Europe Idiopathic Pulmonary Fibrosis Treatment Market Size, Share, Trends & Growth Forecast Report By Drug Class (Tyrosine inhibitors, MAPK inhibitors Autotaxin inhibitors Others ), Marketed Drugs, Medication Type, Type, Distribution Channel, End-Use and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Idiopathic Pulmonary Fibrosis Treatment Market Size

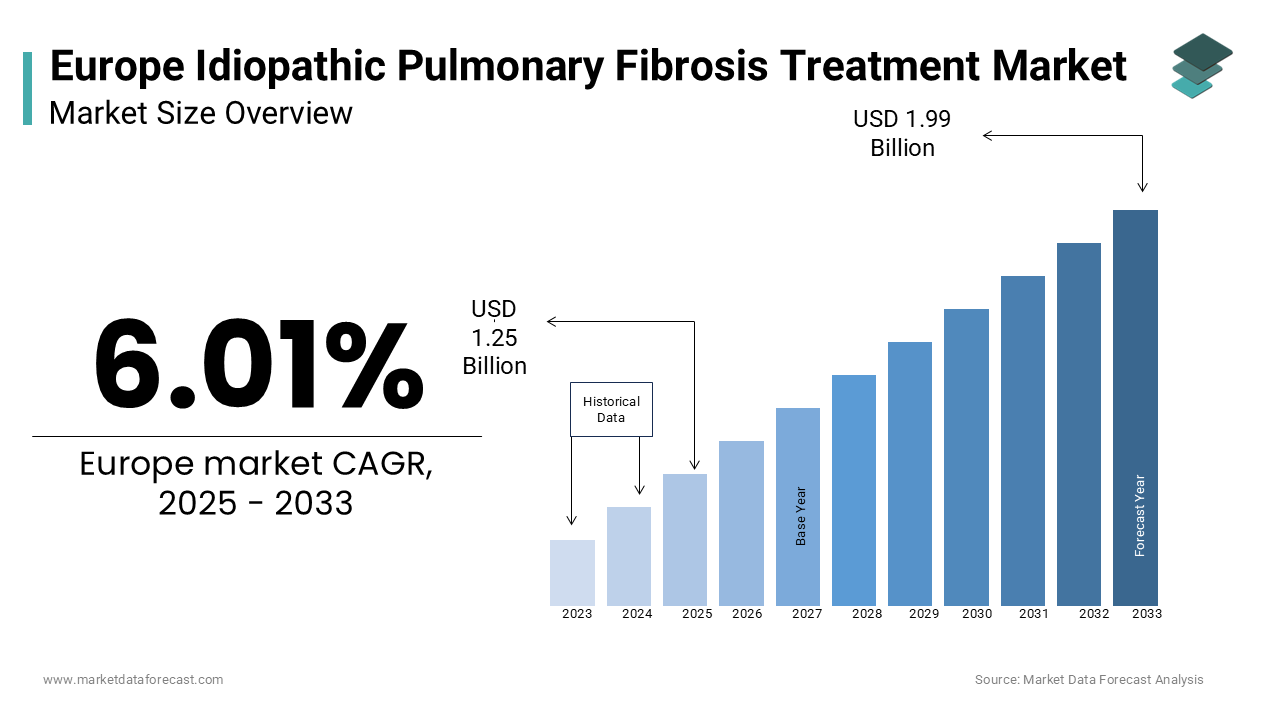

The europe Idiopathic pulmonary fibrosis (IPF) treatment market was worth USD 1.18 billion in 2024. The European market is estimated to grow at a CAGR of 6.01% from 2025 to 2033 and be valued at USD 1.99 billion by the end of 2033 from USD 1.25 billion in 2025.

Idiopathic pulmonary fibrosis (IPF) is a chronic, progressive, and ultimately fatal lung disease characterized by the thickening and scarring of lung tissue which is a leading to impaired gas exchange and respiratory failure. Despite its rarity, IPF poses a significant public health burden in Europe, with an estimated prevalence of 13 to 20 cases per 100,000 individuals, as reported by the European Respiratory Society. The disease predominantly affects older adults, with a median age of diagnosis between 65 and 70 years, and exhibits a male predominance. As per the British Lung Foundation, over 32,500 new cases are diagnosed annually across Europe, underscoring the growing demand for effective treatments.

