Europe Gelatin and Bone Glue Market Size, Share, Trends & Growth Forecast Report By Product (Gelatin, Bone Glue), Application, End User, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Gelatin and Bone Glue Market Size

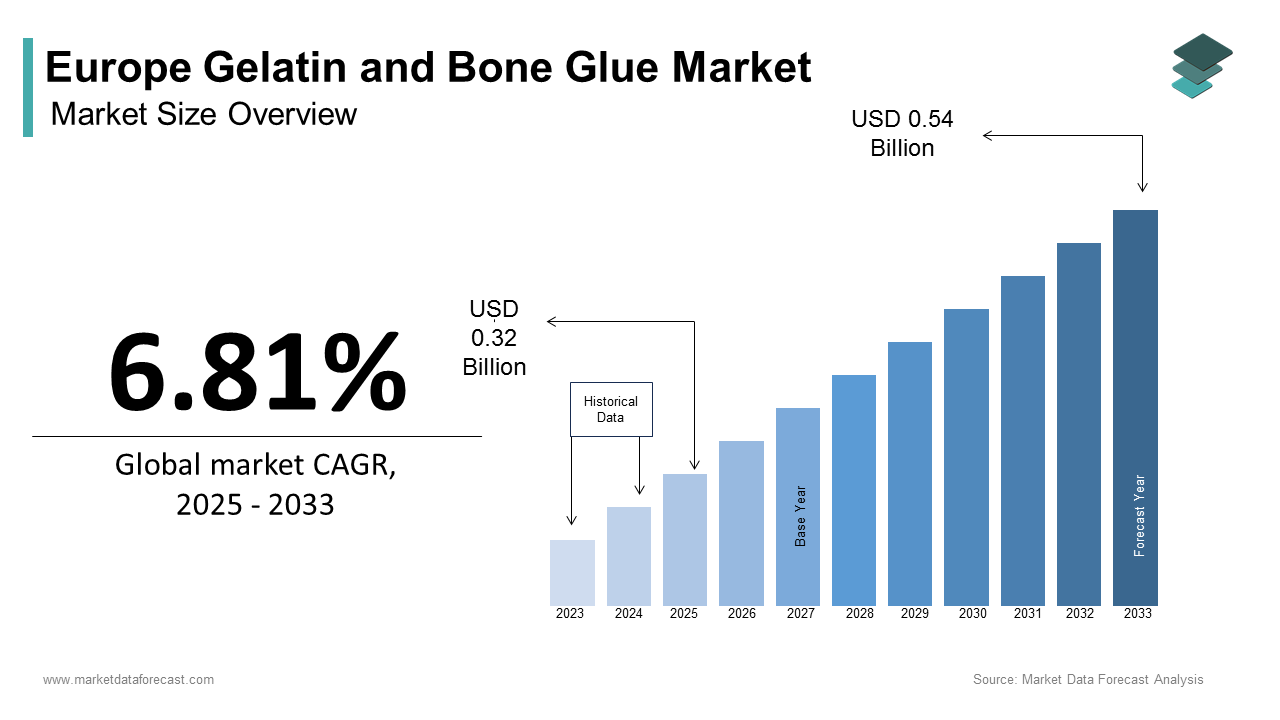

The Europe Gelatin and Bone Glue Market size was calculated to be USD 0.30 billion in 2024 and is anticipated to be worth USD 0.54 billion by 2033, from USD 0.32 billion in 2025, growing at a CAGR of 6.81% during the forecast period.

The European gelatin and bone glue market involves the commercial production and application of collagen-derived gelatin and adhesive substances extracted from animal bones and connective tissues. These products are primarily sourced from bovine, porcine, and fish-based raw materials, and processed through acid, alkali, or enzymatic hydrolysis methods. Gelatin is widely used in food, pharmaceuticals, and photography, while bone glue finds application in woodworking, restoration, and niche industrial uses.

