Europe Feed Yeast Market Research Report By Type, Type of Animals and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis (2025 to 2033)

Europe Feed Yeast Market Size

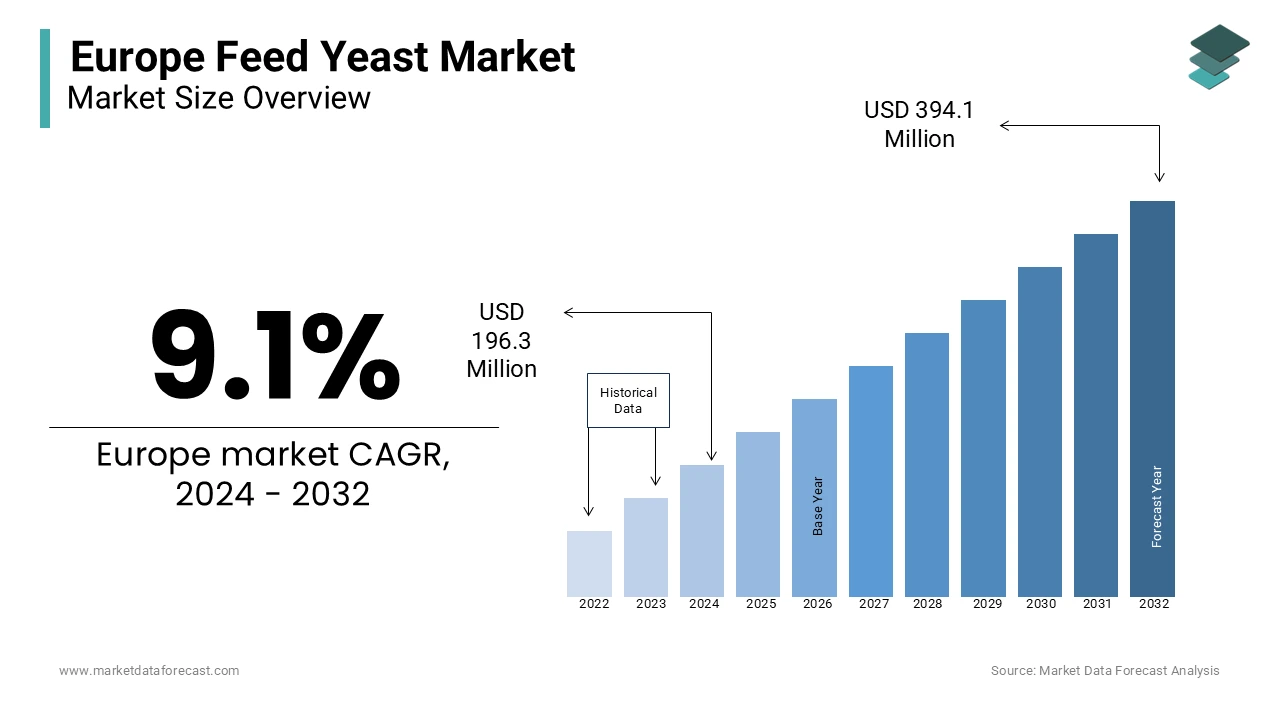

The feed yeast market size in Europe was valued at USD 394.1 million in 2024 and is anticipated to reach USD 429.96 million in 2025 from USD 863.04 million by 2033, registering a CAGR of 9.1% during the forecast period from 2025 to 2033.

Feed yeast is derived from strains such as Saccharomyces cerevisiae and is widely used as a probiotic and nutritional supplement for livestock, poultry, and aquaculture. As per the European Feed Manufacturers' Federation, feed yeast is primarily utilized in ruminant and poultry diets, underscoring its importance in promoting gut health and nutrient absorption. Additionally, advancements in fermentation technologies have improved production efficiency, reducing costs by 15%, as highlighted by the German Federal Ministry of Agriculture. With increasing emphasis on sustainable practices, such as reducing greenhouse gas emissions from livestock, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern agriculture.

