Europe Heat Pump Brazed Plate Heat Exchangers Market Size, Share, Trends, & Growth Forecast Report by Refrigirant Type (Hydrofluorocarbons (HFCs) Hydrofluoroolefins (HFOs) Hydrochlorofluorocarbons (HCFCs)), Heat Transfer Medium, Application, Plate Material, Brazing Technique and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Heat Pump Brazed Plate Heat Exchangers Market Size

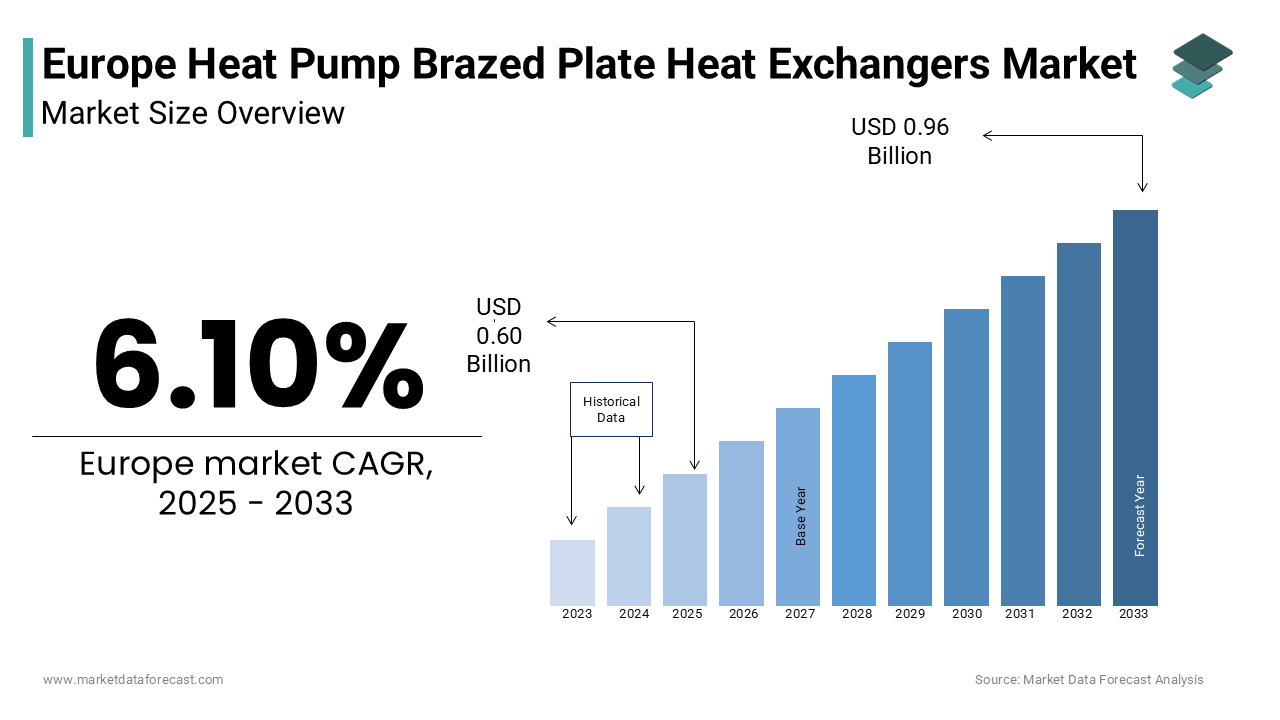

The Europe Heat Pump Brazed Plate Heat Exchangers Market was worth USD 0.56 billion in 2024. The Europe market is expected to reach USD 0.96 billion by 2033 from USD 0.60 billion in 2025, rising at a CAGR of 6.10% from 2025 to 2033.

