Europe Cryochambers Market Size, Share, Trends & Growth Forecast Report, Segmented By Product, Application, End-User, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Cryochambers Market Size

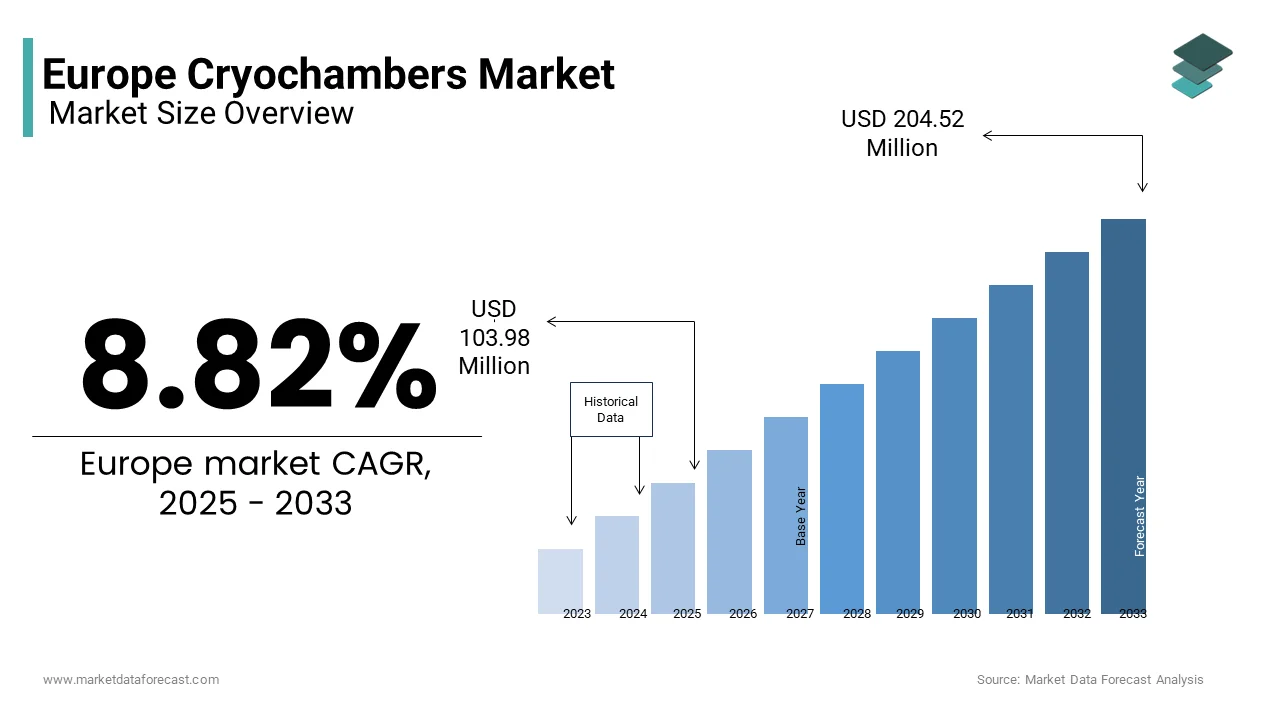

The Europe cryochambers market was valued at USD 95.54 million in 2024 and is anticipated to reach USD 103.98 million in 2025 from USD 204.52 million by 2033, growing at a CAGR of 8.82% during the forecast period from 2025 to 2033.

The Europe cryochambers market has emerged as a significant segment within the broader healthcare and wellness industry, driven by advancements in medical technology and rising consumer interest in non-invasive treatments. The increasing prevalence of chronic pain conditions and the growing adoption of cryotherapy for sports recovery have fueled demand. Furthermore, the European Union’s stringent regulatory framework ensures high-quality standards by fostering trust among end-users. However, the market faces challenges such as high equipment costs and limited awareness in rural areas. Despite this, the region's focus on preventive healthcare and aesthetic enhancements continues to shape favorable market conditions.

MARKET DRIVERS

Rising Demand for Non-Invasive Pain Management Solutions

The growing preference for non-invasive treatments in Europe is a pivotal driver for the cryochambers market. Chronic pain affects nearly 20% of the European population, as stated by the European Pain Federation. Cryotherapy chambers offer an effective alternative to traditional pain management methods by reducing reliance on pharmaceuticals. These chambers use extreme cold to alleviate inflammation and accelerate healing that is making them particularly appealing to athletes and elderly individuals. This trend is supported by endorsements from professional sports organizations, such as UEFA, which promotes cryotherapy for injury recovery. Additionally, government initiatives promoting active lifestyles have bolstered awareness will further drive the adoption.

