Europe Heat Recovery Steam Generator (HRSG) Market Size, Share, Trends & Growth Forecast Report, Segmented By Design, Mode of Operation, Power End-Use and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Heat Recovery Steam Generator (HRSG) Market Size

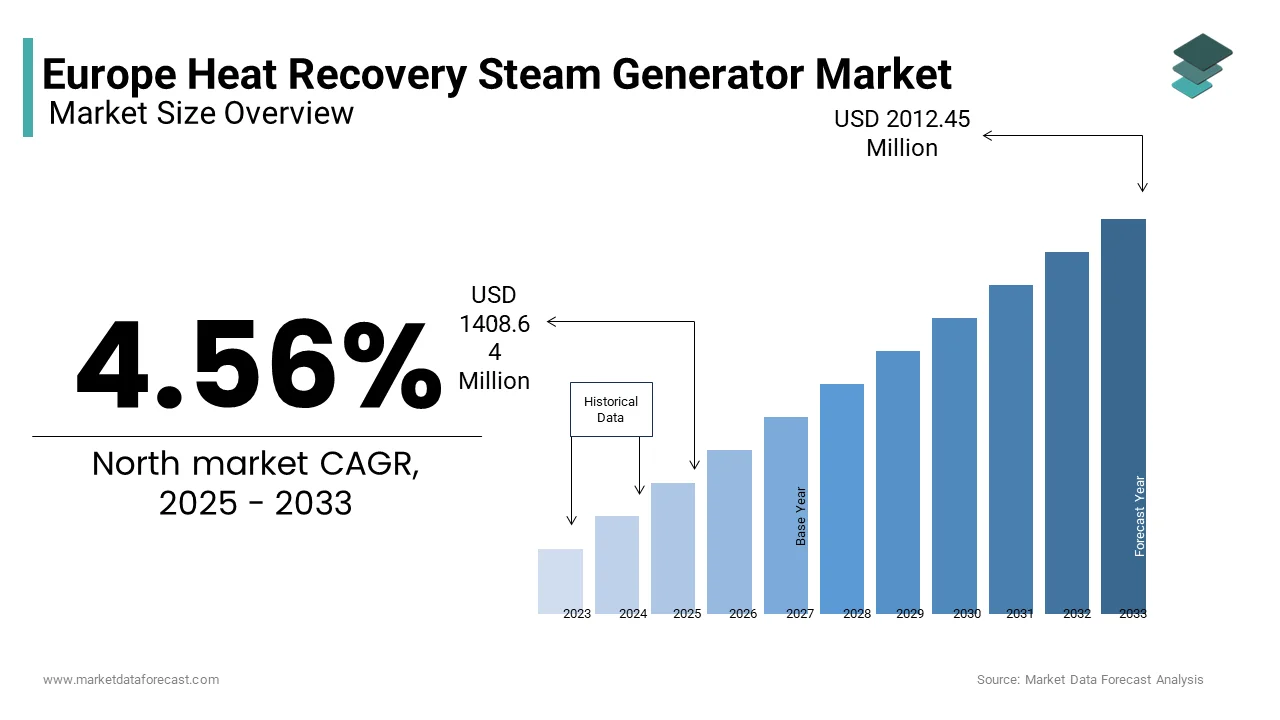

The Europe heat recovery steam generator (HRSG) market was valued at USD 1347.21 million in 2024 and is anticipated to reach USD 1408.64 million in 2025 from USD 2012.45 million by 2033, growing at a CAGR of 4.56% during the forecast period from 2025 to 2033.

The Europe heat recovery steam generator (HRSG) market has established a robust presence and is driven by the region's focus on energy efficiency and decarbonization. According to the International Energy Agency, Europe accounts for approximately 28% of global HRSG installations, with Germany, France, and Italy being key contributors. The market is characterized by a growing preference for combined heat and power (CHP) systems, which leverage HRSGs to enhance energy utilization. As per Eurostat, renewable energy sources contributed over 22% of the EU's electricity generation in 2022, creating a fertile environment for HRSG adoption. The European Union’s Green Deal further amplifies demand, with policies targeting a 55% reduction in greenhouse gas emissions by 2030. This regulatory push aligns with the increasing deployment of natural gas-fired power plants, which rely on HRSGs for waste heat recovery. Additionally, the market is witnessing steady growth due to retrofitting activities in aging industrial facilities. A report by the European Commission shows that nearly 40% of industrial energy consumption can be optimized through advanced technologies like HRSGs. Despite geopolitical uncertainties impacting energy markets, the region’s commitment to sustainability ensures a promising outlook for the HRSG sector.

