Europe Medical Products Market Size, Share, Trends & Growth Forecast Report By Medical Beds (Patient Beds, Examination Beds), Walkers, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Medical Products Market Size

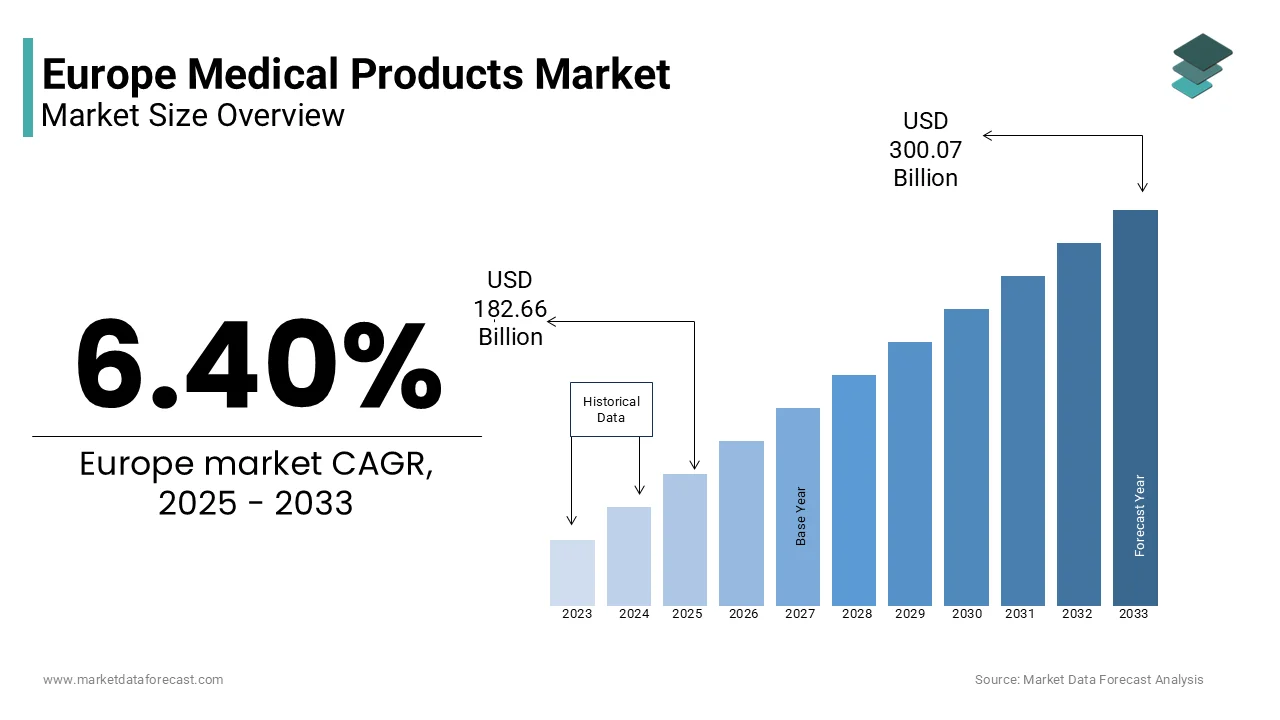

The Europe medical products market size was valued at USD 171.66 billion in 2024. The European market size is estimated to be worth USD 300.07 billion by 2033 from USD 182.66 billion in 2025, growing at a CAGR of 6.40% from 2025 to 2033.

The Europe medical products market involves a broad range of devices, equipment, consumables, and diagnostic tools used in healthcare settings across the region. This includes everything from basic disposable items like syringes and bandages to advanced technologies such as MRI machines, robotic surgical systems, and implantable devices. The market is characterized by its high regulatory standards, innovation-driven growth, and strong presence of global manufacturers and emerging local players. According to the European Coordination Committee of the Radiological, Electromedical and Healthcare IT Industry (COCIR), the medical technology sector in Europe contributes significantly to public health outcomes and economic development. The aging population, rising prevalence of chronic diseases, and increasing adoption of home healthcare solutions are reshaping the market dynamics. Besides, post-pandemic investments in strengthening healthcare infrastructure have further accelerated procurement activities across hospitals and clinics.

