Europe Dry Eye Syndrome Market Research Report – Segmented By Type ( Evaporative Dry Eye Syndrome , Aqueous Deficient Dry Eye Syndrome ) Drugs, Product & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis From 2025 to 2033

Europe Dry Eye Syndrome Market Size

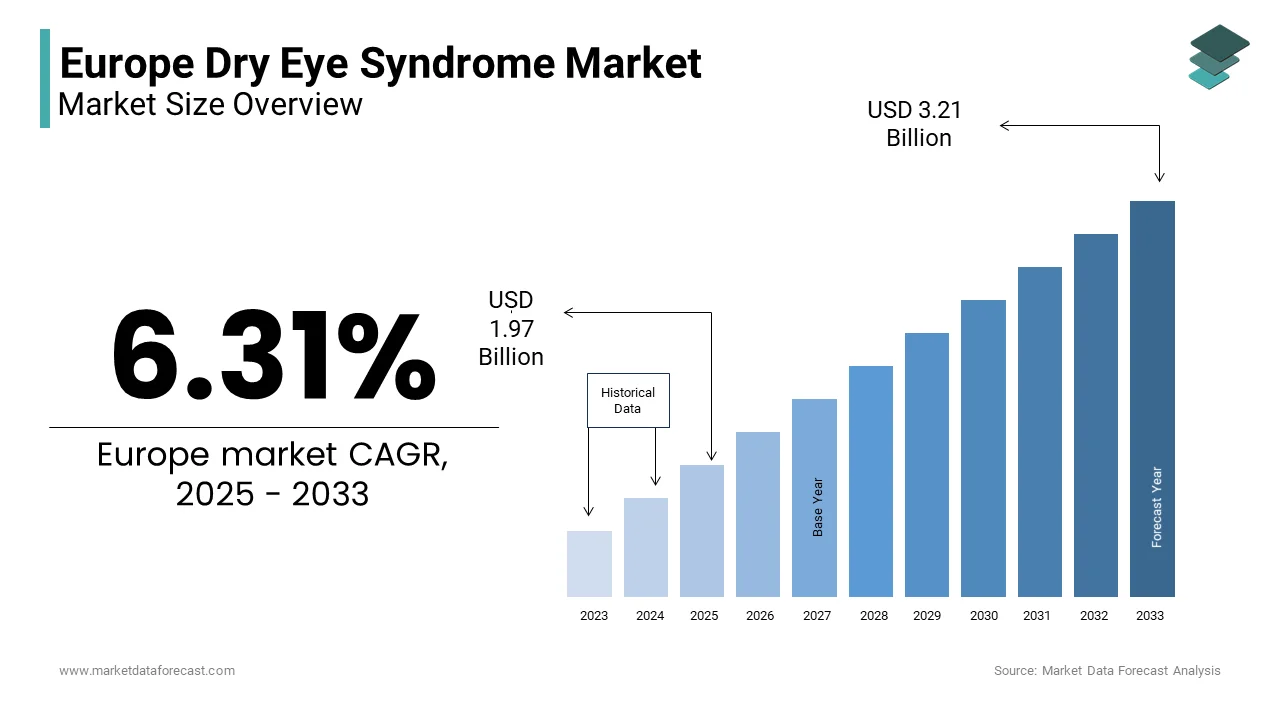

The Europe Dry Eye Syndrome Market Size was valued at USD 1.85 billion in 2024. The Europe Dry Eye Syndrome Market size is expected to have 6.31 % CAGR from 2025 to 2033 and be worth USD 3.21 billion by 2033 from USD 1.97 billion in 2025.

Dry Eye Syndrome (DES), also known as keratoconjunctivitis sicca, is a multifactorial disease of the ocular surface characterized by loss of homeostasis of the tear film. It is accompanied by ocular symptoms such as irritation, redness, and blurred vision. In Europe, DES has emerged as a significant public health concern due to its high prevalence and impact on quality of life. The condition affects individuals across all age groups but is more prevalent among aging populations and those with chronic conditions such as diabetes or Sjögren’s syndrome.

Recent epidemiological data indicate that a significant portion of the adult population in Europe experiences symptoms consistent with dry eye at some point in their lives. According to the European Society of Ophthalmology, around 67 million adults in the region suffer from mild to severe forms of dry eye disease. This growing patient pool has driven increased attention from healthcare providers, regulatory bodies, and pharmaceutical companies alike.

