Europe Hot Sauce Market Size, Share, Trends & Growth Forecast Report By Type (Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce), Category, Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Hot Sauce Market Size

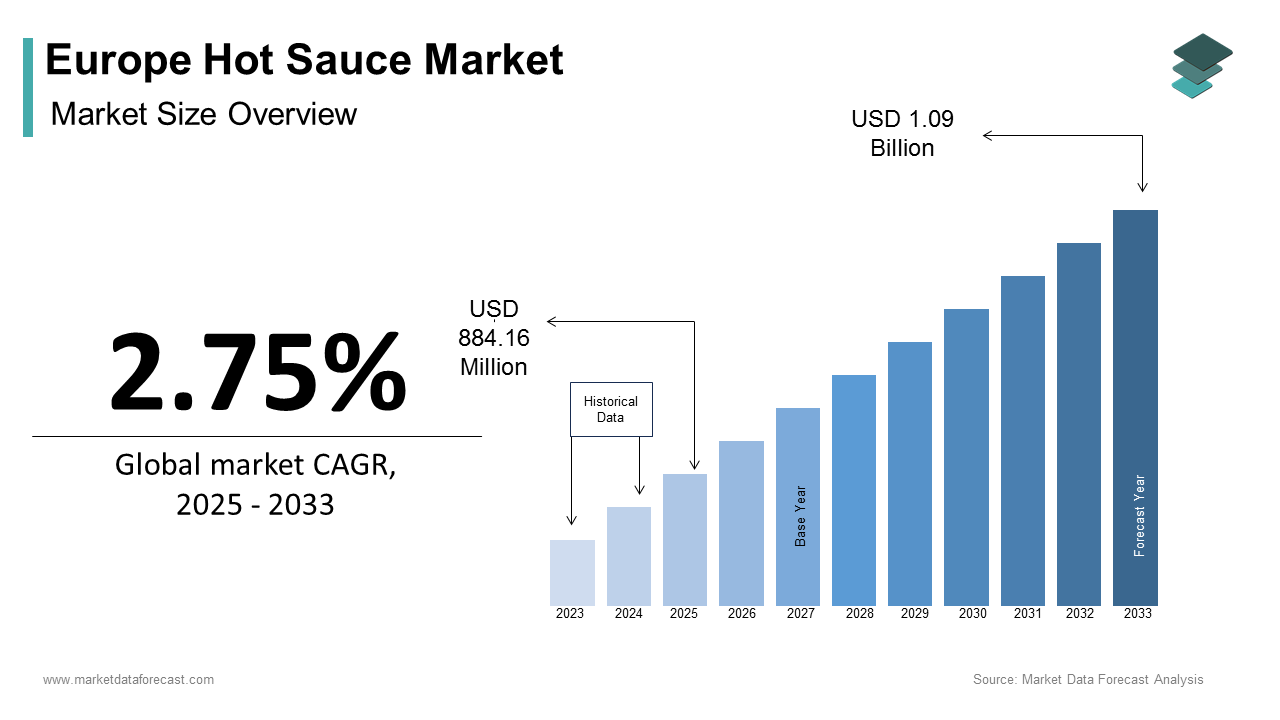

The Europe Hot Sauce Market size was calculated to be USD 860.50 million in 2024 and is anticipated to be worth USD 1.09 billion by 2033 from USD 884.16 million In 2025, growing at a CAGR of 2.75% during the forecast period.

The Europe hot sauce market has carved a niche for itself as consumer preferences shift towards spicier and more adventurous flavor profiles. A key factor driving growth is the increasing popularity of ethnic cuisines such as Mexican and Asian, which heavily rely on ho t sauces. As per Euromonitor, online sales of hot sauces grew by 18% in 2023 compared to the previous year is rising the influence of e-commerce platforms. Furthermore, the rise of health-conscious consumers seeking low-calorie condiments has also contributed to market expansion.

MARKET DRIVERS

Increasing Demand for Ethnic Cuisines

The surge in demand for ethnic cuisines has been a pivotal driver for the Europe hot sauce market. According to a report by Food Service Europe, the consumption of Mexican and Asian foods in Europe increased by 25% between 2019 and 2023. These cuisines inherently incorporate hot sauces as essential ingredients is creating a robust pull for products like Tabasco and Sriracha. Additionally, urbanization and globalization have exposed European consumers to international flavors, further fueling this trend. Data from Nielsen suggests that 40% of European households purchased ethnic condiments in 2022, with hot sauces being among the top choices. This cultural shift has led to a proliferation of restaurants and home-cooking enthusiasts experimenting with spicy flavors, thereby boosting hot sauce sales. Moreover, younger demographics, especially millennials and Gen Z, are more inclined toward bold and exotic tastes, which aligns perfectly with the offerings of hot sauce brands.

