Europe E-Invoicing Market Research Report – Segmented By Deployment (Cloud-Based vs. On-Premises)By Application (Energy & Utilities, FMCG, E-Commerce, BFSI, Government, Others) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis From 2025 to 2033

Europe E-Invoicing Market Size

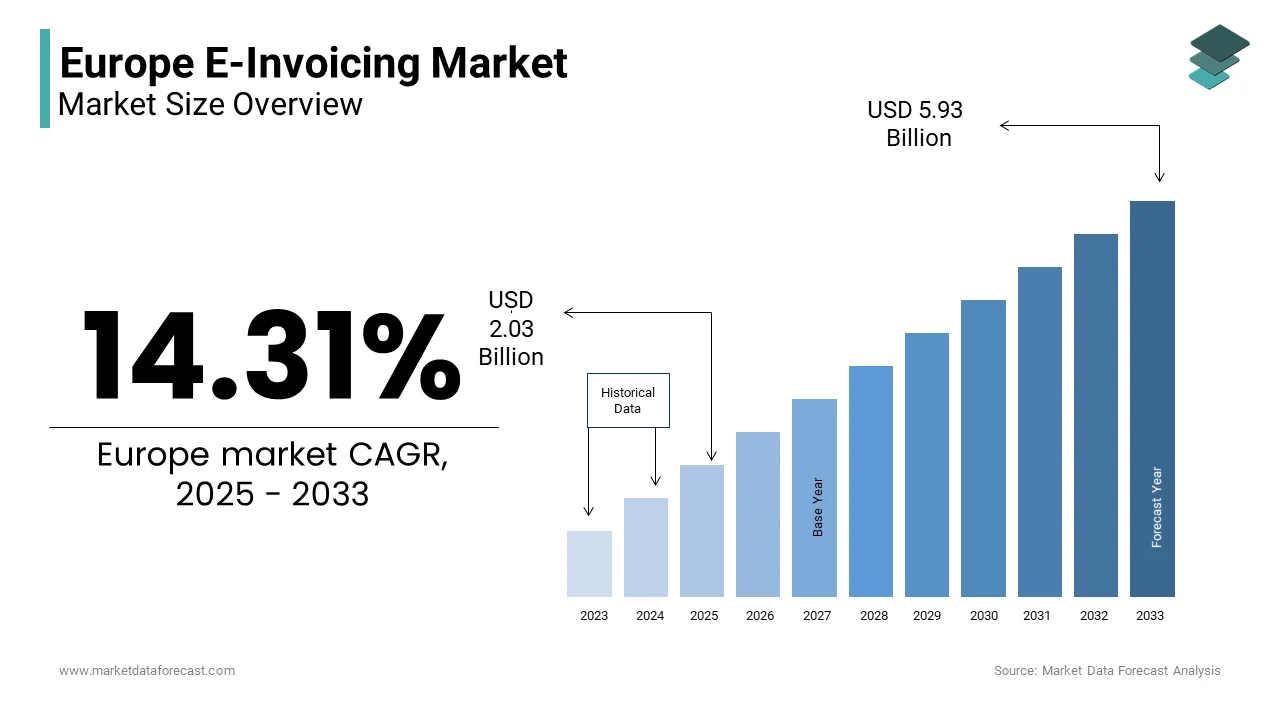

The Europe E-Invoicing Market Size was valued at USD 1.78 billion in 2024. The Europe E-Invoicing Market size is expected to have 14.31 % CAGR from 2025 to 2033 and be worth USD 5.93 billion by 2033 from USD 2.03 billion in 2025.

