Europe Food Acidulants Market Size, Share, Trends & Growth Forecast Report By Type (Acetic Acid, Lactic Acid, Citric Acid, Malic Acid, Phosphoric Acid), Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Food Acidulants Market Size

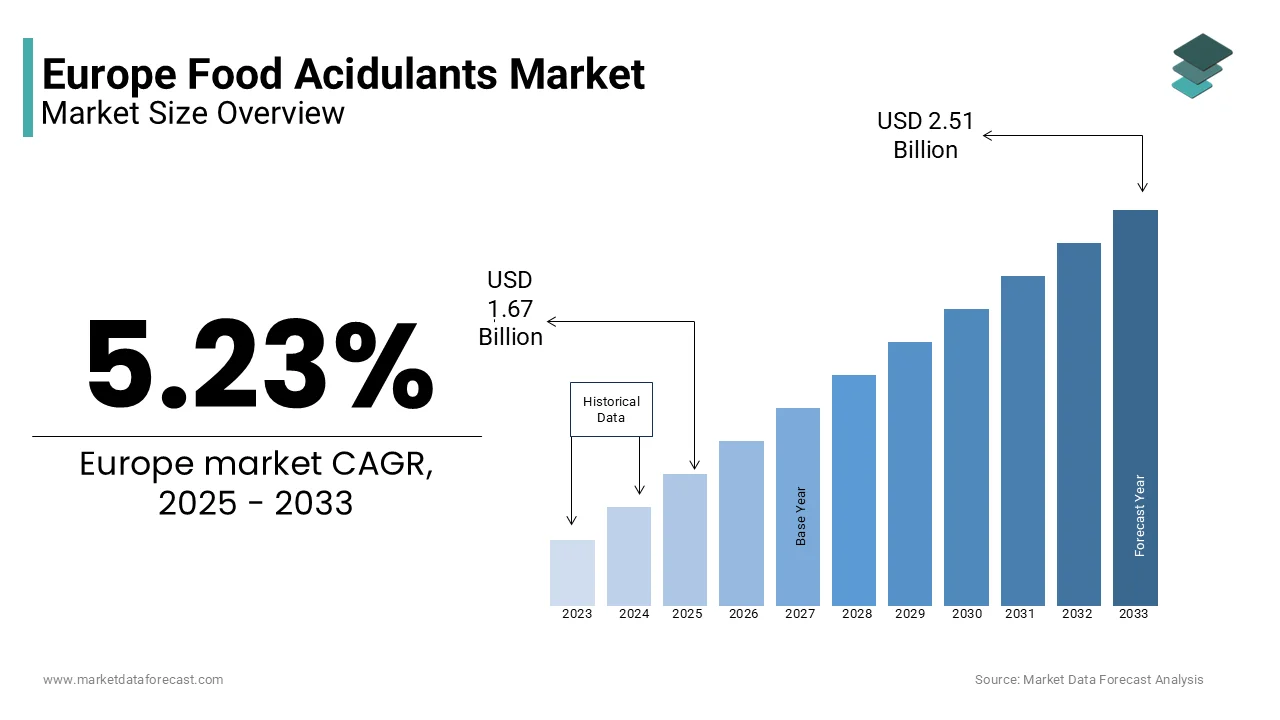

The Europe Food Acidulants market size was valued at USD 1.59 billion in 2024. The European market is estimated to be worth USD 2.51 billion by 2033 from USD 1.67 billion in 2025, growing at a CAGR of 5.23% from 2025 to 2033.

The Europe Food Acidulants Market is stressing on the production and application of acidulants that enhance flavour, preserve food, and regulate pH levels in various products. Acidulants are organic or inorganic acids that impart a sour taste and are commonly used in a wide range of applications including beverages, dairy products, confectionery, and meat processing. The market has witnessed significant growth which is driven by the increasing consumer demand for flavourful and preserved food products.

The market is featured by various types of acidulants, including citric acid, acetic acid, lactic acid, and phosphoric acid, each serving specific functions in food processing. The growing emphasis on health and wellness is also propelling the demand for natural and organic acidulants, as consumers increasingly seek clean-label products.

