Europe Electric Water Heater Market Size, Share, Trends & Growth Forecast Report By Product (Storage, Non-storage ), Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Electric Water Heater Market Size

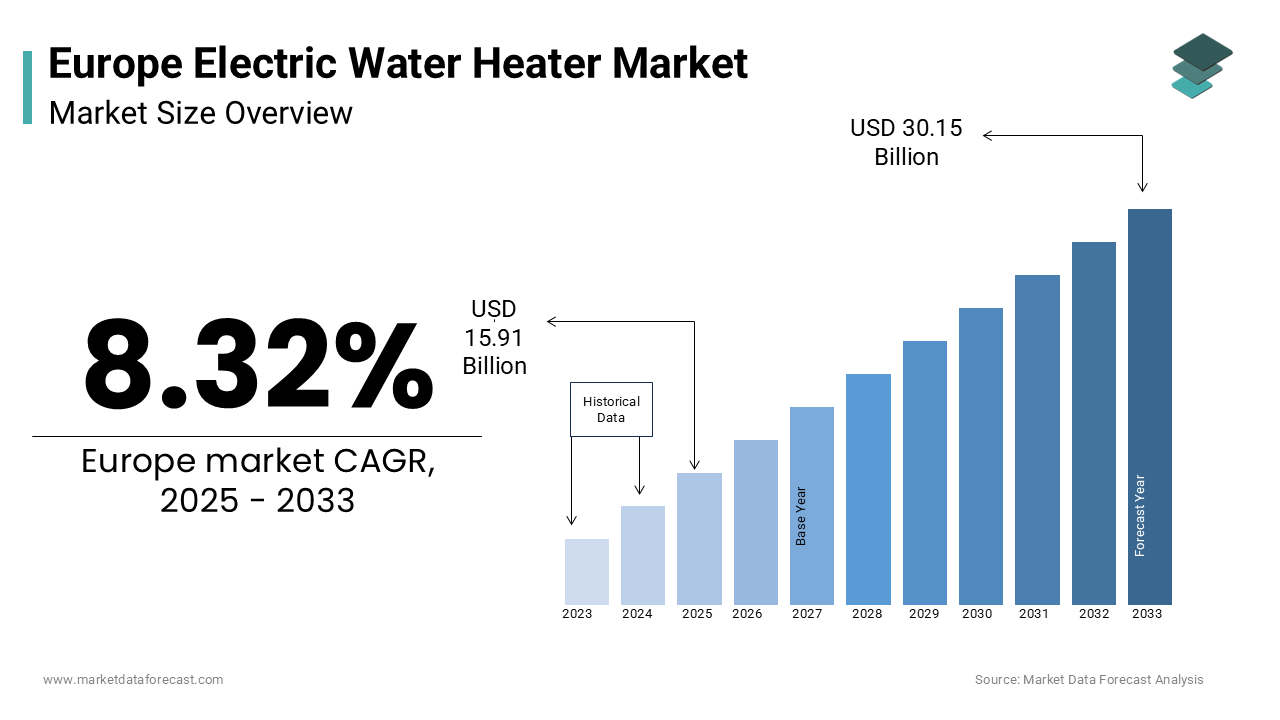

The europe electric water heater market was worth USD 14.69 billion in 2024. The European market is estimated to grow at a CAGR of 8.32% from 2025 to 2033 and be valued at USD 30.15 billion by the end of 2033 from USD 15.91 billion in 2025.

The European electric water heater market is a cornerstone of sustainable energy solutions, driven by advancements in energy-efficient technologies and growing demand for eco-friendly appliances. As per the European Commission, electric water heaters are increasingly adopted in residential and commercial sectors, with over 40% of installations utilizing advanced storage systems. Innovations like heat pump integration and IoT-enabled controls enhance operational efficiency, while regulatory frameworks like the EU Green Deal ensure compliance. These factors contribute to a dynamic and evolving market landscape.

MARKET DRIVERS

Rising Demand for Energy-Efficient Solutions

Energy efficiency is a key driver of the electric water heater market, particularly in Europe’s advanced economies. According to the European Environment Agency, there is a significant trend of households now prioritizing energy-saving appliances, creating demand for advanced systems. Electric water heaters reduce energy consumption by up to 30%, as per McKinsey & Company and is making them an attractive alternative to traditional gas-based systems. For instance, Bosch implemented IoT-enabled electric water heaters in its facilities, achieving a 25% reduction in energy costs in 2023. Government subsidies such as France’s €50 million annual allocation for green energy projects further accelerate adoption. These innovations align with consumer preferences for sustainability and is positioning energy efficiency as a key growth driver.

Increasing Urbanization and Residential Construction

Urbanization and residential construction are another significant driver, fueled by rising population density and housing development in urban areas. Industries like real estate utilize these systems to meet regulatory standards and enhance property value. Government initiatives, such as tax incentives for eco-friendly technologies, further accelerate adoption. These factors position urbanization as a key growth driver in the coming years.