The e-invoicing replaces traditional paper-based invoicing with standardized electronic formats, enhancing efficiency, transparency, and regulatory compliance. The adoption of e-invoicing has accelerated significantly due to legislative mandates, such as the EU’s Directive 2014/55/EU requiring public sector entities to accept e-invoices by April 2019. E-invoicing systems are typically integrated with ERP platforms and follow standards like PEPPOL (Pan-European Public Procurement On-Line), UBL (Universal Business Language), and EN16931. These frameworks ensure interoperability across borders and sectors. According to the European Commission, cross-border B2B e-invoicing transactions grew by 27% between 2020 and 2022. Additionally, the implementation of the e-invoicing obligation under VAT reforms in several countries, including Italy and Spain, has further strengthened compliance and data traceability. The integration of technologies like AI and blockchain into e-invoicing platforms is also contributing to fraud reduction and improved transaction verification.

MARKET DRIVERS

Regulatory Mandates Driving Compliance Across Member States

One of the most influential drivers of the Europe e-invoicing market is the increasing number of regulatory mandates enforced by national governments and supranational bodies like the European Commission. The mandatory adoption of e-invoicing for public procurement, as outlined in Directive 2014/55/EU, set a precedent that many member states have extended to the private sector. For instance, Italy introduced real-time e-invoicing through its Sistema di Interscambio (SDI) platform in 2019, mandating all B2B and B2G transactions to be processed electronically. According to the Italian Revenue Agency, this policy led to the processing of over 3.2 billion e-invoices in 2022 alone. Similarly, Spain implemented a mandatory e-invoicing system for large companies in 2023, which is affecting nearly 70,000 businesses. As per the Spanish Tax Agency, this reform was projected to increase tax collection efficiency by 12% annually while reducing fraud. The ripple effect of these policies has prompted neighboring countries like France and Germany to consider similar enforcement mechanisms.

Digital Transformation Initiatives Boosting SME Adoption

Another significant driver of the Europe e-invoicing market is the accelerating digital transformation across small and medium enterprises (SMEs). Traditionally slower to adopt digital tools compared to larger corporations, SMEs are now increasingly integrating e-invoicing solutions due to government incentives and simplified access to cloud-based platforms. According to Eurostat, in 2022, approximately 62% of SMEs in the EU used cloud computing services, facilitating seamless integration with e-invoicing systems. Programs like the European Digital Innovation Hubs (EDIHs) and the SME Instrument under Horizon Europe have played a pivotal role in funding and guiding SMEs through digital transitions. This trend reflects a broader movement toward digital inclusivity, ensuring that even smaller firms can participate efficiently in pan-European supply chains.

MARKET RESTRAINTS

Fragmentation of Technical Standards Across Countries

A major restraint impeding the unified growth of the Europe e-invoicing market is the fragmentation of technical standards and compliance requirements across different member states. While the European Committee for Standardization (CEN) has established EN16931 as the core standard for e-invoicing, individual countries have implemented additional specifications that complicate cross-border interoperability. For instance, Italy's e-invoicing system requires XML format adherence to AgID specifications, whereas France mandates compliance with the Chorus Pro platform, which uses a different structure. According to the European Commission’s 2023 report on digital single market progress, these discrepancies result in increased operational complexity for multinational businesses. This lack of uniformity leads to higher integration costs, particularly for SMEs attempting to operate across multiple jurisdictions. The Federation of European Accountants (FEE) noted in 2022 that nearly 40% of SMEs faced delays in cross-border transactions due to format incompatibilities. Additionally, the need for intermediary service providers to convert invoices from one standard to another increases both time and cost.

Resistance to Change Among Legacy Businesses

Another critical restraint affecting the Europe e-invoicing market is the resistance encountered from legacy businesses accustomed to traditional invoicing methods. Many long-established firms, particularly in rural or less digitally advanced regions, continue to rely on manual processes due to familiarity, perceived cost barriers, or skepticism about digital security. According to a 2023 survey conducted by the European Central Bank, nearly 38% of micro-enterprises in Southern and Eastern Europe still preferred paper-based invoicing despite available digital alternatives. This reluctance stems from concerns regarding initial setup costs, learning curves, and data privacy risks. In Greece, for example, the Hellenic Federation of Enterprises reported that only 22% of micro-businesses had adopted e-invoicing by mid-2023, citing inadequate digital literacy as a key barrier. Furthermore, older accounting systems in some industries are incompatible with modern e-invoicing platforms, necessitating costly upgrades. As per McKinsey’s 2023 analysis on digital adoption trends, businesses without IT support infrastructure were 2.5 times more likely to delay digital migration.

