Europe Data Center Rack Market Research Report – Segmented By Rack Type (Cabinet Racks,Open Frame Racks ) Height ( 42 U Racks,Above 42 U Racks) Width ( 19-Inch Racks,23-Inch Racks) Vertical ( IT & Telecom,Healthcare) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Data Center Rack Market Size

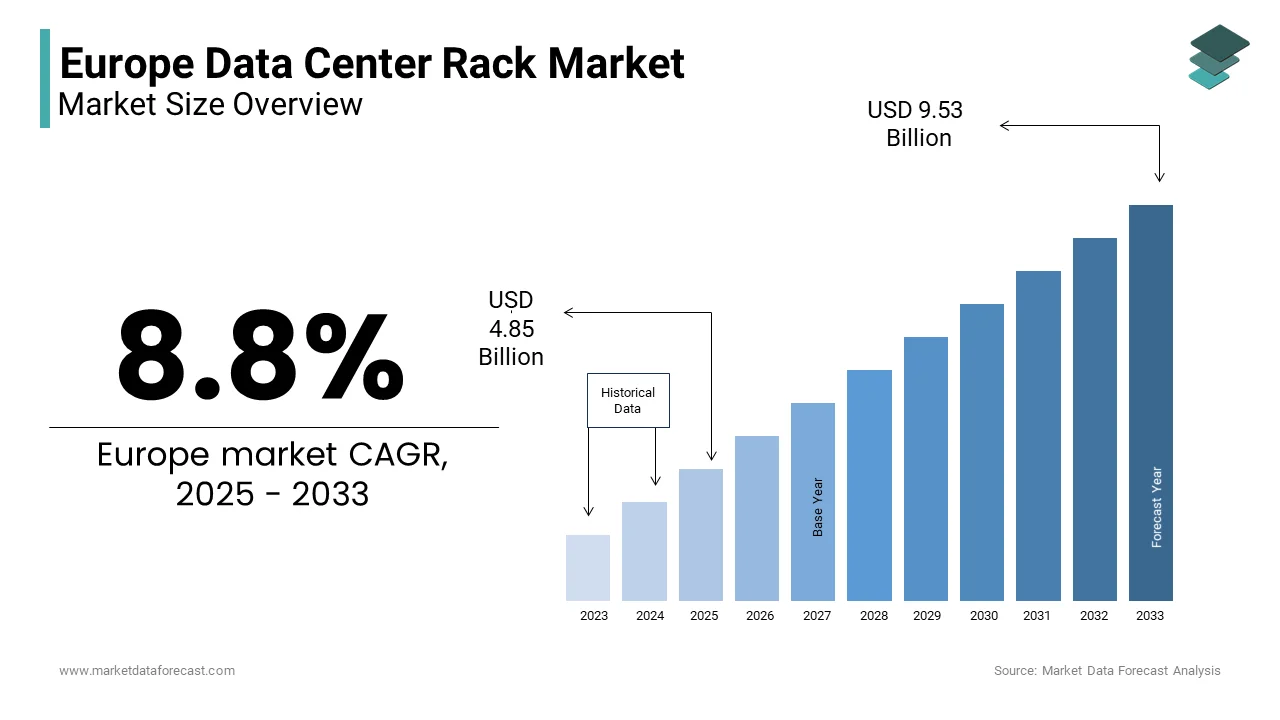

The Europe Data Center Rack Market Size was valued at USD 4.46 billion in 2024. The Europe Data Center Rack Market size is expected to have 8.8 % CAGR from 2025 to 2033 and be worth USD 9.53 billion by 2033 from USD 4.85 billion in 2025.

The Europe data center rack market is a cornerstone of the region’s digital infrastructure, driven by the exponential growth of data generation and cloud computing. According to the European Data Center Association, over 60% of European enterprises have adopted cloud-based solutions, necessitating robust data center infrastructure. For instance, Germany and France are leading adopters, leveraging advanced rack systems to optimize server density and cooling efficiency. Additionally, the growing prevalence of IoT devices and AI applications has propelled demand for high-density racks capable of supporting intensive workloads. As per Gartner Research, Scandinavian countries report a 15% annual increase in data center rack adoption due to their focus on sustainability and energy-efficient designs. These factors collectively create a fertile environment for sustained expansion.