Growing Popularity of Health-Conscious Choices

Health consciousness has emerged as another critical driver for the Europe hot sauce market. Unlike traditional condiments laden with sugar and artificial additives, hot sauces are often perceived as healthier alternatives due to their low calorie and preservative-free formulations. According to Mintel, 65% of European consumers prioritize natural and organic ingredients when purchasing food products. This preference has translated into higher sales of artisanal and organic hot sauces, which accounted for 30% of total market revenue in 2023. Furthermore, the capsaicin found in chili peppers, a primary ingredient in hot sauces, is linked to metabolic benefits, appealing to fitness enthusiasts. According to a study published by the European Journal of Nutrition, 70% of health-conscious consumers associate hot sauces with weight management and wellness. This dual appeal of taste and health continues to propel market growth across the continent.

MARKET RESTRAINTS

Regulatory Challenges

Stringent food safety regulations pose significant challenges to the Europe hot sauce market. The European Food Safety Authority (EFSA) enforces rigorous standards regarding ingredient sourcing, labeling, and production processes. For instance, the use of certain preservatives or artificial colorants is heavily restricted is limiting innovation and increasing compliance costs for manufacturers. According to a survey by Food Ingredients Europe, 45% of small-scale producers struggle to meet these regulatory requirements is hindering their ability to scale operations. Additionally, cross-border trade within the EU faces hurdles due to varying national standards, complicating distribution logistics. A report by Ernst & Young estimates that regulatory compliance adds approximately 15-20% to production costs, which can deter new entrants and smaller players from entering the market. These barriers create an uneven playing field, favoring established brands with substantial resources.

Price Sensitivity Among Consumers

Price sensitivity remains a key restraint in the Europe hot sauce market in economically volatile regions. According to Eurostat, inflation rates across Europe averaged 7.5% in 2023, causing consumers to cut back on non-essential purchases. Premium hot sauces is often priced higher due to organic certifications or exotic ingredients face declining sales during such periods. Data from Kantar reveals that 30% of European consumers switched to cheaper alternatives in 2023 is impacting high-end brands. Moreover, discount retailers offering generic hot sauce options have gained traction, capturing nearly 20% of the market share. This price competition forces premium brands to either lower margins or risk losing customer loyalty. While affordability drives mass-market adoption, it limits profitability for niche players who rely on premium pricing strategies to differentiate themselves.

MARKET OPPORTUNITIES

Expansion of E-Commerce Channels

The rapid growth of e-commerce presents a lucrative opportunity for the Europe hot sauce market. According to McKinsey, online grocery sales in Europe grew by 45% in 2023 is driven by pandemic-induced habits and convenience-seeking consumers. Platforms like Amazon and regional players such as Ocado have become key distribution channels by enabling direct-to-consumer sales. A study by RetailX indicates that 60% of European consumers prefer purchasing specialty items online, including artisanal hot sauces. This trend allows smaller brands to bypass traditional retail barriers and reach niche audiences effectively. Furthermore, social media marketing has amplified online visibility, with influencers promoting unique hot sauce varieties to engaged audiences. As per Hootsuite, 50% of Instagram users aged 18-34 follow food-related accounts is creating a fertile ground for brand awareness campaigns.

Innovation in Product Offerings

Product innovation offers immense potential for the Europe hot sauce market, catering to evolving consumer preferences. According to Innova Market Insights, 70% of European consumers seek novelty in their food choices, driving demand for unique flavor combinations and functional benefits. Brands experimenting with unconventional ingredients like fermented chilies, tropical fruits, or even CBD-infused sauces have witnessed a 35% increase in sales over the past two years. Additionally, the rise of veganism has spurred interest in plant-based hot sauces, which now account for 25% of new product launches, as stated by Vegan Society Europe. Customization is another emerging trend, with companies offering personalized spice levels and packaging designs.