Increasing Focus on Aesthetic and Wellness Applications

The integration of cryotherapy into beauty and wellness routines is another key driver. Cryosaunas and localized cryotherapy devices are increasingly used in spas to enhance skin rejuvenation and reduce cellulite. Consumers are willing to spend significantly on these treatments, with average session costs ranging from €50 to €100. The rise of social media influencers advocating cryotherapy has amplified its popularity, particularly among younger demographics.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints hindering the growth of the cryochambers market in Europe is the substantial upfront investment required for equipment installation. Such expenses pose a significant barrier for small and medium-sized enterprises (SMEs) operating in the wellness sector. Additionally, maintenance costs and the need for trained personnel further strain budgets. In countries like Italy and Spain, where economic recovery remains uneven, businesses often hesitate to invest in expensive technologies. This financial burden limits market penetration in less affluent regions. Consequently, the high capital expenditure acts as a deterrent by slowing down adoption rates despite growing consumer interest.

Limited Awareness and Misconceptions

Another critical restraint is the lack of widespread awareness about cryotherapy’s benefits and safety. A survey conducted by the European Society for Medical Oncology revealed that only 30% of respondents were familiar with cryotherapy applications beyond surgical procedures. Misconceptions regarding potential side effects, such as frostbite or nerve damage, further deter potential users. Rural areas, in particular, exhibit lower awareness levels due to limited access to information and fewer healthcare facilities offering cryotherapy services. As per McKinsey & Company, regions with low digital literacy face additional challenges in disseminating accurate information. These knowledge gaps hinder market expansion, as consumers remain hesitant to adopt new treatments without sufficient understanding or reassurance.

MARKET OPPORTUNITIES

Expansion into Emerging Wellness Tourism Hubs

Europe’s booming wellness tourism industry presents a lucrative opportunity for cryochambers. Integrating cryotherapy into wellness retreats and luxury spas can attract high-net-worth individuals seeking unique experiences. Collaborations between cryochamber manufacturers and wellness resorts could drive adoption in regions with strong tourism infrastructure. Additionally, the post-pandemic focus on health-conscious travel is expected to boost demand, as travelers prioritize rejuvenation and recovery during their stays.

Technological Advancements Enhancing Accessibility

Technological innovations are paving the way for more accessible and affordable cryotherapy solutions. Portable cryochambers and compact devices are being developed to cater to smaller clinics and home users. These advancements lower entry barriers for new players and enable existing providers to expand their reach. Furthermore, the integration of IoT and AI into cryochambers allows for real-time monitoring and personalized treatment plans, enhancing user experience. Such developments align with Europe’s digital transformation goals are encouraging widespread adoption across diverse settings, from urban fitness centers to rural rehabilitation clinics.

MARKET CHALLENGES

Stringent Regulatory Frameworks

The Europe cryochambers market faces significant hurdles due to the region’s strict regulatory environment. The European Medicines Agency mandates rigorous testing and certification processes for medical devices, including cryosurgery and cryotherapy equipment. According to Deloitte, obtaining CE marking can take up to 18 months and requires extensive documentation, clinical trials, and compliance audits. These delays increase time-to-market and operational costs, particularly for startups and SMEs. Moreover, frequent updates to regulations necessitate continuous adaptation, straining resources. Non-compliance risks product recalls or legal penalties that is complicating market entry. While these measures ensure safety and efficacy, they also slow innovation and expansion by posing a persistent challenge for the market players.

Competition from Alternative Therapies

The presence of established alternative therapies poses another challenge for cryochambers in Europe. Traditional methods like physiotherapy, acupuncture, and massage therapy dominate the pain management landscape, with millions of patients relying on these treatments annually. According to PwC, alternative therapies account for over 40% of the European healthcare market is overshadowing emerging options like cryotherapy. Additionally, insurance coverage for conventional treatments makes them more accessible to a broader audience. Cryotherapy’s relatively higher costs and limited reimbursement options further widen the gap. This competitive pressure forces cryochamber providers to invest heavily in marketing and education efforts to differentiate their offerings and secure a foothold in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.82% |

|

Segments Covered |

By Product, Application, End-User and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Medtronic (Ireland), Galil Medical (US), and CooperSurgical (US) Cryotherapy (US), Zimmer MedizinSysteme (Germany), Metrum Cryoflex (Poland), Brymill Cryogenic Systems (UK), Erbe Elektromedizin (Germany), CryoConcepts (US), US Cryotherapy (US), Professional Products (US), and Kriosystem Life (Poland). |

SEGMENTAL ANALYSIS

By Product Insights

The cryosurgery devices segment was the largest and held 45.3% of the Europe cryochambers market share in 2024. This dominance is attributed to their widespread use in treating cancerous tumors, skin lesions, and other medical conditions. The increasing incidence of skin cancer, with over 150,000 new cases annually in Europe, according to the European Cancer Information System, drives demand. Hospitals and specialty clinics are the primary adopters, leveraging cryosurgery’s precision and minimal invasiveness. Additionally, advancements in probe technology and cooling mechanisms have enhanced device efficiency, boosting adoption rates. Government funding for cancer research and treatment further supports this segment’s growth in next coming years.

