Europe Heat Exchanger Market Size, Share, Trends & Growth Forecast Report By Type (Shell & tube, Plate & frame, Air-cooled, Microchannel, and Others), End-User, Material and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Heat Exchanger Market Size

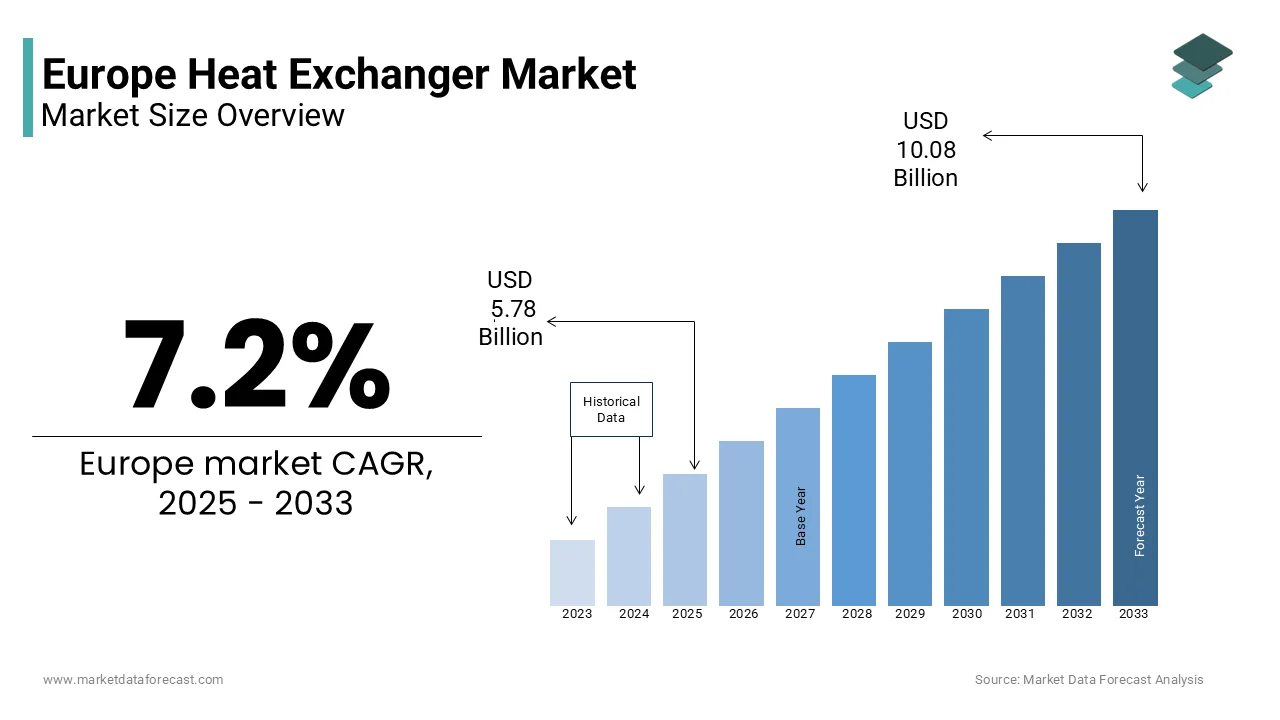

The heat exchanger market size in Europe was valued at USD 5.39 billion in 2024. The European market is estimated to be worth USD 10.08 billion by 2033 from USD 5.78 billion in 2025, growing at a CAGR of 7.2% from 2025 to 2033.

The Europe heat exchanger market is a cornerstone of industrial efficiency, with its prominence rooted in the region's robust manufacturing and energy sectors. According to a report by Eurostat, the industrial sector accounts for a major share of the EU’s GDP, showcasing the critical role of heat exchangers in maintaining operational efficiency.

The market has witnessed steady growth due to stringent environmental regulations pushing industries toward energy-efficient solutions. As per the International Energy Agency (IEA), Europe's push for carbon neutrality by 2050 has led to a surge in demand for advanced heat exchangers that optimize energy use.

Furthermore, France and the UK have shown significant adoption rates, driven by investments in renewable energy projects. The market is also witnessing consolidation, with key players focusing on innovation to meet evolving regulatory standards.

MARKET DRIVERS

Increasing Demand for Energy Efficiency

The Europe heat exchanger market is propelled by the growing emphasis on energy efficiency across industries. According to the European Commission, energy consumption in industrial processes accounts for nearly 25% of the EU’s total energy use, making energy-saving technologies indispensable. These exchangers play a pivotal role in reducing energy wastage by facilitating efficient heat transfer. For instance, as per a study by the European Heat Pump Association, integrating advanced heat exchangers can reduce energy consumption by up to 30%. Similarly, the HVACR sector, which holds a significant share of this market, particularly benefits from these innovations. Moreover, with the EU mandating energy performance standards under the Energy Efficiency Directive, industries are increasingly adopting high-efficiency heat exchangers.

