Europe Feed Phosphate Market Size, Share, Trends & Growth Forecast Report – Segmented By Type, Livestock, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

Europe Feed Phosphate Market Size

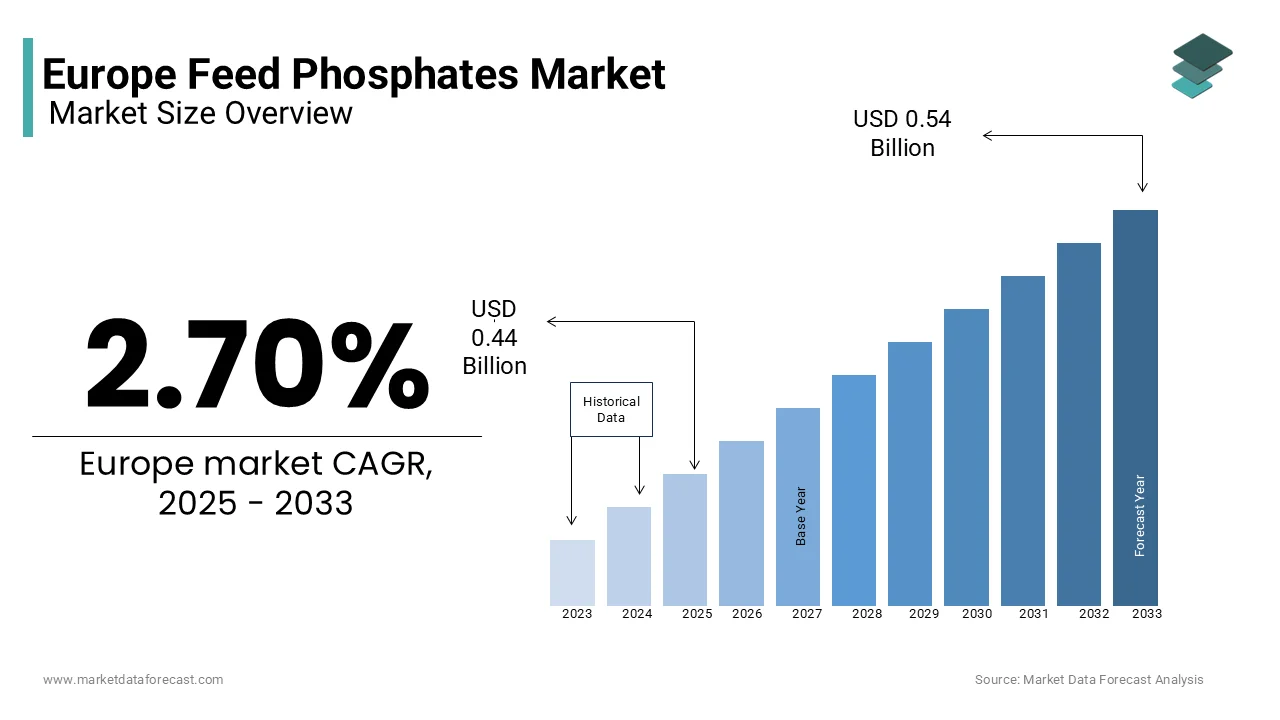

The Europe's feed phosphate market was valued at USD 0.43 billion in 2024 and is anticipated to reach USD 0.44 billion in 2025 from USD 0.54 billion by 2033, growing at a CAGR of 2.70% from 2025 to 2033.

Current Scenario of The European Feed Phosphate Market

The feed phosphates are essential mineral supplements used in animal nutrition to enhance growth with bone development, and overall health. These compounds, derived from phosphate rock or chemical processes, provide a bioavailable source of phosphorus, a critical nutrient for livestock and aquatic animals. In Europe, the feed phosphate market is driven by the region's robust livestock industry, stringent nutritional standards, and growing demand for high-quality animal protein. According to the European Feed Manufacturers' Federation, the feed industry accounts for approximately 5% of Europe's agricultural GDP, with feed phosphates representing a significant component of feed formulations. The European Commission's Common Agricultural Policy (CAP) promotes sustainable farming practices with the growing need for efficient and eco-friendly feed additives. Additionally, according to Eurostat, investments in animal nutrition technologies exceeded €10 billion in 2022.