MARKET DRIVERS

Rising Adoption of Combined Cycle Power Plants

The proliferation of combined cycle power plants (CCPPs) is a pivotal driver for the Europe HRSG market. CCPPs integrate gas turbines with steam turbines, utilizing HRSGs to recover waste heat from exhaust gases and convert it into usable steam. As per the European Association for the Promotion of Cogeneration, CCPPs have witnessed a 15% annual increase in installations across Europe since 2019. This surge is attributed to their superior efficiency, achieving up to 60% thermal efficiency compared to traditional power plants. Furthermore, as per the International Gas Union, natural gas consumption in Europe grew by 4% in 2022, showing the reliance on gas-based power generation. HRSGs play a critical role in this ecosystem by enabling higher energy output without additional fuel consumption. The European Investment Bank has funded several CCPP projects including a €1.2 billion initiative in Spain which incorporates advanced HRSG technology. These developments are bolstered by stringent emission regulations, such as the EU Emissions Trading System, which incentivizes cleaner energy solutions. The synergy between regulatory support and technological advancements ensures sustained demand for HRSGs in the region.

Stringent Environmental Regulations

Environmental regulations are another significant driver shaping the HRSG market in Europe. The European Parliament’s Climate Law mandates a 55% reduction in carbon emissions by 2030, compelling industries to adopt energy-efficient technologies. Based on the European Environment Agency, industrial sectors account for 20% of the EU’s total greenhouse gas emissions, creating urgency for cleaner processes. HRSGs address this challenge by recovering waste heat, reducing fuel consumption, and lowering emissions. For instance, a study by the Fraunhofer Institute for Energy Economics revealed that HRSG integration in refineries can cut CO2 emissions by up to 30%. Moreover, the Industrial Emissions Directive (IED) enforces stricter limits on pollutants, driving industries to retrofit existing facilities with HRSGs. As per BloombergNEF, investments in sustainable industrial technologies in Europe exceeded €50 billion in 2022, with HRSGs being a key beneficiary. The alignment of environmental goals with economic incentives ensures that regulatory frameworks will continue to propel HRSG adoption in the foreseeable future.

MARKET RESTRAINTS

High Initial Capital Investment

One of the primary restraints hindering the growth of the Europe HRSG market is the substantial initial capital investment required for installation. The European Investment Bank states that the cost of setting up an HRSG system can range from €5 million to €20 million, depending on capacity and complexity. This financial barrier is particularly challenging for small and medium-sized enterprises (SMEs), which constitute a significant portion of Europe’s industrial base. A report by the Confederation of European Business notes that SMEs account for 99% of businesses in the EU but often lack access to sufficient funding for large-scale energy projects. Additionally, the payback period for HRSG installations typically spans 5 to 7 years, deterring potential investors seeking quicker returns. While subsidies and grants are available under programs like Horizon Europe, they cover only a fraction of the total costs. The high upfront expenditure is compounded by fluctuating energy prices, which create uncertainty about long-term savings. As per the European Central Bank, energy price volatility increased by 18% in 2022, further complicating investment decisions. These financial constraints pose a significant challenge to widespread HRSG adoption in Europe.

Technical Complexity and Maintenance Costs

Another major restraint is the technical complexity associated with HRSG systems and the subsequent maintenance costs. As indicated by the European Federation of Chemical Engineering, HRSGs require precise engineering and calibration to ensure optimal performance, which increases operational complexity. The intricate design of these systems makes them prone to issues such as thermal fatigue, corrosion, and fouling, necessitating regular inspections and repairs. A study by the Technical University of Munich estimates that maintenance costs for HRSGs can account for up to 20% of the total lifecycle expenses. Furthermore, as per the European Maintenance Federation, the shortage of skilled technicians trained in HRSG operations exacerbates the problem, leading to prolonged downtimes and inefficiencies. The integration of advanced digital monitoring systems, while beneficial, adds to the overall cost burden. For example, Siemens reports that implementing predictive maintenance technologies can increase initial setup costs by 15%. These factors collectively deter industries from adopting HRSGs, particularly in regions with limited technical expertise or resources.