Expansion of Renewable Energy Projects

A further major driver is the rapid expansion of renewable energy projects across Europe. The European Union aims to generate 42.5% of its energy from renewable sources by 2030, according to the European Environment Agency. Also, this shift necessitates advanced heat exchangers for applications such as solar thermal systems and geothermal power plants. For example, the concentrated solar power (CSP) sector, which relies heavily on heat exchangers, grew in 2023. Additionally, wind energy projects require heat exchangers for cooling systems, further boosting demand. The oil and gas sector, traditionally a key end-user, is also transitioning to sustainable practices, driving demand for specialized heat exchangers.

MARKET RESTRAINTS

High Initial Costs

One of the primary restraints hindering the Europe heat exchanger market is the high initial investment required for advanced systems. Small and medium enterprises (SMEs) often face financial constraints when adopting energy-efficient technologies. In addition, high-grade materials like stainless steel and nickel, which are essential for durability and performance, contribute significantly to the overall cost. This cost barrier is particularly evident in emerging economies within Europe, where industries prioritize short-term affordability over long-term efficiency. As per a survey conducted by the Federation of European Heating, Ventilation, and Air Conditioning Associations, nearly 30% of SMEs cited budget limitations as a deterrent to adopting advanced heat exchangers in 2023.

Stringent Regulatory Compliance

Stringent regulatory compliance poses one more challenge for the Europe heat exchanger market. The European Chemicals Agency mandates rigorous testing and certification for materials used in heat exchangers to ensure safety and environmental compatibility. For example, compliance with the REACH regulation adds layers of complexity and cost to the manufacturing process. Besides, the frequent updates to environmental and safety standards create uncertainty for manufacturers and end-users alike. A Deloitte study in 2022 revealed that nearly 45% of companies faced compliance-related issues, indicating a struggle to keep pace with evolving regulations, leading to delays in product launches and increased operational costs.

MARKET OPPORTUNITIES

Growth in Electric Vehicle Production

The burgeoning electric vehicle (EV) industry creates a lucrative opportunity for the Europe heat exchanger market. According to the European Automobile Manufacturers' Association, EV production in the region grew by 35% in 2023, driven by government incentives and consumer demand. Heat exchangers are integral to EV battery thermal management systems, ensuring optimal performance and longevity. For instance, Tesla’s Gigafactory in Germany utilizes advanced microchannel heat exchangers to regulate battery temperatures efficiently. Additionally, collaborations between automotive manufacturers and heat exchanger suppliers are fostering innovation, creating a fertile ground for market growth.

Adoption of Smart Technologies

The integration of smart technologies into heat exchangers offers another promising avenue for growth. Also, these smart systems provide real-time data on performance metrics, enabling predictive maintenance and reducing downtime. Governments’ focus on Industry 4.0 initiatives further amplifies this opportunity, positioning the region as a leader in innovative heat exchanger solutions.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a pressing challenge for the Europe heat exchanger market. The Russia-Ukraine conflict has exacerbated shortages of critical raw materials like nickel and stainless steel. Additionally, logistical bottlenecks caused by port congestion and labor shortages have delayed deliveries, affecting project timelines. According to a survey by the European Logistics Association, a notable portion of manufacturers faced supply chain-related challenges in the past year. These disruptions not only increase operational costs but also hinder the ability to meet rising demand, particularly in the HVACR and petrochemical sectors.

Intense Market Competition

Intense competition among key players constitutes another challenge. The market is characterized by price wars and aggressive marketing strategies, particularly among regional manufacturers. This competition has led to margin erosion, with profit margins declining. Also, smaller players struggle to compete with established giants like Alfa Laval and Kelvion, who dominate with extensive R&D capabilities and global distribution networks. Apart from these, the influx of low-cost imports from Asia has intensified competitive pressures. Local manufacturers reported losing market share due to price undercutting by international competitors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, End-User, Material, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Vahterus Oy, Alfa Laval, Danfoss A/S, Hisaka Works Ltd, LARSEN, and TOUBRO LIMITED, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The shell & tube heat exchangers segment in 2024 dominatd the Europe heat exchanger market with a 34.3% share. Widespread adoption of this segment is driven by their versatility and robustness, making them suitable for high-pressure applications in industries like petrochemicals and oil & gas. For instance, these heat exchangers are extensively used in refineries, where they account for a notable portion of all thermal management systems. The demand is further bolstered by their ability to handle corrosive fluids and extreme temperatures, which aligns with the stringent operational requirements of heavy industries. Moreover, investments in refinery expansions across Germany and France contributed to an increase in shell & tube heat exchanger sales. Additionally, their modular design allows for easy maintenance, reducing downtime and operational costs.