Brazed plate heat exchangers (BPHEs) are compact, highly efficient thermal transfer devices commonly used in heat pump systems due to their ability to facilitate rapid heat exchange with minimal energy loss. In the context of Europe’s growing emphasis on sustainable heating and cooling solutions, these components have become integral to residential, commercial, and industrial heat pump applications. The European market for brazed plate heat exchangers tailored specifically for heat pump systems is witnessing a surge driven by regulatory support, increasing adoption of renewable energy sources, and advancements in HVAC technologies. This demand has been further amplified by the European Green Deal's target to achieve climate neutrality by 2050.

MARKET DRIVERS

Increasing Adoption of Heat Pumps Across Residential and Commercial Sectors

One of the primary drivers of the Europe heat pump brazed plate heat exchangers market is the rising adoption of heat pump systems in both residential and commercial buildings. This trend is largely fueled by stringent energy efficiency regulations and government incentives aimed at reducing carbon emissions. This growth reflects an expanding base of end-users seeking sustainable alternatives to conventional heating and cooling systems. Brazed plate heat exchangers play a crucial role in these systems due to their compact design, high thermal conductivity, and durability under varying operational conditions. Their integration into air-source and ground-source heat pumps allows for optimized performance, especially in low-temperature environments typical of Northern European climates. As a result, manufacturers of brazed plate heat exchangers are experiencing heightened demand, particularly in countries like Germany and France where policy frameworks strongly support the electrification of heating systems.

Technological Advancements in Compact and Corrosion-Resistant Brazed Plate Heat Exchangers

Technological innovation in brazed plate heat exchanger design has significantly enhanced their suitability for heat pump applications, driving market expansion across Europe. Modern BPHEs now feature advanced materials such as stainless steel and nickel alloys, which offer superior resistance to corrosion and extended service life—critical attributes in high-efficiency heat pump systems. According to research published by the Fraunhofer Institute for Solar Energy Systems, recent developments in microchannel brazing techniques have improved thermal efficiency while also reducing pressure drop within the system. These improvements contribute to lower energy consumption and higher overall performance of heat pump units. Moreover, the miniaturization of BPHEs has enabled their integration into smaller-scale residential heat pumps without compromising efficiency, broadening their applicability. Manufacturers such as SWEP and Danfoss have reported increased orders from OEMs integrating these upgraded BPHEs into next-generation heat pump models.

MARKET RESTRAINTS

High Initial Investment and Cost Sensitivity Among SMEs

Despite the growing demand for brazed plate heat exchangers in heat pump systems, one major restraint affecting market expansion is the relatively high initial investment associated with these components. While BPHEs offer long-term cost savings through energy efficiency, their upfront costs can be a deterrent, particularly for small and medium-sized enterprises (SMEs) operating on tight budgets. According to a 2023 study by the European Federation of Engineering Consultancy Associations (EFCA), a significant share of SMEs in the HVAC sector cited equipment cost as the primary barrier to adopting high-efficiency heat exchangers. This sensitivity is particularly pronounced in Eastern and Southern Europe, where capital availability is more constrained compared to Western Europe. Furthermore, while subsidies exist in several countries, they often do not fully offset the cost of premium-grade BPHEs made from stainless steel or nickel-brazed plates, which are preferred for their durability and thermal performance.

Supply Chain Disruptions and Raw Material Price Volatility

Another significant challenge facing the Europe heat pump brazed plate heat exchangers market is the ongoing volatility in raw material prices and supply chain disruptions. Key materials such as copper, stainless steel, and nickel—essential for manufacturing brazed plate heat exchangers—have experienced sharp price fluctuations in recent years. These cost increases place upward pressure on production expenses for BPHE manufacturers, making it difficult to maintain competitive pricing for end-users. Additionally, logistical bottlenecks following the pandemic and exacerbated by regional conflicts have led to delays in the delivery of critical components and raw materials. These supply-side challenges are particularly acute for smaller manufacturers who lack the financial flexibility to absorb sudden cost spikes or inventory shortages. Consequently, some heat pump OEMs have delayed product launches or opted for alternative, less efficient heat exchanger designs to mitigate cost pressures.

