Europe Inactive Dry Yeast Market Size, Share, Trends, & Growth Forecast Report by Type (Live Yeast, Inactive Yeast ), Form, Animal Type, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Inactive Dry Yeast Market Size

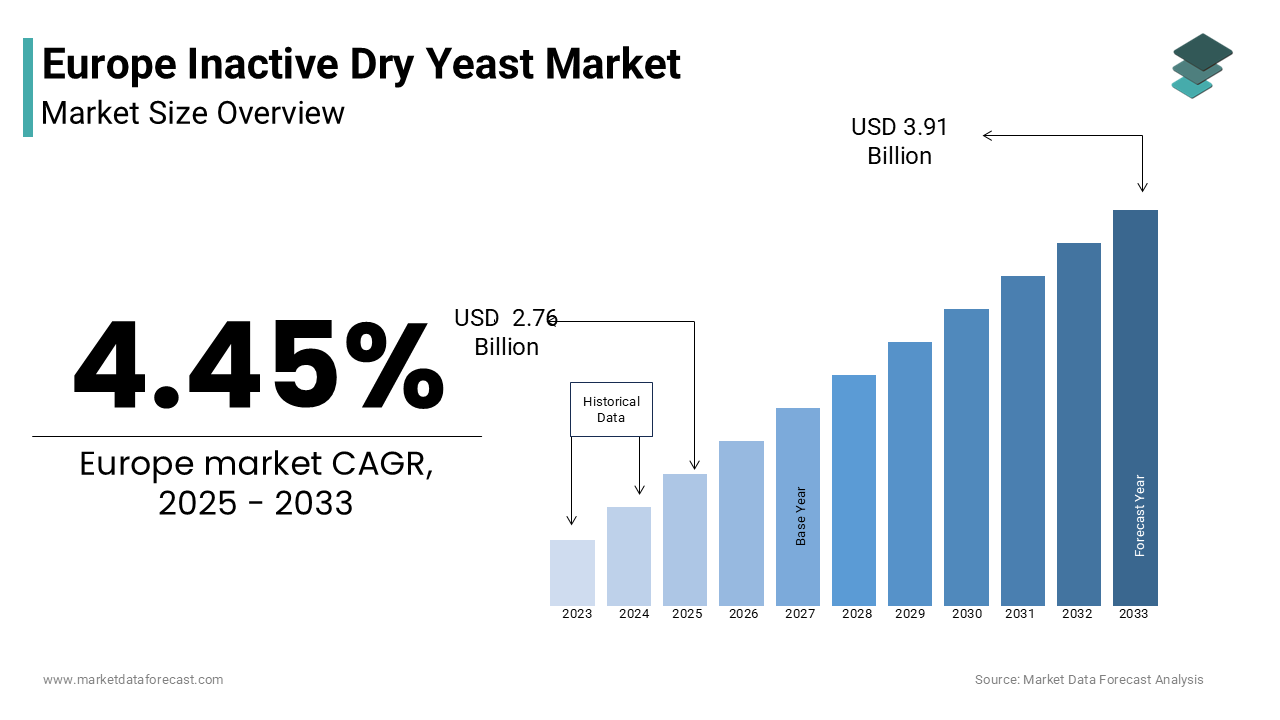

The Europe inactive dry yeast market was worth USD 2.64 billion in 2024. The Europe market is expected to reach USD 3.91 billion by 2033 from USD 2.76 billion in 2025, rising at a CAGR of 4.45% from 2025 to 2033.

Inactive dry yeast is a widely used feed additive in the animal nutrition industry, primarily valued for its rich content of proteins, amino acids, vitamins, and minerals. Unlike active yeast, which functions as a probiotic, inactive dry yeast serves as a nutritional enhancer and digestibility aid in livestock diets. It is commonly utilized in poultry, swine, dairy, and aquaculture sectors across Europe due to its ability to improve gut health, boost immunity, and enhance overall animal performance.

