Europe High-Performance Liquid Chromatography (HPLC) Market Size, Share, Trends & Growth Forecast Report By Product, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis, From (2025 to 2033)

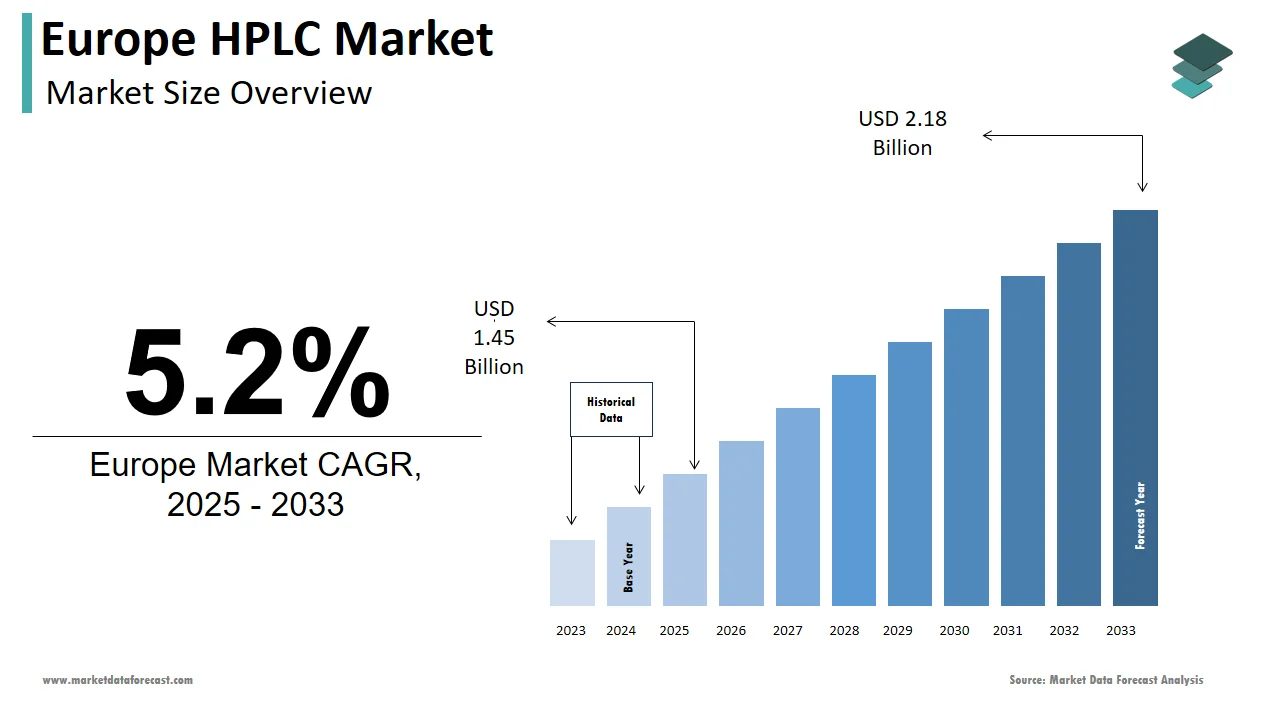

Europe HPLC Market Size

The high-performance liquid chromatography market size in Europe was valued at USD 1.38 billion in 2024. The European market is estimated to be worth USD 2.18 billion by 2033 from USD 1.45 billion in 2025, growing at a CAGR of 5.2% from 2025 to 2033.

MARKET DRIVERS

The European HPLC market is expected to be driven by the developed healthcare infrastructure, the escalation in various industries over time, the high rate of acquisition of technologically advanced products, and the escalation of healthcare expenditure and research expertise in the region. The other key factors driving the growth of the European high-performance liquid chromatography market during the forecast period include better sensitivity and precision compared to conventional chromatographic techniques. However, in food analysis and the study of several fat-soluble vitamins, High-Performance Liquid Chromatography (HPLC) has provided numerous benefits.

In addition, the rising usage of high-performance liquid chromatography in pharmaceuticals for factory testing and quality control enhanced the popularity of LC-MS (Liquid Chromatography-Mass Spectrography). Other factors that are expected to fuel the expansion of the European market through 2025 include outcomes, faster separation, and technological advancement. Also, the growing number of medications in both developed and emerging countries is likely to propel the European market for high-performance liquid chromatography to new heights.

Moreover, manufacturers are focusing on new technologies to assist researchers in obtaining high-quality analysis, which represents a significant opportunity for the high-performance liquid chromatography market to develop. Furthermore, the market is expected to get benefitted from the rise in demand for HPLC procedures. HPLC applications are being expanded in the medical, research, and manufacturing sectors due to ongoing research and development. Furthermore, due to the high sensitivity and accuracy of HPLC, it is increasingly being used by law enforcement organizations to detect performance-enhancing chemicals in Urine, boosting the market growth.

MARKET RESTRAINTS

A significant challenge that is expected to impede the market’s growth in Europe is the high cost of a High-Performance Liquid Chromatography system. Furthermore, the high service price, which results in operating expenses, is another vital aspect that is predicted to hinder the target market’s growth.

REGIONAL ANALYSIS

Regionally, the European market is expected to account for the second-highest share of the global market during the forecast period. The market is expected to be fuelled by an increase in the awareness of HPLC procedures and government legislation. In addition to bioinformatics and DNA fingerprinting, HPLC is utilized. Furthermore, the HPLC’s high sensitivity and precision assist its growing use by law enforcement authorities to detect performance-enhancing drugs in Urine, boosting the European market’s growth. The United Kingdom, Germany, and Russia are the most significant contributors to the European market.

The UK HPLC market is expected to hold a significant share of the European HPLC market during the forecast period. The market growth is attributed to the availability of advanced healthcare infrastructure, favorable reimbursement policies, and technological advancements. Other factors driving the growth of the European HPLC market include the growing popularity of the Liquid Chromatography-Mass Spectrography (LCMS) technology and increased spending on research and development in the life sciences.

KEY MARKET PLAYERS

A few notable companies operating in the European high-performance liquid chromatography market profiled in this report are Waters Corporation, Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific Inc., GE Healthcare, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Phenomenex Inc., and JASCO Inc.

MARKET SEGMENTATION

This Europe high-performance liquid chromatography market research report is segmented and sub-segmented into the following categories.

By Product

- Instruments

- Consumables

- Accessories

By Instruments

- Systems

- Detectors

By Consumables

- Columns

- Filters

By Application

- Clinical Research

- Diagnostics

- Forensics

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]