Europe Crane Rental Market Size, Share, Trends & Growth Forecast Report By Type (Mobile Cranes, Fixed Cranes), End Use Industry, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Crane Rental Market Size

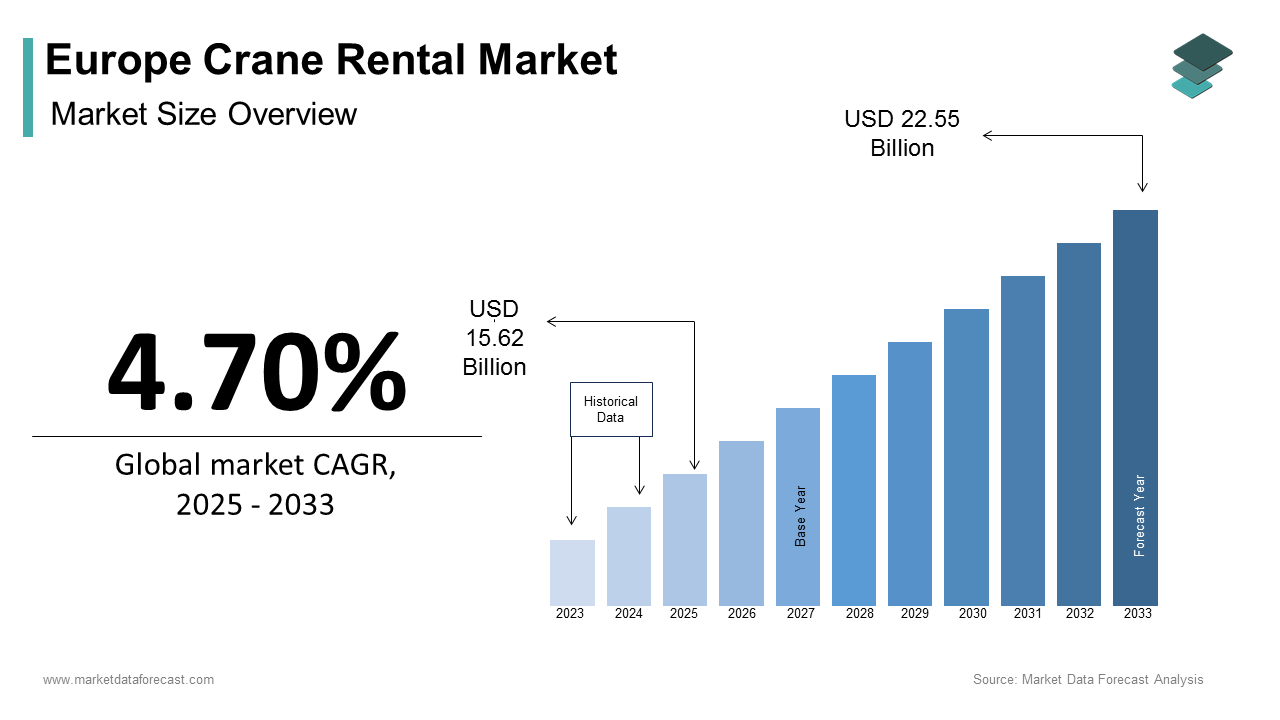

The Europe crane rental market size was calculated to be USD 14.92 billion in 2024 and is anticipated to be worth USD 22.55 billion by 2033, from USD 15.62 billion in 2025, growing at a CAGR of 4.70% during the forecast period.

The Europe crane rental market encompasses a wide range of lifting equipment services, including mobile cranes, tower cranes, overhead cranes, and specialized lifting solutions for construction, infrastructure, energy, and industrial applications. As businesses increasingly shift from capital-intensive ownership models to flexible, cost-effective rental arrangements, crane rental has emerged as a preferred option across industries that require temporary but high-capacity lifting capabilities.

