Europe Intelligent Vending Machine Market Size, Share, Trends & Growth Forecast Report By Product (Beverages, Food), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Intelligent Vending Machine Market Size

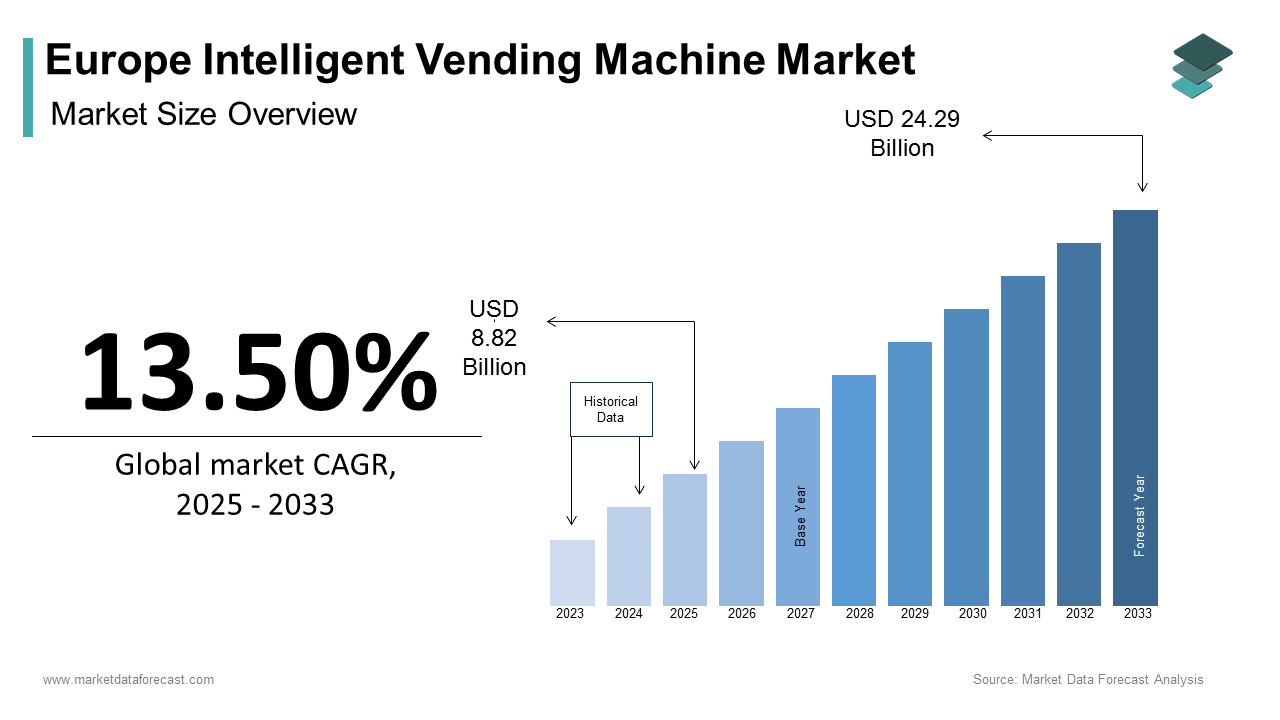

The Europe Intelligent Vending Machine Market size was calculated to be USD 7.77 billion in 2024 and is anticipated to be worth USD 24.29 billion by 2033, from USD 8.82 billion in 2025, growing at a CAGR of 13.50% during the forecast period.

The European intelligent vending machine market refers to the growing segment of automated retail systems equipped with advanced technologies such as IoT connectivity, real-time inventory tracking, cashless payment integration, and AI-driven demand forecasting. These machines are deployed across a wide range of locations including airports, train stations, universities, corporate offices, hospitals, and entertainment venues, offering consumers convenient access to food, beverages, personal care products, and even pharmaceuticals.