Europe has emerged as a key region for the consumption of inactive dry yeast in animal feed applications, driven by increasing demand for high-quality animal protein and sustainable livestock production practices. The market benefits from the presence of advanced agricultural systems, strong veterinary regulations, and a growing emphasis on feed efficiency and food safety. The growing consumer preference for antibiotic-free meat and dairy products is further reinforcing the adoption of natural feed supplements.

MARKET DRIVERS

Increasing Demand for Natural Feed Additives to Replace Antibiotics

A significant driver behind the growth of the Europe inactive dry yeast market for animal feed application is the rising shift toward natural feed additives as alternatives to antibiotics. With mounting concerns over antimicrobial resistance and regulatory restrictions on antibiotic use in livestock, farmers and feed producers are increasingly turning to functional ingredients that support animal health without compromising productivity. In response, feed manufacturers have incorporated inactive dry yeast into formulations due to its immunomodulatory properties and ability to enhance gut microbiota balance.

Moreover, research conducted by Wageningen University has demonstrated that inactive yeast derivatives can improve nutrient absorption and reduce pathogenic bacterial colonization in the digestive tract, making them effective replacements for antibiotic growth promoters. Also, consumer awareness regarding food safety and ethical livestock farming is influencing purchasing behavior. This growing preference for clean-label animal products is encouraging producers across Europe to adopt yeast-based feed solutions, thereby fueling the demand for inactive dry yeast in the region's animal nutrition sector.

Expansion of Organic and Sustainable Livestock Farming Practices

The expansion of organic and sustainable livestock farming across Europe is another major factor driving the demand for inactive dry yeast in animal feed applications. As governments and consumers emphasize environmentally responsible agriculture, there is a growing focus on using natural and biologically derived feed components that align with organic certification standards. Organic farming regulations often restrict the use of synthetic additives and pharmaceuticals, prompting farmers to seek alternative feed ingredients like inactive yeast that offer nutritional and health benefits without chemical residues. Furthermore, inactive dry yeast contributes to improved feed conversion ratios and enhanced animal immunity, making it a valuable component in sustainable feeding programs. The European Commission's Farm to Fork Strategy, part of the broader Green Deal initiative, supports this shift by promoting reduced reliance on chemical inputs and fostering circular agricultural models. In addition, several feed additive manufacturers have introduced certified organic yeast-based products tailored to meet the requirements of eco-friendly livestock operations.

MARKET RESTRAINTS

High Cost of Specialty Yeast-Based Feed Ingredients

One of the primary restraints affecting the Europe inactive dry yeast market for animal feed application is the relatively high cost associated with specialty yeast-based feed ingredients compared to conventional additives. While inactive dry yeast offers substantial nutritional and health benefits, its production involves complex processing techniques that increase manufacturing expenses. This price differential poses a challenge for small-scale farmers and budget-conscious feed producers, particularly in Eastern European markets where cost sensitivity remains a dominant purchasing factor. Also, fluctuations in raw material prices—especially for molasses and other fermentation substrates—further impact the affordability of yeast-based products. Despite the growing recognition of yeast’s functional advantages, economic constraints continue to limit its widespread adoption, especially in commodity-driven livestock segments where margins are narrow and price competitiveness is crucial.

Limited Awareness and Technical Expertise Among Farmers

Another significant constraint hindering the growth of the Europe inactive dry yeast market for animal feed application is the limited awareness and technical expertise among certain farmer communities regarding the benefits and optimal usage of yeast-based feed additives. Although larger commercial farms and agribusinesses are well-informed about advanced feed technologies, smaller rural operations often lack access to updated information and training. Many remained reliant on conventional feed formulations due to familiarity and perceived simplicity. Moreover, the correct dosage and integration of inactive yeast into existing feed regimens require technical knowledge, which is not always available at the grassroots level. To address this gap, industry players and agricultural institutions are launching educational campaigns and advisory services.

