Europe Leather Market Size, Share, Trends, & Growth Forecast Report by Source (Full Grain Leather, Synthetic Leather), Product, End-User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Leather Market Size

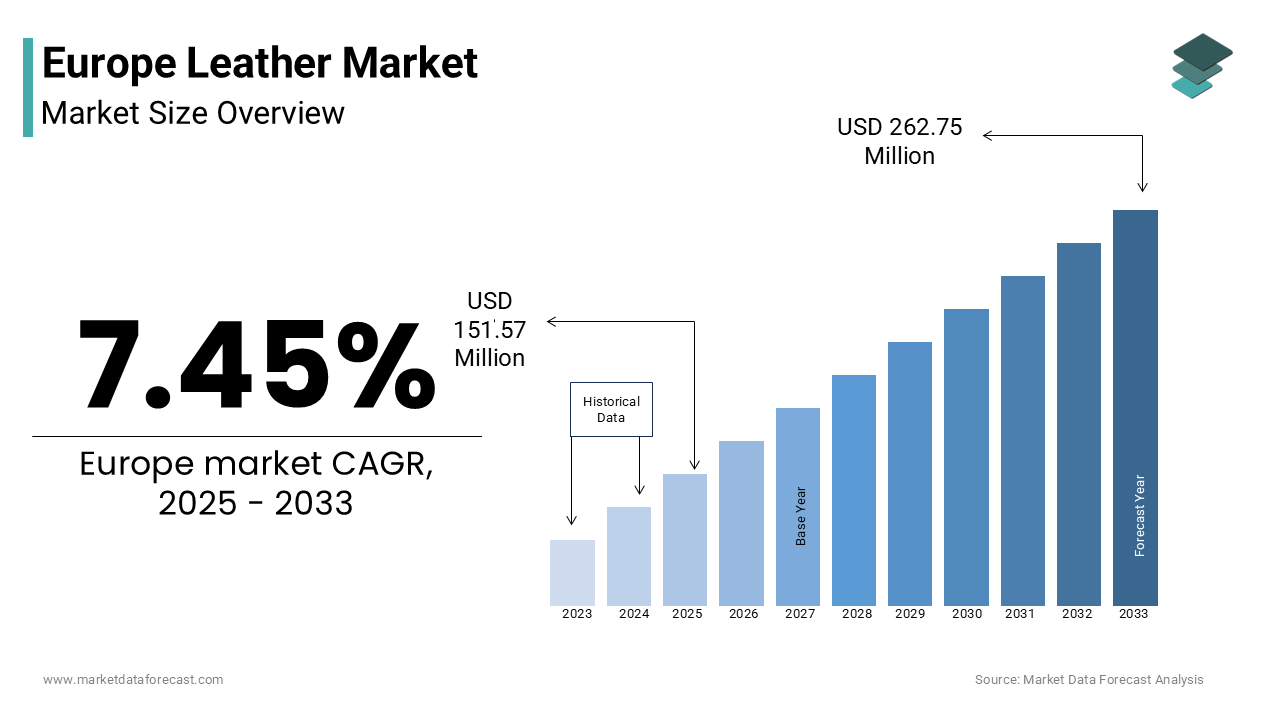

The Europe Leather Market was worth USD 141.49 million in 2024. The Europe market is expected to reach USD 262.75 million by 2033 from USD 151.57 million in 2025, rising at a CAGR of 7.45% from 2025 to 2033.

Europe’s leather market is particularly concentrated in countries like Italy, France, Spain, and Germany, which are renowned for their premium leather outputs and brand equity in luxury fashion. According to the European Commission's Industrial Policy Report, the leather and tanning sector contributes significantly to regional economies through employment and export revenues. The region also emphasizes sustainability and ethical sourcing, aligning with broader environmental regulations such as REACH and the EU Strategy for Sustainable and Circular Textiles. These policies have shaped the modern dynamics of the leather value chain in Europe, pushing for cleaner production methods and traceable sourcing practices. Such regulatory and economic frameworks continue to influence the structure and competitiveness of the Europe leather market.

MARKET DRIVERS

Growth of the Luxury Fashion Industry in Western Europe

One of the key drivers of the Europe leather market is the robust growth of the luxury fashion industry, especially in Western Europe. Countries like Italy, France, and Spain are home to globally recognized fashion houses such as Gucci, Louis Vuitton, Prada, and Loewe, which heavily rely on high-quality leather for their product lines. Additionally, consumer preference for sustainable and ethically produced materials has led many European luxury brands to invest in traceable leather supply chains. The continued expansion of luxury fashion retail and e-commerce platforms further amplifies demand for European leather by reinforcing its strategic importance within the broader textile and apparel sector.

