Europe Electric Radiators Market Size, Share, Trends & Growth Forecast Report By Type (Fan Heaters, Convection Radiators, Infrared Radiators, and Oil-Based Electric Radiators), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Electric Radiators Market Size

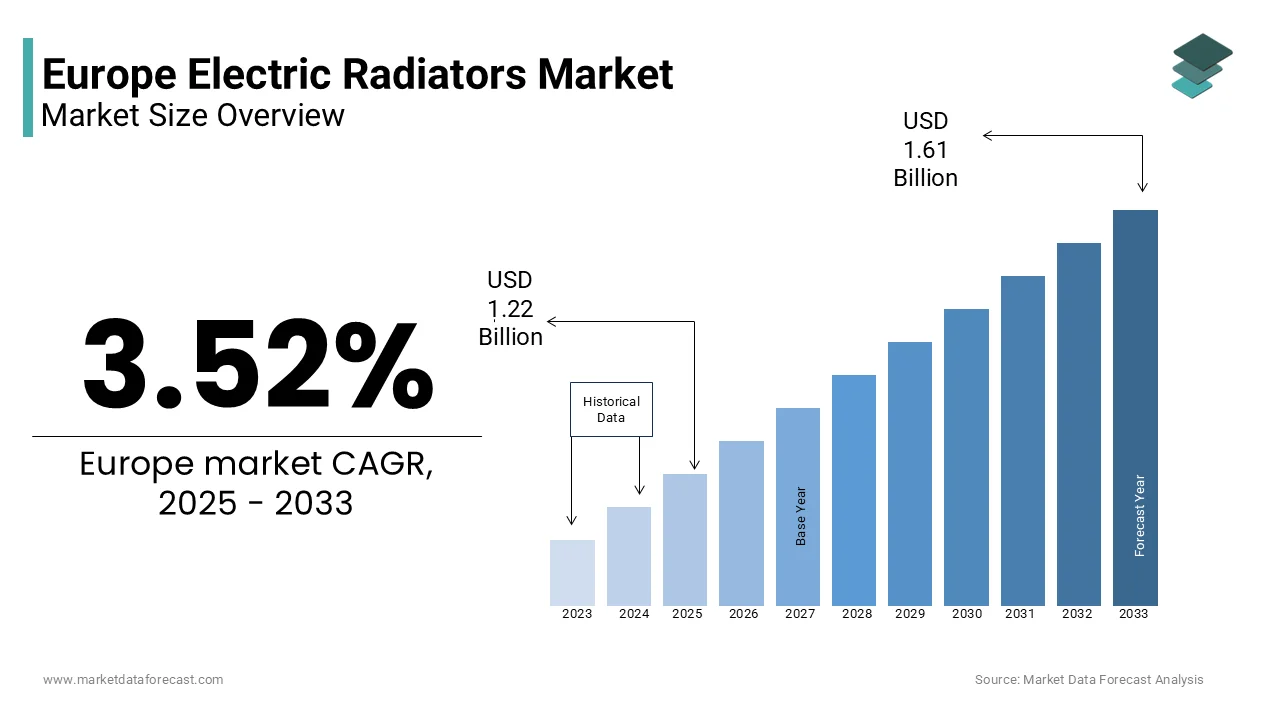

The Europe electric radiators market size was valued at USD 1.18 billion in 2024. The European market size is estimated to be worth USD 1.61 billion by 2033 from USD 1.22 billion in 2025, growing at a CAGR of 3.52% from 2025 to 2033.

Electric radiators offer an efficient alternative to traditional central heating systems, especially in urban dwellings, retrofit projects, and off-grid locations where gas connections are limited or unavailable. These devices operate using electricity to generate heat through convection or radiant methods, offering precise temperature control and ease of installation.

