Europe HVAC Cables Market Size, Share, Growth, Trends, and Forecast Report – Segmented By Voltage (110 kV – 220 kV, > 220 kV), Category, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe HVAC Cables Market Size

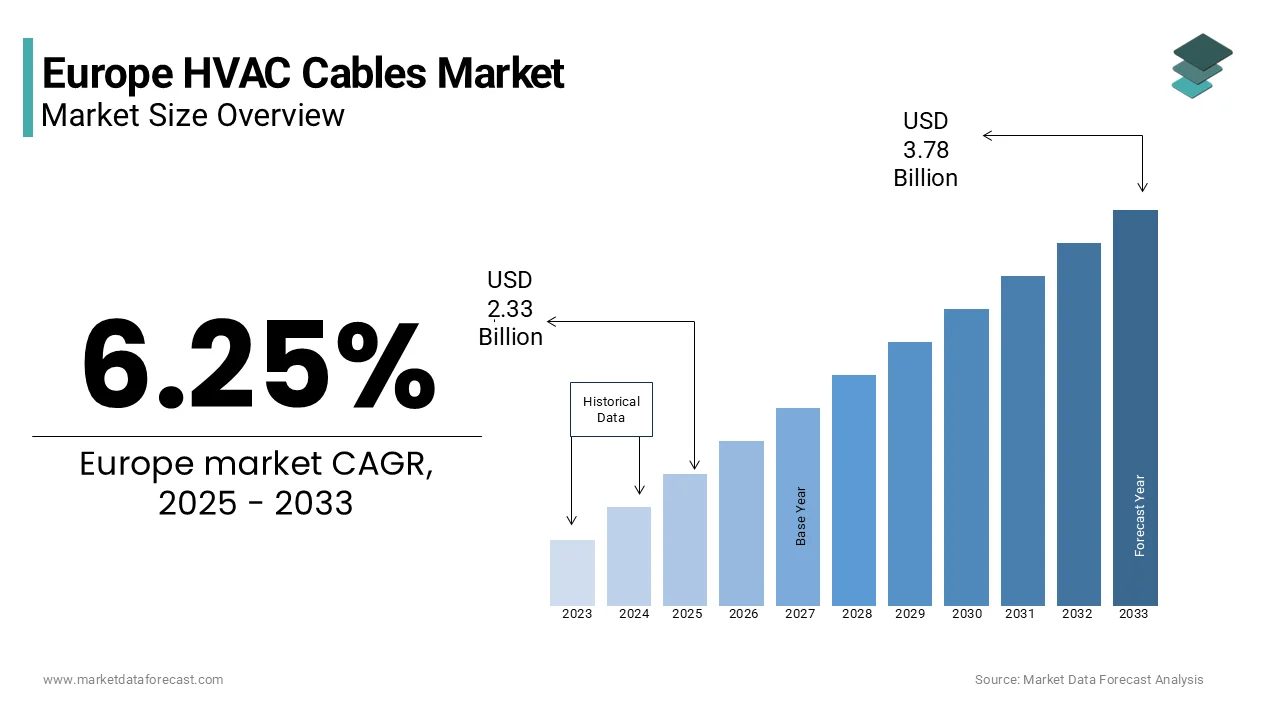

Europe HVAC cables market size was valued at USD 1.94 billion in 2024, and the market size is expected to reach USD 3.78 billion by 2033 from USD 2.33 billion in 2025. The market's promising CAGR for the predicted period is 6.25%.

The Europe HVAC cables market refers to the specialized segment of electrical wiring and cabling solutions designed for heating, ventilation, and air conditioning systems. These cables are essential components in both residential and commercial buildings, facilitating power transmission and control functions in HVAC equipment such as compressors, fans, thermostats, and motors. The demand for HVAC cables is closely linked to the expansion of construction activities, energy efficiency regulations, and the modernization of building infrastructure across the region. Furthermore, the push for green building certifications such as BREEAM and DGNB has led to a rise in demand for fire-resistant, low-smoke, and halogen-free cables that comply with safety and environmental norms.

MARKET DRIVERS

Expansion of Energy-Efficient Building Infrastructure

One of the primary drivers of the Europe HVAC cables market is the expansion of energy-efficient building infrastructure, driven by stringent government regulations and increasing awareness of sustainable development. According to the European Commission’s Energy Performance of Buildings Directive (EPBD), all new buildings in EU member states must be nearly zero-energy by 2030, significantly influencing the design and installation of HVAC systems. This directive necessitates the use of high-performance cables that support smart controls, variable speed drives, and integrated building automation systems. In the UK, the Building Research Establishment Environmental Assessment Method (BREEAM) certification has incentivized developers to adopt fire-resistant, low-emission cables that align with green building standards. Similarly, France’s RE2020 regulation mandates improved energy efficiency for new constructions, further boosting demand for specialized HVAC wiring.

