Europe Inland Waterways Vessel Market Size, Share, Trends & Growth Forecast Research Report, Segmented By Vessel Type, Fuel Type, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Inland Waterways Vessel Market Size

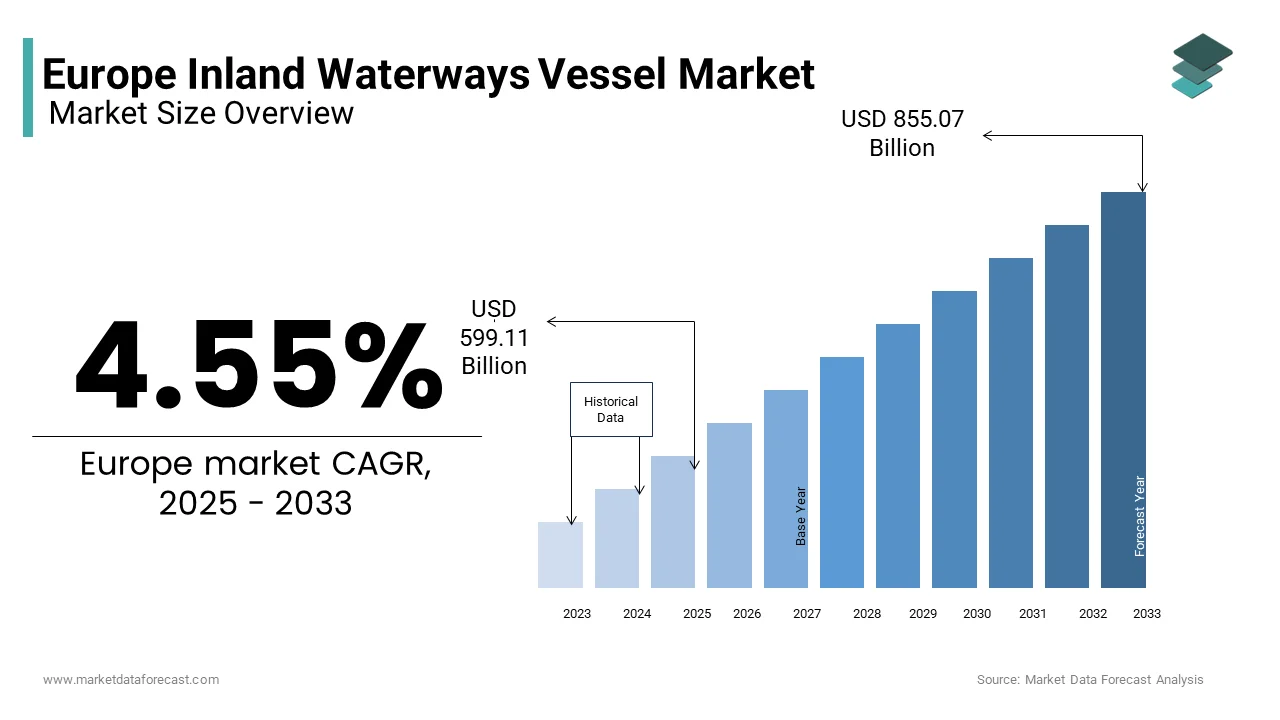

The Europe inland waterways vessel market was valued at USD 573.03 billion in 2024 and is anticipated to reach USD 599.11 billion in 2025 from USD 855.07 billion by 2033, growing at a CAGR of 4.55% during the forecast period from 2025 to 2033.

The Europe inland waterways vessel market includes a wide range of vessels designed for transporting goods and passengers through rivers, canals, and other internal water networks. This sector plays a crucial role in the continent's multimodal logistics system, offering an energy-efficient and environmentally friendly alternative to road and rail transport. As of recent years, Europe has maintained one of the most developed inland waterway infrastructures globally, spanning over 37,000 kilometers across 21 countries. According to the Central Commission for the Navigation of the Rhine, the Rhine River alone facilitates the movement of more than 150 million tons of cargo annually, underlining its significance as a key commercial artery. The fleet includes push boats, barges, tankers, and multipurpose vessels, many of which are undergoing modernization to meet new emission norms such as the EU’s Green Deal and Sulphur Content Directive.