In recent years, the European market has experienced steady growth due to rising demand for natural binders and gelling agents across various sectors. In addition, the pharmaceutical sector has seen a surge in gelatin usage for capsule manufacturing, with Germany and France leading production volumes.

MARKET DRIVERS

Increasing Demand in the Pharmaceutical Industry

One of the primary drivers fueling the Europe gelatin and bone glue market is the growing demand from the pharmaceutical industry. Gelatin plays a crucial role in the formulation of hard and soft capsules, serving as an ideal encapsulating agent due to its biocompatibility, film-forming properties, and ability to dissolve quickly in the stomach. The rise in chronic diseases such as diabetes, cardiovascular ailments, and respiratory conditions has significantly increased the production of medicated capsules across Europe. Moreover, the shift toward plant-based and Halal-certified gelatin alternatives has also spurred innovation, but animal-derived gelatin continues to dominate due to its superior mechanical strength and lower cost. This continued reliance underscores the indispensable role of gelatin in pharmaceutical applications, directly influencing market expansion.

Expansion of the Food & Beverage Sector

Another key driver propelling the European gelatin and bone glue market is the robust growth of the food and beverage industry, particularly in the confectionery, dairy, and meat processing segments. Gelatin functions as a gelling agent, stabilizer, and texturizer, making it essential in products such as gummy candies, marshmallows, yogurts, and canned meats. Its unique thermo-reversible gelling behavior makes it irreplaceable in many formulations. Specifically, the confectionery segment saw a notable year-over-year increase in production volume, with countries like Italy, Spain, and Poland witnessing notable upticks. Furthermore, the trend toward premiumization and functional foods—such as protein-enriched jellies and collagen-infused beverages—has amplified the need for high-quality gelatin. This evolving consumer preference, coupled with strong regional manufacturing capabilities, continues to drive sustained demand for gelatin in the food industry.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Animal Health Concerns

A significant restraint affecting the Europe gelatin and bone glue market is the imposition of strict regulatory frameworks governing the sourcing and processing of animal-derived materials. The European Union enforces rigorous traceability and safety protocols under the TSE (Transmissible Spongiform Encephalopathies) Regulation, aimed at preventing diseases such as Bovine Spongiform Encephalopathy (BSE). These regulations limit the types of animal materials that can be used and mandate comprehensive testing and documentation procedures. This restriction significantly narrows the available feedstock pool, increasing production costs and limiting supply flexibility. Besides, outbreaks of animal diseases such as foot-and-mouth disease (FMD) and avian influenza have further complicated sourcing logistics.

Ethical and Religious Concerns Regarding Animal-Derived Ingredients

Ethical and religious concerns surrounding the use of animal-derived ingredients represent another critical restraint in the Europe gelatin and bone glue market. With rising vegetarianism, veganism, and adherence to specific dietary laws such as Halal and Kosher, there is growing resistance to conventional gelatin sourced from pigs and cattle. This shift in consumer preferences has led to increased scrutiny of product labels, particularly in the food and pharmaceutical sectors. Major retailers and food service providers across Europe have responded by reformulating products to exclude animal-based gelatin, favoring alternatives such as agar-agar, carrageenan, and pectin. Moreover, religious communities often avoid products containing unspecified gelatin unless explicitly labeled as Halal or Kosher-certified. The European Jewish Association estimated that in 2023, over 600,000 Jews residing in Europe required Kosher-certified food options, further pressuring manufacturers to seek certified alternatives. While some companies have successfully introduced alternatives, the transition is neither immediate nor cost-effective, leaving many smaller producers reliant on conventional gelatin.