Europe’s well-established construction and renewable energy sectors are key contributors to the demand for crane rental services. The region is also at the forefront of green energy development, with significant investments in offshore wind farms and solar installations that require heavy lifting operations.

Apart from these, logistical advancements and the need for improved project efficiency have spurred demand for rental-based crane services, particularly among small and medium-sized enterprises that seek to avoid the financial burden of equipment ownership.

MARKET DRIVERS

Growth in Construction and Infrastructure Development

One of the primary drivers of the European crane rental market is the ongoing expansion of construction and infrastructure development across the continent. Governments and private investors continue to prioritize large-scale infrastructure projects aimed at modernizing transportation networks, expanding urban housing, and upgrading aging utilities. According to the European Investment Bank, infrastructure investments in the EU exceeded substantially in 2023, with a significant portion allocated to roadways, railways, bridges, and public buildings. This surge in construction activity has led to increased demand for cranes, particularly mobile and tower cranes, which are essential for lifting heavy materials and assembling structural components. In Germany alone, the Federal Ministry of Transport reported that more than 350 major infrastructure projects were underway, including railway upgrades and highway expansions, all requiring extensive crane support. In addition, urban regeneration initiatives in cities such as London, Paris, and Amsterdam have boosted demand for compact and versatile crane models suited for dense urban environments. The trend toward mixed-use developments and high-rise construction further reinforces the need for tower cranes on long-term rental contracts.

Expansion of Renewable Energy Projects Requiring Heavy Lifting Equipment

A significant driver fueling the Europe crane rental market is the rapid expansion of renewable energy projects, particularly in wind and solar power generation. These sectors require extensive use of heavy-duty cranes for the installation of wind turbines and large photovoltaic structures, making crane rental an indispensable component of project execution.

According to WindEurope, over 17 gigawatts of new wind capacity was installed across Europe in 2023, with offshore wind accounting for a major share of total additions. Offshore wind farm construction demands ultra-heavy lift cranes capable of transporting and erecting massive turbine components in challenging marine environments. Onshore wind installations also rely heavily on mobile crane rentals for blade and tower segment assembly. Similarly, the solar energy sector has seen exponential growth, with utility-scale solar farms requiring crane-assisted deployment of mounting structures and inverters. The European Commission's Renewable Energy Directive III has set ambitious targets for member states, prompting accelerated investments in clean energy infrastructure.

MARKET RESTRAINTS

High Operational and Maintenance Costs of Cranes

A key restraint affecting the European crane rental market is the high operational and maintenance costs associated with heavy lifting equipment. Cranes—especially large mobile and tower models—require regular servicing, skilled operators, and periodic part replacements to ensure safe and efficient functioning. Like, maintenance expenses can account for a major share of a crane’s total lifecycle cost, posing a financial challenge for rental companies aiming to maintain profitability. These costs are further exacerbated by the need for compliance with stringent safety regulations enforced by national occupational health and safety bodies. For instance, the German Social Accident Insurance mandates frequent inspections and certifications for crane operations in construction zones, increasing administrative and labor expenditures. Moreover, fluctuations in fuel prices and insurance premiums add to the financial burden, particularly for mobile crane fleets that operate on diesel engines.

Skilled Labor Shortage and Training Requirements

Another critical constraint facing the European crane rental market is the shortage of trained and certified crane operators, riggers, and maintenance technicians. Operating modern cranes requires specialized knowledge, particularly for advanced models equipped with digital controls, telematics, and load management systems. Also, there was a notable decline in the number of certified crane operators entering the workforce between 2020 and 2023. Many countries face challenges in attracting younger workers to trades involving heavy machinery, leading to a skills gap that hampers project timelines and service availability. In France, the National Construction Industry Committee reported that a significant portion of crane rental inquiries could not be fulfilled immediately due to operator unavailability, causing delays in construction and infrastructure projects. Furthermore, regulatory requirements mandate continuous training and recertification for crane personnel, adding to the time and cost burdens for rental firms. Compliance with EN 12999 standards for crane safety necessitates rigorous operator evaluations, limiting the flexibility of workforce deployment.