MARKET DRIVERS

Growing Emphasis on Sustainable Freight Transport

One of the primary drivers of the Europe inland waterways vessel market is the increasing emphasis on sustainable and low-emission freight transportation. As governments across Europe intensify their climate action strategies, there is a strong push toward a modal shift from road to inland waterways. According to the International Transport Forum, inland waterway transport emits less CO₂ compared to equivalent road transport over similar distances. This efficiency makes it a preferred mode for moving bulk commodities such as coal, minerals, construction materials, and agricultural products. Moreover, regulatory frameworks like the European Green Deal and the Fit for 55 package have mandated significant reductions in greenhouse gas emissions by 2030. In response, companies are increasingly adopting inland water transport to align with these targets. For instance, the Netherlands has reported a notable increase in freight volumes moved via inland waterways between 2018 and 2022, as per the Dutch Ministry of Infrastructure and Water Management. Additionally, the European Commission estimates that shifting just 10% of freight from roads to waterways could reduce transport-related CO₂ emissions by 3.5 million tons annually. This transition is further supported by public investment in green propulsion technologies, including hybrid and electric vessels. Shipbuilders in Germany and France have launched several zero-emission pilot projects, backed by funding from national and EU-level sustainability programs.

Expansion of Trans-European Transport Networks (TEN-T)

Another significant driver of the Europe inland waterways vessel market is the continued development and integration of trans-European transport corridors under the TEN-T framework. The European Commission has prioritized inland waterways as core components of this network, aiming to enhance connectivity between major ports, industrial hubs, and urban centers. As part of this initiative, substantial funding has been allocated for TEN-T infrastructure development through 2027—is being directed toward improving navigability, lock capacities, and intermodal terminals along key routes such as the Rhine, Danube, and Seine rivers. According to the European Conference of Ministers of Transport, the TEN-T program is expected to increase inland waterway freight capacity by 2030. This expansion not only improves operational efficiency but also encourages private sector participation in vessel chartering and fleet modernization. Countries like Austria and Hungary have already upgraded river locks and bridges to accommodate larger vessels, directly contributing to higher cargo throughput. For example, the Danube Corridor VIII project has enabled barge sizes to increase from 1,500 to 4,000 tons, enhancing economies of scale. Also, real-time digital navigation systems funded under the SafeSeaNet and River Information Services (RIS) initiatives are reducing transit times and boosting reliability.

MARKET RESTRAINTS

High Capital Expenditure and Fleet Modernization Costs

Despite the growing environmental and logistical benefits associated with inland waterways transport, high capital expenditure remains a critical restraint in the Europe inland waterways vessel market. Acquiring or constructing new-generation vessels equipped with advanced propulsion systems, digital navigation tools, and emission-reducing technologies involves substantial initial investment. This financial burden is particularly challenging for small and medium-sized operators who dominate the sector. Furthermore, the need to retrofit older fleets to comply with evolving regulations adds another layer of complexity. The European Environment Agency reports that a notable number of the current inland vessel fleet is more than 25 years old, requiring extensive upgrades to meet the sulfur content limits and nitrogen oxide emission standards set by the EU. Retrofitting costs can reach up to €500,000 per vessel, discouraging fleet renewal among financially constrained operators. As a result, many companies opt to extend the operational life of outdated vessels, which compromises fuel efficiency and increases maintenance expenses. This financial pressure is compounded by fluctuating freight rates and limited access to financing options tailored for inland shipping. Unlike the road and rail sectors, the inland waterways industry lacks robust subsidy mechanisms, making it harder to attract private investment.

