Europe Medical Aesthetics Market Size, Share, Trends & Growth Forecast Report, Segmented By Type of Devices, Application, Form and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Medical Aesthetics Market Size

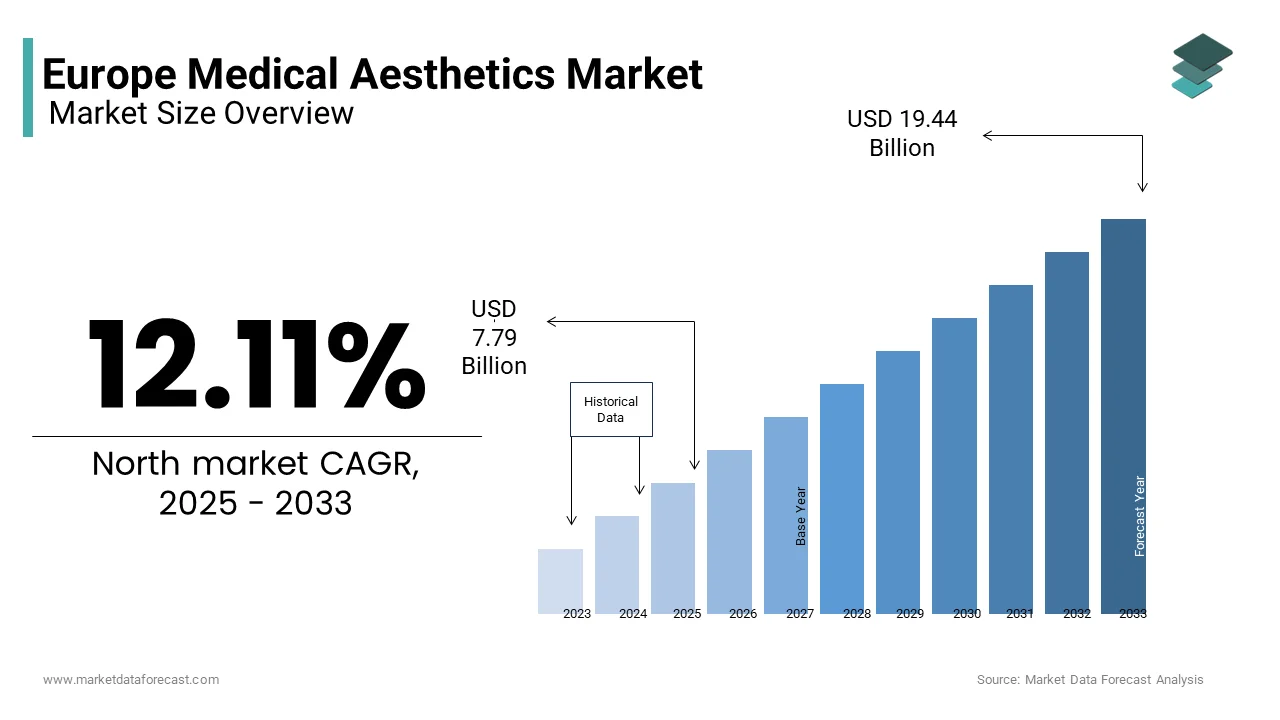

The Europe medical aesthetics market was valued at USD 6.95 billion in 2024 and is anticipated to reach USD 7.79 billion in 2025 from USD 19.44 billion by 2033, growing at a CAGR of 12.11% during the forecast period from 2025 to 2033.

The Europe medical aesthetics market is a rapidly evolving sector, driven by advancements in technology and increasing consumer awareness about aesthetic procedures. Germany holds the largest share by accounting for nearly 25% of the regional market, attributed to its robust healthcare infrastructure and high adoption of advanced technologies. France and the UK follow closely, contributing significantly due to their strong focus on non-invasive treatments. The rise in disposable incomes and growing emphasis on personal appearance have also fueled this expansion. Additionally, as per the International Society of Aesthetic Plastic Surgery (ISAPS), Europe accounts for over 30% of global aesthetic procedures annually, underscoring its prominence in the industry.