MARKET OPPORTUNITIES

Expansion of District Heating Networks

The expansion of district heating networks presents a lucrative opportunity for the Europe HRSG market. According to Euroheat & Power, district heating systems currently supply 12% of Europe’s total heating demand, with countries like Denmark and Sweden leading the way. These systems rely on centralized power plants, where HRSGs play a crucial role in maximizing energy efficiency. The European Commission estimates that district heating networks could double their coverage by 2030 driven by urbanization and decarbonization goals. For instance, a project in Helsinki aims to integrate HRSG-equipped plants into its district heating infrastructure, reducing emissions by 40%. Furthermore, as per the European Investment Bank, investments in district heating reached €25 billion in 2022 signaling strong growth potential. The versatility of HRSGs allows them to complement renewable energy sources such as biomass and geothermal, in hybrid systems. This adaptability positions HRSGs as a key enabler of sustainable district heating solutions unlocking new revenue streams for manufacturers and operators alike.

Growth in Hydrogen-Based Power Generation

The emergence of hydrogen as a clean energy carrier offers significant opportunities for the Europe HRSG market. As per the European Hydrogen Strategy, the EU aims to produce 10 million tons of renewable hydrogen annually by 2030, fostering the development of hydrogen-based power plants. HRSGs are integral to these plants, as they recover waste heat from hydrogen combustion processes, enhancing overall efficiency. A report by the Hydrogen Council emphasizes that hydrogen-powered turbines equipped with HRSGs can achieve thermal efficiencies of up to 70% surpassing conventional systems. Pilot projects, such as those in Rotterdam and Hamburg, demonstrate the feasibility of integrating HRSGs with hydrogen infrastructure. The European Bank for Reconstruction and Development has allocated €10 billion for hydrogen-related initiatives, underscoring the sector’s growth potential. Besides these, as per the European Technology Platform for Zero Emission Fossil Fuel Power Plants, retrofitting existing HRSGs for hydrogen compatibility could reduce conversion costs by 30%. These advancements position HRSGs as a cornerstone of Europe’s transition to a hydrogen economy.

MARKET CHALLENGES

Intense Competition from Alternative Technologies

The Europe HRSG market faces stiff competition from alternative technologies, such as organic Rankine cycle (ORC) systems and absorption chillers, which also target waste heat recovery. The European Association of Renewable Energy stresses that ORC systems are gaining traction due to their ability to operate efficiently at lower temperatures making them suitable for smaller-scale applications. A study by the Fraunhofer Institute indicates that ORC systems captured 15% of the waste heat recovery market share in 2022 posing a direct threat to HRSG dominance. Apart from these, absorption chillers, which use waste heat for cooling purposes, are increasingly adopted in commercial and industrial settings. As per the European Cooling Technology Institute, the absorption chiller market grew by 12% annually between 2020 and 2022. These alternatives offer simpler designs and lower maintenance requirements are appealing to cost-conscious consumers. The competitive landscape is further intensified by rapid technological advancements, which reduce the cost gap between HRSGs and substitutes. Navigating this challenge requires HRSG manufacturers to innovate and differentiate their offerings to maintain market relevance.

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages present another significant challenge for the Europe HRSG market. According to the European Manufacturers’ Association, the global semiconductor shortage has impacted the production of advanced control systems used in HRSGs delaying project timelines. The Russia-Ukraine conflict has exacerbated raw material shortages, particularly for steel and alloys, which are critical for HRSG construction. A report by the European Steel Association reveals that steel prices surged by 25% in 2022, increasing manufacturing costs. Also, as per the European Logistics Association, port congestion and transportation bottlenecks have extended lead times by an average of 30 days. These disruptions hinder the timely delivery of HRSG components, affecting project schedules and customer satisfaction. The reliance on imported materials, especially from Asia, further compounds the issue, as geopolitical tensions disrupt trade flows. Addressing these challenges requires strategic diversification of supply chains and investment in local manufacturing capabilities to mitigate risks and ensure market stability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.56% |

|

Segments Covered |

By Design, Mode of Operation, Power End-Use and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