Seasonal Variability and Hydrological Constraints

A major challenge impeding the consistent operation of inland waterways in Europe is the seasonal variability of water levels, which affects navigability and vessel deployment. Droughts, floods, and unpredictable weather patterns—increasingly influenced by climate change—have led to frequent disruptions in river traffic. According to the European Drought Observatory, the summer of 2022 witnessed historically low water levels on the Rhine River, with some sections recording depths below 40 centimeters. These hydrological constraints directly impact freight economics. Lower load capacities increase per-ton transport costs, diminishing the competitiveness of inland shipping against road transport. In extreme cases, entire stretches of key waterways become impassable, forcing shippers to seek alternate modes of transport. For instance, during the 2018 drought, the economic loss for the German inland shipping sector was estimated at €1.8 billion due to prolonged service interruptions. Investments in dredging and river regulation infrastructure have helped mitigate some of these issues, but they require continuous maintenance and are often limited by environmental protection laws.

MARKET OPPORTUNITY

Adoption of Alternative Fuels and Decarbonization Initiatives

A transformative opportunity emerging in the Europe inland waterways vessel market is the adoption of alternative fuels and propulsion technologies aimed at achieving carbon neutrality. With the European Union targeting a 55% reduction in greenhouse gas emissions by 2030 under the Fit for 55 legislative package, the inland shipping sector is witnessing a surge in research and pilot projects focused on hydrogen, liquefied natural gas (LNG), methanol, and battery-electric propulsion systems. According to the European Clean Hydrogen Alliance, over 20 hydrogen-powered inland vessel demonstration projects have been initiated since 2021, with Germany and the Netherlands leading the innovation drive. Similarly, Belgium’s Compagnie Maritime Belge introduced LNG-powered push boats that cut nitrogen oxide emissions by 85% and particulate matter by nearly 95%, as reported by the Belgian Maritime Cluster. These developments are being supported by targeted subsidies and grants under the EU’s Innovation Fund and Connecting Europe Facility, which collectively allocated a substantial amount for clean maritime technologies through 2027.

The transition to cleaner fuels not only aligns with regulatory mandates but also enhances operational efficiency and reduces long-term fuel costs.

Digitalization and Smart Navigation Technologies

The rapid advancement of digital technologies presents a compelling opportunity for the Europe inland waterways vessel market, particularly through the integration of smart navigation, automation, and real-time monitoring systems. Digitalization is enabling increased operational efficiency, safety, and route optimization, all of which contribute to enhanced competitiveness vis-à-vis road transport. According to the European Commission’s Directorate-General for Mobility and Transport, the implementation of River Information Services (RIS) has reduced transit delays in key corridors such as the Rhine and Danube rivers. Projects like the European Inland Navigation Traffic System (EINES) and the Smart Rivers initiative have facilitated the deployment of digital tools such as electronic chart display systems, automated identification systems (AIS), and predictive maintenance software. These technologies allow vessel operators to optimize fuel consumption, avoid congested areas, and improve coordination with port authorities. Moreover, the rise of blockchain-based cargo tracking platforms and AI-driven logistics planning tools is streamlining supply chain visibility and reducing idle time for vessels.

MARKET CHALLENGES

Labor Shortages and Aging Workforce

A pressing challenge confronting the Europe inland waterways vessel market is the persistent shortage of skilled labor and an aging workforce. The sector relies heavily on specialized personnel, including captains, engineers, deckhands, and logistics coordinators, yet recruitment and retention have become increasingly difficult. According to the European Transport Workers’ Federation, the average age of inland waterway crew members in Western Europe exceeds 50 years, with fewer young professionals entering the profession. This demographic imbalance threatens the continuity of operations and the ability to scale up the fleet in line with growing freight demands. Compounding this issue is the relatively unattractive nature of the job profile compared to other transport sectors. Long working hours, periods away from home, and limited career progression opportunities deter younger generations from pursuing careers in inland shipping. Data from the European Centre for the Development of Vocational Training indicates that vocational training enrollments in maritime professions have declined over the past five years, particularly in Germany and France. Efforts to address the skills gap through training programs and automation have had mixed results. While digital navigation systems reduce the cognitive load on crews, they do not eliminate the need for human oversight. Moreover, language barriers and varying certification requirements across EU member states hinder the cross-border mobility of seafarers.