MARKET DRIVERS

Rising Demand for Non-Invasive Procedures

The surge in demand for minimally invasive aesthetic treatments is one of the primary drivers of the Europe medical aesthetics market. As per the ISAPS, non-surgical procedures such as injectables and laser therapies accounted for over 60% of all aesthetic interventions in 2023. This trend is largely driven by their affordability reduced recovery time, and lower risk compared to surgical alternatives. For instance, botulinum toxin injections witnessed a 20% year-on-year increase in usage across Europe, as per data from the European Society of Aesthetic Surgery. Furthermore, technological innovations have made these procedures more accessible and effective, attracting a younger demographic. Millennials and Gen Z consumers are increasingly investing in preventive skincare solutions propelling the market forward. The convenience offered by clinics offering walk-in services has further boosted adoption rates.

Growing Awareness and Social Media Influence

Increased awareness about aesthetic procedures, amplified by social media platforms, is another key driver shaping the market. Platforms like Instagram and TikTok have popularized trends such as "Instagram face" and body positivity movements, encouraging individuals to invest in their appearance. Based on a report by GlobalWebIndex, nearly 40% of Europeans aged 16-34 engage with beauty content online weekly. Influencers and celebrities endorsing aesthetic treatments have normalized procedures like lip fillers and skin tightening. Moreover, campaigns promoting self-care and mental health have shifted societal perceptions, reducing stigma around cosmetic enhancements. As per Euromonitor International, the number of aesthetic consultations initiated through digital channels grew by 25% in 2023 alone, showcasing the role of online engagement in driving demand.

MARKET RESTRAINTS

High Costs Associated with Advanced Treatments

One significant restraint in the Europe medical aesthetics market is the high cost associated with cutting-edge treatments and devices. Premium technologies like ultrasound-based body contouring systems or fractional CO2 lasers often require substantial investment making them less accessible to smaller clinics and price-sensitive consumers. This economic burden limits penetration in rural areas and among middle-income populations. As stated by McKinsey & Company, approximately 40% of potential patients cite affordability as a deterrent, hindering broader market expansion despite rising demand.

Stringent Regulatory Frameworks

Another major challenge is the stringent regulatory environment governing medical aesthetics in Europe. The European Medicines Agency (EMA) mandates rigorous clinical trials and certifications for new devices and products, which delays market entry timelines. Moreover, post-market surveillance requirements impose additional compliance costs on manufacturers. These regulations, while ensuring safety, create operational complexities for small- and medium-sized enterprises (SMEs). As noted by PwC, nearly 30% of startups in the aesthetics sector struggle to navigate these regulatory hurdles effectively, impacting overall market dynamism and competitiveness.

MARKET OPPORTUNITIES

Expansion into Emerging Markets within Europe

A promising opportunity lies in expanding services to emerging markets within Eastern and Southern Europe, where untapped potential exists. Countries like Poland, Romania, and Greece are witnessing rapid urbanization and rising disposable incomes, fueling interest in aesthetic treatments. The Eurostat reveals that GDP growth in Eastern Europe averaged 4.5% annually between 2020 and 2023, outpacing Western counterparts. This economic progress has led to increased spending on personal care and wellness. Strategic partnerships with local providers could enable established players to establish footholds, leveraging cost-effective operations while meeting regional needs.

Integration of Artificial Intelligence (AI) in Aesthetic Solutions

The integration of artificial intelligence (AI) into diagnostic tools and treatment planning presents another lucrative avenue. AI-powered platforms can analyze patient data to recommend personalized treatment plans, enhancing outcomes and customer satisfaction. According to Accenture, AI applications in healthcare could generate €40 billion in annual savings by 2025, including efficiencies in aesthetic medicine. For example, AI-driven imaging software can predict results of procedures like breast augmentation or skin tightening with remarkable accuracy, boosting confidence among prospective patients. Moreover, as per Gartner, over 60% of healthcare organizations plan to adopt AI technologies by 2024 signaling strong momentum. Companies investing in AI capabilities will gain a competitive edge, catering to tech-savvy consumers seeking precision and reliability.

MARKET CHALLENGES

Ethical Concerns Surrounding Cosmetic Procedures

Ethical concerns surrounding cosmetic procedures pose a significant challenge to the Europe medical aesthetics market. Critics argue that aggressive marketing tactics targeting vulnerable groups may promote unrealistic beauty standards, leading to psychological distress. As suggested by a study published in the British Journal of Dermatology, approximately 35% of patients undergoing aesthetic treatments reported dissatisfaction linked to unmet expectations. Such issues undermine trust in the industry and attract scrutiny from policymakers. Furthermore, as per the World Health Organization (WHO), there is growing advocacy for stricter advertising guidelines to prevent exploitation. These ethical dilemmas not only tarnish reputations but also hinder efforts to normalize aesthetic enhancements as part of routine self-care practices.

