Europe Malt Extract Market Size, Share, Trends & Growth Forecast Report By Type (Bakery, Confectionery, Beverages, Animal Feed, Pharmaceuticals), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Malt Extract Market Size

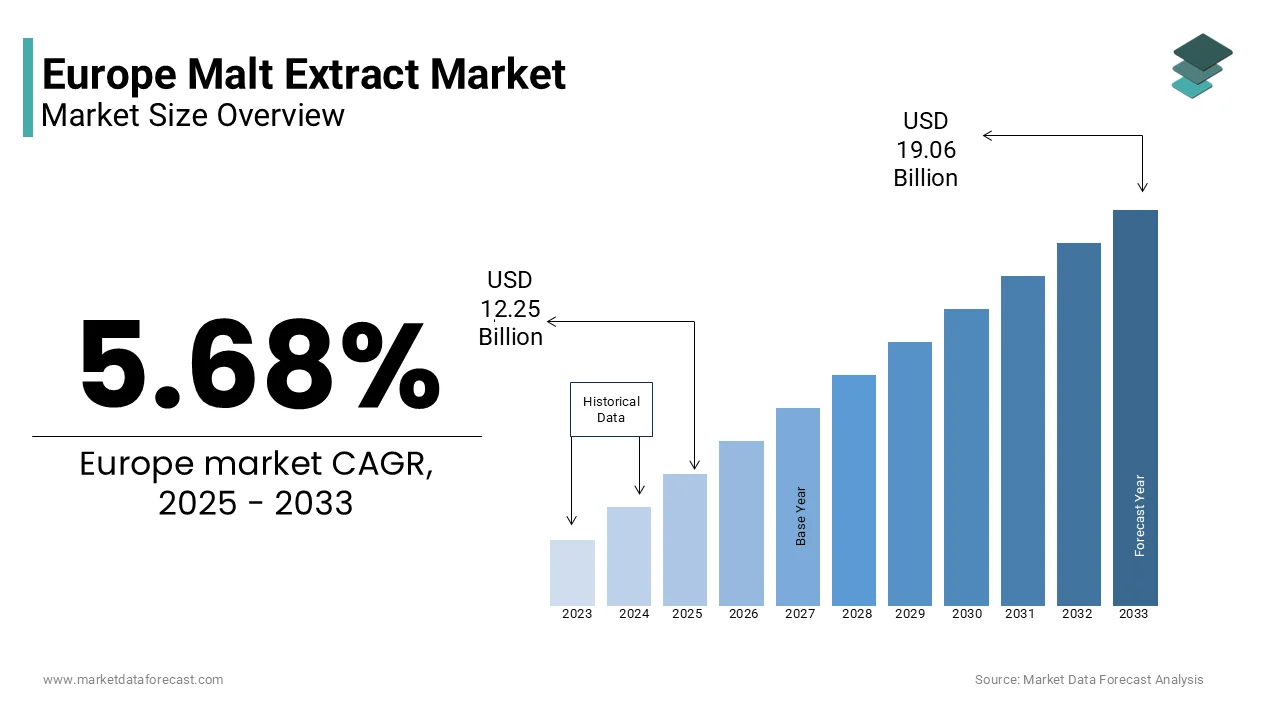

The Europe Malt Extract market size was valued at USD 11.59 billion in 2024. The European market size is estimated to be worth USD 19.06 billion by 2033 from USD 12.25 billion in 2025, growing at a CAGR of 5.68% from 2025 to 2033.

Malt extracts are valued for their natural sweetness, nutritional benefits, and functional properties such as enzymatic activity and flavor enhancement. The market has evolved significantly due to increasing demand for clean-label ingredients, growing artisanal brewing culture, and rising health consciousness among consumers. This growth is supported by the region’s deep-rooted brewing heritage and expanding use of malt in health-focused food formulations. Additionally, the shift toward plant-based diets and natural sweeteners has spurred interest in malt extracts as an alternative to high-fructose corn syrup and refined sugars. As per Euromonitor International, there has been a notable rise in consumer preference for organic and non-GMO ingredients, influencing manufacturers to invest in sustainable sourcing and cleaner production methods. Moreover, government support for traditional agriculture and brewing practices in countries like Belgium and Austria has reinforced domestic supply chains and export potential.

