Europe Corn Glucose Market Size, Share, Trends, & Growth Forecast Report by Type (HFCS 42, HFCS 55, Others), End-Use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Corn Glucose Market Size

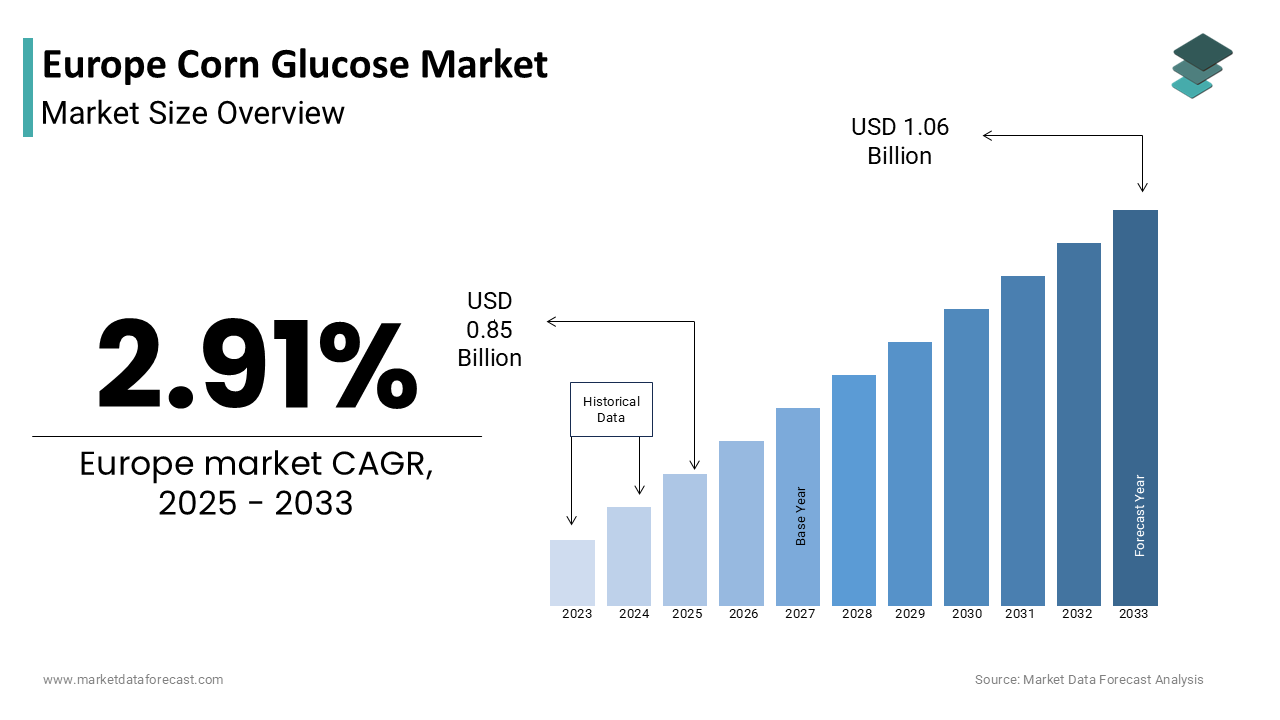

The Europe corn glucose market was worth USD 0.82 billion in 2024. The Europe market is expected to reach USD 1.06 billion by 2033 from USD 0.85 billion in 2025, rising at a CAGR of 2.91% from 2025 to 2033.

Corn glucose serves as a vital ingredient across various industries, including food and beverage, pharmaceuticals, industrial manufacturing, and animal feed. It is widely used as a sweetener, thickening agent, energy source, and fermentation substrate in large-scale applications. Unlike traditional cane sugar, corn glucose offers cost efficiency, functional versatility, and a neutral flavor profile that makes it suitable for processed foods, soft drinks, and bioethanol production.

As per Eurostat, European starch industry associations reported that corn glucose production facilities have increasingly adopted sustainable practices, including water recycling, reduced carbon emissions, and co-product utilization, aligning with the EU’s Green Deal objectives. Additionally, the shift toward plant-based diets and clean-label formulations has spurred interest in modified corn glucose derivatives for use in meat substitutes, dairy alternatives, and nutritional supplements.

