Europe Disposable Thermometer Market Size, Share, Trends, & Growth Forecast Report by Type (Digital thermometers, Strip thermometers ), Target Area, End-Use , and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Disposable Thermometer Market Size

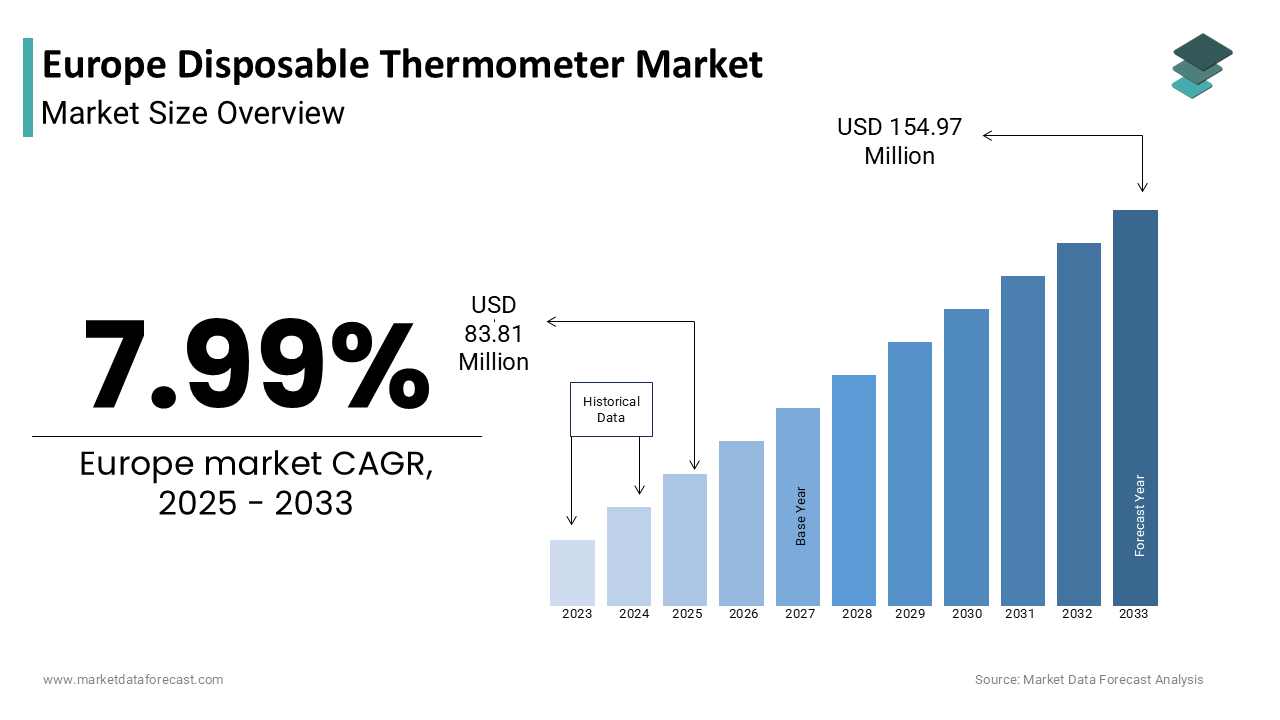

The Europe Disposable Thermometer Market was worth USD 77.61 million in 2024. The Europe market is expected to reach USD 154.97 million by 2033 from USD 83.81 million in 2025, rising at a CAGR of 7.99% from 2025 to 2033.

The Europe disposable thermometer market covers single-use temperature measurement devices designed for hygienic and accurate body temperature monitoring in both clinical and home care settings. These thermometers are widely used in hospitals, clinics, long-term care facilities, and households due to their ability to prevent cross-contamination between users, a critical factor in infection control. Available in formats such as strip, digital patch, and chemical-based types, disposable thermometers are particularly favored in pediatric and geriatric patient populations where hygiene and ease of use are paramount.

As per the European Centre for Disease Prevention and Control (ECDC), approximately 7% of hospitalized patients acquire at least one HAI during their stay, prompting healthcare institutions to adopt disposable diagnostic tools as part of standard infection prevention protocols. Additionally, rising awareness regarding personal health monitoring has spurred demand among consumers, especially post-pandemic, where self-monitoring became a norm.

