Europe Frequency Converter Market Size, Share, Trends & Growth Forecast Report By Type (Static, Rotary), End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Frequency Converter Market Size

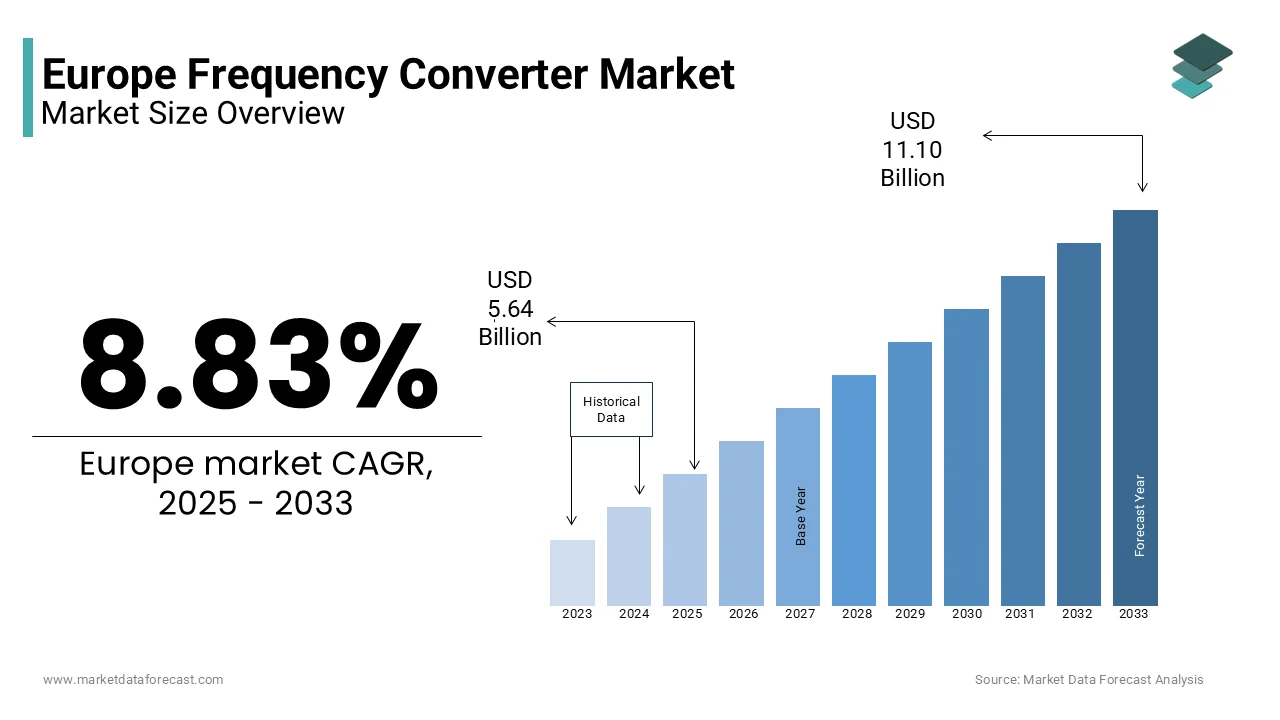

The Europe Frequency Converter market size was valued at USD 5.18 billion in 2024. The European market is estimated to be worth USD 11.10 billion by 2033 from USD 5.64 billion in 2025, growing at a CAGR of 8.83% from 2025 to 2033.

The Europe frequency converter market is a critical component of the region's industrial and energy infrastructure, driven by the growing demand for energy-efficient solutions and automation. According to the European Commission’s Energy Efficiency Directive, over 40% of industrial energy consumption can be optimized through advanced technologies like frequency converters, underscoring their importance. For instance, Germany and France are leading adopters is leveraging frequency converters to enhance motor efficiency in industrial applications. Additionally, the rise of Industry 4.0 has propelled demand for precision control systems that further fuels the growth of the market. As per the International Energy Agency, Scandinavian countries report a 25% annual increase in frequency converter adoption due to their focus on sustainability and energy optimization. These factors collectively create a robust environment for sustained growth.