MARKET DRIVERS

Aging Population and Rise in Chronic Diseases

One of the most significant drivers of the Europe medical products market is the rapidly aging population, which is directly increasing the demand for diagnostic, therapeutic, and monitoring devices. This demographic shift has led to a surge in age-related conditions such as cardiovascular diseases, diabetes, and osteoarthritis, necessitating increased use of medical devices for treatment and management. The European Observatory on Health Systems and Policies reports that chronic diseases account for over 80% of all deaths in Europe, noting the burden on healthcare systems and the corresponding need for long-term care solutions. For instance, the International Diabetes Federation estimates that more than 60 million adults in Europe were living with diabetes in 2023, fueling demand for glucose monitors, insulin delivery systems, and related consumables. These trends are prompting healthcare providers and governments to invest in advanced medical products that enable early diagnosis, continuous monitoring, and minimally invasive treatments.

Technological Advancements and Digital Health Integration

Technological innovation is another key driver propelling the Europe medical products market forward. The integration of digital health solutions—such as artificial intelligence, telemedicine, remote patient monitoring, and connected medical devices—is transforming how healthcare is delivered and managed. Germany and the UK are at the forefront of this transformation, with national initiatives promoting the use of smart medical devices and AI-powered diagnostics. For example, the German Federal Ministry of Education and Research has funded multiple projects aimed at integrating machine learning into radiology and pathology workflows. Meanwhile, the UK’s National Health Service (NHS) has expanded its use of wearable sensors and mobile health applications to monitor patients with chronic illnesses remotely. Also, the European Commission’s Digital Health and Care Strategy encourages cross-border data exchange and interoperability among medical devices, facilitating seamless integration within healthcare systems. Companies like Siemens Healthineers, Philips, and BD are capitalizing on these developments by launching next-generation diagnostic imaging systems, automated lab equipment, and cloud-connected infusion pumps.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Burdens

A major restraint affecting the Europe medical products market is the complex and evolving regulatory environment that governs medical device approvals and compliance. The implementation of the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) by the European Commission has introduced more rigorous conformity assessment procedures, clinical evidence requirements, and post-market surveillance obligations. According to Deloitte, over 80% of small and medium-sized medical device manufacturers reported delays in product launches due to compliance challenges under the new regulations. The transition to MDR, which became fully applicable in May 2024, has placed significant pressure on manufacturers to reclassify their products and undergo additional testing, leading to extended time-to-market durations. The shortage of notified bodies accredited to assess compliance has further exacerbated bottlenecks. This regulatory complexity disproportionately impacts smaller firms and startups, limiting their ability to compete with larger multinational corporations that have greater resources for compliance.

Pricing Pressures and Reimbursement Constraints

Pricing Pressures and Reimbursement Constraints

Another significant challenge facing the Europe medical products market is the increasing pricing pressure exerted by healthcare payers and government agencies seeking to control rising healthcare costs. Publicly funded healthcare systems in countries like France, Italy, and Spain frequently implement price caps, mandatory tendering processes, and reference pricing mechanisms to reduce expenditures on medical devices. Reimbursement policies vary widely across the EU, making market entry and commercialization strategies more complex. Similarly, the UK’s National Institute for Health and Care Excellence (NICE) evaluates medical devices based on value-based criteria, influencing purchasing decisions in the NHS. In response, many manufacturers are forced to adopt competitive pricing strategies or demonstrate superior clinical outcomes to justify premium pricing.

MARKET OPPORTUNITIES

Expansion of Home Healthcare and Remote Monitoring Solutions

One of the most promising opportunities in the Europe medical products market is the rapid expansion of home healthcare and remote patient monitoring (RPM) solutions. The shift toward decentralized care models, accelerated by the pandemic, has created substantial demand for portable, user-friendly, and connected medical devices that allow patients to receive treatment outside traditional hospital settings. Chronic disease management, post-operative care, and elderly support programs are key drivers behind this trend. Devices such as pulse oximeters, blood glucose meters, ECG monitors, and nebulizers are increasingly being adopted for home use. Moreover, the integration of IoT-enabled diagnostics and mobile health platforms is enhancing patient engagement and enabling real-time health tracking. Countries like Sweden and the Netherlands are leading in RPM adoption due to favorable reimbursement policies and digital infrastructure readiness. Manufacturers are responding by developing compact, wireless, and AI-assisted devices that integrate seamlessly with telehealth platforms. Companies such as Roche, Abbott, and ResMed are expanding their portfolios to cater to this growing demand, positioning home healthcare as a pivotal growth avenue in the European medical products landscape.