A key enabler of this market’s evolution is the increasing digitalization of commerce and the rising consumer preference for contactless, on-the-go purchasing solutions. This trend has extended into physical retail environments, where intelligent vending machines offer seamless user experiences through mobile app integration, facial recognition, and dynamic pricing models. Apart from these, labor shortages and rising operational costs in the retail and hospitality sectors have prompted businesses to explore automation as a viable alternative.

MARKET DRIVERS

Growth of Smart Cities and Digitally Integrated Urban Infrastructure

One of the primary drivers of the European intelligent vending machine market is the rapid development of smart cities and digitally integrated urban infrastructure. Across the region, governments are investing heavily in smart mobility, intelligent public services, and digitized commerce to enhance urban efficiency and sustainability. According to the European Innovation Partnership on Smart Cities and Communities (EIP-SCC), a significant number of cities in Europe were actively implementing smart infrastructure projects, many of which included automated retail solutions.

Intelligent vending machines align perfectly with these initiatives by offering a scalable, low-footprint method for distributing goods in high-traffic urban areas such as transit hubs, university campuses, and office complexes. These machines support real-time data exchange, allowing operators to optimize restocking schedules, monitor product performance, and personalize offerings based on consumer preferences. Moreover, municipal authorities are increasingly promoting cashless transactions and contactless interactions to reduce dependency on physical currency and streamline customer experiences.

Increasing Demand for Automated Retail Solutions in Healthcare and Education Sectors

Another significant driver shaping the European intelligent vending machine market is the rising deployment of automated retail solutions in healthcare and educational institutions. Hospitals, clinics, and universities are increasingly adopting intelligent vending machines to improve service delivery, reduce staffing burdens, and provide round-the-clock access to essential goods.

In healthcare settings, these machines are being used to dispense medications, personal protective equipment (PPE), hygiene kits, and nutritional supplements. Similarly, in the education sector, universities and vocational schools are leveraging these systems to offer students snacks, stationery, electronics, and even textbooks without requiring manned retail outlets. These applications not only improve convenience but also support cost-effective operations, making intelligent vending machines an attractive investment for institutional buyers seeking modernization and efficiency gains.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

A major restraint affecting the European intelligent vending machine market is the high initial capital expenditure and ongoing maintenance costs associated with deploying and operating these advanced systems. Unlike traditional vending machines, intelligent units incorporate IoT sensors, cloud connectivity, AI-based analytics, and secure payment gateways—components that significantly increase procurement and installation expenses. Also, the average cost of setting up a fully functional intelligent vending machine is approximately 2.5 times higher than that of a conventional unit. This financial barrier discourages small and medium-sized businesses from entering the market or expanding their fleets.

Furthermore, regular software updates, cybersecurity protections, and hardware replacements add to the total cost of ownership. Like, a survey by the German Mechanical Engineering Industry Association (VDMA) found that nearly 35% of vending operators cited technical complexity and repair expenses as key challenges in maintaining intelligent machines.

Regulatory and Data Privacy Concerns Surrounding Smart Transactions

Regulatory and data privacy concerns pose a significant challenge to the expansion of the European intelligent vending machine market. As these machines increasingly rely on biometric identification, mobile payments, and consumer behavior analytics, they collect and process vast amounts of personal data, raising compliance issues under the General Data Protection Regulation (GDPR).

According to the European Data Protection Board (EDPB), over 150 data privacy complaints related to automated retail devices were filed in 2023, prompting regulatory scrutiny of how vending operators handle user information. The requirement to obtain explicit consent for data collection, ensure encryption, and implement breach notification protocols adds administrative and technical complexity for manufacturers and operators alike. Moreover, the use of facial recognition for age verification—particularly in alcohol-dispensing vending machines—has faced legal restrictions in several EU countries, including Belgium and Austria. As per a ruling by the Court of Justice of the European Union (CJEU), any processing of biometric data must be justified by legitimate interest or explicit user consent, limiting certain functionalities of intelligent vending systems.

