Europe EV Powertrain Testing Services Market Size, Share, Trends & Growth Forecast Report By Service Type (Battery Testing, Simulation Testing), Vehicle Type, Test Methodology, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe EV Powertrain Testing Services Market Size

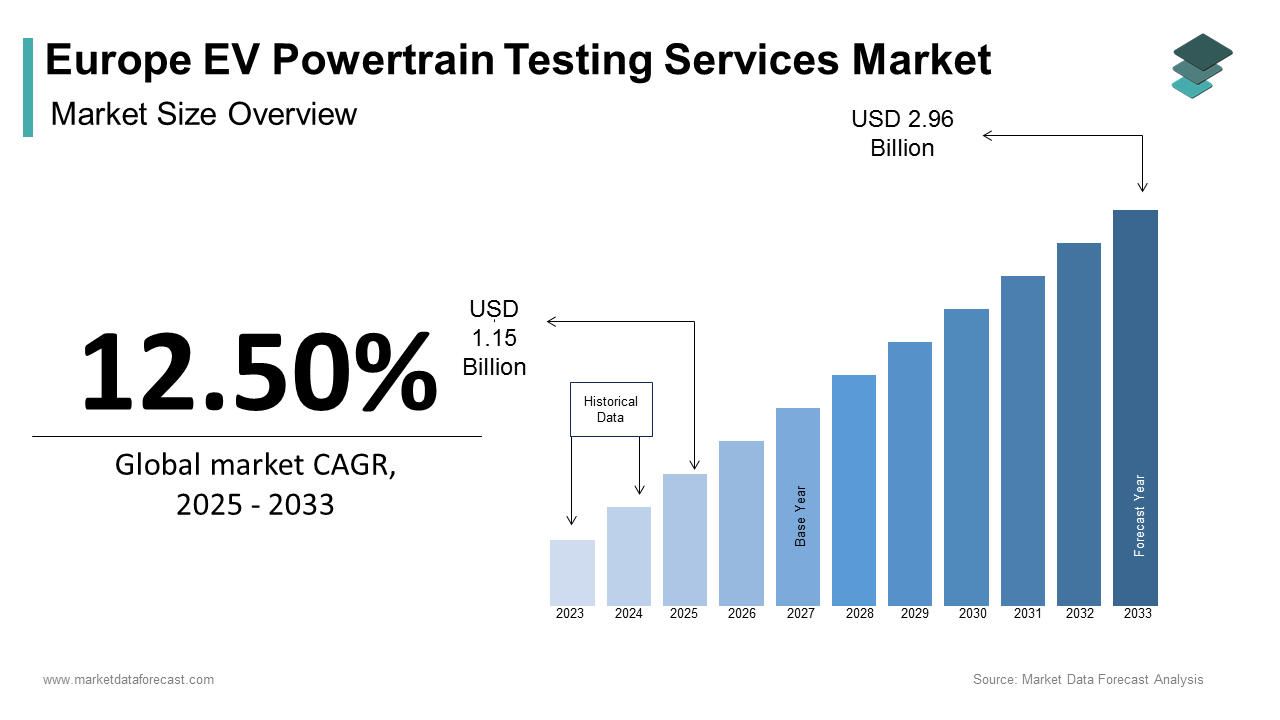

The Europe EV powertrain testing services market size was calculated to be USD 1.03 billion in 2024 and is anticipated to be worth USD 2.96 billion by 2033, from USD 1.15 billion in 2025, growing at a CAGR of 12.50% during the forecast period.

The Europe EV powertrain testing services market refers to a specialized sector within the automotive industry that focuses on evaluating and validating electric vehicle propulsion systems, including electric motors, inverters, battery packs, and transmission components. These testing services ensure compliance with performance, efficiency, durability, and safety standards before mass production and deployment. As automakers transition from internal combustion engines to electrified powertrains, the demand for advanced testing infrastructure has surged across the region.

According to the European Automobile Manufacturers’ Association (ACEA), major automotive manufacturers in Europe are investing heavily in electric mobility, with several committing to phase out conventional vehicles by 2035. This shift is backed by stringent emissions regulations set forth by the European Commission, which mandates a reduction in CO₂ emissions for new cars by 2030 compared to 2021 levels.