MARKET OPPORTUNITIES

Rising Demand for Functional Animal Feed in Aquaculture Sector

A significant opportunity emerging in the Europe inactive dry yeast market for animal feed application is the growing demand for functional feed ingredients in the aquaculture sector. As seafood consumption rises and wild fish stocks face depletion, aquaculture production has expanded rapidly, necessitating high-performance feed solutions that ensure both fish health and environmental sustainability. In this context, inactive dry yeast has gained traction due to its ability to enhance immune response, improve digestion, and support disease resistance in farmed aquatic species. Additionally, these supplements contribute to better feed conversion rates, which is crucial for optimizing production costs in intensive aquaculture systems.

Innovation in Yeast Derivatives and Value-Added Formulations

Advancements in yeast processing technologies and the development of value-added yeast derivatives are creating new opportunities for the Europe inactive dry yeast market in animal feed applications. Innovations such as yeast cell wall extracts, mannan-oligosaccharides (MOS), and beta-glucans are expanding the functional scope of yeast-based feed additives beyond basic nutrition. These benefits are particularly valuable in organic and antibiotic-free production systems, where natural immunity boosters are essential. Several manufacturers have launched specialized yeast fractions tailored for specific animal categories, including broilers, dairy cattle, and piglets. For instance, Lallemand Animal Nutrition and DSM have introduced customized yeast-based solutions designed to optimize performance in different stages of animal growth. Moreover, collaborations between research institutions and feed additive companies are accelerating product innovation.

MARKET CHALLENGES

Regulatory Complexity and Approval Processes for Feed Additives

A major challenge facing the Europe inactive dry yeast market for animal feed application is the complex and time-consuming regulatory framework governing feed additives. The approval process for new feed ingredients in the EU is highly stringent, requiring extensive scientific documentation, safety assessments, and efficacy trials before market authorization is granted. This lengthy procedure delays product launches and increases compliance costs for manufacturers, particularly smaller firms with limited resources. Furthermore, evolving regulatory guidelines and periodic reassessments of approved substances add uncertainty to market planning. In 2023, EFSA revised its approach to evaluating microbial feed additives, imposing stricter criteria on strain characterization and stability testing, which affected several yeast-based products already on the market. While these regulations aim to ensure feed safety and consumer protection, they also create barriers to innovation and market entry.

Competition from Alternative Nutritional Supplements

The Europe inactive dry yeast market for animal feed application faces stiff competition from alternative nutritional supplements, including synthetic amino acids, plant-based proteins, and microbial enzymes. These substitutes often offer comparable or complementary benefits at lower costs, influencing purchasing decisions among feed formulators and livestock producers. Similarly, plant-derived feed ingredients such as algae meal and insect protein have gained traction due to their sustainability credentials and growing acceptance in organic farming. Moreover, advancements in enzyme-based feed additives have enabled improved digestion and nutrient utilization, reducing reliance on yeast-based supplements in some applications. A 2023 study by the European Feed Business Technology Platform highlighted that carbohydrase and protease enzymes were being increasingly adopted to enhance feed efficiency and reduce waste.

SEGMENTAL ANALYSIS

By Type Insights

The Inactive Yeast segment dominates the Europe market by accounting for 62.6% of total revenue in 2024. This dominance is attributed to its widespread use as a nutritional enhancer rather than a live probiotic, making it suitable for broader applications across livestock categories. A key driver behind this segment's leadership is the increasing preference for yeast-based feed additives that do not require viability maintenance during storage or processing. Unlike live yeast, which must be carefully handled to preserve microbial activity, inactive yeast remains stable under varying conditions, enhancing its shelf life and ease of integration into compound feeds. Furthermore, regulatory support for non-viable feed additives under EU Regulation (EC) No 1831/2003 has facilitated easier approvals and broader adoption, reinforcing the segment’s dominant position in the regional market.

The Live Yeast segment is projected to grow at the highest CAGR of 9.2%. While currently smaller than the inactive yeast segment, live yeast is gaining traction due to its role in modulating gut microbiota and improving digestion in ruminants and monogastric animals. One major factor driving this growth is the rising demand for natural probiotics in animal nutrition, particularly in organic and antibiotic-free livestock farming. Besides, advancements in yeast strain development have improved the stability and efficacy of live yeast products under commercial feed processing conditions. Companies like Lallemand and DSM have introduced heat-tolerant strains that maintain viability even after pelleting, expanding their applicability in large-scale operations. Moreover, growing awareness among farmers about the benefits of live yeast in reducing methane emissions from ruminants aligns with the European Green Deal’s sustainability goals. A study published by the European Federation of Animal Science found that live yeast supplementation reduced enteric methane output, contributing to climate-conscious livestock management strategies.