MARKET OPPORTUNITIES

Adoption of Smart and Connected Crane Technologies

A major opportunity emerging in the European crane rental market is the growing adoption of smart and connected crane technologies that enhance operational efficiency, safety, and remote monitoring capabilities. As industries move toward digitization and automation, crane manufacturers and rental providers are integrating IoT-enabled sensors, GPS tracking, predictive maintenance algorithms, and real-time data analytics into their fleet offerings. According to the European Construction Technology Platform, a significant portion of large construction firms surveyed in 2023 had begun incorporating telematics into their rented crane equipment to optimize usage, reduce downtime, and improve job site coordination. These technologies allow rental companies to monitor fuel consumption, engine performance, and wear indicators remotely, enabling proactive maintenance and minimizing unplanned breakdowns. Moreover, the implementation of AI-driven scheduling software enables crane rental providers to allocate resources more efficiently based on real-time demand patterns and project timelines. This reduces idle time and improves asset utilization rates, enhancing overall profitability. Smart cranes equipped with automated control features also appeal to clients seeking enhanced precision in complex lifting tasks, particularly in confined or hazardous environments.

Surge in Offshore Wind Farm Installations Driving Demand for Specialized Cranes

The rapid expansion of offshore wind energy projects across Europe is creating a substantial opportunity for the crane rental market, particularly for ultra-heavy lift and floating cranes used in turbine installation and maintenance. Countries such as Denmark, the Netherlands, Germany, and the UK are leading this transition, investing billions in offshore wind farms to meet climate targets and reduce dependence on fossil fuels. Each offshore wind turbine consists of massive components—including towers, nacelles, and blades—that require specialized lifting equipment for installation at sea. Crane rental companies are responding by deploying jack-up vessels equipped with onboard cranes or contracting with marine engineering firms that operate floating heavy-lift cranes. The demand for such specialized assets has surged, with rental rates for offshore-capable cranes increasing significantly in recent years. Also, the need for scheduled maintenance and repairs in harsh marine conditions has extended the rental cycle beyond initial installation phases, offering recurring revenue opportunities for crane rental providers.

MARKET CHALLENGES

Regulatory Compliance and Permitting Complexities Across EU Member States

One of the foremost challenges facing the European crane rental market is the complexity of regulatory compliance and permitting procedures across different EU member states. While harmonized safety standards exist through directives such as the Machinery Directive and EN 12999, individual countries impose additional national requirements that affect crane operation, transportation, and certification processes. Besides, cross-border transportation of large cranes often involves navigating diverse road restrictions, weight limits, and convoy permits, complicating logistics, and increasing delivery timelines. The European Road Transport Confederation reported that permit approval delays for oversized loads—such as tower crane sections—extended average mobilization periods by up to two weeks in several countries in 2023.

Volatility in Fuel Prices and Rising Operational Expenses

Volatility in fuel prices poses a significant challenge to the Europe crane rental market, particularly for mobile crane operators who rely on diesel-powered units. The cost of fuel constitutes a major portion of operational expenses, and unpredictable fluctuations in global oil markets directly impact rental pricing and profit margins. This volatility makes it difficult for rental companies to offer stable pricing models to clients, leading to hesitancy among construction and infrastructure firms when planning long-term budgets. Some crane rental providers have attempted to mitigate this risk by passing fuel cost increases onto customers, but this approach can deter price-sensitive users and reduce overall demand. Furthermore, rising insurance premiums due to increased liability risks and inflationary pressures have added to the financial strain on rental operators. The European Insurance and Occupational Risks Observatory noted that insurance costs for crane-related activities rose by an average of 15% in 2023, driven by stricter liability claims and heightened safety expectations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.70% |

|

Segments Covered |

By Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Sarens, Mammoet, ALE (part of Mammoet), Mediaco, Wagenborg Nedlift, Eisele AG, BMS A/S, Prangl, BigMove AG, Weldex |

