Europe Indoor Location-Based Services (LBS) Market Size, Share, Trends & Growth Forecast Report By Product (Analytics and Insights, Automotive Services), Technology (RFID and NFC, Wi-Fi/WLAN, BT/BLE), Application (Monitoring, Navigation), End-Use (Retail, Transportation & Logistics, Healthcare), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Indoor Location-Based Services (LBS) Market Size

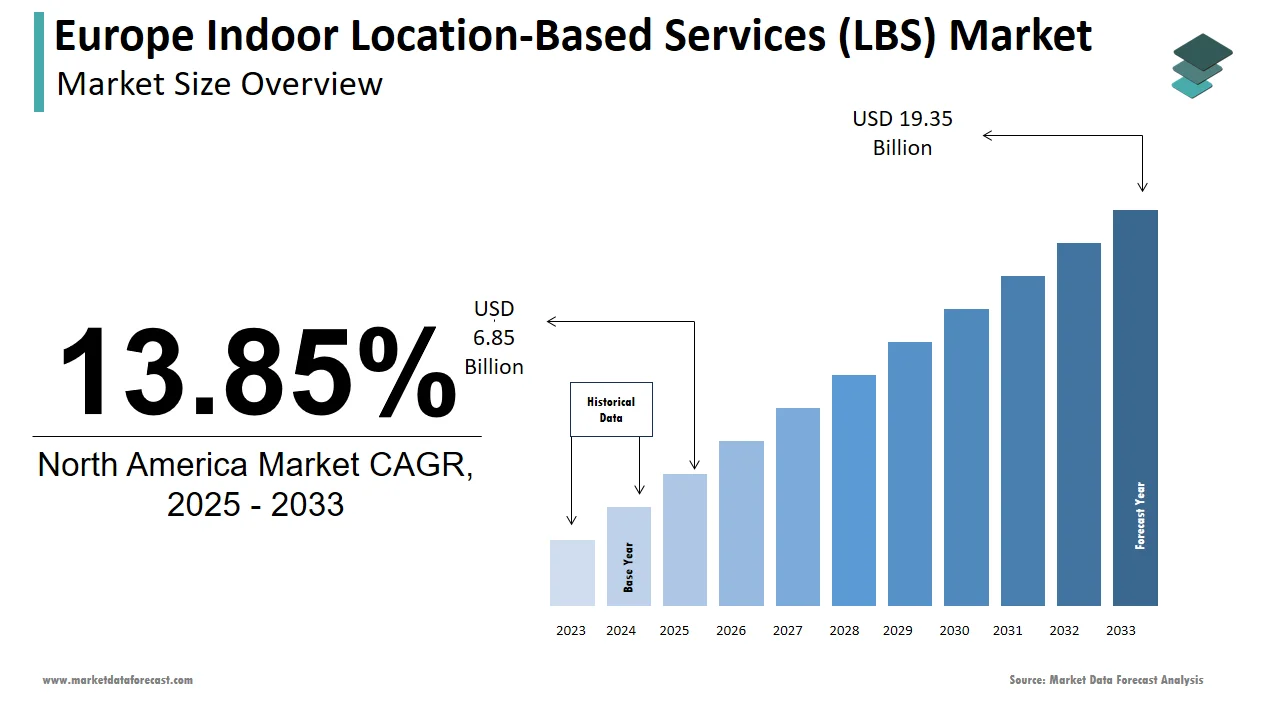

The indoor location-based services (LBS) market size in Europe was valued at USD 6.02 billion in 2024. The European market is estimated to be worth USD 19.35 billion by 2033 from USD 6.85 billion in 2025, growing at a CAGR of 13.85% from 2025 to 2033.

The Europe indoor location-based services (LBS) market has witnessed significant traction, driven by technological advancements and the increasing demand for precise indoor navigation. The proliferation of GPS-unfriendly environments, such as shopping malls, airports, and hospitals, has further fueled the need for indoor positioning systems.