MARKET OPPORTUNITIES

Growth in Nutraceutical and Functional Food Applications

An emerging opportunity in the Europe gelatin and bone glue market lies in the rapid expansion of the nutraceutical and functional food sectors. Consumers across Europe are increasingly prioritizing wellness-focused diets, driving demand for collagen-based supplements, protein bars, and fortified beverages. Gelatin, being a rich source of collagen peptides, plays a pivotal role in these formulations, offering benefits such as joint support, skin elasticity, and digestive health. Additionally, the popularity of "clean label" products has encouraged food manufacturers to incorporate natural, recognizable ingredients like gelatin into their formulations. Brands such as Algramo and Nuda Collagen have capitalized on this trend by introducing ready-to-drink collagen beverages and edible jelly shots enriched with vitamins. Given the aging population in Europe, the demand for age-defying and mobility-enhancing products is expected to rise further.

Innovation in Sustainable and Circular Production Methods

Sustainability trends and the push for circular economy models have opened up a significant opportunity for the Europe gelatin and bone glue market. Traditionally viewed as by-products of the meat industry, gelatin, and bone glue are gaining recognition as sustainable materials that contribute to waste reduction and resource efficiency. European governments and environmental organizations are actively promoting the valorization of slaughterhouse waste to minimize landfill usage and greenhouse gas emissions. The remaining portion either ended up in landfills or required costly disposal. Several companies have begun adopting innovative extraction technologies to enhance yield and purity while reducing energy consumption. Moreover, the European Circular Economy Stakeholder Platform (ECESP) has recognized gelatin production as a model case of circularity, encouraging collaboration between food processors, tanneries, and pharmaceutical firms.

MARKET CHALLENGES

Volatility in Raw Material Supply and Pricing

One of the foremost challenges confronting the Europe gelatin and bone glue market is the volatility in raw material supply and pricing. The availability of high-quality animal bones and hides—primary inputs for gelatin and bone glue—is heavily dependent on livestock production cycles, trade policies, and global meat consumption trends. Any disruption in the upstream supply chain directly impacts production timelines and cost structures. For instance, the Ukraine-Russia conflict disrupted key transit routes, causing an increase in raw material costs for gelatin producers in Eastern Europe, as reported by the Polish Agricultural and Food Union. Additionally, the consolidation of slaughterhouses and processing plants has reduced the number of reliable raw material suppliers. This concentration has led to imbalances in raw material procurement and weakened bargaining power for gelatin manufacturers. Environmental factors, including disease outbreaks and changing agricultural practices, further complicate supply stability. The European Commission noted in 2023 that avian flu outbreaks had affected poultry populations in several member states, indirectly impacting collagen-rich by-products used in gelatin production.

Technological Limitations in Alternative Feedstock Integration

Despite growing interest in alternative feedstocks, technological limitations in integrating novel sources into existing production systems pose a major challenge for the Europe gelatin and bone glue market. While marine gelatin (from fish by-products) and insect-based proteins are being explored as substitutes, they face hurdles related to scalability, functionality, and regulatory approval. Only a small number of surveyed manufacturers in France and the Netherlands considered switching to fish-derived gelatin due to these performance issues. Similarly, efforts to produce recombinant gelatin using microbial fermentation are still in the early stages. Though biotech startups like PB Gelatins and Geltor have made progress, large-scale commercialization remains distant. The technical complexity involved in replicating the amino acid structure of native gelatin has resulted in high R&D expenditures. Regulatory uncertainties further impede the adoption of bioengineered alternatives. The European Food Safety Authority (EFSA) has yet to finalize safety assessments for several lab-grown gelatin variants, delaying market entry. As a result, most companies continue to rely on traditional feedstock, despite rising ethical and supply chain pressures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.81% |

|

Segments Covered |

By Product, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Johnson & Johnson, Baxter International Inc., CryoLife Inc., Becton, Dickinson and Company, Luna Innovations Incorporated, B. Braun Melsungen AG, Cohera Medical Inc., Integra LifeSciences Corporation, Tissuemed Ltd., Chemence Medical Inc. |

SEGMENTAL ANALYSIS

By Product Insights

Gelatin dominated the Europe gelatin and bone glue market in 2024. This overwhelming dominance is primarily attributed to its widespread application across food, pharmaceuticals, and dietary supplements. The pharmaceutical sector also plays a crucial role in reinforcing gelatin’s leading position. Moreover, the rise in health-conscious consumer behavior has spurred demand for collagen-based supplements, further boosting gelatin usage. With an aging population exceeding 90 million individuals aged 65+, the demand for such supplements is expected to remain strong, ensuring gelatin's continued dominance in the regional market.