Growth in Personalized and Precision Medicine Technologies

Growth in Personalized and Precision Medicine Technologies

Personalized and precision medicine is emerging as a transformative force in the Europe medical products market, offering tailored diagnostics and therapies based on individual genetic profiles, biomarkers, and lifestyle factors. This approach is gaining traction in oncology, rare diseases, and autoimmune disorders, where conventional treatments often yield suboptimal results. Medical device companies are capitalizing on this trend by developing specialized diagnostic tools and implantable devices that align with personalized treatment protocols. For example, liquid biopsy kits, next-generation sequencing platforms, and AI-driven imaging systems are enabling earlier and more accurate disease detection. In addition, implantable biosensors and programmable drug delivery devices are allowing clinicians to customize therapies based on patient-specific responses. Governments and research institutions across Europe are investing heavily in biobanks, genomic databases, and collaborative health data initiatives to accelerate the adoption of precision medicine. The European Reference Networks (ERNs), established by the EU to facilitate cross-border collaboration in rare diseases, further enhance the potential for innovative medical product deployment.

MARKET CHALLENGES

Supply Chain Disruptions and Component Shortages

A pressing challenge currently affecting the Europe medical products market is supply chain instability and shortages of critical components used in device manufacturing. The aftermath of the global semiconductor crisis, geopolitical tensions, and logistical bottlenecks have disrupted the availability of essential materials such as microchips, rare earth metals, and specialty polymers. The reliance on single-source suppliers, especially from Asia, has exposed vulnerabilities in the supply chain. For instance, disruptions in the supply of silicon wafers and passive electronic components from China and Taiwan have affected the production timelines of several key diagnostic and monitoring devices. Additionally, regulatory scrutiny on raw material sourcing and quality control has further complicated supplier diversification efforts.

Data Security and Cybersecurity Risks in Connected Medical Devices

Data Security and Cybersecurity Risks in Connected Medical Devices

As the medical products market in Europe becomes increasingly digitized, cybersecurity threats targeting connected medical devices pose a growing concern for manufacturers and healthcare providers alike. With the proliferation of IoT-enabled implants, remote monitoring tools, and networked diagnostic equipment, the risk of cyberattacks compromising patient data and device functionality has escalated. According to ENISA (European Union Agency for Cybersecurity), there was a major increase in reported cyber incidents involving healthcare infrastructure in 2023 compared to the previous year. Medical device manufacturers must now comply with stringent cybersecurity regulations such as the EU Cyber Resilience Act, which mandates security-by-design principles for all digital products, including medical devices. Ensuring end-to-end encryption, secure firmware updates, and vulnerability management throughout a device's lifecycle adds complexity to product development and increases compliance costs. In addition, breaches in medical device networks can lead to severe consequences, including unauthorized access to patient records and even manipulation of device operations. Hospitals and regulatory authorities are demanding higher levels of transparency and resilience from device vendors, pushing companies to invest in cybersecurity certifications and threat response frameworks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.40% |

|

Segments Covered |

By Medical Beds, Walkers, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Medtronic plc, Siemens Healthineers AG, Koninklijke Philips N.V., Fresenius Medical Care AG & Co. KGaA, B. Braun SE, GE Healthcare, Stryker Corporation, Johnson & Johnson Services, Inc., Abbott Laboratories, and Boston Scientific Corporation, and others. |

SEGMENT ANALYSIS

By Medical Beds Insights

The patient beds segment constituted the largest in the Europe medical products market for medical beds in 2024. This dominance is primarily attributed to the increasing demand for hospital beds and long-term care beds across healthcare facilities, driven by a growing elderly population and rising prevalence of chronic diseases requiring extended hospitalization. Moreover, post-pandemic investments in expanding critical care capacity have further boosted procurement of advanced patient beds equipped with pressure ulcer prevention features, adjustable positioning, and integrated monitoring systems.

