Europe Emergency Medical Supplies Market Size, Share, Trends & Growth Forecast Report By Services (Basic Life Support (BLS), Advanced Life Support (ALS)), , Providers, Fleet, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Emergency Medical Supplies Market Size

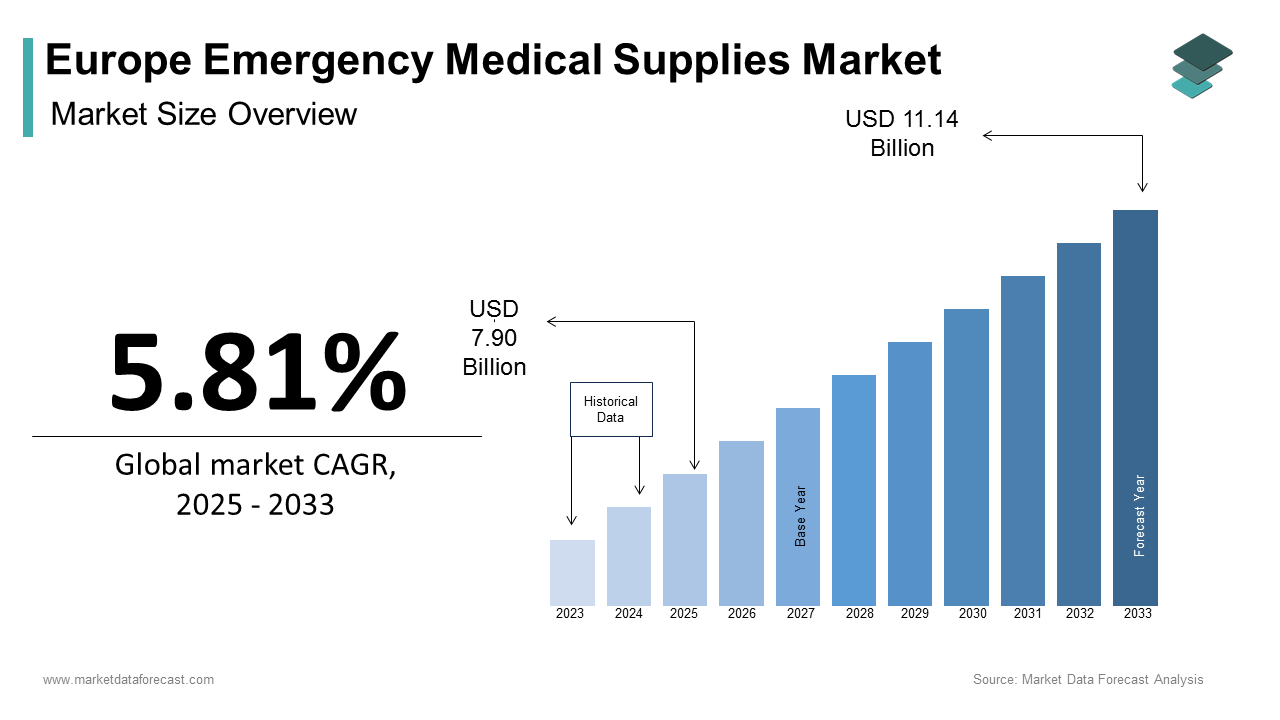

The Europe Emergency Medical Supplies Market size was calculated to be USD 6.70 billion in 2024 and is anticipated to be worth USD 11.14 billion by 2033, from USD 7.09 billion in 2025, growing at a CAGR of 5.81% during the forecast period.

The European emergency medical supplies market encompasses a broad range of critical healthcare products essential for immediate response during medical emergencies, trauma care, and life-support interventions. These supplies include defibrillators, oxygen delivery systems, airway management tools, wound dressings, splints, diagnostic kits, and resuscitation equipment, among others. The market is primarily driven by the urgent need for rapid response in pre-hospital and hospital-based emergency settings across the continent.

Europe has seen an increasing demand for emergency medical infrastructure due to rising incidences of road accidents, chronic disease prevalence, and aging populations. Moreover, the region's well-established healthcare systems and regulatory frameworks have facilitated the timely procurement and deployment of emergency medical equipment.