Regulatory Complexity and Cross-Border Operational Hurdles

The Europe inland waterways vessel market faces considerable challenges arising from regulatory fragmentation and complex cross-border compliance requirements. Although the EU has harmonized certain aspects of inland waterway transport through directives such as the Directive 2006/87/EC on technical requirements for inland waterway vessels, national-level variations persist in taxation, crew licensing, customs procedures, and environmental standards. Like, navigating these differences can add to administrative costs for operators engaged in multi-country operations. Each country maintains its own inspection regimes and documentation protocols, leading to delays and inefficiencies at border crossings and lock systems.

Environmental regulations further compound the complexity. While the EU-wide Sulfur Content Directive mandates the use of low-sulfur fuels, individual nations impose additional local restrictions. Belgium, for instance, enforces stricter NOx limits than the EU baseline, requiring retrofits that may not be economically viable for all operators. Such regulatory asymmetry impedes seamless operations and discourages pan-European fleet standardization.

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.55% |

|

Segments Covered |

By Vessel Type, Fuel Type, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Viking, Sanmar, Rhenus Group, European CruiseServiceE, Sneed Shipbuilding, CMA CGM Group, Bayliner, Windcat Workboats, Seacontractors, DFDS, Norfolk Tug Company, CIWTC, Construction Navale Bordeaux, Daewoo Shipbuilding & Marine Engineering Company Limited, Damen Shipyards Group, EURO-RIJN B.V., Hodder Tugboat Co. Ltd, Hyundai Heavy Industries, McKeil Marine Limited, Norfolk Tug Company, Royal Wagenborg. |

SEGMENTAL ANALYSIS

By Vessel Type Insights

The non-passenger vessels dominated the European inland waterways vessel market in 2024. This segment includes a diverse range of freight-carrying ships such as push boats, barges, tankers, and container carriers that facilitate the movement of bulk commodities, liquid cargo, and manufactured goods across river networks. According to data from the European Environment Agency, over 500 million tons of cargo were transported via inland waterways in 2023, with more volume handled by non-passenger vessels. One key driver behind this dominance is the increasing demand for cost-effective and energy-efficient freight transport solutions. Non-passenger vessels can carry up to 4,000 tons of cargo per trip, equivalent to the capacity of nearly 200 trucks, making them ideal for high-volume logistics. As per the European Commission’s Directorate-General for Mobility and Transport, shifting freight from road to inland waterways reduces fuel consumption, significantly lowering transport costs and emissions. Besides, infrastructure investments along major corridors like the Rhine–Main–Danube axis have enhanced navigability and expanded cargo-handling capacities at inland ports. The Netherlands, Germany, and Belgium are leading in fleet modernization efforts, with growing adoption of digital navigation tools and automated loading systems tailored for freight vessels.

The passenger ships represent the fastest-growing segment in the Europe inland waterways vessel market, projected to expand at a CAGR of around 6.1%. This upward trajectory is primarily fueled by the resurgence of river tourism and the expansion of urban mobility solutions across major cities. A major contributing factor to this growth is the rising popularity of luxury river cruises, particularly in France, Germany, and Austria. Operators such as CroisiEurope and Viking River Cruises have reported increased bookings, with occupancy rates high in peak seasons. The International Transport Forum highlights that the average CO₂ emission per passenger-kilometer for river cruise ships is less than half that of domestic air travel, reinforcing their appeal among environmentally conscious travelers. Simultaneously, cities like Amsterdam, Paris, and Berlin are investing in eco-friendly commuter ferries and sightseeing boats to alleviate urban congestion and improve public transport connectivity. For instance, the city of Lyon has introduced electric-powered water taxis as part of its sustainable mobility strategy, aligning with broader EU green transport policies.