SEGMENTAL ANALYSIS

By Type Insights

The mobile crane segment continued to be the most prominent category of the Europe crane rental market accounting for 62.8% of total revenue in 2024. This dominance is primarily driven by the versatility and adaptability of mobile cranes across a wide range of applications, particularly in construction, infrastructure development, and energy projects. The demand is especially high in countries like Germany, France, and the UK, where urban development and transport infrastructure modernization initiatives are accelerating. Moreover, mobile cranes are preferred for short-term and medium-duration contracts, aligning with the flexible nature of rental services. Like, mobile crane rentals considerably increased year-on-year between 2021 and 2023, reflecting strong adoption among small and mid-sized contractors who seek cost-effective solutions without long-term asset ownership. Apart from these, advancements in hybrid and electric-powered mobile cranes have made them more attractive from an environmental compliance perspective, particularly in city centers with low-emission zones.

The fixed crane segment is the fastest-growing area within the European crane rental market, projected to expand at a CAGR of 7.9%. This is being fueled by increasing investments in large-scale industrial plants, manufacturing facilities, and offshore wind installations that require permanent or semi-permanent lifting infrastructure. One of the primary contributors to this trend is the expansion of offshore wind farms across the Northern and Baltic Sea regions. Tower cranes—classified under fixed cranes—are extensively used due to their high lifting capacities and operational stability in harsh marine environments. In addition, the automotive and heavy manufacturing sectors are investing heavily in factory automation, necessitating the installation of overhead bridge cranes for material handling. A report by the European Automobile Manufacturers’ Association noted that industrial crane installations in German auto plants rose in 2023, supporting production efficiency and logistics optimization. Furthermore, the need for long-term crane solutions in petrochemical and steel processing plants has boosted demand for gantry and jib cranes.

By End-Use Industry Insights

The building and construction industry was spearheaded in the Europe crane rental market and represented 7.7% of total market value in 2024. This is attributed to the region's ongoing investment in residential, commercial, and public infrastructure projects, which require extensive use of both mobile and tower cranes for material lifting and structural assembly. Urban regeneration efforts in cities such as London, Paris, and Amsterdam have also spurred demand for compact and high-reach cranes suited for dense environments. Besides, the rise in mixed-use and high-rise construction projects has led to increased adoption of tower cranes on long-term rental contracts.

The marine and offshore segment is the swiftest expanding application area in the European crane rental market, expected to grow at a CAGR of 9.3% during the forecast period. This surge is primarily driven by the exponential expansion of offshore wind energy projects and maritime infrastructure upgrades, particularly in the North Sea and Baltic Sea regions. Each offshore wind turbine requires specialized ultra-heavy lift cranes for transporting and erecting massive components such as towers, nacelles, and blades. Crane rental companies are responding by deploying jack-up vessels equipped with onboard cranes or partnering with marine engineering firms that operate floating heavy-lift cranes. Beyond wind energy, the shipbuilding and port modernization sectors are also contributing to growth.

REGIONAL ANALYSIS

Germany had the leading market share and industrial strength accounting for 3.8% of total regional revenue in 2024. The country’s prominence is underpinned by its robust industrial base, well-developed infrastructure sector, and strong presence of multinational manufacturers that rely on crane services for plant construction and maintenance. In particular, the expansion of offshore wind projects in the North Sea and Baltic regions has driven demand for specialized cranes capable of handling turbine components. Moreover, the automotive and mechanical engineering sectors continue to invest in automated manufacturing lines, requiring overhead and jib cranes for efficient material handling. As per the German Machinery Association, industrial crane installations in production facilities increased significantly in recent years, reinforcing the importance of crane rental services in maintaining operational efficiency.

