Europe composites Market Size, Share, Trends & Growth Forecast Report By Manufacturing Process(Lay-Up Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding (Rtm) Process, Other Manufacturing Processes), Fiber Type, Resin Type, End Use, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Composites Market Size

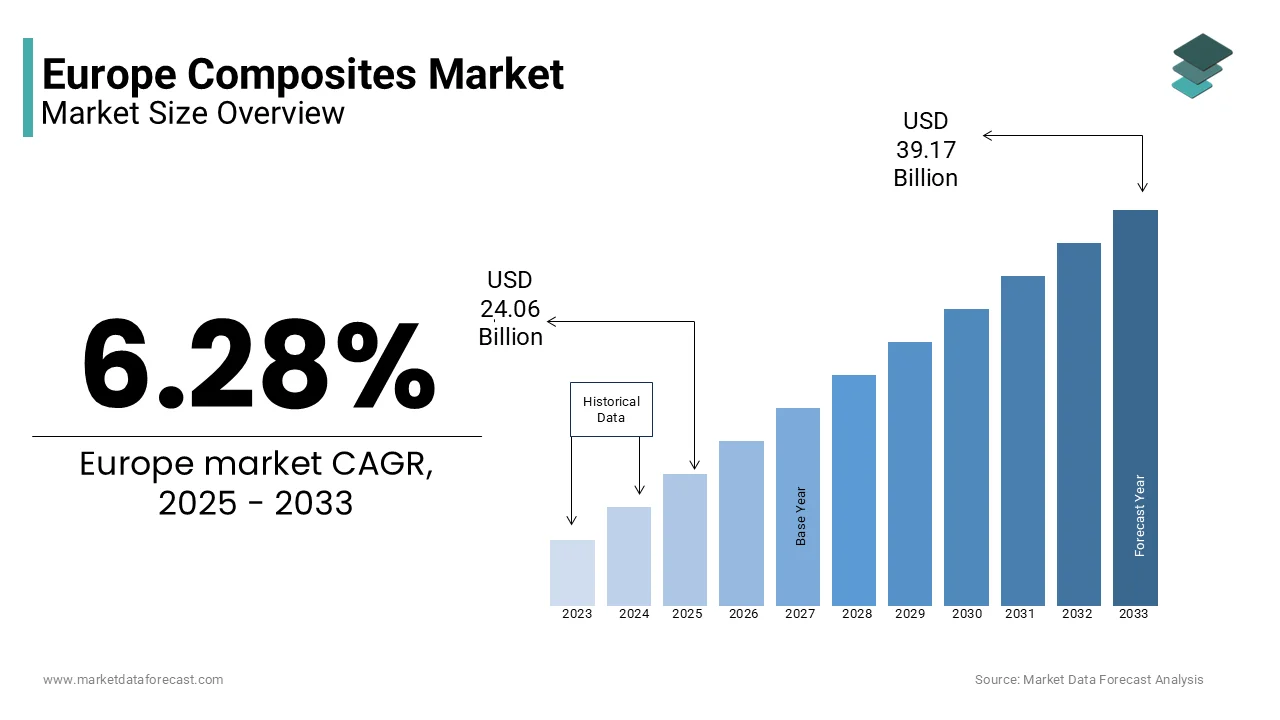

The composites market size in Europe was valued at USD 22.64 billion in 2024. The European market size is estimated to be worth USD 39.17 billion by 2033 from USD 24.06 billion in 2025, growing at a CAGR of 6.28% from 2025 to 2033.

The European composites market represents a dynamic and rapidly evolving sector. It is characterized by the integration of advanced materials such as fiber-reinforced polymers, thermoplastics, and other engineered composites. These materials are widely utilized across industries including aerospace, automotive, construction, wind energy, and marine, due to their superior strength-to-weight ratio, corrosion resistance, and design flexibility. According to a report by JEC Group, a leading composites industry organization, Europe accounts for nearly 25% of global composites products, emphasizing its pivotal role in shaping global trends within this domain.

