Europe Computational Fluid Dynamics Market Size, Share, Trends & Growth Forecast Report, Segmented By Development Model, End-User, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Computational Fluid Dynamics Market Size

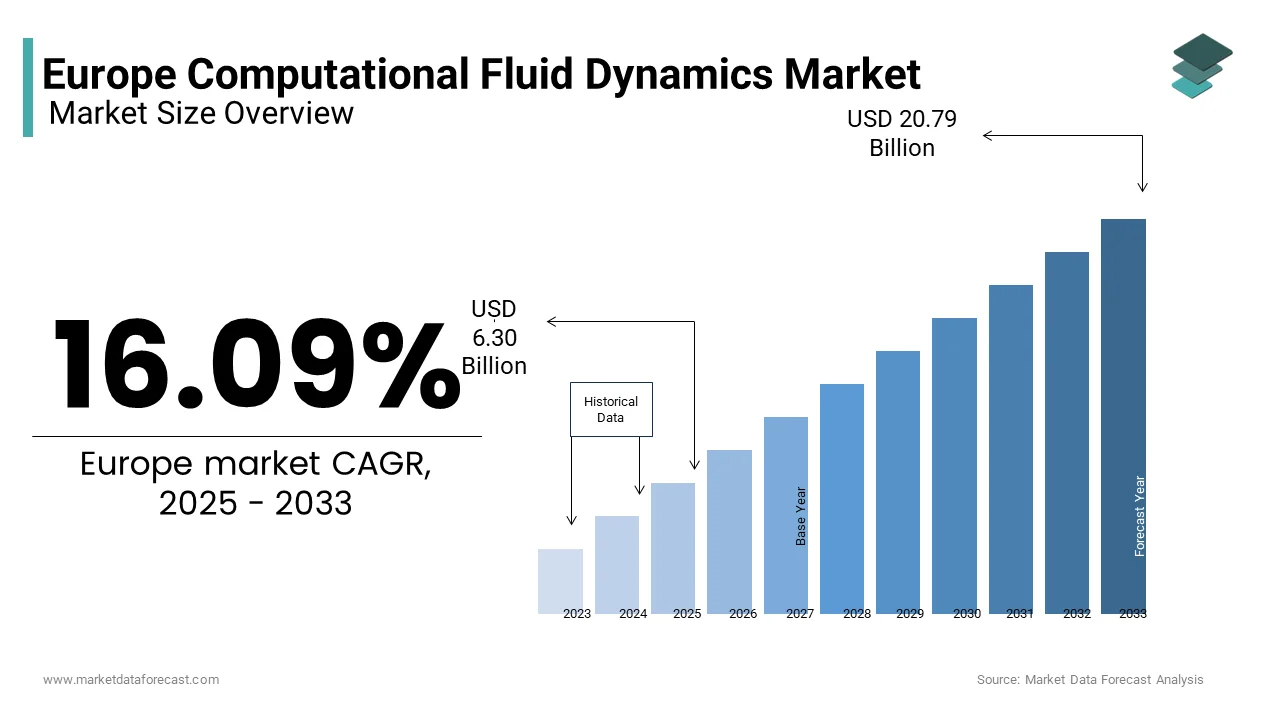

The Europe computational fluid dynamics (CFD) market was valued at USD 2822.2 million in 2024 and is anticipated to reach USD 3013.26 million in 2025 from USD 5088.98 million by 2033, growing at a CAGR of 6.77% during the forecast period from 2025 to 2033.

The Europe computational fluid dynamics (CFD) market is a critical component of the region’s advanced engineering and manufacturing landscape, driven by its applications in optimizing designs and improving efficiency across industries. The cloud-based deployment models are gaining traction with the investments in digital transformation. According to Eurostat, many European manufacturers now integrate simulation tools into their workflows with the technology’s importance.

MARKET DRIVERS

Increasing Demand for Energy Efficiency

The push for energy-efficient designs in industries such as automotive, aerospace, and HVAC systems has significantly driven the adoption of computational fluid dynamics (CFD) tools. According to the European Automobile Manufacturers’ Association, automakers reduced vehicle drag coefficients by an average of 15% using CFD simulations, saving approximately 10% on fuel consumption. In 2022, over 70% of new car designs utilized CFD, as stated by the European Green Vehicles Initiative. These advancements align with the EU’s Green Deal, which mandates a 55% reduction in carbon emissions by 2030. The demand for CFD solutions is expected to rise steadily as industries increasingly prioritize sustainability.

Advancements in Cloud-Based Technology

The proliferation of cloud-based deployment models has revolutionized accessibility and scalability for computational fluid dynamics (CFD) tools. According to the European Cloud Alliance, cloud adoption in engineering and manufacturing surged by 40% between 2020 and 2022 by enabling smaller firms to leverage advanced simulations without significant upfront investments. Cloud-based CFD platforms reduce hardware dependency and offer real-time collaboration, making them ideal for distributed teams. For instance, Siemens reported a 35% increase in cloud-based CFD usage among its European clients in 2022, citing faster processing times and cost savings. The flexibility and cost-effectiveness of cloud-based solutions ensure their dominance in the CFD market is driving innovation and broadening accessibility.

