athletes and fitness enthusiasts. Additionally, the rise of wellness trends has positioned plain coconut water as a staple in detox diets and clean-eating routines. As per a study by ProVeg International, 5% of European consumers prefer plain variants over flavored options.

The flavored coconut water segment is anticipated to exhibit a fastest CAGR of 9.8% during the forecast period. This growth is fueled by the increasing consumer appetite for innovative and exotic taste experiences. For instance, a report by Mintel reveals that flavored coconut water sales surged by 40% in 2023 with the popularity of tropical infusions like mango, passion fruit, and lime. These variants cater to younger demographics among millennials and Gen Z, who seek beverages that align with their adventurous palates. Additionally, partnerships with local flavor experts have enabled brands to introduce region-specific flavors by enhancing cultural relevance and appeal. These factors collectively propel the segment’s rapid expansion.

By Form Insights

The coconut water segment was the largest in the Europe coconut water market with a significant share in 2024 owing to its widespread availability and ease of consumption by making it the preferred choice for on-the-go hydration. A key factor fueling this dominance is the convenience offered by ready-to-drink liquid formats. European consumers prioritize beverages that are easy to consume and store by aligning with the fast-paced urban lifestyle prevalent in cities like London, Paris, and Berlin. Additionally, aggressive marketing campaigns by leading brands have enhanced product visibility by ensuring widespread adoption. These trends solidify liquid coconut water’s position as the largest segment in the market.

The coconut water powder segment is likely to gain traction with a CAGR of 12.3% during the forecast period. This growth is fueled by its extended shelf life and portability, which appeal to travelers, hikers, and fitness enthusiasts. The powdered coconut water gained significant traction in 2023 among eco-conscious consumers seeking sustainable alternatives to single-use plastic bottles. Additionally, collaborations with gyms and fitness influencers have amplified its appeal by positioning it as a convenient and eco-friendly hydration solution. These innovations not only drive adoption but also position coconut water powder as a future-proof segment.

By Packaging Insights

The bottles segment dominated the Europe coconut water market with a prominent share in 2024. The segment growth is driven due to their convenience, durability, and widespread use across retail channels, including supermarkets and online platforms. A key factor fueling this dominance is the growing preference for portable packaging solutions. According to a study by McKinsey, 80% of European consumers prioritize beverages packaged in resealable or recyclable bottles that is aligning with sustainability goals. Additionally, advancements in bottle design, such as lightweight and shatterproof materials that have enhanced user experience.

The cartons segment is projected to grow with a fastest CAGR of 10.5% in the next coming years. This growth is fueled by their eco-friendly attributes, including reduced carbon footprint and higher recyclability rates compared to traditional plastic bottles. According to a report by the Ellen MacArthur Foundation, carton-based packaging gained significant traction in 2023 among environmentally conscious consumers. Brands leveraging cartons have successfully differentiated themselves in the market by capitalizing on the EU’s stringent regulations on plastic usage. These factors collectively propel the segment’s rapid expansion.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was the largest by occupying a dominant share of the Europe coconut water market in 2024. The segment is likely to be driven by their extensive reach and ability to offer a wide variety of brands and product formats under one roof. The strategic placement of coconut water in high-traffic aisles, often alongside other health-focused beverages is also leveraging the growth of the segment in next coming years. According to a study by IRI Worldwide, promotional campaigns and discounts offered by supermarkets have significantly boosted sales, with a 25% increase in volume recorded in 2023.

The online retail stores are the fastest-growing category, with a projected CAGR of 14.2% between 2022 and 2027, according to Statista. This growth is fueled by the rising popularity of e-commerce platforms, which offer convenience, competitive pricing, and subscription-based models. For example, a report by Euromonitor have shown that the online sales of coconut water grew by 35% in 2023 by platforms like Amazon and HelloFresh. The ability to deliver products directly to consumers’ doorsteps has made online retail particularly appealing in urban areas. Additionally, collaborations with fitness apps and wellness influencers have expanded the customer base is propelling the segment’s rapid expansion.

REGIONAL ANALYSIS

The United Kingdom was the top performer in the Europe coconut water market with 22.3% of share in 2024. The country’s growth is driven with the robust retail infrastructure and growing demand for health-focused beverages among urban populations in cities like London and Manchester. A pivotal factor fueling this dominance is the rise of fitness culture and wellness trends. According to Mintel, over 65% of UK consumers prioritize beverages with functional health benefits, creating a fertile ground for coconut water adoption. Additionally, partnerships between brands and gyms have amplified visibility by ensuring widespread availability.

Germany coconut water market is likely to grow with a CAGR of 11.2% during the forecast period. Berlin, Munich, and Frankfurt have emerged as key consumption hubs, which was supported by a strong emphasis on organic and plant-based products. The increasing popularity of veganism has significantly bolstered demand. According to ProVeg International, 10% of Germans follow a vegan diet by driving the adoption of plant-based beverages like coconut water. Additionally, government initiatives promoting sustainable practices have encouraged eco-friendly packaging solutions.