MARKET DRIVERS

Rising Prevalence of Infectious Diseases and Hospital-Acquired Infections

One of the primary drivers of the Europe disposable thermometer market is the increasing prevalence of infectious diseases and hospital-acquired infections (HAIs), which necessitate the use of single-use thermometers to minimize cross-contamination risks. According to the European Centre for Disease Prevention and Control (ECDC), over 3.8 million HAIs were reported in EU healthcare settings in 2023, with urinary tract infections, surgical site infections, and bloodstream infections being the most common.

Given these concerns, healthcare institutions have increasingly adopted disposable thermometers as part of standard infection control measures. In particular, the use of single-use strip thermometers has gained traction in intensive care units (ICUs) and emergency departments where rapid, safe, and accurate temperature assessments are essential. For instance, the UK’s National Health Service (NHS) updated its infection control guidelines in 2023 to recommend disposable thermometers for all ICU admissions, reinforcing their role in reducing microbial transmission. Moreover, the lingering impact of the COVID-19 pandemic has heightened public awareness about hygiene and disease transmission, leading to greater acceptance of disposable medical products even in non-clinical environments.

Increasing Elderly Population Requiring Frequent Temperature Monitoring

Another key driver of the Europe disposable thermometer market is the aging demographic, particularly in Western and Northern European countries, where the proportion of individuals aged 65 and above continues to rise. This demographic shift is associated with a higher incidence of chronic illnesses such as diabetes, cardiovascular diseases, and respiratory conditions, all of which often require regular temperature monitoring.

Disposable thermometers offer a convenient and hygienic solution for caregivers and family members managing the health of elderly individuals at home or in assisted living facilities. Unlike reusable thermometers, they eliminate the risk of bacterial buildup and ensure accuracy with each use factors that are crucial when dealing with immunocompromised seniors.

In response to this trend, several healthcare providers and pharmacies across Germany and France have included disposable thermometers in senior health management kits distributed under national wellness programs. Besides, telehealth services have begun recommending disposable thermometers for remote patient monitoring, enhancing their adoption beyond traditional clinical settings. These factors collectively contribute to sustained market growth across Europe.

MARKET RESTRAINTS

Availability of Reusable and Digital Thermometers Offering Cost Efficiency

A major restraint affecting the Europe disposable thermometer market is the widespread availability and growing preference for reusable and digital thermometers, which offer cost efficiency and environmental benefits. Unlike disposable variants, which are intended for single-use and discarded after each reading, reusable thermometers—especially digital ones—are perceived as more economical for long-term use, particularly among budget-conscious consumers and healthcare facilities seeking to reduce operational costs.

According to the European Environment Agency (EEA), healthcare institutions are under increasing pressure to minimize waste generation and adopt sustainable practices. This has led many hospitals and clinics to transition toward durable infrared and digital thermometers that can be sterilized and reused multiple times without compromising hygiene standards. Furthermore, technological advancements in smart thermometry, including Bluetooth-enabled devices that sync with mobile apps for continuous temperature tracking, are gaining popularity among consumers.

Regulatory Restrictions on Certain Types of Disposable Thermometers

Regulatory scrutiny over specific disposable thermometer types poses a significant challenge to market expansion in Europe. Some chemical-based disposable thermometers, particularly those containing mercury or other restricted substances, face increasing restrictions under directives such as the EU’s Restriction of Hazardous Substances (RoHS) Regulation and the Medical Device Regulation (MDR). According to the European Chemicals Agency (ECHA), the use of mercury-containing thermometers has been largely phased out since 2021, pushing manufacturers to reformulate products using safer alternatives.

However, some newer disposable thermometers based on liquid crystal technology or thermal-sensitive strips have encountered hurdles in obtaining full CE certification due to variability in accuracy and reliability. These regulatory constraints not only delay market entry but also increase compliance costs for producers.