In recent years, countries like France, Germany, and the UK have witnessed a growing shift towards electric heating systems due to stringent building regulations and incentives promoting low-emission technologies. According to the European Environment Agency, the share of renewable energy in the EU’s final energy consumption reached 22% in 2021, supporting the viability of electric heating systems powered increasingly by clean energy sources. Additionally, the International Energy Agency notes that over 35 million households in Europe rely on electric heating, with a significant portion adopting newer, more efficient radiator models.

MARKET DRIVERS

Increasing Urbanization and Housing Renovation Initiatives Across Europe

One of the key drivers propelling the Europe electric radiators market is the surge in urbanization and housing renovation activities, particularly in Western and Central Europe. The rapid pace of city expansion and population growth has led to a greater demand for compact, flexible, and easy-to-install heating solutions, especially in multi-unit residential buildings and smaller living spaces. According to study, nearly 60% of Europeans live in urban areas, and this figure is expected to rise to over 70% by 2050. This trend necessitates efficient, decentralized heating systems that can be integrated into modern architectural designs without requiring extensive plumbing or gas infrastructure.

In addition, governments across the EU have launched large-scale renovation programs aimed at improving the energy performance of existing buildings. For instance, the EU’s Renovation Wave Strategy, introduced in 2020, aims to double the annual renovation rate of buildings to achieve climate neutrality by 2050. Under this initiative, over 35 million buildings are expected to undergo energy-efficient upgrades by 2030. Electric radiators, known for their plug-and-play installation and compatibility with renewable energy sources, are becoming preferred choices for retrofitting older homes and commercial properties. Moreover, cities such as Paris, Berlin, and Amsterdam have implemented stricter emissions standards, encouraging property developers and homeowners to adopt cleaner heating alternatives.

Rising Demand for Smart and Programmable Heating Systems

Rising Demand for Smart and Programmable Heating Systems

A significant factor fueling the growth of the Europe electric radiators market is the increasing consumer preference for smart and programmable heating systems. With advancements in Internet of Things (IoT) technology and home automation, consumers are seeking intelligent heating solutions that offer improved control, energy savings, and remote access. Electric radiators equipped with smart thermostats, adaptive programming, and mobile app integration are gaining traction among homeowners and landlords who aim to reduce energy consumption while maintaining comfort levels. The European Commission estimates that up to 40% of household energy use in Europe comes from space heating, making efficiency improvements a top priority. Smart electric radiators address this need by enabling zone-based heating and learning algorithms that adjust temperatures according to occupancy patterns. This digital transformation supports the adoption of intelligent electric heating systems, allowing users to optimize usage and lower utility bills. Similarly, in Germany, the Federal Ministry for Economic Affairs and Climate Action reported that nearly 25% of new residential heating installations in 2022 included smart controls, many of which were paired with electric radiators.

MARKET RESTRAINTS

High Initial Cost and Limited Consumer Awareness

Despite the growing interest in electric radiators across Europe, one of the primary restraints hindering widespread adoption is the relatively high initial cost compared to conventional heating systems. While electric radiators offer long-term energy savings and reduced maintenance, their upfront investment remains a barrier for budget-conscious consumers, particularly in Eastern and Southern Europe. Furthermore, limited consumer awareness regarding the benefits of advanced electric radiator technologies poses another challenge. Many potential buyers remain unfamiliar with innovations such as fluid-filled thermal storage, dynamic programming, and smart connectivity features. This lack of knowledge results in continued reliance on outdated and less efficient heating alternatives, slowing down market growth. Additionally, misinformation and confusion between different types of electric heating—such as panel heaters versus oil-filled radiators—further complicates purchasing decisions. To overcome these barriers, targeted education campaigns and financial incentives will be essential in reshaping consumer perceptions and accelerating market uptake.