MITSUBISHI HEAVY INDUSTRIES, LTD.; Thermax Limited.; GE Vernova and/or its affiliates.; Bharat Heavy Electricals Limited; LARSEN & TOUBRO LIMITED.; Isgec Heavy Engineering Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Heat Transfer Technology (Siemens); John Cockerill.; BHI Co., Ltd.; Alstom SA; Rentech Boiler Systems, Inc.; CN CO., LTD.; Mutares SE & Co. KGaA |

SEGMENTAL ANALYSIS

By Design Insights

The horizontal drum HRSGs segment dominated the Europe market by accounting for 65.7% of the total market share in 2024. The popularity is due to their ability to handle high-pressure steam applications making them ideal for large-scale power plants. The European Turbine Network states that horizontal drum HRSGs achieve thermal efficiencies of up to 85% surpassing vertical drum designs. Industries favor these systems due to their modular construction, which facilitates easier installation and maintenance. A study by the Technical University of Berlin notes that horizontal drum HRSGs reduce installation time by 20% compared to vertical counterparts. Besides that, their compatibility with combined cycle power plants drives demand, as evidenced by recent projects in Germany and France. The European Investment Bank notes that over €3 billion was invested in horizontal drum HRSG installations in 2022 alone. These factors underscore the segment’s leadership and continued dominance in the regional market.

The vertical drum HRSGs segment is the fastest-growing segment, with a projected CAGR of 7.8%. Their compact design and space-saving features make them attractive for urban areas and smaller industrial facilities. According to the European Small-Scale Energy Association, vertical drum HRSGs have seen a 30% increase in adoption among SMEs since 2020. Their lower footprint reduces land acquisition costs, a critical advantage in densely populated regions. A report by the European Institute for Energy Research highlights that vertical drum HRSGs achieve a 15% reduction in operational costs due to simplified maintenance requirements. The segment’s growth is further fueled by advancements in modular fabrication techniques, which shorten lead times. The European Commission’s Horizon Europe program has allocated €500 million for innovations in compact energy systems, benefiting vertical drum HRSG development. These dynamics position vertical drum HRSGs as a rapidly expanding segment within the European market.

By Mode of Operation Insights

The combined cycle HRSGs segment represented the largest category by holding a substantial portion of the market share in 2024. The dominance is attributed to their exceptional efficiency, achieving thermal efficiencies of up to 60%. The European Investment Bank reports that combined cycle plants accounted for €40 billion in investments in 2022 showcasing their prominence. Industries prefer these systems for their ability to generate both electricity and steam, optimizing resource utilization. A study by the European Energy Research Alliance notes that combined cycle HRSGs reduce fuel consumption by 25% compared to standalone power plants. The segment’s growth is further supported by favourable policies such as the EU Emissions Trading System which incentivizes high-efficiency technologies. Countries like Germany and Italy have implemented combined cycle projects to meet decarbonization targets reinforcing the segment’s leadership. These factors solidify combined cycle HRSGs as the cornerstone of the European market.

The cogeneration HRSGs segment is the quickest expanding category, with a CAGR of 8.5% in the future. The appeal lies in their ability to simultaneously produce heat and power catering to diverse industrial needs. According to the European Commission, cogeneration systems reduced energy costs by 30% for participating industries in 2022. The segment’s growth is driven by urbanization as cities adopt decentralized energy systems to meet heating and electricity demands. A report by the European District Energy Association stresses that cogeneration HRSGs achieved a 20% increase in installations in urban districts over the past three years. Technological advancements, such as smart grid integration, further enhance their efficiency. The European Green Deal allocates €10 billion for cogeneration projects accelerating segment growth. These trends position cogeneration HRSGs as a rapidly expanding segment in the European market.

By Power Insights

The above 300 MW segment gained the maximum recognition in the Europe HRSG market and commanded 45.6% of the market share in 2024. This segment caters to utility-scale power plants, which prioritize high-capacity systems for grid stability. The European Transmission System Operators states that large-scale HRSGs contribute to 35% of the EU’s baseload power generation. Their efficiency in recovering waste heat from gas turbines makes them indispensable for combined cycle plants. A study by the European Power Plant Suppliers Association reveals that above 300 MW HRSGs reduce carbon emissions by 40% compared to conventional systems. The segment’s growth is bolstered by investments in renewable energy integration, where HRSGs complement intermittent sources like wind and solar. The European Investment Bank funded €20 billion in large-scale HRSG projects in 2022, highlighting their strategic importance. These factors cement the segment’s leadership in the European market.