MARKET DRIVERS

Surge in Cloud Computing and Edge Computing Adoption

The rapid adoption of cloud computing and edge computing is a primary driver of the Europe data center rack market. As per the Eurostat, over 70% of European businesses now rely on cloud services, creating a pressing need for scalable and efficient rack systems. For example, the UK reported a 25% annual increase in hyperscale data center construction between 2021 and 2023, as highlighted by the British Cloud Industry Forum. Edge computing, which processes data closer to the source, requires compact yet powerful rack systems to support real-time applications like autonomous vehicles and smart cities. For instance, Sweden saw a 30% surge in edge computing rack installations in 2023, driven by government initiatives promoting smart infrastructure. Innovations in modular rack designs have further expanded use cases, particularly in industries like retail and healthcare. These trends underscore how technological advancements are reshaping demand dynamics.

Growing Focus on Energy Efficiency and Sustainability

The increasing emphasis on energy efficiency and sustainability has significantly contributed to the demand for advanced data center racks. According to the European Commission’s Green Deal, data centers account for 2.7% of Europe’s total electricity consumption, necessitating eco-friendly solutions. For instance, France reported a 20% increase in adoption of energy-efficient racks in 2023, driven by partnerships with green tech firms. Similarly, the Netherlands’ focus on sustainable energy practices has positioned it as a leader in adopting liquid-cooled racks, achieving a 15% reduction in power usage effectiveness (PUE). Retailers like OVHcloud have expanded their green data center lines, further driving adoption. These dynamics highlight how sustainability goals are propelling market growth.

MARKET RESTRAINTS

High Initial Costs and Complexity

The high upfront costs associated with advanced data center racks pose a significant barrier, particularly for smaller enterprises. The European Small Business Alliance states that initial setup costs including hardware and installation, can exceed USD 50,000 for large-scale deployments, deterring adoption. This financial burden is particularly acute in Eastern Europe, where access to affordable financing remains limited. For example, Romania reports that only 15% of SMEs have adopted advanced rack systems due to budget constraints. Apart from these, the complexity of integrating these systems into existing infrastructure often requires specialized expertise, increasing implementation time and costs. These challenges hinder widespread adoption and contribute to socioeconomic disparities in technological advancement.

Concerns Overheat Dissipation and Cooling Efficiency

Concerns overheat dissipation and cooling efficiency remain persistent challenges, emphasizingthe reliability of data center racks. As indicated by the European Data Center Infrastructure Management Association, over 20% of data centers face overheating issues, reducing system lifespan. For instance, Italy reported a 10% decline in rack adoption in 2023 due to performance concerns related to inadequate cooling solutions. Furthermore, stringent energy regulations necessitate additional compliance measures, increasing operational complexity. Addressing these concerns requires investments in advanced cooling technologies to ensure uninterrupted service.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe present a lucrative opportunity for the data center rack market, driven by increasing digital transformation and urbanization. According to the European Investment Bank, internet penetration in Eastern Europe grew by 25% between 2020 and 2023 creating a fertile ground for cloud infrastructure development. For example, Poland’s government initiatives to promote digital entrepreneurship resulted in a 20% increase in data center rack adoption among startups in 2023. Similarly, Turkey’s rapid urbanization and tech-savvy workforce have positioned it as a growth hub, with adoption rates exceeding 30% annually. These dynamics show how emerging markets are unlocking new revenue streams for rack manufacturers.

Integration with AI and Automation

The integration of artificial intelligence (AI) and automation into data center operations offers transformative opportunities for the rack market. As per the European Artificial Intelligence Association, AI-driven features such as predictive analytics and automated cooling systems enhance operational efficiency and reduce downtime. For instance, Sweden reported a 40% annual increase in AI-enabled rack adoption, driven by partnerships between telecom providers and AI startups. Innovations in smart rack designs have further expanded use cases, particularly in hyperscale data centers. As noted by the McKinsey & Company, Scandinavian landscape report a 35% annual growth in AI-integrated racks, spotlightingtheir potential to drive market expansion.

MARKET CHALLENGES

Stringent Regulatory Standards

Stringent regulatory requirements for energy efficiency and safety significantly impede market scaling. As stated by the European Committee for Electrotechnical Standardization, data center racks must comply with complex standards such as EN 50600, necessitating costly testing and certification processes. For instance, a new provider entering the French market faced delays due to additional scrutiny, postponing its launch by six months. These challenges are compounded by the need for continuous updates to align with evolving regulations, which can cost up to USD 1 million annually per provider. Smaller firms, in particular, struggle to meet these standards, stifling innovation. The European Federation of Energy Traders notes that nearly 25% of new entrants abandon ventures due to regulatory hurdles.