By Fuel Type Insights

The low-sulphur fuel Oil (LSFO) had the largest share of the Europe inland waterways vessel fuel market, i.e., 41.3% of total fuel consumption in 2024. This dominance is due to regulatory mandates aimed at reducing sulphur emissions from inland shipping. Consequently, LSFO has become the preferred choice for both new and retrofitted vessels. The environmental benefits of LSFO are well-documented; compared to HFO, it reduces sulphur oxide emissions, which has led to improved air quality along heavily trafficked rivers such as the Rhine and Danube. Another contributing factor is the relative affordability and availability of LSFO compared to alternative fuels like LNG or biofuels. While newer propulsion technologies are gaining traction, they require significant infrastructure investments. LSFO, on the other hand, can be used in existing engines with minimal modifications, making it an economically viable transition solution.

The biofuel is emerging as the swiftly advancing fuel segment in the Europe inland waterways vessel market, projected to grow at a CAGR of 9.4% over the next decade. This rapid expansion is driven by stringent climate targets set under the European Green Deal, which aims to make the transport sector carbon-neutral by 2050. A primary catalyst for this growth is the increasing adoption of biodiesel blends derived from waste vegetable oil, animal fats, and second-generation feedstocks. These fuels offer a drop-in replacement for conventional diesel without requiring engine modifications, making them attractive for retrofitting older fleets. Government incentives further support this transition. France, for instance, offers a €0.20 per liter subsidy on certified renewable marine fuels, encouraging operators to switch. Additionally, inland ports such as Rotterdam and Duisburg have established dedicated bunkering facilities for biofuels, enhancing supply chain reliability.

COUNTRY-LEVEL ANALYSIS

Germany occupied the top position in the Europe inland waterways vessel market by commanding 21.4% of total regional activity in 2024. This dominance is underpinned by an extensive navigable waterway network spanning large kilometers, including critical arteries like the Rhine, Main, and Elbe rivers. The country's industrial density and reliance on efficient freight logistics contribute significantly to this robust performance. Major sectors such as chemicals, steel, and automotive utilize inland waterways to transport raw materials and finished goods at lower costs compared to road or rail. Moreover, Germany leads in fleet modernization initiatives. A notable trend is the adoption of hybrid propulsion systems, supported by subsidies under the National Innovation Program for Hydrogen and Fuel Cell Technology.

The Netherlands is another key player in the market and is due to its advanced logistics infrastructure and strategic location at the confluence of major European trade routes. The country's inland waterways span over large kilometers, connecting key ports such as Rotterdam and Amsterdam to neighboring countries. Rotterdam, Europe’s largest seaport, plays a central role in facilitating barge traffic to and from the hinterland. The Dutch government supports this sector through proactive policy measures, including investment in smart lock systems and digital navigation platforms. Furthermore, the Netherlands is a pioneer in green inland shipping, with over 120 zero-emission vessels either operational or under development. Public-private partnerships like the Inland Waterway Electrification Project are accelerating the deployment of shore-side charging stations and battery-powered barges, positioning the Netherlands as a sustainability leader in the inland vessel sector.

France holds a prominent position in the European inland waterways vessel market. Also, France leverages its extensive river system—including the Seine, Rhône, and Garonne—to facilitate domestic and cross-border freight transport. According to the French Ministry of Ecological Transition, inland shipping moved over 85 million tons of cargo in 2023, marking a steady recovery from pandemic-related disruptions. A key strength of the French inland vessel sector lies in its integration with multimodal logistics chains. The country’s inland ports, particularly those in Dunkirk, Le Havre, and Lyon, serve as crucial nodes linking maritime and terrestrial transport. Investments in infrastructure modernization, such as the Rhône-Saône high-capacity corridor project, aim to accommodate larger vessels and increase freight efficiency. Environmental regulations are also shaping the market dynamics in France. The national Clean Ports Strategy incentivizes the use of alternative fuels, including LNG and hydrogen-based propulsion systems. T