Moreover, countries like Germany, France, and the UK are leading contributors to this growth, owing to their robust retail sectors and investments in smart city initiatives. Retailers are leveraging indoor LBS to enhance customer experiences through personalized promotions and seamless navigation within stores. Meanwhile, healthcare facilities are adopting these solutions to streamline asset tracking and improve patient care.

The regulatory landscape also plays a pivotal role, with stringent data protection laws like GDPR shaping how businesses implement these technologies. A report by Deloitte emphasizes that privacy concerns remain a challenge, yet they have also spurred innovation in anonymized data collection methods. Overall, the European market stands as a dynamic hub for indoor LBS, balancing technological innovation with consumer-centric applications.

MARKET DRIVERS

Rising Adoption of Smart Infrastructure and IoT Integration

The proliferation of smart infrastructure across Europe has emerged as a key driver for the indoor location-based services (LBS) market. According to a study by the European Investment Bank, investments in smart city projects exceeded €150 billion in 2022, with significant focus on integrating IoT-enabled devices into urban environments. This trend is particularly evident in sectors like transportation hubs, shopping malls, and healthcare facilities, where precise indoor navigation and asset tracking are critical. For instance, airports such as Heathrow and Charles de Gaulle have implemented indoor LBS to optimize passenger flow and enhance retail experiences. As per PwC, over 60% of European airports are expected to adopt advanced indoor positioning technologies by 2025. The growing reliance on IoT devices, which Statista estimates will reach 3 billion units in Europe by 2024, further amplifies this demand. These devices generate vast amounts of data, enabling real-time location analytics that improve operational efficiency. Moreover, the integration of 5G networks has bolstered connectivity, making indoor LBS more reliable and scalable. With cities like Amsterdam and Stockholm leading the charge in smart infrastructure development, the demand for indoor LBS is poised to grow, driven by the need for seamless, data-driven solutions.

Increasing Consumer Expectations for Personalized Experiences

Consumer behavior in Europe is shifting toward hyper-personalization, fueling the demand for indoor LBS in retail and hospitality sectors. A survey conducted by McKinsey revealed that 71% of European consumers expect personalized interactions, and businesses failing to meet these expectations risk losing up to 38% of their customer base. Indoor LBS enables retailers to deliver tailored promotions and navigation assistance within stores, enhancing customer satisfaction. For example, major European retailers like IKEA and Zara have adopted beacon technology to provide shoppers with real-time product information and discounts based on their location within the store. According to a report by Boston Consulting Group, retailers leveraging indoor LBS have observed a 15-20% increase in foot traffic and a 10% rise in sales conversions. Additionally, the growing popularity of experiential retail formats has created a need for immersive, tech-driven shopping environments. Indoor LBS also supports contactless services, which gained prominence during the pandemic. As per Eurostat, over 70% of European consumers now prefer digital or contactless interactions, showcasing that the importance of location-based technologies in meeting evolving consumer demands. This convergence of personalization and convenience is a major catalyst for market growth.

MARKET RESTRAINTS

Stringent Data Privacy Regulations and Consumer Skepticism

The implementation of stringent data privacy laws, such as the General Data Protection Regulation (GDPR), has posed a significant restraint on the Europe indoor LBS market. Based on a study by DLA Piper, GDPR-related fines in Europe totaled over €1.6 billion in 2022 alone, with many penalties linked to improper handling of location data. This regulatory environment has made businesses cautious about deploying indoor LBS solutions, as these systems often rely on collecting and processing sensitive user data. A Deloitte analysis shows that nearly 45% of European companies have delayed or scaled back their adoption of location-based technologies due to compliance challenges. Furthermore, consumer skepticism about data misuse remains a barrier. As per a survey conducted by the European Consumer Organisation (BEUC), 68% of European consumers express concerns about how their location data is utilized, even when anonymized. This lack of trust can deter users from enabling location services on their devices are limiting the effectiveness of indoor LBS applications. While anonymization techniques are being developed to address these concerns, the balance between innovation and compliance continues to challenge market players. The regulatory landscape when combined with public apprehension acts as a significant roadblock to widespread adoption.