Regulatory Constraints and Energy Pricing Volatility

Another significant restraint affecting the Europe electric radiators market is the fluctuating electricity pricing landscape and evolving regulatory environment. Although several EU member states encourage electrification of heating through policy support, concerns around grid capacity and carbon intensity persist. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), wholesale electricity prices in Europe saw a 70% increase between 2021 and 2022 due to geopolitical tensions and supply chain disruptions, raising concerns over the economic viability of electric heating solutions. High energy tariffs discourage consumers from switching to electric radiators, especially in regions where natural gas remains a more affordable option. This price disparity makes electric heating less attractive unless supported by subsidies or time-of-use tariffs. Moreover, some national governments impose restrictions on all-electric heating systems in new constructions to ensure grid stability and prevent overloads. France’s Energy Transition Law mandates that new buildings must integrate hybrid or dual-energy heating systems in certain zones, limiting the standalone deployment of electric radiators.

MARKET OPPORTUNITIES

Expansion of Renewable Energy Integration Across the EU

A major opportunity for the Europe electric radiators market lies in the expanding integration of renewable energy sources into national grids, which enhances the environmental and economic viability of electric heating. As the European Union continues to push for decarbonization, the share of renewables in electricity generation has grown significantly. According to the European Environment Agency, renewable energy accounted for over 42% of electricity production in the EU in 2023, marking a steady increase from previous years. This transition toward cleaner energy sources makes electric radiators a more sustainable and appealing alternative to fossil-fuel-based heating systems. Countries such as Sweden, Denmark, and Germany are leading the way in renewable-powered heating solutions, leveraging wind, solar, and hydroelectric energy to power residential and commercial heating systems. In Germany, for instance, the Federal Environment Agency (UBA) reported that in 2022, over 50% of electricity generated came from renewable sources, providing a conducive environment for the adoption of electric heating technologies. This trend enables electric radiators to function with a lower carbon footprint, aligning with EU climate goals and attracting environmentally conscious consumers. Moreover, the rise of smart grids and time-of-use electricity tariffs allows users to optimize heating schedules based on periods of peak renewable generation.

Growth in Off-Grid and Remote Residential Applications

The increasing demand for heating solutions in off-grid and remote residential applications presents a compelling opportunity for the Europe electric radiators market. In many rural and isolated regions across the continent, access to centralized gas networks is either limited or nonexistent, prompting a shift toward independent and easily installable electric heating systems. As efforts to phase out polluting fuels intensify, electric radiators emerge as a viable and cleaner substitute. This transition is particularly evident in countries like Ireland and parts of Eastern Europe, where government initiatives are promoting the replacement of outdated coal and wood stoves with modern electric heating units. These programs not only enhance indoor air quality but also contribute to national emissions reduction targets. Additionally, advancements in thermal efficiency and insulation technologies have made modern electric radiators more suitable for continuous use in remote settings. Devices with built-in heat retention features, such as ceramic or thermodynamic fluid cores, provide consistent warmth without excessive energy consumption.

MARKET CHALLENGES

Seasonal Variability and Grid Capacity Limitations

A pressing challenge facing the Europe electric radiators market is the impact of seasonal variability on electricity demand and the limitations of existing grid infrastructure to accommodate surges in heating-related consumption. During winter months, especially in Northern and Eastern Europe, the reliance on electric heating causes sharp increases in electricity usage, straining local distribution networks. This issue is further exacerbated by the intermittent nature of renewable energy sources, which are increasingly contributing to Europe’s electricity mix. Wind and solar generation fluctuates depending on weather conditions, making it difficult to match supply with the heightened demand for electric heating during cold spells. To mitigate these challenges, system operators are investing in grid reinforcements and demand-side response strategies. However, the current pace of infrastructure modernization lags behind the rising adoption of electric heating, creating a bottleneck for market expansion.

Technological Competition from Alternative Electric Heating Solutions

An emerging challenge for the Europe electric radiators market is the proliferation of competing electric heating technologies that offer similar or enhanced functionalities. As the demand for efficient and eco-friendly heating options rises, products such as infrared panels, electric underfloor heating systems, and hybrid heat pumps are gaining traction, potentially diverting consumer interest away from conventional electric radiators. According to a report by the Building Performance Institute Europe (BPIE), electric underfloor heating systems accounted for nearly 15% of new residential heating installations in Germany in 2023, owing to their even heat distribution and space-saving design.