The market's growth is further bolstered by stringent environmental regulations and the European Union’s Green Deal, which emphasizes reducing carbon emissions and promoting circular economy practices. For instance, the adoption of composites in wind turbine blades has surged, contributing significantly to renewable energy capacity expansion. A study published by the European Composites Industry Association shows that over 40% of all wind turbine blades produced in Europe now incorporate advanced composite materials. Also, the automotive sector is witnessing increased utilization of composites to meet fuel efficiency standards, with electric vehicle manufacturers leveraging these materials for structural components. Despite challenges such as high production costs and recycling complexities, innovations in bio-based resins and recyclable composites are expected to mitigate these issues. The convergence of regulatory support, industrial innovation, and sustainability goals positions the European composites market as a cornerstone of modern material science and industrial transformation.

MARKET DRIVERS

Sustainability and the European Green Deal

The European composites market is significantly driven by the region's commitment to sustainability, as articulated in the European Green Deal. This landmark initiative is introduced by the European Commission and aims to achieve climate neutrality by 2050 fostering demand for materials that reduce energy consumption and carbon emissions. Lightweight composites are pivotal in this transition, particularly in renewable energy and transportation sectors. According to the International Energy Agency, wind energy capacity in Europe expanded by 17% in 2022, composites materials comprising nearly 90% of turbine blades due to their durability and efficiency-enhancing properties. Also, the European Environment Agency notes that lightweight composites in electric vehicles can reduce energy consumption by up to 15%, aligning with stringent emission reduction targets under the EU’s regulatory framework.

Aerospace and Defense Sector Investments

The aerospace and defense industries serve as another major driver for the European composites market, fueled by substantial investments in advanced material technologies. The Horizon Europe program, a flagship research initiative by the European Union, has allocated over €1 billion for aerospace innovation, emphasizing the development of lightweight composites. Eurostat reports that the aerospace sector contributes approximately €110 billion annually to the EU economy, with composites accounting for nearly 50% of the structural weight in modern aircraft like the Airbus A350. These materials offer an exceptional strength-to-weight ratio, reducing fuel consumption and operational costs. Furthermore, the European Defence Agency notes that defense applications are increasingly adopting composites for ballistic protection and structural components, driven by heightened security concerns across Europe. This dual demand from the aerospace and defense sectors continues to propel the growth of the composites market.

MARKET RESTRAINTS

High Production Costs and Economic Constraints

One of the primary restraints of the European composites market is the high production cost associated with advanced composite materials, which limits their widespread adoption across price-sensitive industries. The European Commission’s Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs notes that the manufacturing costs of composites are approximately 30-40% higher than traditional materials like steel or aluminum. This cost disparity is primarily due to the energy-intensive processes involved in producing carbon fiber and specialized resins. Further, Eurostat reports that small and medium-sized enterprises (SMEs), which form the backbone of Europe’s industrial sector, face significant financial barriers in adopting composites technologies, with only 20% of SMEs currently integrating these materials into their operations. As a result, the high upfront investment required for composites production and processing equipment acts as a deterrent, particularly during periods of economic uncertainty or inflationary pressures.

Recycling Challenges and Environmental Concerns

Another major restraint is the difficulty in recycling composite materials, which poses environmental and regulatory challenges. The European Environment Agency found that less than 15% of composite waste is currently recycled in Europe, with the majority ending up in landfills due to the complex nature of separating fibers from polymer matrices. This issue contradicts the European Union’s Circular Economy Action Plan, which mandates increased recycling rates and reduced landfill use. Apart from this, the International Renewable Energy Agency notes that the wind energy sector alone generates over 60,000 tons of composites waste annually from decommissioned turbine blades raising concerns about sustainable waste management. While innovations in recyclable composites are emerging, they remain limited in scalability and application. These recycling challenges not only hinder market growth but also attract stricter regulatory scrutiny, creating additional compliance burdens formanufacturerse