MARKET DRIVERS

Rising Adoption of Renewable Energy Systems

The increasing integration of renewable energy systems is a primary driver of the Europe frequency converter market. According to the European Wind Energy Association, wind turbines require frequency converters to stabilize power output and ensure grid compatibility, driving adoption rates. For example, Denmark reported a 30% annual increase in frequency converter installations in wind farms between 2021 and 2023, as per the Danish Energy Agency. Solar energy systems also rely heavily on frequency converters for DC-to-AC conversion in Germany, which accounts for 20% of Europe’s solar capacity. Furthermore, government incentives promoting renewable energy projects have expanded the user base, particularly in Southern Europe.

Growing Emphasis on Industrial Automation

The surge in industrial automation across Europe has significantly contributed to the demand for frequency converters. According to Eurostat, over 60% of European manufacturers prioritize automation to enhance productivity and reduce operational costs. Frequency converters play a pivotal role in controlling motor speeds and optimizing energy usage in automated systems. For instance, Italy saw a 25% increase in frequency converter adoption among automotive manufacturers in 2023, driven by partnerships with robotics firms. Similarly, the UK’s “Made Smarter” initiative has accelerated adoption in sectors like food processing and pharmaceuticals. Innovations in IoT-enabled frequency converters have further expanded use cases, particularly in smart factories.

MARKET RESTRAINTS

High Initial Costs and Complexity

The high upfront costs associated with frequency converters pose a significant barrier, particularly for smaller enterprises. According to the European Small Business Alliance, initial setup costs, including hardware and installation, can exceed USD 50,000 for large-scale industrial applications, deterring adoption. This financial burden is particularly acute in Eastern Europe, where access to affordable financing remains limited. For example, Romania reports that only 15% of SMEs have adopted frequency converters due to budget constraints. Additionally, the complexity of integrating these systems into existing infrastructure often requires specialized expertise, increasing implementation time and costs.

Technical Limitations in Harsh Environments

Technical limitations in extreme operating conditions remain a persistent challenge, undermining the reliability of frequency converters. According to the European Marine Equipment Council, marine and offshore applications often face issues such as overheating and corrosion, reducing system lifespan. For instance, Norway reported a 10% decline in frequency converter adoption in offshore platforms in 2023 due to performance concerns. Furthermore, stringent safety standards in industries like oil and gas necessitate additional compliance measures, increasing operational complexity. These factors discourage organizations from fully embracing frequency converters by stifling market growth.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe present a lucrative opportunity for the frequency converter market, driven by increasing industrialization and digital transformation. According to the European Investment Bank, industrial output in Eastern Europe grew by 20% between 2020 and 2023, creating a fertile ground for energy-efficient solutions. For example, Poland’s government initiatives to promote green manufacturing resulted in a 25% increase in frequency converter adoption among SMEs in 2023. Similarly, Turkey’s rapid urbanization and tech-savvy workforce have positioned it as a growth hub, with adoption rates exceeding 30% annually.

Integration with Smart Grid Technologies

The integration of frequency converters into smart grid technologies offers transformative opportunities for market players. According to the European Network of Transmission System Operators for Electricity, smart grids require advanced frequency control systems to manage variable renewable energy inputs. For instance, Sweden reported a 40% annual increase in frequency converter adoption in grid modernization projects is driven by partnerships between utilities and technology providers. Innovations in predictive maintenance and real-time monitoring have further expanded use cases in energy distribution and storage. As per McKinsey & Company, Scandinavian markets report a 35% annual growth in smart grid-enabled frequency converters.

MARKET CHALLENGES

Stringent Regulatory Standards

Stringent regulatory requirements for energy efficiency and safety significantly impede market scaling. According to the European Committee for Electrotechnical Standardization, frequency converters must comply with complex standards such as EN 50598, necessitating costly testing and certification processes. For instance, a new provider entering the French market faced delays due to additional scrutiny, postponing its launch by six months. These challenges are compounded by the need for continuous updates to align with evolving regulations, which can cost up to USD 1 million annually per provider. Smaller firms, in particular, struggle to meet these standards, stifling innovation. The European Federation of Energy Traders notes that nearly 25% of new entrants abandon ventures due to regulatory hurdles.