Expansion of the Automotive Interior Sector Using Genuine Leather

Another significant driver of the Europe leather market is the growing use of genuine leather in automotive interior design, particularly among premium car manufacturers based in Germany, the UK, and Sweden. European automakers such as BMW, Mercedes-Benz, Audi, and Volvo frequently incorporate high-grade leather into seats, steering wheels, dashboards, and gear shifts to enhance comfort, aesthetics, and perceived value. The increasing demand for personalized and high-end interiors has resulted in a parallel rise in automotive leather consumption. Moreover, the trend toward electric vehicles (EVs) has further reinforced the use of leather in vehicle interiors, as manufacturers aim to offset the higher cost of EVs with premium features that justify price premiums.

MARKET RESTRAINTS

Rising Environmental Regulations and Compliance Costs

One of the primary restraints affecting the Europe leather market is the tightening of environmental regulations governing leather production processes. The leather tanning industry is known for its high water consumption and chemical discharge, which pose serious environmental risks if not properly managed. In response, the European Union has implemented stringent directives such as the REACH Regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the Industrial Emissions Directive (IED), which mandate strict controls on effluent discharge, chemical usage, and waste management.

Compliance with these regulations requires substantial investment in advanced wastewater treatment systems, eco-friendly tanning agents, and process modifications. As per data from the Confederation of National Associations of Tanners and Dressers (COTANCE), the average compliance cost for medium-sized tanneries increased by 18% between 2020 and 2023, significantly impacting profit margins. Smaller producers, in particular, face challenges in keeping up with these rising costs, leading to consolidation in the market and reduced entry opportunities for new players.

Increasing Availability and Popularity of Synthetic Leather Alternatives

Another significant restraint on the Europe leather market is the growing popularity and availability of synthetic leather substitutes, which are increasingly being adopted across various sectors including fashion, furniture, and automotive interiors. Consumer preferences in Europe have shifted significantly in recent years, driven by concerns over animal welfare and the ecological footprint of leather production. A survey conducted by Euromonitor International in 2023 found that nearly 42% of European consumers preferred purchasing products made from vegan or synthetic materials, particularly in urban centers such as Berlin, Amsterdam, and London. Additionally, major fashion brands like H&M and Zara have expanded their vegan leather product lines, further influencing market trends. From an industrial perspective, automotive manufacturers such as Volkswagen and Renault have also begun incorporating bio-based synthetic leathers in their vehicle interiors to meet sustainability targets.

MARKET OPPORTUNITIES

Surge in Demand for Sustainable and Ethically Sourced Leather

A major opportunity for the Europe leather market lies in the increasing demand for sustainable and ethically sourced leather, driven by heightened consumer awareness and corporate responsibility initiatives. European consumers in countries like Germany, France, and the Netherlands are showing a clear preference for transparency in sourcing and production practices. This growing emphasis on sustainability has prompted tanneries and leather manufacturers to adopt greener technologies and obtain certifications such as Leather Working Group (LWG) accreditation, which ensures environmentally sound production practices. Furthermore, the European Green Deal and related policy frameworks are incentivizing businesses to reduce carbon footprints and improve resource efficiency. Brands like Stella McCartney and Hugo Boss have capitalized on this trend by launching collections featuring traceable, chrome-free, and vegetable-tanned leather.

Integration of Advanced Technologies in Leather Processing

Another significant opportunity for the Europe leather market is the adoption of advanced technologies in leather processing and manufacturing. Innovations such as digital printing, laser cutting, automated grading systems, and smart tanning solutions are enhancing efficiency, precision, and customization capabilities across the value chain. According to a 2023 report by Deloitte, the implementation of Industry 4.0 technologies in the leather sector has improved productivity by up to 15% in select European tanneries by reducing material waste and energy consumption.

Digitalization has also enabled greater traceability and quality control throughout the leather supply chain. Companies like Haas Group in Italy and Guidetti in Germany have invested heavily in AI-driven sorting systems and IoT-enabled monitoring tools to ensure consistent product quality and optimize resource use. Additionally, biotechnology is playing a transformative role, with startups such as Modern Meadow developing biofabricated leather that mimics natural properties without requiring animal hides. These technological advancements not only improve operational performance but also open new avenues for product differentiation and market expansion by positioning Europe as a leader in innovative leather production.