MARKET OPPORTUNITIES

Expansion of District Heating Networks in Urban Areas

The growing development of district heating networks across European cities presents a substantial opportunity for the brazed plate heat exchangers market. District heating systems rely heavily on efficient heat transfer mechanisms to distribute warmth generated from centralized plants to residential and commercial buildings. As per the International Energy Agency (IEA), district heating already supplies about 12% of Europe’s building heat demand, with plans underway to expand this share to 25% by 2050 under the EU’s Renovation Wave Strategy. In these systems, brazed plate heat exchangers are extensively used due to their compactness, high thermal efficiency, and ability to operate under variable load conditions. Cities such as Copenhagen, Stockholm, and Vienna have pioneered large-scale district heating projects that integrate heat pumps using BPHEs to recover waste heat from industrial processes and power generation. The European Environment Agency (EEA) reports that heat recovery through heat pumps in district heating systems can improve energy efficiency, making them a vital tool in urban decarbonization efforts. As municipalities push for greener heating solutions, the demand for brazed plate heat exchangers tailored for district heating applications is poised for considerable growth across the continent.

Integration of Heat Pumps in Industrial Process Heating Applications

Beyond residential and commercial use, a growing opportunity for the Europe heat pump brazed plate heat exchangers market lies in industrial process heating applications. Industries such as food processing, textiles, chemicals, and pharmaceuticals require consistent thermal energy for operations, traditionally supplied by fossil fuel-based boilers. However, as part of decarbonization strategies, many European manufacturers are turning to high-temperature heat pumps equipped with advanced BPHEs to meet these demands sustainably. Brazed plate heat exchangers are increasingly favored in these setups due to their ability to handle elevated temperatures—up to 150°C—while maintaining structural integrity and minimizing fouling. Additionally, the European Commission’s Industrial Emissions Directive (IED) mandates stricter emissions controls, encouraging industries to adopt cleaner thermal solutions.

MARKET CHALLENGES

Technical Limitations in Extreme Climatic Conditions

A notable challenge confronting the Europe heat pump brazed plate heat exchangers market is the technical limitations these components face in extreme climatic conditions. While BPHEs are known for their high thermal efficiency, their performance can degrade in sub-zero outdoor temperatures, particularly in northern regions such as Finland, Norway, and parts of Sweden. This inefficiency stems from frost formation on heat exchange surfaces and reduced refrigerant evaporation rates, both of which hinder optimal operation. Although anti-frost coatings and adaptive control systems are being developed to mitigate these issues, widespread implementation remains limited due to cost and complexity. Additionally, in high-humidity environments common in coastal areas, condensation and potential corrosion pose long-term reliability concerns, even for BPHEs constructed from stainless steel or nickel alloys.

Lack of Standardization and Compatibility Issues Across Component Suppliers

Another pressing challenge for the Europe heat pump brazed plate heat exchangers market is the lack of standardization and compatibility issues among different component suppliers. Heat pump systems are typically assembled using parts sourced from multiple manufacturers, and variations in design specifications, connection types, and performance metrics can create integration difficulties. According to a 2023 white paper issued by the European Committee for Standardization (CEN), only 38% of heat exchangers currently available in the European market adhere to harmonized dimensional and operational standards, leading to inefficiencies during system assembly and field installation. This fragmentation hampers scalability and complicates after-sales service, as technicians must adapt to diverse configurations. Furthermore, the absence of universal testing protocols means that BPHEs from different vendors may exhibit inconsistent performance under similar operating conditions, affecting overall system reliability. In addition, non-standardized BPHEs often necessitate custom modifications, which can compromise safety and reduce energy efficiency.