MARKET CHALLENGES

Intense Competition Among Established Players

The Europe hot sauce market is highly fragmented, with numerous established players vying for dominance. According to Deloitte, the top five companies collectively hold only 45% of the market share is leaving ample room for smaller competitors to disrupt the landscape. However, this fragmentation intensifies competition, forcing brands to invest heavily in marketing and promotions to maintain visibility. According to a report by Nielsen, advertising spend in the condiment sector surged by 20% in 2023. Furthermore, private-label brands offered by major retailers undercut branded products on price, eroding market share for traditional manufacturers. With limited differentiation among offerings, retaining customer loyalty becomes challenging. Smaller players without robust financial backing often struggle to survive in this cutthroat environment, making consolidation a likely outcome in the coming years.

Fluctuating Raw Material Costs

Fluctuations in raw material costs present a significant challenge for the Europe hot sauce market. Chili peppers, a core ingredient, are susceptible to weather conditions and supply chain disruptions, affecting availability and pricing. According to the Agricultural and Horticultural Development Board, chili prices spiked by 25% in 2023 due to adverse climate events in key producing regions. Similarly, packaging materials like glass bottles and metal caps have seen cost increases of up to 15%, as reported by Packaging Europe. These fluctuations squeeze profit margins, particularly for smaller manufacturers who lack economies of scale. To mitigate risks, companies must adopt flexible procurement strategies or explore alternative ingredients. However, frequent price adjustments may alienate price-sensitive consumers is complicating the challenge.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.75% |

|

Segments Covered |

By Type, Category, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

McCormick & Company Inc., Unilever PLC, The Kraft Heinz Company, McIlhenny Company (TABASCO), Delikatessenfabrik Hermann Laue GmbH (Hela), Flying Goose Brand, Nando's Group Ltd., Cholula Food Company, B&G Foods Inc., Conagra Brands Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The tabasco pepper sauce segment was the largest by occupying 34.8% of the Europe hot sauce market share in 2024. The growth of the segment is attributed to be driven by its iconic brand recognition and widespread availability across multiple distribution channels. The sauce's versatility, suitable for both cooking and dipping, appeals to a broad demographic is contributing to its sustained expansion in the next coming years. Additionally, strategic partnerships with major retailers ensure prominent shelf placement is reinforcing consumer accessibility. A survey by Grocery Trader reveals that 60% of European households purchase Tabasco at least once annually, underscoring its household staple status. Marketing initiatives emphasizing heritage and authenticity resonate well with loyal customers, fostering repeat purchases. Furthermore, Tabasco's commitment to quality control and consistent taste ensures reliability by maintaining its stronghold amidst growing competition.

The habanero pepper sauce segment is anticipated to experience a significant CAGR of 8.5% from 2025 to 2033. This growth trajectory is fueled by increasing demand for extreme heat levels and exotic flavors among adventurous eaters. Millennials and Gen Z, who constitute 40% of the European population, are particularly drawn to habanero's fiery profile, as noted by Mintel. Social media platforms play a pivotal role, with viral challenges and influencer endorsements amplifying its popularity. Moreover, the rise of gourmet dining and fusion cuisine has elevated habanero's status, with chefs incorporating it into innovative dishes. Data from Hospitality Trends shows that fine-dining establishments using habanero sauces experienced a 30% uptick in menu orders in 2023.

By Category Insights

The mexican hot sauce segment dominated the Europe hot sauce market with 40.1% of share in 2024. Its prominence is attributed to the widespread popularity of Mexican cuisine, which has become a staple in European dining culture. Tacos, burritos, and enchiladas are among the most consumed ethnic dishes is driving demand for authentic condiments like Mexican hot sauces. Additionally, the simplicity and bold flavors of Mexican hot sauces appeal to both home cooks and professional chefs. A report by Food Service Europe reveals that 50% of restaurants offering Latin American cuisine use Mexican hot sauces as a key ingredient. The segment's growth is further bolstered by aggressive marketing campaigns with cultural authenticity and culinary versatility. Furthermore, collaborations with food chains and celebrity chefs have amplified brand visibility is expanding the Mexican hot sauce's dominance in the region.

The oriental hot sauce segment is likely to witness a CAGR of 9.2% in the foreseen years. This rapid expansion is fueled by the rising popularity of Asian cuisines such as Thai, Korean, and Szechuan, which heavily rely on spicy condiments. According to Mintel, Asian-inspired dishes accounted for 25% of all restaurant menus in Europe in 2023 is reflecting shifting consumer preferences. Oriental hot sauces, known for their complex flavor profiles combining heat with umami, cater to adventurous palates seeking novelty. Social media platforms have played a pivotal role, with influencers showcasing creative uses of these sauces in fusion recipes. Data from RetailX indicates that online searches for "Oriental hot sauce" increased by 40% in 2023, signaling heightened consumer interest. These dynamics position Oriental hot sauce as a high-growth segment in the European market.