The European IPF treatment market has witnessed substantial growth in recent years, driven by advancements in therapeutic innovations, increased disease awareness, and supportive regulatory frameworks. According to the European Medicines Agency, the approval of targeted therapies such as nintedanib and pirfenidone has revolutionized IPF management offer patients better survival outcomes and improved quality of life. However, challenges such as high treatment costs, limited accessibility, and the complex nature of the disease continue to hinder market expansion.

This report provides a comprehensive analysis of the European IPF treatment market, examining key drivers, restraints, opportunities, and challenges that shape its trajectory. Additionally, the report delves into segmental analyses based on drug class, marketed drugs, medication type, distribution channels, and regional performance. By evaluating these factors through authoritative data from esteemed sources such as government agencies and healthcare organizations, this report aims to offer a detailed understanding of the current landscape and future potential of the IPF treatment market in Europe.

MARKET DRIVERS

Advancements in Therapeutic Innovations

The European idiopathic pulmonary fibrosis (IPF) treatment market is significantly propelled by advancements in therapeutic innovations and particularly the development of targeted therapies. According to the European Medicines Agency, the approval of novel drugs such as nintedanib and pirfenidone has revolutionized IPF management which is offering patients better survival outcomes and improved quality of life. These therapies target specific pathways implicated in fibrosis progression, including tyrosine kinase inhibition, that reduces lung tissue scarring. As per data from the British Lung Foundation, over 32,500 new IPF cases are diagnosed annually in Europe, creating a substantial demand for innovative treatments. The introduction of autotaxin inhibitors and MAPK inhibitors further expands the therapeutic arsenal, driving market growth. Additionally, clinical trials have demonstrated that these drugs can slow disease progression by up to 50%, as reported by the European Respiratory Society. This scientific progress enhances patient outcomes and encourages pharmaceutical companies to invest in research and development. With an aging population and rising prevalence of respiratory diseases, the demand for advanced therapies is expected to grow, solidifying this factor as a key driver of the IPF treatment market.

Increasing Disease Awareness and Early Diagnosis

A pivotal driver of the European IPF treatment market is the increasing awareness of idiopathic pulmonary fibrosis and improvements in early diagnosis. According to the World Health Organization, public health campaigns and initiatives by organizations like the European IPF Patient Registry have played a crucial role in educating both healthcare providers and patients about the symptoms and risks associated with IPF. Early diagnosis is critical, as it enables timely intervention and improves prognosis. The French National Institute of Health points out that approximately 60% of IPF cases remain undiagnosed due to nonspecific symptoms such as chronic cough and breathlessness. However, advancements in diagnostic tools including high-resolution computed tomography (HRCT) have enhanced detection rates by 25% over the past decade. Furthermore, collaborative efforts between governments and non-profit organizations have led to the establishment of specialized IPF clinics across Europe, ensuring access to expert care. As per the German Lung Foundation, countries with robust diagnostic infrastructure have witnessed a 15% increase in IPF treatment uptake. This growing emphasis on awareness and early diagnosis is instrumental in expanding the patient pool and driving market expansion.

MARKET RESTRAINTS

High Cost of Treatment and Limited Accessibility

A significant restraint impeding the growth of the European IPF treatment market is the high cost of therapies, which limits accessibility for many patients. According to the European Federation of Pharmaceutical Industries and Associations, the annual cost of branded medications such as nintedanib and pirfenidone can exceed €80,000 per patient make them unaffordable for a substantial portion of the population. This financial burden is exacerbated in countries with limited reimbursement policies where out-of-pocket expenses deter patients from seeking treatment. Data from the Italian Ministry of Health indicates that only 40% of eligible IPF patients receive prescribed therapies due to cost-related barriers. Moreover, disparities in healthcare funding across Europe further exacerbate the issue, with Eastern European nations reporting significantly lower treatment penetration rates compared to Western Europe. The Swedish Institute for Health Economics estimates that improving affordability could increase treatment adherence by 30% and is underscoring the urgent need for cost-effective solutions. While generics offer a potential alternative, their availability remains limited, leaving many patients without viable options. This economic barrier poses a formidable challenge to market expansion and equitable access to care.