By Form Insights

The Dry form holds the largest market share of around 85% in 2024. This control over the market the form’s superior handling properties, longer shelf life, and compatibility with standard feed manufacturing processes. A primary reason for the preference of dry yeast is its ease of incorporation into pelleted and mash feed formulations. Unlike instant forms, which often require specialized mixing equipment, dry yeast can be seamlessly blended with other feed ingredients without compromising product integrity. Another significant factor is cost efficiency. Dry yeast requires less energy-intensive drying techniques compared to instant yeast, lowering production costs. As per a 2023 report by the European Agricultural Economics Association, dry yeast formulations were found to be approximately 15–20% cheaper than instant variants, making them more accessible to mid-sized and budget-focused feed producers. In addition, dry yeast exhibits better storage stability, especially in regions with variable climatic conditions.

The Instant yeast segment is anticipated to expand at the highest CAGR of 10.4%. Although currently a smaller portion of the market, instant yeast is gaining momentum due to its enhanced solubility and rapid activation properties, particularly in liquid or semi-liquid feed applications. One key driver behind this growth is the increasing adoption of precision feeding systems in modern livestock operations. These systems often rely on liquid feeding technologies that require quick-dissolving ingredients to ensure uniform nutrient distribution. According to the European Precision Livestock Farming Network, a significant portion of pig and poultry farms in Germany and the Netherlands had implemented automated liquid feeding solutions by 2023, boosting demand for instant yeast formulations. Additionally, advancements in yeast encapsulation and granulation technologies have improved the functional attributes of instant yeast, making it more attractive to high-performance livestock sectors. Companies like Lesaffre and AB Mauri have introduced microencapsulated yeast variants that dissolve rapidly in water, offering superior bioavailability and digestive tract targeting. Moreover, the rise in pet food and aquafeed production—segments that frequently utilize liquid or semi-liquid diets—has further fueled demand.

By Animal Type Insights

The Ruminants category accounts for the largest market share of 58.2% in 2024. This dominance is primarily attributed to the extensive use of yeast-based feed additives in dairy and beef cattle nutrition to improve rumen function, fiber digestion, and overall productivity. A key factor driving this segment’s leadership is the well-established scientific backing regarding the benefits of yeast in ruminant diets. According to the European Federation of Animal Science (EAAP), numerous studies have confirmed that inactive yeast enhances ruminal microbial activity, stabilizes pH levels, and increases volatile fatty acid production, leading to improved feed efficiency and milk yield. Given the emphasis on maintaining high milk quality and reducing reliance on antibiotics, feed manufacturers increasingly incorporate yeast derivatives into ruminant diets. Moreover, government-backed initiatives promoting sustainable livestock practices have reinforced the use of yeast-based feed additives.

The Poultry segment is projected to grow at the highest CAGR of 11.3%. This rapid expansion is driven by increasing poultry meat and egg consumption across Europe, coupled with a shift toward antibiotic-free and naturally enhanced feed formulations. One major factor fueling this growth is the rising demand for broiler and layer production that prioritizes gut health and disease resistance without relying on antimicrobial growth promoters. In addition, research conducted by the Wageningen Livestock Research Institute has demonstrated that inactive yeast improves intestinal morphology and pathogen binding in poultry, thereby enhancing weight gain and feed conversion ratios. These benefits are particularly valuable in intensive poultry farming systems where maximizing output while minimizing health risks is crucial. Moreover, consumer preferences for clean-label poultry products are influencing feed formulation choices.