Belgium is a strategic hub with high utilization, owing to its compact yet highly interconnected waterway system. Moreover, Belgium’s inland waterways connect seamlessly with the Rhine and Meuse rivers, facilitating access to major economic centers in Germany, the Netherlands, and France. The country’s strategic geographic location enhances its role as a transit hub. Antwerp-Bruges, one of Europe’s busiest inland ports, recorded more than 25,000 inland vessel arrivals in 2022, as reported by the Port Authority. This high level of activity is supported by continuous investments in lock expansions and dredging projects aimed at accommodating larger vessels. The Belgian government has committed €900 million toward waterway modernization through 2027, focusing on improving navigability and reducing congestion. Sustainability initiatives are also driving market momentum. The introduction of the Blue Economy Fund has spurred the adoption of electric and LNG-powered vessels. For example, CMB Technologies deployed several hydrogen-burning push boats on the Scheldt River in 2023, demonstrating Belgium’s leadership in clean inland shipping technologies.

Italy is an emerging market with steady expansion, which is driven by the revitalization of its fluvial transport system and growing emphasis on sustainable logistics. The country possesses a huge area of navigable waterways, with the Po River forming the backbone of its inland freight movement. A major factor supporting Italy’s inland vessel market is the government’s push for modal shift to reduce road congestion and emissions. Projects such as the Padana Energetica initiative aim to enhance the navigability of the Po River basin, enabling larger vessels to operate efficiently. Additionally, the adoption of cleaner propulsion technologies is gaining traction.

KEY MARKET PLAYERS

Viking, Sanmar, Rhenus Group, European Cruise Service, Sneed Shipbuilding, CMA CGM Group, Bayliner, Windcat Workboats, Seacontractors, DFDS, Norfolk Tug Company, CIWTC, Construction Navale Bordeaux, Daewoo Shipbuilding & Marine Engineering Company Limited, Damen Shipyards Group, EURO-RIJN B.V., Hodder Tugboat Co. Ltd, Hyundai Heavy Industries, McKeil Marine Limited, Norfolk Tug Company, Royal Wagenborg. Are the market players that are dominating the Europe inland waterways vessel market?

Top Players In The Market

Port-Liner

Port-Liner is a leading innovator in the European inland waterways vessel market, specializing in the design and operation of zero-emission electric push boats. The company has played a crucial role in advancing sustainable inland shipping by introducing battery-powered vessels that eliminate exhaust emissions and significantly reduce noise pollution. Port-Liner’s initiatives have influenced regulatory developments and encouraged other players to invest in green technologies. By focusing on automation and digital integration, the company has positioned itself as a pioneer in reshaping inland transport logistics.

Compagnie Maritime Belge (CMB)

Compagnie Maritime Belge (CMB) is a key player known for its commitment to clean energy solutions in inland and maritime transport. CMB has been at the forefront of hydrogen-powered vessel development, demonstrating a strong vision for decarbonization. Through its subsidiary, Hydrotug, the company launched one of the first hydrogen-fueled inland vessels, setting a benchmark for future propulsion systems. CMB's influence extends beyond Europe, contributing to global discussions on sustainable shipping practices and alternative fuel adoption across multiple transport sectors.

Wagenborg Nedlloyd

Wagenborg Nedlloyd is a prominent Dutch inland shipping operator with a diverse fleet that serves both freight and logistics needs across Europe. The company is recognized for its operational efficiency, multimodal transport integration, and investment in modern, fuel-efficient vessels. Wagenborg Nedlloyd plays a strategic role in connecting major ports with inland destinations, supporting just-in-time supply chain models. Its emphasis on reliability and customer-centric services has reinforced its reputation as a dependable partner in Europe’s evolving inland waterway transport landscape.

Top Strategies Used By Key Market Participants

One of the primary strategies adopted by leading companies in the Europe inland waterways vessel market is investing heavily in clean propulsion technologies. Firms are prioritizing research and development into hydrogen, LNG, and battery-electric powertrains to align with stringent environmental regulations and meet growing demand for low-emission transport solutions. This shift not only enhances their sustainability profile but also positions them ahead of regulatory changes.