MARKET DRIVERS

Rising Incidence of Trauma-Related Injuries Across Europe

One of the most significant drivers influencing the Europe emergency medical supplies market is the growing number of trauma-related injuries, particularly from road traffic accidents, workplace incidents, and urban violence. According to data published by the European Transport Safety Council (ETSC), in 2022, 20,653 people lost their lives in road crashes across EU member states, with hundreds of thousands sustaining serious injuries requiring emergency medical intervention. These incidents necessitate immediate access to life-saving supplies such as tourniquets, splints, intravenous fluids, and advanced airway devices.

Furthermore, workplace-related injuries remain a persistent issue. As reported by the European Agency for Safety and Health at Work (EU-OSHA), approximately 3.2 million non-fatal work-related injuries were recorded in the EU in 2021, many of which required emergency treatment. The construction and manufacturing sectors accounted for the majority of these incidents. This trend has led to increased preparedness at industrial sites, with companies investing in emergency medical kits and training personnel in first aid response protocols.

Besides, urbanization and population density contribute to higher accident rates in major metropolitan areas. Cities like London, Paris, and Berlin experience high volumes of emergency calls annually, prompting ambulance services and hospitals to maintain adequate stock levels of emergency medical supplies.

Aging Population and Associated Health Emergencies

Another pivotal driver of the Europe emergency medical supplies market is the rapidly aging population, which has significantly increased the prevalence of age-related health emergencies. This demographic shift has directly contributed to a surge in emergency medical events such as strokes, heart attacks, falls, and respiratory distress, all of which require immediate medical intervention using specialized emergency supplies. Chronic conditions like hypertension, diabetes, and chronic obstructive pulmonary disease (COPD) are prevalent among elderly individuals, often leading to sudden deterioration requiring emergency care. This has led to an increased reliance on portable diagnostic tools, oxygen therapy devices, and cardiac monitoring equipment in both pre-hospital and emergency room settings.

In addition, geriatric patients are more prone to falls, which can result in severe injuries needing immobilization and transport equipment. According to the European Commission’s Public Health report, approximately 30% of adults over the age of 65 experience at least one fall annually, with 5% resulting in fractures or head trauma. Such statistics underline the critical role of emergency medical supplies in managing age-related health crises, thereby fueling sustained market growth across the region.

MARKET RESTRAINTS

Regulatory Complexity and Compliance Burdens

A significant restraint affecting the Europe emergency medical supplies market is the stringent regulatory framework governing medical device approvals and compliance. The European Union operates under the Medical Device Regulation (MDR) 2017/745, which came into full application in May 2021, replacing the earlier Medical Devices Directive. This regulation mandates rigorous clinical evaluations, post-market surveillance, and conformity assessments, which have substantially increased time-to-market for manufacturers of emergency medical supplies. This bottleneck has particularly affected small and medium-sized enterprises (SMEs) that lack the resources to navigate complex regulatory processes. A report indicated that the average approval timeline for medical devices in the EU increased after the implementation of MDR, compared to pre-regulation periods. Such regulatory hurdles not only delay the availability of new emergency medical products but also increase operational costs, which are often passed on to healthcare providers and public institutions. Given that emergency medical supplies must be readily available for unpredictable scenarios, any delay in regulatory clearance can compromise readiness and responsiveness, especially in rural and under-resourced regions.

Supply Chain Disruptions and Procurement Challenges

Supply chain disruptions have emerged as a critical challenge for the Europe emergency medical supplies market, particularly following the global impact of the COVID-19 pandemic and ongoing geopolitical tensions. The region relies heavily on imported raw materials and components for the production of essential emergency medical products such as personal protective equipment (PPE), ventilators, and disposable diagnostic kits. Like, in early 2022, approximately 60% of medical devices used in EU hospitals were sourced from outside the bloc, with China and the United States being primary suppliers.

The war in Ukraine and subsequent sanctions have further exacerbated logistics bottlenecks, leading to shortages of critical components and prolonged lead times. Also, inflationary pressures have impacted procurement budgets. As noted by the Organisation for Economic Co-operation and Development (OECD), healthcare inflation in several EU countries exceeded 7% in 2023, limiting the ability of public health systems to stockpile emergency supplies. These factors collectively constrain market expansion and affect the readiness of emergency response units across the continent.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Emergency Care Technologies

A transformative opportunity within the Europe emergency medical supplies market lies in the integration of telemedicine and remote emergency care technologies. With advancements in digital health infrastructure and increasing adoption of connected medical devices, there is a growing potential to enhance pre-hospital emergency response through real-time diagnostics and virtual consultations. Like, a significant share of EU member states have implemented national telehealth strategies aimed at improving emergency care accessibility, particularly in rural and underserved regions. Telemedicine platforms now enable paramedics to transmit live patient data—such as ECG readings, blood oxygen levels, and vital signs—to hospital emergency departments before arrival. This allows physicians to make faster triage decisions and prepare necessary emergency supplies accordingly. Moreover, wearable biosensors and mobile diagnostic kits are gaining traction in emergency response scenarios. These innovations are expected to drive demand for compatible emergency medical supplies, creating a new revenue stream for manufacturers adapting to digital transformation in healthcare.