MARKET CHALLENGES

Supply Chain Disruptions Due to Geopolitical and Economic Instabilities

A major challenge facing the Europe leather market is the vulnerability of its supply chain to geopolitical tensions and macroeconomic fluctuations. Recent events such as the Russia-Ukraine war, Brexit-related trade adjustments, and inflationary pressures have disrupted the flow of essential inputs and increased operational costs. The conflict in Ukraine, for example, affected the availability of certain chemicals used in tanning, as Eastern Europe had been a key supplier. Similarly, post-Brexit customs checks have led to delays in cross-channel shipments, impacting just-in-time manufacturing models used by several European tanneries. These disruptions have forced many small and mid-sized enterprises to either stockpile raw materials at higher costs or seek alternative sourcing channels, which may compromise quality and consistency.

Labor Shortages and Declining Skilled Workforce in Traditional Leather Manufacturing

Another significant challenge confronting the Europe leather market is the persistent shortage of skilled labor and the declining interest among younger generations in pursuing careers in traditional leather manufacturing. Despite the region’s historical expertise in artisanal leatherwork, the industry faces difficulties in sustaining a trained workforce due to aging demographics and limited vocational training programs. According to a 2023 report by the European Centre for the Development of Vocational Training (CEDEFOP), the leather and tanning sector in the EU experienced a 9% decline in active workers over the past five years, with an average age of employees exceeding 52 years.

This skills gap is particularly pronounced in countries like Italy and Spain, where craftsmanship plays a crucial role in producing high-value leather goods. The lack of apprenticeship opportunities and the perception of leather work as outdated or physically demanding have deterred young professionals from entering the field. Furthermore, automation and digital transformation efforts, while beneficial for efficiency, require technical knowledge that many existing workers do not possess, exacerbating the labor mismatch. As per data from the European Trade Union Confederation, only 14% of vocational education programs in the EU include leather-specific training modules, limiting the pipeline of future talent.

SEGMENTAL ANALYSIS

By Source Insights

The full grain leather dominated the Europe leather market by accounting for 58.3% of share in 2024 with its superior quality, natural texture, and high durability, making it a preferred material for luxury goods, automotive interiors, and premium footwear. European consumers in Italy and France, exhibit a strong preference for full grain leather due to its association with craftsmanship and exclusivity.

According to the Italian National Tanners Association (UNIC), Italy alone produces over 18% of the world’s full grain leather and exports nearly 70% of its output to high-end fashion and automobile sectors globally. The country's dominance in artisanal tanning techniques reinforces the segment’s strength. Additionally, the resurgence of heritage brands like Tod’s and Bottega Veneta has further boosted demand for authentic, unaltered leather surfaces. The continued emphasis on sustainability and traceability also supports this segment, as many European tanneries have adopted eco-friendly processing methods that align with consumer expectations for ethical luxury.

The synthetic leather segment is lucratively growing with an estimated CAGR of 6.3% in the next coming years. This rapid expansion is attributed to increasing environmental awareness, animal welfare concerns, and advancements in material technology that have enhanced the aesthetics and performance of synthetic alternatives. A 2023 survey by Euromonitor International found that over 45% of European consumers consider synthetic leather a viable alternative to traditional leather, particularly in urban markets such as Berlin, Amsterdam, and Copenhagen. Moreover, regulatory support for sustainable manufacturing practices has encouraged companies to adopt bio-based polyurethane and plant-derived materials. Companies like Volvo and IKEA have integrated vegan leathers into their product lines to meet evolving consumer preferences and reduce environmental impact.

By Product Insights

The footwear segment was the largest and held 34.2% of the Europe leather market share in 2024 with the long-standing tradition of leather shoe manufacturing in countries like Italy, Spain, and Portugal, where artisanal craftsmanship meets global brand recognition. European consumers place a high value on comfort, durability, and aesthetic appeal, all of which are key attributes of leather footwear. As reported by the European Footwear Confederation (CEC), the EU produced over 680 million pairs of leather shoes in 2023, with Italy contributing nearly 30% of total output. Leading brands such as Geox, Camper, and Church’s continue to drive demand through innovation in design and materials. Additionally, the presence of premium retail chains and e-commerce platforms has expanded access to leather footwear across the region.

The luggage segment is likely to grow with a CAGR of 7.1% in the next coming years. This surge is primarily driven by the rebound in international travel post-pandemic, coupled with the growing demand for premium travel accessories among affluent consumers. According to the European Travel Commission, international overnight stays in Europe increased by 42% in 2023 compared to the previous year, which is stimulating purchases of durable and stylish luggage products.

Luxury brands such as Louis Vuitton, Rimowa, and Samsonite have capitalized on this trend by introducing high-end leather-trimmed suitcases, duffels, and carry-ons that cater to discerning travelers. Moreover, the shift toward experiential consumption and status-driven buying behavior has elevated the appeal of branded luggage. In parallel, manufacturers are integrating lightweight yet resilient leather composites to enhance functionality without compromising aesthetics.