Supply Chain Disruptions Amid Geopolitical Tensions

Geopolitical tensions and supply chain disruptions represent another critical challenge affecting the availability of essential devices and consumables. The ongoing conflict in Ukraine has disrupted imports of raw materials used in manufacturing aesthetic equipment is causing delays and escalating costs. According to KPMG, logistics bottlenecks contributed to a 15% increase in procurement expenses for European aesthetics companies in 2023. Additionally, trade restrictions imposed by certain nations have limited access to innovative technologies developed abroad. As noted by the European Commission, reliance on international suppliers exposes the market to vulnerabilities, necessitating diversification strategies. Addressing these challenges requires collaborative efforts to strengthen domestic production capacities and foster resilient supply networks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.11% |

|

Segments Covered |

By Type Of Devices, Application, End-Use and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Allergan PLC (AbbVie, Inc.), Alma Lasers Ltd. (Sisram Medical Ltd.), Bausch Health Companies Inc, Anika Therapeutics, Inc, Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Candela corporation, Lumenis Be Ltd., Galderma S.A., Cutera, Inc. |

SEGMENTAL ANALYSIS

By Type of Devices Insights

The energy-based aesthetic devices segment dominated the Europe medical aesthetics market by capturing 65.7% of the total market share in 2024. This position in the market is credited to their versatility and efficacy in addressing a wide range of cosmetic concerns, from skin tightening to hair removal. Technologies such as laser systems, radiofrequency devices, and ultrasound-based platforms are widely adopted due to their proven safety and high patient satisfaction rates. The increasing prevalence of chronic skin conditions like acne scars and pigmentation issues has further fueled adoption. Additionally, as per the European Dermatology Forum, over 70% of dermatologists recommend energy-based treatments for their precision and long-lasting results. The affordability of these devices compared to surgical alternatives also contributes to their widespread use across clinics and hospitals.

The non-energy-based aesthetic devices are the fastest-growing segment, with a projected CAGR of 9.8% during the forecast period. This growth is driven by innovations in injectables, dermal fillers, and thread lifts, which cater to the rising demand for minimally invasive solutions. The International Society of Aesthetic Plastic Surgery (ISAPS) notes that injectable procedures accounted for over 40% of all non-surgical interventions in 2023 reflecting their popularity. Advancements in biocompatible materials have improved the safety and durability of these products, encouraging repeat usage. The growing preference for quick, office-based procedures among working professionals has further accelerated this segment’s expansion.

By Application Insights

The skin resurfacing and tightening segment represented the largest application by having a market share of 35.1% in 2024. This command is due to the growing prevalence of photoaging and sun damage caused by environmental factors. As per the European Academy of Dermatology and Venereology, over 60% of adults aged 30–50 exhibit signs of premature aging driving demand for corrective treatments. Laser resurfacing and micro-needling technologies are particularly popular due to their ability to stimulate collagen production and improve skin texture. Furthermore, the introduction of fractional CO2 lasers has enhanced treatment outcomes, attracting both new and repeat patients. The segment’s prominence is also bolstered by its alignment with preventive skincare trends appealing to younger demographics seeking early intervention.

The body contouring and cellulite reduction segment is rising at the swift pace, with a CAGR of 10.5%. This rapid progress is caused by the increasing focus on fitness and body positivity, coupled with advancements in non-invasive fat reduction technologies like cryolipolysis and radiofrequency-assisted lipolysis. As per Euromonitor International, over 40% of Europeans aged 25–45 actively pursue body sculpting solutions showcasing strong consumer interest. Innovations in device design have reduced procedure times and improved comfort levels, enhancing patient compliance. The affordability of multiple sessions compared to surgical options further propels this segment’s momentum.

By End-User Insights

The clinics segment accounted for the biggest share of the Europe medical aesthetics market by representing 55.2% of end-users in 2024. This influence is backed by their accessibility, specialized services, and personalized care offerings. As indicated by the European Union of Private Hospitals, clinics are preferred for their convenience often located in urban centers and offering flexible appointment schedules. The availability of cutting-edge technologies and skilled practitioners attracts a diverse clientele, from millennials seeking injectables to older adults opting for skin rejuvenation. Moreover, as stated by Deloitte Insights, clinics benefit from lower operational costs compared to hospitals, enabling competitive pricing strategies that appeal to price-sensitive consumers. Their agility in adopting emerging trends ensures sustained leadership in the market.