SEGMENTAL ANALYSIS

By Refrigerant Type Insights

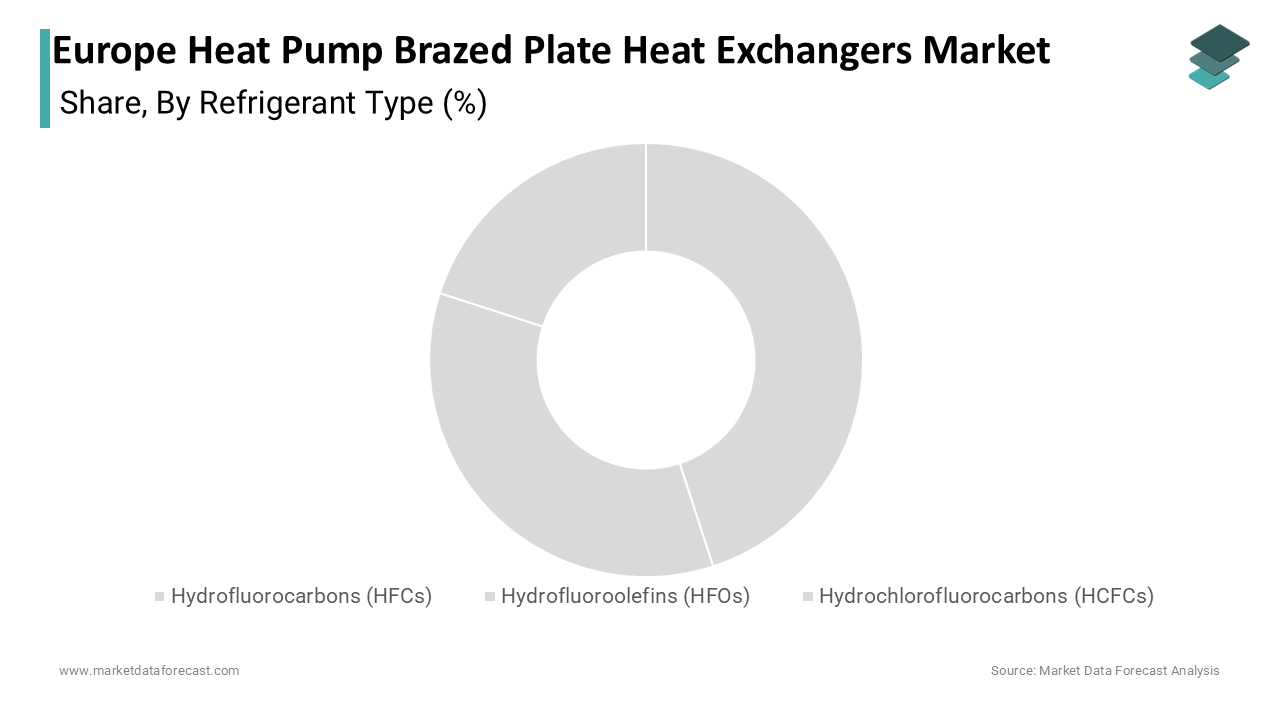

The Hydrofluorocarbons (HFCs) segment held the largest share of the Europe heat pump brazed plate heat exchangers market, accounting for 48.5% in 2024. This dominance is primarily due to their widespread adoption across both residential and commercial heat pump systems. HFCs such as R-410A and R-134a are extensively used because of their favorable thermodynamic properties, compatibility with existing refrigeration systems, and relatively high energy efficiency. The continued reliance on these refrigerants stems from their availability, well-established supply chains, and minimal retrofitting requirements compared to newer alternatives. Furthermore, despite regulatory pressure under the EU F-Gas Regulation to phase down high-GWP refrigerants, the transition to low-GWP alternatives remains gradual, allowing HFCs to maintain a strong foothold in the market.