The segment of microchannel heat exchangers is the fastest-growing segment, with a projected CAGR of 8.5% through 2033. This growth is fueled by their compact size and superior thermal efficiency, which make them ideal for HVACR and electric vehicle applications. For example, microchannel heat exchangers reduce refrigerant charge by up to 30%, aligning with environmental regulations. In 2023, the HVACR sector contributed considerably to microchannel heat exchanger sales, driven by the increasing adoption of energy-efficient air conditioning systems. Also, microchannel heat exchangers can improve system efficiency, making them a preferred choice for modern applications. Furthermore, advancements in manufacturing techniques have reduced production costs, enhancing affordability.

By End-User Insights

Under this category, the petrochemical industry held the largest share of 28.1% in the Europe heat exchanger market in 2024. This dominance is attributed to the industry’s reliance on heat exchangers for critical processes such as distillation, cracking, and cooling. For instance, in 2023, petrochemical plants in Germany invested in upgrading their thermal management systems, elevating demand for advanced heat exchangers. The focus on sustainability has further propelled adoption, with companies aiming to reduce energy consumption through efficient heat transfer solutions. Besides, the integration of corrosion-resistant materials like stainless steel has extended the lifespan of heat exchangers, ensuring long-term cost savings.

The food & beverage industry is the swiftly expanding segment, with a CAGR of 7.2% in the coming years. This rise is caused by the rising demand for pasteurization and sterilization processes, which require precise temperature control. For example, the dairy sector is utilizing plate heat exchangers for milk processing. The adoption of energy-efficient heat exchangers in breweries and wineries increased reflecting the industry’s commitment to sustainability. Also, heat exchangers reduce energy usage making them indispensable for modern food processing facilities.

By Material Insights

The carbon steel heat exchangers segment commanded the market, accounting for 40.3% of the total share in 2024. Segment’s prevalence is due to their cost-effectiveness and durability, making them ideal for high-pressure and high-temperature applications. For instance, carbon steel heat exchangers are widely used in power generation plants, where they contribute to thermal management systems. The material’s resilience to mechanical stress ensures longevity, reducing replacement costs. In addition, investments in coal-fired and natural gas power plants drove an increase in carbon steel heat exchanger sales in 2023. Additionally, advancements in coating technologies have enhanced corrosion resistance, expanding their application scope.

Nickel-based alloy heat exchangers are the rapidly emerging segment, with a CAGR of 9.5% in the coming years. Their exceptional resistance to corrosion and high-temperature stability make them indispensable for chemical processing and renewable energy applications. Also, these heat exchangers improve system efficiency, making them a preferred choice for cutting-edge projects. Furthermore, the growing availability of recycled nickel has reduced production costs, boosting affordability.

REGIONAL ANALYSIS

Germany led the Europe heat exchanger market by contributing 28.3% of the total revenue in 2023. This dominance is driven by its strong industrial base, particularly in automotive and chemical sectors. The country’s commitment to sustainability has also spurred investments in energy-efficient technologies. For instance, in 2023, German industries spent notably on upgrading heat exchangers to meet EU energy standards. Nation’s focus on innovation ensures its leadership in adopting advanced thermal solutions.

Spain is the fastest-growing market, with a CAGR of 6.8%. This growth is fueled by renewable energy projects, particularly solar thermal installations. In 2023, Spain increased the solar capacity, driving demand for specialized heat exchangers. The government’s Green Energy Plan aims to achieve 74% renewable energy by 2030, further amplifying opportunities.

France and Italy are expected to grow steadily, with a focus on HVACR and food processing. The UK’s market will benefit from post-Brexit industrial strategies, emphasizing local manufacturing.

KEY MARKET PLAYERS

Vahterus Oy, Alfa Laval, Danfoss A/S, Hisaka Works Ltd, LARSEN, and TOUBRO LIMITED are some of the notable companies in the Europe Heat Exchanger market.