Infrared heating panels, in particular, are gaining popularity due to their ability to directly warm objects and people rather than the surrounding air, offering faster and more targeted heating. Similarly, hybrid heat pump systems, which combine electric heating with heat recovery mechanisms, are being promoted under various national subsidy programs, including the UK’s Boiler Upgrade Scheme and the German Market Transparency Unit for Fuels. These alternatives often come with perceived advantages such as silent operation, sleeker designs, and better integration with smart home ecosystems, posing a competitive threat to standard electric radiators. Unless manufacturers continue to innovate with differentiated features such as improved thermal efficiency, AI-based controls, and aesthetic customization, the market may face pressure from these emerging technologies, affecting its long-term growth prospects in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.52% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Aeon, Eco Volt, Electric Heating Company, Electrorad, Elnur, Eskimo, Glen Dimplex, Haverland, Jaga, Lucht, Rointe, Stelrad, Technotherm, Tubes Radiatori, and Zehnder, and others. |

SEGMENT ANALYSIS

By Type Insights

The Oil-Based Electric Radiators hold the largest market share by accounting for 38.6% of the overall market in 2024. This segment has maintained dominance due to its superior heat retention capabilities and widespread adoption in residential settings across diverse climatic zones in Europe. One key factor driving the popularity of oil-based radiators is their ability to provide consistent and long-lasting warmth without continuous energy consumption. Unlike fan heaters or convection models that cool down quickly after being switched off, oil-filled units retain heat for extended periods, making them ideal for intermittent heating needs. Another critical driver is the increasing demand for portable and plug-and-play heating solutions in older housing stock. In countries like France and Germany, where a significant portion of homes were built before the implementation of modern insulation standards, oil-based radiators are preferred for their ease of installation and compatibility with existing electrical systems.

The Infrared Radiators segment is projected to grow at the fastest CAGR of 9.6% during the forecast period. This rapid progress is attributed to technological advancements and shifting consumer preferences toward energy-efficient, space-saving heating alternatives. A major driver behind this expansion is the unique heating mechanism of infrared radiators, which emit radiant heat that directly warms objects and people rather than heating the surrounding air. This method ensures quicker thermal response and improved efficiency, particularly in high-ceilinged or poorly insulated spaces. Additionally, the aesthetic appeal and design flexibility of infrared radiators are contributing significantly to their adoption. Manufacturers are now offering these units in customizable designs, including mirror and artwork finishes, allowing integration into interior décor without compromising functionality. These advantages are accelerating the uptake of infrared radiators across Europe, positioning them as the fastest-growing segment within the electric radiators market.

By Application Insights

The Residential Use segment dominates with a market share of 67% in 2024. This control is primarily fueled by rising urbanization, aging housing stock requiring retrofitting, and increasing government support for energy-efficient home heating solutions. One of the key drivers of this segment is the growing trend of smart home adoption across Europe, particularly in Western European countries. Smart electric radiators equipped with programmable thermostats, Wi-Fi connectivity, and adaptive learning features are becoming increasingly popular among homeowners seeking greater control over indoor climate and energy costs. Another important factor is the renovation wave strategy launched by the European Commission, aimed at improving the energy performance of buildings. Countries like France and Germany have implemented financial incentives such as subsidies and tax rebates for residents adopting low-emission heating systems. For instance, in Germany, the Federal Office for Economic Affairs and Export Control (BAFA) provided funding for over 85,000 residential heating upgrades in 2023, many of which involved the installation of modern electric radiators.