MARKET OPPORTUNITIES

Integration of Smart Technologies in Disposable Thermometers

An emerging opportunity within the Europe disposable thermometer market lies in the integration of smart technologies into single-use temperature monitoring devices. While traditionally viewed as basic analog tools, disposable thermometers are undergoing innovation through the incorporation of wireless connectivity, real-time data tracking, and compatibility with mobile health applications. This evolution aligns with the broader digital transformation of healthcare across Europe, where remote patient monitoring and telemedicine services are gaining prominence.

According to the European Commission’s eHealth Action Plan, digital health solutions have seen accelerated adoption post-pandemic, particularly in home care and outpatient settings. Companies are now developing disposable thermometers embedded with NFC chips or ultra-thin sensors capable of transmitting temperature data directly to smartphones or cloud-based platforms. These advancements enhance usability for caregivers and improve data accuracy for healthcare professionals.

Expansion of Home Healthcare Services Driving Demand for Hygienic Diagnostic Tools

The expanding home healthcare sector in Europe presents a substantial growth opportunity for the disposable thermometer market. With rising healthcare costs and an aging population, governments and private insurers are increasingly promoting home-based care models to reduce hospital readmissions and ease the burden on public health systems. Disposable thermometers play a vital role in this context, offering caregivers and patients a safe, reliable method for monitoring fevers and infections without the risk of cross-contamination. Their ease of use and minimal maintenance make them ideal for home settings, particularly for families managing the health of elderly relatives or children recovering from illness.

Pharmacies and online health retailers across the UK, France, and Spain have responded to this trend by stocking disposable thermometers alongside other home diagnostic kits. Additionally, telehealth platforms have begun bundling disposable thermometers with remote monitoring packages, encouraging wider adoption.

MARKET CHALLENGES

Ensuring Accuracy and Consistency Across Disposable Thermometer Variants

Ensuring consistent accuracy across different types of disposable thermometers remains a critical challenge in the Europe market. Unlike digital or infrared thermometers, which provide precise numerical readings, certain disposable variants such as liquid crystal strip thermometers, rely on color-coded indicators that can be subject to interpretation errors. According to the European Society of Clinical Microbiology and Infectious Diseases (ESCMID), variations in ambient temperature, skin contact duration, and individual physiological differences can impact the reliability of disposable strip thermometers.

This inconsistency raises concerns among healthcare professionals about the suitability of disposable thermometers for clinical decision-making, particularly in critical care settings. Manufacturers are responding by investing in sensor-enhanced disposable designs that integrate thin-film technology for improved accuracy. However, achieving regulatory approval for these advanced versions while maintaining cost-effectiveness remains a hurdle.

Environmental Concerns Regarding Disposal and Waste Management

Environmental concerns surrounding the disposal and waste management of single-use thermometers pose a growing challenge for the Europe disposable thermometer market. With increasing emphasis on sustainability and plastic reduction across the region, disposable medical products are facing scrutiny for their contribution to biomedical waste. Unlike reusable thermometers, which can be disinfected and used multiple times, disposable variants generate waste after each application, raising concerns among both policymakers and environmentally conscious consumers. In response, several municipalities in Sweden and the Netherlands have introduced stricter regulations on the segregation and recycling of medical plastics, adding complexity to disposal logistics for disposable thermometers. To address these concerns, manufacturers are exploring biodegradable materials and recyclable packaging options. However, transitioning to eco-friendly alternatives without compromising product functionality or affordability remains a technical and economic challenge.

SEGMENTAL ANALYSIS

By Type Insights

The digital thermometers segment held the largest share of the Europe disposable thermometer market by accounting for 58.7% in 2024. This dominance is primarily driven by their widespread adoption across healthcare facilities and homecare settings due to superior accuracy, ease of use, and rapid temperature readings compared to traditional strip-based alternatives. According to the European Centre for Disease Prevention and Control (ECDC), digital thermometers are preferred in hospital wards and outpatient clinics where precise and consistent measurements are essential for diagnosing febrile conditions. Their compatibility with infection control protocols further enhances their appeal as single-use variants eliminate cross-contamination risks between patients. Apart from these, growing consumer awareness regarding health monitoring has spurred demand among households, particularly during seasonal flu outbreaks and post-viral recovery periods.

Strip thermometers represent the fastest-growing segment in the Europe disposable thermometer market, projected to expand at a CAGR of 9.1% through 2033. Despite being an older technology, these thermometers are experiencing renewed interest due to their affordability, non-invasive nature, and suitability for pediatric and elderly populations.