MARKET DRIVERS

Rising Demand from the Brewing Industry

One of the most influential drivers shaping the Europe malt extracts market is the sustained demand from the brewing sector, particularly the expansion of craft breweries and microbreweries across the continent. Malt extract serves as a foundational ingredient in beer production, providing fermentable sugars, color, and distinct flavor profiles essential to various beer styles. According to Brewers of Europe , the number of active breweries in the EU exceeded 14,000 in 2024, which is marking a 12% increase since 2020, largely driven by consumer interest in premium and locally brewed beers.

Germany remains at the forefront of this trend, with over 5,000 breweries operating nationwide, many of which rely on high-quality malt extracts sourced domestically. As per Brau Beviale , Germany’s leading brewing trade fair, approximately 70% of craft brewers prefer using liquid or dry malt extracts due to their consistency, ease of use, and ability to maintain traditional brewing characteristics without requiring extensive infrastructure. The UK and Belgium have witnessed a surge in independent breweries leveraging regional malt varieties to differentiate their offerings in a competitive marketplace. This growing brewery ecosystem not only sustains demand but also encourages innovation in malt formulation, including low-color, high-enzyme, and specialty roasted variants.

Increasing Use in Functional Foods and Health Supplements

A significant driver fueling the Europe malt extracts market is the rising incorporation of malt-based ingredients into functional foods and dietary supplements, driven by consumer demand for natural, easily digestible, and energy-rich components. Malt extract is increasingly favored in nutrition bars, sports drinks, infant formulas, and energy boosters due to its rich carbohydrate content, B-vitamin profile, and mild flavor. One of the key factors behind this growth is the perception of malt as a clean-label, minimally processed ingredient that aligns with the broader movement toward natural and wholesome nutrition. As per Statista, nearly 40% of European consumers now actively seek out products labeled as “naturally sweetened” or “no added sugar,” making malt extracts an attractive alternative to artificial sweeteners and syrups. This trend is particularly strong in Germany and Scandinavia, where health-conscious consumers favor plant-based and organic formulations. Moreover, malt extract’s role in digestive health and sustained energy release has made it a preferred component in baby food and senior nutrition products. According to The European Food Safety Authority (EFSA), malt-derived carbohydrates are associated with improved gut microbiota function and enhanced nutrient absorption. These health-linked benefits are reinforcing product development strategies and expanding the application scope of malt extracts beyond traditional brewing and confectionery uses.

MARKET RESTRAINTS

Fluctuating Raw Material Prices and Supply Chain Disruptions

One of the primary restraints affecting the Europe malt extracts market is the volatility in raw material prices, particularly barley, which is the main input for malt production. Barley cultivation is highly dependent on climatic conditions, agricultural policies, and global trade dynamics, all of which influence yield and pricing stability. These fluctuations pose significant challenges for malt extract manufacturers, especially smaller players who lack the financial flexibility to absorb sudden cost increases. As per COPA-COGECA, the European farmers’ association, extreme weather events linked to climate change have disrupted planting and harvesting cycles by reducing overall grain quality and availability.

Moreover, malt producers face difficulties in passing these increased costs onto end-users, particularly in price-sensitive markets like Eastern Europe. According to McKinsey & Company , this squeeze on profit margins has led some companies to delay capacity expansions or reduce investments in new product development. Until the agricultural sector achieves greater resilience through sustainable farming practices and policy interventions, raw material instability will remain a persistent challenge for the European malt extracts market.

Regulatory Constraints and Labeling Requirements

Another key restraint impacting the Europe malt extracts market is the complex regulatory landscape governing food labeling, ingredient sourcing, and nutritional claims. While malt extract is generally recognized as safe and widely used, manufacturers must navigate stringent EU regulations regarding allergen declarations, traceability, and permitted health claims. This regulatory burden disproportionately affects small and mid-sized malt producers, who may lack the resources to comply with frequent changes in legislation. Additionally, concerns about cross-contamination in processing facilities have prompted stricter audits, which is further delaying time-to-market for new products. Moreover, consumer confusion around gluten content has created marketing challenges, despite malt extract typically being derived from barley a gluten-containing grain. According to Coeliac UK, while many malt-based products are still consumed by individuals with less severe gluten sensitivities, stricter labeling rules have led to hesitancy among health-conscious buyers. These constraints complicate promotional efforts and limit market penetration in the health and wellness segment where gluten-free alternatives are gaining traction.