MARKET OPPORTUNITIES

Expansion of Cross-Border Trade Within the Single Market

A compelling opportunity driving the Europe e-invoicing market is the expansion of cross-border trade within the EU's single market. As per Eurostat, intra-EU trade accounted for 61% of total EU exports in 2022, highlighting the significance of efficient B2B documentation flows. E-invoicing plays a crucial role in reducing administrative burdens associated with international transactions. Traditional invoicing methods often lead to delays, currency conversion issues, and compliance mismatches. However, the adoption of the PEPPOL network has enabled businesses in 35 European countries to exchange e-invoices across borders without format restrictions. Additionally, the European Commission’s initiative to establish a Single Digital Gateway aims to simplify regulatory procedures for cross-border businesses, further encouraging e-invoicing adoption. This efficiency gain positions e-invoicing as a catalyst for deeper economic integration and enhanced competitiveness among European firms operating internationally.

Integration of AI and Automation in E-Invoicing Platforms

The integration of artificial intelligence (AI) and automation into e-invoicing platforms presents a transformative opportunity for the Europe e-invoicing market. These technologies enable intelligent data extraction, automatic validation, and real-time error detection, which is significantly improving operational efficiency and accuracy. According to IDC’s 2023 European FinTech Report, organizations adopting AI-driven e-invoicing solutions experienced a 40% reduction in manual intervention and a 32% decrease in invoice processing time. Leading vendors such as Basware and Tradeshift have introduced AI-powered engines capable of recognizing invoice patterns, which is matching purchase orders, and flagging anomalies without human input. In Sweden, where AI-enabled e-invoicing adoption reached 68% among large enterprises in 2023, the Swedish Tax Authority reported a 25% improvement in fraud detection rates. Moreover, natural language processing (NLP) is being leveraged to interpret unstructured invoice formats, allowing businesses to process diverse document types seamlessly. As per Accenture’s 2023 Finance Automation Index, 55% of finance executives cited AI-enhanced e-invoicing as a top priority for digital transformation strategies.

MARKET CHALLENGES

Data Privacy and Cybersecurity Concerns

A pressing challenge confronting the Europe e-invoicing market is the heightened concern around data privacy and cybersecurity. As e-invoicing systems handle sensitive financial information, they become prime targets for cyberattacks. This rise in cyber threats has prompted businesses to scrutinize the safety of digital invoicing platforms before full-scale adoption. Regulations such as the General Data Protection Regulation (GDPR) impose stringent requirements on data handling by adding complexity to e-invoicing implementations.

Non-compliance can result in penalties amounting to 4% of global annual turnover. Moreover, small and medium enterprises (SMEs) often lack the resources to invest in robust encryption and threat detection systems. The European Banking Authority reported that 63% of SMEs did not have dedicated cybersecurity personnel by leaving them vulnerable. Addressing these vulnerabilities requires continuous innovation in secure protocols and increased awareness initiatives to ensure the integrity of the expanding e-invoicing ecosystem. Another significant challenge impacting the Europe e-invoicing market is the high implementation cost for small businesses, which acts as a deterrent to widespread adoption. In countries like Bulgaria and Croatia, where SMEs constitute over 99% of all businesses, adoption rates lag behind Western European counterparts. The Croatian Chamber of Economy reported that only 18% of SMEs had deployed certified e-invoicing solutions by early 2024, largely due to affordability issues. To mitigate this, some governments have launched subsidy programs and low-interest loans, yet uptake remains slow.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.31 % |

|

Segments Covered |

By Deployment, Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Basware Corp., SAP SE, Coupa Software Inc., IBM Corp., TradeShift Inc |