A key driver behind this growth is the increasing deployment of strip thermometers in schools, daycare centers, and assisted living homes, where quick, contactless temperature checks are required without causing discomfort. Moreover, manufacturers are enhancing product performance by integrating thermal-sensitive materials that improve color differentiation and readability. In 2023, several companies launched eco-friendly versions using biodegradable substrates, aligning with regional sustainability trends. As healthcare providers seek cost-effective yet hygienic temperature monitoring solutions, strip thermometers are gaining traction, particularly in budget-constrained settings across Central and Eastern Europe.

By Target Area Insights

The axillary (underarm) measurement method was the top performer in the Europe disposable thermometer market by capturing 43.6% in 2024. This preference is because of its non-invasive nature, making it especially suitable for infants, elderly individuals, and patients who may find oral or rectal methods uncomfortable or impractical. Like, axillary thermometry remains the most commonly used approach in primary care settings across Germany and France due to its ease of administration and minimal risk of injury. Additionally, as per guidelines issued by the UK’s National Institute for Health and Care Excellence (NICE), axillary thermometers are recommended for initial fever screening in neonatal and geriatric patients, reinforcing their clinical relevance. Furthermore, rising consumer adoption in home healthcare environments has bolstered demand.

Oral thermometers are emerging as the rapidly advancing target area segment in the Europe disposable thermometer market, anticipated to expand at a CAGR of around 8.7%. This growth is attributed to their balance between accuracy and user-friendliness, particularly among adults and older children who can tolerate oral placement. One key driver is the increasing integration of oral thermometers into telehealth and remote patient monitoring systems. With the rise of digital health platforms in countries like the Netherlands and Switzerland, oral disposable thermometers are being bundled with mobile-connected devices for real-time tracking of body temperature in chronic illness management and post-surgical recovery. Besides, advancements in sensor technology have improved the reliability of oral disposable thermometers, making them more competitive against infrared and tympanic alternatives.

By End Use Insights

Hospitals remained the biggest end-use segment in the Europe disposable thermometer market by holding a 49.1% of total market share in 2024. This control over the market is largely driven by stringent infection control policies and the need for hygienic, single-use medical tools to prevent cross-contamination among high-risk patient populations. According to the European Centre for Disease Prevention and Control (ECDC), hospital-acquired infections affect nearly 4 million patients annually across EU member states, prompting healthcare institutions to prioritize disposable diagnostic equipment. In response, many hospitals have transitioned away from reusable thermometers in favor of disposable variants, particularly in intensive care units (ICUs), emergency departments, and isolation wards. Furthermore, regulatory mandates such as the Medical Device Regulation (MDR) and directives from national health authorities have reinforced the adoption of disposable thermometers as part of standard hygiene protocols. For instance, the French Ministry of Health mandated the exclusive use of single-use thermometers in all public hospitals starting in 2023 to reduce nosocomial infection rates.

The homecare is the swiftest progressing end-use segment in the Europe disposable thermometer market, projected to expand at a CAGR of 10.2%. This surge is mainly fueled by the rising prevalence of chronic diseases, aging demographics, and the growing preference for self-monitoring and home-based treatment options. This shift is supported by government initiatives promoting decentralized care models to alleviate pressure on public hospitals and improve patient outcomes. Disposable thermometers are increasingly included in home health kits distributed by pharmacies and telemedicine providers, ensuring accurate temperature tracking for individuals managing post-viral recovery, respiratory illnesses, or long-term conditions such as diabetes and cardiovascular disease.

REGIONAL ANALYSIS

Germany spearheaded the Europe disposable thermometer market by accounting for a 23.5% in 2024. As the continent's largest economy and a hub for advanced healthcare infrastructure, Germany leads in both domestic consumption and medical device manufacturing. The country’s emphasis on hygiene and patient safety has prompted widespread adoption of single-use thermometers in ICUs, ambulatory care centers, and home health settings. Regulatory alignment with the Medical Device Regulation (MDR) ensures compliance with CE marking requirements, fostering confidence in product quality. Additionally, Germany’s aging population has increased demand for temperature monitoring in long-term care and home-based services.