MARKET RESTRAINTS

High Implementation Costs

The high cost of implementing computational fluid dynamics (CFD) solutions remains a significant barrier for small and medium-sized enterprises (SMEs). According to the European Manufacturing Alliance, initial setup costs for CFD software and hardware can exceed €100,000 is deterring adoption among budget-constrained organizations. Furthermore, maintaining specialized IT infrastructure adds to operational expenses. While larger corporations can absorb these costs, SMEs struggle to justify the investment is also limiting market penetration.

Shortage of Skilled Professionals

A persistent shortage of skilled professionals proficient in computational fluid dynamics (CFD) poses another significant challenge. The complexity of CFD tools requires expertise in fluid mechanics, numerical methods, and software programming, making it difficult for companies to find suitable talent. The European Engineering Federation estimates that over 50,000 additional CFD specialists will be needed by 2025 to meet growing demand. Training programs are limited, with only a handful of universities offering specialized courses. This skills gap not only delays project timelines but also increases reliance on external consultants are raising costs. Addressing this issue requires targeted educational initiatives and industry-academia collaborations to bridge the talent deficit.

MARKET OPPORTUNITIES

Growth in Renewable Energy Applications

The renewable energy sector presents a lucrative opportunity for the computational fluid dynamics (CFD) market, driven by the need for optimized designs in wind turbines, solar panels, and hydropower systems. Similarly, the SolarPower Europe association reports that CFD simulations enhanced solar panel cooling systems by increasing energy output by 15%. Hydropower projects also rely on CFD to model water flow and turbine performance, reducing energy losses by up to 10%. The EU’s Green Deal aims to quadruple offshore wind capacity by 2030, creating substantial demand for CFD tools. A study by the European Renewable Energy Council projects that renewable energy applications will account for 30% of the CFD market by 2028. These developments ensure sustained growth for the market amid the energy transition.

Expansion in Industrial Machinery Optimization

The industrial machinery sector offers another promising avenue for the computational fluid dynamics (CFD) market. Industries such as chemical processing and manufacturing leverage CFD to simulate fluid flow, heat transfer, and material interactions is improving efficiency by up to 20%. For instance, BASF reported a 12% reduction in production costs after implementing CFD tools to optimize reactor designs. The European Commission’s Industry 5.0 initiative further emphasizes smart manufacturing by encouraging the integration of simulation technologies.

MARKET CHALLENGES

Complexity of Integration with Legacy Systems

Integrating computational fluid dynamics (CFD) tools with legacy systems remains a significant challenge in traditional manufacturing sectors. According to the European Manufacturing Alliance, over 60% of industrial firms still rely on outdated infrastructure by complicates the adoption of modern simulation technologies. Legacy systems often lack compatibility with advanced CFD software is requiring costly upgrades or custom integrations. A study by the European Engineering Federation reveals that integration challenges extend project timelines by an average of 25%, while increasing costs by 15%. Additionally, data silos and interoperability issues hinder seamless workflows by reducing the effectiveness of CFD solutions. While cloud-based platforms offer some relief, they are not universally adopted, leaving many organizations struggling to modernize. Addressing this issue requires targeted investments in digital transformation and standardized interfaces.

Regulatory Compliance and Data Security Concerns

Stringent regulatory requirements and data security concerns pose additional hurdles for the computational fluid dynamics (CFD) market. According to the European Data Protection Board, industries handling sensitive data must comply with GDPR, which mandates strict controls on data storage and processing. This is particularly challenging for cloud-based CFD platforms, where data breaches could result in penalties exceeding €20 million, as reported by the European Cybersecurity Organization. Furthermore, industries such as aerospace and defense face additional compliance mandates, requiring robust encryption and access controls. According to the European Commission’s Digital Trust Framework, 40% of CFD users cite security as a primary concern. These challenges not only increase operational complexity but also deter adoption among risk-averse organizations. Strengthening cybersecurity measures and ensuring regulatory alignment are critical to overcoming these barriers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.09% |

|

Segments Covered |

By Development Model, End-User and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Ansys Inc., Dassault Systemes, COMSOL AB, Siemens, Autodesk, The MathWorks, Inc., etc |

SEGMENTAL ANALYSIS

By Development Model Insights

The on-premises deployment model was the largest segment in the Europe computational fluid dynamics (CFD) market by capturing 56.4% of the share on 2024 owing to its reliability and control over sensitive data, appealing to industries like aerospace and defense. Additionally, large enterprises with established IT infrastructures favor this model for its customization capabilities.

The cloud-based deployment model is likely to experience a fastest CAGR of 12.5% from 2025 to 2033. Its growth is fueled by affordability and scalability by attracting SMEs and startups. Siemens reports a 40% annual increase in cloud-based CFD adoption owing to the rsemote collaboration features. The European Commission’s Digital Europe Programme allocates €2 billion to promote cloud technologies, further accelerating adoption. These trends ensure sustained growth for the segment.

By End-User Insights

The automotive sector led the Europe computational fluid dynamics (CFD) market by accounting for 30.5% of the share in 2024 with the increasing need for aerodynamic optimization and emissions reduction.