By End-User Insights

The women was the largest and held 46.3% of share in 2024. According to the European Apparel and Textile Confederation (EURATEX), women’s leather clothing accounted for over 55% of total leather apparel sales in Europe during the same period. Countries such as France, Italy, and Germany have seen a consistent rise in the purchase of leather jackets, skirts, and trousers among millennials and Gen Z consumers who prioritize style and versatility. A 2023 report by McKinsey & Company highlighted that 63% of European women aged 18–45 considered leather as a must-have fabric in their wardrobes by citing durability and sophistication as key factors. Additionally, the growth of fast-fashion retailers like Zara and H&M, which offer affordable leather-look items, has broadened accessibility. The rising influence of social media and celebrity endorsements has further amplified the appeal of leather-based fashion among female consumers, ensuring sustained demand in this dominant category.

The kids’ segment is likely to grow with a CAGR of 6.8% in the next coming years. This growth is primarily driven by increasing parental expenditure on premium children’s footwear and clothing, as well as a growing preference for durable and hypoallergenic materials. According to Eurostat, household spending on children’s apparel in the EU rose by 7.4% in 2023, with leather-based products gaining traction due to their perceived longevity and comfort. Parents, particularly in Nordic and Western European countries, are increasingly opting for high-quality leather shoes and jackets for infants and toddlers, believing them to be safer and more adaptable to changing weather conditions. As per a study by Mintel, nearly 58% of surveyed parents in Germany and the Netherlands preferred leather footwear for their children due to its breathability and resilience. Furthermore, major footwear brands like Puma and Adidas have introduced leather-based junior collections tailored for school and outdoor activities, tapping into this growing demand.

REGIONAL ANALYSIS

Italy was positioned top by accounting for 24.5% of Europe leather market share in 2024 due to its centuries-old expertise in leather craftsmanship in regions like Tuscany and Veneto, where renowned tanneries such as Ilcea, Dani and Cuoio produce some of the finest leathers used in luxury fashion and automotive interiors. Additionally, the country plays a crucial role in supplying leather to premium automakers such as Ferrari and Maserati, reinforcing its industrial significance. The Italian leather sector is also embracing sustainability, with over 60% of tanneries now certified by the Leather Working Group. As a result, Italy remains a pivotal force in shaping the dynamics of the European leather market.

France leather market was next by holding 16.2% of the market share in 2024. The country's prominence is closely tied to its luxury fashion industry, which includes globally recognized brands such as Louis Vuitton, Hermès, and Chanel. These companies drive substantial demand for premium leather sourced both domestically and from trusted European suppliers. The country imports significant volumes of high-quality raw hides from Italy and Germany for local finishing and product development. Moreover, Parisian fashion weeks and trade events like Première Vision continue to attract international buyers, boosting export opportunities for French leather-based products. The government’s support for sustainable fashion initiatives has also spurred investments in eco-friendly leather treatments and circular supply chains.

Germany is likely to grow with a prominent growth opportunity during the forecast period. The country’s leather market is driven with a robust industrial framework, particularly in the automotive and footwear sectors, where high standards of quality and precision are paramount.

According to the German Leather Association (Deutscher Lederverband), the country processed over 1.2 million tons of hides in 2023, with a significant portion allocated to automotive interiors for brands like BMW, Mercedes-Benz, and Audi. In addition, Germany serves as a key logistics and distribution center for leather goods within Europe, facilitating trade flows between Southern and Northern markets. The country’s commitment to technological advancement is evident in the adoption of automated cutting systems and digital inventory management, enhancing efficiency across the supply chain. Moreover, growing consumer interest in vegan leather alternatives has led German companies like Covestro to develop innovative bio-based synthetic materials.

Spain leather market growth is due to its deep-rooted heritage in leather manufacturing and footwear production. The country is home to several renowned leather clusters in regions like Alicante and León, known for their high-quality shoe exports and artisanal tanning traditions. Major domestic brands such as Camper, Lola Cruz, and Castañer have gained international acclaim for their distinctive designs and use of locally sourced leather. Additionally, Spain acts as a bridge between Mediterranean leather producers and Northern European markets, benefiting from its strategic geographic location and well-developed logistics infrastructure.