In response, research institutions such as Fraunhofer Institute and independent testing facilities like HORIBA MIRA have expanded their capabilities to support end-to-end validation of EV powertrains. Besides, national governments in Germany, France, and Sweden are funding test centers focused on battery performance, thermal management, and energy efficiency under programs like the EU Battery Innovation Initiative.

Moreover, as consumer expectations around driving range, charging speed, and reliability grow, automakers increasingly rely on third-party testing partners to accelerate time-to-market while ensuring regulatory compliance and product quality.

MARKET DRIVERS

Stringent Emissions Regulations and Government Mandates

One of the primary drivers fueling the European EV powertrain testing services market is the implementation of stringent emissions regulations and aggressive government mandates aimed at reducing carbon footprints. The European Union has set ambitious climate targets under the Fit for 55 package, requiring a 55% reduction in greenhouse gas emissions by 2030 and achieving climate neutrality by 2050. According to the European Environment Agency (EEA), road transport accounts for nearly one-fifth of the EU’s total CO₂ emissions, prompting policymakers to enforce stricter emission norms and incentivize electric vehicle adoption. This regulatory push necessitates rigorous testing of electric powertrains to meet homologation requirements and ensure compliance with WLTP (Worldwide Harmonized Light Vehicles Test Procedure) and RDE (Real Driving Emissions) standards. The German Federal Motor Transport Authority (Kraftfahrt-Bundesamt) reported that in 2023, over 40% of all new vehicle type approvals involved full electric or hybrid powertrains, significantly increasing the workload for testing service providers. As automakers strive to meet these deadlines without compromising performance, they are increasingly outsourcing testing operations to specialized laboratories and engineering firms capable of delivering precise, repeatable results under diverse conditions.

Surge in Electric Vehicle Production and R&D Investments

Another key driver propelling the Europe EV powertrain testing services market is the rapid increase in electric vehicle production and substantial investments in research and development by automotive manufacturers and startups alike. According to ACEA, electric vehicle registrations in the EU notably grew year-over-year in 2023, with Germany, France, and Norway leading the charge. Automotive OEMs such as Volkswagen, BMW, and Renault are expanding their EV portfolios, with each new model requiring extensive validation of its powertrain components. Beyond established automakers, emerging EV brands like Polestar, Rivian, and local European startups are also entering the market, further intensifying the need for third-party testing services. The European Investment Bank (EIB) noted in 2023 that over €20 billion had been allocated to automotive electrification projects across the continent, much of which was directed toward R&D and prototype validation. Additionally, academic and industrial collaborations, such as the ones supported by the European Battery Alliance, are accelerating innovation in solid-state batteries and high-efficiency drivetrains.

MARKET RESTRAINTS

High Cost of Setting Up Advanced Testing Facilities

A significant restraint affecting the European EV powertrain testing services market is the high capital expenditure required to establish and maintain state-of-the-art testing infrastructure. Developing fully equipped laboratories with dynamometers, thermal chambers, and battery cyclers capable of simulating real-world conditions demands substantial investment. These costs include not only equipment but also facility modifications, software licensing, and skilled workforce training. Many independent testing firms and smaller contract engineering organizations find it financially challenging to keep pace with rapidly evolving technologies, such as 800V architectures, silicon carbide inverters, and multi-motor all-wheel-drive systems. Furthermore, maintaining accreditation with international standards such as ISO/IEC 17025 adds another layer of complexity and expense.

Shortage of Skilled Professionals and Technical Expertise

Another critical challenge hindering the growth of the European EV powertrain testing services market is the shortage of skilled professionals and technical experts capable of operating complex testing equipment and interpreting advanced data analytics. The rapid evolution of EV technology has created a widening skills gap, particularly in areas such as battery diagnostics, power electronics, and thermal simulation. Over 60% of surveyed companies indicated difficulties in recruiting personnel with expertise in electric drivetrain validation and embedded software integration. Universities and vocational institutions are gradually adapting curricula to address this deficit, but the process remains slow compared to industry needs. The German Association of the Automotive Industry (VDA) noted that in 2023, nearly half of all automotive engineering graduates lacked hands-on experience with EV-specific testing protocols, delaying their readiness for employment. Additionally, the turnover rate among experienced engineers has increased as top talent is often poached by OEMs offering higher salaries and direct involvement in product development.