MARKET DRIVERS

Rising Demand for Processed and Convenience Foods

The rising demand for processed and convenience foods is a primary driver of the Europe Food Acidulants Market. The lifestyles are becoming increasingly fast-paced, hence, consumers are gravitating towards ready-to-eat meals and packaged food products that offer convenience without compromising on taste. Acidulants play a crucial role in enhancing the flavor profile and extending the shelf life of these products. According to the Food and Drink Federation, the UK processed food market alone was valued at approximately €30 billion in 2022, reflecting a growing trend towards convenience foods across Europe. This shift in consumer behaviour is particularly evident in the beverage sector, where acidulants such as citric acid and phosphoric acid are widely used to provide tartness and balance sweetness in soft drinks and fruit juices. The demand for acidulants in processed foods is projected to grow greatly and is propelled by the increasing production of convenience foods and the need for effective preservation methods.

Health and Wellness Trends

The growing health and wellness trends among consumers represent another significant driver of the Europe Food Acidulants Market. Since awareness of health issues and dietary preferences increases, consumers are seeking products that align with their health goals, including lower sugar content and natural ingredients. Acidulants, particularly those derived from natural sources, are increasingly being used as alternatives to artificial preservatives and flavor enhancers. According to a report by the European Commission, the demand for clean-label products has surged, with 60% of consumers indicating a preference for foods with recognizable ingredients. This trend is particularly relevant in the dairy and beverage sectors, where acidulants such as lactic acid and citric acid are utilized not only for flavor enhancement but also for their preservative qualities. As creators adapt to these health-conscious trends by incorporating natural acidulants into their products, the demand for high-quality food acidulants is expected to rise, further propelling market growth.

MARKET RESTRAINTS

Regulatory Challenges

Regulatory challenges associated with the approval and use of food additives form as the main restraint for the Europe Food Acidulants Market. The food industry in Europe is governed by stringent regulations aimed at ensuring food safety and consumer protection. The European Food Safety Authority (EFSA) evaluates food additives including acidulants to determine their safety for consumption. This rigorous approval process can be time-consuming and costly for manufacturers often leading to delays in product launches. As per the industry experts, the time taken for regulatory approval can extend up to two years for new food additives. These regulatory hurdles can hinder innovation and limit the introduction of new acidulants into the market. Additionally, the evolving nature of regulations can create uncertainty for manufacturers, as they must continuously adapt to new requirements and standards. This can impact the overall growth of the food acidulants market, as companies may be reluctant to invest in new product development without clear regulatory pathways.

Price Volatility of Raw Materials

Price volatility of raw materials used in the production of acidulants is another key obstacle for the Europe Food Acidulants Market. The primary raw materials for many acidulants such as citric acid and lactic acid and are derived from agricultural products, which are subject to fluctuations in supply and demand. Factors such as climate change, crop yields, and geopolitical tensions can significantly impact the availability and pricing of these raw materials. According to industry data, the prices of citric acid have seen fluctuations of up to 30% over the past few years due to supply chain disruptions and changing agricultural conditions. These price fluctuations can pose challenges for manufacturers, as they may struggle to maintain consistent production costs and pricing strategies. Increased raw material costs can lead to higher prices for end products, potentially affecting consumer demand. Additionally, manufacturers may be forced to explore alternative sourcing options or invest in more expensive raw materials, which can further strain their profit margins.

MARKET OPPORTUNITIES

Expansion of Natural and Organic Products

The expansion of natural and organic products presents a significant opportunity for the Europe Food Acidulants Market. The consumers have become more health-conscious and environmentally aware, so, there is a growing preference for food products that are free from artificial additives and preservatives. This trend is driving the demand for natural acidulants derived from plant sources, such as citric acid from citrus fruits and lactic acid from fermentation processes. A report by the Organic Trade Association says that the organic food market in Europe is projected to reach €50 billion by 2025, reflecting a robust growth trajectory. Manufacturers that focus on developing and marketing natural food acidulants can capitalize on this growing consumer demand. The food manufacturers seek to reformulate their products to meet consumer preferences, hence, the demand for high-quality natural acidulants is anticipated to rise, positioning this segment for significant growth.

Technological Advancements in Production

Technological advancements in production processes present another major opportunity for the Europe Food Acidulants Market. Innovations in fermentation technology, extraction methods, and bioprocessing are enhancing the efficiency and yield of acidulant production. These advancements enable manufacturers to produce acidulants more sustainably and cost-effectively, reducing reliance on traditional chemical synthesis methods. In line with the industry forecasts, the global market for bioprocessing technologies is expected to reach €20 billion by 2026, with a significant portion of this growth driven by the demand for natural food additives. Since producers invest in research and development to create more efficient production methods, the demand for high-quality food acidulants is expected to rise. Players that stress on leveraging these technological advancements to improve their production capabilities can capture a significant share of the growing market, positioning themselves for long-term success in the competitive landscape of food acidulants.