MARKET OPPORTUNITIES

Expansion of On-Demand Retail Models in Public Transportation Hubs

An emerging opportunity within the European intelligent vending machine market lies in the expansion of on-demand retail models in public transportation hubs such as airports, train stations, and metro terminals. With millions of daily commuters and travelers seeking quick access to food, beverages, travel essentials, and even electronics, these locations present ideal environments for deploying intelligent vending solutions. Airports such as Amsterdam Schiphol and London Heathrow have already begun integrating smart vending kiosks that offer real-time inventory updates, mobile ordering, and loyalty program integrations.

Additionally, the rise of last-mile logistics and micro-fulfillment centers near transport nodes allows for efficient restocking and dynamic product rotation. As part of its Smart Mobility Framework, the European Commission has encouraged the integration of automated retail solutions in transport infrastructure to enhance traveler experience and reduce congestion around traditional retail points.

Integration with E-Grocery and Last-Mile Delivery Networks

The integration of intelligent vending machines with e-grocery and last-mile delivery networks presents a substantial growth opportunity in the Europe market. As online grocery shopping continues to gain traction, retailers and logistics companies are exploring hybrid fulfillment models that combine home delivery with automated pickup points via smart lockers and vending stations.

According to the European Grocery E-commerce Report 2023, online grocery sales in Europe surpassed €120 billion, with consumers increasingly expecting flexible and contactless delivery options. Intelligent vending machines serve as ideal nodes for after-hours pickups, reducing delivery costs and enhancing order accuracy.

Supermarket chains such as Carrefour in France and Rewe in Germany have piloted vending-based parcel pickup systems, enabling customers to retrieve pre-ordered groceries and household essentials at their convenience. These machines are often equipped with temperature-controlled compartments to preserve perishable items, ensuring product integrity. With the European Green Deal pushing for reduced emissions in urban logistics, vending-integrated delivery models offer a sustainable alternative to repeated home deliveries.

MARKET CHALLENGES

Technical Complexity in Maintaining Real-Time Connectivity and System Uptime

Ensuring consistent real-time connectivity and system uptime remains a critical challenge for the European intelligent vending machine market. Unlike traditional vending units, intelligent machines rely heavily on continuous internet access to support features such as live inventory tracking, remote diagnostics, dynamic pricing, and mobile payment integration. However, inconsistent network coverage, especially in underground metro stations, rural areas, and older buildings, poses a risk to seamless operation.

According to a report by the European Telecommunications Network Operators’ Association (ETNO), a notable portion of urban zones in Western Europe still experience intermittent 4G connectivity, while rural regions face even greater limitations. This affects the ability of vending operators to remotely monitor stock levels, receive fault alerts, and update software in real-time. Besides, reliance on cloud-based analytics and AI-driven demand forecasting requires uninterrupted server availability. A single outage can disrupt multiple machines simultaneously, leading to lost sales and diminished customer trust.

Consumer Skepticism Toward Product Quality and Hygiene in Automated Dispensing

Consumer skepticism regarding product quality and hygiene in automated dispensing represents another significant challenge for the European intelligent vending machine market. Despite technological advancements, some users remain hesitant to purchase perishable items like dairy products, fresh meals, or pharmaceuticals from vending machines due to concerns about storage conditions, expiration dates, and contamination risks. To address these concerns, vending operators must invest in transparent monitoring systems, visible expiration date indicators, and self-sanitizing mechanisms. However, incorporating such features increases manufacturing costs and complicates maintenance routines. Moreover, enforcing strict hygiene protocols across thousands of distributed machines proves logistically challenging.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.50% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Crane Co., Seagate Technology Holdings PLC, Sanden Corp, Royal Vendors, Advantech, Azkoyen, FAS International, Bianchi Vending, Rheavendors Servomat, N&W Global Vending S.p.A., Westomatic, Jofemar SA |