MARKET DRIVERS

Growing Demand from the Beverage Industry

One of the primary drivers influencing the Europe corn glucose market is the sustained demand from the beverage sector in the production of non-alcoholic drinks such as carbonated soft drinks, flavored waters, and energy beverages. Corn glucose, especially in the form of glucose syrups and high-fructose corn syrup (HFCS), is favored for its ability to provide sweetness, texture, and stability without altering the natural flavors of the final product. Germany and France are key contributors to this trend, where beverage producers have increasingly opted for corn glucose to maintain consistent taste profiles and reduce dependency on imported sugar. Additionally, rising investments in functional and fortified beverages such as sports drinks and vitamin-enhanced waters have expanded the application scope of corn glucose beyond mere sweetening.

Expansion of the Starch-Derived Industrial Applications

A significant driver fueling the Europe corn glucose market is the expanding range of industrial applications for starch-derived glucose, particularly in the biochemical, pharmaceutical, and biodegradable materials sectors. Corn glucose serves as a foundational feedstock for producing ethanol, amino acids, organic acids, and bioplastics, all of which are gaining traction due to shifting regulatory landscapes and corporate sustainability commitments. According to European Starch Association (ESA), over 40% of industrial glucose consumption in Europe is now directed toward fermentation-based processes used in biofuel and biopolymer production.

One of the key growth areas is the use of corn glucose in bioethanol production, especially in countries like Germany, France, and Poland, where renewable energy policies encourage blending mandates. As per Eurostat, bioethanol output in the EU increased by 7% in 2023 compared to the previous year, largely driven by agricultural surplus conversion into value-added products. This trend not only supports energy independence but also enhances the economic viability of corn starch processors.

MARKET RESTRAINTS

Regulatory Scrutiny and Health Concerns Surrounding High-Fructose Corn Syrup

One of the most pressing restraints affecting the Europe corn glucose market is the increasing regulatory scrutiny and public health concerns surrounding high-fructose corn syrup (HFCS), a major derivative of corn glucose. Despite being chemically similar to sucrose, HFCS has been linked to obesity, insulin resistance, and metabolic disorders in several epidemiological studies, which is prompting policymakers and health organizations to advocate for reduced consumption. According to The European Food Safety Authority (EFSA), while current intake levels of fructose from all sources remain within acceptable limits, there is growing pressure on food manufacturers to reformulate products using alternative sweeteners.

Several European governments have introduced sugar taxes or dietary guidelines discouraging excessive use of refined sugars and syrups. As per Eurostat, countries such as France, Belgium, and Finland have implemented policies aimed at limiting HFCS usage in ultra-processed foods and beverages. These measures have prompted some beverage companies to switch back to sucrose or explore stevia and monk fruit-based sweeteners by reducing reliance on corn glucose derivatives in certain segments.

Additionally, consumer perception plays a critical role in shaping demand. According to McKinsey & Company, nearly 45% of European consumers actively avoid products containing HFCS, even if they do not fully understand the scientific nuances behind its impact. This sentiment has led to a decline in HFCS-based formulations in premium and health-oriented product lines, indirectly affecting the broader corn glucose market.

Fluctuating Raw Material Prices and Agricultural Policy Changes

Another key restraint impacting the Europe corn glucose market is the volatility in raw material prices, primarily driven by fluctuations in corn supply and evolving agricultural policy frameworks. Corn, the primary feedstock for glucose production, is subject to seasonal variations, weather disruptions, and geopolitical influences that affect yield and pricing stability. These price fluctuations create financial uncertainty for glucose syrup manufacturers, particularly smaller players who lack the purchasing power to hedge against sudden cost increases. Additionally, shifts in EU Common Agricultural Policy (CAP) subsidies have altered land-use patterns, which is affecting long-term corn cultivation trends.

Moreover, competition for corn from the biofuel and livestock feed sectors has intensified, further straining availability for industrial glucose extraction. Nearly 30% of EU corn output is now diverted to ethanol production, reducing the share available for starch processing. Unless stable supply chains and policy incentives can be established, raw material volatility will continue to pose a significant challenge to the European corn glucose market.

MARKET OPPORTUNTIES

Rising Use in Biodegradable Packaging and Green Chemistry Applications

An emerging opportunity in the Europe corn glucose market lies in its increasing utilization in biodegradable packaging and green chemistry applications, reflecting broader efforts to reduce plastic waste and promote circular economy principles. Corn glucose serves as a key feedstock in the production of polylactic acid (PLA) and other biopolymers used in compostable packaging, disposable cutlery, and food service ware. Corn-derived glucose is particularly valuable in fermentation processes that yield lactic acid, the building block of PLA, offering an environmentally friendly alternative to petroleum-based plastics. Additionally, green chemistry initiatives are leveraging corn glucose in enzymatic synthesis, solvent-free reactions, and bio-based adhesives, further expanding its industrial footprint. According to The European Commission’s Circular Economy Action Plan , government-backed funding programs are encouraging the development of glucose-based polymers for automotive, textile, and electronics applications.