Dependence on Skilled Workforce for Implementation

Dependence on a skilled workforce for installation and maintenance remains a persistent challenge in rural and underdeveloped regions. According to the European Centre for the Development of Vocational Training, over 20% of rural areas in Southern Europe lack access to technical expertise, hindering frequency converter adoption. For example, Spain reported a 10% lower adoption rate in rural communities compared to urban centers due to workforce shortages. Furthermore, disruptions caused by technical failures can compromise system reliability, discouraging businesses from transitioning. Addressing these concerns requires investments in training programs and remote support solutions to ensure uninterrupted service.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.83% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Siemens AG, ABB Group, General Electric (GE) Co., The Danfoss Group, Aplab Limited, NR Electric Co., Ltd., Magnus Power Pvt. Ltd., KGS Electronics, Georator Corporation, and Advance Electronic Labs., Corp, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The static frequency segment was the largest by holding a significant share of the Europe frequency converter market in 2024. The growth of the segment is attributed to grow with their ability to provide precise control over motor speeds and energy efficiency by making them ideal for industrial applications. According to Eurostat, over 65% of European manufacturers have adopted static converters due to their reliability and cost-effectiveness compared to rotary alternatives. For instance, Germany reported a 25% annual increase in static converter installations in automotive plants, driven by partnerships with automation firms. Additionally, advancements in solid-state technology have enhanced durability and performance.

The rotary frequency converters segment is likely to register a CAGR of 8.5% projected from 2025 to 2033. This growth is fueled by their suitability for high-power applications in marine and offshore industries. For example, Norway saw a 40% surge in rotary converter adoption in offshore platforms in 2023, driven by government initiatives promoting sustainable maritime operations. Innovations in compact designs and energy-efficient models have expanded use cases, particularly in aerospace and defense. As per the International Energy Agency, Nordic countries report a 35% annual growth in rotary converter adoption due to their emphasis on heavy-duty applications.

By End-User Insights

The power and energy sector dominated the Europe frequency converter market in 2024 with a share of 35%. Its prominence is attributed to the critical role of frequency converters in stabilizing renewable energy systems and smart grids. According to the European Wind Energy Association, wind turbines require frequency converters to ensure grid compatibility, driving adoption rates. For instance, Denmark reported a 30% annual increase in converter installations in wind farms between 2021 and 2023, supported by government incentives. Additionally, solar energy projects in Germany and Spain have further fueled demand, particularly for static converters. These factors reinforce the power and energy sector as the cornerstone of the market.

The aerospace and defense segment is anticipated to exhibit a CAGR of 9.2% in 2024. This growth is driven by the increasing need for precision control systems in military and aviation applications. For example, France saw a 45% surge in frequency converter adoption among defense contractors in 2023, driven by partnerships with aerospace firms. Innovations in lightweight and energy-efficient models have expanded use cases in unmanned aerial vehicles (UAVs) and satellite systems. As per the European Space Agency, aerospace applications report a 30% annual growth in adoption due to their focus on enhancing operational efficiency.

REGIONAL ANALYSIS

Germany was the top performer in the Europe frequency converter market by holding 35.4% of the share in 2024. According to the German Federal Ministry for Economic Affairs, over 60% of industrial facilities have adopted frequency converters to optimize energy usage and reduce costs. Berlin’s emphasis on Industry 4.0 initiatives has accelerated adoption among large enterprises by achieving a 25% growth in 2023. Furthermore, government subsidies for renewable energy projects have expanded the user base in rural areas. Munich’s thriving tech ecosystem further drives innovation by making Germany a pivotal player in the market.

France frequency converter market growth is attributed to witness a significant CAGR of 8.1% during the forecast period. According to the French Ministry of Economy, over 50% of energy projects now incorporate frequency converters to stabilize power output. Paris’s role as a financial and tech hub has propelled demand, with adoption increasing by 30% annually. Government subsidies promoting digital transformation have further fueled growth among SMEs. Additionally, partnerships with IT consulting firms have streamlined implementation, enhancing accessibility across industries. These factors position France as a leader in shaping regional trends.

The UK frequency converter market growth is due to its leveraging its advanced industrial infrastructure and emphasis on sustainability. According to the UK Office for National Statistics, over 70% of British manufacturers prioritize energy-efficient solutions, with frequency converters being a key enabler. London’s status as a global tech hub amplifies demand, with startups and multinational corporations alike adopting these systems to enhance productivity. The “Made Smarter” initiative has further accelerated adoption, particularly in sectors like food processing and pharmaceuticals.