Environmental factors such as prolonged screen exposure, air pollution, and contact lens usage have further exacerbated the condition's prevalence. As per the European Environment Agency, urban areas in Western Europe report higher levels of particulate matter (PM2.5) emissions, which are linked to ocular discomfort and dryness. Besides, lifestyle changes, including sedentary habits and digital device overuse, are contributing to rising incidence rates.

MARKET DRIVERS

Rising Prevalence of Digital Device Usage Amongst All Age Groups

One of the key drivers fueling the Europe Dry Eye Syndrome market is the increasing use of digital devices across all demographics. With smartphones, tablets, computers, and televisions becoming integral parts of daily life, people are spending significantly more time staring at screens—often with reduced blink rates. This surge in screen time directly correlates with an increase in dry eye symptoms, as prolonged visual tasks reduce tear production and accelerate tear evaporation. Research published by the European Eye Epidemiology Consortium found that individuals who spent more than six hours daily on digital screens had a higher risk of developing dry eye symptoms compared to those with less than two hours of screen exposure. This behavioral shift has led to a growing demand for lubricant eye drops, anti-inflammatory medications, and advanced treatment options such as intense pulsed light therapy and punctal plugs. As awareness about the correlation between screen exposure and ocular discomfort increases, both patients and healthcare professionals are seeking effective management strategies.

Increasing Geriatric Population Prone to Chronic Diseases

Another major driver influencing the growth of the Europe Dry Eye Syndrome market is the expanding geriatric population, particularly in countries like Germany, Italy, and France. Aging is a well-documented risk factor for dry eye syndrome due to natural declines in tear production and changes in eyelid function. This demographic shift is amplifying the burden of age-related diseases, including dry eye syndrome. Moreover, older adults often suffer from comorbidities such as diabetes, rheumatoid arthritis, and Sjögren’s syndrome, which exacerbate dry eye symptoms. Besides, long-term use of systemic medications such as antihypertensives, antidepressants, and antihistamines—commonly prescribed to elderly patients—can further impair tear secretion and ocular surface health. Governments and healthcare institutions across Europe are recognizing the need for better diagnostic protocols and treatment accessibility for this vulnerable group.

MARKET RESTRAINTS

Limited Awareness and Underdiagnosis of Dry Eye Syndrome

A significant restraint impeding the growth of the Europe Dry Eye Syndrome market is the low level of awareness and widespread underdiagnosis of the condition. Many patients fail to seek medical attention because they perceive dry eye symptoms as minor inconveniences rather than treatable medical issues. This gap in patient engagement results in a large portion of the affected population remaining untreated or relying on over-the-counter remedies without proper medical supervision. In addition, misdiagnosis remains a prevalent issue, as dry eye symptoms overlap with other ocular disorders such as allergic conjunctivitis or blepharitis. This diagnostic ambiguity hampers timely intervention and reduces the effectiveness of available therapies. In response, several European ophthalmological societies, including the European Society of Cataract & Refractive Surgeons, have launched educational campaigns to improve physician and patient knowledge.

High Cost of Advanced Therapies and Reimbursement Challenges

Another key constraint affecting the Europe Dry Eye Syndrome market is the high cost associated with advanced treatment modalities and inconsistent reimbursement policies across the region. While traditional treatments such as artificial tears and lubricating gels are widely accessible, newer therapies—including cyclosporine-based eye drops, lifitegrast, and autologous serum eye drops—are significantly more expensive. Reimbursement structures for dry eye treatments also vary widely across Europe. In some nations, including the UK and Sweden, certain advanced therapies are partially covered under national health schemes, while in others like Poland and Greece, patients bear most of the financial burden. This disparity limits access to effective treatments, especially for lower-income populations. Moreover, despite clinical evidence supporting the efficacy of procedures such as intense pulsed light therapy and thermal pulsation systems, many national health insurance programs do not include them in standard coverage.