SEGMENT ANALYSIS

By Deployment Insights

The cloud-based deployment segment dominated the Europe e-invoicing market share in 2024 with the increasing preference for scalable, cost-effective, and easily integrable solutions that align with modern business operations. One key driver behind this trend is the reduction in infrastructure costs. Traditional on-premises systems require substantial investment in hardware, maintenance, and IT personnel. In contrast, cloud-based models offer subscription-based pricing by allowing businesses to pay only for what they use. Moreover, regulatory mandates such as Italy’s mandatory real-time e-invoicing system have spurred demand for cloud-hosted platforms capable of integrating with government portals like Sistema di Interscambio (SDI). The Italian Revenue Agency recorded over 3.4 billion cloud-based e-invoices processed through SDI in 2023 alone by reinforcing the scalability and reliability of cloud infrastructure in high-volume environments. Another contributing factor is the ease of integration with ERP systems such as SAP Ariba and Oracle NetSuite. These platforms enable seamless data synchronization across procurement, finance, and compliance modules.

The cloud-based deployment segment is likely to register a CAGR of 14.3% from 2025 to 2033. A primary catalyst is the growing reliance on Software-as-a-Service (SaaS) models, which reduce entry barriers for smaller firms. Accorxding to McKinsey’s 2023 Digital Finance Report, SaaS-based e-invoicing adoption among SMEs increased by 39% year-over-year with the flexible pricing and low upfront costs. Additionally, platforms like Pagero and Basware have introduced automated, AI-enhanced cloud solutions that minimize manual intervention and improve invoice accuracy.

Cross-border trade within the EU further fuels this growth. The PEPPOL network, which facilitates pan-European e-invoicing exchanges, reported a 37% increase in registered businesses in 2023, most of whom opted for cloud-based connectivity. As per OpenPEPPOL, over 1.9 billion transactions were processed via the network that year with its expanding influence.

The advancements in cybersecurity tailored for cloud environments are alleviating concerns around data integrity. The European Union Agency for Cybersecurity (ENISA) noted in its 2023 report that cloud providers had improved encryption standards and multi-factor authentication mechanisms, making them more secure than traditional on-premise servers. These developments collectively reinforce the momentum behind cloud-based e-invoicing in Europe.

By Application Insights

The government sector was the largest and held Europe e-invoicing market by capturing 32.3% of share in 2024. The European Union’s Directive 2014/55/EU mandated all public sector entities to accept e-invoices by April 2019, setting a foundational framework for widespread adoption. According to the European Commission’s 2023 progress report on digital public procurement, over 90% of EU member states had fully implemented e-invoicing requirements for government agencies, by leading to a significant rise in transaction volumes.

In countries like Denmark and Sweden, where digital governance is deeply embedded, e-invoicing in the public sector has become the norm rather than the exception. The Danish Agency for Digitisation reported that over 95% of invoices received by public authorities were processed electronically in 2023. Additionally, governments are leveraging e-invoicing to enhance tax transparency and combat fraud.

The e-commerce sector is likely to experience a CAGR of 16.8% during the forecast period. This rapid expansion is driven by the exponential growth of online retail and the need for streamlined, automated financial processes to support high-volume transaction flows. This trend necessitates standardized e-invoicing frameworks that support multiple languages, currencies, and tax regulations. Platforms like Tradeshift and Avalara have responded by integrating AI-powered translation and compliance features by enabling seamless international invoice handling. The proliferation of dropshipping and third-party seller models has further intensified the need for real-time invoicing and payment reconciliation.

COUNTRY LEVEL ANALYSIS

Germany was the largest and held 18.6% of the Europe e-invoicing market share in 2024. The country’s push toward digital transformation gained momentum with the introduction of the “ZUGFeRD” standard, a hybrid PDF/XML format that enables structured electronic invoicing. Additionally, the German Tax Authority (Bundeszentralamt für Steuern or BZSt) launched a pilot program in 2022 aimed at testing real-time invoice reporting by aligning with broader EU efforts to curb VAT fraud. Germany’s emphasis on industry 4.0 and digital supply chain optimization further supports e-invoicing adoption.