MARKET OPPORTUNITIES

Expansion of Battery Testing and Certification Services

An emerging opportunity in the European EV powertrain testing services market is the growing demand for battery testing and certification services, driven by the increasing complexity of battery systems and the need for standardized safety assessments. With the proliferation of lithium-ion and next-generation solid-state batteries, ensuring reliability, longevity, and thermal stability has become paramount. Each of these facilities requires extensive battery validation to meet UN GTR 20 and UNECE R100 standards, creating a surge in demand for third-party testing services. Testing providers are now expanding their offerings to include electrochemical impedance spectroscopy, cycle life testing, crash simulations, and abuse testing to validate battery resilience under extreme conditions. The European Committee for Electrotechnical Standardization (CENELEC) emphasized in 2023 that harmonized testing procedures would be essential in fostering cross-border battery trade and ensuring interoperability across EV platforms. Moreover, initiatives such as the EU-funded BATTERY 2030+ project are encouraging collaboration between research institutes and testing labs to develop predictive maintenance tools and digital twin-based diagnostics.

Integration of AI and Digital Twin Technologies in Testing Processes

The integration of artificial intelligence (AI) and digital twin technologies into EV powertrain testing represents a transformative opportunity for the Europe market. These innovations enable virtual validation of electric drivetrains, reducing reliance on physical prototypes and accelerating development cycles. Several testing firms are adopting digital twin platforms to replicate real-world driving scenarios and stress-test components under diverse environmental conditions. Apart from these, cloud-based analytics and machine learning algorithms are being deployed to detect anomalies in powertrain performance data, enabling proactive adjustments and improving overall system reliability. Companies like Siemens and AVL List are partnering with automakers to embed these technologies directly into the testing workflow, enhancing precision and reducing time-to-market.

MARKET CHALLENGES

Rapid Technological Evolution and Compatibility Issues

A major challenge confronting the European EV powertrain testing services market is the rapid pace of technological evolution and the resulting compatibility issues across different generations of electric drivetrains. The automotive industry is witnessing continuous advancements in motor design, battery chemistry, and control algorithms, making it difficult for testing facilities to maintain up-to-date validation protocols. This dynamic environment creates operational inefficiencies, particularly for smaller testing centers that struggle to keep pace with the latest industry benchmarks. In addition, variations in global standards—such as differences between IEC, ISO, and UN GTR guidelines—pose challenges in ensuring consistent and universally accepted test results. To remain relevant, testing service providers must continuously invest in adaptive infrastructure and staff retraining, placing financial strain on entities lacking strong backing from parent organizations or government grants.

Increasing Complexity of Integrated Powertrain Systems

The rising complexity of integrated powertrain systems presents another significant challenge for the European EV powertrain testing services market. Modern electric vehicles feature highly interconnected components, including dual- and triple-motor setups, regenerative braking systems, and intelligent energy management software, all of which require synchronized validation. According to the European Committee for Standardization (CEN), traditional component-level testing is no longer sufficient, as system-wide interactions can lead to unforeseen performance deviations. Testing firms are now required to simulate entire vehicle ecosystems using hardware-in-the-loop (HIL) and software-in-the-loop (SIL) techniques, which demand high computational resources and interdisciplinary expertise. As automakers move toward platform-based modular architectures and over-the-air updates, the ability to test integrated systems comprehensively will become even more crucial, posing ongoing technical and logistical hurdles for the EV powertrain testing industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.50% |

|

Segments Covered |

By Service Type, Vehicle Type, Test Methodology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Applus+ IDIADA, Ricardo Plc, TÜV SÜD, AVL List GmbH, CTAG Automotive Technology Centre of Galicia, Intertek Group Plc, ATESTEO GmbH & Co. KG, HORIBA MIRA Ltd, Element Materials Technology, FEV Group GmbH. |

SEGMENTAL ANALYSIS

By Service Type Insights

Battery testing is the largest service type in the Europe EV powertrain testing services market accounting for 34.8% of the total market share in 2024. This dominance is primarily driven by the critical role batteries play in determining electric vehicle performance, range, and safety. Each facility must conduct extensive tests on parameters such as cycle life, thermal stability, internal resistance, and safety under extreme conditions. The European Committee for Electrotechnical Standardization (CENELEC) emphasizes that compliance with international standards like UN GTR 20 and UNECE R100 has become mandatory for cross-border battery trade within the EU. As a result, automakers and suppliers are increasingly relying on third-party testing labs to ensure conformity before mass production. Moreover, incidents of battery fires and degradation issues have heightened consumer concerns, prompting regulatory bodies such as the European Commission’s Joint Research Centre (JRC) to advocate for standardized battery testing protocols.