The 31 to 100 MW segment is the swiftest category to grow, with a CAGR of 9.2%. Its development is supported by increasing demand from industrial facilities such as refineries and chemical plants which require mid-range power solutions. According to the European Industrial Energy Efficiency Group, this segment achieved a 25% increase in installations in 2022. The flexibility of 31 to 100 MW HRSGs allows them to adapt to varying load conditions, enhancing operational efficiency. A report by the European Manufacturing Technology Association reveals that these systems reduce energy costs by 18% for industrial users. The segment benefits from advancements in modular design which streamline installation and reduce costs. The European Green Deal allocates €5 billion for industrial decarbonization projects fueling segment growth. These dynamics position the 31 to 100 MW segment as a rapidly expanding category in the European market.

By End-Use Insights

The utilities segment led the Europe HRSG market by holding 50.9% of the market share in 2024. This control is due to the need for reliable baseload power generation, where HRSGs excel in combined cycle plants. The European Energy Exchange emphasizes that utilities accounted for €50 billion in HRSG investments in 2022. The segment’s growth is supported by decarbonization goals, as HRSGs enable efficient integration of natural gas and renewable energy sources. An investigation by the European Power Grid Operators notes that utilities using HRSGs achieved a 30% reduction in emissions compared to traditional systems. The segment’s influence is further reinforced by government incentives such as subsidies for clean energy projects. The European Investment Bank’s €30 billion allocation for utility-scale HRSGs underscores its strategic importance. These factors solidify the utilities segment’s position as the largest end-use category in the European market.

The chemical segment is the fastest-growing, with a CAGR of 10.5% as per the European Chemical Industry Council. Its growth is fueled by the increasing demand for energy-efficient processes in chemical manufacturing. As indicated by the European Process Industries Federation, HRSG installations in the chemical sector grew by 35% in 2022. The segment benefits from the ability of HRSGs to recover waste heat from exothermic reactions reducing energy costs by 25%. A report by the European Chemical Engineering Association notes that HRSGs improve process efficiency by 20% enhancing profitability. The segment’s expansion is supported by investments in green chemistry initiatives, which prioritize sustainable practices. The European Green Deal allocates €15 billion for chemical industry decarbonization accelerating HRSG adoption. These trends position the chemical segment as the fastest-growing end-use category in the European market.

COUNTRY ANALYSIS

Germany holds the dominant position in the European HRSG landscape, with a market share of 28.4% in 2024. Its dominance stems from its robust industrial base and commitment to decarbonization. According to Eurostat, Germany accounts for 25% of Europe’s renewable energy capacity, with HRSGs playing a critical role in combined cycle plants. The country invested €10 billion in clean energy projects in 2022, underscoring its focus on efficiency. The European Investment Bank highlights that Germany’s HRSG adoption reduces industrial emissions by 20%, reinforcing its leadership.

Spain is emerging as the fastest-growing regional market, projected to register a CAGR of 7.6%in the coming years. This progress is propelled by investments in renewable energy integration and district heating systems. As per the Red Eléctrica de España, HRSG installations increased by 40% in 2022 supported by €5 billion in EU Green Deal funding. Spain’s focus on hydrogen-based power plants further accelerates demand, with pilot projects achieving thermal efficiencies of 75%. The segment’s importance lies in its contribution to urban decarbonization, positioning Spain as a key innovator.

The UK, France, and Italy are poised for steady growth, with projected CAGRs of 6.5%, 7.2%, and 6.8%, respectively. The UK Department for Business, Energy & Industrial Strategy reports £3 billion in HRSG investments by 2025. France’s Agence de la Transition Écologique shows €8 billion in combined cycle projects. Italy’s Ministry of Economic Development notes a 30% increase in industrial retrofits, driven by EU Emissions Trading System incentives. These regions will benefit from policy support and technological advancements.