Italy was positioned second by holding 15.4% of the Europe e-invoicing market share in 2024. Introduced in 2019, the SDI mandate required businesses to transmit invoices directly to the Italian Revenue Agency before sending them to customers. This regulatory model has significantly enhanced tax collection efficiency and transparency. The OECD highlighted in its 2023 Taxation Trends report that Italy’s e-invoicing initiative contributed to a 12% rise in VAT revenue recovery between 2020 and 2023. Major Italian banks and ERP vendors have also aligned with the new regime, offering integrated solutions that simplify compliance. Companies like Nexi and SIA have developed APIs that allow businesses to automate invoice submission and validation by reinforcing Italy’s position as a leader in mandatory e-invoicing adoption.

France e-invoicing market growth is lucratively growing with the third-largest position due to strong institutional backing and a well-developed digital ecosystem. Launched by the French Ministry of Economy, Chorus Pro serves as the national access point for e-invoicing in public procurement. Beyond the public sector, France’s private industry has also seen steady adoption, especially among mid-sized enterprises. Furthermore, the French government extended e-invoicing obligations to certain sectors in 2024, including transportation and logistics, aiming to harmonize digital documentation across industries.

The United Kingdom e-invoicing market growth is driven by the maintaining a strong presence despite its exit from the EU. Brexit-induced regulatory divergence has prompted UK businesses to accelerate digital transformation efforts to maintain seamless trade relationships with continental Europe. HM Revenue & Customs (HMRC) launched the Making Tax Digital (MTD) initiative in 2019, mandating businesses with a turnover above £85,000 to keep digital records and submit VAT returns through compatible software. Additionally, the UK’s Financial Conduct Authority (FCA) has encouraged financial institutions to adopt e-invoicing for interbank settlements and supplier payments.

Spain e-invoicing market growth is propelled by aggressive legislative enforcement and a focus on tax transparency. In 2023, Spain introduced a mandatory e-invoicing regime for large companies under the Facturae standard, affecting over 70,000 businesses nationwide. The Spanish Tax Agency (Agencia Tributaria) estimated that the new mandate would result in the processing of over 1.2 billion e-invoices annually, improving traceability and reducing fraudulent practices. Moreover, Spain’s alignment with the European EN16931 standard ensures compatibility with other EU markets, facilitating smoother intra-European trade. The government has also rolled out support programs for SMEs, offering subsidized training and software licensing to ease adoption.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe E-Invoicing Market are Basware Corp. , SAP SE , Coupa Software Inc. , IBM Corp. , TradeShift Inc. , Zoho Corp. Pvt. Ltd. , Cegedim SA , Comarch SA , Esker SA , Sage Group Plc , Kofax Inc. , Pagero AB , Compello AS , Amalto Technologies S.A. , Visma , Billingo , aifinyo AG , Billit , Blue10 , compacer GmbH , crossinx

The competition in the Europe e-invoicing market is marked by a dynamic interplay between established enterprise software providers and agile fintech startups. As regulatory pressures intensify across the region, vendors are striving to differentiate themselves through enhanced compliance capabilities, superior user experiences, and seamless integration with existing business systems. The market features a mix of global giants offering comprehensive, enterprise-grade solutions and niche players focusing on specific verticals or country-specific mandates. Innovation is a key battleground, with companies investing heavily in AI-driven automation, blockchain-based verification, and cloud-native architectures. Additionally, the growing demand for cross-border compatibility has spurred collaboration among service providers by fostering the development of standardized networks like PEPPOL. Amid this competitive environment, customer-centricity, adaptability, and technological agility have become critical success factors.