Growth of Home-Based Emergency Preparedness and First Aid Kits

An emerging opportunity in the Europe emergency medical supplies market is the rising interest in home-based emergency preparedness and first aid education among consumers. Heightened awareness around personal health safety, coupled with government initiatives promoting basic life support skills, has spurred demand for consumer-grade emergency kits and self-administered medical devices. This shift has been influenced by campaigns encouraging CPR training and injury prevention education, particularly in countries like Germany, France, and the Netherlands, where first aid certification is mandatory for obtaining driving licenses. This growing consumer base presents a lucrative avenue for manufacturers to diversify their product portfolios beyond institutional clients and cater to individual buyers seeking reliable emergency solutions.

MARKET CHALLENGES

Standardization Gaps Across National Emergency Response Systems

One of the foremost challenges confronting the Europe emergency medical supplies market is the lack of harmonized standards across national emergency response systems. While the European Union has made strides in coordinating healthcare policies, disparities persist in emergency medical protocols, equipment requirements, and responder training among member states. These variations create logistical complexities for manufacturers and distributors of emergency medical supplies, who must tailor their offerings to meet different regulatory and operational expectations. For example, ambulance configurations and onboard medical equipment differ significantly between Germany, where paramedics are highly trained and authorized to perform advanced procedures, and countries like Greece, where emergency responders may have a limited scope of practice. Moreover, cross-border emergency operations, such as those during large-scale disasters or refugee movements, face complications due to incompatible supply chains and differing emergency care guidelines. As noted by the European Centre for Disease Prevention and Control (ECDC), during the 2022 floods in Central Europe, discrepancies in emergency supply inventories hampered coordinated relief efforts among affected nations.

Budgetary Constraints in Public Healthcare Systems

Budgetary limitations within Europe’s public healthcare systems represent a critical challenge for the emergency medical supplies market. Despite high healthcare expenditures in Western European countries, austerity measures and rising costs of chronic disease management have constrained funding allocations for emergency preparedness and equipment upgrades. According to the Organisation for Economic Co-operation and Development (OECD), healthcare inflation in several EU countries surpassed 7% in 2023, driven by wage increases, energy costs, and supply chain expenses, leaving limited room for investments in emergency medical infrastructure. Public hospitals and ambulance services, which constitute the primary purchasers of emergency medical supplies, often face budget caps imposed by national health ministries. For instance, in the UK, the National Audit Office reported in 2023 that ambulance trusts had collectively overspent their budgets by £120 million due to rising call volumes and equipment demands, forcing some to defer purchases of non-essential emergency items. Similarly, in Southern and Eastern Europe, where healthcare budgets are relatively lower, emergency departments frequently operate with outdated equipment and insufficient stockpiles. This financial disparity limits access to modern emergency medical tools and hampers the ability of healthcare systems to respond effectively to emergencies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.81% |

|

Segments Covered |

By Services, Providers, Fleet, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Stryker Corporation, Medtronic plc, Smiths Medical, B. Braun Melsungen AG, Koninklijke Philips N.V., GE Healthcare, Drägerwerk AG & Co. KGaA, ZOLL Medical Corporation, Cardinal Health, Inc., Fresenius SE & Co. KGaA, Ambu A/S, Laerdal Medical, Teleflex Incorporated, 3M Company, Becton, Dickinson and Company, Johnson & Johnson, Schiller AG, Nihon Kohden Corporation, Ferno-Washington, Inc., Mindray Medical International Limited |

SEGMENTAL ANALYSIS

By Services Insights

The Basic Life Support (BLS) segment dominated the Europe emergency medical supplies market by accounting for 42% of total revenue share in 2024. This segment includes essential equipment such as oxygen delivery systems, airway management tools, splints, and defibrillators used during initial patient stabilization before advanced care is administered. One key driver behind BLS dominance is its widespread deployment across both urban and rural emergency response systems. Another critical factor is the increasing integration of BLS training into public health initiatives. For instance, France introduced mandatory first aid education in schools in 2023, aiming to train 80% of young people by 2027.