The Commercial Applications segment is anticipated to register the highest CAGR of 8.9%, outpacing other application segments. This development is largely driven by the increasing deployment of electric radiators in offices, retail centers, hotels, and public infrastructure as part of broader efforts to reduce carbon footprints and enhance building energy performance. One key factor propelling this segment is the rise in green building certifications and sustainability mandates for commercial real estate developments. Initiatives such as BREEAM (Building Research Establishment Environmental Assessment Method) and LEED (Leadership in Energy and Environmental Design) encourage the use of electric heating systems that integrate well with renewable energy sources and smart controls. Additionally, the post-pandemic shift toward flexible workspaces and remote working hubs has created a surge in demand for modular and easily installable heating solutions. Electric radiators, especially those with smart controls and zone heating capabilities, offer an efficient way to manage temperature variations across open-plan offices and co-working environments.

REGIONAL ANALYSIS

The United Kingdom held a prominent position in the Europe electric radiators market by capturing a 14.8% of total regional market share in 2024. As one of the early adopters of electrified heating solutions, the UK has seen a steady transition away from gas-based systems, particularly in urban centers and off-grid locations. This shift is supported by national policies such as the Heat and Buildings Strategy, which aims to phase out high-carbon heating systems in favor of cleaner alternatives. Additionally, the increasing prevalence of smart meters—reaching 15.5 million installations nationwide—has enabled better monitoring and optimization of electric heating usage.

France was the largest contributor with high adoption in residential retrofits in 2024, making it the largest contributor to regional demand. The country's leadership is primarily driven by extensive housing renovation programs and favorable policy frameworks that promote electrification of heating. Under the "MaPrimeRénov'" scheme, the French government allocated over €2.5 billion in 2023 to support energy-efficient home upgrades, including the replacement of outdated heating systems with modern electric radiators. Additionally, France’s commitment to reducing greenhouse gas emissions under its National Low-Carbon Strategy has reinforced the preference for clean, plug-and-play heating solutions. These structural and policy-driven factors ensure France remains at the forefront of the European electric radiators landscape.

Germany has strong industrial and residential demand fuels growth in 2024. The country's robust industrial base, combined with aggressive energy efficiency targets, contributes significantly to the widespread adoption of electric radiators across both residential and commercial sectors. Germany’s Renewable Energies Act (EEG) mandates increased reliance on clean electricity, which aligns well with the growing preference for electric heating solutions. Furthermore, the German government’s KfW subsidy program supported over 90,000 residential and commercial heating retrofits in 2023, many of which included electric radiator installations. In industrial and logistics facilities, the demand for localized and controllable heating has also surged, particularly in warehouses and distribution centers where central heating systems are impractical.

Italy held a notable market share of the Europe electric radiators market in 2024, emerging as a key growth hub driven by urbanization and evolving energy policies. The country’s increasing reliance on electric heating is particularly evident in densely populated cities like Milan, Rome, and Naples, where gas pipeline infrastructure is either limited or costly to extend. Additionally, Italy’s push towards electrifying heating in historic buildings—where traditional heating modifications are challenging—has positioned electric radiators as a preferred alternative. With continued policy backing and infrastructural development, Italy is poised for sustained growth in the electric radiators sector.

Spain saw a steady growth in the Europe electric radiators market in 2024, experiencing steady growth due to rising off-grid heating demand and supportive regulatory measures. The country’s rural regions, where natural gas networks have limited reach, are increasingly turning to electric radiators as a reliable and cost-effective heating solution. In addition, the Spanish government introduced the “Plan Renove” initiative, providing financial incentives for replacing inefficient heating appliances with energy-saving alternatives. With growing awareness and expanding incentive programs, Spain is solidifying its position as a key player in the European electric radiators market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Aeon, Eco Volt, Electric Heating Company, Electrorad, Elnur, Eskimo, Glen Dimplex, Haverland, Jaga, Lucht, Rointe, Stelrad, Technotherm, Tubes Radiatori, and Zehnder are the key market players in the Europe electric radiators market.