Bone glue, though smaller in volume compared to gelatin, is emerging as the fastest-growing segment in the Europe gelatin and bone glue market, registering a CAGR of 4.1%. This accelerated growth is largely driven by increasing adoption in niche industrial applications such as wood restoration, musical instrument assembly, and archival preservation. Additionally, the growing interest in sustainable materials has bolstered bone glue’s appeal. Furthermore, the resurgence of violin-making schools in Austria and Germany has led to increased procurement of bone glue for string instrument construction, as it allows for precise adjustments without damaging delicate wooden structures. These evolving industrial preferences are fueling the segment’s rapid expansion despite its relatively small size.

By Application Insights

Arthroplasty stood out as the largest application segment in the Europe gelatin and bone glue market by capturing 35.4% of total revenue in 2024. This segment primarily involves joint replacement procedures such as knee and hip implants, where gelatin-based hemostats and bone adhesives are increasingly used to manage intraoperative bleeding and promote tissue integration. The rising prevalence of osteoarthritis and rheumatoid arthritis, especially among the elderly, has been a key driver. In addition, advancements in orthopedic biomaterials have facilitated the incorporation of gelatin derivatives into surgical sealants and bone cement. Coupled with favorable reimbursement policies in countries like Sweden and the Netherlands, this trend continues to strengthen arthroplasty’s dominant position in the market.

Sports injury treatment is currently the fastest-growing application segment within the Europe gelatin and bone glue market exhibiting a CAGR of 6.2%. This surge is linked to the rising participation in high-impact sports and physical activities, coupled with an increase in musculoskeletal injuries requiring advanced wound care and tissue repair solutions. Medical professionals are increasingly turning to gelatin-based hemostatic agents and bioadhesives for faster recovery and reduced surgical invasiveness. Additionally, regulatory approvals from the European Medicines Agency (EMA) for new formulations of gelatin-based wound dressings have further boosted adoption, making sports injury one of the most dynamic segments in the market.

By End User Insights

Hospitals represent the largest end-user segment in the Europe gelatin and bone glue market, holding approximately 68.8% of the total market share in 2024. This dominance is because of the extensive use of gelatin-based hemostats, surgical sealants, and bone adhesives in major operating theaters and trauma centers across the region. Furthermore, the integration of gelatin-thrombin sealants in minimally invasive surgeries has gained traction. The United Kingdom’s National Health Service (NHS) documented a key increase in the use of gelatin-based hemostats in major hospitals between 2021 and 2023, attributing this rise to improved patient outcomes and shorter hospital stays. Coupled with centralized procurement systems and well-established supply chains, hospitals continue to be the primary consumers of gelatin and bone glue in Europe.

Ambulatory Surgical Centers (ASCs) are witnessing the fastest growth within the Europe gelatin and bone glue market, recording a CAGR of 5.8%. This rapid expansion is fueled by the shift toward outpatient surgical procedures aimed at reducing healthcare costs and hospital overcrowding. These centers prioritize cost-effective, fast-recovery solutions, which has led to increased adoption of gelatin-based sealants that minimize post-operative bleeding and shorten recovery times. Also, government initiatives promoting decentralized healthcare delivery have contributed to this trend.

REGIONAL ANALYSIS

Germany held the leading position in the Europe gelatin and bone glue market, contributing approximately 22% of the total market share in 2023. Its strong industrial base, particularly in pharmaceuticals and food processing, drives consistent demand for high-quality gelatin. Simultaneously, the country’s thriving confectionery industry, led by companies such as Haribo and Storck, consumes significant volumes of food-grade gelatin. Germany is also at the forefront of medical-grade gelatin adoption, particularly in surgical sealants and orthopedic applications.