Competition from Alternative Cooling Technologies

Competition from alternative cooling technologies remains a persistent challenge, undermining the market share of traditional data center racks. The European Thermal Management Association notes that liquid cooling systems are often more effective and energy-efficient than air-cooled racks, posing a threat to traditional manufacturers. For example, Germany reported a 10% decline in air-cooled rack sales in 2023 due to the rising popularity of liquid immersion cooling. Consumers’ heightened sensitivity to price fluctuations discourages experimentation with new brands, further stifling market growth. Addressing these challenges requires investments in research and development to enhance the competitive edge of rack systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.8 % |

|

Segments Covered |

By Rack Type,Height,Width,Vertical and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

AMCO Enclosures,Belden Inc.,Chatsworth Products,Cisco Systems, Inc.,Dell Inc. |

SEGMENT ANALYSIS

By Rack Type Insights

The Cabinet racks segment dominated the Europe data center rack market by capturing 60.1% of the total share in 2024. The position of this segment is due to their ability to provide secure and organized housing for IT equipment while offering superior cooling and cable management capabilities. According to Gartner Research, over 75% of hyperscale data centers in Europe utilize cabinet racks due to their compatibility with high-density server deployments. For instance, Germany reported a 25% annual increase in cabinet rack installations in cloud service providers’ facilities, driven by partnerships with global tech firms like Amazon Web Services (AWS) and Microsoft Azure. Besides these, advancements in modular designs have enhanced scalability, making cabinet racks ideal for both enterprise and colocation facilities. These factors collectively solidify their leadership in the market.

The open frame racks segment is the fastest-growing segment, with a CAGR of 9.5% projected from 2023 to 2028, according to the European Thermal Management Association. This growth is fueled by their cost-effectiveness and improved airflow, which reduce cooling costs in edge computing applications. For example, France saw a 40% surge in open frame rack adoption among IoT-enabled edge data centers in 2023 and is driven by government initiatives promoting smart city infrastructure. Innovations in lightweight materials and customizable designs have expanded use cases, particularly in industries like retail and healthcare. As per McKinsey & Company, Nordic countries report a 35% annual growth in open frame rack adoption due to their emphasis on energy-efficient solutions. These advancements position open frame racks as a key growth driver.

By Height Insights

The 42 U rack segment commanded the market by holding a 55.2% share in 2024. Its dominance is attributed to its optimal balance between capacity and space efficiency, making it ideal for medium to large-scale data centers. The Eurostat states that over 60% of European enterprises prefer 42 U racks for their ability to house a wide range of IT equipment while maintaining manageable dimensions. For instance, the UK reported a 20% annual increase in 42 U rack usage in financial institutions and is driven by partnerships with cloud providers. Also, the growing demand for high-density storage solutions has further fueled adoption, particularly in hyperscale facilities. These factors reinforce the 42 U rack’s leadership in the market.

The above 42 U racks segment is witnessing a quick rise with a CAGR of 10.2% anticipated from 2025 to 2033. This acceleration is supported by the increasing need for higher server density in hyperscale and colocation data centers. For example, Sweden saw a 45% surge in above 42 U rack adoption in AI-driven data centers in 2023, driven by collaborations with tech giants like Google and IBM. Innovations in vertical cooling systems have expanded use cases, particularly in energy-intensive applications. As per the International Data Corporation, Scandinavian landscape report a 30% annual growth in above 42 U rack adoption due to their focus on maximizing space utilization. These trends showwhy above 42 U racks are outpacing other height categories.

By Width Insights

The 19-inch racks segment secured top spot in the market by capturing a substantial portionof the total share in 2024 owing to their universal compatibility with standard IT equipment, ensuring seamless integration across diverse applications. According to the British Cloud Industry Forum, over 80% of European enterprises utilize 19-inch racks due to their cost-effectiveness and ease of deployment. For instance, Germany reported a 30% annual increase in 19-inch rack installations in colocation facilities, driven by partnerships with hardware manufacturers. Additionally, advancements in modular designs have enhanced adaptability making 19-inch racks the go-to choose for both small and large-scale deployments. These factors collectively ensure their leadership in the market.

