Europe High Purity Alumina (HPA) Market Size, Share, Trends & Growth Forecast Report By Product (4N, 5N, 6N), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe High Purity Alumina (HPA) Market Size

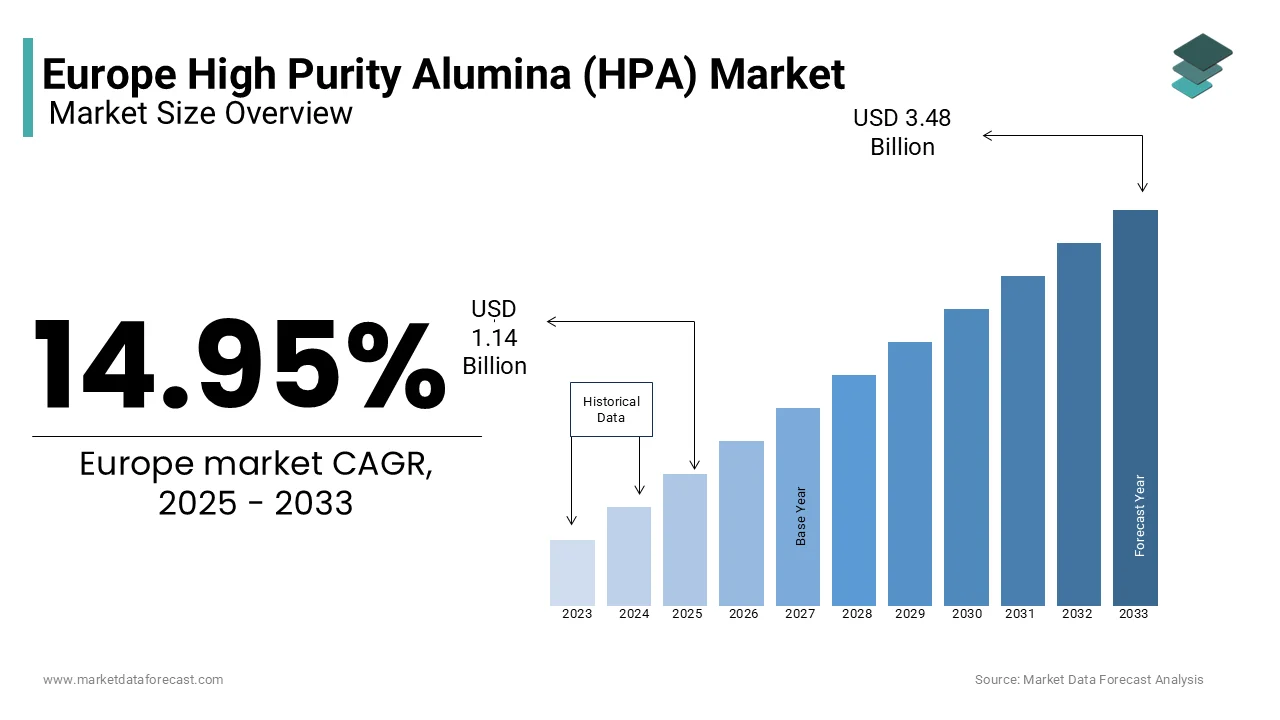

The Europe high purity alumina (HPA) market size was valued at USD 0.99 billion in 2024. The European market is estimated to be worth USD 3.48 billion by 2033 from USD 1.14 billion in 2025, growing at a CAGR of 14.95% from 2025 to 2033.

High purity alumina (HPA) is characterized by an aluminum oxide content exceeding 99.9% and is a critical material used in advanced applications such as semiconductors, LEDs, lithium-ion batteries, and sapphire substrates. In Europe, the HPA market is driven by the region's robust electronics, automotive, and renewable energy sectors, which demand materials with exceptional thermal, electrical, and chemical properties. According to the European Chemical Industry Council, the demand for HPA in Europe grew by 12% in 2022, supported by its adoption in cutting-edge technologies like electric vehicle (EV) batteries and LED lighting. The European Commission's Green Deal initiative emphasizes sustainable manufacturing practices, further boosting demand for eco-friendly and high-performance materials like HPA.