MARKET OPPORTUNITIES

Expansion into Plant-Based and Alternative Protein Markets

An emerging opportunity in the Europe malt extracts market lies in its growing adoption within the plant-based and alternative protein sectors, reflecting broader shifts toward sustainable and health-oriented diets. Malt extract plays a crucial role in enhancing flavor, texture, and browning in meat substitutes, dairy-free products, and plant-based beverages, making it a valuable ingredient for formulators aiming to improve sensory appeal. Malt extract’s natural caramelization properties make it particularly useful in mimicking the Maillard reaction, which gives grilled or roasted meats their characteristic taste and appearance. As per Statista, nearly 45% of European consumers purchasing plant-based products cite taste improvement as a key factor in brand selection, highlighting the importance of functional ingredients like malt in product development. In response, several alternative protein manufacturers have integrated malt extracts into burger patties, sausages, and ready-to-drink shakes to enhance palatability and mouthfeel.

Additionally, the rising popularity of fermented plant-based milks and yogurts has created new avenues for malt utilization, particularly in prebiotic-enriched formulations. The demand for malt extracts in this sector is expected to grow steadily by offering substantial opportunities for ingredient suppliers.

Innovation in Specialty Malts for Craft Beverages and Premium Applications

A significant opportunity in the Europe malt extracts market is the rising demand for specialty malts tailored to craft beverages, premium beers, and gourmet food products. Consumers are increasingly seeking unique flavor profiles, distinctive aromas, and high-quality ingredients, driving innovation in malt processing techniques such as roasting, kilning, and infusion with botanicals.

Specialty malts offer a diverse range of characteristics from chocolate and coffee notes to caramel sweetness and smoky undertones, which is catering to niche segments of the beverage industry. As per McKinsey & Company , nearly 30% of European consumers expressed a willingness to pay a premium for beers with complex flavor profiles, encouraging breweries to experiment with custom malt blends. Furthermore, gourmet food producers are incorporating specialty malt extracts into sauces, dressings, and bakery items to add depth and richness without artificial additives.

MARKET CHALLENGES

Balancing Traditional Production Methods with Industrial Efficiency

One of the primary challenges facing the Europe malt extracts market is reconciling traditional malt production techniques with the need for industrial efficiency and scalability. Malt extraction has historically relied on time-intensive processes involving steeping, germination, and kilning, which are difficult to standardize across large-scale operations. This dichotomy creates tension between preserving regional authenticity and adapting to modern supply chain requirements. As per McKinsey & Company, larger malt producers have invested heavily in automation and controlled-environment germination systems to ensure consistent quality and faster turnaround times. However, these advancements sometimes compromise the nuanced flavors and enzymatic profiles that define traditional malt varieties, alienating niche consumers and craft brewers. Additionally, small-scale maltsters face mounting pressure from consolidation trends, where multinational suppliers dominate procurement contracts with major beverage and food companies. According to COPA-COGEA , over 20% of independent European malt producers have exited the market since 2020 due to economic viability issues.

Addressing Consumer Misconceptions About Gluten Content

A significant challenge confronting the Europe malt extracts market is overcoming consumer misconceptions regarding gluten content, which has led to declining consumption in certain health-conscious segments. Although malt extract is traditionally derived from barley is a gluten-containing grain many consumers mistakenly assume that any presence of gluten renders malt-based products unsuitable for those with sensitivities or dietary restrictions. According to Coeliac UK, while malt extract contains minimal gluten levels and is generally tolerated by most people with mild sensitivities, widespread misinformation persists.

This perception issue is particularly pronounced in the health and wellness sector, where gluten-free certifications have become a dominant selling point. To address this challenge, malt producers have begun investing in advanced refining techniques to reduce residual gluten content below detectable thresholds. According to The European Food Safety Authority (EFSA), ongoing research into enzymatic treatments and selective filtration shows promise in developing truly gluten-reduced malt extracts. However, until these innovations gain widespread acceptance and regulatory clarity improves, consumer apprehensions will continue to constrain market growth in sensitive dietary categories.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.68% |

|

Segments Covered |

By Type, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Axereal Group, Cargill, Incorporated, IREKS GmbH, Doehler Group SE, VIVESCIA Industries, Polttimo Oy, Malt Products Corporation, Malteries Soufflet SAS, Simpsons Malt Limited and Muntons Plc., and others. |

SEGMENT ANALYSIS

By Type Insights

The beverages segment dominates the Europe malt extracts market, capturing of 39% of total revenue share in 2024, which is attributed to the region’s deep-rooted brewing heritage and the extensive use of malt extract in beer production, particularly among craft and specialty breweries. According to Brewers of Europe, over 14,000 breweries operate across the continent, with Germany alone accounting for more than a third of this number. Malt extract serves as a key source of fermentable sugars, flavor, color, and body in beer by making it indispensable in both traditional and modern brewing processes. As per Brau Beviale, Germany’s premier brewing industry report, around 70% of small and medium-sized breweries prefer using liquid or dry malt extracts due to their consistency, ease of handling, and ability to replicate classic beer styles without requiring large-scale malting infrastructure.