France benefits from a well-established food industry, a growing nutraceutical sector, and progressive healthcare policies that support the use of gelatin-based medical products. In addition, the popularity of collagen supplements among health-conscious consumers has surged, with the French Health Products Agency (ANSM) noting a key increase in registered collagen-based products between 2021 and 2023. In the medical field, France leads in the development of gelatin-based hemostats, particularly in cardiac and vascular surgeries. Moreover, the presence of global players like Rousselot and PB Gelatins ensures a steady supply chain and innovation pipeline, sustaining France’s strong market position.

The United Kingdom maintains a prominent role in the Europe gelatin and bone glue market. Despite Brexit-related trade disruptions, the UK has sustained demand through robust domestic manufacturing and strategic imports. Brands like Rowntree and McVitie’s continue to incorporate gelatin in popular products such as jelly sweets and layered puddings, maintaining consumer familiarity and demand. In the healthcare sector, the NHS has expanded the use of gelatin-based surgical sealants, particularly in trauma and orthopedic wards. Moreover, the UK is witnessing growing interest in Halal-certified gelatin alternatives, driven by religious demographics and ethical considerations.

Italy contributes majorly to the Europe gelatin and bone glue market and is driven by its deep-rooted presence in the food and luxury goods sectors. The country’s renowned culinary traditions, including gelato, pasta, and gourmet desserts, rely heavily on gelatin for texture and stabilization. Premium chocolate brands such as Perugina and Ferrero utilize gelatin in truffle fillings and nougat layers, enhancing product consistency and shelf life. Beyond food, Italy has a growing market for gelatin in artisanal woodworking and musical instrument restoration. In addition, Italy is expanding its use of gelatin in medical applications, particularly in orthopedic and dermatological fields.

Spain is supported by a vibrant food industry, increasing healthcare expenditure, and growing awareness of functional foods. The Iberian ham and cheese sectors, in particular, benefit from gelatin’s emulsifying properties, enhancing product quality and export potential. In the healthcare domain, Spain has seen a surge in orthopedic procedures, particularly in Catalonia and Andalusia. Furthermore, Spain is embracing sustainable production methods. These innovations are positioning Spain as a forward-looking player in the regional market.

LEADING PLAYERS IN THE EUROPE GELATIN AND BONE GLUE MARKET

Rousselot

Rousselot is a leading global player in the gelatin industry, with a strong presence across Europe. The company specializes in high-quality collagen-based ingredients for food, pharmaceutical, and medical applications. In Europe, Rousselot plays a crucial role in supplying functional gelatin products that meet stringent regulatory standards. Its innovation in clean-label and nutrition-focused solutions has positioned it as a preferred partner for major food and healthcare companies. The company's commitment to sustainability and traceability further enhances its market position.

PB Gelatins (Gelita AG)

PB Gelatins, part of the Gelita Group, is one of the largest producers of edible and pharmaceutical gelatin in Europe. With decades of expertise, the company delivers customized gelatin solutions tailored to diverse industries such as confectionery, dairy, and nutraceuticals. PB Gelatins is known for its advanced production techniques and focus on product purity, making it a trusted supplier in both traditional and emerging markets. Their continuous investment in research supports evolving consumer demands for health-enhancing ingredients.

Weishardt Group

The Weishardt Group has established itself as a key player in the European gelatin and bone glue market, particularly in specialty applications such as adhesives, woodworking, and artisanal uses. The company’s long-standing heritage and deep technical knowledge allow it to serve niche markets effectively. Weishardt is also recognized for its ability to innovate within industrial and pharmaceutical segments, offering tailored formulations that align with customer-specific requirements. Its agility in adapting to market shifts contributes significantly to its enduring relevance.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by key players in the Europe gelatin and bone glue market is product diversification and application-specific innovation. Companies are investing heavily in R&D to develop specialized gelatin variants tailored for pharmaceutical, nutraceutical, and medical applications. This enables them to cater to evolving consumer preferences and regulatory demands while expanding their revenue streams beyond traditional food-based applications.