Expansion into Functional Foods and Nutritional Supplements

A significant opportunity in the Europe corn glucose market is the growing incorporation of corn-derived glucose into functional foods and dietary supplements, driven by rising consumer interest in energy-dense, easily digestible ingredients. Corn glucose is increasingly being used in sports nutrition bars, infant formulas, electrolyte powders, and fortified beverages due to its rapid absorption rate, mild sweetness, and compatibility with various formulation techniques. As per The European Food Safety Authority (EFSA), corn glucose is considered hypoallergenic and well-tolerated, making it a preferred carbohydrate source in medical nutrition and pediatric formulations. Moreover, the rise of endurance sports and fitness culture across Scandinavia and Central Europe has fueled demand for isotonic drinks and recovery supplements containing corn glucose derivatives.

MARKET CHALLENGES

Navigating the Complex Regulatory Landscape Across Member States

A primary challenge facing the Europe corn glucose market is the complex and sometimes inconsistent regulatory framework governing food additives, labeling requirements, and health claims across EU member states. While the European Food Safety Authority (EFSA) sets overarching safety standards, individual countries often impose additional restrictions or interpret existing regulations differently, which is creating compliance challenges for manufacturers and distributors. According to The European Commission’s Directorate-General for Health and Food Safety (DG SANTE), recent amendments to food labeling laws require more detailed disclosure of added sugars, including those derived from corn glucose, which is potentially affecting consumer perception and product marketing strategies.

This regulatory fragmentation complicates cross-border trade and necessitates customized product formulations to meet varying national requirements. As per FoodDrinkEurope, compliance with these diverse rules has increased operational costs by up to 10% for medium-sized glucose syrup producers. Furthermore, public health agencies in several countries continue to scrutinize fructose content in glucose syrups, despite EFSA assessments affirming their safety within recommended daily intakes.

Competition from Alternative Sweeteners and Natural Sugars

A significant challenge confronting the Europe corn glucose market is the growing competition from alternative sweeteners and natural sugars, which are increasingly favored by consumers seeking healthier or more transparent ingredient options. Stevia, monk fruit extract, erythritol, and allulose have gained popularity due to their low-calorie profiles and perceived health benefits, directly challenging the dominance of corn-derived sweeteners in the food and beverage sector.

This shift is particularly evident in the premium beverage and confectionery markets, where health-conscious consumers are opting for products labeled as “no added sugar” or “naturally sweetened.” Moreover, rising demand for transparency and clean labels has prompted major food manufacturers to reformulate products, replacing glucose-based syrups with honey, agave nectar, and coconut blossom nectar. Additionally, the growing influence of social media and digital health influencers has amplified consumer skepticism toward highly processed ingredients, even when scientifically proven safe. According to McKinsey & Company, brand loyalty is increasingly tied to perceptions of healthfulness rather than just taste or cost, which is forcing corn glucose producers to innovate or risk losing relevance in key market segments.

SEGMENTAL ANALYSIS

By Type Insights

The HFCS 42 segment was the largest and held 46.5% of the Europe corn glucose market share in 2024. One key driver behind this dominance is HFCS 42’s cost-effectiveness compared to sucrose and other sweeteners. Additionally, its ability to enhance texture, retain moisture, and improve shelf life makes it a preferred ingredient in confectionery and dairy products. According to Euromonitor International, nearly 55% of industrial bakers in Germany and France rely on HFCS 42 to maintain product consistency without compromising taste or quality.

Another significant factor is the regulatory environment that permits its usage within defined limits across most EU countries. According to The European Food Safety Authority (EFSA), HFCS 42 remains approved as a safe food additive, contributing to sustained demand despite growing health-conscious consumer trends.

The “Others” category in the Europe corn glucose market is projected to expand with a CAGR of 6.8% from 2025 to 2033. A major driver of this segment’s rapid expansion is the rising demand for pure glucose derivatives in medical and nutritional formulations. Additionally, glucose monohydrate is increasingly used in intravenous solutions and oral rehydration therapies, especially in hospital and emergency care settings. Moreover, the shift toward biobased chemicals has boosted the use of glucose syrups in fermentation processes for producing lactic acid, citric acid, and bioethanol. According to Statista, this trend is particularly strong in Germany, the Netherlands, and Sweden, where green chemistry initiatives have gained regulatory and corporate backing.