The Advanced Life Support (ALS) segment is projected to be the fastest-growing within the Europe emergency medical supplies market, exhibiting a CAGR of 6.9%. ALS involves highly specialized equipment and trained personnel capable of performing complex interventions such as intubation, intravenous drug administration, and advanced cardiac monitoring—services that are increasingly being demanded due to rising critical care emergencies. A major growth catalyst is the surge in cardiovascular diseases across Europe. Additionally, advancements in pre-hospital telemetry and real-time diagnostics are enhancing ALS capabilities. These innovations are enabling faster decision-making and higher survival rates, encouraging broader adoption of ALS services and driving sustained growth in this segment.

By Providers Insights

The Hospital-Based EMS segment had the largest share of the European emergency medical supplies market by contributing 38.5% of total revenue in 2024. This dominance is due to the central role hospitals play in coordinating emergency medical responses, particularly in acute care scenarios requiring immediate access to high-end diagnostic and therapeutic tools. One key factor driving this segment is the strong integration between hospital emergency departments and pre-hospital care systems. Countries like Germany and France maintain well-established trauma centers that operate around the clock, directly influencing procurement volumes of resuscitation kits, defibrillators, and life-support devices. Another contributing factor is the growing emphasis on hospital-led emergency response models. Furthermore, hospital-based EMS providers often receive direct government funding, allowing them to invest in modernization and expand their emergency preparedness infrastructure, reinforcing their leading position in the market.

The Private Ambulance Service segment is coming up as the quickly expanding category provider category in the Europe emergency medical supplies market, registering a CAGR of 7.4%. This rapid expansion is attributed to the increasing privatization of emergency medical services, especially in response to public sector capacity constraints and rising demand for premium emergency care. A primary driver of this growth is the surge in outsourcing of ambulance services by public health institutions. Private operators are leveraging this opportunity to enhance fleet modernization and adopt digital dispatching systems, thereby increasing the demand for high-quality emergency medical supplies. Moreover, rising consumer preference for private emergency transport is accelerating market growth. These clients often request premium-grade equipment such as portable ventilators and cardiac monitors, directly fueling demand for advanced emergency medical products in the private EMS sector.

By Fleet Insights

The Ground Transport segment will remain the dominant mode of emergency medical transportation across Europe in 2024. This overwhelming majority is primarily due to the extensive road networks, cost-effectiveness, and accessibility of ground ambulances compared to air-based alternatives. One of the main factors sustaining ground transport’s dominance is its widespread use in both urban and semi-urban areas. These vehicles are equipped with essential emergency medical supplies such as defibrillators, oxygen tanks, and trauma kits, ensuring prompt on-site care before hospital transfer. Apart from these, ground transport is more economically viable for routine emergency responses.

The Air Transport segment is experiencing the highest growth rate within the Europe emergency medical supplies market, with a projected CAGR of 8.1%. This accelerated expansion is driven by increasing demand for rapid inter-facility transfers, especially in remote and mountainous regions where ground access is limited or impractical. A key growth enabler is the expansion of helicopter emergency medical services (HEMS) across Western and Northern Europe. These helicopters are equipped with high-end life-support systems, including portable ventilators and advanced cardiac monitors, which drive demand for specialized emergency medical supplies. Furthermore, advancements in aeromedical evacuation technology are enhancing air transport capabilities. A 2023 study by the Scandinavian Journal of Trauma, Resuscitation, and Emergency Medicine found that air ambulance response reduced mortality in severe trauma cases compared to ground transport. This has prompted increased investment in air-based EMS infrastructure, further propelling the growth of this segment and associated medical supply requirements.

REGIONAL ANALYSIS

Germany maintained a leading position in the Europe emergency medical supplies market by capturing an estimated market share of 22% in 2024. As Europe’s largest economy and a hub for advanced healthcare infrastructure, Germany benefits from high healthcare expenditure, well-equipped emergency response units, and a strong presence of domestic and international medical device manufacturers. One major driver underpinning Germany’s dominance is its substantial per capita healthcare spending. This financial commitment ensures continuous procurement of emergency medical supplies, including defibrillators, oxygen delivery systems, and trauma kits. In addition, Germany’s structured emergency medical services (EMS) system, which integrates fire department-based, hospital-based, and private ambulance services, enhances operational efficiency.