MARKET DRIVERS

Rising Demand for Lithium-Ion Batteries

The escalating demand for lithium-ion batteries is driving the growth of the European high purity alumina market. According to the European Battery Alliance, the production capacity of lithium-ion batteries in Europe is projected to reach 700 GWh by 2030, driven by the rapid adoption of electric vehicles (EVs) and renewable energy storage systems. High purity alumina plays a critical role as a separator coating material in lithium-ion batteries, enhancing their thermal stability and safety. The European Investment Bank reports that over 60% of EV battery manufacturers in Europe utilize HPA, reflecting its indispensable role in achieving high performance. Additionally, as per the European Commission, investments in battery technologies reached €30 billion in 2022, further amplifying demand for HPA. This trend positions HPA as a cornerstone of growth in the EV and renewable energy sectors.

Growing Adoption in Semiconductor Manufacturing

The growing adoption of high purity alumina in semiconductor manufacturing represents another significant driver for the European market. According to the European Semiconductor Industry Association, the semiconductor industry in Europe grew by 15% in 2022, driven by advancements in 5G technology, artificial intelligence, and IoT devices. HPA is extensively used as a substrate material in semiconductor fabrication due to its superior thermal conductivity and electrical insulation properties. The European Commission's Horizon Europe program emphasizes innovation in semiconductor technologies, further boosting demand for HPA.

MARKET RESTRAINTS

High Production Costs

High production costs associated with high purity alumina is a major restraint for the European market. According to the European Federation of Chemical Industries, the cost of producing HPA is approximately 40-50% higher than traditional alumina, limiting its affordability for small and medium-sized enterprises (SMEs). The European Chemical Industry Council notes that over 60% of manufacturers cite affordability as a primary barrier to integrating HPA into their formulations, particularly in low-margin industries. Additionally, fluctuations in raw material prices, particularly aluminum hydroxide, exacerbate this issue. According to the European Metals Association, the cost of aluminum hydroxide surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Availability of Raw Materials

Limited availability of raw materials required for high purity alumina production is further restraining the growth of the European high purity alumina market. According to the European Raw Materials Alliance, over 80% of high-purity aluminum hydroxide, a key precursor for HPA, is imported from non-European countries, creating dependency on external suppliers. The European Commission highlights that geopolitical tensions and trade restrictions have disrupted the supply of these raw materials, leading to shortages and price volatility. This lack of availability not only slows the adoption of HPA but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, industry stakeholders, and research institutions to develop sustainable and localized supply chains.

MARKET OPPORTUNITIES

Advancements in Clean Energy Technologies

Advancements in clean energy technologies is a lucrative opportunity for the European high purity alumina market. According to the European Commission's Green Deal initiative, over 30% of Europe's energy needs are expected to be met through renewable sources by 2030, driving demand for materials like HPA in solar panels, wind turbines, and energy storage systems. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of HPA in lithium-ion batteries and fuel cells, further amplifying demand. This opportunity positions HPA as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing carbon footprints.

Expansion into Emerging Applications

The growing focus on emerging applications such as solid-state batteries and advanced ceramics is another promising opportunity for the European HPA market. According to the European Battery Alliance, the demand for solid-state batteries is projected to grow by 20% annually, driven by their superior safety and energy density compared to conventional lithium-ion batteries. HPA is extensively used as a solid electrolyte material, ensuring enhanced performance and durability. Similarly, the European Ceramic Society reports a 15% annual increase in the use of HPA in advanced ceramics, where it provides superior mechanical and thermal properties. Additionally, the European Commission's Circular Economy Action Plan supports the development of sustainable energy solutions, amplifying the need for advanced materials like HPA. This opportunity underscores the immense potential for market expansion in these high-growth sectors.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions is a significant challenge to the European high purity alumina market, exacerbated by logistical bottlenecks and geopolitical tensions. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022, affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as aluminum hydroxide, which accounts for nearly 70% of HPA production expenses. As per the European Chemical Industry Council, imports of certain raw materials declined by 40% in 2022, leading to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules, impacting market stability. According to Eurostat, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges, underscoring the severity of this issue.

