Europe Copper Pipes and Tubes Market Size, Share, Trends & Growth Forecast Report, Segmented By Application and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Copper Pipes and Tubes Market Size

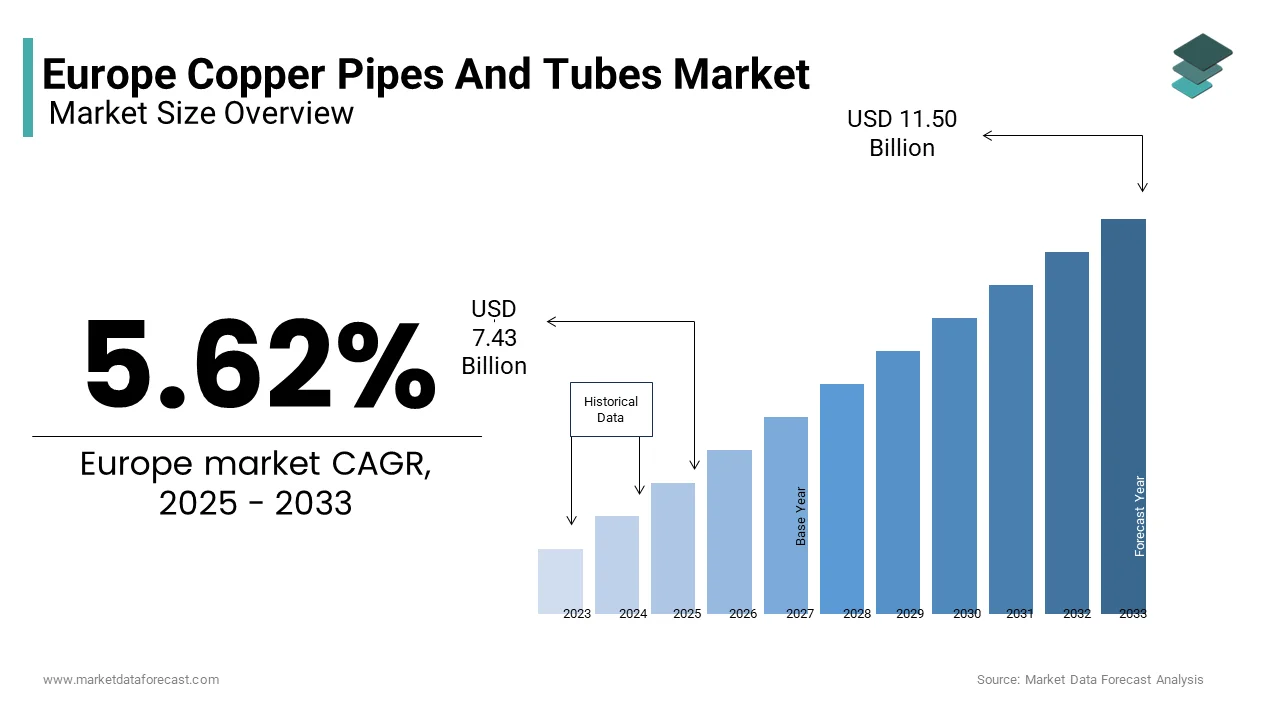

The Europe copper pipes and tubes market was valued at USD 7.03 billion in 2024 and is anticipated to reach USD 7.43 billion in 2025 from USD 11.50 billion by 2033, growing at a CAGR of 5.62% during the forecast period from 2025 to 2033.

The copper pipes and tubes is a cornerstone of the Europe’s industrial and construction sectors, underpinned by its versatility and reliability in applications such as plumbing, HVAC, and electrical systems. As per Eurostat, the construction sector accounted for over 10% of the EU’s GDP in 2022, with copper products playing a pivotal role due to their durability and conductivity. Meanwhile, stringent environmental regulations favoring sustainable materials have further bolstered copper’s adoption. However, supply chain disruptions caused by geopolitical tensions have intermittently affected market stability.