France has a strong public healthcare framework and when coupled with a centralized emergency response system, supports steady demand for emergency medical equipment and consumables. A major contributor to France’s prominent position is its well-developed SAMU (Service d’Aide Médicale Urgente) system, which coordinates pre-hospital emergency care nationwide. According to the French Ministry of Health, in 2023, SAMU responded to 29.7 million emergency calls, with a significant portion requiring immediate life-saving interventions using specialized emergency supplies. Moreover, France has been actively investing in digital health technologies to improve emergency response efficiency. A 2023 report by the French National Agency for Medicines and Health Products Safety (ANSM) highlighted that a significant share of emergency medical dispatch centers had integrated telemedicine solutions, enabling real-time diagnostics and better resource allocation.

The United Kingdom captured a notable position in the market. The country's mature National Health Service (NHS) infrastructure and high demand for emergency interventions contribute to its sustained market presence. A primary growth driver is the increasing burden of emergency hospital admissions. According to NHS England, in 2022–2023, there were over 5.8 million emergency admissions, placing immense pressure on ambulance services and emergency departments to maintain adequate stock levels of medical supplies. Additionally, the UK has been investing in ambulance service modernization.

Italy is positioning it among the top five contributors in the region. The Italian emergency medical system is characterized by a mix of public and private providers, ensuring broad coverage across urban and rural areas. One of the key drivers of Italy’s market position is its aging population, which contributes to a high incidence of emergency medical events. This demographic profile increases demand for emergency interventions related to cardiovascular diseases and falls, necessitating a constant supply of emergency medical equipment. Also, Italy has been expanding its emergency medical infrastructure. A 2023 report by the Italian Ministry of Health revealed that the country added over 300 new emergency ambulances in the past two years, many of which are equipped with advanced life support systems. These developments are directly stimulating demand for high-quality emergency medical supplies, strengthening Italy’s market footprint.

Spain had a smaller market share. The country’s emergency medical system is managed through a decentralized model, with autonomous regions overseeing local EMS operations, contributing to a diverse yet coordinated response framework. A key growth factor is the increasing number of emergency calls and ambulance dispatches. Also, Spain has been focusing on improving emergency response times, particularly in rural and island regions, where accessibility challenges exist. As per the Ministry of Health, this initiative led to an increase in ambulance availability in 2023, directly boosting demand for emergency medical supplies. These strategic investments are helping Spain solidify its position in the regional market.

LEADING PLAYERS IN THE EUROPE EMERGENCY MEDICAL SUPPLIES MARKET

Medtronic plc is a global leader in medical technology and holds a dominant presence in the Europe emergency medical supplies market. The company offers a broad portfolio of life-saving products, including defibrillators, ventilators, cardiac monitors, and resuscitation equipment. Medtronic’s commitment to innovation and its strong distribution network across European countries enable it to maintain a leading position. Its integration of digital health technologies into emergency care solutions has significantly enhanced pre-hospital response capabilities.

Stryker Corporation is another key player shaping the landscape of emergency medical supplies in Europe. Known for its advanced trauma care products, Stryker provides critical equipment such as stretchers, immobilization devices, and emergency room furniture designed for rapid deployment and patient safety. The company emphasizes strategic acquisitions and R&D investments to expand its product offerings and address evolving clinical needs in emergency settings.

Philips Healthcare plays a pivotal role in equipping emergency departments and ambulatory services with cutting-edge diagnostic and monitoring systems. Its portfolio includes portable ultrasound devices, telemetry units, and integrated ICU solutions tailored for high-pressure environments. Philips focuses on integrating AI-driven diagnostics and telehealth platforms to support real-time decision-making during emergencies, thereby enhancing efficiency and outcomes in European healthcare systems.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Europe emergency medical supplies market is product innovation and technological advancement. Companies are investing heavily in developing next-generation emergency care devices that offer greater portability, faster response times, and integration with digital health platforms. This helps them stay ahead in a competitive environment driven by the need for efficient and reliable emergency interventions.

Another crucial approach is strategic partnerships and collaborations. Leading firms are partnering with healthcare providers, government agencies, and research institutions to enhance product development, improve regulatory compliance, and streamline supply chain logistics. These alliances also facilitate better alignment with national emergency response frameworks across European countries.