The 23-inch rack segment is growing quickly, with an expected annual growth rate of 8.8% in the coming years. These racks are especially useful in telecommunications and networking, where wider equipment is often needed. In 2023, France saw a 35% increase in the use of 23-inch racks by telecom companies, mainly due to the expansion of 5G networks. New improvements in design, such as better stability and cooling, have made these racks more suitable for high-performance computing. According to Gartner Research, Western Europe is seeing a 25% yearly rise in adoption, as these racks support new and emerging technologies.

By Vertical Insights

The IT & telecom sector commanded the vertical segment by holding a 35.q% market share in 2024. The strong demand for data center racks comes from their key role in powering cloud services, 5G networks, and IoT systems. Eurostat reports that more than 65% of telecom companies in Europe use advanced rack systems to improve server space and cooling. In Spain, rack use by telecom providers rose by 25% in one year, thanks to collaborations with major cloud platforms like AWS and Microsoft Azure. The rise of edge computing, especially in cities, has also increased demand. Together, these trends make the IT and telecom sector a major driving force in the market.

Healthcare is the fastest-growing sector in the market, with an expected annual growth rate of 11.5% in the coming years. This rapid growth is due to the rising use of telemedicine, electronic health records (EHR), and AI-based diagnostics all of which need reliable data storage systems. In 2023, hospitals in France increased their use of racks by 50%, helped by government support for digital health programs. New, secure rack designs that meet health data regulations are now used more often, especially for handling patient information. According to the International Data Corporation, healthcare rack adoption in Northern Europe is growing by 40% each year, driven by a push for better efficiency.

Country Level Analysis

Germany held the largest market share by accounting for an estimated 28.6% of the European data center rack market in 2024 and is driven by its robust industrial base and leadership in cloud computing adoption. According to the German Federal Ministry for Economic Affairs, over 60% of enterprises have transitioned to cloud-based solutions and is necessitating advanced rack systems to support hyperscale and edge data centers. Berlin’s emphasis on Industry 4.0 initiatives has accelerated adoption, particularly among automotive and manufacturing sectors, achieving a 25% growth in 2023. Furthermore, government subsidies for green data centers ensure affordability, while certification programs guarantee energy efficiency. Munich’s thriving tech ecosystem further drives innovation, making Germany a pivotal player in the market.

France is entering a phase of accelerated modernization in its data infrastructure which supported by its focus on digital transformation and smart city initiatives. As per the French Ministry of Economy, over 50% of public and private organizations now prioritize sustainable IT infrastructure, driving demand for energy-efficient racks. Paris’s role as a financial and tech hub has propelled demand, with adoption increasing by 30% annually. Government subsidies promoting digital entrepreneurship have further fueled growth, particularly among SMEs. Besides these, partnerships with IT consulting firms have streamlined implementation, enhancing accessibility across industries. These factors position France as a leader in shaping regional trends.

The UK remains one of the most mature data center markets in Europe and is leveraging its advanced digital infrastructure and emphasis on financial services. According to the British Cloud Industry Forum, over 70% of financial institutions utilize high-density racks to support real-time trading and analytics, underscoring their popularity. London’s status as a global tech hub amplifies demand, with startups and multinational corporations alike adopting these systems to enhance productivity. The “Digital Strategy 2023” initiative has further accelerated adoption, particularly in sectors like fintech and e-commerce. These advancements underscore the UK’s pivotal role in driving market expansion.

Sweden is currently the fastest-growing market and regeisted an impressive CAGR of 7.4% in 2024. It is supported by its reputation for technological innovation and high prevalence of renewable energy-powered data centers. As per the Swedish Energy Agency, over 90% of data centers are powered by renewable energy and is necessitating advanced cooling and rack systems. Stockholm’s emphasis on sustainability aligns with modular rack designs, which reduce energy consumption compared to traditional setups. The rise of AI-driven features, such as predictive maintenance, has also fueled adoption, with growth rates exceeding 25% annually. These advancements highlight Sweden’s pivotal role in the market.