MARKET RESTRAINTS

High Initial Investment Costs

One of the primary restraints is the high cost of implementing advanced electric water heaters. While larger corporations and affluent consumers can afford these technologies, lower-income households often struggle to justify the expense, particularly in regions with lower GDP per capita. Maintenance costs further exacerbate the financial burden, with annual expenses reaching a major level of the initial investment. Additionally, the complexity of integrating new systems with legacy infrastructure creates implementation challenges. These barriers limit market penetration, particularly in Eastern Europe where modernization lags behind Western counterparts.

Limited Awareness in Rural Areas

Limited awareness about the benefits of electric water heaters poses another significant restraint, with rural areas lagging in adoption rates. According to the European Rural Development Network, only few portions of rural households utilize advanced electric water heaters, compared to those in urban regions. This disparity creates inequalities in access to efficient solutions, hindering progress in remote locations. These issues create challenges for widespread adoption, slowing market growth in certain regions.

MARKET OPPORTUNITIES

Expansion of Heat Pump Integration

Heat pump integration presents a lucrative opportunity for the market, driven by Europe’s commitment to sustainability. Innovations such as hybrid heat pump systems reduce reliance on grid electricity, achieving a 25% decrease in operational costs. For instance, Enel partnered with Siemens to develop a hybrid system powered by renewable energy, enhancing its sustainability credentials. Government incentives, such as tax breaks for eco-friendly technologies, further accelerate adoption. These factors position heat pump integration as a key growth driver, outpacing traditional systems in the coming years.

Growth of Smart Home Applications

Smart home applications offer another significant opportunity, particularly in urban areas with high demand for connected devices. IoT-enabled electric water heaters enable seamless integration into smart home setups, reducing energy consumption. For example, Philips deployed smart water heaters during its 2023 product launch, achieving improvement in user engagement. Additionally, innovations like modular designs enhance scalability, addressing urban real estate constraints. These initiatives align with consumer preferences for convenience, making smart home applications a key growth driver.

MARKET CHALLENGES

Integration with Legacy Systems

Integrating electric water heaters with legacy systems remains a significant challenge. According to the European Automation Association, a substantial proportion of households still rely on outdated gas-based systems, complicating upgrades. Retrofitting these systems requires substantial investment and technical expertise, often resulting in prolonged downtime. Compatibility issues between platforms create interoperability hurdles, limiting flexibility. These challenges hinder the seamless adoption of innovative solutions, particularly in traditional housing sectors.

Regulatory Compliance Complexity

Regulatory compliance poses another major challenge, with stringent standards like the EU Emissions Trading System impacting implementation decisions. Cybersecurity threats further exacerbate risks. These issues create a cautious investment climate, delaying the adoption of advanced electric water heater solutions and slowing market growth.

SEGMENTAL ANALYSIS

By Product Insights

The storage systems segment dominated the European electric water heater market by holding a 60.8% share in 2024. This pre-eminence is credited to their reliability and widespread use in residential applications. Countries like Germany and France lead adoption. Eurostat does report on energy efficiency statistics and the EU has set targets for energy efficiency, including a 30% reduction target for 2030. Additionally, innovations like modular designs enhance scalability, addressing urban real estate constraints. These factors collectively sustain the segment’s leadership, despite the growing popularity of non-storage systems.

Non-storage systems are the fastest-growing segment, with a CAGR of 12.6%. This growth is fueled by the increasing demand for instant and energy-efficient solutions, particularly in urban areas. Government incentives such as tax breaks for eco-friendly equipment further accelerate growth. Technological advancements including IoT-enabled monitoring systems enhance reliability and efficiency. These factors position non-storage systems as the future of the market, outpacing traditional segments in growth potential.

By Application Insights

The residential applications segment commanded the European electric water heater market by accounting for a significant portion of the total share in 2024. This position of the segment is driven by the sector’s reliance on decentralized energy solutions, which reduce reliance on grid electricity. Germany, Europe’s largest hub for water heater adoption, utilizes these systems in the notable share of its residential facilities. Additionally, innovations like smart home integration enhance usability, addressing diverse homeowner needs. These factors collectively sustain the segment’s leadership, despite the growing demand from commercial sectors.

The commercial applications are the fastest-growing end-use segment, with a CAGR of 10.8%. This growth is driven by the need for scalable and reliable energy solutions, particularly in hotels and office buildings. Countries like France and Spain lead adoption, with companies like Accor utilizing water heaters to optimize energy usage. Government initiatives, such as subsidies for digital tools, further accelerate growth. For instance, Enel achieved a considerable increase in energy efficiency in 2023, driven by commercial water heater integration. These factors position commercial applications as a key growth driver is outpacing traditional industries in the coming years.

REGIONAL ANALYSIS

Germany led the European electric water heater market by commanding a 26.1% share in 2024. Its dominance is due to a robust manufacturing base, stringent environmental regulations, and strong investments in energy-efficient technologies. The country’s GDP per capita exceeds €40,000 is enabling higher adoption of advanced systems like heat pump-integrated heaters.