MARKET OPPORTUNITIES

Expansion of Teleophthalmology and Remote Diagnostic Tools

A promising opportunity shaping the future of the Europe Dry Eye Syndrome market is the rapid expansion of teleophthalmology and remote diagnostic technologies. With the ongoing digital transformation in healthcare, particularly accelerated by the pandemic, virtual consultations and digital diagnostics have become increasingly accepted across Europe. Teleophthalmology platforms now allow patients to undergo preliminary dry eye assessments remotely using smartphone-compatible imaging devices and symptom tracking apps. Companies such as Nocturne AI and Eyenovia are introducing AI-powered tools capable of analyzing blink patterns and corneal staining digitally. These innovations facilitate early detection and continuous monitoring of dry eye conditions without requiring frequent clinic visits. Furthermore, the integration of wearable technology—such as smart contact lenses capable of measuring tear osmolarity—is gaining traction. Such advancements not only enhance patient convenience but also support personalized treatment plans, improving therapeutic outcomes.

Growing Focus on Personalized Medicine and Biologics

An emerging opportunity within the Europe Dry Eye Syndrome market lies in the development and adoption of personalized medicine and biologic therapies tailored to individual patient profiles. Traditional dry eye treatments have largely followed a one-size-fits-all approach, often failing to address the heterogeneity of the disease. However, recent advances in biomarker research and molecular diagnostics are enabling more targeted interventions. This classification system paves the way for precision therapies that match specific pathophysiological mechanisms in each patient. For instance, companies like Santen Pharmaceutical and Bausch + Lomb are investing heavily in autologous serum eye drops and recombinant growth factor formulations aimed at restoring ocular surface integrity in severe cases. Moreover, regenerative medicine approaches, including stem cell-derived therapies, are being explored in clinical trials across academic institutions in Germany and the Netherlands. The University Medical Center Utrecht reported that in 2023, phase II trials involving limbal stem cell transplants showed a improvement in corneal epithelial healing among dry eye patients. Regulatory agencies such as the European Medicines Agency (EMA) are increasingly supportive of novel biologics, expediting approval timelines for therapies demonstrating robust clinical outcomes.

MARKET CHALLENGES

Regulatory Hurdles and Lengthy Approval Processes for Novel Therapies

A major challenge confronting the Europe Dry Eye Syndrome market is the complex and time-consuming regulatory landscape governing the approval of novel therapeutics. Unlike fast-track markets such as the United States, where the FDA offers expedited pathways for breakthrough therapies, the European Medicines Agency (EMA) maintains a more rigorous and centralized evaluation process. According to a 2023 report by the European Federation of Pharmaceutical Industries and Associations (EFPIA), the average time required for EMA marketing authorization exceeds 400 days, compared to approximately 300 days under the FDA. This extended timeline delays the availability of innovative dry eye treatments, such as gene therapies and next-generation immunomodulators, to European patients. Furthermore, the EMA mandates extensive post-marketing surveillance and pharmacovigilance requirements, adding to the operational burden for manufacturers. In particular, biologics and regenerative medicines face additional scrutiny due to concerns over long-term safety and variability in manufacturing processes. Differences in regulatory standards across EU member states further complicate market entry. While centralized EMA approvals apply to all EU countries, local reimbursement decisions and clinical guidelines vary, necessitating multiple submissions and negotiations.

Lack of Standardized Diagnostic Criteria Across Europe

A persistent challenge in the Europe Dry Eye Syndrome market is the absence of universally accepted diagnostic criteria, leading to inconsistencies in patient identification and treatment planning. Although international consensus reports such as the Tear Film & Ocular Surface Society’s Dry Eye Workshop II (TFOS DEWS II) provide comprehensive guidance, their implementation varies widely across European countries. This lack of standardization stems from differences in national guidelines, training protocols, and available diagnostic tools. For example, while Germany and the Netherlands incorporate advanced tests such as matrix metalloproteinase-9 (MMP-9) assays and meibography into routine dry eye evaluations, these techniques are rarely utilized in Eastern European countries due to cost and infrastructure limitations. Consequently, diagnosis often relies on subjective patient-reported symptoms, leading to potential misclassification and suboptimal treatment selection. Efforts by organizations such as the European Society of Ophthalmology and the European Cornea and Cell Society aim to harmonize diagnostic practices. However, progress remains slow due to disparities in healthcare funding and physician education levels.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.31% |

|

Segments Covered |

By Type, Drugs, Product and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Novartis AG ADR, AbbVie Inc, Sun Pharmaceutical Industries, Santen Pharmaceutical Co Ltd, Johnson & Johnson, Otsuka Pharmaceutical |