The Hydrofluoroolefins (HFOs) segment is the fastest-growing within the Europe heat pump brazed plate heat exchangers market, projected to expand at a CAGR of 13.7%. This rapid growth is driven by the increasing regulatory push toward environmentally friendly refrigerants with ultra-low global warming potential (GWP). HFOs like R-1234yf and R-1234ze have GWPs below 10, making them ideal replacements for phased-out HCFCs and restricted HFCs. According to the European Commission’s updated F-Gas Regulation, fluorinated gases with a GWP above 150 will be banned in most new stationary refrigeration and heat pump applications by 2025, accelerating the shift toward HFO-based systems. Besides, major HVAC manufacturers such as Daikin, Carrier, and Mitsubishi have actively introduced heat pump models compatible with HFO refrigerants, further stimulating demand for BPHEs tailored to handle these fluids. Moreover, industry reports from BSRIA indicate that HFO adoption in new-build residential and commercial heating systems rose in 2023 compared to the previous year, signaling a structural shift in refrigerant preference that directly benefits the brazed plate heat exchanger sector.

By Heat Transfer Medium Insights

The water-based heat transfer medium segment dominated the Europe heat pump brazed plate heat exchangers market by capturing a 52.5% market share in 2024. Water is the most widely used medium due to its excellent thermal conductivity, abundance, and compatibility with a broad range of heat pump configurations, especially in ground-source and hybrid systems. This preference is particularly evident in countries like Sweden, Switzerland, and Germany, where groundwater and aquifer-based systems are prevalent. The Swedish Energy Agency notes that water-based BPHEs exhibit higher efficiency than glycol-based systems under optimal conditions, making them highly desirable for residential and district heating applications. In addition, the integration of water-based heat exchangers into district heating networks, such as those in Copenhagen and Vienna, has further reinforced their dominance. With ongoing investments in sustainable urban infrastructure and growing reliance on renewable heat sources, the water segment continues to lead the market with robust adoption rates across Europe

The refrigerant-based heat transfer medium segment is emerging as the fastest-growing within the Europe heat pump brazed plate heat exchangers market, expected to grow at a CAGR of 12.4%. This accelerated growth is attributed to the rising deployment of direct-expansion (DX) heat pump systems, which eliminate the need for intermediate heat transfer loops by using refrigerant directly within the ground loop. DX systems offer higher efficiency and reduced installation costs, particularly in space-constrained environments. The increasing use of advanced refrigerants such as HFOs and mildly flammable hydrocarbons (e.g., propane) has further enhanced system efficiency while complying with environmental regulations. The European Heating and Cooling Strategy indicates that DX heat pump installations increased in 2023, particularly in urban retrofit projects across France, the Netherlands, and Belgium. Moreover, companies like Nibe and Vaillant have launched compact heat pump units utilizing refrigerant-based BPHEs, targeting small-scale residential applications.

By Application Insights

The heating and cooling application segment accounted for the biggest portion of the Europe heat pump brazed plate heat exchangers market by representing a 64.4% of total demand in 2024. This control is mainly driven by the widespread adoption of heat pumps in residential and commercial buildings, supported by aggressive decarbonization policies and rising consumer awareness about energy-efficient HVAC solutions. Countries such as Germany, France, and Sweden have seen exponential growth in heat pump sales, with the latter reporting over 200,000 units sold. Brazed plate heat exchangers are integral to these systems due to their high thermal efficiency and compact design, enabling seamless integration into both air-source and ground-source heat pump configurations. Additionally, initiatives like the French MaPrimeRénov scheme and the German Market Incentive Program (MIP) have provided significant financial incentives for homeowners opting for heat pump-based heating systems.

The industrial process cooling application segment is the fastest-growing within the Europe heat pump brazed plate heat exchangers market, expanding at a CAGR of 11.9% during the forecast period. This expansion is fueled by increasing demand for energy-efficient thermal management solutions in manufacturing sectors such as food processing, pharmaceuticals, and chemical production. Unlike traditional cooling methods reliant on fossil fuels or inefficient electric chillers, industrial heat pumps integrated with brazed plate heat exchangers enable waste heat recovery and reuse, significantly reducing operational costs and carbon emissions. Apart from these, stringent regulations such as the Industrial Emissions Directive (IED) are pushing industries to adopt cleaner technologies, further boosting demand. Companies like Alfa Laval and SWEP have reported a surge in inquiries from OEMs developing industrial heat pump modules optimized for BPHE integration. As circular economy principles gain traction and energy prices remain volatile, industrial process cooling is set to become a key growth engine for the brazed plate heat exchangers market in Europe.