High Implementation Costs and Infrastructure Limitations

The high cost of implementing indoor LBS infrastructure is another major restraint hindering market growth in Europe. Additionally, maintaining and upgrading these systems requires ongoing investment, which further strains budgets.

Another factor is the uneven technological readiness across regions. A study by the European Investment Bank points out that Eastern European countries lag behind in smart infrastructure development, with only 30% of commercial spaces equipped to support advanced indoor LBS solutions. This disparity creates fragmented demand and limits scalability. Moreover, reliance on existing Wi-Fi or Bluetooth networks for positioning can lead to inaccuracies, especially in older buildings with poor connectivity. These infrastructure limitations, coupled with the steep upfront costs, make it challenging for businesses to justify investments in indoor LBS, thereby restraining market expansion.

MARKET OPPORTUNITES

Integration with Augmented Reality for Enhanced User Experiences

The convergence of indoor location-based services (LBS) with augmented reality (AR) presents a transformative opportunity for the European market. Based on a report by Gartner, AR adoption in commercial applications is projected to grow by 40% annually in Europe driven by its ability to enhance user engagement and operational efficiency. Indoor LBS, when combined with AR, enables immersive experiences in retail, tourism, and education sectors. For instance, museums like the Louvre in Paris are experimenting with AR-enabled indoor navigation to guide visitors through exhibits while providing rich, interactive content. A study by Accenture notes that businesses incorporating AR into their customer journeys have reported a 25% increase in user satisfaction and a 15% rise in repeat visits. The gaming industry also stands to benefit, as AR games leveraging precise indoor positioning can create hyper-localized experiences. Furthermore, the European Commission estimates that AR technologies could contribute €30 billion to the EU economy by 2025 spotlighting the vast potential of this integration. With advancements in 5G networks enhancing AR's real-time capabilities, the synergy between indoor LBS and AR offers a lucrative growth avenue fostering innovation and expanding use cases across diverse industries.

Expansion into Healthcare and Elderly Care Applications

The healthcare sector represents a significant untapped opportunity for indoor LBS in Europe, particularly in patientcare and elderly monitoring. As per Eurostat, the region’s aging population, with over 20% aged 65 or above has created a pressing need for solutions that ensure safety and mobility within care facilities. Indoor LBS can address this demand by enabling real-time tracking of patients and assets, such as medical equipment, reducing search times by up to 30%, according to a study by Capgemini. Hospitals like Charité in Berlin have already begun deploying these systems to streamline workflows and improve emergency response times. Additionally, wearable devices integrated with indoor positioning are being developed to monitor elderly individuals in assisted living environments alerting caregivers in case of falls or abnormal behavior. With governments increasingly investing in digital health infrastructure, the adoption of indoor LBS in healthcare settings not only enhances operational efficiency but also aligns with broader public health goals, creating a promising growth trajectory for the market.

MARKET CHALLENGES

Fragmented Market and Lack of Standardization

The Europe indoor LBS market faces significant challenges due to its fragmented nature and the absence of universal standards for technology deployment. This lack of standardization creates inefficiencies, as different vendors offer proprietary solutions that may not work seamlessly together. For instance, while Bluetooth Low Energy (BLE) is widely used in retail environments, ultra-wideband (UWB) technology dominates industrial applications, leading to interoperability issues. Findings by the European Telecommunications Standards Institute (ETSI) indicates that the absence of unified frameworks increases implementation costs by up to 25%, as businesses often need to invest in additional middleware or custom integrations. Also, this fragmentation limits scalability, particularly for multinational corporations operating across multiple European countries. As per McKinsey, only 30% of large-scale indoor LBS projects in Europe achieve their intended outcomes due to these technical inconsistencies. The challenge is compounded by varying regional preferences for specific technologies, making it harder for solution providers to develop universally applicable products. Addressing this issue requires industry-wide collaboration to establish common standards, but progress has been slow, hindering broader market adoption.