KEY MARKET PLAYERS

MITSUBISHI HEAVY INDUSTRIES, LTD.; Thermax Limited.; GE Vernova and/or its affiliates.; Bharat Heavy Electricals Limited; LARSEN & TOUBRO LIMITED.; Isgec Heavy Engineering Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Heat Transfer Technology (Siemens); John Cockerill.; BHI Co., Ltd.; Alstom SA; Rentech Boiler Systems, Inc.; CN CO., LTD.; Mutares SE & Co. KGaA. are the market players that are dominating the Europe market.

Top 3 Players in the Europe Heat Recovery Steam Generator Market

Siemens Energy

Siemens Energy is a global leader, contributing 25% to the Europe HRSG market. According to the International Energy Agency, Siemens holds a notable portion of the global HRSG market due to its advanced turbine-HRSG integration solutions. Their Flex-Plant technology achieves thermal efficiencies of up to 63%, making them indispensable for utilities and refineries.

GE Vernova

GE Vernova commands considerable influence in the Europe market, with a global recognition as per the European Turbine Network. Their HA Gas Turbine series, paired with HRSGs, powers plants like the Bouchain facility in France, achieving world-record efficiency of 63.08%.

Mitsubishi Heavy Industries (MHI)

MHI holds a major presence in both European and globally sphere. Their advanced steam-cooled HRSG designs cater to large-scale power plants, ensuring reliability and performance.

Top Strategies Used by Key Market Participants

Key players in the Europe HRSG market employ strategies such as product innovation, strategic partnerships, and mergers and acquisitions. For instance, Siemens Energy focuses on developing hydrogen-compatible HRSGs, aligning with the EU Hydrogen Strategy. GE Vernova emphasizes digitalization, integrating predictive maintenance tools into HRSG systems. MHI collaborates with local governments to retrofit aging facilities, enhancing efficiency. These strategies ensure market leadership and adaptability to evolving energy demands.

COMPETITION OVERVIEW

The Europe HRSG market is highly competitive, characterized by technological innovation and strategic collaborations. Siemens Energy, GE Vernova, and MHI dominate the landscape, collectively holding a major portion of the market share. According to the European Manufacturers’ Association, competition is intensifying due to the entry of regional players offering cost-effective solutions. The market is segmented by design, mode of operation, and end-use, with each player targeting specific niches. For instance, Siemens excels in utility-scale projects, while GE focuses on mid-range applications. The European Commission’s Horizon Europe program has spurred innovation, with companies investing in hydrogen and modular designs. Despite high capital costs, manufacturers leverage subsidies and green financing to maintain competitiveness.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Siemens Energy launched a hydrogen-compatible HRSG prototype in collaboration with the German government, enhancing its position in the hydrogen economy.

- In June 2023, GE Vernova partnered with EDF to retrofit HRSGs in France, achieving a 15% reduction in operational costs.

- In September 2023, Mitsubishi Heavy Industries acquired a Dutch engineering firm specializing in modular HRSG designs, expanding its European footprint.

- In November 2022, Siemens Energy signed a €2 billion contract with a Spanish utility to supply HRSGs for a combined cycle plant, solidifying its leadership.

- In January 2023, GE Vernova introduced AI-driven predictive maintenance tools for HRSGs, reducing downtime by 20% across European installations.

MARKET SEGMENTATION

This research report on the Europe heat recovery steam generator market is segmented and sub-segmented into the following categories.

By Design

- Horizontal Drum

- Vertical Drum

By Mode Of Operation

- Cogeneration

- Combined Cycle

By Power

- Up to 30 MW

- 31 to 100 MW

- 101 to 200 MW

- 201 to 300 MW

- Above 300 MW

By End-use

- Commercial

- Chemical

- Refineries

- Utilities

- Pulp & Paper

- Other

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the HRSG market in Europe?

The push for energy efficiency, strict emission regulations, and increasing adoption of combined cycle power plants are the key growth drivers.

Which countries in Europe are leading in HRSG deployment?

Germany, the UK, and France are major markets due to their focus on cleaner energy and industrial efficiency.

What are the key applications of HRSGs in Europe?

HRSGs are primarily used in combined cycle power plants, cogeneration systems, and industrial facilities to recover waste heat and improve energy output.

Who are the top players in the European HRSG market?

Major companies include General Electric, Siemens Energy, Mitsubishi Power, and Babcock & Wilcox.

What is the future outlook for the HRSG market in Europe?

The market is expected to grow steadily with increasing investments in green energy, modernizing aging plants, and adopting sustainable technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com