By Plate Material Insights

The stainless steel segment prevailed in the Europe heat pump brazed plate heat exchangers market in 2024. This influence is attributed to stainless steel's superior corrosion resistance, mechanical strength, and compatibility with a wide range of refrigerants and heat transfer fluids. It is particularly favored in ground-source and brine-based heat pump systems, where exposure to moisture and varying pH levels necessitates durable materials. In addition, advancements in nickel-brazing techniques have improved the sealing integrity and thermal conductivity of stainless steel plates, further solidifying their market position. As the European Union continues to promote long-lasting, high-efficiency components under its Ecodesign for Sustainable Products Regulation (ESPR), stainless steel remains the material of choice for the majority of heat pump manufacturers across the region.

The titanium segment is emerging as the fastest-growing within the Europe heat pump brazed plate heat exchangers market, projected to expand at a CAGR of 14.2%. This progress is primarily driven by titanium’s exceptional resistance to corrosion, particularly in aggressive environments such as coastal areas and industrial settings where salt-laden air or chemically treated water is present. Although titanium has traditionally been limited to niche applications due to its high cost, recent advancements in brazing technologies and material processing have made it more viable for broader use in high-end heat pump systems. Like, titanium-based brazed plate heat exchangers can withstand chloride concentrations exceeding 20,000 ppm without degradation, making them ideal for seawater heat pump applications in regions like Denmark and the Netherlands. Additionally, the rise in luxury residential developments and high-performance commercial buildings has spurred demand for premium components capable of delivering extended durability and minimal maintenance. Manufacturers such as Kelvion and SWEP have begun offering titanium-based BPHE options, catering to this growing segment.

REGIONAL ANALYSIS

Germany maintained the leading position in the Europe heat pump brazed plate heat exchangers market by holding an estimated 22.7% market share in 2024. The country's strong industrial base, coupled with proactive government policies promoting renewable heating solutions, has positioned it as a regional leader. The Federal Ministry for Economic Affairs and Climate Action (BMWK) has played a pivotal role through initiatives such as the Market Incentive Program (MIP), which offers subsidies covering installation costs for residential and commercial users. German manufacturers like Viessmann and Stiebel Eltron have ramped up production of high-efficiency heat pumps equipped with brazed plate heat exchangers, contributing to the country’s dominant market position. With ongoing investments in green hydrogen integration and district heating modernization, Germany is set to maintain its leadership in the European market.

France has experienced rapid adoption of heat pump technology, driven by national sustainability goals and generous financial incentives. The government-backed "MaPrimeRénov'" program provides substantial rebates for homeowners switching to heat pump systems, with additional support available under the "Éco-Prêt à Taux Zéro" interest-free loan scheme. Major HVAC players such as Atlantic, ACV, and Bosch Thermotechnology have expanded their BPHE-integrated product lines to meet growing demand. With policy momentum and public awareness on the rise, France is poised to sustain its strong presence in the European market.

Italy has witnessed a steady uptick in heat pump adoption, particularly in residential applications, supported by tax incentives and renovation grants. According to the Italian National Agency for New Technologies, Energy and Sustainable Economic Development (ENEA), over 300,000 heat pumps were installed in Italy in 2023, reflecting a year-on-year increase. The Italian Association of Refrigeration and Air Conditioning (AiCARR) notes that brazed plate heat exchangers are increasingly favored in split-system heat pumps due to their compact size and ease of integration with existing HVAC infrastructure. In addition, southern regions such as Sicily and Sardinia are adopting heat pumps for dual-purpose heating and cooling, further boosting demand. Manufacturers like Robur and Clivet have introduced specialized BPHE-equipped models designed for Mediterranean climates.