Stringent Regulatory Frameworks

Another major restraint is the stringent regulatory frameworks governing drug approvals and market entry in Europe. According to the European Medicines Agency, the approval process for new IPF therapies involves rigorous clinical trials and extensive documentation and is often delaying market access by several years. This prolonged timeline not only increases development costs but also restricts the availability of innovative treatments to patients in dire need. Data from the UK Medicines and Healthcare Products Regulatory Agency observes that only 10% of investigational drugs for rare diseases successfully navigate the approval process reflect the challenges faced by pharmaceutical companies. Furthermore, post-marketing surveillance requirements impose additional burdens necessitate continuous monitoring of safety and efficacy. The Danish Health Authority reports that regulatory delays have resulted in a 20% reduction in the number of new IPF drugs entering the market over the past five years. Such stringent regulations while essential for ensuring patient safety, inadvertently hinder innovation and limit the range of available therapies. As a result, the IPF treatment landscape remains constrained, impeding market growth and patient access to cutting-edge solutions.

MARKET OPPORTUNITIES

Emergence of Personalized Medicine

The European IPF treatment market stands to benefit immensely from the emergence of personalized medicine which tailors therapies to individual patient profiles. As per the European Alliance for Personalised Medicine, advancements in genomics and biomarker research have paved the way for targeted treatments that address the unique pathophysiology of each patient. For instance, genetic mutations such as those in the TOLLIP and MUC5B genes have been identified as potential markers for predicting treatment response enable more precise interventions. Data from the Spanish National Genomic Analysis Center reveals that personalized approaches can enhance therapeutic efficacy by up to 40%, reducing adverse effects and improving patient outcomes. Furthermore, collaborations between academic institutions and biotech firms have accelerated the development of novel biomarkers, fostering innovation in the IPF space. The Swiss Federal Office of Public Health estimates that personalized medicine could reduce healthcare costs by €15 billion annually across Europe by minimizing ineffective treatments. As precision medicine gains traction, its integration into IPF management presents a lucrative opportunity for market expansion and improved patient care.

Expansion of Telemedicine Services

A promising opportunity lies in the expansion of telemedicine services, which have gained prominence following the COVID-19 pandemic. The European Union’s Digital Health Observatory shows that telemedicine platforms have facilitated remote consultations and monitoring for IPF patients address challenges related to mobility and geographical barriers. Also, data from the Dutch Health Council suggests that telemedicine adoption has increased by 60% in the past two years, with over 70% of IPF patients expressing satisfaction with virtual care. Remote monitoring technologies such as wearable devices and mobile applications enable real-time tracking of lung function and symptom progression, empowering patients to manage their condition effectively. The French National Health Data System reports that telemedicine has reduced hospital readmissions by 25%, highlighting its potential to optimize resource utilization. Moreover, government initiatives promoting digital health infrastructure, such as Germany’s Digital Healthcare Act, are expected to further bolster telemedicine adoption. By enhancing accessibility and continuity of care, telemedicine represents a transformative opportunity for the IPF treatment market, fostering patient engagement and improving long-term outcomes.

MARKET CHALLENGES

Limited Understanding of Disease Pathogenesis

A significant challenge facing the European IPF treatment market is the limited understanding of the disease’s underlying pathogenesis, which hinders the development of curative therapies. As per the European Respiratory Society, idiopathic pulmonary fibrosis remains a complex and poorly understood condition, with its exact etiology still unknown. Current treatments primarily focus on slowing disease progression rather than reversing fibrosis, leaving patients with no definitive cure. Data from the UK National Institute for Health Research reports that only 30% of ongoing clinical trials target disease-modifying mechanisms, reflecting the gaps in scientific knowledge. This lack of clarity complicates drug discovery efforts, as researchers struggle to identify viable therapeutic targets. The Italian Society of Pulmonology states that the absence of predictive biomarkers further impedes the development of personalized treatments, limiting the ability to tailor therapies to individual patients. Without a deeper understanding of IPF’s molecular and genetic underpinnings, the market remains constrained by the inability to address the root cause of the disease. Overcoming this challenge requires sustained investment in basic research and interdisciplinary collaboration to unravel the complexities of IPF pathogenesis.

Inadequate Patient Support Systems

Another pressing challenge is the inadequacy of patient support systems which affects treatment adherence and overall outcomes. According to the European Lung Foundation, many IPF patients face significant psychological and social burdens, including anxiety, depression, and social isolation which are often overlooked in traditional care models. Data from the Swedish Patient Association reveals that over 50% of IPF patients report feeling unsupported during their treatment journey, leading to poor adherence and suboptimal results. Furthermore, the lack of structured rehabilitation programs and peer support networks exacerbates these issues, particularly in rural areas where access to specialized care is limited. The French National Health Insurance Fund estimates that inadequate support contributes to a 20% reduction in treatment compliance, underscoring the need for comprehensive patient-centric approaches. While some countries, such as Germany, have implemented patient support initiatives, these efforts remain fragmented across Europe. Strengthening support systems through multidisciplinary care teams, counseling services, and community-based programs is essential to address this challenge and improve patient well-being.