RECENT MARKET DEVELOPMENTS

Germany was the largest market in Europe by accounting for 23.5% of regional revenue in 2024. The country’s strong agricultural sector, advanced feed manufacturing infrastructure, and commitment to sustainable livestock practices contribute to its leading position. Germany’s livestock industry is highly developed, with a particular emphasis on dairy and swine production. This high livestock density necessitates efficient and health-conscious feeding strategies, encouraging the adoption of yeast-based feed additives. Additionally, the presence of major feed additive manufacturers such as Evonik and BASF supports a robust supply chain for specialty ingredients like inactive yeast. These companies have invested in R&D initiatives aimed at developing customized yeast formulations tailored to local farming needs. Regulatory support also plays a role. Germany actively participates in EU feed safety programs and promotes alternatives to antibiotic growth promoters.

France is another key player in the market. The country’s strong presence in both dairy and poultry farming creates a substantial demand for feed additives that enhance animal performance and health. France is the largest agricultural producer in the EU, with a diverse livestock sector that includes cattle, sheep, goats, and poultry. One of the key drivers of market growth is the government’s push for sustainable and organic livestock farming. Under the Ecophyto Plan and National Strategy for Animal Health, France has encouraged the reduction of antibiotic use in agriculture, leading to increased adoption of yeast-based feed supplements. In addition, France is home to several major feed additive producers, including Lallemand and Lesaffre, which have been instrumental in promoting yeast derivatives in animal nutrition. These companies have launched region-specific yeast formulations designed to meet the nutritional requirements of French livestock breeds. Furthermore, consumer demand for ethically raised and antibiotic-free animal products is rising.

Netherlands secures the key position in the Europe inactive dry yeast market for animal feed application. The country’s intensive livestock farming model and focus on export-oriented agriculture create a favorable environment for the adoption of advanced feed technologies. The Netherlands is one of the world’s top exporters of dairy and pork products, despite its relatively small land area. A key driver behind the uptake of inactive yeast in Dutch animal feed is the country’s commitment to reducing antimicrobial usage. Additionally, the Netherlands hosts several leading feed ingredient manufacturers and research institutions focused on livestock nutrition.

Spain is placing it among the top five contributors in the region. The country’s growing livestock industry, particularly in the pig and poultry sectors, is driving increased demand for yeast-based feed additives. It is one of the leading pork producers in the EU. The country exports a significant portion of its pork production, necessitating high feed quality and health management practices to meet international standards. One of the main factors supporting market growth is the increasing shift toward antibiotic-free livestock production. Additionally, Spain has seen a rise in integrated livestock operations that prioritize feed efficiency and disease prevention. Large-scale feed mills are incorporating yeast-based products into their formulations to enhance digestion and immune response in animals. Consumer demand for sustainably raised meat is also influencing market dynamics.

Italy is securing its place among the top five contributors in the region. It’s diverse livestock industry, including dairy, swine, and poultry farming, supports a steady demand for feed additives that improve animal health and productivity. Italy is one of the major dairy producers in the EU. The country’s renowned cheese-making tradition necessitates high-quality milk production, which in turn drives the adoption of feed solutions that enhance rumen function and nutrient absorption. One of the key drivers of market growth is the increasing implementation of organic and sustainable farming practices. The Italian Ministry of Agricultural, Food and Forestry Policies has promoted policies encouraging reduced antibiotic use in livestock, aligning with broader EU regulations. This has led to a growing preference for yeast-based feed additives as natural alternatives. Moreover, Italy hosts several domestic feed additive manufacturers and research institutions focused on yeast technology.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Lesaffre, Lallemand Inc., Angel Yeast Co., Ltd., Leiber GmbH, Alltech, Ohly, ADM, Nutreco, BioSpringer, and Cargill. are some of the key market players in the market.

The competition in the Europe inactive dry yeast market for animal feed application is marked by a balance between established multinational corporations and emerging regional players, all striving to differentiate themselves through product quality, functional benefits, and sustainability credentials. As consumer demand for ethically produced, antibiotic-free animal products grows, feed additive manufacturers are intensifying efforts to offer scientifically backed, value-added yeast solutions that support animal health without compromising productivity. This has led to increased investment in research and development, with companies focusing on refining yeast derivatives to improve digestibility, immunity, and overall performance in various livestock categories. Additionally, the regulatory landscape in Europe, which emphasizes food safety and environmental responsibility, influences how companies position their offerings in the market. While larger firms leverage brand reputation and extensive distribution networks, smaller innovators are capitalizing on specialized applications and localized needs, creating a dynamic and competitive environment. Strategic partnerships, product diversification, and continuous innovation remain central to maintaining and expanding market presence in this evolving sector.