The United Kingdom leather market growth is driving with a focus on luxury leather goods, bespoke tailoring, and niche footwear brands. According to the British Retail Consortium, luxury leather product sales in the UK rose by 8.3% in 2023, driven by affluent consumers in London and Manchester. Iconic British brands like Burberry, Mulberry, and John Lobb remain influential in shaping domestic demand for fine leather apparel and accessories. Additionally, the country’s growing vegan leather market, supported by brands such as Will’s Vegan Store and Vegetarian Shoes, reflects shifting consumer preferences toward ethical alternatives.

Top Players in the Europe Leather Market

Ilcea S.p.A. (Italy)

Ilcea is one of Italy’s most respected tanneries, known for producing premium leathers used extensively in luxury fashion and automotive interiors. Based in Tuscany, Ilcea has built a reputation for excellence in full-grain and vegetable-tanned leather, supplying to global brands such as Gucci and Prada. The company emphasizes sustainable practices and traceability, aligning with European environmental standards. Its commitment to craftsmanship and innovation has positioned it as a key player not only in Europe but also ininternational luxury markets.

Guidetti Group (Italy)

The Guidetti Group is a leading Italian manufacturer specializing in machinery and chemical solutions for the leather processing industry. With decades of experience, the group supports tanneries across Europe by offering advanced automation and eco-friendly technologies that enhance efficiency and reduce environmental impact. Their contributions have been instrumental in modernizing leather production processes.

Haas Group International (France/Italy)

Haas Group International is a major supplier of chemicals and solutions for leather processing, operating across Europe and beyond. The company provides tanning agents, dyes, and finishing products essential for high-quality leather manufacturing. Haas is recognized for its research-driven approach and dedication to developing environmentally responsible formulations that comply with EU regulations. Through strategic partnerships and continuous innovation, Haas supports both large-scale producers and artisanal tanneries, reinforcing its influence in the European leather market.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Europe leather market is sustainable sourcing and green manufacturing. Companies are increasingly investing in eco-friendly tanning methods, chrome-free processing, and renewable energy usage to meet regulatory demands and consumer expectations for ethical production. This shift enhances brand reputation and ensures long-term viability in a market increasingly governed by environmental policies.

Another critical strategy is technological innovation and digital transformation. Leading firms are integrating automation, AI-based quality control systems, and smart supply chain management tools to improve efficiency, reduce waste, and maintain product consistency. These advancements help manufacturers adapt to fluctuating demand while maintaining competitive pricing and superior output.

Lastly, strategic collaborations and vertical integration play a vital role. Many companies are forming alliances with raw material suppliers, luxury brands, and technology providers to streamline operations and ensure traceability. Some are even acquiring smaller tanneries or setting up captive processing units to strengthen control over the value chain and secure a stable supply of premium leather.

RECENT MARKET DEVELOPMENTS

- In February 2024, Ilcea launched a new line of carbon-neutral leathers developed using bio-based tanning agents and renewable energy-powered production methods. This initiative was aimed at catering to environmentally conscious luxury brands seeking sustainable yet premium materials.

- In June 2023, the Haas Group introduced an innovative waterless dyeing technology in partnership with several Italian tanneries. This breakthrough was designed to significantly reduce water consumption and chemical discharge, aligning with stricter EU environmental regulations and enhancing operational efficiency.

- In October 2024, Guidetti Group expanded its digital monitoring system to include real-time data analytics for tanneries across Europe. The move was intended to improve process transparency, optimize resource usage, and support compliance with sustainability certifications.

- In March 2023, a consortium of European leather manufacturers, including UNIC members, formed a joint venture to develop a blockchain-based traceability platform. The initiative aimed to provide end-to-end visibility into leather sourcing and processing, strengthening consumer trust and brand integrity.

- In November 2024, a leading German footwear brand partnered with a Dutch biotech startup to incorporate lab-grown leather into its upcoming product lines. This collaboration was part of a broader effort to diversify material offerings and appeal to consumers seeking cruelty-free and sustainable options.

MARKET SEGMENTATION

This research report on the europe leather market is segmented and sub-segmented into the following categories.

By Source

- Full Grain Leather

- Synthetic Leather

By Product

- Apparel

- Luggage

- Footwear

- Others

By End-User

- Men

- Women

- Kids

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the leather market in Europe?

Key growth drivers include increasing demand for luxury leather goods, expansion of the automotive industry, rising preference for sustainable and premium products, and technological advancements in leather processing.

What factors are driving the growth of the leather market in Europe?

Key growth drivers include increasing demand for luxury leather goods, expansion of the automotive industry, rising preference for sustainable and premium products, and technological advancements in leather processing.

What challenges does the European leather market face?

Major challenges include volatile raw material costs, stringent environmental laws, competition from synthetic and vegan leathers, and concerns over animal welfare.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com