MARKET OPPORTUNITIES

Growth in Electric Vehicle Manufacturing

The rapid expansion of the electric vehicle (EV) industry presents a significant opportunity for the European composites market, which is driven by the need for lightweight materials to enhance energy efficiency. The European Automobile Manufacturers’ Association reports that EV sales in Europe surged by 65% in 2022, accounting for over 20% of total car sales. Lightweight composites are critical in reducing vehicle weight, which directly impacts battery efficiency and driving range. As per the International Energy Agency, incorporating advanced composites into EVs can reduce vehicle weight by up to 3,0%, leading to a 10-15% improvement in energy efficiency. Besides these, the European Commission’s Strategic Action Plan on Batteries emphasizes the role of innovative materials in achieving the EU’s goal of producing 30 million EVs by 2030. This growing demand for sustainable mobility solutions positions composites as a key enabler of the EV revolution.

Expansion of Renewable Energy Infrastructure

The ongoing expansion of renewable energy infrastructure, particularly wind and solar, offers another major opportunity for the European composites market. The European Commission’s Renewable Energy Progress Report states that renewables accounted for 22% of the EU’s total energy consumption in 2022, with wind energy being a dominant contributor. Composites are integral to wind turbine blades, with the Global Wind Energy Council estimating that Europe installed over 17 GW of new wind capacity in 2022. In addition, the European Environment Agency shows that offshore wind projects that rely heavily on durable composites are expected to grow by 150% by 2030. Beyond wind, solar panel frames and mounts are increasingly adopting composite materials due to their corrosion resistance and longevity. These developments align with the EU’s target of achieving 4a 2.5% renewable energy share by 2030, creating a robust demand for advanced composites in the renewable energy sector.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Dependence

The European composites market faces significant challenges due to supply chain disruptions and heavy reliance on imported raw materials, such as carbon fiber and specialized resins. The European Commission’s Directorate-General for Trade highlights that over 60% of the raw materials used in composites production are sourced from non-EU countries, making the industry vulnerable to geopolitical tensions and trade restrictions. For instance, during the COVID-19 pandemic, disruptions led to a 25% increase in lead times for critical raw materials, as reported by Eurostat. Moreover, the International Energy Agency notes that the rising demand for carbon fiber, driven by industries like aerospace and automotive, has caused price volatility, with costs increasing by nearly 15% in 2022. These supply chain vulnerabilities hinder production scalability and raise operational risks, particularly for small and medium-sized enterprises reliant on consistent material availability.

Regulatory Compliance and Standardization Gaps

Another pressing challenge is the complexity of regulatory compliance and the lack of standardized practices across the European composites market. The European Chemicals Agency emphasizes that composites often contain substances subject to stringent REACH regulations, which govern chemical safety and environmental impact. Non-compliance can result in fines exceeding €5 million for large manufacturers, as seen in recent enforcement actions. Also, the European Committee for Standardization reports that the absence of unified testing and certification standards for composite materials creates barriers to market entry and cross-border trade. This fragmentation is particularly evident in the construction sector, where varying national standards delay project approvals. According to the European Environment Agency, these regulatory hurdles, coupled with evolving sustainability mandates, require significant investment in research and adaptation, posing financial and operational challenges for market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.28% |

|

Segments Covered |

By Manufacturing process, Fiber Type, Resin Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Hexcel Corporation, SGL Carbon SE, Toray Industries Inc., Teijin Limited, Solvay SA, Owens Corning, Gurit Holding AG, Exel Composites, and Tricel |

SEGMENTAL ANALYSIS

By Manufacturing Process Insights

The injection molding process segment was the largest in the European composites market by holding a market share of 35.4% in 2024. Its dominance is credited to its ability to produce high volumes of intricate parts with consistent quality, making it indispensable in the automotive and consumer goods sectors. The International Energy Agency brings to attention that advancements in thermoplastic composites have reduced cycle times by 20%, further boosting adoption. With over 40% of lightweight components in electric vehicles manufactured using this process, its importance in driving sustainability and efficiency is undeniable.