Market Drivers

Rising Demand for High-Quality Animal Protein

The escalating demand for high-quality animal protein serves as a major driver for the European feed phosphate market. According to the European Food Safety Authority, per capita consumption of poultry and swine meat in Europe increased by 8% in 2022 with the population growth and urbanization. Feed phosphates play a pivotal role in enhancing animal growth, bone strength, and overall health by making them indispensable in livestock nutrition. According to the European Commission, over 60% of commercial feed formulations in Europe contain feed phosphates.

Stringent Nutritional Standards in Livestock Farming

The stringent nutritional standards governing livestock farming represent another significant driver for the European feed phosphate market. According to the European Union's Feed Hygiene Regulation, feed manufacturers must ensure optimal nutrient levels to support animal health and productivity with the rising demand for high-quality feed phosphates. As per the European Feed Manufacturers' Federation, over 70% of feed producers prioritize feed phosphates due to their superior digestibility and effectiveness in preventing phosphorus deficiencies. The versatility and performance of feed phosphates ensure their sustained dominance in the market for applications requiring compliance with nutritional and environmental standards.

Market Restraints

Fluctuating Raw Material Prices

The fluctuating raw material prices of phosphate rock and sulfuric acid is slowly degrading the growth of the European feed phosphate market. According to the European Chemical Industry Council, the cost of phosphate rock surged by over 40% in 2022 due to supply chain disruptions and geopolitical tensions. According to the European Federation of Chemical Employers, over 60% of companies in the feed phosphate market reported reduced profitability in 2022 due to rising production expenses. These financial pressures not only hinder market growth but also constrain investments in research and development is limiting innovation and technological advancement.

Environmental Concerns and Regulatory Scrutiny

The environmental concerns and regulatory scrutiny surrounding phosphorus usage pose another critical challenge to the European feed phosphate market. According to the European Environment Agency, excessive phosphorus runoff from agricultural activities contributes to water pollution is prompting regulatory bodies to enforce strict limits on fertilizer and feed additive usage. The Nitrates Directive, enforced by the European Commission, mandates rigorous testing and documentation to ensure compliance by compelling manufacturers to invest heavily in eco-friendly solutions. According to Eurostat, compliance costs for feed phosphate producers have risen by 25% over the past three years by impacting profit margins. According to the European Federation of Chemical Industries, several small-scale facilities have ceased operations due to non-compliance or prohibitive expenses.

Market Opportunities

Growing Emphasis on Sustainable Farming Practices

The growing emphasis on sustainable farming practices presents a lucrative opportunity for the European feed phosphate market. According to the European Commission's Common Agricultural Policy (CAP), over 30% of European farms have adopted eco-friendly practices is driving demand for bioavailable and low-impact feed additives like feed phosphates. According to the European Feed Manufacturers' Federation, the increasing adoption of precision feeding techniques, which optimize nutrient delivery and reduce environmental impact.

Expansion into Aquaculture Applications

The growing focus on aquaculture applications offers another promising opportunity for the European feed phosphate market. According to the European Aquaculture Society, the demand for feed phosphates in aquaculture grew by 15% in 2022, which was driven by increasing consumer awareness of seafood as a healthy protein source. Feed phosphates are extensively used in fish and shrimp diets to enhance growth, bone development, and overall health. Additionally, the European Commission's Blue Economy initiative supports the development of sustainable aquaculture practices by amplifying the need for advanced feed additives.

Market Challenges

Supply Chain Disruptions

The supply chain disruptions pose a significant challenge to the European feed phosphate market. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022 by affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as phosphate rock, which accounts for nearly 70% of feed phosphate production expenses. According to the European Chemical Industry Council, imports of certain raw materials declined by 40% in 2022 that leads to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules by impacting market stability.