SEGMENT ANALYSIS

By Type Insights

The evaporative Dry Eye Syndrome was the largest segment in the Europe Dry Eye Syndrome market by accounting for 62% of total market share as of 2024. This dominance is due to its high prevalence across various age groups and increasing exposure to environmental and lifestyle factors that exacerbate tear film instability. One key driver behind the segment's prowess is the rising incidence of meibomian gland dysfunction (MGD), which underlies most cases of evaporative dry eye. According to a 2023 epidemiological study published by the European Society of Ophthalmology, MGD affects over 45% of the adult population in Western Europe , particularly in urban centers where digital screen usage and air pollution are more pronounced. Another contributing factor is the growing adoption of diagnostic technologies such as meibography, which has improved detection rates. These advancements enable earlier diagnosis and targeted interventions, further reinforcing the segment’s dominant position in the regional market.

The aqueous Deficient Dry Eye Syndrome is currently the fastest-growing segment in the Europe Dry Eye Syndrome market, projected to expand at a CAGR of 10.4%. This rapid growth trajectory is primarily attributed to an aging population and the rising burden of systemic autoimmune diseases that impair lacrimal gland function. Age-related decline in tear production makes the elderly particularly susceptible to aqueous deficiency. Furthermore, conditions such as Sjögren’s syndrome, rheumatoid arthritis, and lupus—which are more prevalent in older adults—directly contribute to tear insufficiency. In additional, the increasing prescription of anticholinergic medications—including antidepressants and antihypertensives—has exacerbated the condition.

By Drugs Insights

Restasis (cyclosporine ophthalmic emulsion) held the commanding share in the Europe Dry Eye Syndrome drug market by capturing a 35.2% of total revenue in 2024. This control can be attributed to its long-standing presence in the therapeutic landscape and widespread acceptance among ophthalmologists treating moderate to severe dry eye. Developed by Allergan, now part of AbbVie, Restasis was one of the first FDA-approved treatments specifically designed to increase tear production by modulating inflammation. Moreover, patient adherence remains high due to its twice-daily dosing regimen and availability in preservative-free formulations.

Tyrvaya nasal spray is the rapidly advancing drug segment in the Europe Dry Eye Syndrome market, projected to grow at a CAGR of 18.6%. This quick ascent is primarily fueled by its unique mode of action and growing adoption among patients seeking non-invasive treatment options. Unlike conventional eye drops, Tyrvaya works through trigeminal nerve stimulation to naturally enhance basal tear production. In addition, clinical trials have demonstrated superior efficacy compared to placebo, with a improvement in Schirmer’s test scores after eight weeks of use.

By Product Insights

Artificial tears remain the biggest product segment in the Europe Dry Eye Syndrome market by holding an estimated 41.3% of total market share in 2024. Their widespread adoption is largely driven by their accessibility, affordability, and suitability for mild to moderate dry eye cases. These over-the-counter lubricants serve as the first line of defense for millions of patients across the continent. Their popularity is further reinforced by the absence of stringent prescription requirements and minimal side effect profiles compared to pharmacologic agents. Moreover, manufacturers continue to innovate with preservative-free formulations and viscosity-modified solutions tailored to different severities of dry eye.

The punctal plugs are the burgeoning product segment in the Europe Dry Eye Syndrome market, expanding at a CAGR of 12.3%. This growth is being driven by technological advancements in plug design, rising procedural adoption in specialist clinics, and improved patient awareness regarding long-term management options. Traditionally used for aqueous-deficient dry eye, punctal plugs have evolved from temporary collagen-based inserts to permanent silicone and biodegradable variants offering sustained relief. Additionally, integration of punctal occlusion with other therapies—such as topical cyclosporine or intense pulsed light—has enhanced clinical outcomes. With rising investments in outpatient surgical centers and favorable reimbursement policies in select countries, punctal plugs are set to outpace other product categories in terms of growth momentum.