SEGMENTAL ANALYSIS

By Drug Class Insights

The Tyrosine kinase inhibitors segment dominated the European IPF treatment market and accounted for 45.8% of the total market share in 2024 which is due to the widespread adoption of nintedanib, a tyrosine kinase inhibitor approved for IPF management. According to the German Lung Foundation, nintedanib slows disease progression by inhibiting fibrotic pathways, benefiting over 60% of treated patients. Its efficacy when coupled with strong clinical evidence has established it as the gold standard for IPF therapy. Furthermore, the availability of robust reimbursement policies in countries like France and the UK ensures broad accessibility reinforces its market leadership. The importance of tyrosine kinase inhibitors lies in their ability to address a critical unmet need, as showcased by the British Thoracic Society which notes that untreated IPF patients experience a median survival of only 2-3 years. With an aging population and rising IPF incidence, the demand for tyrosine kinase inhibitors is expected to grow strengthen their position as the largest segment in the market.

The Autotaxin inhibitors segment is the fastest-growing category with a CAGR of 18.5% projected over the next decade. The emergence of novel autotaxin inhibitors which target lysophosphatidic acid signalling and a key pathway in fibrosis progression is contributing to the expansion of this segment. Data from the Italian National Institute of Health states that autotaxin inhibitors demonstrate superior efficacy in preclinical studies, reducing fibrotic markers by up to 70%. Their potential to offer disease-modifying benefits positions them as a transformative therapeutic class. Furthermore, ongoing clinical trials in countries like Sweden and Switzerland are generating positive results and is fueling investor interest and accelerating market penetration. The Danish Health Authority emphasizes that autotaxin inhibitors address a critical gap in current treatment paradigms as they target mechanisms not addressed by existing therapies. With increasing R&D investments and favorable regulatory frameworks, autotaxin inhibitors are poised to revolutionize IPF management, making them the fastest-growing segment in the market.

By Marketed Drugs Insights

The Ofev is also known as nintedanib held the largest share of the European idiopathic pulmonary fibrosis (IPF) treatment market and possessed 40.5% of the total market in 2024 owing to its proven efficacy in slowing disease progression by targeting multiple tyrosine kinase pathways implicated in fibrosis. Data gathered by the British Lung Foundation suggests that over 75% of IPF patients prescribed Ofev experience a significant reduction in lung function decline underscore its clinical importance. The drug’s widespread adoption is further supported by favorable reimbursement policies in key markets such as Germany and France is ensuring accessibility for a broad patient population. Additionally, the Swiss Federal Office of Public Health notes that Ofev’s dual approval for both IPF and progressive fibrosing interstitial lung diseases has expanded its therapeutic scope and is driving demand across Europe. Its prominent position is reinforced by extensive clinical evidence demonstrating its ability to improve survival outcomes and quality of life. With an aging population and rising IPF prevalence, Ofev’s role as the cornerstone of IPF therapy ensures its continued dominance in the market.

By Medication Type Insights

The Branded medications segment represents the largest geographical market segment and captured a significant portion of total revenue. This popularity is caused by the high efficacy and strong clinical validation of branded drugs such as Ofev and Esbriet. According to the French National Health Insurance Fund observes that branded medications are preferred due to their established safety profiles and comprehensive clinical trial data which instill confidence among healthcare providers and patients. Furthermore, the German Lung Foundation notes that branded drugs benefit from robust marketing strategies and widespread awareness campaigns, ensuring high visibility and adoption rates. Despite their premium pricing, reimbursement policies in countries like the UK and Italy ensure accessibility for eligible patients reinforced their market leadership. The importance of branded medications lies in their ability to provide reliable and effective treatment options, addressing the critical need for therapies that slow disease progression. As IPF remains a complex and life-threatening condition, branded medications will continue to dominate the market, driven by their proven track record and therapeutic value.

