Europe Masterbatch Market Size, Share, Trends & Growth Forecast Report Segmented By Resin Type (Color, White, Additive, Filler etc.), Polymer, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Masterbatch Market Size

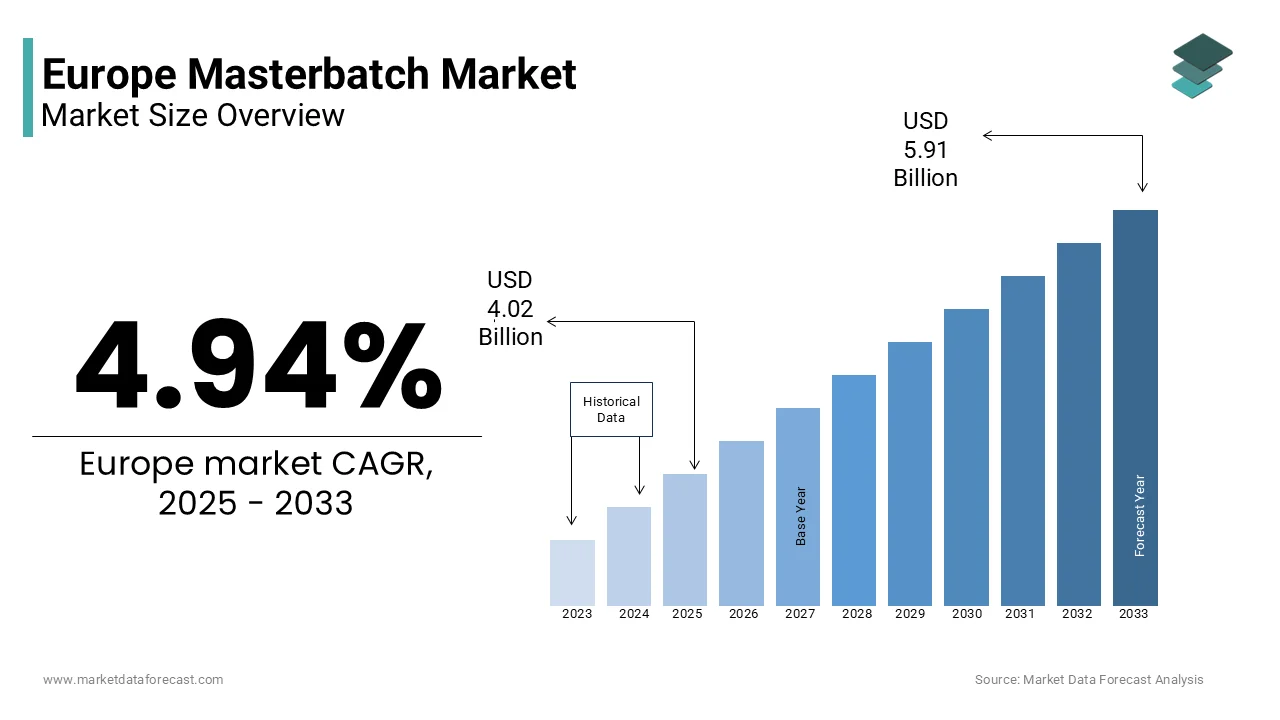

The Europe masterbatch market size was valued at USD 3.83 billion in 2024, and the market size is expected to reach USD 5.91 billion by 2033 from USD 4.02 billion in 2025. The market is growing at a CAGR of 4.94%.

The usage of plastics as a substitute for metals has been the driving force for the growth of the Europe Masterbatch market. The demand for high-performing, advanced materials is continuously growing and the Masterbatch market has been on the positive side of growth. The demand for colored pigments has also increased across various sectors which further improves the growth opportunities for the Masterbatch colour segment market. The market opportunities for bioplastic materials are continuously growing in the European region. An increase in investments in research and development is also a key factor for the growing market in the European region.

MARKET RESTRAINTS

The high cost and complexity associated with colour masterbatches, the demand for more manufacturing capacity, large tools, long lead times, and other elements are foreseen to impede the growth of the European market over the outlook period. In addition, the growing preference of industries for composites is also acting as a threat to the European Masterbatch industry.

MARKET SEGMENTATION

This research report on the Europe Masterbatch market has been segmented and sub-segmented based on the following categories.

By Type

- Colour

- White

- Filler

- Additive

By Polymers

- PP

- LDPE

- HDPE

- PVC

- PUR

- PS

By Application

- Building and Construction

- Paper and Cardboards

- Consumer Goods

- Automotive

- Textile

- Household

- Personal Care

The personal care market has grown rapidly in the European region during the COVID-19 pandemic. The building and construction sector has flourished in these times and as a consequence, the masterbatch industry has also gained a lot. The colour segment is expected to lead the market from 2024 to 2029. This is due to the fact that coloured pigments are heavily used in the packaging, consumer goods, and construction sectors. Bioplastics are increasingly being used in the pharmaceutical, automotive, and agricultural sectors, they require bio-additive masterbatches to provide durability and colour. Thus, in the coming years, we can expect a high growth rate in this segment.

By Country

- Germany

- Italy

- France

- United Kingdom

In Europe, Germany is expected to dominate the masterbatch market. It has become one of the production powerhouses of the world and is one of the strongest economies. Automotive sectors in the region are planning huge investments in the Masterbatch industry in the upcoming years which will increase its demand. Europe is the second-largest market for Masterbatch, behind the Asia Pacific region Purchasing power of consumers in Europe is significantly higher than the majority of the other countries, therefore, more investments are being made. Eastern European countries such as Poland and Belarus are expected to outperform the rest of the European nations in the upcoming years.

KEY MARKET PLAYERS

Ampacet Corporation, A Schulman Inc.,Polyone Corporation, Penn Color Inc. are some of the notable companies in the Europe Masterbatch Market.

RECENT HAPPENINGS IN THE MARKET

- In August 2022, Avient announced that they are developing a new dairy packaging additive to meet the Titanium Dioxide restrictions.

- A.Schulman, Inc. is developing innovative products, which will enable it to stay competitive and cater to the specific needs of customers. The company aims to manufacture masterbatches along with engineered plastic compounds, colour concentrates, and additives. A. Schulman has a worldwide presence with over 50 manufacturing plants.

- In March’2019, Ampacet started a new production line situated in Belgium aiming to improve the overall consumer experience through their expansion.

Frequently Asked Questions

1. What are the key opportunities driving the Europe masterbatch market growth?

The market is benefitting from rising demand for color and additive masterbatches in packaging, automotive, and consumer goods sectors, alongside growing adoption of sustainable and biodegradable plastics.

2. What challenges could hinder the growth of the Europe masterbatch market?

Volatile raw material prices, environmental concerns regarding plastic use, and regulatory pressures on plastic waste management pose notable challenges.

3. Who are the major players in the Europe masterbatch market?

Key players include Clariant AG, Ampacet Corporation, Cabot Corporation, BASF SE, and Avient Corporation, which are actively innovating to meet sustainability goals and customer demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]