The competition in the Europe electric radiators market is characterized by a mix of established manufacturers and emerging brands striving to capture market share through differentiation and innovation. As demand for efficient and sustainable heating solutions rises, companies are increasingly investing in research and development to enhance product performance, design, and smart functionality. The market is highly fragmented, with several regional and global players competing based on technology, pricing, and after-sales services. Consumer awareness regarding energy efficiency and environmental impact is growing, prompting manufacturers to emphasize eco-friendly materials and low-emission operations. Additionally, regulatory pressures and incentives aimed at reducing carbon footprints are influencing product strategies and market positioning. While larger firms benefit from brand recognition and extensive distribution networks, smaller players are leveraging niche innovations and localized marketing to gain traction. The competitive landscape is further shaped by mergers, acquisitions, and strategic collaborations aimed at expanding market presence and enhancing product portfolios across different segments and geographies.

TOP PLAYERS IN THIS MARKET

Dimplex

Several key players dominate the Europe electric radiators market through innovation, brand reputation, and strategic expansion. Among them, Dimplex stands out as a leading manufacturer known for its advanced electric heating solutions tailored to both residential and commercial applications. The company has consistently introduced energy-efficient and smart-enabled radiator models that align with evolving consumer preferences and sustainability goals across Europe.

Stiebel Eltron

Another major player is Stiebel Eltron, a German-based company recognized for its high-quality electric heating systems that integrate seamlessly with renewable energy sources. Stiebel Eltron's strong presence in Europe is supported by its commitment to technological advancement and energy efficiency, making it a trusted name in the sector.

Atlantic Group

Lastly, Atlantic Group plays a pivotal role in shaping the European market with a diverse portfolio of electric radiators designed for comfort and performance. With a strong distribution network and emphasis on eco-friendly product development, Atlantic Group continues to influence market trends and consumer adoption across the region.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One of the primary strategies employed by key players in the Europe electric radiators market is product innovation and smart technology integration . Companies are focusing on developing radiators with intelligent controls, adaptive programming, and compatibility with home automation systems to meet the rising demand for energy-efficient and user-friendly heating solutions.

Another crucial strategy is expanding distribution networks and partnerships . Leading manufacturers are strengthening their regional foothold by collaborating with local distributors, retailers, and installers, ensuring broader market reach and improved customer accessibility across diverse geographic areas in Europe.

Lastly, sustainability-driven product development has become a central focus. Market participants are designing radiators that support low-carbon heating, aligning with EU regulations and consumer demand for greener alternatives. This approach not only enhances brand value but also ensures long-term competitiveness in a rapidly evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Dimplex launched a new line of smart electric radiators equipped with AI-based temperature learning features, aiming to improve energy efficiency and user experience across residential markets in Western Europe.

- In May 2024, Stiebel Eltron expanded its production facility in Germany to increase manufacturing capacity for electric heating systems, supporting growing demand driven by stricter emissions regulations and building modernization initiatives.

- In July 2024, Atlantic Group partnered with a leading European home automation provider to integrate its electric radiators with voice-controlled smart home ecosystems, enhancing convenience and connectivity for end users.

- In September 2024, De’Longhi entered into a strategic collaboration with Italian utility providers to promote electric radiators under subsidized energy efficiency programs, targeting retrofit projects in southern Europe.

- In November 2024, EcoCute Technologies introduced a new range of ultra-slim infrared radiators designed for architectural integration, appealing to modern residential and commercial developments across Scandinavia and Benelux regions.

MARKET SEGMENTATION

This research report on the Europe electric radiators market is segmented and sub-segmented into the following categories.

By Type

- Fan Heaters

- Convection Radiators

- Infrared Radiators

- Oil-Based Electric Radiators

By Application

- Residential Use

- Commercial Applications

- Industrial & Infrastructure Buildings

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe electric radiators market by 2033?

The Europe electric radiators market is expected to reach approximately USD 1.61 billion by 2033.

2. What factors are driving the growth of the electric radiators market in Europe?

Growth is likely driven by increasing energy efficiency regulations, demand for low-carbon heating solutions, and advancements in electric heating technology.

3. Which countries in Europe are leading in the adoption of electric radiators?

Leading markets often include the UK, Germany, France, and Scandinavian countries due to their emphasis on sustainable and energy-efficient heating.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com