MARKET DRIVERS

Rising Demand for Antibiotic-Free Animal Feed in Europe

The escalating demand for antibiotic-free animal feed that has been catalyzed by stringent regulations banning the use of antibiotics as growth promoters is one of the major factors propelling the European feed yeast market growth. According to the European Medicines Agency, over 60% of livestock farms have transitioned to natural alternatives like feed yeast, driven by consumer preferences for chemical-free meat and dairy products. This trend is particularly evident in countries like Germany and Denmark, where antibiotic-free farming accounts for over 30% of total livestock production, as reported by the Danish Veterinary and Food Administration. For instance, a study by the French National Institute for Agricultural Research highlights that feed yeast usage in poultry diets increased by 25% in 2022, driven by its ability to enhance gut health and reduce pathogenic bacteria. Additionally, partnerships between feed manufacturers and biotech companies have reduced production costs by 20%, making these products more accessible. By ensuring animal health and enhancing productivity, feed yeast has become indispensable for modern livestock farming, driving market growth across the continent.

Growing Adoption in Aquaculture

The rapid adoption of feed yeast in aquaculture that require sustainable solutions to improve fish health and feed efficiency is further boosting the European feed yeast market growth. According to the European Aquaculture Society, aquaculture production in Europe grew by 18% in 2022, with feed yeast accounting for over 40% of nutritional supplements used in fish diets. This trend is particularly pronounced in countries like Norway and Spain, where salmon and trout farming dominate the industry, as noted by the Norwegian Directorate of Fisheries. A report by the Italian National Institute for Marine Research highlights that feed yeast usage in aquaculture grew by 20% in 2022, driven by investments in high-protein and digestible formulations. Additionally, advancements in yeast-based probiotics have enhanced scalability, making them ideal for diverse applications. By addressing the demands of large-scale aquaculture projects and ensuring product reliability, feed yeast is unlocking immense growth potential in this sector.

MARKET RESTRAINTS

High Costs of Production and Application

High cost associated with production and application that often limits accessibility for small-scale farmers is one of the key restraints for the European feed yeast market growth. According to the German Federal Ministry of Agriculture, the average cost of producing feed yeast exceeds €300 per ton, creating financial barriers for rural producers. This issue is particularly pronounced in Eastern Europe, where over 60% of farmers lack access to advanced fermentation technologies, as reported by the Czech Ministry of Agriculture. A study by the Italian National Institute of Statistics reveals that only 35% of surveyed farms in rural areas have adopted feed yeast, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of these products. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Limited Awareness Among Small-Scale Farmers

Limited awareness among small-scale farmers regarding the benefits and proper usage of feed yeast is further hindering the growth of the European feed yeast market. According to the Swedish Board of Agriculture, over 50% of small-scale livestock farmers in Scandinavia lack technical knowledge about feed formulation and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that farmers aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce feed yeast efficacy by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNTIIES

Expansion into Organic Livestock Farming

The expansion into organic livestock farming that offers stable solutions for enhancing animal health and productivity without synthetic additives is one of major opportunities for the European feed yeast market. According to the European Organic Farming Association, the area under organic livestock farming in Europe grew by 25% in 2022, driven by consumer demand for chemical-free produce. This trend is particularly evident in countries like Austria and Sweden, where organic farms account for over 20% of total agricultural land, as reported by the Austrian Federal Ministry of Agriculture. For instance, a study by the French National Institute for Agricultural Research highlights that feed yeast usage in organic livestock diets increased by 30% in recent years, driven by government subsidies and certification programs. Additionally, partnerships between farmers and biotech companies have reduced production costs by 20%, making these products more accessible. By ensuring animal health and enhancing biodiversity, feed yeast has become indispensable for modern organic farming, driving market growth across the continent.