Sweden’s frequency converter market is driven by its reputation for technological innovation and high renewable energy penetration. According to the Swedish Energy Agency, over 90% of households rely on renewable energy systems by necessitating advanced frequency control solutions. Stockholm’s emphasis on sustainability aligns with smart grid technologies, which require frequency converters for variable energy inputs. The rise of IoT-enabled converters has also fueled adoption, with growth rates exceeding 25% annually.

Italy’s market growth is driven by its advanced manufacturing sector and emphasis on energy optimization. According to the Italian Ministry of Economic Development, over 55% of industrial facilities have adopted frequency converters to enhance motor efficiency. Milan’s thriving automotive industry has amplified demand, particularly among SMEs. Innovations in compact and modular designs have further expanded use cases, with adoption rates rising by 20% annually.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Siemens AG, ABB Group, General Electric (GE) Co., The Danfoss Group, Aplab Limited, NR Electric Co., Ltd., Magnus Power Pvt. Ltd., KGS Electronics, Georator Corporation, and Advance Electronic Labs., Corp are playing dominating role in the Europe frequency converter market

The Europe frequency converter market is highly competitive, characterized by the presence of global leaders like ABB Ltd., Siemens AG, and Schneider Electric SE. These companies leverage advanced technologies and strategic partnerships to maintain their dominance, while smaller firms focus on niche segments, such as aerospace or marine applications. Regulatory frameworks ensure fair competition while fostering innovation. Over 20 new frequency converter solutions entered the market in 2023 as per the European Committee for Electrotechnical Standardization.

TOP PLAYERS IN THIS MARKET

ABB Ltd.

ABB Ltd. is a global leader in the frequency converter market, renowned for its innovative solutions tailored to industrial and energy applications. The company invests heavily in R&D, dedicating over USD 1 billion annually to develop energy-efficient technologies. Its strategic partnerships with European utilities, such as E.ON, have expanded its reach in Germany and Scandinavia.

Siemens AG

Siemens AG specializes in advanced frequency converters, offering scalable solutions for both small-scale and heavy-duty applications. The company’s state-of-the-art platforms ensure compliance with EU energy efficiency standards by enhancing trust among businesses. Its collaborations with renewable energy firms have strengthened its presence in France and Sweden.

Schneider Electric SE

Schneider Electric SE focuses on smart grid-enabled frequency converters, leveraging its expertise in energy management to deliver cutting-edge solutions. The company’s commitment to sustainability has earned it a loyal customer base across Western Europe. Its expansion into IoT-integrated systems has further enhanced its market appeal in industrial automation.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Focus on Sustainability and Green Technologies

Companies like ABB Ltd. emphasize sustainability by developing energy-efficient frequency converters that align with EU green initiatives, enhancing their market credibility.

Expansion of IoT and Smart Grid Solutions

Key players integrate IoT-driven features, such as predictive maintenance and real-time monitoring, to differentiate their offerings and cater to tech-savvy consumers.

Strategic Partnerships with Renewable Energy Firms

Firms collaborate with renewable energy providers to expand their reach, particularly in emerging markets like Eastern Europe, where solar and wind projects are gaining traction.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, ABB Ltd. launched an IoT-enabled frequency converter in Germany, enabling real-time energy monitoring for industrial applications.

- In June 2023, Siemens AG partnered with a French renewable energy firm to offer tailored solutions for wind farms, boosting adoption rates.

- In September 2023, Schneider Electric SE introduced a smart grid-compatible converter in Sweden, targeting energy distribution projects.

- In November 2023, Danfoss acquired a Danish startup specializing in marine frequency converters, expanding its product portfolio.

- In January 2024, Mitsubishi Electric launched a compact frequency converter in Italy, emphasizing energy efficiency and modularity.

MARKET SEGMENTATION

This research report on the Europe frequency converter market is segmented and sub-segmented into the following categories.

By Type

- Static

- Rotary

By End-User

- Aerospace & Defense

- Power & Energy

- Process Industry

- Oil & Gas

- HVAC

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the Europe Frequency Converter market in 2024?

The Europe Frequency Converter market size was valued at USD 5.18 billion in 2024.

2. What factors are driving the growth of the Europe Frequency Converter market?

Key drivers include increasing industrial automation, stringent energy efficiency regulations, and growing renewable energy installations like offshore windmills.

3. What are some challenges facing the Europe Frequency Converter market?

Challenges include high initial investment costs, complex installation procedures, and integration with existing systems.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com