Another major strategy involves sustainability-driven sourcing and production practices. Leading firms are increasingly focusing on traceable, ethically sourced raw materials and eco-friendly processing methods. By aligning with circular economy principles and reducing environmental impact, companies enhance brand credibility and ensure compliance with stringent EU regulations on animal by-product utilization and carbon footprint reduction.

Lastly, strategic partnerships, mergers, and acquisitions have become a common approach to consolidate market presence. Companies are collaborating with biotech firms, acquiring smaller regional players, or entering joint ventures to strengthen supply chain efficiency, access new technologies, and expand their geographic reach across Europe.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe gelatin and bone glue market include Johnson & Johnson, Baxter International Inc., CryoLife Inc., Becton, Dickinson and Company, Luna Innovations Incorporated, B. Braun Melsungen AG, Cohera Medical Inc., Integra LifeSciences Corporation, Tissuemed Ltd., Chemence Medical Inc.

The competition in the European gelatin and bone glue market is characterized by a mix of established multinational corporations and regional specialists vying for dominance across diverse application sectors. While large-scale producers leverage economies of scale, technological expertise, and extensive distribution networks, niche players capitalize on specialized offerings and localized demand. The market landscape is shaped by ongoing innovations in product formulation, increasing regulatory scrutiny over sourcing and safety, and shifting consumer preferences toward ethical and sustainable alternatives. Companies are under pressure to maintain quality while adapting to evolving dietary trends, religious certifications, and health-conscious consumption patterns. Additionally, advancements in alternative feedstocks and bioengineered gelatin pose both challenges and opportunities, prompting traditional players to either invest in new technologies or reinforce their core competencies in conventional gelatin production. As a result, competitive differentiation is increasingly driven by brand reputation, traceability, and the ability to offer customized solutions tailored to specific industry needs.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Rousselot announced the expansion of its production facility in Poland to enhance capacity and meet the growing demand for pharmaceutical-grade gelatin across Europe.

- In May 2024, PB Gelatins launched a new line of collagen peptides designed specifically for sports nutrition and joint health supplements, targeting the expanding wellness market in Western Europe.

- In September 2024, the Weishardt Group formed a strategic partnership with a French biotech startup to explore enzymatic hydrolysis methods that improve gelatin functionality and reduce processing time.

- In November 2024, Rousselot introduced a blockchain-based traceability system for raw material sourcing, reinforcing transparency and compliance with EU food safety regulations.

- In January 2025, PB Gelatins acquired a small Italian gelatin producer specializing in artisanal and niche applications, strengthening its foothold in Southern Europe and broadening its product portfolio.

MARKET SEGMENTATION

This research report on the Europe gelatin and bone glue market has been segmented and sub-segmented based on product, application, end-user, and region.

By Product

- Gelatin

- Bone Glue

By Application

- Arthroplasty

- Sports Injury

By End User

- Hospitals

- Ambulatory Surgical Centers

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe gelatin and bone glue market?

Growth is driven by increasing surgical procedures, the aging population, rising demand for minimally invasive surgeries, and technological advancements in biocompatible adhesives.

2. Which countries in Europe are leading the market?

Germany, the United Kingdom, France, and Italy are among the leading markets due to advanced healthcare infrastructure and high demand for surgical interventions.

3. How is the regulatory environment affecting the market in Europe?

The market is regulated under the EU MDR (Medical Device Regulation), which emphasizes safety and performance. Compliance is crucial and can affect product approvals and market entry.

4. Who are the key market players in this sector?

Johnson & Johnson, Baxter International Inc., CryoLife Inc., Becton, Dickinson and Company, Luna Innovations Incorporated, B. Braun Melsungen AG, Cohera Medical Inc., Integra LifeSciences Corporation, Tissuemed Ltd., Chemence Medical Inc.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com