United Kingdom is moving ahead in the Europe heat pump brazed plate heat exchangers market. Despite slower initial adoption compared to continental Europe, the UK has recently intensified efforts to scale up heat pump deployment as part of its net-zero strategy. The Energy Systems Catapult forecasts that heat pump installations could reach 600,000 annually by 2030 if current policy trajectories continue. British manufacturers such as Kensa Heat Pumps and Glen Dimplex have incorporated brazed plate heat exchangers into their latest models to improve efficiency and reduce footprint. As the UK moves closer to banning gas boiler sales by 2035, the market for heat pump components, including BPHEs, is expected to expand significantly.

Spain has experienced notable growth in heat pump adoption, especially in residential and tourism-related commercial sectors. Government initiatives such as the Plan Renove and the Integrated National Energy and Climate Plan (INECP) have incentivized homeowners and businesses to replace conventional heating systems with energy-efficient alternatives. Brazed plate heat exchangers are increasingly used in multi-family housing complexes due to their space-saving attributes and high efficiency in moderate climate zones. Also, the Canary Islands and Balearic Islands have emerged as early adopters of sea-source heat pump systems utilizing BPHEs, capitalizing on coastal proximity for sustainable heating and cooling. Companies like Ferroli and Orbegozo have expanded their BPHE-integrated product portfolios to cater to diverse climatic conditions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Alfa Laval, Kelvion Holding GmbH, Danfoss, SWEP International AB, Hisaka Works Ltd., Kaori Heat Treatment Co., Ltd., API Heat Transfer, and Paul Mueller Company are some of the key market players.

The competition in the Europe heat pump brazed plate heat exchangers market is characterized by a mix of established industrial players and emerging suppliers striving to capture market share through differentiation in product performance, reliability, and sustainability. As demand for energy-efficient heating and cooling solutions grows, manufacturers are increasingly focused on delivering high-quality, application-specific BPHEs that meet stringent European energy regulations. The market exhibits a high level of technical specialization, with companies differentiating themselves through material selection, design optimization, and integration capabilities with next-generation heat pump technologies. Innovation remains a core battleground, particularly in adapting to new refrigerants and improving thermal efficiency under varying climatic conditions. Additionally, the rising emphasis on circular economy principles and recyclable materials is influencing product development strategies. While large multinational firms leverage their extensive distribution networks and R&D capabilities, mid-sized companies are focusing on niche applications and regional customization to remain competitive. Overall, the market remains dynamic, with competition intensifying as the transition toward decarbonized heating accelerates across Europe.

Top Players in the Europe Heat Pump Brazed Plate Heat Exchangers Market

One of the leading players in the Europe heat pump brazed plate heat exchangers market is SWEP International AB. Known for its innovative and high-efficiency heat exchanger solutions, SWEP has established itself as a key supplier to major heat pump manufacturers across Europe. The company specializes in compact brazed plate heat exchangers tailored for both residential and industrial applications. Their focus on advanced thermal technology, product customization, and sustainability has positioned them as a preferred partner in the HVAC industry.

Alfa Laval AB is another dominant player shaping the European market for brazed plate heat exchangers used in heat pumps. With a strong global presence and decades of expertise, Alfa Laval delivers high-performance BPHEs designed for durability and energy efficiency. Their products are widely integrated into air-source and ground-source heat pump systems. The company’s commitment to research and development ensures continuous improvement in materials, design, and manufacturing processes that meet evolving environmental standards.

Danfoss A/S holds a significant position in the Europe heat pump brazed plate heat exchangers market through its comprehensive portfolio of energy-efficient components. As a major player in the broader heating and cooling sector, Danfoss integrates brazed plate heat exchangers into its own heat pump offerings while also supplying to third-party manufacturers. The company emphasizes system integration, digitalization, and sustainability, making it a strategic contributor to the growth of the heat pump market in Europe.