The Europe heat exchanger market is marked by intense competition, driven by the presence of both global giants and regional players striving to capture a larger share of this lucrative industry. At the forefront are companies like Alfa Laval , Kelvion , and Danfoss , which collectively dominate the market through their extensive product portfolios, cutting-edge technologies, and strong distribution networks. Alfa Laval, for instance, holds a significant share of the market, particularly in the plate heat exchanger segment, thanks to its focus on energy efficiency and sustainability. The company’s ability to innovate and cater to diverse industries, including petrochemicals, HVACR, and food processing, has solidified its leadership position. According to a report by the European Federation of Chemical Engineering, Alfa Laval’s market share in Europe stands at approximately 20%, making it the largest player in the region.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

The Europe heat exchanger market is characterized by intense competition, with key players employing a variety of sophisticated strategies to strengthen their market position and expand their footprint. These strategies are tailored to address evolving customer demands, regulatory pressures, and technological advancements. One of the most prominent strategies is heavy investment in research and development (R&D) . For instance, Alfa Laval, a global leader in thermal solutions, allocates considerable portion of its annual revenue to R&D initiatives focused on developing energy-efficient and compact heat exchangers. In 2023, the company introduced advanced plate heat exchangers designed for high-pressure applications in the petrochemical sector, which significantly improved operational efficiency while meeting stringent environmental standards.

Another key strategy is strategic partnerships and collaborations . Kelvion Holding GmbH, another major player, has forged alliances with renewable energy firms to design heat exchangers specifically for solar thermal and geothermal applications. In 2022, the company partnered with a leading European solar energy provider to develop microchannel heat exchangers capable of handling extreme temperatures, thereby catering to the growing demand for sustainable energy solutions. Similarly, Danfoss, known for its expertise in HVACR systems, collaborated with Siemens to integrate IoT-enabled monitoring systems into its heat exchangers, allowing real-time performance tracking and predictive maintenance. This collaboration not only enhanced product reliability but also positioned Danfoss as a pioneer in smart thermal management solutions.

Geographic expansion and capacity enhancement are also critical strategies adopted by market leaders. SPX Corporation, for example, expanded its manufacturing facility in Germany in 2023 to meet rising demand from the European automotive and industrial sectors. The company invested in state-of-the-art production lines, enabling it to produce lightweight and corrosion-resistant heat exchangers at scale. Meanwhile, API Heat Transfer established new distribution hubs in France and Italy to streamline supply chain operations and reduce lead times, ensuring timely delivery to customers across the region.

Another notable approach is product diversification and customization . Leading players like Alfa Laval and Kelvion have introduced specialized heat exchangers tailored to niche applications, such as electric vehicle battery cooling systems and food processing equipment. For example, Alfa Laval launched a range of compact heat exchangers optimized for EVs, which contributed to an increase in its automotive segment sales in 2023. Similarly, Kelvion developed corrosion-resistant nickel-based heat exchangers for chemical processing plants, addressing the industry’s need for durable and reliable thermal solutions.

Finally, mergers and acquisitions (M&A) have played a pivotal role in consolidating market leadership. In 2024, Alfa Laval acquired CompactHeat, a startup specializing in microchannel technology, to bolster its presence in the fast-growing HVACR segment. This acquisition not only expanded Alfa Laval’s product portfolio but also strengthened its competitive edge against rivals like Danfoss and SPX. Overall, these strategic moves reflect the dynamic nature of the Europe heat exchanger market, where innovation, collaboration, and adaptability are essential for sustained growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Alfa Laval acquired CompactHeat, enhancing its microchannel portfolio.

- In June 2024, Kelvion partnered with Siemens for smart heat exchanger solutions.

- In August 2024, Danfoss launched a new line of eco-friendly heat exchangers.

- In October 2024, SPX expanded its production facility in Germany.

- In December 2024, API Heat Transfer introduced IoT-enabled systems for predictive maintenance.

MARKET SEGMENTATION

This research report on the Europe heat exchanger market is segmented and sub-segmented into the following categories.

By Type

- Shell & tube

- Plate & frame

- Air-cooled

- Microchannel

- Others

By End-User

- Petrochemical

- Oil & gas

- HVACR

- Food & beverage

- Power generation

- Others.

By Material

- Carbon steel

- Stainless steel

- Nickel

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the Europe heat exchanger market by 2033?

The Europe heat exchanger market is expected to reach USD 10.08 billion by 2033.

2. Which countries in Europe have the highest demand for heat exchangers?

Germany, France, the UK, Italy, and Spain are among the leading countries driving demand for heat exchangers in Europe.

3. What challenges does the heat exchanger market in Europe face?

The challenges faced by heat exchanger market are High initial investment costs, Fluctuations in raw material prices, Maintenance and operational challenges, Competition from alternative cooling technologies

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com