Hospitals are the swiftest developing end-user segment, with a CAGR of 8.2%. This growth is propelled by the integration of advanced aesthetic departments within hospital settings, offering comprehensive care under one roof. Based on findings by the European Hospital and Healthcare Federation, hospitals are increasingly investing in state-of-the-art facilities to attract affluent patients seeking premium treatments. The trust associated with hospital brands, coupled with stringent safety protocols, reassures individuals undergoing complex procedures like breast augmentation or reconstructive surgeries. Additionally, as per McKinsey & Company, collaborations between hospitals and insurance providers have expanded coverage for aesthetic treatments, reducing financial barriers. These initiatives position hospitals as key players in meeting evolving consumer expectations.

COUNTRY ANALYSIS

Germany continues to anchor the European medical aesthetics market by holding a market share of 24.7% in 2024. Its prominence is rooted in a robust healthcare infrastructure and high disposable incomes, enabling widespread adoption of advanced treatments. According to Eurostat, Germany’s expenditure on personal care and wellness increased by 18% between 2020 and 2023, reflecting strong consumer interest. The country’s emphasis on research and development has also fostered innovation, positioning it as a hub for cutting-edge technologies.

Spain exhibits the highest CAGR of 11.3% which is driven by rising tourism and government initiatives promoting medical tourism. The affordability of treatments and favourable regulatory policies attract international patients, boosting market growth.

France, Italy, and the UK are expected to grow steadily, supported by increasing awareness and investments in aesthetic technologies. According to the UK Department of Health, these nations collectively contribute over 40% to regional revenues, underscoring their significance.

KEY MARKET PLAYERS

Allergan PLC (AbbVie, Inc.), Alma Lasers Ltd. (Sisram Medical Ltd.), Bausch Health Companies Inc, Anika Therapeutics, Inc, Johnson & Johnson, Merz Pharma GmbH & Co. KGaA, Candela corporation, Lumenis Be Ltd., Galderma S.A., Cutera, Inc. are the market players that are dominating the Europe medical aesthetics market.

Top 3 Players in the Europe Medical Aesthetics Market

Allergan Aesthetics (AbbVie)

Allergan Aesthetics, a subsidiary of AbbVie, is a global leader in the medical aesthetics market, renowned for its comprehensive portfolio of injectables, skincare products, and energy-based devices. The company’s flagship product, Botox Cosmetic, remains a gold standard in neuromodulators, widely used for wrinkle reduction and facial contouring. Allergan’s strengths lie in its strong brand recognition, extensive R&D investments, and strategic partnerships with clinics and practitioners across Europe. Its commitment to innovation is evident in the launch of next-generation dermal fillers like Juvederm Vycross, which offer enhanced longevity and natural results. Additionally, Allergan’s emphasis on practitioner training programs ensures high standards of application, fostering trust among end-users. By addressing diverse aesthetic needs, from anti-aging solutions to body contouring, Allergan maintains a dominant position in both the European and global markets.

Merz Aesthetics

Merz Aesthetics is another key player, distinguished by its focus on innovative and patient-centered solutions. The company’s flagship products, such as Radiesse and Belotero, cater to a wide range of aesthetic procedures, including facial rejuvenation and lip enhancement. Merz’s strengths include its expertise in biocompatible materials and its ability to develop tailored solutions for specific patient demographics. For instance, its Ultherapy system uses ultrasound technology for non-invasive skin tightening, appealing to consumers seeking minimally invasive options. Merz’s proactive approach to integrating digital tools, such as virtual consultations and AI-driven treatment planning, enhances user experience and expands its market reach. By prioritizing safety, efficacy, and customization, Merz Aesthetics continues to strengthen its position as a trusted provider in the European and global markets.

Galderma

Galderma stands out as a leader in dermatological aesthetics, offering a diverse range of products that blend medical science with beauty. The company’s Restylane line of hyaluronic acid-based fillers is highly regarded for its versatility and precision in facial sculpting. Galderma’s strengths include its deep understanding of dermatological conditions and its ability to innovate in skincare and aesthetic treatments. For example, its Sculptra product stimulates natural collagen production, addressing volume loss while promoting long-term skin health. Galderma’s collaborations with dermatologists and aesthetic practitioners ensure its solutions remain at the forefront of clinical advancements. By focusing on sustainability and ethical practices, Galderma has built a reputation for delivering safe and effective products, solidifying its role as a major contributor to the global medical aesthetics industry.