The aerospace and defense segment is anticipated to witness a CAGR of 11.5% during the forecast period. Innovations in aircraft design and regulatory mandates propel its rapid expansion.

COUNTRY ANALYSIS

Germany held the largest share of the Europe computational fluid dynamics (CFD) market by occupying 30.2% in 2024. The growth of the segment is attributed by the robust automotive and manufacturing sectors, which extensively utilize CFD for aerodynamic optimization, emissions reduction, and process efficiency. Additionally, stringent regulatory standards favoring sustainability have driven adoption, with industries leveraging CFD to

Spain is esteemed to hit a fastest CAGR of 10.8% from 2025 to 2033. This growth is fueled by investments in renewable energy projects, particularly wind and solar power, which rely heavily on CFD for design optimization. For instance, Spain’s National Renewable Energy Plan aims to achieve 74% renewable electricity by 2030 by creating substantial demand for CFD tools. Furthermore, government incentives for industrial modernization and smart manufacturing are accelerating adoption across sectors such as aerospace and automotive.

France and Italy are expected to witness steady growth, supported by advancements in aerospace and defense, as well as industrial machinery optimization. According to France’s Ministry of Ecological Transition, investments in sustainable aviation technologies are rising, driving CFD adoption. Similarly, Italy’s focus on precision engineering aligns with increased demand for simulation tools.

KEY MARKET PLAYERS

Ansys Inc., Dassault Systemes, COMSOL AB, Siemens, Autodesk, The MathWorks, Inc., etc. are the market players that are dominating the Europe computational fluid dynamics (CFD) market.

Top Strategies Used By Key Players

Key players in the Europe computational fluid dynamics (CFD) market employ diverse strategies to maintain their competitive edge. One prominent approach is the expansion of cloud-based solutions, enabling scalable and cost-effective access for small and medium-sized enterprises (SMEs). For instance, Siemens AG launched a cloud-native CFD platform in 2023 by targeting SMEs seeking affordable yet powerful simulation tools. Strategic partnerships also play a crucial role, with Dassault Systèmes collaborating with renewable energy firms to develop tailored solutions for wind turbine optimization. Additionally, companies focus on mergers and acquisitions to enhance their product portfolios. ANSYS Inc., for example, acquired a niche cloud platform provider to integrate advanced data analytics capabilities into its offerings. Investments in research and development remain central, with firms prioritizing user-friendly interfaces and AI-driven enhancements to improve accessibility and performance.

COMPETITION OVERVIEW

The Europe computational fluid dynamics (CFD) market is characterized by intense competition, with established players vying for market share through innovation and customer-centric strategies. These companies leverage their expertise in advanced engineering simulations, global distribution networks, and strategic collaborations to maintain their dominance. Smaller players, however, are gaining traction by offering niche solutions tailored to specific industries or applications. Regulatory compliance and sustainability initiatives further differentiate competitors, with firms emphasizing eco-friendly practices to align with EU directives. The competitive landscape is also shaped by technological advancements, such as AI integration and cloud-based platforms by enabling participants to address emerging challenges effectively and cater to evolving customer needs.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, ANSYS Inc. acquired a cloud platform provider specializing in data analytics to enhance its cloud-based CFD offerings. This acquisition is anticipated to streamline workflows and improve scalability for its clients.

- In June 2023, Siemens AG launched a cloud-native CFD tool designed specifically for small and medium-sized enterprises. This initiative aims to democratize access to advanced simulation technologies while reducing costs.

- In January 2023, Dassault Systèmes partnered with a leading renewable energy firm to develop customized CFD solutions for optimizing wind turbine designs. This collaboration escalates its commitment to supporting Europe’s green energy transition.

- In March 2022, ANSYS Inc. invested €50 million in research and development to integrate artificial intelligence capabilities into its CFD software. This move positions the company as a leader in AI-driven simulation tools.

- In July 2021, Siemens AG opened a state-of-the-art CFD training center in France to bridge the skills gap and provide hands-on learning opportunities for engineers. This facility is expected to train over 5,000 professionals annually.

MARKET SEGMENTATION

This research report on the Europe computational fluid dynamics (CFD) market is segmented and sub-segmented into the following categories.

By Development Type

- Cloud-Based Model

- On-Premises Model

By End-User

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Industrial Machinery

- Energy

- Material and Chemical Processing

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the CFD market in Europe?

The market is growing due to increased demand in the automotive, aerospace, and energy sectors for simulation-based design optimization and efficiency improvements.

Which countries in Europe are leading in CFD adoption?

Germany, the UK, and France are the frontrunners, supported by strong industrial bases and investment in R&D.

What industries are the main users of CFD in Europe?

Key users include automotive, aerospace, power generation, healthcare, and chemical processing industries.

What trends are shaping the CFD market in Europe?

Key trends include the integration of AI and machine learning, cloud-based simulation, and the growing use in renewable energy applications.

What are the major challenges for CFD market growth in Europe?

Challenges include high software costs, a need for skilled professionals, and complex regulatory requirements in certain sectors.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com