By End-Use Insights

The food and beverages sector was the largest by capturing 59.3% of the Europe corn glucose market share in 2024. One of the primary drivers behind this segment’s growth is the continued reliance on high-fructose corn syrup (HFCS) in beverage manufacturing. Germany and France, being among the top consumers of soft drinks in the region, which contribute significantly to this demand.

Additionally, corn glucose plays a crucial role in the baking and confectionery sectors, where it enhances browning, extends shelf life, and improves moisture retention. Moreover, growing interest in gluten-free and low-lactose formulations has increased the use of maltose and dextrose in specialty food applications.

The pharmaceuticals segment is swiftly emerging with a CAGR of 7.3% in the next coming years. This rapid ascent reflects increasing utilization of glucose derivatives in medical formulations, including oral rehydration solutions, tablet binders, intravenous nutrition, and dietary supplements.

Moreover, the growing prevalence of metabolic disorders and post-operative recovery treatments has spurred demand for glucose-rich formulations in enteral nutrition and electrolyte therapy. Additionally, the rise of nutraceuticals and functional health products has further expanded the application scope of corn glucose in vitamins, sports recovery powders, and immunity boosters.

REGIONAL ANALYSIS

Germany was the top performer with 22.3% of the Europe corn glucose market share in 2024. According to Statista, Germany is one of the top corn-producing countries in the EU, supplying raw materials to major starch processors like Agrana and Cargill, which operate large-scale glucose extraction facilities. The country's advanced infrastructure enables efficient conversion of corn into glucose syrups, high-fructose corn syrup (HFCS), and dextrose, supporting both domestic consumption and exports to neighboring markets.

As per Euromonitor International, German beverage manufacturers account for a significant portion of HFCS demand, particularly in soft drink production, where HFCS 55 is preferred for its optimal sweetness and solubility. Additionally, the country’s pharmaceutical and nutraceutical industries are increasingly utilizing glucose derivatives in medical nutrition and dietary supplements. Furthermore, Germany leads in biochemical and green chemistry applications, leveraging corn glucose as a feedstock for lactic acid, citric acid, and biopolymer production.

France was positioned second by leading with 11.2% of the Europe corn glucose market share in 2024 with a combination of industrial starch processing, food manufacturing, and evolving health and wellness trends. One of the key drivers of market growth in France is the presence of major starch processors such as Roquette Frères and Tereos, which supply glucose syrups to the food, beverage, and pharmaceutical industries. Additionally, the French beverage industry continues to rely on high-fructose corn syrup (HFCS) in soft drinks and flavored waters, despite increasing scrutiny around sugar alternatives. Moreover, the pharmaceutical and nutraceutical sectors have seen rising adoption of glucose-based excipients and energy sources in medical formulations.

The Netherlands corn glucose market growth is driven by the strategic role as a logistics and distribution hub for agricultural commodities and processed food ingredients. Despite not being a major corn producer itself, the Netherlands serves as a key intermediary, facilitating imports, refining, and export of corn glucose derivatives across Western and Northern Europe.

Additionally, the Dutch government has been actively promoting circular economy principles, encouraging the use of glucose-based feedstocks in bioplastics and bioethanol production. As per European Bioplastics e.V., the Netherlands accounted for nearly 15% of total biopolymer output in Europe in 2024, with glucose-derived lactic acid serving as a core component in compostable packaging and disposable cutlery. According to McKinsey & Company, this shift is being driven by stringent EU regulations on single-use plastics and corporate sustainability commitments.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Cargill, Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Roquette Frères, Ingredion Incorporated, Tereos S.A., Agrana Group, and Avebe U.A are some of the key market players in the Europe corn glucose market.

The competition in the Europe corn glucose market is characterized by a mix of large multinational corporations, regional starch processors, and specialized ingredient suppliers vying for dominance across diverse industrial applications. While established players benefit from scale, brand recognition, and well-developed distribution networks, smaller and mid-sized companies are leveraging differentiation through niche formulations, clean-label positioning, and localized sourcing strategies. This creates a competitive yet fragmented landscape where both tradition and innovation play crucial roles.

Market participants are increasingly focused on expanding their product portfolios to include value-added corn glucose derivatives such as low-calorie syrups, modified starches, and fermentation-grade glucose tailored for bio-based chemical production. Additionally, sustainability pressures are driving companies to invest in cleaner production methods, carbon-neutral facilities, and traceable, non-GMO certified products, further intensifying rivalry among suppliers aiming to meet regulatory and consumer expectations.