Simulation testing is emerging as the fastest-growing segment within the Europe EV powertrain testing services market, recording a CAGR of 14.6%. This rapid expansion is attributed to the increasing adoption of digital twin technologies, AI-driven analytics, and virtual validation tools that reduce reliance on physical prototypes. Additionally, academic institutions such as the Fraunhofer Institute for Industrial Mathematics (ITWM) have been at the forefront of developing predictive maintenance models using machine learning algorithms. Furthermore, major engineering firms like AVL List and Siemens are integrating cloud-based simulation platforms into their service offerings, allowing real-time collaboration between OEMs and testing partners.

By Vehicle Type Insights

Battery Electric Vehicles (BEVs) commanded the European EV powertrain testing services market by capturing around 58.5% of the total market share in 2024. This leading position is due to the growing number of BEV model launches, government incentives promoting zero-emission mobility, and stringent emissions regulations phasing out internal combustion engine vehicles. As reported by the European Automobile Manufacturers’ Association (ACEA), BEV registrations in the EU increased year-over-year in 2023, with Germany, France, and Norway leading adoption rates. Automotive giants such as Volkswagen, BMW, and Renault have committed to electrifying their fleets, necessitating comprehensive powertrain validation for each new model. For instance, Volkswagen Group plans to launch over 70 new electric models by 2030, each requiring rigorous testing of motors, inverters, and battery systems. Additionally, the European Investment Bank (EIB) has allocated significant funding to support BEV manufacturing and infrastructure projects, further stimulating demand for testing and certification services.

Commercial Electric Vehicles represent the quickest expanding vehicle type segment in the Europe EV powertrain testing services market, registering a CAGR of 18.3%. This surge is fueled by the rapid electrification of logistics and delivery fleets, supported by regulatory mandates and corporate sustainability commitments Major players such as DHL, Amazon, and DB Schenker have pledged to electrify large portions of their fleets by 2030. This shift necessitates extensive validation of high-voltage powertrains, regenerative braking systems, and battery durability under frequent stop-start cycles. Moreover, the European Green Deal’s push for clean urban logistics and reduced freight emissions has prompted city-level incentives for adopting electric vans and trucks. As a result, testing providers are expanding their capabilities to accommodate larger-scale commercial EV validation, positioning this segment as a key growth driver in the market.

By Test Methodology Insights

Lab testing was the biggest methodology in the Europe EV powertrain testing services market holding 39.3% of the total market share in 2024. This control is attributed to the controlled environment it provides for assessing component performance, reliability, and safety under standardized conditions. Like, lab testing allows engineers to replicate a wide range of operating scenarios—including extreme temperatures, vibration, and electrical stress—without exposing vehicles to unpredictable real-world variables. This ensures repeatable and precise results essential for regulatory compliance and product certification. Major test centers such as HORIBA MIRA, AVL List, and SGS SA have expanded their laboratory capacities to accommodate the rising volume of EV validation requests. These regulatory requirements, coupled with the need for early-stage failure detection, continue to drive sustained demand for lab testing services.

Simulation testing is also the quickly surging methodology within the Europe EV powertrain testing services market by exhibiting a CAGR of 14.6%. This growth is propelled by the increasing integration of AI-driven modeling, digital twin technology, and predictive analytics in validating complex EV powertrains. This reduces development costs and accelerates time-to-market, particularly for startups and mid-sized manufacturers. Academic institutions like Fraunhofer ITWM have played a pivotal role in advancing simulation capabilities. In addition, major engineering firms such as Siemens and AVL List have incorporated cloud-based simulation platforms into their service portfolios, enhancing remote collaboration and data analysis. The ability to simulate long-term wear, energy consumption patterns, and system interactions makes simulation testing indispensable in modern EV development cycles.