MARKET DRIVERS

Increasing Demand in HVAC Systems

The surge in demand for HVAC systems across Europe has significantly propelled the copper pipes and tubes market. Copper’s superior thermal conductivity makes it indispensable for heat exchangers and refrigeration systems. According to the International Energy Agency (IEA), HVAC systems account for approximately 10% of Europe’s total energy consumption, with copper being the preferred material due to its efficiency. In 2022, the HVAC segment consumed nearly 2.5 million tons of copper globally, with Europe representing 30% of this demand, as reported by the European Heat Pump Association. Additionally, rising awareness about energy-efficient buildings has led to stricter regulations is mandating the use of high-performance materials like copper. For instance, the EU’s Energy Performance of Buildings Directive encourages retrofitting old structures with energy-efficient HVAC systems, further boosting copper demand.

Expansion of Electrical and Electronics Applications

The proliferation of renewable energy projects and electrification initiatives has intensified the demand for copper pipes and tubes in electrical applications. Copper’s exceptional electrical conductivity makes it ideal for wiring, transformers, and solar panel installations. According to the European Renewable Energy Council, renewable energy capacity in Europe grew by 17% in 2022, with solar power installations alone reaching 41 GW. This expansion required an estimated 500,000 tons of copper, as stated by the European Copper Institute. Furthermore, the EU’s Green Deal targets achieving carbon neutrality by 2050 with the significant investments in smart grids and electric vehicle charging infrastructure. These developments are expected to increase copper demand by 3.5% annually through 2028, according to the European Commission.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

The volatility of copper prices poses a significant challenge to the Europe copper pipes and tubes market. Copper is a globally traded commodity, and its prices are highly sensitive to geopolitical tensions, supply chain disruptions, and currency fluctuations. According to the London Metal Exchange (LME), copper prices surged by over 25% in 2022 due to supply constraints caused by the Russia-Ukraine conflict. Such price instability increases manufacturing costs and impacts profit margins for companies operating in the region. For instance, the European Association of Metal Traders reported that small and medium-sized enterprises faced a 15% rise in input costs during the same period. Moreover, unpredictable pricing discourages long-term investments in copper-based projects in price-sensitive sectors like construction.

Stringent Environmental Regulations

Stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability are hindering the growth of the Europe copper pipes and tubes market. The extraction and processing of copper are energy-intensive processes is contributing significantly to greenhouse gas emissions. The manufacturers must invest heavily in cleaner technologies to comply with the EU’s Emissions Trading System (ETS). A study by the European Copper Institute revealed that compliance costs increased by 12% annually between 2019 and 2022. Additionally, regulatory delays in approving new mining projects have limited raw material availability, further complicating market dynamics.

MARKET OPPORTUNITIES

Growth in Electric Vehicle Infrastructure

The rapid adoption of electric vehicles (EVs) presents a lucrative opportunity for the Europe copper pipes and tubes market. EVs require up to three times more copper than conventional vehicles, primarily for batteries, wiring, and charging infrastructure. According to the European Automobile Manufacturers’ Association, EV sales in Europe grew by 65% in 2022, reaching 2.6 million units. This trend is expected to accelerate, with the EU mandating that all new cars be zero-emission by 2035. The European Copper Institute estimates that the EV charging network alone will require an additional 200,000 tons of copper by 2030. Furthermore, investments in battery production facilities, such as Tesla’s Gigafactory in Germany, are driving localized demand for copper components.

Advancements in Renewable Energy Projects

The expansion of renewable energy projects offers another promising avenue for the copper pipes and tubes market. Copper’s role in solar panels, wind turbines, and energy storage systems underscores its importance in Europe’s green energy transition. According to the European Wind Energy Association, wind energy capacity in Europe increased by 18% in 2022, requiring an estimated 400,000 tons of copper. Similarly, the SolarPower Europe association reports that solar installations grew by 47% during the same period, further amplifying copper demand. The EU’s Green Deal aims to quadruple offshore wind capacity by 2030 by creating substantial opportunities for copper-intensive technologies. According to a study by the European Copper Institute, renewable energy applications could account for 40% of Europe’s copper demand by 2030.