Top Players in the Market

SAP SE

SAP is a dominant player in the Europe e-invoicing market, offering robust and scalable solutions through its SAP Ariba Network. The company provides end-to-end digital invoicing capabilities that integrate seamlessly with enterprise resource planning systems. SAP’s contribution lies in enabling large enterprises across Europe to automate invoice processing, ensure compliance with regional regulations, and streamline supplier interactions. Its cloud-based platform supports cross-border transactions by adhering to EN16931 and PEPPOL standards.

Oracle Corporation

Oracle plays a significant role in shaping the Europe e-invoicing landscape through its comprehensive cloud-based financial management suite, including Oracle Financials Cloud and Oracle Procurement Cloud. These platforms facilitate automated invoice generation, validation, and submission, ensuring alignment with evolving tax and regulatory mandates. Oracle’s strength lies in its ability to deliver highly integrated, secure, and compliant e-invoicing solutions tailored for both public and private sector organizations. Oracle supports multinational corporations in navigating complex e-invoicing ecosystems across European markets by leveraging its global infrastructure and deep industry expertise.

Tradeshift Inc.

Tradeshift has emerged as a leading innovator in the Europe e-invoicing market by offering an open, API-driven platform that connects businesses of all sizes to global supply chains. The company enables seamless exchange of invoices across different formats and standards, supporting compliance with national and EU-wide mandates. Tradeshift's emphasis on collaboration, transparency, and scalability makes it a preferred choice among SMEs and large enterprises alike. Through continuous product enhancements and strategic partnerships, Tradeshift is helping reshape how companies manage financial transactions digitally across Europe.

Top strategies used by the key market participants

A primary strategy employed by key players in the Europe e-invoicing market is product innovation and feature enhancement, where vendors continuously refine their platforms to support emerging compliance requirements and integrate advanced technologies such as artificial intelligence and machine learning.

Another major approach is strategic partnerships and ecosystem integration , wherein leading providers collaborate with ERP vendors, government portals, and logistics networks to create interconnected platforms that simplify cross-border invoicing and improve interoperability across systems. These alliances help expand reach and usability. Expanding into high-growth regional markets within Europe remains a crucial tactic. Companies are tailoring their offerings to meet local compliance frameworks and building localized support structures to accelerate adoption in countries undergoing digital transformation.

RECENT HAPPENINGS IN THE MARKET

In February 2024, SAP announced the expansion of its Ariba Network capabilities to include real-time VAT validation for intra-EU transactions by enhancing compliance for businesses operating across multiple jurisdictions.

In May 2024, Oracle partnered with the PEPPOL network to enable direct connectivity for its European customers, which is facilitating seamless cross-border e-invoicing without the need for intermediary gateways.

In July 2024, Tradeshift launched a new AI-powered invoice matching engine designed specifically for SMEs, which is improving accuracy and reducing manual intervention in invoice reconciliation processes.

In September 2024, Basware introduced a localized version of its e-invoicing platform tailored for the Spanish market by aligning with Spain’s mandatory Facturae format and easing adoption for domestic businesses.

In November 2024, Pagero expanded its integration with Microsoft Dynamics 365 Finance, which is allowing more streamlined e-invoicing workflows for mid-sized enterprises relying on Microsoft’s ERP ecosystem.

MARKET SEGMENTATION

This research report on the europe e-invoicing market has been segmented and sub-segmented into the following categories.

By Deployment

- Cloud-Based vs

- On-Premises

By Application

- Energy & Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is driving the growth of the e-invoicing market in Europe?

Key drivers include: Regulatory mandates from EU member states (e.g., e-invoicing required for B2G and B2B transactions). VAT compliance and fraud reduction.

Which European countries have mandatory e-invoicing regulations?

Several countries have mandated e-invoicing for B2G and/or B2B transactions, including: Italy (mandatory B2B and B2G) France (phased mandatory B2B e-invoicing Germany, Poland, and Spain are also implementing or expanding mandatory e-invoicing frameworks.

What is the PEPPOL network, and how is it related to e-invoicing in Europe?

PEPPOL (Pan-European Public Procurement Online) is a network that enables standardized and secure e-invoicing and e-procurement across Europe.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com