The localized cryotherapy devices segment is projected to grow at the highest CAGR of 9.2% from 2025 to 2033. This rapid growth stems from their versatility in addressing sports injuries, arthritis, and cosmetic concerns. The rising popularity of cryotherapy among athletes, coupled with endorsements from sports federations, fuels demand. For instance, UEFA recommends localized cryotherapy for muscle recovery is citing faster healing times compared to traditional methods. Furthermore, the proliferation of boutique cryotherapy clinics in urban areas caters to health-conscious consumers seeking quick, non-invasive treatments. Affordable session costs and shorter treatment durations make localized cryotherapy highly accessible is contributing to its accelerated adoption.

By Application Insights

The surgical applications segment was accounted in holding 50.4% of the Europe cryochambers market share in 2024 with the increasing use of cryosurgery in treating prostate cancer, liver tumors, and dermatological conditions. According to the European Association of Urology, cryosurgery as a preferred option for localized prostate cancer, given its minimal side effects and high success rates. Hospitals equipped with advanced cryosurgical systems benefit from higher patient inflow and improved outcomes. Additionally, government initiatives promoting early cancer detection have expanded the patient pool.

The health and beauty applications segment is poised to grow with a CAGR of 8.7% throughout the forecast period. This growth is fueled by the rising demand for anti-aging treatments and skin rejuvenation. Cryotherapy’s ability to stimulate collagen production and reduce cellulite appeals to aesthetically conscious consumers. Urban centers like Paris and Milan witness a surge in cryotherapy clinics is targeting affluent clients willing to pay premium prices. Influencer marketing and celebrity endorsements amplify awareness. Moreover, collaborations between cryochamber manufacturers and luxury spas create synergistic opportunities is accelerating market penetration.

By End User Insights

The hospitals and specialty clinics segment was accounted in holding 60.1% of the Europe cryochambers market share in 2024. This dominance arises from their role as primary providers of cryosurgery and pain management treatments. The availability of skilled medical professionals and state-of-the-art infrastructure enables hospitals to deliver high-quality care. Additionally, the prevalence of chronic diseases, such as arthritis and cancer that ensures a steady patient flow. Government funding for hospital upgrades further strengthens this segment’s position by ensuring sustained growth.

Spas segment is likely to gain huge tarction over the growth rate with an expected CAGR of 10.5% during the forecast period. This growth is driven by the integration of cryotherapy into wellness programs is attracting health-conscious consumers. Spas in tourist hotspots like Santorini and the French Riviera leverage cryotherapy to enhance their service offerings is appealing to international visitors. Affordable pricing models and flexible packages make cryotherapy accessible to a broader audience. Moreover, partnerships with fitness centers and wellness brands expand reach by fostering rapid adoption.

COUNTRY ANALYSIS

Germany dominated the Europe cryochambers market with 25.4% of share in 2024 with its robust healthcare infrastructure, high disposable income levels, and a strong emphasis on technological innovation. Germany’s aging population, with over 21% aged 65 and above, drives demand for pain management and surgical applications of cryotherapy. Additionally, government initiatives promoting preventive healthcare and funding for advanced medical technologies have positioned Germany as a key hub for cryochambers.

Spain is expected to showcase with a CAGR of 11.3% in the next coming years. This growth is fueled by rising investments in wellness tourism and the proliferation of urban cryotherapy clinics. Spain’s warm climate and scenic locations make it a popular destination for health-conscious travelers seeking rejuvenation. Furthermore, increased awareness of cryotherapy’s benefits among younger demographics has driven adoption rates in cities like Barcelona and Madrid.

France and Italy are expected to exhibit steady growth due to increasing health awareness and government-backed wellness programs. France’s focus on integrating alternative therapies into mainstream healthcare has bolstered cryotherapy adoption. In Italy, partnerships between cryochamber manufacturers and luxury spas are driving market penetration. Meanwhile, the UK’s market is stabilizing as awareness spreads, supported by endorsements from the National Health Service (NHS) and growing interest in non-invasive treatments.