The pultrusion process is the fastest-growing segment, with a CAGR of 6% during the forecast period. This growth is fueled by increasing demand for durable, corrosion-resistant profiles in construction and infrastructure projects. Eurostat data shows that pultruded composites are replacing traditional materials like steel and aluminum in applications such as bridges and building facades, driven by their superior strength-to-weight ratio and lower maintenance costs. As Europe invests heavily in sustainable construction, pultrusion’s role in enabling eco-friendly designs underscores its rapid expansion and significance.

By Fiber Type Insights

The Glass composites segment dominated the European composites market by holding a 60.4% market share in 2024. This grip over the market is due to its cost-effectiveness, versatility, and widespread use in key industries like wind energy and construction. Eurostat reports that glass fiber composites are used in over 85% of wind turbine blades, supporting Europe’s renewable energy expansion. The International Energy Agency stresses that wind energy capacity in Europe grew by 17% in 2022, driven by these materials. Their excellent mechanical properties and corrosion resistance make them indispensable for durable, high-performance applications, ensuring their continued dominance in the composites market.

The natural composites segment is rising quickly in the market, with a CAGR of 12.2%. This growth is fueled by increasing demand for sustainable materials, with natural fibers like flax and hemp replacing synthetic alternatives in the automotive and packaging sectors. Eurostat data shows that industries adopting natural fibers reduced carbon footprints by up to 30%. Stricter environmental regulations and Europe’s Green Deal further accelerate adoption. As industries prioritize eco-friendly solutions, natural fiber composites are critical for achieving sustainability goals, making them a transformative force in the composites market.

By Resin Type Insights

The thermoset composites segment commanded the European composites market by contributing a 66.3% market share in 2024. This is because of their superior mechanical properties and widespread use in critical applications such as wind turbine blades and aerospace components. The International Energy Agency notes that thermosets are used in over 90% of wind turbine blades, supporting Europe’s renewable energy expansion, which saw a 17% increase in wind energy capacity in 2022. Despite challenges in recyclability, their durability and cost-effectiveness make them indispensable for high-performance industries, ensuring their continued dominance in the composites market.

The thermoplastic composite category is expanding rapidly in the market, with a CAGR of 8%. This development is influenced by increasing demand for recyclable materials and alignment with Europe’s sustainability goals, including the Green Deal. Eurostat found that thermoplastics reduce vehicle weight by up to 25%, improving EV energy efficiency and reducing emissions. Their compatibility with automated manufacturing processes further accelerates adoption. As industries prioritize eco-friendly solutions, thermoplastic composites are becoming pivotal in achieving circular economy objectives, making them a transformative force in the European composites market.

By End-User Industry Insights

The wind energy segment was the biggest end-user in the European composites market by accounting for 25.5% of the market share in 2024. Its market control is linked to the growing demand for renewable energy, with Europe installing over 17 GW of new wind capacity in 2022, according to the International Energy Agency. Composites are used in 90% of turbine blades due to their durability and ability to enhance energy efficiency. As the EU targets 42.5% renewable energy by 2030, wind energy remains critical for reducing carbon emissions. The sector’s reliance on composites underscores their importance in achieving Europe’s sustainability goals.

The Automotive & transportation is the fastest-growing segment, with a CAGR of 1,0% owing to the surge in electric vehicle (EV) adoption, with EV sales increasing by 65% in 2022. Composites reduce vehicle weight by up to 3%,% improving energy efficiency and aligning with stringent emission reduction targets under the European Green Deal. Eurostat emphasizes that lightweight materials are pivotal for meeting the EU’s goal of producing 30 million EVs by 2030. As the automotive industry transitions to sustainable mobilitycomposites are becoming indispensable for innovation and environmental compliance.