COUNTRY LEVEL ANALYSIS

Germany held the top position in the Europe Dry Eye Syndrome market by capturing a 23.8% of total regional revenue in 2024. As Europe’s largest economy and a leader in healthcare innovation, Germany benefits from advanced diagnostic infrastructure, high per capita healthcare expenditure, and a rapidly aging population. According to Eurostat, in 2023, 22.3% of Germany’s population was aged 65 or older , making it highly susceptible to age-related ocular conditions such as dry eye syndrome. Apart from these, Germany leads in the adoption of advanced diagnostics such as meibography and tear osmolarity testing. Coupled with a thriving medical device ecosystem and government support for R&D initiatives, Germany remains the undisputed market leader in the region.

France has strong clinical infrastructure and high awareness. The country's prominence is driven by a well-established healthcare system, proactive government initiatives, and high patient awareness regarding ocular health. The French National Authority for Health (HAS) has been instrumental in promoting standardized dry eye screening protocols across public and private clinics. This high treatment-seeking behavior is supported by universal health coverage, which partially reimburses prescription dry eye therapies. Moreover, France hosts several leading research institutions focused on ophthalmology, including the Vision Institute in Paris. With growing emphasis on digital diagnostics and teleophthalmology, France is strengthening its foothold in the regional market.

The United Kingdom has high adoption of innovative therapies. Despite uncertainties surrounding post-Brexit regulatory frameworks, the UK maintains a strong presence in the market due to high healthcare spending, advanced clinical research, and early access to innovative therapies. NHS Digital reported in 2023 that over 9 million Britons consulted general practitioners or optometrists for dry eye-related complaints in the past five years. Additionally, the UK’s participation in global clinical trials ensures early access to emerging treatments. For instance, the University of Manchester led a multi-center trial evaluating autologous serum eye drops, demonstrating a improvement in corneal staining scores.

Italy is positioning it as the fourth-largest contributor. The country’s market growth is primarily driven by a rapidly aging demographic and high prevalence of comorbid conditions such as diabetes and Sjögren’s syndrome. This aging cohort is particularly vulnerable to dry eye due to decreased lacrimal function and prolonged medication use. The Italian Society of Ophthalmology noted that more than 8 million Italians suffer from dry eye , with nearly half experiencing symptoms daily. Furthermore, Italy has seen an uptick in the use of thermal pulsation systems and intense pulsed light (IPL) therapy for evaporative dry eye.

Spain has expanding healthcare access and diagnostic penetration. The country’s market dynamics are shaped by improving healthcare access, rising disposable incomes, and growing adoption of advanced diagnostic tools. In addition, Spain has expanded the use of point-of-care diagnostic devices such as TearLab’s osmolarity test. These developments are enhancing diagnostic accuracy and driving treatment personalization, positioning Spain for continued growth in the dry eye syndrome sector.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Dry Eye Syndrome Market are Novartis AG ADR, AbbVie Inc, Sun Pharmaceutical Industries, Santen Pharmaceutical Co Ltd, Johnson & Johnson, Otsuka Pharmaceutical, OASIS Medical, Bausch & Lomb Corp, AFT Pharmaceuticals, Oyster Point Pharmaceuticals

The competition in the Europe dry eye syndrome market is intense and dynamic, driven by the presence of established pharmaceutical and medical device companies vying for dominance across different therapy areas. As awareness about dry eye conditions grows, so does the demand for effective, long-term solutions, prompting manufacturers to differentiate themselves through innovation, branding, and patient-centric approaches. While larger multinational firms leverage extensive distribution networks and deep R&D resources, smaller niche players focus on specialized formulations or novel delivery mechanisms to carve out distinct market positions. The market also benefits from ongoing advancements in diagnostics, including point-of-care testing and AI-driven symptom tracking, which are reshaping how dry eye is managed. Competitive pressure is further intensified by increasing regulatory scrutiny, reimbursement limitations, and the need for cost-effective therapies—factors that compel companies to continuously refine their offerings and business models. Strategic alliances, geographic expansion, and investment in digital health infrastructure are becoming essential tools for maintaining a competitive edge in this rapidly evolving landscape.

Top Players in the Market

Allergan (AbbVie Inc.)