France is another major player in the market. The country’s healthcare system prioritizes infection prevention, driving the widespread use of disposable thermometers in hospitals, nursing homes, and community health centers. According to the French Directorate General for Health (DGS), over 80,000 disposable thermometers were distributed to public hospitals in 2023 as part of national hygiene improvement initiatives. France also benefits from a well-established pharmaceutical and medtech industry, with major players actively involved in developing next-generation disposable temperature monitoring solutions. The country’s regulatory environment, overseen by ANSM (National Agency for Medicines and Health Products Safety), ensures adherence to high-quality standards while encouraging innovation. Moreover, rising awareness among consumers about personal health tracking has boosted retail sales, particularly in urban areas.

The United Kingdom continues to play a key role in the market. The NHS’s emphasis on reducing hospital-acquired infections has led to increased procurement of disposable thermometers for use in acute care settings. Post-pandemic health consciousness has also driven homecare demand, with online pharmacy sales surging compared to pre-2020 levels. Retailers such as Boots and Lloyds Pharmacy have expanded their offerings to include single-use variants tailored for families and elderly users. Despite Brexit-related supply chain adjustments, the UK continues to maintain strong ties with European manufacturers and distributors. The British Standards Institution (BSI) plays a key role in ensuring conformity with international medical device regulations, supporting market stability.

Italy’s aging population—a notable share aged 65 or older—fuels continuous demand for temperature monitoring tools in both clinical and home settings. Its healthcare system places a strong emphasis on hygiene and sanitation, particularly in regions with high patient turnover such as Lombardy and Lazio. The Italian Medicines Agency (AIFA) regularly updates medical device guidelines to ensure compliance with EU-wide standards, influencing purchasing decisions among hospitals and clinics. Additionally, local manufacturers and importers have strengthened their distribution networks to meet growing retail demand. Consumer electronics retailers such as MediaWorld and e-commerce platforms like Amazon Italy have integrated disposable thermometers into wellness kits, expanding accessibility.

Spain’s healthcare system has increasingly adopted disposable thermometers to curb the spread of infectious diseases, particularly in public hospitals and primary care centers. Spain’s aging demographic profile has further intensified demand for reliable and hygienic temperature monitoring solutions. Pharmacies and online health retailers have responded by stocking a diverse range of disposable thermometers suited for different age groups and medical needs. Moreover, the country’s participation in EU-funded healthcare innovation programs has facilitated the introduction of smart disposable thermometers equipped with wireless connectivity features.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

3M, Medline Industries, Inc., Omron Healthcare, Inc., Terumo Corporation, Medical Indicators Inc. (MII), Tempagenix, LLC, and Hangzhou CarePatch are some of the key market players in the europe disposable thermometer market.

The competition in the Europe disposable thermometer market is shaped by a blend of established multinational corporations and emerging regional players, all striving to meet growing demand for hygienic, accurate, and cost-effective temperature monitoring solutions. As healthcare institutions prioritize infection control and homecare services expand, companies face increasing pressure to differentiate their offerings through technological advancements and superior product design.

Market participants compete not only on product performance but also on pricing strategies, distribution networks, and regulatory compliance. While large firms leverage their R&D capabilities and brand recognition to maintain dominance, smaller innovators are gaining traction by introducing niche products tailored for specific patient groups or healthcare settings. Additionally, environmental concerns are influencing competitive positioning, with some manufacturers emphasizing eco-friendly materials and recyclable packaging to appeal to sustainability-conscious buyers.

The regulatory environment in Europe further intensifies competition, requiring companies to continuously adapt to evolving medical device standards. As disposable thermometers become integral to both clinical and personal health monitoring, the battle for market share is increasingly defined by innovation, strategic alliances, and responsiveness to changing consumer and institutional preferences.

Top Players in the Europe Disposable Thermometer Market

Becton, Dickinson and Company (BD)

BD is a global leader in medical technology, including diagnostic tools and patient monitoring devices. In the Europe disposable thermometer market, BD plays a crucial role through its portfolio of single-use temperature monitoring solutions tailored for hospital and homecare settings. The company emphasizes innovation, product reliability, and compliance with stringent healthcare regulations.