The pharmaceuticals segment is swiftly emerging as a CAGR of 8.7% during the forecast period. This rapid ascent reflects increasing recognition of malt extract’s nutritional and therapeutic benefits, including its role in digestive health, immune support, and energy replenishment. A key driver behind this growth is the rising integration of malt-derived ingredients into pediatric and geriatric nutrition products. Additionally, pharmaceutical manufacturers are leveraging malt extract in oral rehydration solutions, dietary supplements, and cough syrups due to its natural binding and stabilizing qualities. The expansion of plant-based medicine and functional foods has further reinforced this trend, positioning the pharmaceuticals segment as a high-growth avenue within the European malt extracts market.

REGIONAL ANALYSIS

Germany was the largest in the Europe malt extracts market with 24.3% of share in 2024 due to its status as a global brewing powerhouse, with an unparalleled density of breweries and a long-standing tradition of malt production rooted in the Reinheitsgebot. According to Brau Beviale, Germany operates over 5,000 breweries, more than any other country in the world, consuming vast quantities of high-quality malt extract annually. In addition to brewing, the country's food and pharmaceutical sectors have increasingly incorporated malt-based ingredients into functional foods and dietary supplements. Moreover, Germany leads in technological advancements in malt processing, with companies investing in automated germination systems and sustainable drying techniques.

The United Kingdom was positioned second with 13.3% of the Europe malt extracts market share in 2024, which is driven by a robust brewing tradition, growing interest in plant-based nutrition, and expanding applications in pharmaceutical formulations. As one of Europe’s leading producers and consumers of malt-based products, the UK benefits from a well-established supply chain and a diverse end-user base.

France is lucratively growing with a Europe malt extracts market in 2024 with the combination of traditional brewing practices, evolving food manufacturing trends, and increasing demand in the pharmaceutical and animal feed sectors. According to Syntec Bioénergie , the French bioenergy and bioproducts association, malt usage in the brewing industry increased by 7% between 2020 and 2024, reflecting renewed interest in premium and locally sourced ingredients. Additionally, the French food industry has been incorporating malt into breakfast cereals, cereal bars, and organic snacks, which is aligning with broader health-conscious consumption patterns.

The Netherlands malt extracts market in 2024 by benefiting from a strong presence in brewing, food manufacturing, and export-oriented malt production. Another contributing factor is the country’s emphasis on sustainable and functional food development. As per Rabobank Agri-Food Outlook 2024 , Dutch food manufacturers are increasingly using malt extracts in plant-based protein formulations and gluten-free products, capitalizing on consumer demand for clean-label ingredients.

Denmark malt extracts market is projected to grow with prominent CAGR in the next coming years by a strong tradition in brewing, a growing focus on functional foods, and increasing use in animal nutrition. A key driver of Denmark’s market strength lies in its well-established brewing industry, which includes both large-scale commercial breweries and a growing number of craft operations. According to Danish Food Industry Federation (Dansk Fødevareforening) , the country produced over 700 million liters of beer in 2023, much of which relied on domestically sourced malt extract. Carlsberg, headquartered in Copenhagen, remains one of the largest consumers of malt in the region, influencing procurement standards across the Nordic and Baltic markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Axereal Group, Cargill, Incorporated, IREKS GmbH, Doehler Group SE, VIVESCIA Industries, Polttimo Oy, Malt Products Corporation, Malteries Soufflet SAS, Simpsons Malt Limited and Muntons Plc.

The competition in the Europe malt extracts market is shaped by a mix of large multinational corporations, regional maltsters, and specialized ingredient suppliers vying for dominance across diverse industrial applications. While established players benefit from scale, brand recognition, and well-developed distribution networks, smaller artisanal malt houses are leveraging differentiation through unique flavor profiles, heritage techniques, and localized sourcing strategies. This dynamic creates a competitive yet fragmented landscape where both tradition and innovation play crucial roles.