Increasing Focus on Sustainable Protein Sources

The rising emphasis on sustainable protein sources is another prominent opportunity for the European feed yeast market. According to the European Environment Agency, over 60% of feed manufacturers are investing in bio-based proteins, such as yeast-derived alternatives, to meet regulatory standards. A study by the Swedish Environmental Protection Agency highlights that the adoption of sustainable feed yeast alternatives grew by 18% in 2022, driven by government incentives for green chemistry practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Industrial Research. Additionally, advancements in fermentation technologies enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

The ongoing supply chain disruptions and raw material shortages is a significant challenge to the European market. According to the European Feed Manufacturers' Federation, global shortages of key raw materials, such as molasses and corn steep liquor, led to a 15% decline in feed yeast production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry of Agriculture. A study by the Italian National Institute of Statistics highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as bio-based feedstocks, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Infrastructure for Large-Scale Production

The limited availability of robust infrastructure required for large-scale production and distribution of feed yeast is another major challenge to the European feed yeast market. According to the European Biotechnology Industry Association, less than 10% of European feed yeast plants are equipped to handle biological inputs, primarily due to inconsistent investment in biotech facilities. This issue is compounded by the absence of standardized production protocols, as highlighted by the French National Institute for Agricultural Research, which notes that improper handling often results in material losses of up to 40%. Furthermore, a report by the Swedish Waste Management Association underscores that inadequate investments in processing technologies have left many facilities ill-equipped to handle large volumes. For instance, the UK Department for Environment, Food & Rural Affairs estimates that only 25% of fermentation plants are capable of producing high-quality feed yeast efficiently. Without scaling up infrastructure capabilities, the market risks exacerbating environmental concerns and missing opportunities to recover valuable resources.

SEGMENTAL ANALYSIS

Europe Feed Yeast Market By Type

The live yeast segment occupied 46.1% of the European market share in 2024. The growing need in improving gut health and nutrient absorption in livestock, particularly ruminants like cattle and sheep is majorly driving the domination of the live yeast segment in the European market. According to the European Federation of Animal Health (EFAH), live yeast enhances rumen function, increasing feed efficiency by up to 20%. A study published in Animal Feed Science and Technology notes that live yeast reduces methane emissions from ruminants by 15%, aligning with the EU’s sustainability goals under the Green Deal. Additionally, the growing demand for organic and antibiotic-free animal feed is fuelling the adoption of live yeast as a natural probiotic. For instance, companies like Lallemand Animal Nutrition have developed proprietary live yeast strains that improve livestock immunity and productivity. With Europe prioritizing eco-friendly farming practices, live yeast remains pivotal in fostering healthier and more efficient livestock systems.

The yeast derivatives segment is anticipated to witness a promising CAGR of 9.12% over the forecast period. The versatility and ability of yeast derivatives to enhance immune response and stress resistance in animals is one of the major factors propelling the growth of the yeast derivatives segment in the European market. As per a report by the European Food Safety Authority (EFSA), yeast derivatives, such as beta-glucans and mannans, boost immunity by up to 30%, making them ideal for high-value livestock like poultry and swine. For example, brands like Bio-Mos utilize yeast derivatives to reduce mortality rates in broiler chickens by enhancing gut integrity. Additionally, the rise of aquaculture is increasing the demand for yeast derivatives as a sustainable alternative to fishmeal. A study in Aquaculture Nutrition highlights that yeast derivatives improve growth rates and survival rates in farmed fish by up to 25%. As Europe intensifies efforts to combat antibiotic resistance under initiatives like the One Health Action Plan, yeast derivatives emerge as a transformative solution for sustainable animal nutrition.

Europe Feed Yeast Market By Form

The dry yeast segment captured 61.3% of the European market share in 2024. The dominating position of dry yeast segment in the European market is attributed to its long shelf life and ease of storage, making it ideal for large-scale agricultural operations. The European Feed Manufacturers' Federation (FEFAC) reports that dry yeast accounts for over 70% of yeast used in animal feed due to its stability during transportation and storage. A study published in Journal of Applied Microbiology highlights that dry yeast retains its probiotic properties for up to two years, ensuring consistent performance in feed formulations. Additionally, the growing trend of precision feeding has increased demand for standardized yeast products. For instance, companies like Lesaffre optimize dry yeast formulations to meet the nutritional requirements of diverse livestock species. With the EU investing €5 billion in rural infrastructure, dry yeast remains central to ensuring efficient and scalable feed solutions across Europe.