BD’s contributions extend beyond product development, as it actively engages in partnerships with healthcare institutions to improve infection control protocols. Its focus on user-friendly designs and integration with digital health platforms enhances clinical efficiency. By consistently aligning with evolving hygiene standards, BD reinforces its leadership in the European disposable thermometer landscape.

3M Company

3M is a diversified technology company that has made significant contributions to the disposable thermometer market through its healthcare business segment. Known for its innovation in materials science, 3M develops disposable thermometers that combine accuracy with ease of use, catering to both professional and consumer markets across Europe.

The company's strength lies in its ability to integrate advanced sensor technologies into cost-effective, hygienic products. It also supports healthcare providers through educational initiatives aimed at improving temperature measurement practices. With a strong distribution network and commitment to quality assurance, 3M maintains a prominent presence in the European market.

Exergen Corporation (A part of Wound Care Technologies Inc.)

Exergen is widely recognized for its expertise in non-invasive temperature measurement. Although best known for its temporal artery thermometers, the company also supplies disposable variants suited for clinical and home environments. Exergen's focus on precision and patient comfort has earned trust among medical professionals and caregivers alike.

In Europe, Exergen contributes to advancing patient safety by offering disposable thermometers compatible with infection control guidelines. Its commitment to continuous improvement and adherence to regulatory standards ensures sustained relevance in a competitive market. Through strategic collaborations and targeted product launches, Exergen strengthens its position in the region.

Top Strategies Used by Key Market Participants

One key strategy employed by leading players in the Europe disposable thermometer market is continuous product innovation to enhance accuracy, usability, and hygiene. Companies are investing in research and development to introduce disposable thermometers with improved sensor technology, faster readings, and better ergonomics to meet the evolving needs of healthcare professionals and consumers.

Another major approach is strengthening partnerships with healthcare institutions, distributors, and government agencies to ensure widespread adoption of disposable thermometers. These collaborations help companies align their offerings with national health policies, expand market reach, and influence procurement decisions within public and private healthcare systems.

Lastly, manufacturers are increasingly focusing on expanding their digital integration capabilities, incorporating smart features such as wireless connectivity and mobile app compatibility into disposable thermometers. This trend supports remote patient monitoring and aligns with the broader shift toward connected health solutions, reinforcing brand value and customer loyalty in the competitive European market.

RECENT MARKET DEVELOPMENTS

- In January 2024, BD launched a new line of ultra-thin disposable thermometers designed for enhanced patient comfort and rapid temperature detection, targeting intensive care units and ambulatory clinics across Germany and France.

- In March 2024, 3M announced a collaboration with a leading European telehealth provider to integrate disposable thermometers into remote patient monitoring kits, aiming to support post-hospitalization care and chronic disease management.

- In June 2024, Exergen introduced an upgraded version of its disposable strip thermometer featuring improved color-coded indicators for more accurate fever detection, particularly suited for pediatric use in home and school settings.

- In August 2024, Heraeus Medical Components expanded its manufacturing capacity in Italy to scale up production of biodegradable disposable thermometers, addressing growing environmental concerns while maintaining high hygiene standards.

- In November 2024, Geratherm Medical AG entered into a strategic distribution agreement with a UK-based medical supply chain firm to increase availability of its disposable thermometers in primary care centers and pharmacies nationwide.

MARKET SEGMENTATION

This research report on the Europe disposable thermometer market is segmented and sub-segmented into the following categories.

By Type

- Digital thermometers

- Strip thermometers

By Target Area

- Oral

- Axilla

- Rectal

- Other target areas

By End Use

- Hospitals

- Diagnostic centers

- Homecare

- Other end use

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the disposable thermometer market in Europe?

The market growth in Europe is driven by increasing awareness of infection control, the rising demand for hygienic and cost-effective temperature measurement in hospitals, and the growing use of disposable thermometers in emergency and home care settings.

What is the future outlook for the disposable thermometer market in Europe?

The future of the disposable thermometer market in Europe is expected to remain stable, with continued demand in healthcare, growing interest in infection prevention, and the integration of low-cost temperature solutions in emergency and remote care services.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com