MARKET CHALLENGES

Supply Chain Disruptions

One of the major challenges facing the Europe Food Acidulants Market is the vulnerability of supply chains. The production of food acidulants relies on a complex network of suppliers for various raw materials, including agricultural products and chemical precursors. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted the fragility of supply chains, leading to delays and increased costs. According to industry analysts, supply chain disruptions have resulted in a 20% increase in lead times for food additives, including acidulants. These disruptions can hinder manufacturers' ability to meet production schedules and fulfill customer orders, ultimately impacting revenue and market share. Additionally, fluctuations in the availability and cost of raw materials can further complicate the supply chain, as manufacturers may struggle to source the necessary components for their acidulant production.

Competition from Alternative Acidulants

The competition from alternative acidulants presents a significant challenge for the Europe Food Acidulants Market. As the food and beverage industry evolves, various alternatives to traditional acidulants are emerging, including natural acids derived from fruits and vegetables, as well as synthetic options that may offer cost advantages. These alternatives may provide unique benefits, such as enhanced flavor profiles or improved functional properties. As per the market research, approximately 30% of food manufacturers are exploring alternative acidulants to reduce costs and improve product performance. This competitive landscape can make it difficult for traditional acidulant manufacturers to maintain market share, particularly as companies seek innovative solutions to enhance their products. Additionally, investing in research and development to enhance the performance of traditional acidulants can help manufacturers stay competitive in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.23% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

TATE & LYLE, HAWKIN WATTS, CARGILL, BRENNTAG, and ADM, and others. |

SEGMENTAL ANALYSIS

By Type Insights

In the Europe Food Acidulants Market, The natural emulsifiers segment became the best performing category by accounting for 55.8% of the total market share in 2024 which is mainly due to the increasing consumer preference for clean-label products that contain natural ingredients. Natural emulsifiers are derived from sources such as plants and animals and are favoured for their ability to stabilize emulsions and improve the texture of food products without the use of synthetic additives. The growing trend towards health-conscious eating is driving the demand for natural emulsifiers in various applications, including dairy, bakery, and sauces. The relevance of this segment is demonstrated by the rising demand for products that align with consumer preferences for transparency and sustainability. Manufacturers remain on course to innovate and develop high-quality natural emulsifiers, consequently, this segment is likely to remain a key driver of growth in the food acidulants market.

The synthetic emulsifiers segment is the fastest-growing category within the Europe Food Acidulants Market, with a projected CAGR of 7.2% from 2025 to 2033. This progress can be influenced by the increasing demand for synthetic emulsifiers in various food applications, particularly in processed foods and beverages. Synthetic emulsifiers are often more cost-effective and provide consistent performance, making them a popular choice among manufacturers. The significance of this segment lies in its ability to cater to the growing consumer demand for stable and high-quality food products. As the food industry continues to evolve and demand more advanced emulsification solutions, the need for synthetic emulsifiers is expected to rise. Companies that focus on developing innovative synthetic emulsifier solutions tailored for specific applications can capitalize on this growing market opportunity, positioning themselves for success in the competitive food acidulants landscape.

By Application Insights

The meat and poultry application segment gained the maximum prominence in Europe Food Acidulants Market and accounted for 30.5% of the total market in 2024. This dominance is fuelled by the extensive use of acidulants in meat processing to enhance flavor, improve texture, and extend shelf life. Acidulants such as citric acid and lactic acid are commonly used in marinades, brines, and curing processes to achieve desired flavor profiles and preserve product quality. This segment is brought to attention by the increasing consumer demand for high-quality meat products that are both flavorful and safe. Since manufacturers continue to innovate and develop advanced acidulant solutions for meat processing, this segment is believed to be a key driver of growth in the food acidulants market.

The dairy application segment grows quickly within the Europe Food Acidulants Market, with a predicted CAGR of 6.5% owing to the increasing demand for dairy products, including yogurt, cheese, and milk-based beverages, which often require acidulants for flavor enhancement and preservation. Acidulants such as lactic acid are essential in the fermentation process of yogurt and cheese, contributing to their unique taste and texture. Moreover, the this segment is stressed by its ability to cater to the growing consumer preference for dairy products that are both nutritious and flavourful. Because the dairy industry continues to innovate and expand its product offerings, the demand for food acidulants in dairy applications is expected to rise.