France is likely to have steady growth pace in the future period. Paris has emerged as a critical hub with high consumer awareness of coconut water’s hydration benefits. A major driver of this growth is the integration of exotic flavors into mainstream diets. Additionally, the rise of detox diets and clean-eating routines has positioned coconut water as a staple beverage. These factors collectively propel France’s prominence in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The Coca Cola Co., The Green Coconut Foods Co. Ltd., Chi, Cocofina Ltd., Cocos Pure Beverage Corp., First Grade International, FORCE BIO SAS, Goya Foods Inc., Gracekennedy Ltd., Happy Coco BV, Helios Ingredients Ltd., MightyBee Ltd., NATURE INNOVATION, PepsiCo Inc., The Vita Coco Co. Inc., TIANA Fairtrade Organics Ltd. are playing dominating role in the Europe coconut water market.

The Europe coconut water market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Vita Coco, Harmless Harvest, and O.N.E. Coconut Water dominate the landscape by leveraging their extensive expertise in product innovation and marketing strategies. However, the market also features niche players specializing in organic and flavored variants by creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in sustainable packaging and exotic flavor infusions to differentiate themselves. According to Mintel, over 60% of European consumers prioritize beverages with functional health benefits, intensifying competition among providers to offer cutting-edge solutions. Additionally, stringent EU regulations mandating sustainability have forced companies to innovate responsibly.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common, particularly in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as flavored variants and eco-friendly packaging driving future competition.

TOP PLAYERS IN THIS MARKET

Vita Coco

Vita Coco is a global leader in the coconut water market is playing a pivotal role in shaping the Europe segment. The brand’s focus on premium quality and innovative marketing strategies has positioned it as a household name among health-conscious consumers. Vita Coco’s partnerships with fitness chains and wellness influencers have amplified its reach, while its commitment to sustainability by including ethical sourcing and recyclable packaging, aligns with EU environmental goals.

Harmless Harvest

Harmless Harvest specializes in organic and minimally processed coconut water by catering to the growing demand for clean-label beverages. The company’s unique fermentation process enhances the nutritional profile of its products is setting it apart from competitors. Harmless Harvest’s commitment to transparency and sustainability has earned it a loyal customer base, particularly among environmentally conscious consumers. Its collaborations with local distributors ensure widespread availability while maintaining high standards of quality.

O.N.E. Coconut Water

O.N.E. Coconut Water is renowned for its flavored variants, which combine natural ingredients with exotic infusions. The brand’s focus on innovation and regional preferences has made it a leader in the flavored coconut water segment. By partnering with local distributors, O.N.E. has ensured widespread availability while maintaining high standards of quality. Its emphasis on recyclable packaging further reinforces its commitment to sustainability, appealing to eco-conscious consumers across Europe.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Emphasis on Sustainability

Leading players in the Europe coconut water market have embraced sustainability as a core strategy to enhance their competitive edge. For instance, partnerships with eco-friendly packaging suppliers have resonated with environmentally conscious consumers. These initiatives not only align with EU regulations but also foster brand loyalty among eco-minded customers.

Innovation in Product Offerings

Investments in innovative product offerings have become a cornerstone strategy for staying ahead in the market. Companies leverage exotic flavors, functional ingredients, and unique packaging designs to differentiate themselves. This approach allows them to address evolving consumer preferences while maintaining its dominance in product innovation.

Expansion into Emerging Channels

Expanding into emerging distribution channels, such as online retail and subscription-based models, has become a priority for key players. By establishing localized e-commerce platforms and partnerships, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Vita Coco partnered with Virgin Active, a leading European fitness chain, to promote its coconut water as a post-workout hydration solution. This initiative aims to enhance brand visibility and attract health-conscious consumers.

- In June 2023, Harmless Harvest launched a line of biodegradable cartons in France, designed to reduce plastic waste and align with EU environmental goals. This move underscores the company’s commitment to sustainability.

- In September 2023, O.N.E. Coconut Water introduced a new range of exotic flavors, including guava and dragon fruit, targeting younger demographics. This launch seeks to capitalize on the growing demand for unique taste experiences.

- In January 2024, Innocent Drinks expanded its coconut water portfolio in the UK by introducing affordable pricing options for budget-conscious consumers. This strategy aims to increase market penetration and accessibility.

- In November 2023, Cocofina unveiled its coconut water powder in Germany, designed to cater to outdoor enthusiasts and travelers. This initiative positions Cocofina as a leader in portable hydration solutions.

MARKET SEGMENTATION

This research report on the Europe Coconut Water market is segmented and sub-segmented into the following categories.

By Type

- Sweetened

- Unsweetened

By Form

- Coconut Water

- Coconut Water Powder

By Packaging

- Carton

- Bottles

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate for the Europe coconut water market?

The Europe coconut water market is expected to grow at a compound annual growth rate (CAGR) of 13.26% from 2025 to 2033.

2. What factors are driving the growth of the Europe coconut water market?

Key drivers include increasing consumer preference for healthy and functional beverages, growing awareness about hydration benefits, and innovations in eco-friendly packaging.

3. What trends are influencing the Europe coconut water market?

Trends include rising demand for plant-based and low-calorie drinks, innovative product offerings such as flavored coconut water, and increasing use of sustainable packaging materials.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com