SEGMENTAL ANALYSIS

By Product Insights

The beverages segment dominated the European intelligent vending machine market by accounting for 42.7% of total revenue in 2024. This control over the market is primarily attributed to the widespread consumer demand for coffee, tea, bottled water, soft drinks, and energy beverages across office spaces, retail centers, and transportation hubs. The integration of premium brewing technologies into intelligent vending machines—such as bean-to-cup systems and customizable temperature settings—has significantly enhanced product appeal. Also, workplace wellness initiatives have spurred interest in healthier drink options, including herbal teas, plant-based milks, and low-sugar alternatives. With continuous innovation in flavor personalization and mobile ordering capabilities, the beverages segment remains the cornerstone of intelligent vending machine deployments across the region.

The food segment is emerging as the fastest-growing category in the European intelligent vending machine market, projected to expand at a CAGR of 14.8% from 2025 to 2033. This surge is propelled by rising demand for ready-to-eat meals, fresh sandwiches, dairy products, and gourmet snacks that cater to time-constrained consumers seeking convenience without compromising quality. Like, on-the-go eating habits have become increasingly prevalent, with a major share of working professionals in France and Spain opting for pre-packaged meals due to limited lunch breaks and flexible work schedules. Intelligent vending machines equipped with temperature-controlled compartments are well-positioned to meet this demand while ensuring food safety and freshness. Moreover, major supermarket chains such as Carrefour and Rewe have partnered with vending operators to offer branded meal kits and chilled entrees through smart dispensing units located near transit stations and business districts. These collaborations have led to an increase in vending-based food purchases in the last few years.

By Application Insights

The commercial malls and retail stores represented the top-performing application segment in the European intelligent vending machine market by capturing 49.1% of total value in 2024. This influence is due to the high footfall in shopping centers, department stores, and hypermarkets, where consumers seek quick access to snacks, beverages, and lifestyle products between shopping sessions. These machines enhance customer experience by offering contactless purchasing, loyalty program integrations, and real-time promotions based on user preferences. Furthermore, retailers are leveraging vending kiosks to supplement traditional checkout points during peak hours, reducing queue times and improving store efficiency. In Germany, leading mall operators such as Unibail-Rodamco-Westfield have installed AI-powered vending machines that adjust product offerings based on time-of-day analytics and seasonal trends.

The educational institutes are the swiftest expanding application segment in the Europe intelligent vending machine market, expected to rise at a CAGR of 13.5% through 2033. Universities, colleges, and vocational training centers are increasingly adopting intelligent vending solutions to provide students and staff with 24/7 access to nutritious meals, study essentials, and personal care items. Intelligent vending machines placed in dormitories, libraries, and campus cafeterias offer extended availability beyond regular dining hours, aligning with flexible academic schedules. In response to rising concerns about student nutrition, several universities—including ETH Zurich and the University of Copenhagen—have introduced vending units featuring calorie-count displays, allergen information, and dietary filtering options via mobile apps.

REGIONAL ANALYSIS

Germany had the largest share of the Europe intelligent vending machine market by accounting for a 23.6% in 2024. As a technologically advanced economy with a strong emphasis on automation and digital infrastructure, Germany leads in both manufacturing and deployment of intelligent vending solutions. The country’s robust logistics network and high urbanization rate facilitate efficient restocking and maintenance, supporting large-scale adoption. Moreover, Germany's workforce culture prioritizes productivity and convenience, making vending-based snack and beverage access an essential feature in modern office environments.

France exhibits positive growth trends in the market. The country’s market growth is driven by its extensive retail ecosystem, evolving consumer preferences, and government support for digital commerce initiatives. Paris, Lyon, and Marseille have emerged as key adoption hubs, particularly for food and beverage dispensers integrated with cashless payment platforms. Also, France’s focus on sustainable consumption has encouraged vending operators to incorporate energy-efficient cooling systems and recyclable packaging materials. Major brands such as Auchan and Carrefour have launched pilot programs integrating vending-based grocery pickup, enhancing last-mile delivery efficiency.