Regulatory Scrutiny and Compliance Costs

Regulatory scrutiny and compliance costs surrounding the use of advanced materials is further challenging the growth of the European HPA market. According to the European Chemicals Agency, HPA must comply with strict environmental and safety regulations under the REACH Directive, which mandates rigorous testing and documentation to ensure compliance. According to the European Commission, over 40% of HPA projects face delays due to these stringent requirements, impacting time-to-market. Additionally, the European Federation of Chemical Industries highlights that compliance costs for HPA manufacturers have risen by 20% over the past three years, limiting affordability for SMEs. These regulatory hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.95% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Alcoa Corporation, Altech Chemicals Ltd, Baikowski Sas, Nippon Light Metal Holdings Company Ltd, Norsk Hydro Asa, Sasol Ltd, Sumimoto Chemical Co Ltd, Xuancheng Jingrui New Material Co Ltd, Zibo Honghe Chemical Co Ltd, Alpha Hpa Limited, Andromeda Metals Ltd, Polar Sapphire Ltd, Rusal, and Fyi Resources Ltd, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The 5N grade high purity alumina segment occupied 51.8% of the European market share in 2024. The leading position of 5N grade segment in the European market is attributed to its widespread use in lithium-ion batteries and semiconductor applications, where it provides a balance of purity, performance, and cost-effectiveness. According to the European Commission, over 60% of HPA consumed in Europe is utilized in these high-growth sectors, reflecting its widespread adoption. The versatility and reliability of 5N grade HPA ensure its sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards.

The 6N grade high purity alumina segment is predicted to register a CAGR of 6.2% over the forecast period. The increasing adoption of 6N grade in advanced applications such as solid-state batteries and high-performance ceramics, where it provides unparalleled purity and thermal stability is propelling the growth of the 6N grade segment in the European market. According to the European Commission's Horizon Europe program supports the development of next-generation energy solutions, amplifying the need for 6N grade HPA. This trend positions 6N grade HPA as a key driver of innovation in the European market.

By Application Insights

The lithium-ion batteries segment occupied 40.7% of the European market share in 2024. The leading position of lithium-ion batteries segment in the European market is driven from the extensive use of HPA as a separator coating material, enhancing thermal stability and safety in EV batteries. The European Commission reports that over 60% of HPA consumed in Europe is utilized in lithium-ion battery applications, reflecting its widespread adoption. The versatility and reliability of HPA ensure its sustained dominance in the lithium-ion battery sector.

The solid-state batteries segment is anticipated to witness a promising CAGR of 15.5% over the forecast period owing to the increasing demand for safer and more energy-dense battery technologies, where HPA is used as a solid electrolyte material. Additionally, the European Commission's Green Deal initiative supports the development of sustainable energy solutions, amplifying the need for advanced materials like HPA. This trend positions solid-state batteries as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany held 26.1% of the European high purity alumina market share in 2024. The prominent position of Germany in the European market is attributed to the Germany’s robust electronics and automotive industries, which account for over 40% of total HPA consumption in Europe. The German Federal Ministry for Economic Affairs and Climate Action reports that over 60% of domestic HPA production is utilized in lithium-ion batteries and semiconductors, reflecting the region's leadership in adopting advanced materials. Additionally, Germany's strategic investments in green energy technologies create a favorable environment for market growth, aligning with the European Green Deal initiative.

France is playing a key role in the European high purity alumina market. The presence of France in the aerospace and renewable energy sectors drives HPA adoption. The French Ministry of Ecology highlights the growing use of HPA in advanced ceramics and energy storage systems, while the French Environment Agency reports a 15% annual increase in its use in lithium-ion batteries. Furthermore, France's focus on sustainability boosts the use of eco

KEY MARKET PLAYERS

The major key players in Europe high purity alumina (HPA) market are Alcoa Corporation, Altech Chemicals Ltd, Baikowski Sas, Nippon Light Metal Holdings Company Ltd, Norsk Hydro Asa, Sasol Ltd, Sumimoto Chemical Co Ltd, Xuancheng Jingrui New Material Co Ltd, Zibo Honghe Chemical Co Ltd, Alpha Hpa Limited, Andromeda Metals Ltd, Polar Sapphire Ltd, Rusal, and Fyi Resources Ltd.

MARKET SEGMENTATION

This research report on the Europe high purity alumina (HPA) market is segmented and sub-segmented into the following categories.

By Product

- 4N

- 5N

- 6N

By Application

- LED

- Semiconductor

- Li-ion Batteries

- Sapphire Glass

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the European high purity alumina market in 2024?

The European high purity alumina market size was valued at approximately USD 0.99 billion in 2024.

2. What are the key drivers of the high purity alumina market growth in Europe?

Key drivers include increasing demand from industries like electronics and automotive, particularly for applications in LED manufacturing and lithium-ion batteries.

3. How does the European market compare to the global high purity alumina market?

The global market is larger and growing faster, driven by strong demand from regions like Asia-Pacific, but Europe remains a significant player due to its advanced electronics and automotive sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com