Limited Accuracy in Complex Indoor Environments

Achieving high accuracy in complex indoor environments remains a persistent challenge for the Europe indoor LBS market. This limitation is particularly problematic in sectors like warehousing and logistics, where precise asset tracking is critical. For example, a survey by Logistics UK reveals that 60% of warehouses in Europe face operational disruptions due to inaccurate location data leading to delays and increased labor costs. Additionally, dependence on technologies like Wi-Fi or BLE, which are susceptible to environmental factors, further exacerbates the issue. While advancements in UWB and LiDAR technologies have shown promise, their high costs and limited availability restrict widespread adoption. A report estimates that less than 15% of European businesses currently use advanced positioning technologies capable of delivering sub-meter accuracy. As industries demand higher precision, overcoming these technological limitations becomes imperative. However, the cost and complexity of deploying cutting-edge solutions remain significant barriers, slowing market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.85% |

|

Segments Covered |

By Product, Technology, Application, End-Use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Apple Inc., Cisco Systems, Inc., Glopos Technologies, Google LLC, HERE, Inside Secure, IndoorAtlas, Microsoft, Navizone Limited, Qualcomm Technologies, Inc., CommScope, Inc., Shopkick, Inc., Invigor, and YOOSE Pte. Ltd., and others. |

SEGMENTAL ANALYSIS

By Technology Insights

The Wi-Fi/WLAN segment dominated the Europe indoor LBS market by accounting for 35.1% of the market share in 2024. This influence of the segment is driven by the widespread availability of Wi-Fi infrastructure across urban environments and its cost-effectiveness compared to other technologies. The proliferation of smart devices and IoT-enabled ecosystems has further bolstered the adoption of Wi-Fi-based indoor positioning systems. One of the key factors propelling Wi-Fi’s dominance is its ability to deliver relatively high accuracy at a lower cost. A Deloitte report notes that Wi-Fi-based solutions can achieve location precision within 5-15 meters making them suitable for applications such as asset tracking and navigation in large indoor spaces. Moreover, the integration of Wi-Fi with cloud-based analytics platforms has enabled real-time data processing, enhancing operational efficiency. For instance, retail chains in Europe have reported a 20% increase in customer engagement after implementing Wi-Fi-based indoor navigation systems, according to PwC. Also, the growing emphasis on contactless services accelerated by the pandemic has reinforced Wi-Fi’s role in enabling seamless digital experiences. With over 500 million Wi-Fi hotspots expected to be operational in Europe by 2025, as projected by the Wireless Broadband Alliance, Wi-Fi/WLAN is likely to maintain its stronghold in the market.

The Ultra-Wideband (UWB) is the fastest-growing segment in the Europe indoor LBS market, with a CAGR of 32.5% during the forecast period. This rapid growth is fueled by UWB’s unparalleled accuracy, which can pinpoint locations within centimeters, making it ideal for applications requiring precision such as industrial automation and healthcare. Among the primary aspects supporting the UWB’s growth is its immunity to signal interference, a critical advantage in dense indoor environments. A report by McKinsey notes that industries like manufacturing and logistics are increasingly adopting UWB for real-time asset tracking reducing operational inefficiencies by up to 40%. Furthermore, the technology’s low power consumption makes it suitable for wearable devices, which are gaining traction in elderly care and remote health monitoring. For example, hospitals in Germany and France have begun deploying UWB-enabled wearables to monitor patient movements and prevent accidents, as highlighted by Frost & Sullivan. Supplementary factor is the growing investment in smart city initiatives, where UWB is being integrated into public infrastructure for enhanced security and navigation. The European Commission estimates that investments in smart city projects will reach €200 billion by 2025, providing a fertile ground for UWB’s expansion. These technological and application-driven factors position UWB as a transformative force in the indoor LBS landscape.