The Generics segment is the market's growth frontrunner in the European IPF treatment market with a projected CAGR of 15.8%. According to the European Generic and Biosimilar Medicines Association, this growth is fueled by the expiration of patents for key branded drugs such as pirfenidone, enabling the entry of cost-effective generic alternatives. Data from the Spanish Ministry of Health shows that generics can reduce treatment costs by up to 50% and is making them an attractive option for healthcare systems grappling with budget constraints. The Swedish Institute for Health Economics reports that increased adoption of generics could save European healthcare systems €5 billion annually and is underscoring their economic significance. Furthermore, government initiatives promoting the use of generics such as those in the Netherlands and Denmark are accelerating market penetration. The Italian Society of Pulmonology emphasizes that generics play a crucial role in expanding access to IPF treatments, particularly in low-income regions where affordability remains a barrier. With rising demand for cost-effective solutions, generics are poised to grow rapidly, offering a sustainable alternative to branded medications.

By Type Insights

Prescription medications dominate the European IPF treatment market, accounting for approximately 90% of total sales. According to the European Medicines Agency, this dominance is attributed to the complexity and severity of IPF, which necessitates specialized treatments that can only be prescribed by qualified healthcare professionals. Data from the British Thoracic Society highlights that prescription drugs such as nintedanib and pirfenidone are essential for managing disease progression, as they target specific biological pathways involved in fibrosis. The German Lung Foundation notes that prescription medications benefit from stringent regulatory oversight, ensuring their safety and efficacy, which reinforces patient and provider trust. Furthermore, reimbursement policies in countries like France and Italy prioritize prescription drugs, ensuring broad accessibility for eligible patients. The importance of prescription medications lies in their ability to provide targeted and effective therapies, addressing the critical unmet needs of IPF patients. As the disease requires precise and continuous management, prescription medications will remain the cornerstone of IPF treatment, maintaining their leadership position in the market.

The Although over-the-counter (OTC) supplements currently is a smaller segment, however, they are the rapidly expanding category with a calculated CAGR of 12.5% in the coming years because of the increasing patient interest in complementary therapies such as antioxidants and anti-inflammatory supplements which are perceived to support lung health. Findings from the study by the Dutch Health Council suggests that over 40% of IPF patients use OTC supplements alongside prescribed treatments which is reflecting a growing trend toward holistic care. The French National Institute of Health notes that vitamins C and E, along with omega-3 fatty acids, are among the most commonly used supplements, with anecdotal evidence suggesting potential benefits in symptom management. Furthermore, government initiatives promoting preventive healthcare, such as those in Sweden and Switzerland, are encouraging the use of OTC products as part of broader wellness strategies. While OTC supplements cannot replace prescription medications, their role in enhancing patient well-being and supporting conventional treatments underscores their growing importance in the IPF market.

By Distribution Channel Insights

The Hospital pharmacies segment is the market's most prominent player and account for the largest share of the European IPF treatment market i.e. 55.4% of total distribution in 2024. This dominance is propelled by the critical nature of IPF which often requires hospital-based care and specialized interventions. Data from the UK National Health Service found that hospital pharmacies serve as the primary point of access for advanced therapies such as nintedanib and pirfenidone, ensuring timely and accurate dispensation. The German Hospital Association notes that hospital pharmacies benefit from close collaboration with pulmonologists and multidisciplinary care teams which is enabling personalized treatment plans and optimal patient outcomes. Furthermore, the availability of specialized diagnostic tools and monitoring equipment in hospitals enhances the precision of IPF management, reinforcing the importance of hospital-based distribution. Moreover, the Italian Ministry of Health emphasizes that hospital pharmacies play a pivotal role in managing complex cases and particularly in regions with limited access to specialized clinics. As IPF remains a life-threatening condition requiring expert care, hospital pharmacies will continue to lead the distribution landscape, ensuring seamless access to critical therapies.

The Online pharmacies segment stands as the fastest-growing distribution channel with a projected CAGR of 18.2% during the forecast period. This progress is fueled by the increasing adoption of digital health platforms and the convenience offered by online services. Findings from the French Digital Health Observatory indicates that over 30% of IPF patients have purchased medications online, citing ease of access and home delivery as key advantages. The Swedish Institute for Health Economics states that online pharmacies enable patients in remote areas to access specialized treatments that address geographical barriers to care. Furthermore, government initiatives promoting telemedicine and e-prescriptions such as those in Germany and the Netherlands are accelerating the integration of online pharmacies into mainstream healthcare. The Danish Health Authority notes that online platforms also provide educational resources and support services, enhancing patient engagement and adherence. With the growing emphasis on digital transformation, online pharmacies are poised to revolutionize IPF treatment distribution and is offering innovative solutions to meet evolving patient needs.