MARKET CHALLENGES

Rising Competition from Alternative Materials

The Europe copper pipes and tubes market faces increasing competition from alternative materials such as aluminum and plastic, which are often cheaper and lighter. Aluminum, for instance, is gaining traction in HVAC and electrical applications due to its lower cost and comparable performance in certain scenarios. Similarly, plastic pipes are widely adopted in plumbing due to their corrosion resistance and ease of installation. A report by the European Plastics Converters Association reveals that plastic pipes now account for 45% of the plumbing market. While copper remains the preferred choice for high-performance applications, the encroachment of substitutes threatens its dominance, particularly in price-sensitive segments. Industry players must innovate to maintain competitiveness amidst this shifting landscape.

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Europe copper pipes and tubes market and exacerbated by geopolitical tensions and logistical bottlenecks. The Russia-Ukraine conflict has disrupted copper imports, with Europe relying heavily on external suppliers for raw materials. Additionally, port congestion and shipping delays have further strained supply chains is leading to inventory shortages. As per a study by the European Logistics Association, transportation costs increased by 20% in 2022 is impacting the affordability of copper products. These disruptions not only hinder market growth but also create uncertainty for manufacturers and end-users. Addressing these challenges requires diversifying supply sources and investing in local production capabilities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.62% |

|

Segments Covered |

By Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Mueller Industries Inc.; Wieland Group; Cambridge-Lee Industries LLC; Kobe Steel; MetTube Berhad; KME Group S.p.A.; MM Kembla; LUVATA; Cerro Flow Products LLC; Shanghai Metal Corporation. |

SEGMENTAL ANALYSIS

By Application Insights

The plumbing segment dominated the Europe copper pipes and tubes market by holding a share of 45.7% in 2024. Copper’s corrosion resistance, longevity, and hygienic properties make it the material of choice for water distribution systems. According to Eurostat, the construction sector, which heavily relies on plumbing solutions, accounted for over 10% of the EU’s GDP in 2022. Urbanization trends and infrastructure development further drive demand, with Germany and France leading in plumbing installations. Additionally, stringent water quality regulations mandate the use of durable materials, ensuring copper’s continued dominance. The European Copper Institute reports that copper pipes reduce maintenance costs by 20% compared to alternatives. These factors collectively position plumbing as the largest and most stable segment in the market.

The electrical and electronics segment is likely to register a Europe copper pipes and tubes market, with a projected CAGR of 6.2% from 2025 to 2033. This growth is fueled by the expansion of renewable energy projects and electrification initiatives. For instance, the European Renewable Energy Council states that solar energy capacity grew by 47% in 2022 with the extensive copper wiring. Similarly, the EU’s Green Deal emphasizes smart grid development is requiring copper for efficient energy transmission. The European Commission projects that investments in renewable energy will exceed €1 trillion by 2030. Copper’s unparalleled conductivity and reliability make it indispensable in these applications by ensuring sustained growth for the segment.

COUNTRY ANALYSIS

Germany was the top performer in the Europe copper pipes and tubes market with an estimated share of 25.3% in 2024. This dominance is driven by the country’s strong industrial base, stringent regulatory standards favoring durable materials like copper, and a thriving construction sector. Urbanization trends and investments in energy-efficient infrastructure further bolster demand. For instance, Germany’s National Energy Efficiency Action Plan mandates the use of sustainable materials in public projects by ensuring copper remains a preferred choice.

Spain is likely to experience a projected CAGR of 5.8% from 2025 to 2033. The growth is fueled by government incentives for renewable energy projects, urbanization, and smart city development. Investments in solar energy installations have surged by requiring extensive copper wiring and components. Furthermore, Spain’s commitment to achieving carbon neutrality by 2050 underpins its rapid adoption of copper-intensive technologies.

France and Italy are expected to witness steady growth with the infrastructure modernization and green energy projects. According to France’s Ministry of Ecological Transition, investments in HVAC systems are rising due to energy efficiency mandates. Similarly, Italy’s focus on retrofitting old buildings aligns with increased copper demand. Meanwhile, the UK’s post-Brexit industrial strategy emphasizes domestic manufacturing by creating opportunities for localized copper production.