Limited Awareness Among Small-Scale Farmers

The limited awareness among small-scale farmers regarding the benefits of feed phosphates represents another critical challenge for the European market. According to the European Federation of Agricultural Cooperatives, less than 40% of small and medium-sized farms in Europe utilize feed phosphates in their livestock nutrition programs by creating a significant knowledge gap. According to the European Commission, over 50% of small-scale farmers struggle to adopt advanced feed technologies due to insufficient training and education. This lack of awareness not only slows the adoption of feed phosphates but also limits innovation and technological advancement.

SEGMENTAL ANALYSIS

By Feed Type

The monocalcium phosphate segment was the largest by occupying 40.1% of the European feed phosphate market share in 2024 due to its high phosphorus content and superior digestibility by making it ideal for enhancing animal growth and bone development. According to the European Commission, over 60% of poultry and swine feed formulations in Europe utilize monocalcium phosphate by reflecting its widespread adoption. The versatility and performance of monocalcium phosphate ensure its sustained dominance in the market for applications requiring high nutrient delivery.

The defluorinated phosphate segment is likely to experience a CAGR of 9.2% from 2025 to 2033. This rapid growth is fueled by its increasing adoption in cattle and aquatic animal feed, where it provides a safe and bioavailable source of phosphorus without fluorine toxicity risks. Additionally, the European Commission's Blue Economy initiative supports the development of sustainable aquaculture practices by amplifying the need for advanced feed additives like defluorinated phosphate. This trend positions defluorinated phosphate as a key driver of innovation in the European market.

By Livestock Type

The poultry segment dominated the market and held 34.9% of the European feed phosphate market share in 2024 with the extensive use of feed phosphates in poultry diets to enhance growth, bone strength, and egg production. According to the European Commission, poultry production in Europe grew by 10% in 2022 by creating a favorable environment for feed phosphate adoption. The versatility and performance of feed phosphates ensure their sustained dominance in the poultry segment.

The aquatic animals segment is swiftly emerging with a CAGR of 12.3% from 2025 to 2033. This rapid growth is driven by the increasing demand for seafood as a healthy protein source, coupled with advancements in aquaculture technologies. Feed phosphates are extensively used in fish and shrimp diets to enhance growth, bone development, and overall health. Additionally, the European Commission's Blue Economy initiative supports the development of sustainable aquaculture practices by amplifying the need for advanced feed additives. This trend positions aquatic animals as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany

Germany led the European feed phosphate market by holding a share of 25.4% in 2024. This prominence is attributed to the country's robust livestock industry and strong emphasis on sustainable farming practices. According to the German Federal Ministry of Agriculture, over 60% of poultry and swine farms in Germany utilize feed phosphates by reflecting the region's leadership in adopting cutting-edge technologies. Additionally, Germany's strategic investments in precision feeding techniques create a favorable environment for market growth.

France

France feed phosphate market is anticipated to achieve a CAGR of 4.2% during the forecast period. The country's poultry and cattle sectors are key contributors to feed phosphate adoption. According to the French Ministry of Agriculture, the growing use of feed phosphates in sustainable farming practices is escalating the growth of the market.

The UK’s support through investments in poultry and aquaculture sectors drives feed phosphate market in next coming years. The UK government's commitment to sustainable agriculture supports the use of high-performance feed additives by ensuring steady market growth.

Italy feed phosphate market is likely to grow steadily during the forecast period. The country's thriving livestock and aquaculture sectors rely heavily on feed phosphates for enhancing animal health and productivity. The rising sustainable farming amplifies demand for eco-friendly solutions will further propel the growth of the market in Italy.

According to the Spanish Ministry for Ecological Transition, country's commitment to circular economy initiatives is driving demand for sustainable feed additives like defluorinated phosphate that is anticipated to accelerate the growth of the market in spain.

KEY MARKET PLAYERS

The key players in the market include EuroChem Ltd., The Mosaic Company, PhosAgro, Potash Corp., and OCP Group. Are the market players that are dominating the Europe feed phosphate market.

MARKET SEGMENTATION

This research report on the Europe feed phosphate market is segmented and sub-segmented into the following categories.

By Type

- Dicalcium Phosphate

- Monocalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others

By Livestock

- Poultry

- Swine

- Aquatic Animals

- Cattle

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]