The United Kingdom has a significant position in the market. The UK’s mature retail and hospitality sectors, coupled with a digitally savvy population, contribute to the strong demand for automated retail solutions. The rise of hybrid work models has further boosted demand for office-based vending units offering personalized snack and beverage options. Moreover, the UK government’s Smart Cities initiative has facilitated the integration of vending machines into public transport networks, enabling commuters to purchase travel essentials seamlessly. Companies such as Coca-Cola Europacific Partners and Vendekin have expanded their fleets to capitalize on this trend and

Italy remains a key player in the market. The country’s deep-rooted café culture and preference for freshly brewed coffee have fueled the proliferation of intelligent beverage dispensers in workplaces, airports, and public squares. The integration of vending-based espresso dispensers in office buildings and co-working spaces has been particularly well-received. Also, Italy’s aging population and growing elderly workforce have increased demand for accessible, self-service retail options. Municipal authorities in Turin and Florence have piloted vending units for pharmaceuticals and nutritional supplements, expanding the scope of intelligent vending applications.

Spain holds a decent share of the market. The country’s tourism-driven economy and vibrant urban lifestyle create favorable conditions for vending machine deployments in high-traffic areas such as Barcelona, Madrid, and Valencia. The integration of vending machines into tourist attractions and cultural venues has further boosted adoption, offering visitors easy access to refreshments and local products. Besides, Spain’s progressive stance on digital payments and mobile connectivity has enabled seamless transactions through NFC and QR code scanning. Startups and tech firms have capitalized on this trend by launching smart vending solutions tailored for university campuses and office parks.

LEADING PLAYERS IN THE EUROPE INTELLIGENT VENDING MACHINE MARKET

Crane Payment Innovations (A Subsidiary of Crane Co.)

Crane Payment Innovations is a leading global provider of payment solutions for intelligent vending machines, playing a crucial role in enabling cashless and contactless transactions across Europe. The company contributes to the market by offering secure, high-performance payment systems that integrate seamlessly with smart vending infrastructure.

Its expertise in digital payment processing, fraud detection, and real-time transaction analytics enhances the efficiency and user experience of automated retail platforms. By continuously advancing its NFC, QR code, and mobile wallet integration capabilities, Crane supports vending operators in adapting to evolving consumer preferences.

N&W Group (Nu-Wave Technologies)

N&W Group, known for its Nu-Wave Technologies division, is a key player in the development of intelligent vending systems tailored for European markets. The company specializes in end-to-end vending automation solutions, including IoT-enabled controllers, telemetry systems, and cloud-based management platforms.

N&W’s contributions lie in enhancing operational efficiency, remote monitoring, and predictive maintenance for vending fleets deployed in high-traffic environments such as offices, educational institutions, and public transport hubs. Its focus on modular, scalable hardware architecture allows operators to customize machine functionality based on location-specific needs. By fostering partnerships with major beverage and snack brands, N&W strengthens the deployment of next-generation vending ecosystems.

Azkoyen Group

Azkoyen Group is a prominent European manufacturer of intelligent vending solutions, recognized for its advanced payment systems, dispensing mechanisms, and integrated software platforms. The company plays a vital role in driving automation across the food service and retail sectors by equipping vending machines with smart technologies that support dynamic pricing, real-time inventory tracking, and AI-driven demand forecasting.

Azkoyen's contributions extend beyond product development; it actively participates in shaping industry standards through collaboration with regulatory bodies and trade associations focused on digital commerce and smart city initiatives.

Its emphasis on sustainability—through energy-efficient components and eco-conscious design—resonates with European environmental policies, reinforcing its leadership position.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the European intelligent vending machine market is integrating advanced digital technologies into vending systems to enhance user experience and operational efficiency. Companies are embedding IoT sensors, AI-driven analytics, and cloud-based management tools to enable real-time monitoring, personalized recommendations, and seamless payment options via mobile apps and contactless cards.