REGIONAL ANALYSIS

Germany led the Europe EV powertrain testing services market with a 25.2% share in 2024. As the continent's largest automotive manufacturer, Germany is home to major OEMs such as Volkswagen, BMW, and Mercedes-Benz, all of which are accelerating their electrification roadmaps. According to the German Association of the Automotive Industry (VDA), over 40% of all new vehicle registrations in 2023 involved electric or hybrid powertrains. This transition has spurred investment in domestic testing facilities, including those operated by AVL List, SGS, and independent research institutes like Fraunhofer IPA. Apart from these, the German government has allocated substantial funding through initiatives like the National Innovation Program for Hydrogen and Fuel Cell Technology to support EV infrastructure and testing capabilities. The presence of numerous Tier-1 suppliers and battery gigafactories further reinforces Germany’s central role in shaping the future of EV powertrain validation across Europe.

France benefits from strong government backing for electric mobility, a well-established automotive sector, and strategic investments in battery and drivetrain R&D. To support this growth, the government launched the "Recovery Plan for Mobility" to fund test centers focused on battery longevity, thermal management, and motor efficiency. Paris-based testing firms such as AKKA Technologies and FEV France have expanded their EV-specific validation services, collaborating closely with academic institutions like Mines ParisTech to develop advanced diagnostics and simulation tools. These efforts position France as a key player in the regional EV testing landscape.

The United Kingdom remains a hub for innovation in electric mobility, supported by a robust network of research institutions and independent testing providers. This shift has led to increased demand for third-party validation of motors, inverters, and battery packs. HORIBA MIRA and Millbrook Proving Ground have expanded their EV testing capabilities, offering end-to-end validation services for both passenger and commercial vehicles. Also, the Advanced Propulsion Centre (APC) continues to fund R&D initiatives aimed at improving EV efficiency and reducing dependency on imported components, reinforcing the UK’s competitive position in the market.

The Netherlands is driven by its strong focus on sustainable transportation, smart grid integration, and electric commercial vehicle deployment. Cities like Amsterdam and Rotterdam have implemented strict low-emission zones, pushing logistics companies to adopt zero-emission delivery solutions. Dutch testing firms such as TNO and VDL ETG have developed specialized validation frameworks for commercial EVs, emphasizing battery durability, charging infrastructure compatibility, and system interoperability. In addition, the Dutch government supports public-private partnerships to advance digital twin technologies and AI-based diagnostics, ensuring the Netherlands remains at the forefront of EV powertrain innovation.

Sweden is supported by its progressive environmental policies, growing battery industry, and a strong emphasis on circular economy principles. Northvolt’s gigafactory in Skellefteå has emerged as a focal point for battery validation, working closely with local testing firms and research institutions. Besides, Sweden’s commitment to achieving fossil-free transport by 2030 has spurred the adoption of electric buses, trucks, and two-wheelers, increasing demand for standardized testing procedures. With its combination of policy support, industrial innovation, and technical expertise, Sweden plays an increasingly influential role in shaping the European EV testing ecosystem.

LEADING PLAYERS IN THE EUROPE EV POWERTRAIN TESTING SERVICES MARKET

AVL List GmbH

AVL List is a leading global provider of simulation, testing, and development solutions for powertrain systems, including electric vehicles. In Europe, AVL plays a pivotal role in supporting automotive manufacturers with end-to-end validation of electric motors, inverters, and battery systems. The company's deep expertise in virtual testing and integration of AI-driven diagnostics has made it a preferred partner for OEMs seeking to accelerate time-to-market while ensuring compliance with evolving regulatory standards. AVL’s commitment to innovation and sustainability aligns closely with Europe’s electrification goals.

HORIBA MIRA

HORIBA MIRA offers comprehensive EV powertrain testing services, including performance evaluation, thermal analysis, and safety certification. Based in the UK, the company supports both established automakers and emerging EV startups across Europe with advanced laboratory facilities and real-world simulation capabilities. HORIBA MIRA’s focus on developing robust testing protocols for high-voltage systems and battery durability makes it a key player in ensuring product reliability and regulatory compliance. Its strategic collaborations with academic institutions further enhance its technical leadership.

SGS S.A.

SGS is a globally recognized leader in inspection, verification, and testing services, including specialized offerings in EV powertrain validation. With a strong presence across Europe, SGS provides integrated testing solutions covering emissions, safety, performance, and standard compliance for electric drivetrains. The company supports manufacturers in navigating complex certification requirements and ensures alignment with international quality benchmarks. SGS’s emphasis on digital transformation and cross-sector collaboration strengthens its position as a trusted partner in the evolving EV ecosystem.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by leading players in the European EV powertrain testing services market is expanding digital testing capabilities through AI and simulation technologies. Companies are investing heavily in virtual validation tools that enable predictive analysis, reduce reliance on physical prototypes, and accelerate development cycles.