The United Kingdom will be a key player in the Europe crane rental market in 2024. Despite post-Brexit economic volatility, the UK remains a major consumer of crane rental services due to its mature construction sector, offshore energy investments, and ongoing urban development projects. Offshore wind development has also played a crucial role. Companies such as Siemens Gamesa and Ørsted have been actively deploying heavy-lift cranes for turbine installation in the North Sea. Post-Brexit trade adjustments have prompted some firms to adopt more flexible asset strategies, favoring rental models over capital purchases.

France occupied a notable position in the Europe crane rental market in 2024. The country’s market dynamics are shaped by stringent regulatory enforcement, a strong presence of multinational corporations, and an increasing focus on infrastructure modernization and green energy projects. Also, the construction industry remains a key contributor, with major projects such as Grand Paris Express—a metropolitan transit expansion—driving demand for mobile and tower cranes. The National Construction Council indicated substantial public infrastructure spending in France in 2023, further reinforcing the need for flexible lifting solutions.

Italian market is supported by its vibrant industrial sector, growing exports, and increasing emphasis on infrastructure renewal. The country’s manufacturing base, particularly in machinery, automotive components, and food processing, drives consistent demand for crane services in factory expansions and logistics operations. The expansion of logistics hubs and intermodal terminals has further increased reliance on crane rental services for cargo handling. The renewable energy sector has also gained traction. Additionally, urban mobility projects like Milan Metro Line 4 and Rome’s tram network upgrades have contributed to construction-related crane rentals.

Spain is supported by rising urbanization, infrastructure modernization, and growing awareness of process efficiency in industrial operations. The country’s economic recovery post-pandemic has spurred investments in transportation, energy, and real estate, all of which rely on extensive crane usage for construction and material handling. The expansion of renewable energy projects, particularly in bioethanol and biodiesel production, has led to increased deployment of cranes for biomass handling and facility expansion. The logistics sector has also seen significant growth, with the Port of Barcelona and Madrid Logistics Park expanding their cargo-handling capabilities using rented mobile and overhead cranes.

LEADING PLAYERS IN THE EUROPE CRANE RENTAL MARKET

Manitowoc Cranes (Germany)

Manitowoc is a globally recognized leader in the design and manufacturing of mobile and tower cranes, with a strong presence in the European rental market. The company offers a comprehensive portfolio tailored for construction, infrastructure, and energy projects. Manitowoc's emphasis on innovation, durability, and operator safety has made it a preferred brand among crane rental firms across Western and Northern Europe. Its commitment to developing fuel-efficient and hybrid crane models aligns with the region’s sustainability goals, reinforcing its competitive edge.

Liebherr Group (Switzerland/Germany)

Liebherr is one of the largest and most respected manufacturers of construction machinery, including a wide range of mobile and crawler cranes. With extensive distribution and service networks across Europe, Liebherr plays a crucial role in supplying high-performance lifting equipment to rental companies. Known for engineering excellence and cutting-edge technology, the company continues to introduce advanced crane systems that meet evolving industry demands, particularly in offshore wind and urban infrastructure sectors.

Terex Corporation (United States, with significant operations in Europe)

Terex operates a major footprint in the European crane rental market through its Demag and Genie brands, offering a diverse selection of overhead, rough-terrain, and all-terrain cranes. The company serves a broad spectrum of industries, from logistics and manufacturing to oil and gas. Terex supports rental firms with modular, easy-to-maintain crane solutions, making them ideal for short and long-term hire contracts across Europe’s dynamic industrial landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Expansion Through Strategic Acquisitions and Mergers

Leading players in the European crane rental market are actively acquiring regional crane rental firms and complementary equipment providers to expand their geographic reach and service capabilities. These acquisitions allow companies to integrate local expertise, enhance fleet diversity, and establish a stronger foothold in emerging markets within Eastern Europe and the Balkans.