Top Strategies Used By Key Market Participants

Leading companies in the European medical aesthetics market employ innovative strategies to maintain their competitive edge and drive growth. Product innovation is a cornerstone, with firms investing heavily in R&D to introduce advanced solutions. For instance, Allergan Aesthetics launched CoolSculpting Elite, an upgraded version of its fat-freezing technology, to address evolving consumer preferences. Strategic acquisitions are another key strategy, enabling companies to expand their portfolios and enter new markets. Merz Aesthetics acquired ON Light Sciences, enhancing its capabilities in laser-based therapies. Partnerships with clinics and aesthetic practitioners also play a vital role, ensuring widespread adoption of new technologies. Galderma, for example, collaborates with dermatology associations to promote education and awareness about aesthetic treatments. These strategies collectively position companies as leaders in a rapidly evolving market, fostering innovation and expanding access to cutting-edge solutions.

COMPETITION OVERVIEW

The European medical aesthetics market is characterized by intense competition, driven by rising consumer demand for minimally invasive procedures and technological advancements. Key players like Allergan Aesthetics, Merz Aesthetics, and Galderma dominate the landscape, leveraging their strong brand presence and innovative product portfolios. Smaller firms, however, are gaining traction by targeting niche segments, such as eco-friendly skincare or personalized treatments. The competitive dynamics are further shaped by collaborations with tech companies, enabling the integration of AI and digital tools into aesthetic practices. Regulatory compliance remains a critical differentiator, with companies striving to meet stringent safety and efficacy standards. As consumer preferences evolve, competition is expected to intensify, fostering innovation and expanding access to advanced aesthetic solutions. This dynamic environment ensures continuous growth and transformation within the European market, influencing trends on a global scale.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Allergan Aesthetics launched its CoolSculpting Elite device in Europe, featuring enhanced applicators for targeted fat reduction, strengthening its leadership in body contouring solutions.

- In June 2023, Merz Aesthetics acquired ON Light Sciences, expanding its portfolio of laser-based therapies and enhancing its capabilities in skin rejuvenation technologies.

- In February 2023, Galderma partnered with leading dermatology clinics to promote its Restylane Skinboosters, emphasizing hydration and anti-aging benefits to attract younger consumers.

- In October 2022, Allergan introduced a virtual consultation platform for Botox treatments, improving accessibility and convenience for patients across Europe.

- In August 2022, Merz collaborated with AI developers to integrate predictive analytics into its Ultherapy system, setting a new benchmark for precision in non-invasive skin tightening procedures.

MARKET SEMENTATION

This research report on the Europe medical aesthetics market is segmented and sub-segmented into the following categories.

By Type of Devices

- Energy-Based Aesthetic Devices

- Laser-based Aesthetic Devices

- Radiofrequency (RF) Based Aesthetic Devices

- Light-based Aesthetic Devices

- Ultrasound Aesthetic Devices

- Non-Energy-Based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Chemical Peels

- Microdermabrasion

- Implants

- Facial Implants

- Breast Implants

- Other Implants

- Other Aesthetic Devices

By Application

- Skin Resurfacing and Tightening

- Body Contouring and Cellulite Reduction

- Hair Removal

- Breast Augmentation

- Other Applications

By End-User

- Hospitals

- Clinics

- Other End-Users

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the most in-demand treatments in the European medical aesthetics market?

Botulinum toxin (Botox), dermal fillers, skin rejuvenation (laser & RF), and non-surgical body are the most in-demand treatments in the European market.

What Is the European medical aesthetics market CAGR?

The current European medical aesthetics market CAGR are 12.11% during the forecast period from 2025 to 2033.

Who are the main consumers of aesthetic treatments in Europe?

Primarily women aged 30–55, though male clientele is rising fast, especially for anti-aging and hair treatments.

Are regulations for aesthetic procedures strict in Europe?

Yes, especially in countries like Germany and France. Most procedures must be performed by licensed medical professionals.

Which countries lead the European aesthetics market?

The UK, Germany, France, and Italy dominate, but markets in Eastern Europe are rapidly emerging.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com