Growth of Smart and Connected HVAC Systems

Growth of Smart and Connected HVAC Systems

Another significant driver of the Europe HVAC cables market is the rapid adoption of smart and connected HVAC systems, which rely on advanced cabling infrastructure to enable real-time monitoring, remote control, and predictive maintenance. According to McKinsey & Company, the integration of IoT-enabled HVAC systems in commercial and residential buildings has increased since 2021, driven by rising consumer demand for comfort, energy savings, and indoor air quality management. Similarly, in the Netherlands, major office developments in Amsterdam have incorporated Building Management Systems (BMS) that integrate HVAC controls via Ethernet-based communication protocols, requiring specialized data and power cables. As digital transformation reshapes the built environment, the demand for intelligent HVAC solutions and their associated cabling infrastructure is expected to grow steadily across Europe.

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Price Volatility

A major restraint affecting the Europe HVAC cables market is the persistent volatility in raw material prices and supply chain disruptions, particularly for copper, aluminum, and polymer-based insulation materials. This escalation has directly impacted cable manufacturing costs, leading to price increases for end users and project delays. Additionally, polyvinyl chloride (PVC) and cross-linked polyethylene (XLPE), widely used in cable insulation, experienced price hikes due to higher crude oil costs. Manufacturers in Germany and Italy reported production bottlenecks and extended lead times, as shortages of semiconductor chips and logistics constraints affected the availability of industrial-grade cables. Smaller HVAC contractors faced difficulties absorbing these cost increases, leading to reduced profit margins and delayed installations.

Complexity of Compliance with Regional Standards and Certifications

Complexity of Compliance with Regional Standards and Certifications

Another critical constraint on the Europe HVAC cables market is the complexity of meeting diverse regional standards and certification requirements across different EU member states. While harmonized directives such as the Construction Products Regulation (CPR) and Low Voltage Directive apply across the bloc, individual countries impose additional national testing and approval procedures, complicating product approvals and market entry strategies. For example, the German Institute for Standardization (DIN) enforces strict fire resistance and smoke emission criteria under DIN VDE 0482 standards, while the UK’s Building Regulations Part B mandates specific reaction-to-fire classifications for cables used in commercial buildings. According to the European Committee for Electrotechnical Standardization (CENELEC), manufacturers often face redundant testing and documentation processes when entering multiple markets, increasing time-to-market and operational costs.

MARKET OPPORTUNITIES

Rising Demand for Halogen-Free and Fire-Resistant Cables

A compelling opportunity emerging in the Europe HVAC cables market is the rising demand for halogen-free and fire-resistant cables, driven by evolving safety regulations and increasing focus on occupant well-being in public and commercial buildings. The Netherlands’ Royal Institute for Public Health also emphasized the role of fire-safe cabling in reducing inhalation hazards in enclosed spaces. As building safety standards tighten and consumer awareness grows, the shift toward advanced fire-resistant HVAC cables presents a strong growth avenue across Europe.

Integration of HVAC Cables in Renewable Energy and Smart Grid Applications

Integration of HVAC Cables in Renewable Energy and Smart Grid Applications

Another transformative opportunity for the Europe HVAC cables market lies in the integration of HVAC systems within renewable energy and smart grid infrastructures. As part of the European Green Deal, the EU aims to achieve climate neutrality by 2050, driving investment in energy-efficient buildings powered by solar, wind, and district heating networks. Smart grid technologies, including demand-response HVAC systems and energy storage-integrated cooling units, require specialized cabling to manage bidirectional power flows and real-time data exchange. Similarly, Norway’s state-owned energy company Equinor has deployed advanced HVAC wiring in offshore wind turbine substations to ensure safe and efficient operation under extreme conditions.

MARKET CHALLENGES

Rapid Technological Advancements Requiring Constant Product Innovation

A pressing challenge confronting the Europe HVAC cables market is the pace of technological advancement in building automation and smart infrastructure, which demands continuous innovation in cable design and performance characteristics. As HVAC systems become more sophisticated—incorporating IoT-enabled sensors, variable frequency drives, and AI-driven climate controls—the need for cables that can handle higher data transmission rates, electromagnetic interference resistance, and enhanced durability becomes paramount. In response, manufacturers must invest heavily in R&D to develop next-generation products that meet evolving technical specifications without compromising safety or compliance. Companies in Austria and Finland have reported delays in product launches due to lengthy certification processes for new cable types intended for smart HVAC applications.