Market participants are increasingly focused on expanding their product portfolios to include value-added malt derivatives such as enzyme-rich extracts, roasted malts, and gluten-reduced variants that cater to evolving dietary trends and brewing innovations. Additionally, sustainability pressures are driving companies to invest in cleaner production methods, carbon-neutral facilities, and ethical sourcing certifications, further intensifying rivalry among suppliers aiming to meet regulatory and consumer expectations.

Moreover, the growing convergence between agriculture, food science, and biotechnology is enabling new entrants to challenge incumbents with novel fermentation-based or enzymatically modified malt ingredients. As demand diversifies beyond brewing into pharmaceuticals, plant-based nutrition, and functional foods, the European malt extracts market continues to witness heightened competition, requiring continuous adaptation and strategic positioning from all players involved.

TOP PLAYERS IN THIS MARKET

Cargill

Cargill is a global leader in food and agricultural commodities, with a strong presence in the Europe malt extracts market through its specialty ingredients division. The company supplies high-quality malt extracts used across brewing, food manufacturing, and animal nutrition sectors. Cargill plays a crucial role in ensuring consistent product availability and innovation in malt-based formulations.

Malteurop

Malteurop is one of Europe’s largest malt producers, specializing in both traditional and specialty malts tailored to the brewing, food, and pharmaceutical industries. With extensive operations across France, Germany, and the UK, Malteurop has built a reputation for quality, craftsmanship, and technological advancement in malt processing. The company actively collaborates with craft breweries and research institutions to develop new malt profiles that meet evolving consumer preferences.

DCL (Dairy Crest Limited) Ingredients

DCL Ingredients, now integrated into FrieslandCampina Ingredients, is recognized for its expertise in dairy and malt-based nutritional ingredients. While primarily known for dairy applications, the company has expanded into malt extracts used in infant nutrition, sports nutrition, and functional foods. Its focus on clean-label solutions and digestive health benefits has positioned it as a key player in specialized malt extract applications within the European market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One major strategy employed by leading players in the Europe malt extracts market is product diversification and application-specific formulation development . Companies are investing in R&D to create malt extracts tailored for specific end-use markets such as plant-based beverages, pharmaceuticals, and specialty brewing styles by allowing them to cater to niche consumer demands and expand beyond traditional applications.

Another key approach is sustainability-driven sourcing and production practices . Top manufacturers are increasingly aligning with sustainable barley farming initiatives, which is reducing carbon footprints in processing, and offering traceable, non-GMO certified products to appeal to environmentally conscious customers across food, beverage, and health sectors.

A third strategic focus involves strategic partnerships and collaborations with craft breweries, food innovators, and ingredient technology firms. Co-develop innovative products, and strengthen relationships with emerging and premium segments within the European market landscape by working closely with industry stakeholders, malt extract suppliers enhance their market relevance.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Cargill launched a new line of clean-label malt extracts specifically designed for use in plant-based protein formulations, targeting the growing alternative protein sector across Western Europe.

- In May 2024, Malteurop announced a strategic partnership with a German craft brewing association to develop region-specific malt blends aimed at enhancing local beer authenticity while supporting small-scale brewers.

- In July 2024, FrieslandCampina Ingredients (formerly DCL Ingredients) expanded its facility in the UK to increase production capacity for malt-based nutritional ingredients used in infant and sports nutrition products.

- In September 2024, Briess Malt & Ingredients Co., though a U.S.-based company, entered into a distribution agreement with a Dutch wholesaler to strengthen its presence in Northern and Central Europe.

- In November 2024, Weyermann Specialty Malts introduced a carbon-neutral production initiative across its Bavarian facilities, which is reinforcing its commitment to sustainability and appealing to eco-conscious brewers and food manufacturers.

MARKET SEGMENTATION

This research report on the Europe malt extract market is segmented and sub-segmented into the following categories.

By Type

- Bakery

- Confectionery

- Beverages

- Animal Feed

- Pharmaceuticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving growth in the Europe malt extract market?

Key growth drivers include increased demand for natural and clean-label ingredients, expansion of the craft beer segment, rising health awareness, and the use of malt extract in nutritional and functional foods.

2. What challenges does the market face?

Challenges include price volatility of raw materials, supply chain disruptions, and increased competition from alternative natural sweeteners and flavoring agents.

3. Who are the major players in the Europe malt extract market?

Leading companies include Muntons plc, Boortmalt, Malteurop Group, Briess Malt & Ingredients Co., and Cargill, Incorporated, among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com