Another critical approach is expanding partnerships with retailers, food service providers, and logistics companies to optimize product offerings and supply chain integration. These collaborations allow vending operators to diversify their inventory, ensure freshness, and leverage existing distribution networks for efficient restocking and maintenance.

Lastly, manufacturers are increasingly focusing on customization and modularity, allowing clients to configure vending machines according to specific location requirements, whether in corporate offices, transit hubs, or university campuses. This flexibility supports broader adoption across diverse verticals and reinforces competitive differentiation in a rapidly evolving market landscape.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Europe Intelligent Vending Machine Market include Crane Co., Seagate Technology Holdings PLC, Sanden Corp, Royal Vendors, Advantech, Azkoyen, FAS International, Bianchi Vending, Rheavendors Servomat, N&W Global Vending S.p.A., Westomatic, Jofemar SA.

The competition in the European intelligent vending machine market is marked by rapid technological innovation, shifting consumer expectations, and increasing convergence between digital commerce and physical retail. A mix of established industrial equipment manufacturers, emerging tech startups, and regional vendors are vying for dominance, each leveraging unique strengths to capture market share.

Incumbent players benefit from extensive distribution networks, brand recognition, and deep integration with existing vending ecosystems. However, agile newcomers are disrupting the space by introducing cutting-edge features such as AI-powered personalization, biometric authentication, and blockchain-based loyalty programs. This dynamic environment fosters continuous product evolution and service enhancement.

Moreover, competition extends beyond hardware to encompass software capabilities, data analytics, and payment security frameworks, making digital integration a decisive factor in market positioning. As urbanization accelerates and smart city initiatives gain momentum, vendors must differentiate not only through technical superiority but also through strategic partnerships, sustainability efforts, and localized service models to maintain relevance and scalability in a highly fragmented yet growth-oriented market.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Crane Payment Innovations launched an enhanced NFC-enabled payment module designed specifically for vending applications, aiming to improve transaction speed and security across public and commercial installations in Germany and France.

- In April 2024, N&W Group partnered with a leading European logistics platform to introduce real-time inventory tracking and predictive restocking algorithms, improving operational efficiency for vending operators managing large-scale deployments in Spain and Italy.

- In June 2024, Azkoyen introduced a new line of modular intelligent vending units capable of dispensing fresh meals, pharmaceuticals, and specialty beverages, expanding its footprint in healthcare and food service segments across Scandinavia and the Netherlands.

- In September 2024, Glory Global Solutions acquired a UK-based fintech startup specializing in vending payment encryption, strengthening its ability to offer secure, multi-currency transaction solutions tailored for pan-European vending networks.

- In November 2024, Fujitsu Frontech expanded its intelligent vending software portfolio with an AI-driven demand forecasting system, enabling operators in Belgium and Austria to dynamically adjust pricing and product availability based on foot traffic and purchasing behavior patterns.

MARKET SEGMENTATION

This research report on the Europe Intelligent Vending Machine Market has been segmented and sub-segmented based on product, application, and region.

By Product

- Beverages

- Food

By Application

- Commercial Malls & Retail Stores

- Educational Institutes

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What challenges must vendors overcome?

High upfront hardware/software integration costs, ensuring cybersecurity and GDPR-compliant data handling, managing complex back-end connectivity, and keeping machine UIs and product assortments up to date.

2. How are intelligent vending machines transforming retail in Europe?

By offering 24/7, contact-free shopping; enabling dynamic pricing and promotions; reducing shrinkage through real-time stock monitoring; and using data-driven insights to tailor assortments to local demand.

3. Which payment and authentication methods do they support?

Modern machines accept EMV chip & contactless cards, mobile wallets (Apple Pay, Google Pay), QR-code scans, and even biometric or NFC-based employee badges for corporate deployments.

4. Who are the main end-users deploying these machines?

Offices and corporate campuses, hospitals and care facilities, universities, transit hubs (airports/train stations), retail malls, and “last-mile” locations like apartment lobbies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com