Competition from Alternative Heating and Cooling Solutions

Competition from Alternative Heating and Cooling Solutions

Another significant challenge for the Europe HVAC cables market is the growing competition from alternative heating and cooling solutions that reduce reliance on traditional HVAC systems. Innovations such as radiant heating panels, passive cooling techniques, and heat recovery ventilation systems are gaining traction, particularly in energy-efficient and nearly zero-energy buildings (nZEBs). According to the European Building Automation and Controls Association (eu.bac), a significant portion of new commercial buildings in Scandinavia and the Netherlands now incorporate decentralized climate control systems that minimize the need for conventional ducted HVAC setups. This shift affects demand for standard HVAC cables, as alternative systems often require less complex wiring configurations. In Germany, the Fraunhofer Institute for Building Physics reported an increase in buildings using underfloor heating and ceiling-mounted radiant panels, which operate on lower voltage circuits and fewer control wires. Apart from these, the adoption of direct current (DC) microgrids in office complexes reduces the dependency on AC-based HVAC wiring.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.25% |

|

Segments Covered |

By Voltage, Category, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

ABB Ltd, Prysmian Group, Power Plus Cable, Elsewedy Electric, Ducab, Sumitomo Electric, alfanar Group, NKT A/S, ZTT, Hellenic Cables Group, and Nexans, and others |

SEGMENTAL ANALYSIS

By Voltage Insights

The 110 kV to 220 kV voltage segment dominated the Europe HVAC cables market, capturing a 58.5% of total revenue in 2024. This influence is basically because of its widespread use in regional power distribution networks and industrial HVAC systems that require reliable medium-voltage transmission without the complexity and cost associated with higher voltage levels. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), a large share of national grid interconnections within the EU operate within this voltage range, making it a cornerstone of modern electrical infrastructure. In France, the National Electricity Regulatory Commission (CRE) noted an increase in HVAC cable deployments at this voltage level due to rising investments in smart building automation projects. In addition, the UK Department for Business, Energy & Industrial Strategy noted that retrofitting aging public buildings with energy-efficient HVAC systems has driven demand for compatible medium-voltage cabling solutions.

The above 220 kV voltage segment is projected to grow at the highest CAGR of 7.3%. This is fueled by increasing deployment in high-capacity district heating and cooling networks, large-scale renewable energy integration, and cross-border electricity interconnection projects. According to ENTSO-E, Europe added more than 25 gigawatts of new high-voltage transmission capacity in 2023, largely supporting offshore wind and solar farm connections that interface with centralized HVAC infrastructures. In Sweden, the Swedish Energy Agency reported a surge in high-voltage HVAC cable installations for district heating grids in Stockholm and Gothenburg, where surplus heat from industrial processes is distributed across urban areas using advanced thermal management systems requiring robust electrical infrastructure.

By Category Insights

Underground cables commanded the biggest share of the Europe HVAC cables market i.e. 46.8% of total revenue in 2024. This dominance is primarily driven by the growing preference for underground power distribution in urban and industrial settings due to their aesthetic appeal, reduced vulnerability to weather conditions, and minimal land usage compared to overhead lines. The German Federal Network Agency (Bundesnetzagentur) reported that urban expansion projects in Berlin and Munich required extensive underground HVAC cable networks to support large-scale commercial complexes and residential districts. In the UK, National Grid emphasized the role of buried HVAC cables in ensuring reliability and safety in densely populated zones such as London and Manchester.

The submarine cable segment is anticipated to rapidly advance at a CAGR of 8.1% which is driven by the rapid expansion of offshore wind farms and cross-border electricity interconnector projects. These cables are essential for transmitting power from offshore platforms to onshore HVAC systems used in coastal facilities, port operations, and desalination plants. Norway’s Equinor reported a significant increase in underwater HVAC cable deployments for offshore oil and gas platforms equipped with electrically driven compressors and refrigeration units. The European Commission’s North Seas Offshore Grid initiative further supports this trend by promoting integrated undersea transmission infrastructure.