Moreover, the growing convergence between agriculture, food science, and biotechnology is enabling new entrants to challenge incumbents with novel enzymatic or fermentation-based glucose variants. As demand diversifies beyond traditional food and beverage uses into pharmaceuticals, green chemistry, and bioplastics, the European corn glucose market continues to witness heightened competition by requiring continuous adaptation and strategic positioning from all players involved.

Top Players in the Europe Corn Glucose Market

Cargill

Cargill is a global leader in food and agricultural commodities, with a significant presence in the Europe corn glucose market through its starch and sweeteners division. The company produces high-quality glucose syrups, dextrose, and high-fructose corn syrup (HFCS) used across food, beverage, pharmaceutical, and industrial applications. Cargill’s contribution to the global market lies in its extensive supply chain network, sustainability initiatives, and continuous investment in clean-label ingredient development.

Roquette Frères

Roquette Frères is a major European producer of plant-based ingredients, including corn-derived glucose, maltose, and polyols. Based in France, the company plays a key role in supplying functional carbohydrates to the food, pharmaceutical, and nutraceutical industries. Roquette is known for its innovation in clean-label formulations and sustainable sourcing practices, which is making it a preferred partner for health-focused brands across Europe and beyond.

Tereos

Tereos is one of Europe’s largest starch processors and a leading supplier of corn glucose derivatives. With operations spanning France, Germany, and Poland, the company supplies glucose syrups, HFCS, and fermentation substrates to various sectors, including bioethanol, bioplastics, and food manufacturing. Tereos emphasizes circular economy principles by integrating co-products into animal feed and renewable energy generation by reinforcing its position as a key player in the European corn glucose landscape.

Top Strategies Used by Key Market Participants

One major strategy employed by leading players in the Europe corn glucose market is product diversification and application-specific formulation development. Companies are expanding their portfolios to include tailored glucose solutions for niche markets such as sports nutrition, infant formulas, and biodegradable materials by enabling them to cater to evolving consumer and industrial demands.

Another key approach involves sustainability-driven sourcing and production innovations. Top manufacturers are investing in eco-friendly processing technologies, water recycling systems, and carbon-reduction initiatives to align with EU environmental regulations and meet growing consumer expectations for transparency and responsible sourcing.

A third strategic focus is on strategic partnerships and collaborations with downstream industries, including beverage producers, pharmaceutical companies, and biochemical firms. By engaging closely with end-users, corn glucose suppliers enhance product relevance, drive innovation, and strengthen relationships across value chains, which is ensuring long-term competitiveness in a dynamic market environment.

RECENT MARKET DEVELOPMENTS

- In January 2024, Cargill announced the expansion of its starch processing facility in Belgium, aimed at increasing production capacity for specialty glucose syrups used in food and pharmaceutical applications by enhancing its supply chain resilience in Western Europe.

- In March 2024, Roquette Frères launched a new line of clean-label glucose solutions designed specifically for use in plant-based beverages and sports nutrition products, targeting the rising demand for natural, which are easily digestible carbohydrates in premium food formulations.

- In June 2024, Tereos entered into a strategic partnership with a German biochemical firm to develop next-generation glucose-based feedstocks for lactic acid production by supporting the growth of biodegradable packaging materials across the EU.

- In September 2024, Ingredion, though headquartered in the U.S., expanded its European distribution network by establishing a dedicated glucose syrup logistics hub in the Netherlands, which is strengthening its foothold in the region's industrial and food ingredient markets.

- In November 2024, Royal Cosun invested in a state-of-the-art fermentation research center in the Netherlands, focusing on optimizing corn glucose utilization in bioethanol and biopolymer production by reinforcing its commitment to sustainable industrial applications.

MARKET SEGMENTATION

This research report on the Europe corn glucose market is segmented and sub-segmented into the following categories.

By Type

- HFCS 42

- HFCS 55

- Others

By End-Use

- Food and Beverages

- Pharmaceuticals

- Personal Care Products

- Paper Products

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the corn glucose market in Europe?

The growth of the corn glucose market in Europe is primarily driven by the rising demand for processed and convenience foods, increased use in confectionery and bakery products, and the growing application of glucose syrup in pharmaceutical and industrial sectors.

How is the corn glucose market regulated in Europe?

The corn glucose market in Europe is regulated under food safety and labeling laws by the European Food Safety Authority (EFSA), with specific guidelines on the use of sweeteners and additives in food products

What is the future outlook for the corn glucose market in Europe?

The future of the corn glucose market in Europe is expected to be stable, with moderate growth driven by innovation in food processing, increased demand in non-food sectors, and efforts by manufacturers to develop healthier and more sustainable sweetener alternatives.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com