REGIONAL ANALYSIS

Germany continued to dominate the regional composites landscape by holding an estimated market share of 32.4% in 2024. Its influence is caused by its robust automotive and aerospace industries, which are among the largest in Europe. The European Automobile Manufacturers’ Association notes that Germany accounts for over 30% of electric vehicle production in Europe, composites playing a critical role in lightweighting and emission reduction. Additionally, the country’s strong emphasis on renewable energy, particularly wind power, further boosts demand for composites. According to the International Energy Agency, Germany installed over 4 GW of new wind capacity in,022 r,einforcing its position as a leader in sustainable innovation. The government’s focus on industrial modernization and green technologies ensures Germany remains at the forefront of the composites market.

France maintains a strong position in Europe’s composites market. It is anchored by its thriving aerospace sector, supported by companies like Airbus, which extensively useadvanced compositeins in aircraft manufacturing. The European Space Agency notes that France is a global hub for satellite and spacecraft productioncoarereites are indispensable for their strength-to-weight ratio. Also, France’s commitment to renewable energy, particularly offshore wind projects drives composites demand. Eurostat reports that France invested €10 billion in renewable energy infrastructure in 2022, showcasing its role in advancing sustainable applications of composites.

Italy is emerging as the fastest-growing composites market in this trio and is projected to record a CAGR of 7.3%. Its acceleration is backed by its strong presence in the automotive and marine industries, where composites are widely used for lightweighting and corrosion resistance. The European Marine Equipment Council reveals that Italy is a global leader in yacht manufacturing, with over 50% of luxury yachts incorporating advanced composites. Moreover, Italy’s focus on sustainable construction and infrastructure development has increased the adoption oof compositesin building facades and bridges. The Italian Ministry of Economic Development emphasizes that investments in green technologies and circular economy initiatives further propel the growth of the composites market in the country.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the European composites market include Hexcel Corporation, SGL Carbon SE, Toray Industries Inc., Teijin Limited, Solvay SA, Owens Corning, Gurit Holding AG, Exel Composites, and Tricel.

The European composites market is a highly competitive space, with many companies striving to lead the industry. Large firms like Hexcel, SGL Group, and Owens Corning dominate the market because they produce high-quality materials used in industries such as automotive, aerospace, and construction. These companies focus on innovation, creating advanced composites that are lightweight, strong, and durable. They also invest heavily in research and development to meet the growing demand for sustainable and eco-friendly materials.

Smaller companies also play an important role by targeting niche markets or offering cost-effective solutions. For example, some focus on producing composites for specific applications like wind turbine blades or sports equipment. To stay competitive, many businesses partner with research institutions or collaborate with other firms to improve their products and expand their reach.

Price competition is another key factor in this market. Many companies offer discounts or tailored packages to attract customers. They also educate buyers about the benefits of composites, such as their ability to reduce weight in vehicles, which improves fuel efficiency. Governments in Europe support this competition by promoting green technologies through subsidies and regulations, encouraging the use of sustainable materials.

This competitive environment benefits consumers by providing more choices and driving innovation. Companies are constantly improving their products to meet customer needs while addressing environmental concerns.

TOP PLAYERS IN THIS MARKET

Hexcel Corporation

Hexcel Corporation is one of the leading players in the European composites market, known for its cutting-edge materials used in aerospace, automotive, and industrial applications. The company specializes in advanced carbon fibercomposites andd honeycomb structures, which are lightweight yet incredibly strong. Hexcel has contributed significantly to the European market by providing materials that help reduce the weight of aircraft and vehicles, improving fuel efficient,cy and lowering emissions. Its partnerships with major aerospace companies, such as Airbus, have solidified its position as a key innovator in the industry. By focusing on sustainability, Hexcel has also developed eco-friendly composites that align with Europe’s green initiatives, further enhancing its reputation as a forward-thinking leader in the global composites market.

SGL Carbon

SGL Carbon is another major player in the European composites market, recognized for its expertise in carbon-based solutions. The company produces a wide range of composite materials, including graphite, carbon fibers, and specialty composites, which are used in industries like automotive, renewable energy, and construction. SGL Carbon has played a vital role in advancing wind energy technologies by supplying high-performance materials for wind turbine blades, contributing to Europe’s leadership in renewable energy. Additionally, its focus on innovation and sustainability has enabled it to meet the growing demand for lightweight and durable materials. Through strategic collaborations and investments in research, SGL Carbon continues to strengthen its influence in the global composites market.