KEY MARKET PLAYERS

Medtronic (Ireland), Galil Medical (US), and CooperSurgical (US) Cryotherapy (US), Zimmer MedizinSysteme (Germany), Metrum Cryoflex (Poland), Brymill Cryogenic Systems (UK), Erbe Elektromedizin (Germany), CryoConcepts (US), US Cryotherapy (US), Professional Products (US), and Kriosystem Life (Poland). are the market players that are dominating the Europe cyrochambers market.

Top 3 Players in the Europe Cryochambers Market

Cryoscience

CryoScience is a leading player, known for its advanced cryosurgery devices by focusing on R&D to enhance product efficacy.

Impact Cryotherapy

Impact Cryotherapy specializes in localized cryotherapy devices with its innovative designs cater to both medical and wellness sectors.

Zimmer Medizin Systems

Zimmer MedizinSystems dominates with cryosaunas by making strategic partnerships with European clinics drive market penetration.

Top Strategies Used By Key Market Participants

Key players in the Europe cryochambers market employ diverse strategies to maintain their competitive edge. One prominent approach is product diversification , where companies expand their portfolios to include both medical-grade and consumer-focused devices. For instance, introducing portable cryotherapy units caters to smaller clinics and home users is broadening accessibility. Another strategy is geographic expansion , with firms entering untapped markets in Eastern Europe and rural areas by leveraging local partnerships to establish a foothold. Strategic collaborations, such as alliances with sports organizations or wellness centers, enhance brand visibility and credibility. Additionally, investments in R&D ensure continuous innovation by enabling companies to offer cutting-edge solutions that comply with stringent EU regulations. Marketing campaigns targeting health-conscious consumers and athletes further drive adoption, while mergers and acquisitions consolidate market share by creating synergies and economies of scale.

COMPETITION OVERVIEW

The Europe cryochambers market is characterized by moderate fragmentation, with a mix of global giants and regional players competing for dominance. Leading companies leverage their technological expertise and established distribution networks to capture significant market shares. However, the presence of smaller, niche players focusing on localized solutions creates intense competition in urban centers. Companies differentiate themselves through product innovation, affordability, and strategic partnerships with healthcare providers and wellness centers. Regulatory compliance remains a critical factor, as adherence to EU standards ensures trust and reliability among end-users. Collaborations with fitness centers, sports teams, and aesthetic clinics further expand reach by ensuring sustained growth amidst evolving consumer preferences.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, CryoScience launched a portable cryotherapy device, expanding its product portfolio. This move targets smaller clinics and home users by addressing the growing demand for accessible cryotherapy solutions.

- In June 2024, Impact Cryotherapy partnered with a UK-based spa chain, increasing market access. This collaboration integrates cryotherapy into wellness programs is appealing to health-conscious consumers and boosting adoption rates.

- In August 2024, Zimmer MedizinSystems acquired a German distributor, strengthening regional presence. This acquisition enhances Zimmer’s distribution network by enabling faster delivery and better customer support in key European markets.

- In October 2024, CryoAction introduced AI-enabled cryosaunas, enhancing user experience. These smart devices offer personalized treatment plans and real-time monitoring by aligning with Europe’s digital transformation goals.

- In December 2024, KryoLife Technologies secured EU funding for R&D, accelerating innovation. This financial boost allows the company to develop advanced cryochambers with improved efficiency and safety features is reinforcing its competitive position.

MARKET SEGMENTATION

This research report on the Europe cyrochambers market is segmented and sub-segmented into the following categories.

By Product

- Cryosurgery Devices

- Tissue Contact Probes

- Tissue Spray Probes

- Epidermal and Subcutaneous Cryoablation Devices

- Localized Cryotherapy Devices

- Cryochambers & Cryosaunas

By Application

- Surgical Applications

- Oncology

- Cardiology

- Dermatology

- Other Surgical Applications

- Pain Management

- Recovery, Health, and Beauty

By End User

- Hospitals & Specialty Clinics

- Cryotherapy Centers

- Spas & Fitness Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the cryochambers market in Europe?

Growing demand for wellness therapies, increasing adoption in sports and physiotherapy, and expanding medical applications are key growth drivers.

Which countries in Europe have the highest demand for cryochambers?

Germany, France, and the UK are leading the market due to advanced healthcare infrastructure and rising awareness of cryotherapy benefits.

What are the main applications of cryochambers in Europe?

Primary uses include sports recovery, pain management, skin therapy, and treatment of chronic conditions like arthritis.

Who are the major players in the European cryochambers market?

Leading companies include MECOTEC, Zimmer MedizinSysteme, CryoAction, and Artic Cryo, among others.

What trends are shaping the future of the cryochambers market in Europe?

Trends include growing use in wellness centers, portable chamber innovations, and increased focus on non-invasive treatments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]