The instant yeast segment is fastest-growing form in the Europe feed yeast market and is predicted to showcase a CAGR of 8.7% over the forecast period. The rapid activation and ease of use, particularly in small-scale and artisanal farming operations is majorly driving the growth of the instant yeast segment in the European market. As per a report by the European Small Farmers Association, instant yeast reduces preparation time by up to 50%, appealing to farmers seeking efficient solutions. For example, dairy farmers use instant yeast to enhance milk production in cows by improving rumen fermentation. Additionally, the rise of urban farming and backyard livestock rearing has created new opportunities for instant yeast applications. A study in Livestock Science highlights that instant yeast improves feed palatability, leading to a 10% increase in daily intake among livestock. As Europe prioritizes localized and sustainable food systems under initiatives like the Farm to Fork Strategy, instant yeast emerges as a key enabler of accessible and efficient animal nutrition.

Europe Feed Yeast Market By Animal Type

The ruminants segment occupied 40.7% of the European market share in 2024. The dominating position of ruminants segment in the European market can be credited to the widespread use of feed yeast to enhance digestion and productivity in cattle, sheep, and goats. The European Livestock and Meat Trades Union (UECBV) highlights that ruminants account for over 50% of livestock farming in Europe, creating significant demand for feed additives like yeast. A study in Journal of Dairy Science notes that feed yeast increases milk yield by up to 10% while reducing methane emissions by 15%, aligning with sustainability goals. Additionally, the growing trend of grass-fed and organic beef production has fuelled yeast usage to improve feed efficiency and animal health. For instance, companies like Alltech incorporate yeast into feed formulations to support rumen health and reduce dependency on antibiotics. With Europe prioritizing eco-friendly livestock practices, ruminants remain central to the feed yeast market.

The poultry segment is the fastest-growing segment in the Europe feed yeast market and is estimated to grow at a CAGR of 10.7% over the forecast period owing to the rising demand for affordable and high-quality protein sources, particularly chicken meat and eggs. A report by the European Poultry Federation states that poultry production has grown by 15% annually, driven by consumer preferences for lean and sustainable protein. Feed yeast plays a critical role in enhancing growth rates and immunity in broiler chickens, with studies showing a 20% reduction in mortality rates, as noted in Poultry Science. Additionally, the push for antibiotic-free poultry farming has increased demand for natural alternatives like yeast. For example, brands like Biomin utilize yeast derivatives to improve gut health and reduce pathogen colonization in poultry. As Europe accelerates its transition to sustainable agriculture, poultry emerges as a transformative segment driving innovation in feed yeast applications.

REGIONAL ANALYSIS

The UK holds a significant position in the European feed yeast market and accounted for the leading share of the European feed yeast market in 2024. The robust livestock sector of the UK, particularly in poultry and swine, drives demand for high-quality feed additives. According to the UK Agriculture and Horticulture Development Board, the poultry industry alone contributes over £3 billion to the economy, emphasizing the importance of feed efficiency and animal health. The increasing trend towards natural and organic feed solutions has further propelled the use of feed yeast, as it enhances nutrient absorption and gut health. Additionally, the UK’s stringent regulations on animal feed quality ensure that only the best products are utilized, reinforcing the market's growth. The presence of key players like Alltech and Lesaffre also contributes to the competitive landscape, fostering innovation and product development.

Germany is a powerhouse in the European feed yeast market. The strong agricultural base of Germany, particularly in dairy and meat production that necessitates the use of high-quality feed additives is propelling the German market growth. According to the German Federal Statistical Office, the livestock sector generated approximately €7 billion in 2020, highlighting the economic significance of efficient feed solutions. The growing awareness of animal welfare and the shift towards sustainable farming practices have led to increased adoption of feed yeast, which is known for its probiotic properties. Furthermore, Germany's advanced research and development capabilities in agricultural biotechnology position it as a leader in innovative feed solutions. The presence of major companies like Evonik and Biomin enhances the competitive environment, driving further growth in the sector.