Owens Corning

Owens Corning is a prominent name in the European composites market, particularly for its fiberglass-based products. The company is renowned for producing cost-effective and versatile ccomposites usedin construction, transportation, and infrastructure projects. Owens Corning has made significant contributions to the European market by developing materials that improve energy efficiency in buildings and enhance the performance of vehicles. Its commitment to sustainability is evident in its efforts to create recyclable composites and reduce the environmental impact of its manufacturing processes. By addressing both functional and ecological needs, Owens Corning has established itself as a key contributor to the growth and innovation of the global composites market, particularly in Europe.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Innovation and Advanced Research

One of the key strategies adopted by major players in the European composites market is a strong focus on innovation and advanced research. Companies like Hexcel and SGL Carbon invest heavily in developing cutting-edge materials that meet the evolving demands of industries such as aerospace, automotive, and renewable energy. By creating lighter, stronger, and more sustainable composites, these firms address critical challenges like reducing carbon emissions and improving fuel efficiency. For instance, advancements in carbon fiber technology have enabled the production of lightweight components for aircraft and electric vehicles, giving these companies a competitive edge. Collaborations with research institutions and universities also play a vital role, allowing them to stay ahead of technological trends and offer innovative solutions that set industry benchmarks.

Strategic Partnerships and Collaborations

Key players in the European composites market often form strategic partnerships and collaborations to strengthen their position. For example, companies partner with aerospace giants like Airbus or renewable energy leaders like Siemens Gamesa to supply specialized materials for their projects. These alliances not only expand their customer base but also ensure that their products are tailored to meet specific industry needs. Additionally, collaborations with government bodies and regulatory agencies help align their offerings with sustainability goals and regional policies. By working closely with stakeholders across the value chain, these firms enhance their visibility, credibility, and ability to deliver comprehensive solutions that drive long-term growth.

Sustainability and Eco-Friendly Initiatives

Sustainability has become a cornerstone strategy for companies in the European composites market. With stringent environmental regulations and growing consumer demand for green solutions, firms like Owens Corning and SGL Carbon are prioritizing eco-friendly practices. This includes developing recyclable composites, reducing waste during manufacturing, and using renewable energy sources in production processes. By aligning their strategies with Europe’s ambitious climate goals, these companies not only enhance their brand reputation but also tap into new markets focused on sustainability. Their efforts to create environmentally responsible products resonate well with industries like construction and wind energy, further solidifying their leadership and influence in the global composites market.

MARKET SEGMENTATION

This research report on the Europe composites market is segmented and sub-segmented into the following categories.

By Manufacturing Process

- Lay-Up Process

- Filament Winding Process

- Injection Molding Process

- Pultrusion Process

- Compression Molding Process

- Resin Transfer Molding (RTM) Process

- Other Manufacturing Processes

By Fiber Type

- 7.2 Glass Fiber Composites

- Carbon Fiber composites

- Natural Fiber Composites

- Other Fiber Types

By Resin Type

- Thermoset composites

- Thermoplastic composites

By End-User Industry

- Aerospace & Defense

- Wind Energy

- Automotive & Transportation

- Pipes

- Marine

- Electrical & Electronics

- Other End-Use Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the compound annual growth rate (CAGR) of the Europe composites market during the forecast period?

The Europe composites market is expected to grow at a CAGR of 6.28% from 2025 to 2033.

2. What factors are driving the growth of the Europe composites market?

Key drivers include increasing demand for lightweight, durable materials in industries like automotive, aerospace, wind energy, and construction, as well as advancements in manufacturing techniques and environmental regulations promoting sustainability.

3. Which countries dominate the Europe composites market?

Germany, France, Italy, and the UK are key contributors due to their strong industrial bases and high demand for composites across various sectors.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com