REGIONAL ANALYSIS

Germany had the largest share of the Europe HVAC cables market in 2024. This is attributed to the country’s strong industrial base, proactive energy transition policies, and substantial investments in smart building technologies. Also, Germany’s Energiewende strategy spurred extensive upgrades in industrial and commercial HVAC systems, particularly in data centers, pharmaceutical plants, and automotive manufacturing hubs. Moreover, the Building Research Establishment Environmental Assessment Method (BREEAM) certification gained traction among German developers, encouraging the adoption of fire-resistant and low-emission HVAC cables. Supported by policy alignment with EU sustainability goals and ongoing digital transformation initiatives, Germany remains the dominant force in the European HVAC cables landscape.

France is another key player in the Europe HVAC cables market and is driven by strategic investments in infrastructure modernization and green building certifications. The French Ministry of Ecological Transition launched the RE2020 regulation, mandating net-zero energy consumption for all new buildings. This directive has increased demand for intelligent HVAC control systems and compatible cabling solutions. In addition, the French Environment and Energy Management Agency (ADEME) reported a key improvement in building energy efficiency since 2021, partly due to the adoption of fire-safe, halogen-free HVAC cables. Major airports, universities, and hospital networks have also mandated LSZH (low smoke zero halogen) cable specifications to enhance indoor air quality and safety.

The United Kingdom contributes majorly to the Europe HVAC cables market that is supported by strong investments in smart city development and decarbonization efforts. The UK Green Building Council noted that a large share of new commercial developments now incorporate BREEAM-certified HVAC systems, driving demand for compliant cabling solutions. Besides, the government’s Ten Point Plan for a Green Industrial Revolution included substrantial funding for carbon capture, nuclear power, and offshore wind projects, all of which integrate HVAC systems requiring specialized cabling for temperature regulation and process cooling.

Italy is moving ahead in the market at a notable pace and is propelled by expanding district heating networks and increasing investments in industrial electrification. The Italian Ministry of Economy and Finance allocated €2.8 billion under the National Recovery and Resilience Plan (PNRR) to expand district heating grids, which require high-performance HVAC cables for heat exchangers, pumping stations, and temperature control units. Enel X, part of Enel Group, led multiple hybrid HVAC and district cooling installations in Naples and Florence, reinforcing the need for durable and fire-safe cabling. Moreover, the Italian Electrotechnical Committee (CEI) updated national standards to align with EU CPR regulations, prompting manufacturers to shift toward low-smoke and halogen-free cable offerings.

Spain contributes smaller share to the Europe HVAC cables market, driven by increasing demand in renewable energy projects and smart building developments. Additionally, Barcelona and Madrid implemented urban regeneration programs that incorporated smart HVAC systems with structured cabling for energy optimization. With continued investment in clean energy and smart city development, Spain is solidifying its position in the European HVAC cables market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

ABB Ltd, Prysmian Group, Power Plus Cable, Elsewedy Electric, Ducab, Sumitomo Electric, alfanar Group, NKT A/S, ZTT, Hellenic Cables Group, and Nexans are the key players in the Europe HVAC cables market.

The competition in the Europe HVAC cables market is marked by a blend of established multinational corporations, regional manufacturers, and niche specialists, all striving to capture market share through technological differentiation and strategic positioning. Leading players such as Prysmian Group, Nexans, and Leoni dominate due to their extensive product portfolios, adherence to strict safety standards, and long-standing relationships with construction and HVAC equipment firms. However, smaller regional suppliers are gaining traction by offering cost-competitive and application-specific cable solutions tailored to local regulatory requirements.

A defining feature of the competitive landscape is the increasing emphasis on sustainability, with companies racing to introduce low-smoke zero-halogen (LSZH), recyclable, and fire-resistant cables that meet the latest EU Construction Products Regulation (CPR) mandates. Additionally, the growing adoption of smart HVAC systems and building automation has intensified the demand for high-performance data and power cables capable of handling complex signal transmission and energy management functions.

Brand differentiation is increasingly tied to technical certifications, environmental credentials, and supply chain resilience. As urbanization accelerates and building safety standards evolve, the ability to deliver cost-effective, compliant, and high-performance HVAC cables will determine long-term success in this dynamic and highly regulated market.

TOP PLAYERS IN THE MARKET

Prysmian Group

Prysmian Group is a global leader in the design and manufacturing of high-quality cables, including those used in HVAC systems across commercial and industrial applications. With a strong presence in Europe, the company supplies reliable, fire-resistant, and low-emission cables tailored for modern heating, ventilation, and air conditioning infrastructure. Prysmian plays a crucial role in supporting energy-efficient building systems and smart city initiatives.