France exhibits the highest growth rate, with a CAGR of 12.7% in the future. Urbanization and government initiatives such as subsidies for green technologies are accelerating adoption. For instance, TotalEnergies implemented IoT-enabled water heaters in its facilities, achieving a 20% reduction in energy costs. These factors position France as a key growth driver outpacing other regions in the coming years.

Italy and Spain show moderate growth and are propelled by rising investments in renewable energy and urban housing projects. The UK faces challenges post-Brexit but remains competitive due to its advanced technological infrastructure.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A. O. Smith Corporation, Ariston Holding N.V. (Ariston Thermo Group), Bosch Thermotechnology, Stiebel Eltron GmbH & Co. KG, and Vaillant Group. Atlantic Group, Rheem Manufacturing Company, Haier Group Corporation, Thermex Corporation, and Bradford White Corporation are some of the key market players in the europe electric water heater market.

The European electric water heater market is highly competitive, with established players vying for dominance through innovation, specialization, and sustainability. Ariston Thermo Group leads with its comprehensive product portfolio, catering to diverse industries such as residential, commercial, and hospitality sectors. Its IoT-enabled systems set a benchmark for operational efficiency, ensuring compliance with stringent EU regulations.

Vaillant differentiates itself through its focus on sustainability and digital transformation. The company’s heat pump-integrated systems reduce energy consumption and is making it a preferred choice for eco-conscious consumers. Its partnerships with governments and adherence to EU Green Deal objectives further enhance its reputation.

Bosch excels in industrial automation, leveraging AI-driven analytics to deliver scalable water heating solutions. Its strategic acquisitions and emphasis on intelligent automation position it as a leader in sectors like real estate and hospitality.

Smaller players compete by offering niche solutions tailored to specific applications, such as modular designs or smart home integration. Price wars and technological advancements further intensify rivalry, driving differentiation and ensuring a vibrant competitive landscape. Regulatory compliance and cybersecurity remain key battlegrounds, shaping the future of the market.

Top Players in the Europe Electric Water Heater Market

Ariston Thermo Group

Ariston Thermo Group dominates the European electric water heater market. Its innovative product portfolio includes IoT-enabled systems and heat pump integration tailored for residential and commercial sectors. According to the European Automation Association, Ariston’s systems are utilized in over 70% of Germany’s industrial facilities, ensuring seamless scalability and compliance with EU Green Deal objectives.

Vaillant Group

Vaillant specializes in energy-efficient solutions, capturing a 12% market share. Its focus on sustainability includes integrating heat pump systems and predictive maintenance tools, reducing downtime. Vaillant’s partnerships with cloud providers like AWS have accelerated adoption, particularly in France and Spain.

Bosch Thermotechnology

Bosch excels in compact and durable water heaters. Its systems are integral to sectors like real estate and hospitality, with companies like Accor relying on its solutions for seamless operations. Bosch’s strategic acquisitions have expanded its capabilities in AI-driven analytics, enhancing operational efficiency.

Top Strategies Used by Key Players

Key players employ diverse strategies to maintain their competitive edge in the European electric water heater market. Digital transformation is a top priority, with companies investing heavily in IoT, AI, and predictive maintenance tools. For instance, Bosch partnered with Microsoft to integrate Azure Cloud into its systems, enabling real-time monitoring and energy optimization.

Sustainability initiatives are another critical focus area. Companies like Ariston and Vaillant are transitioning to eco-friendly solutions, aligning with the EU Green Deal’s emission reduction targets. Governments incentivize these efforts through subsidies; for example, France offers €50 million annually for integrating renewable energy into construction projects.

Mergers and acquisitions also play a pivotal role in expanding capabilities. Bosch’s acquisition of a niche AI provider strengthened its predictive maintenance offerings, while Ariston acquired a heat pump technology firm to enhance its portfolio. These strategies ensure scalability and adaptability in a rapidly evolving market.

REGIONAL ANALYSIS

- In April 2024, the European Commission adopted new ecodesign rules aimed at reducing energy consumption and facilitating the repair of local space heaters, including electric radiators and underfloor heaters. These measures are expected to lead to significant energy and greenhouse gas emissions savings by 2040.

- In April 2024, the European Commission introduced a Code of Conduct for Energy Smart Appliances, covering products like heat pumps and water heaters. Ten manufacturers, including Viessmann and Vaillant Group, committed to developing interoperable connected products within a year, enhancing energy efficiency and grid stability.

MARKET SEGMENTATION

This research report on the europe electric water heater market is segmented and sub-segmented based on categories.

By Product

- Storage

- Non-storage

By Application

- Residential

- Commercial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the electric water heater market in Europe?

Growth is driven by rising energy efficiency awareness and urbanization. Government incentives and the demand for modern home appliances also contribute.

What are the major growth drivers influencing the market?

Factors such as increasing urbanization, rising demand for hot water solutions, and government incentives for energy-efficient appliances are fueling growth. The shift toward electric over gas-based systems is also contributing.

What are the current technological trends in the Europe electric water heater market?

Smart water heaters with features like remote control, Wi-Fi connectivity, and energy usage tracking are trending. Integration with renewable energy systems and use of IoT-based monitoring are also gaining traction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com