By Application Insights

The navigation segment held the maximum share of the Europe indoor LBS market by capturing 40.7% of the total market in 2024. This market control is propelled by the growing demand for seamless indoor movement across key sectors such as retail, transportation hubs, and healthcare facilities. A primary factor propelling segment’s position is the integration of indoor LBS with mobile applications, which has transformed user experiences. An investigation by McKinsey reveals that retailers leveraging indoor navigation systems have observed a 15-20% increase in foot traffic and a 10% rise in sales conversions. For instance, IKEA stores in Europe have implemented navigation solutions to guide customers to specific products, enhancing convenience and reducing search times. In addition, transportation hubs like Heathrow Airport have adopted indoor navigation to streamline passenger flow, improving operational efficiency by up to 25%, as noted by PwC. The rise of smart cities has further amplified demand, with urban planners prioritizing technologies that enhance mobility within public infrastructure. These trends emphasize how navigation continues to dominate the indoor LBS landscape.

The proximity is the quickest expanding segment in the Europe indoor LBS market, with a CAGR of 30.8% during the forecast period. This rapid expansion is fueled by the increasing adoption of proximity-based marketing and contactless services, particularly in the retail and hospitality sectors. According to a report by Deloitte, over 65% of European businesses are investing in proximity technologies to enhance customer engagement and drive sales. One of the key drivers of proximity’s growth is the rising consumer preference for personalized experiences. A study by Boston Consulting Group reveals that proximity-based marketing campaigns have led to a 20% increase in customer retention rates among European retailers. For example, luxury brands like Louis Vuitton and Gucci have implemented beacon technology to deliver tailored promotions to shoppers based on their location within stores. Also, the post-pandemic shift toward contactless interactions has accelerated the adoption of proximity solutions. Eurostat reports that over 70% of European consumers now prefer digital or touchless services making proximity technologies indispensable for businesses aiming to meet evolving expectations. Another factor is the integration of proximity with IoT devices, enabling real-time data collection and analysis. These dynamics position proximity as a transformative force in the indoor LBS market.

By End User Insights

Retail is the largest end-use segment in the Europe indoor LBS market BY commanding a market share of 28.9% in 2024. This lead position is backed by the retail sector’s growing reliance on indoor location-based services to enhance customer experiences and operational efficiency. A primary factor behind retail’s dominance is the integration of indoor LBS with mobile applications to provide personalized shopping experiences. A study by McKinsey notes that 71% of European consumers expect tailored interactions, and retailers are leveraging proximity marketing and indoor navigation to meet these expectations. For instance, IKEA has implemented beacon technology to guide customers to specific products, reducing search times and improving satisfaction. In addition, the rise of experiential retail formats, where physical stores combine shopping with immersive experiences, has further amplified demand for indoor LBS. PwC notes that over 60% of European retailers now use location data to optimize store layouts and inventory management. The shift toward omnichannel strategies, where online and offline experiences are seamlessly integrated, has also played a pivotal role. As per Deloitte, investments in digital transformation within the retail sector exceeded €50 billion in 2022, with indoor LBS being a critical component. These trends show why retail remains the leading end-use segment.

Healthcare is the swiftest end-use to accelerate further in the Europe indoor LBS market, with a CAGR of 33.4% during the forecast period. This rapid expansion is influenced by the increasing adoption of indoor LBS for patient monitoring, asset tracking, and operational efficiency in healthcare facilities. Eurostat reports that over 20% of Europe’s population is aged 65 or above, creating a pressing need for advanced healthcare solutions, including indoor positioning systems. A major aspect of healthcare’s growth is the rising demand for real-time patient tracking and safety. A report by Capgemini reveals that hospitals using indoor LBS for asset tracking have reduced equipment search times by up to 30% significantly improving operational workflows. For example, Charité Hospital in Berlin has implemented UWB-enabled systems to monitor patient movements and ensure timely interventions. In addition, the post-pandemic emphasis on remote health monitoring has accelerated the adoption of wearable devices integrated with indoor positioning technologies. Supplementary factor is government initiatives promoting digital health infrastructure. The European Commission estimates that investments in smart healthcare projects will reach €30 billion by 2025 providing a fertile ground for indoor LBS adoption.