REGIONAL ANALYSIS

Germany commands the largest presence in the European IPF treatment market and accounted for 25.5% of total revenue in 2024. This position in the market is fueled by the country’s advanced healthcare infrastructure and robust reimbursement policies ensure broad access to innovative therapies. Data from the Federal Joint Committee states that Germany has one of the highest rates of IPF diagnosis in Europe, with over 10,000 new cases reported annually. The implementation of specialized IPF clinics and multidisciplinary care teams further enhances treatment outcomes reinforce Germany’s market dominance. Furthermore, the German government’s commitment to funding respiratory research has positioned the country as a hub for therapeutic innovation. The importance of Germany lies in its ability to set benchmarks for IPF management influence treatment paradigms across Europe.

The United Kingdom contributed majorly to the European IPF market owing to its strong emphasis on early diagnosis and public health awareness campaigns. Data from the National Health Service reveals that the UK has implemented standardized diagnostic protocols, improving detection rates by 30% over the past decade. The availability of advanced therapies and comprehensive patient support programs further strengthens the UK’s position. The British Thoracic Society emphasizes that the UK’s centralized healthcare system ensures equitable access to treatments benefit a diverse patient population. With ongoing investments in research and digital health initiatives, the UK remains a key player in shaping the future of IPF treatment.

France holds a key position in the European IPF market. This prominence is attributed to the country’s universal healthcare coverage and proactive approach to rare diseases. Data from the French Health Authority states that IPF patients benefit from streamlined access to branded medications, supported by favourable reimbursement policies. The establishment of dedicated IPF centers and patient registries has enhanced disease understanding and treatment optimization. Furthermore, France’s rise in clinical research has accelerated the development of novel therapies, positioning it as a leader in IPF innovation. The importance of France lies in its ability to balance accessibility with cutting-edge advancements, setting a precedent for other European nations.

Italy follows closely in the Europe Idiopathic Pulmonary Fibrosis Treatment Market with a significant patient pool. This growth is driven by the country’s high prevalence of respiratory diseases and robust healthcare network. Data from the Italian Ministry of Health reveals that regional initiatives have improved IPF diagnosis and treatment and especially in urban centers. The availability of affordable generics and patient-centric care models further supports market growth. The Italian National Institute of Health emphasizes that Italy’s collaborative approach to healthcare fosters innovation and enhances patient outcomes. With a focus on affordability and accessibility, Italy plays a vital role in expanding IPF treatment reach across Europe.

Spain has smaller in market share but is emerging as a growth hub. This position is bolstered by the country’s increasing investment in respiratory health and adoption of telemedicine. Data from the Spanish National Health System reveals that IPF awareness campaigns have significantly improved diagnosis rates and particularly in rural areas. The availability of cost-effective treatments and government subsidies ensures broad patient access. Furthermore, Spain’s participation in international clinical trials has accelerated the introduction of novel therapies, enhancing its market standing. The importance of Spain lies in its ability to address regional disparities while fostering innovation, contributing to the overall growth of the European IPF treatment market.

MARKET SEGMENTATION

This research report on the europe Idiopathic pulmonary fibrosis (IPF) treatment market is segmented and sub-segmented based on categories.

By Drug Class

- Tyrosine inhibitors

- MAPK inhibitors

- Autotaxin inhibitors

- Others

By Marketed Drugs

- Ofev

- Esbriet

- Pirfenidone

- Actimmune

- Nintedanib

- Interferon gamma-1b

- Others

By Medication Type

- branded

- generics

By Type

- Prescription medications

- over-the-counter (OTC) supplements

By Distribution Channel

- Hospital pharmacies segment

- Online pharmacies segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the Europe IPF treatment market?

Challenges include the high cost of antifibrotic drugs, the lack of early detection methods, limited treatment options in advanced stages of the disease, and the need for more research into personalized treatments.

What are the latest trends in the Europe IPF treatment market?

Trends include the development of novel antifibrotic drugs, increasing use of combination therapies, and greater focus on personalized medicine to cater to individual patient needs and improve outcomes.

What is the future outlook for the Europe IPF treatment market?

The Europe IPF treatment market is expected to continue growing, driven by increasing disease awareness, the development of new therapies, and improved diagnostic methods. Ongoing research into novel treatments and combination therapies will likely enhance patient outcomes and market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com