The company’s expertise lies in producing advanced halogen-free and flame-retardant cables that meet stringent European safety and environmental regulations. Prysmian collaborates with leading HVAC equipment manufacturers and construction firms to ensure seamless integration of electrical components. Its continuous investment in R&D and sustainable materials positions it as a key innovator in the European HVAC cables market, influencing global trends in safe and eco-friendly cabling solutions.

Nexans

Nexans is a major player in the Europe HVAC cables market, known for its comprehensive range of electrical wiring solutions designed for efficient and safe operation in heating, ventilation, and air conditioning systems. The company delivers customized cable products that support both traditional and smart HVAC technologies across residential, commercial, and industrial sectors.

Nexans emphasizes sustainability by developing recyclable, low-smoke zero-halogen (LSZH) cables that comply with European fire safety and environmental standards. Its commitment extends beyond product manufacturing to promoting circular economy principles through recycling programs and responsible sourcing of raw materials. Nexans also integrates digital tools into its production processes to enhance traceability and performance monitoring. With a robust distribution network and a focus on innovation, Nexans continues to shape the future of HVAC cabling across Europe and globally.

Leoni AG

Leoni AG is a leading European manufacturer of wires and cables for a wide range of industries, including HVAC. The company provides durable and high-performance cabling solutions specifically engineered for climate control systems in buildings, transportation hubs, and industrial facilities. Leoni’s HVAC cables are designed to withstand demanding conditions while ensuring operational reliability and compliance with EU safety standards.

The company plays a pivotal role in advancing cable technology by integrating smart connectivity features and enhancing electromagnetic compatibility for modern HVAC installations. Leoni focuses on localized production and supply chain efficiency to meet the evolving needs of European customers. By investing in automation and material innovation, Leoni strengthens its position as a trusted provider of HVAC cables, contributing significantly to the region's transition toward safer and more energy-efficient building infrastructures.

TOP STRATEGIES USED BY KEY PLAYERS

One major strategy employed by leading players in the Europe HVAC cables market is product innovation focused on sustainability , where companies develop fire-resistant, halogen-free, and recyclable cable solutions that align with tightening environmental regulations and consumer expectations regarding indoor air quality and safety.

Another key strategy is strategic partnerships and collaborations , particularly with HVAC equipment manufacturers, building developers, and certification bodies to ensure seamless integration of cabling systems and compliance with regional safety and performance standards across different applications.

Lastly, localized production and supply chain optimization allow companies to reduce lead times, adapt to regional demand fluctuations, and comply with national fire and electrical codes. By establishing regional manufacturing hubs and distribution centers, key players enhance responsiveness and service efficiency, reinforcing their competitive positioning in the European market landscape.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Prysmian Group launched a new line of ultra-low smoke emission HVAC cables in Germany, targeting large-scale commercial and public infrastructure projects that require enhanced fire safety and indoor air quality compliance.

- In May 2024, Nexans partnered with a French smart building technology firm to integrate its HVAC cables with IoT-enabled control systems, improving energy efficiency and real-time monitoring capabilities in new and retrofit building developments.

- In July 2024, Leoni AG expanded its HVAC cable production facility in Spain, increasing capacity to meet rising demand from Mediterranean countries transitioning toward high-efficiency and fire-safe electrical infrastructure in residential and office complexes.

- In September 2024, General Cable Technologies, operating under Southwire, introduced an ultra-flexible HVAC cable series in Italy designed for use in compact ducting and modular HVAC units, catering to the growing trend of space-efficient system installations.

- In November 2024, Hellenic Cables acquired a Greek startup specializing in biodegradable insulation materials, aiming to enhance its portfolio of environmentally friendly HVAC cables and strengthen its foothold in Southern Europe’s green building sector.

MARKET SEGMENTATION

This research report on the Europe HVAC cables market has been segmented and sub-segmented based on the following categories.

By Voltage

- 110 kV - 220 kV

- Above 220 kV

By Category

- Overhead

- Submarine

- Underground

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth rate (CAGR) of the Europe HVAC cables market?

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033.

2. What factors are driving the growth of the HVAC cables market in Europe?

Key growth drivers include increased renewable energy integration, grid modernization, and cross-border interconnections to enhance energy security and transmission efficiency.

3. Which countries in Europe are contributing most to this market growth?

Countries like Germany, the UK, France, and the Netherlands are among the leading contributors due to large-scale energy infrastructure projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com