COUNTRY LEVEL ANALYSIS

Germany holds the largest share in the European indoor LBS market in 2024 by accounting for 26.4%. The country’s prominence is driven by its robust industrial base and strong investment in smart city initiatives. As per the European Investment Bank, Germany accounted for over €50 billion in smart infrastructure projects in 2022, with indoor LBS playing a pivotal role in sectors like manufacturing and healthcare. For instance, Siemens has integrated indoor positioning systems into its facilities to enhance asset tracking and operational efficiency, reducing downtime by up to 25%. Also, Germany’s aging population, with over 21% aged 65 or above has spurred demand for healthcare applications like patient monitoring and elderly care solutions. A report by Roland Berger shows that German hospitals adopting indoor LBS have improved emergency response times by 30%. The country’s emphasis on digital transformation, supported by the "Industry 4.0" initiative, further amplifies adoption. According to McKinsey, investments in IoT-enabled technologies in Germany are projected to grow by 15% annually, reinforcing its dominance in the regional market.

The UK market has shown steady momentum in the Europe indoor LBS market. This position is bolstered by the UK’s advanced retail sector and widespread adoption of indoor navigation systems in airports and shopping malls. London Heathrow Airport, one of the busiest in Europe uses indoor LBS to streamline passenger flow, improving operational efficiency by 20%, according to PwC. Retailers like John Lewis and Marks & Spencer have also embraced proximity marketing by leveraging beacon technology to deliver personalized promotions, which has led to a 15% increase in customer engagement, as per Deloitte. Moreover, the UK’s focus on smart city development has accelerated adoption. A study by the British Retail Consortium reveals that over £10 billion was invested in digital infrastructure in 2022, with indoor LBS being a key component. The post-Brexit push for technological innovation has also driven growth, with the government allocating £5 billion for digital transformation projects. These factors reinforce the UK’s position as a leading player in the regional market.

France continues to strengthen its presence in the indoor LBS space. The country’s prominence is fostered by its thriving hospitality and tourism sectors, where indoor LBS enhances visitor experiences. For example, the Louvre Museum in Paris uses AR-enabled indoor navigation to guide tourists which is resulting in a 25% increase in visitor satisfaction, as highlighted by Accenture. Over and above that, France’s commitment to sustainable urban development has driven the adoption of smart city technologies. The French government has allocated €30 billion for smart city projects by 2025, as per the European Commission, with indoor LBS being integral to these initiatives. Retailers like Carrefour have also adopted indoor positioning systems to optimize store layouts and improve customer journeys leading to a 10% rise in sales conversions, according to Boston Consulting Group. Moreover, France’s strong regulatory framework for data privacy ensures secure implementation, fostering trust among businesses and consumers alike. These dynamics position France as a key player in the regional market.

Italy is the fastest-growing country in the region, with a projected CAGR of 8.1%. The market status in country is shaped by its vibrant retail and healthcare sectors, where indoor LBS addresses critical operational challenges. Italian retailers like Esselunga have implemented indoor navigation systems to enhance customer convenience reducing search times by 30%, as noted by Capgemini. In healthcare, hospitals such as Ospedale San Raffaele in Milan have adopted UWB-enabled tracking systems to monitor medical equipment, improving asset utilization by 40%. Furthermore, Italy’s growing emphasis on cultural tourism has driven the adoption of indoor LBS in museums and heritage sites. A report by the Italian Ministry of Tourism shows that over €5 billion was invested in digital infrastructure for tourist attractions in 2022. The country’s strategic location as a hub for international trade has also fueled demand in logistics, where indoor LBS optimizes warehouse operations. These factors exhibits that Italy’s significant role in the regional market.