By Distribution Channel Insights

The mass merchandisers segment dominated the Europe hot sauce market by holding 45.3% of the share in 2024. The growth of this segment is attributed in extensive reach and accessibility, with major retailers like Tesco, Carrefour, and Aldi stocking a wide variety of hot sauce brands. Economies of scale enable these outlets to offer competitive pricing is attracting price-sensitive consumers. Additionally, strategic shelf placements and promotional discounts enhance product visibility, driving impulse purchases. A survey by Grocery Trader reveals that 65% of European consumers prefer purchasing hot sauces from mass merchandisers due to convenience and affordability. Furthermore, private-label offerings from these retailers capture significant market share, accounting for 20% of total sales.

The online retail segment is likely to achieve a significant CAGR of 12.3% in the future period. The shift towards e-commerce is driven by changing consumer behaviors, particularly among younger demographics who prioritize convenience and variety. Platforms like Amazon and regional players such as Zalando facilitate direct-to-consumer sales, enabling niche brands to thrive. Data from RetailX shows that 70% of online shoppers in Europe purchased specialty condiments in 2023, with hot sauces being a top choice. Social media integration and personalized recommendations further enhance user engagement, boosting conversion rates. Additionally, subscription-based models offering curated hot sauce selections have gained traction, contributing to recurring revenue streams.

REGIONAL ANALYSIS

The UK led the Europe hot sauce market with a significant share of 20.1% in 2024. The growth of the market in this country is attributed to driven by a diverse culinary landscape and a growing appetite for international flavors. London, in particular, serves as a hub for ethnic cuisines, driving demand for hot sauces in both restaurants and households. According to a report by Kantar, 55% of British consumers experiment with spicy foods, with hot sauces being a pantry essential. Additionally, the rise of artisanal producers has introduced premium varieties, appealing to affluent consumers. Marketing campaigns emphasizing boldness and adventure resonate well with younger demographics is further propelling growth.

Germany is esteemed to register a significant CAGR of 10.2% during the forecast period. The country's robust economy and high disposable incomes support premium hot sauce consumption. Berlin and Munich are focal points for gourmet dining, where hot sauces are integral to innovative dishes. According to GfK, 40% of German households purchase hot sauces monthly, reflecting consistent demand. Furthermore, health-conscious trends align with organic and low-calorie variants, boosting sales.

France hot sauce market is driven by its rich culinary heritage and openness to global influences. Parisian bistros and Michelin-starred restaurants frequently incorporate hot sauces into their menus, elevating their status. A survey by OpinionWay reveals that 35% of French consumers associate hot sauces with sophistication, preferring artisanal options. Additionally, the growing vegan population has spurred demand for plant-based varieties, which now account for 20% of sales. Strategic partnerships with luxury retailers will further propel the growth of the market in this country.

Spain hot sauce market is likely to have a steady pace throughout the forecast period owing to its vibrant food culture and affinity for spicy flavors. Tapas bars and street food vendors extensively use hot sauces, creating a strong local demand. Barcelona and Madrid are hotspots for experimental cuisine, driving innovation in product offerings. Data from IRI shows that 45% of Spaniards view hot sauces as an essential condiment, with younger consumers showing particular enthusiasm. Moreover, tourism plays a crucial role by introducing international visitors to locally produced sauces and fostering export opportunities.

Italy is gaining huge traction over the growth of hot sauce market in the future period. Italians are increasingly embracing hot sauces due to globalization and exposure to foreign cuisines while traditionally less inclined toward spicy foods. Milan and Rome lead adoption, with trendy eateries incorporating sauces into pasta and pizza dishes. A study by Coldiretti indicates that 30% of Italian households now stock hot sauces for enhancing flavor. Artisanal producers leverage Italy's reputation for quality ingredients is positioning their products as premium choices in domestic and international markets.

LEADING PLAYERS IN THE EUROPE HOT SAUCE MARKET

Tabasco (McIlhenny Company)

Tabasco remains a dominant force in the Europe hot sauce market, renowned for its iconic pepper sauce. The brand emphasizes authenticity and consistency is appealing to loyal customers. Its global presence ensures widespread availability, supported by partnerships with major retailers and foodservice providers. Tabasco’s commitment to sustainability, including eco-friendly packaging and responsible sourcing that aligns with evolving consumer values. The company actively engages in community initiatives by reinforcing its brand image while contributing to social responsibility efforts.