France held a substantial share of the European feed yeast market in 2024. The growth of the French market in the European market primarily due to its extensive livestock farming, particularly in cattle and poultry. The French Ministry of Agriculture reported that the livestock sector contributes approximately €14 billion annually to the national economy. The increasing focus on improving feed efficiency and animal health has led to a surge in the use of feed yeast, which is recognized for its ability to enhance digestion and nutrient absorption. Additionally, France's commitment to sustainable agriculture and organic farming practices has spurred demand for natural feed additives. The presence of leading companies such as Lesaffre and Yeast and Co. further strengthens the market, fostering innovation and product diversification. The French market is also characterized by a growing trend towards personalized nutrition solutions for livestock, which is expected to drive future growth.

Italy holds a notable share of the European feed yeast market and the growth of the Italian market in Europe driven by its diverse agricultural landscape, which includes a significant focus on dairy and meat production. The Italian Ministry of Agricultural, Food and Forestry Policies reported that the livestock sector is a vital component of the national economy, contributing approximately €10 billion annually. The increasing demand for high-quality animal products has led to a greater emphasis on feed quality, with feed yeast being recognized for its benefits in enhancing animal performance and health. Moreover, Italy's strong tradition of artisanal cheese and cured meats necessitates the use of superior feed additives to maintain product quality. The presence of companies like Agrivita and Lallemand in the market fosters competition and innovation, further driving the adoption of feed yeast solutions.

Spain is expected to grow at a healthy CAGR in the European feed yeast market over the forecast period owing to the strong emphasis on poultry and swine production. The Spanish Ministry of Agriculture, Fisheries, and Food reported that the livestock sector contributes around €8 billion to the national economy, underscoring its importance. The growing trend towards sustainable and organic farming practices has led to an increased demand for feed yeast, which is known for its ability to improve feed efficiency and animal health. Additionally, Spain's strategic location as a gateway to both European and African markets enhances its role in the feed industry. The presence of key players like Alltech and Lesaffre in the Spanish market promotes innovation and the development of tailored feed solutions. The increasing focus on animal welfare and food safety regulations further drives the demand for high-quality feed additives, positioning Spain as a key player in the European feed yeast market.

KEY MARKET PLAYERS

Alltech, Angel Yeast Co., Ltd, Cargill Inc, Nutreco N.V., Lesaffre Group, Biomin GmbH, ADM. Some of the major key players are involved in the European feed yeast market.

MARKET SEGMENTATION

This market research report on the Europe feed yeast market is segmented and sub-segmented into the following categories.

By Type

- Live Yeast

- Spent Yeast

- Yeast Derivatives

By Type of Animals

- Swine

- Poultry

- Cattle

- Aquatic animals

- Pet animals

- Others

By Region

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

what is the current size of the Europe feed yeast market?

The current feed yeast market size in Europe was valued at USD 429.96 million in 2025.

what is the expected growth value of the Europe feed yeast market?

Europe's feed yeast market is expected to be valued at USD 0.28 billion by 2028, growing at a CAGR of 9.10% during the forecast period from 2023 to 2028.

which segment dominating highly in the Europe feed yeast market?

The poultry segment takes the largest market share for feed yeast, trailed by the swine segment.

which region accounted for the largest share in the Europe feed yeast market?

The European market constituted around 23% of the global feed yeast market in 2024. Europe is the second largest region in consumption of feed yeast and the market is expected to grow at a steady rate during the forecast period.

what are the key market players involved in the Europe feed yeast market?

Alltech, Angel Yeast Co., Ltd, Cargill Inc, Nutreco N.V., Lesaffre Group, Biomin GmbH, ADM. Some of the major key players are involved in the European feed yeast market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com