Another critical approach is the pursuit of strategic partnerships and joint ventures. Companies are collaborating with technology providers, port authorities, and government bodies to accelerate infrastructure development and optimize vessel operations. These alliances facilitate knowledge sharing, cost distribution, and faster deployment of innovative solutions across the inland shipping ecosystem.

Lastly, firms are increasingly focusing on fleet modernization and digital integration. By upgrading existing fleets and incorporating smart navigation systems, operators aim to improve efficiency, safety, and route optimization. This strategy enhances competitiveness and supports seamless integration within broader European transport networks.

COMPETITION OVERVIEW

The competition in the Europe inland waterways vessel market is shaped by a mix of established regional operators and emerging technology-driven enterprises. With a strong presence of traditional shipping companies, the market is highly fragmented yet dynamic, driven by environmental mandates and infrastructure investments. Many firms are vying for dominance by adopting advanced propulsion systems and integrating digital technologies to enhance operational efficiency. As regulatory pressure mounts to reduce emissions, companies are differentiating themselves through innovation in sustainable vessel design and alternative fuel applications. Additionally, competitive positioning is being strengthened through fleet renewal programs and strategic collaborations aimed at expanding service offerings. The growing emphasis on green logistics is compelling industry participants to rethink business models and invest in next-generation inland waterway solutions. This evolving landscape fosters continuous adaptation, ensuring that only those companies that embrace transformation will maintain long-term relevance and leadership in the sector.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Port-Liner announced the launch of its second-generation electric push boat designed specifically for heavy-duty inland cargo transportation. This vessel integrates advanced battery technology and autonomous navigation features, reinforcing the company’s leadership in zero-emission inland shipping.

- In July 2023, Compagnie Maritime Belge (CMB) introduced a hydrogen-powered inland barge on the Rhine River, marking a significant step toward the large-scale commercialization of hydrogen-based propulsion in European inland waterways.

- In November 2024, Wagenborg Nedlloyd expanded its fleet with the addition of ten new multipurpose barges equipped with hybrid propulsion systems, enhancing its ability to serve diverse cargo requirements while reducing environmental impact.

- In February 2023, Fluvius, a consortium led by several European inland shipping firms, initiated a pan-European project to establish standardized charging stations for electric vessels along key river corridors, aiming to accelerate the adoption of electrified transport.

- In September 2024, Scandlines, traditionally a ferry operator, entered the inland waterways market by acquiring a stake in a German inland shipping firm, signaling a strategic move to diversify into sustainable short-sea and inland transport solutions.

MARKET SEGMENTATION

This research report on the Europe inland waterways vessel market is segmented and sub-segmented into the following categories.

By Vessel Type

- Passenger Ships

- Non-Passenger Vessels

By Fuel Type

- LNG

- Low Sulphur Fuel Oil

- Diesel Oil

- Heavy Fuel Oil

- Biofuel

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is fueling growth in Europe’s inland waterways vessel market?

The push for greener logistics, lower transport emissions, and congestion-free freight routes is increasing reliance on inland waterways, especially along the Rhine, Danube, and Elbe corridors.

How are EU environmental regulations shaping vessel modernization?

The EU’s “Green Deal” and Stage V emission standards are accelerating adoption of hybrid and LNG-powered vessels, with funding incentives promoting retrofits and fleet upgrades.

Which countries are leading in inland waterway infrastructure and freight volume?

Germany, the Netherlands, and Belgium dominate, accounting for over 70% of inland freight traffic in the EU, supported by advanced canal networks and port connectivity.

What types of vessels are most in demand in Europe’s inland market?

Container carriers and tank barges are increasingly in demand due to growth in petrochemicals, grain, and intermodal logistics, favoring flat-bottom designs for shallow draft rivers.

How is digitalization impacting inland waterway operations?

Smart navigation systems, AIS tracking, and real-time route optimization are enhancing safety, fuel efficiency, and scheduling accuracy across European waterborne logistics networks.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com