Another major approach involves strategic partnerships and R&D collaborations with academic institutions and government-backed initiatives. By aligning with research bodies and industry consortia, firms can access cutting-edge innovations and stay ahead of rapidly evolving regulatory and technological demands.

Lastly, geographic expansion and facility upgrades play a crucial role in strengthening market position. Leading players are enhancing their laboratory infrastructure, establishing new test centers, and expanding service portfolios to meet rising regional demand driven by increased EV production and stricter compliance standards across Europe.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe EV powertrain testing services market include Applus+ IDIADA, Ricardo Plc, TÜV SÜD, AVL List GmbH, CTAG Automotive Technology Centre of Galicia, Intertek Group Plc, ATESTEO GmbH & Co. KG, HORIBA MIRA Ltd, Element Materials Technology, FEV Group GmbH.

The competition in the Europe EV powertrain testing services market is characterized by a mix of well-established engineering firms, independent testing laboratories, and emerging technology-driven service providers. As the automotive sector undergoes rapid electrification, companies are vying to offer more comprehensive, faster, and cost-effective validation solutions tailored to the complexities of modern electric drivetrains.

Market leaders such as AVL List, HORIBA MIRA, and SGS maintain a dominant position due to their extensive experience, global networks, and continuous investment in advanced testing infrastructure. However, niche players and startup innovators are gaining traction by focusing on specialized services such as battery diagnostics, thermal simulation, and over-the-air software validation.

The competitive landscape is also shaped by evolving regulatory frameworks, increasing consumer expectations for vehicle performance and safety, and the need for standardized compliance across borders. Firms must differentiate themselves through technological agility, domain expertise, and strategic alliances to sustain growth and adapt to the dynamic nature of the EV industry.

Additionally, the convergence of mobility and digitalization is pushing testing providers to integrate AI, cloud-based analytics, and digital twin technologies into their service offerings. This ongoing transformation is redefining how powertrains are validated and accelerating the pace of innovation in the European EV testing ecosystem.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, AVL List announced the expansion of its simulation center in Graz, Austria, aimed at enhancing its virtual testing capabilities for next-generation electric drivetrains, allowing faster validation cycles for automotive clients across Europe.

- In May 2024, HORIBA MIRA partnered with a UK-based battery research institute to develop an advanced thermal management testing protocol, addressing critical safety and performance concerns in high-capacity EV batteries used by major European automakers.

- In September 2024, SGS launched a new EV-specific certification program in Germany, designed to streamline compliance with EU safety and emissions regulations, offering automakers a one-stop solution for market approval and international export.

- In November 2024, TÜV Rheinland opened a state-of-the-art EV powertrain testing facility in Munich, integrating AI-powered diagnostics and real-time data analytics to support OEMs in optimizing motor efficiency and battery longevity.

- In February 2025, FEV Group introduced a cloud-based testing platform that enables remote monitoring and analysis of EV powertrain performance, facilitating collaborative validation between European manufacturers and international partners without requiring physical presence at test centers.

MARKET SEGMENTATION

This research report on the Europe EV Powertrain Testing Services Market has been segmented and sub-segmented based on service type, vehicle type, test methodology, and region.

By Service Type

- Battery Testing

- Simulation Testing

By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Commercial Electric Vehicles

By Test Methodology

- Lab Testing

- Simulation Testing

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the market growth in Europe?

Rising EV adoption due to stringent emission regulations, Government incentives and funding for electric mobility, Technological advancements in testing equipment, and the Need for reliable and safe EV performance validation

2. Which countries in Europe have a high demand for EV powertrain testing services?

Germany, France, the United Kingdom, Norway, and the Netherlands are leading due to strong EV markets and established automotive industries.

3. How big is the European EV powertrain testing services market?

While specific figures vary by source, the market is experiencing robust growth, projected to expand significantly through 2030 due to the rapid shift toward electrification in the European automotive sector.

4. Who are the key players in the Europe EV powertrain testing services market?

Applus+ IDIADA, Ricardo Plc, TÜV SÜD, AVL List GmbH, CTAG, Intertek Group Plc, ATESTEO GmbH, HORIBA MIRA Ltd, Element Materials Technology, and FEV Group GmbH.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com