The Netherlands accounts for 8% of the market, driven by its advanced telecommunications infrastructure and emphasis on colocation facilities. According to the Dutch Chamber of Commerce, over 55% of European colocation providers operate in Amsterdam, amplifying demand for scalable rack systems. Rotterdam’s thriving logistics industry has further increased adoption, particularly among cloud service providers. Innovations in liquid-cooled racks have expanded use cases, with adoption rates rising by 20% annually. These factors position the Netherlands as a growth hub within the region.

Top 3 Players in the market

Schneider Electric SE

Schneider Electric SE is a global leader in the data center rack market, renowned for its innovative EcoStruxure platform that integrates IoT and AI for enhanced efficiency. The company invests heavily in R&D, dedicating over USD 1 billion annually to develop energy-efficient solutions. Its strategic partnerships with European telecom providers, such as Deutsche Telekom, have expanded its reach, particularly in Germany and France.

Vertiv Co.

Vertiv Co. specializes in modular and scalable rack systems, offering tailored solutions for both enterprise and hyperscale data centers. The company’s state-of-the-art platforms ensure compliance with EU energy efficiency standards, enhancing trust among businesses. Its collaborations with renewable energy firms have strengthened its presence in Scandinavia and the UK.

Eaton Corporation Plc

Eaton Corporation Plc focuses on intelligent power management solutions, leveraging its expertise in electrical systems to deliver cutting-edge rack designs. The company’s commitment to sustainability has earned it a loyal customer base across Western Europe. Its expansion into AI-integrated systems has further enhanced its market appeal, particularly in healthcare and finance.

Top strategies used by the key market participants

Focus on Sustainability and Green Technologies

Companies like Schneider Electric emphasize sustainability by developing energy-efficient rack systems that align with EU green initiatives, enhancing their market credibility.

Expansion of Modular and Scalable Solutions

Key players integrate modular designs to cater to diverse applications, from small-scale deployments to hyperscale data centers, ensuring flexibility and scalability.

Collaborations with Telecom and Cloud Providers

Firms collaborate with telecom and cloud service providers to expand their reach, particularly in emerging markets like Eastern Europe, where 5G and edge computing are gaining traction.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Data Center Rack Market are AMCO Enclosures,Belden Inc.,Chatsworth Products,Cisco Systems, Inc.,Dell Inc.,Eaton,Fujitsu,Hewlett Packard Enterprise Development LP,International Business Machines Corporation,Legrand,nVentPanduit Corp.,Rittal GmbH & Co. KG,Schneider Electric,Vertiv Group Corp.

The Europe data center rack market is highly competitive, characterized by the presence of global leaders like Schneider Electric SE, Vertiv Co., and Eaton Corporation Plc. These companies leverage advanced technologies and strategic partnerships to maintain their dominance, while smaller firms focus on niche segments, such as liquid-cooled or AI-enabled racks. Regulatory frameworks ensure fair competition while fostering innovation. As per the European Standards Organization, over 20 new rack solutions entered the market in 2023, intensifying rivalry.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Schneider Electric launched an AI-enabled rack system in Germany, enabling predictive maintenance for hyperscale data centers.

- In June 2023, Vertiv Co. partnered with a French telecom provider to offer tailored solutions for 5G networks, boosting adoption rates.

- In September 2023, Eaton Corporation introduced a liquid-cooled rack system in Sweden, targeting energy-intensive AI applications.

- In November 2023, Rittal acquired a Danish startup specializing in modular rack designs, expanding its product portfolio.

- In January 2024, ABB launched a smart rack platform in Italy, emphasizing energy efficiency and modularity.

MARKET SEGMENTATION

This research report on the Europe Data Center Rack Market has been segmented and sub-segmented into the following categories.

By Rack Type

- Cabinet Racks

- Open Frame Racks

By Height

- 42 U Racks

- Above 42 U Racks

By Width

- 19-Inch Racks

- 23-Inch Racks

By Vertical

- IT & Telecom

- Healthcare

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is the current size of the Europe Data Center Rack Market?

The market size varies based on demand for data storage, increasing cloud adoption, and the growth of colocation data centers. Reports provide detailed revenue figures and growth rates.

What are the key drivers of the Europe Data Center Rack Market?

Factors such as rising cloud computing adoption, the expansion of hyperscale data centers, edge computing, and increasing investments in colocation

Which countries in Europe have the highest demand for data center racks?

The leading markets include the United Kingdom, Germany, France, Netherlands, and Ireland, due to their high concentration of data centers and cloud infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]