Investment in Advanced Crane Technologies and Digital Integration

To stay ahead of the competition, key participants are investing heavily in next-generation crane technologies, including electric-powered models, hybrid mobile cranes, and IoT-enabled monitoring systems. These innovations improve operational efficiency, reduce environmental impact, and offer real-time diagnostics, appealing to environmentally conscious clients and tech-savvy contractors.

Focus on Fleet Diversification and Customized Service Offerings

Market leaders are expanding their fleets to include a broader range of crane types—from compact city cranes to ultra-heavy lift units—ensuring they can cater to diverse project requirements. Additionally, they are enhancing value-added services such as operator training, preventive maintenance contracts, and emergency repair support, strengthening customer retention and service differentiation in a highly fragmented market.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players in the European crane rental market include Sarens, Mammoet, ALE (part of Mammoet), Mediaco, Wagenborg Nedlift, Eisele AG, BMS A/S, Prangl, BigMove AG, and Weldex.

The competition in the European crane rental market is marked by a mix of global equipment manufacturers, established regional rental companies, and specialized niche operators, all vying for dominance through differentiation in fleet quality, service reliability, and technological innovation. While multinational corporations like Manitowoc, Liebherr, and Terex maintain strong positions due to their engineering excellence and brand reputation, numerous regional players compete effectively by offering localized support and cost-effective rental packages.

A defining feature of this competitive environment is the increasing demand for flexible, asset-light business models, which has led to intensified rivalry in pricing, contract structuring, and after-sales service offerings. Companies are also differentiating themselves through digital integration, such as telematics and predictive maintenance systems, to enhance fleet utilization and client satisfaction.

Moreover, the growing complexity of construction and energy projects has prompted rental firms to offer customized crane solutions, including full-service outsourcing and turnkey lifting plans. As demand surges in offshore wind and urban infrastructure development, the market is witnessing strategic consolidations, product innovations, and service enhancements aimed at securing long-term client relationships and capturing new growth opportunities across the continent.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Manitowoc launched an updated line of high-capacity all-terrain cranes designed specifically for challenging terrain conditions in Central and Eastern Europe, featuring enhanced mobility and reduced setup times to improve job site efficiency.

- In May 2024, Liebherr acquired a German-based crane rental firm specializing in tower cranes for high-rise construction, allowing the company to directly serve large-scale urban development projects in Germany and Austria without relying solely on third-party rental partners.

- In March 2024, Terex introduced a cloud-based crane management system for its rental clients, enabling remote monitoring of crane performance, fuel consumption, and maintenance scheduling to reduce downtime and optimize fleet utilization across multiple job sites.

- In August 2023, Konecranes (part of Kone) expanded its service network in Poland to support growing demand for overhead crane rentals in automotive and manufacturing facilities, ensuring faster deployment and localized technical assistance for industrial clients.

- In October 2023, Grove, a Manitowoc brand, partnered with a Dutch marine engineering firm to supply floating cranes for offshore wind installations in the North Sea, strengthening its presence in the renewable energy sector and diversifying its rental offerings beyond traditional construction applications.

MARKET SEGMENTATION

This research report on the Europe Crane Rental Market has been segmented and sub-segmented based on type, end use, and region.

By Type

- Mobile Cranes

- Fixed Cranes

By End Use

- Building & Construction

- Marine & Offshore

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the crane rental market in Europe?

Factors include increased construction and infrastructure projects, cost efficiency of renting vs. purchasing, and growing demand in the energy and transportation sectors.

2. Which countries in Europe have the highest demand for crane rental services?

Germany, the UK, France, Italy, and the Netherlands are among the top markets due to ongoing large-scale infrastructure and urban development projects.

3. How is technology influencing the crane rental market?

Advancements in crane automation, telematics, and fleet management software are enhancing safety, efficiency, and cost-effectiveness.

4. Who are the major players in the Europe crane rental market?

Key players include Sarens, Mammoet, ALE (part of Mammoet), Mediaco, Wagenborg Nedlift, Eisele AG, BMS A/S, Prangl, BigMove AG, and Weldex.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com