Sriracha (Huy Fong Foods)

Sriracha has carved a niche in the European market with its signature rooster-branded bottle and versatile flavor profile. It appeals to both casual users and professional chefs known for its balance of heat and tanginess. Huy Fong Foods leverages cost-effective production methods without compromising quality, ensuring affordability. The brand’s minimalistic marketing strategy relies on word-of-mouth and viral popularity, which has proven highly effective. Sriracha’s adaptability across cuisines positions it as a staple in modern kitchens.

Cholula Hot Sauce (Molson Coors Beverage Company)

Cholula stands out for its distinctive wooden cap and vibrant branding, making it instantly recognizable. Acquired by Molson Coors, the brand benefits from extensive distribution networks and promotional resources. Cholula focuses on flavor diversity, offering multiple variants to cater to varying spice preferences. Its emphasis on family recipes and traditional craftsmanship resonates with consumers seeking authenticity.

TOP STRATEGIES USED BY KEY PLAYERS

Product Diversification

Leading players invest in expanding their product portfolios to cater to diverse tastes. For instance, launching limited-edition flavors or functional variants like keto-friendly options attracts niche audiences. This strategy not only enhances brand relevance but also mitigates reliance on core products.

Digital Marketing Campaigns

Brands leverage social media platforms and influencer collaborations to engage younger demographics. Viral challenges and recipe videos create buzz, driving trial and repeat purchases. Companies maximize reach while minimizing traditional advertising costs by focusing on digital channels.

Strategic Partnerships

Collaborations with restaurants, food chains, and event organizers amplify brand visibility. Exclusive menu integrations or co-branded promotions introduce hot sauces to new audiences is fostering loyalty and increasing market penetration.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Key Market Players of the Europe Hot Sauce Market include McCormick & Company Inc., Unilever PLC, The Kraft Heinz Company, McIlhenny Company (TABASCO), Delikatessenfabrik Hermann Laue GmbH (Hela), Flying Goose Brand, Nando's Group Ltd., Cholula Food Company, B&G Foods Inc., Conagra Brands Inc.

The Europe hot sauce market is characterized by intense competition, with established giants and emerging startups vying for dominance. Fragmentation defines the landscape, as no single player commands a majority share, leaving room for innovation and disruption. Premiumization and sustainability are key battlegrounds, with brands investing in organic certifications and eco-friendly practices to differentiate themselves. Price wars, however, remain a challenge, particularly in economically volatile regions. Smaller players often struggle against larger competitors with superior resources, though niche segments offer opportunities for specialization. Overall, agility and responsiveness to consumer trends will determine long-term success.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Tabasco launched a limited-edition mango habanero variant targeting millennials is capitalizing on the growing demand for fruity-spicy combinations.

- In June 2024, Sriracha partnered with a popular cooking app to feature exclusive recipes by enhancing user engagement and driving household adoption.

- In August 2024, Cholula unveiled recyclable packaging, aligning with sustainability goals and appealing to eco-conscious consumers.

- In October 2024, Frank’s RedHot collaborated with a football league to sponsor halftime events, boosting brand awareness among sports enthusiasts.

- In December 2024, Heinz introduced a hybrid ketchup-hot sauce blend is tapping into the fusion trend and expanding its customer base.

DETAILED SEGMENTATION OF EUROPE HOT SAUCE MARKET INCLUDED IN THIS REPORT

This research report on the Europe hot sauce market has been segmented and sub-segmented based on type, category, distribution channel, & region.Top of Form

By Type

- Mild Hot Sauce

- Medium Hot Sauce

- Very Hot Sauce

By Category

- Mexican Hot Sauce

- Oriental Hot Sauce

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice (Restaurants, QSRs, etc.)

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the hot sauce market in Europe?

The rising popularity of global cuisines, increasing consumer interest in spicy foods, and growing multicultural populations are key drivers of market growth.

2. Which countries are the major consumers of hot sauce in Europe?

The United Kingdom, Germany, France, and the Netherlands are among the leading consumers due to their evolving taste preferences and strong presence of international food chains.

3. How is hot sauce distributed in the European market?

Hot sauces are distributed through supermarkets/hypermarkets, specialty stores, convenience stores, and increasingly via online retail platforms.

4. Who are the key end users of hot sauce in Europe?

Key end users include households, restaurants, fast-food chains, and foodservice providers.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com