REGIONAL ANALYSIS

Germany was the leading country in the Europe Food Acidulants Market in 2024. This is primarily because of its robust food and beverage industry which is one of the largest in Europe. The country is known for its high-quality food products and stringent safety standards which is driving the demand for effective food acidulants in various applications including meat processing, dairy, and beverages. The presence of major food manufacturers and suppliers in Germany further bolsters the market's growth as these companies seek to enhance product quality and comply with stringent regulations.

The French market is believed to grow at a CAGR of 3.8% in the coming years and is propelled by the rising trend of clean-label products and the increasing demand for effective food preservation solutions. The French government has also been proactive in promoting food safety and quality, which further supports the growth of the food acidulants market. As industries invest in modernizing their processes, the demand for food acidulants is anticipated to rise, positioning France as a key player in the European food acidulants landscape. The nation follows closely in the Europe Food Acidulants Market. The French food and beverage sector is characterized by a diverse range of applications for food acidulants, particularly in dairy and bakery products. The country has a well-developed infrastructure for food production, supporting the growth of the food acidulants market.

The United Kingdom positioned itself as a significant player in the Europe Food Acidulants Market. With a strong focus on food safety and quality, the UK market is characterized by a growing demand for high-quality food acidulants. British manufacturers are increasingly investing in advanced acidulant technologies to meet the evolving needs of various food applications. The UK’s diverse food landscape, combined with a growing awareness of the benefits of food acidulants, positions it as a vital market within the European food acidulants sector.

Italy possesses a major share of the Europe Food Acidulants Market. The Italian food and beverage industry is known for its strong presence of manufacturers producing specialized food products, particularly in the pasta, cheese, and wine sectors. With a focus on quality and tradition, Italian consumers and industries are increasingly investing in food acidulants to enhance flavor and preserve product quality. A recent study indicated that around 65% of Italian food manufacturers are investing in modern acidulant technologies to improve their production capabilities. The Italian government’s commitment to food safety and quality further supports the growth of the food acidulants market. The food industry continues to innovate and adapt to changing consumer preferences, so, the demand for food acidulants in Italy is anticipated to rise, positioning the country as a key player in the European food acidulants landscape.

Spain held 12.5% of the market share in 2024. The Spanish food and beverage sector is characterized by a growing interest in food acidulants across various applications, including meat processing, dairy, and beverages. Spanish manufacturers are increasingly investing in food acidulants to enhance the flavor, safety, and shelf life of their products. The mix of a robust culinary tradition and a growing awareness of the benefits of food acidulants positions Spain as an important player in the European food acidulants market. As the food industry continues to evolve, the demand for innovative acidulant solutions in Spain is expected to rise, further solidifying its position in the market.

KEY MARKET PLAYERS

The major key players in Europe food acidulants market are TATE & LYLE, HAWKIN WATTS, CARGILL, BRENNTAG, and ADM, and others.

RECENT HAPPENINGS IN THE MARKET

- In June 2019, Acidulant Company Bartek celebrated its 50th anniversary with an updated brand image, increased capacity, and an expanded and experienced management team that is ready to take the company into maintenance mode to spur new growth. To meet this growing demand, Bartek has increased its malic acid production capacity this year to 4,000 tons per year.

- In November 2018, TorQuest Partners published the purchase of Bartek Ingredients Inc. a specialty chemical manufacturer serving the food and drinks and industry. Bartek distributes in more than 35 countries worldwide and employs 115 people at two production sites in southern Ontario.

MARKET SEGMENTATION

This research report on the Europe food acidulants market is segmented and sub-segmented into the following categories.

By Type

- Acetic Acid

- Lactic Acid

- Citric Acid

- Malic Acid

- Phosphoric Acid

By Application

- Bakery and Confectionery

- Meat Industry

- Dairy And Frozen Products

- Drinks

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current market size of the Europe Food Acidulants market?

The Europe Food Acidulants market was valued at approximately USD 1.59 billion in 2024 and is projected to reach around USD 2.51 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.23% from 2025 to 2033

2. Who are the major players in the Europe Food Acidulants market?

Major companies in this market include Cargill Inc., Brenntag Holding GmbH, Tate & Lyle plc, Archer Daniels Midland Company, and Jungbunzlauer Ladenburg GmbH.

3. What types of acidulants are most commonly used in the market?

The main types of acidulants include citric acid, phosphoric acid, lactic acid, and other specialized acidulants that serve various functions in food processing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]