Allergan, now a part of AbbVie Inc., is a dominant player in the global and European dry eye syndrome market. The company's flagship product, Restasis, has been widely prescribed for chronic dry eye associated with inflammation. Its strong brand reputation, extensive distribution network, and continuous investment in clinical research have solidified its leadership position. In Europe, Allergan plays a crucial role in shaping treatment guidelines and fostering partnerships with ophthalmic institutions to enhance patient access and awareness.

Santen Pharmaceutical Co., Ltd.

Santen is a leading global ophthalmology-focused pharmaceutical company with a strong presence in the European dry eye market. Known for its innovative therapeutic solutions and commitment to ocular health, Santen has made significant contributions through the development of advanced lubricants and anti-inflammatory treatments tailored for European patients. The company actively collaborates with regulatory bodies and healthcare providers to improve diagnosis rates and introduce novel therapies that align with evolving clinical needs.

Bausch + Lomb

Bausch + Lomb is a well-established name in ophthalmology, offering a diverse portfolio of products targeting dry eye disease. With a focus on artificial tears, prescription medications, and ocular surface health devices, the company plays a pivotal role in both over-the-counter and prescription-based segments in Europe. Its strategic emphasis on patient education, physician engagement, and product innovation has enabled it to maintain a strong foothold in the region’s competitive dry eye landscape.

Top Strategies Used by Key Market Participants

One of the major strategies employed by key players in the Europe dry eye syndrome market is expanding their product portfolios through acquisitions and internal R&D initiatives , enabling them to offer comprehensive treatment options across different severity levels of dry eye. This approach helps companies diversify risk and capture multiple market segments simultaneously.

Another prominent strategy is forming collaborations with academic institutions and clinical research organizations to accelerate the development of novel therapeutics and diagnostic tools. These partnerships not only enhance scientific credibility but also facilitate faster regulatory approvals and improved adoption among healthcare professionals.

Lastly, enhancing patient access through digital health platforms and telemedicine integration has become critical for market leaders. By leveraging technology to educate patients, support self-management, and streamline physician-patient communication, companies are strengthening their market positioning and improving long-term adherence to treatment regimens.

RECENT HAPPENINGS IN THE MARKET

In October 2023, Allergan launched a digital patient support program across Germany and France aimed at improving adherence to dry eye treatments. The initiative included mobile-enabled symptom tracking, appointment reminders, and direct consultation access with optometrists, enhancing patient engagement and medication compliance.

In November 2023, Santen Pharmaceutical expanded its European headquarters in Paris with a dedicated dry eye research and innovation center. The facility focuses on developing next-generation therapies tailored to the European population, reinforcing Santen’s leadership in the ophthalmic space.

In January 2024, Bausch + Lomb introduced a new line of preservative-free artificial tears under its Systane brand in several European markets. This launch was supported by an integrated marketing campaign targeting both physicians and consumers to raise awareness of preservative-related ocular irritation.

In March 2024, Nocturne AI, a digital health startup, partnered with leading European ophthalmology clinics to pilot its AI-powered blink analysis app for early detection of dry eye symptoms. The collaboration marked a strategic move towards integrating digital diagnostics into mainstream eye care.

In June 2024, Oyster Point Pharma entered a co-promotion agreement with a major German ophthalmic distributor to expand the reach of its nasal spray therapy Tyrvaya across Central and Eastern Europe, aiming to increase adoption through localized commercial strategies.

MARKET SEGMENTATION

This research report on the europe dry eye syndrome market has been segmented and sub-segmented into the following categories.

By Type

- Evaporative Dry Eye Syndrome

- Aqueous Deficient Dry Eye Syndrome

By Drugs

- Restasis

- Tyrvaya

By Product

- Artificial Tears

- Punctal Plugs

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is driving the growth of the Dry Eye Syndrome market in Europe?

Key drivers include an aging population, increased screen time, rising awareness about eye health, environmental factors, and higher diagnosis rates.

Which countries in Europe are the largest markets for Dry Eye Syndrome treatment?

Major markets include Germany, the United Kingdom, France, Italy, and Spain due to advanced healthcare infrastructure and a high prevalence of the condition.

What are the most commonly used treatments for Dry Eye Syndrome?

Treatments include artificial tears, anti-inflammatory drugs (like cyclosporine), punctal plugs, omega-3 supplements, and advanced therapies like intense pulsed light (IPL).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com