Spain is gaining traction in LBS deployments through its smart city initiatives and upgrades to cultural and tourism infrastructure. Also, the country’s market growth is supported by its booming hospitality and transportation sectors, where indoor LBS enhances user experiences. Barcelona El Prat Airport, one of Spain’s busiest, uses indoor positioning systems to guide passengers, reducing congestion by 20%, according to Eurostat. Additionally, Spain’s focus on smart tourism initiatives has propelled adoption in hotels and resorts. A study by the Spanish Tourism Board reveals that over €15 billion was invested in digital tourism infrastructure in 2022, with indoor LBS being a key enabler. Retailers like El Corte Inglés have also embraced proximity marketing, leveraging beacon technology to deliver tailored promotions, which has led to a 12% increase in foot traffic, as per Deloitte. Furthermore, Spain’s growing elderly population, with over 19% aged 65 or above, has created demand for healthcare applications like remote patient monitoring. These trends shows that Spain’s dynamic contribution to the regional market.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe indoor location-based services (LBS) market profiled in this report are Apple Inc., Cisco Systems, Inc., Glopos Technologies, Google LLC, HERE, Inside Secure, IndoorAtlas, Microsoft, Navizone Limited, Qualcomm Technologies, Inc., CommScope, Inc., Shopkick, Inc., Invigor, and YOOSE Pte. Ltd., and others.

TOP LEADING PLAYERS IN THE MARKET

Cisco Systems

Cisco Systems is a dominant player in the Europe indoor LBS market, leveraging its expertise in networking and IoT to deliver advanced location-based solutions. The company’s Connected Mobile Experiences (CMX) platform integrates Wi-Fi and Bluetooth technologies to provide real-time indoor navigation, asset tracking, and customer analytics. Cisco’s solutions are widely adopted in retail, healthcare, and transportation sectors across Europe, with notable implementations in airports like Heathrow and shopping malls in Germany. Cisco’s robust infrastructure and scalability have made it a preferred choice for enterprises seeking seamless integration of indoor LBS with existing systems. Its commitment to innovation and strong partnerships with European tech firms further solidify its leadership.

Apple Inc.

Apple Inc. has significantly influenced the Europe indoor LBS market through its ecosystem of devices and services, particularly with the introduction of UWB-enabled hardware like the iPhone 11 and later models. The company’s focus on precision location services has enabled applications such as indoor navigation in museums and airports, enhancing user experiences. Apple’s integration of indoor LBS into its Maps application has driven adoption among European consumers, particularly in urban centers like London and Paris. By collaborating with retailers and public institutions, Apple has pioneered the use of AR and indoor positioning, setting new standards for accuracy and usability. Its global brand presence ensures widespread acceptance and trust.

Google LLC

Google LLC has emerged as a key contributor to the Europe indoor LBS market through its Google Maps Indoor platform, which provides detailed indoor mapping for shopping malls, airports, and transit hubs. The platform leverages AI and machine learning to enhance navigation accuracy and deliver personalized recommendations. Google’s extensive database of indoor maps and its ability to integrate with third-party apps have positioned it as a leader in the region. The company’s efforts to expand its indoor mapping coverage to cities like Berlin and Madrid have strengthened its foothold. By prioritizing user-centric design and accessibility, Google continues to drive innovation in the indoor LBS space, influencing both regional and global markets.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Strategic Partnerships and Collaborations

A key strategy adopted by market participants is forming alliances with technology providers, infrastructure developers, and industry-specific solution providers. For instance, companies like HERE Technologies and Cisco have collaborated to integrate indoor mapping APIs into IoT-enabled systems for smart buildings and retail spaces. These partnerships enable players to leverage complementary expertise, expand their technological capabilities, and offer comprehensive solutions that cater to diverse industries such as healthcare, airports, and logistics.