KEY MARKET PLAYERS

Mueller Industries Inc.; Wieland Group; Cambridge-Lee Industries LLC; Kobe Steel; MetTube Berhad; KME Group S.p.A.; MM Kembla; LUVATA; Cerro Flow Products LLC; Shanghai Metal Corporation. are the market players that are dominating the Europe copper pipes and tubes market.

Top Strategies Used By Key Market Participants

Key players in the Europe copper pipes and tubes market employ a variety of strategies to strengthen their competitive edge. One prominent approach is sustainability-focused innovation, with companies investing heavily in eco-friendly production processes. For instance, Aurubis AG has pioneered carbon-neutral smelting technologies by reducing its environmental footprint while meeting regulatory requirements. Another strategy involves mergers and acquisitions to expand market presence. KME Group, for example, acquired smaller manufacturers to enhance its production capabilities and diversify its product portfolio. Strategic partnerships with renewable energy firms also play a crucial role. Wieland-Werke AG collaborates with solar energy companies to supply high-conductivity copper components by aligning with the growing demand for clean energy solutions. Additionally, R&D investments remain central to maintaining technological leadership, enabling companies to develop advanced products tailored to evolving customer needs.

COMPETITION OVERVIEW

The Europe copper pipes and tubes market is characterized by intense competition, with established players vying for market share through innovation and strategic initiatives. The market is moderately consolidated, with top players such as KME Group, Aurubis AG, and Wieland-Werke AG collectively accounting for over 40% of the market, as per industry reports. These companies leverage their expertise in precision engineering, sustainability, and global distribution networks to maintain their dominance. Smaller players, however, are increasingly gaining traction by offering cost-effective solutions and targeting niche segments. Regulatory compliance and customer-centric approaches further differentiate competitors. For instance, companies focusing on recyclable and eco-friendly products have gained an edge amid tightening environmental regulations. The competitive landscape is also shaped by collaborations and alliances by enabling participants to address emerging challenges such as raw material shortages and fluctuating prices effectively.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, KME Group acquired a Polish copper manufacturer to expand its production capacity and enhance its presence in Eastern Europe. This acquisition is anticipated to streamline supply chains and meet rising regional demand.

- In June 2023, Aurubis AG launched a groundbreaking carbon-neutral smelting process, setting a new benchmark for sustainable copper production. This initiative aligns with the EU’s Green Deal objectives and strengthens its market positioning.

- In January 2023, Wieland-Werke AG partnered with a leading renewable energy firm to supply high-conductivity copper components for solar panel installations. This collaboration underscores its commitment to supporting Europe’s energy transition.

- In March 2022, KME Group invested €50 million in research and development to innovate advanced copper alloys tailored for electric vehicle applications. This move positions the company as a key supplier in the burgeoning EV market.

- In July 2021, Aurubis AG opened a state-of-the-art recycling facility in Bulgaria, aimed at reducing dependency on virgin copper and promoting circular economy practices. This facility is expected to process over 100,000 tons of recycled copper annually.

MARKET SEGMENTATION

This research report on the Europe copper pipes and tubes market is segmented and sub-segmented into the following categories.

By Application

- Plumbing

- HVAC

- Electrical & Electronics

- Energy

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What drives the demand for copper pipes and tubes in Europe?

The demand is primarily driven by growth in HVAC systems, plumbing, and renewable energy sectors due to copper’s durability and thermal conductivity.

Which industries are the major consumers of copper pipes and tubes in Europe?

Key industries include construction, automotive, energy, and industrial manufacturing.

How is the trend toward sustainability affecting the copper pipes market?

Copper is recyclable and energy-efficient, making it a preferred material as Europe pushes for greener infrastructure.

Which countries in Europe lead in copper pipe and tube consumption?

Germany, France, Italy, and the UK are among the top consumers due to their robust construction and manufacturing sectors.

Are there any challenges facing the copper pipes and tubes market in Europe?

Yes, high raw material prices and the availability of cheaper substitutes like PEX or plastic pipes pose challenges.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]