Top Strategies Used by Key Market Participants

A primary strategy employed by leading companies in the Europe heat pump brazed plate heat exchangers market is product innovation and technological advancement. Manufacturers continuously invest in R&D to develop high-efficiency, compact, and durable heat exchangers suited for modern heat pump applications. This includes improving corrosion resistance, optimizing thermal transfer, and enhancing compatibility with low-global warming potential refrigerants, ensuring alignment with regulatory trends and customer demands.

Another key approach is strategic partnerships and collaborations with heat pump OEMs and system integrators. By aligning closely with downstream partners, heat exchanger manufacturers ensure seamless integration of their components into new-generation heat pump models. These collaborations help in tailoring products to specific system requirements, fostering long-term business relationships and increasing component adoption across various applications.

Lastly, market expansion through localized production and distribution networks plays a crucial role in strengthening competitive positioning. Companies are investing in regional manufacturing units, service centers, and logistics infrastructure to improve supply chain efficiency, reduce lead times, and offer better after-sales support. This enables them to respond swiftly to changing demand dynamics and maintain a strong foothold across diverse European markets.

RECENT MARKET DEVELOPMENTS

- In May 2024, SWEP International AB launched a new line of ultra-compact brazed plate heat exchangers specifically designed for integration into high-efficiency residential heat pumps. This move was aimed at addressing the growing demand for space-saving, high-performance components in urban retrofit projects across Europe.

- In March 2024, Alfa Laval AB expanded its production capacity at its facility in Poland to better serve the Central and Eastern European markets. The expansion included advanced automation lines dedicated to brazed plate heat exchangers used in heat pump applications, ensuring faster delivery and improved supply chain resilience.

- In January 2024, Danfoss A/S formed a strategic partnership with a leading German heat pump manufacturer to co-develop optimized BPHE modules tailored for decentralized heating systems. This collaboration enabled tighter integration between heat exchangers and control systems, enhancing overall system efficiency and user experience.

- In July 2024, Kelvion Holding GmbH introduced a titanium-based brazed plate heat exchanger variant for use in coastal and industrial environments where corrosion resistance is critical. This innovation targeted specialized segments such as seawater heat pumps and process cooling applications in the chemical industry.

- In September 2024, Güntner GmbH & Co. KG, a subsidiary of Carrier Global Corporation, acquired a German thermal engineering firm specializing in microchannel brazing technologies. This acquisition strengthened Güntner's capability to develop highly efficient BPHEs suitable for next-generation heat pump systems using low-GWP refrigerants.

MARKET SEGMENTATION

This research report on the Europe Heat Pump Brazed Plate Heat Exchangers Market is segmented and sub-segmented into the following categories.

By Refrigerant Type

- Hydrofluorocarbons (HFCs)

- Hydrofluoroolefins (HFOs)

- Hydrochlorofluorocarbons (HCFCs)

By Heat Transfer Medium

- Water

- Brine

- Refrigerant

By Application

- Heating and Cooling

- Industrial Process Cooling

- Refrigeration and Freezing

By Plate Material

- Stainless Steel

- Titanium

- Aluminum

By Brazing Technique

- Vacuum Brazing

- Gas Brazing

- Induction Brazing

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the main drivers of the Europe Heat Pump Brazed Plate Heat Exchangers Market?

Key drivers include the rising adoption of energy-efficient HVAC systems, government incentives for heat pump installation, and growing demand for sustainable heating technologies.

Q6: What is the future outlook of the Europe Heat Pump Brazed Plate Heat Exchangers Market?

The market is expected to witness strong growth from 2025 to 2033 due to the region's focus on decarbonization, net-zero targets, and the phasing out of fossil fuel-based heating systems.

How are environmental concerns influencing the market?

Growing environmental awareness is pushing manufacturers and end-users to adopt low-carbon, energy-efficient heating systems, making brazed plate heat exchangers an ideal choice.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com