Product Innovation and Technological Advancements

Continuous investment in research and development (R&D) has been pivotal for companies aiming to enhance accuracy and user experience in indoor positioning systems. Innovations such as Ultra-Wideband (UWB), Bluetooth Low Energy (BLE), AI-driven analytics, and digital twin technologies are being integrated into solutions. For example, Bosch launched an AI-powered UWB-based tracking system in September 2023 to address industrial needs, demonstrating how cutting-edge technology can differentiate offerings and strengthen market leadership.

Acquisitions and Expansions

Acquiring niche players or expanding portfolios through mergers has allowed firms to consolidate their market position. In February 2024, Siemens acquired NavVis, a leader in indoor mapping and digital twins, enabling Siemens to broaden its smart building solutions. Such acquisitions not only enhance product portfolios but also provide access to new customer bases and geographies, ensuring sustained growth and competitive advantage in the European Indoor LBS market.

These strategies collectively focus on innovation, collaboration, and market consolidation to maintain leadership amidst rising competition.

COMPETITION OVERVIEW

The Europe Indoor Location-Based Services (LBS) market is highly competitive, driven by technological advancements and increasing demand for precise indoor navigation solutions across retail, healthcare, airports, and smart cities. Key players are leveraging innovations like Bluetooth Low Energy (BLE), Wi-Fi, Ultra-Wideband (UWB), and AI to enhance accuracy and user experience. Companies are also focusing on partnerships, mergers, and product launches to gain a competitive edge. The rise of IoT and smart infrastructure has further fueled competition, with firms striving to integrate their services into larger digital ecosystems. Major participants include technology giants like Apple and Google, as well as niche players specializing in indoor mapping and positioning technologies. The regulatory landscape and emphasis on data privacy also play a pivotal role in shaping strategies, as companies must comply with GDPR while delivering seamless services. This dynamic environment fosters innovation but also intensifies rivalry, pushing firms to differentiate themselves through superior offerings and customer-centric solutions.

TOP 5 MAJOR ACTIONS TAKEN BY KEY PLAYERS

- In March 2023, Philips Lighting (Signify) partnered with Cisco to integrate indoor positioning systems using IoT-enabled lighting solutions, enhancing location accuracy for retail customers.

- In June 2023, HERE Technologies collaborated with Deutsche Telekom to develop advanced indoor mapping APIs tailored for European enterprises, improving navigation capabilities within large facilities.

- In September 2023, Bosch launched an AI-powered indoor tracking system leveraging UWB technology, targeting industrial and logistics sectors in Europe for real-time asset monitoring.

- In November 2023, Estimote introduced BLE-based proximity beacons with enhanced battery life, enabling retailers to deliver hyper-personalized shopping experiences across Europe.

- In February 2024, Siemens acquired NavVis, a leader in digital twin and indoor mapping technologies, to expand its portfolio for smart building applications in Europe.

MARKET SEGMENTATION

This Europe indoor location-based services (LBS) market research report is segmented and sub-segmented into the following categories.

By Product

- Analytics and Insights

- Automotive Services

- Campaign Management

- Consumer Services

- Enterprise Services

- Location and Alerts

- Location-based Advertising Services

- Maps

- Precision Geo-targeting

- Proximity Beacons

- Secure Transactions and Redemptions

By Technology

- Context Aware Technology

- OTDOA and E-OTDOA

- RFID and NFC

- Satellite, Microwave and Infrared Sensing

- Wi-Fi/WLAN, UWB, BT/BLE, Beacons, and A-GPS

By Application

- Monitoring

- Navigation

- Proximity

- Tracking

- Others

By End-Use

- Aerospace and Defense

- BFSI

- IT and Telecommunication

- Energy and Power

- Government

- Healthcare

- Hospitality

- Retail

- Transportation & Logistics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are boosting the Europe indoor location-based services market?

Growing demand for real-time navigation is boosting the Europe indoor location-based services market.

2. Which sector uses indoor location-based services the most in Europe?

The retail sector is the major user in the Europe indoor location-based services market.

3. What is a notable trend in the Europe indoor location-based services market?

The integration of AI and IoT is a notable trend in the Europe indoor location-based services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com