Lastly, expansion through mergers and acquisitions is a widely adopted growth strategy. By acquiring smaller firms with niche capabilities or regional market access, industry leaders can rapidly scale their operations, diversify product portfolios, and strengthen their foothold in the European emergency medical supplies sector.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players of the Europe Emergency Medical Supplies Market include Stryker Corporation, Medtronic plc, Smiths Medical, B. Braun Melsungen AG, Koninklijke Philips N.V., GE Healthcare, Drägerwerk AG & Co. KGaA, ZOLL Medical Corporation, Cardinal Health, Inc., Fresenius SE & Co. KGaA, Ambu A/S, Laerdal Medical, Teleflex Incorporated, 3M Company, Becton, Dickinson and Company, Johnson & Johnson, Schiller AG, Nihon Kohden Corporation, Ferno-Washington, Inc., Mindray Medical International Limited.

The competition in the European emergency medical supplies market is marked by a dynamic mix of established multinational corporations and emerging regional players striving to capture market share through innovation, strategic positioning, and operational efficiency. With increasing demand for rapid emergency response solutions, companies are under constant pressure to deliver advanced, reliable, and cost-effective products that align with evolving clinical protocols and regulatory standards. The market features intense rivalry among major players who leverage their extensive distribution networks, brand recognition, and R&D capabilities to maintain dominance. At the same time, smaller firms are gaining traction by focusing on specialized niches and offering customized solutions tailored to local healthcare infrastructures. Regulatory compliance remains a significant challenge, influencing product development cycles and market entry strategies. Additionally, the growing emphasis on digital integration in emergency care is pushing manufacturers to incorporate smart technologies, further intensifying competition. As healthcare systems across Europe continue to modernize, the race to provide superior emergency medical products and services is expected to accelerate, shaping a highly competitive and innovation-driven market landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Philips Healthcare launched a new line of portable cardiac monitors specifically designed for pre-hospital emergency use in Europe. This introduction aimed at improving early diagnosis and treatment decisions during ambulance transport, reinforcing Philips’ leadership in emergency diagnostics.

- In March 2024, Stryker Corporation expanded its trauma care division in Germany by opening a dedicated manufacturing unit focused on producing high-performance immobilization and patient-handling equipment. This move was intended to enhance local supply chain resilience and meet rising demand from German emergency services.

- In May 2024, Medtronic partnered with several European universities and hospitals to develop AI-integrated triage tools for emergency departments. The collaboration aimed at optimizing patient prioritization and resource allocation during high-volume emergencies.

- In July 2024, BD (Becton, Dickinson, and Company) acquired a French medical device startup specializing in disposable emergency airway management kits. This acquisition was part of BD’s strategy to expand its presence in the European emergency care market and diversify its product offerings.

- In September 2024, Zoll Medical, a subsidiary of Asahi Kasei, introduced an updated version of its automated external defibrillator (AED) with enhanced connectivity features for real-time data transmission across selected European markets. This launch supported the roader deployment of AEDs in public spaces and private homes.

MARKET SEGMENTATION

This research report on the Europe Emergency Medical Supplies Market has been segmented and sub-segmented based on services, providers, fleet, and region.

By Services

- Basic Life Support (BLS)

- Advanced Life Support (ALS)

By Providers

- Hospital-Based EMS

- Private Ambulance Service

By Fleet

- Ground Transport

- Air Transport

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key factors driving growth in the Europe emergency medical supplies market?

Growth is propelled by the rising incidence of acute illnesses and trauma, expanding pre-hospital care infrastructure, government initiatives to improve EMS capabilities, and increasing adoption of single-use, sterile products to prevent hospital-acquired infections.

2. Which European countries offer the greatest opportunity for emergency medical supplies manufacturers?

Germany, the UK, France, Italy, and Spain represent the largest markets due to their advanced healthcare infrastructure, high EMS spending, and supportive reimbursement policies.

3. How is the demand for emergency medical supplies distributed across European countries?

Demand is highest in countries with advanced healthcare systems and high population densities, such as Germany, France, and the UK, while Eastern European countries are experiencing growing adoption due to improved healthcare spending.

4. Who are the primary end-users of emergency medical supplies in Europe?

The main end-users include hospitals (emergency departments and ICUs), ambulance services, urgent care clinics, first-responder units (paramedics, fire & rescue), and disaster relief organizations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com