Top Players in the Europe Inactive Dry Yeast Market for Animal Feed Application

Lallemand Animal Nutrition, a division of the French-based Lallemand Inc., is a leading global supplier of yeast-based feed additives, particularly known for its specialized inactive yeast products designed to enhance gut health and immunity in livestock. The company has been instrumental in advancing yeast derivatives such as mannan-oligosaccharides (MOS) and beta-glucans, which are widely adopted in ruminant and poultry nutrition across Europe.

DSM Nutritional Products plays a pivotal role in the European market by offering innovative yeast-based feed solutions that align with sustainable and antibiotic-free livestock production goals. DSM integrates its yeast products within broader nutritional programs, emphasizing performance optimization and animal well-being, contributing significantly to global standards in animal feed formulation and innovation.

AB Mauri, a subsidiary of Associated British Foods, specializes in yeast and fermentation-based feed ingredients. With a strong presence in Europe, the company provides high-quality inactive dry yeast products tailored for inclusion in compound feeds. Its focus on scalable production and strategic partnerships with feed manufacturers supports its leadership position and enhances its influence in global animal nutrition markets.

Top Strategies Used by Key Market Participants

A primary strategy employed by key players in the Europe inactive dry yeast market for animal feed application is product innovation through advanced yeast processing technologies. Companies are investing in research to develop yeast derivatives with enhanced functional properties, such as improved immune modulation and pathogen-binding capabilities, to meet evolving livestock health demands.

Another major approach is strategic collaborations with agricultural institutions and feed manufacturers. By partnering with research bodies and industry stakeholders, companies ensure scientific validation of their products and facilitate widespread adoption among farmers and large-scale producers.

Lastly, expanding into niche livestock segments and promoting region-specific formulations has become crucial for market differentiation. Firms are tailoring yeast-based feed additives to suit regional farming practices and animal types, thereby strengthening their foothold in diverse European markets and fostering long-term growth.

RECNET MARKET DEVELOPMENTS

- In January 2024, Lallemand Animal Nutrition launched a new line of yeast-based feed supplements specifically formulated for organic dairy farms in France and Germany, aiming to enhance rumen efficiency and milk yield while supporting antibiotic reduction initiatives.

- In March 2024, DSM Nutritional Products introduced a novel yeast derivative designed to boost immunity in broiler chickens, targeting poultry producers transitioning to antibiotic-free feeding systems across the Netherlands and Belgium.

- In June 2024, AB Mauri expanded its production capacity at its facility in Spain to meet rising demand for inactive dry yeast in swine feed applications, reinforcing its supply chain resilience and responsiveness to regional market needs.

- In September 2024, Biorigin , a leading yeast derivatives manufacturer, entered a strategic partnership with a German feed integrator to co-develop customized yeast-based feed premixes for use in precision livestock farming operations.

- In November 2024, Lesaffre Feed Ingredients announced the launch of an educational initiative in collaboration with European agricultural universities to promote the benefits of yeast-based feed additives among future livestock professionals and researchers.

MARKET SEGMENTATION

This research report on the Europe inactive dry yeast market is segmented and sub-segmented into the following categories.

By Type

- Live Yeast

- Inactive Yeast

By Form

- Dry

- Instant

- Fresh

By Animal Type

- Ruminants

- Poultry

- Swine

- Aquaculture

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the inactive dry yeast market in Europe?

The rising demand for nutritional animal feed, increasing adoption of vegan diets, and the growing popularity of natural food additives are key growth drivers.

What is the forecasted market trend for inactive dry yeast in Europe?

The market is expected to grow steadily due to increasing awareness of natural and functional food ingredients, especially in the plant-based food segment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com