On the contrary, the examination beds are estimated to advance at the fastest rate within the Europe medical beds market, registering a CAGR of 8.6%. This growth is basically influenced by the expansion of outpatient clinics, diagnostic centers, and primary healthcare networks across the region. Besides, the shift toward decentralized healthcare delivery models is boosting demand for compact, ergonomic, and mobile examination beds that can be used in general practitioner offices, rehabilitation centers, and home healthcare settings. Furthermore, regulatory emphasis on improving patient comfort and clinician ergonomics has prompted manufacturers like Linet and Stryker to innovate with lightweight materials, adjustable height mechanisms, and infection-resistant surfaces. These advancements, combined with increasing government funding for primary care infrastructure, are propelling the rapid expansion of the examination beds segment.

By Walkers Insights

The double-handed walkers segment dominated the Europe medical products market under the walkers category by capturing a 68.4% of total sales in 2024. This segment's influence is largely due to its widespread use among elderly patients and individuals recovering from orthopedic injuries or surgeries. Germany and Italy have been at the forefront of walker adoption, driven by high geriatric populations and robust healthcare reimbursement policies. In addition, the preference for enhanced stability and weight-bearing support makes double-handed walkers more suitable for users with severe balance issues or lower limb weakness. The European Commission’s Age-Friendly Cities initiative has also encouraged public health programs promoting fall prevention, which includes distribution of assistive devices such as walkers.

The single handed walkers are emerging as the fastest-growing segment in the Europe medical products market for walkers, with a projected CAGR of 9.3%. This progress is mainly driven by the increasing adoption of these devices among younger stroke survivors, post-operative patients, and individuals with unilateral mobility impairments who require partial support while maintaining upper body dexterity. The UK and Sweden are leading this trend, supported by rising awareness about early rehabilitation and mobility restoration after injury or surgery. In addition, physiotherapy clinics and rehabilitation centers are increasingly recommending these walkers for short-term usage due to their ease of handling and portability. Manufacturers are responding to this demand by introducing foldable, lightweight aluminum variants designed for indoor and outdoor use.

REGIONAL ANALYSIS

Germany held the largest share of the Europe medical products market i.e. 24.6% in 2024. As the continent’s economic powerhouse, Germany boasts a highly developed healthcare system, strong domestic manufacturing base, and significant R&D investments in medical technology. According to the German Medical Technology Association (BVMed), the country is home to over 600 medical device companies, including global leaders such as Siemens Healthineers and B. Braun. The aging population is driving demand for chronic disease management products, implants, and home healthcare devices. Also, the presence of well-established regulatory frameworks and efficient reimbursement mechanisms ensures rapid adoption of innovative medical technologies, reinforcing Germany’s dominant position in the regional market.

France is positioning itself as a key player in both innovation and regulation. The French healthcare system is known for its structured approach to medical device approvals and reimbursements, ensuring high-quality standards while encouraging technological advancement. Aging demographics and increasing prevalence of cardiovascular and respiratory diseases are major demand drivers. Moreover, France’s commitment to digital transformation through initiatives like the “Ma Santé 2022” plan has accelerated the deployment of connected health solutions, strengthening the overall medical product ecosystem.

The United Kingdom holds a notable share of the Europe medical products market in 2024, leveraging its strengths in digital health and research-driven innovation. Despite uncertainties related to Brexit, the UK remains a strategic hub for medical technology development, supported by institutions such as the NHS and the Medicines and Healthcare products Regulatory Agency (MHRA). Post-pandemic investments in telemedicine and remote diagnostics have spurred demand for AI-powered imaging systems, wearable monitors, and point-of-care testing kits. The UK government’s Life Sciences Vision aims to establish the country as a global leader in personalized medicine and medtech exports. Besides, the expansion of private healthcare providers and increasing homecare adoption are further stimulating the market for durable and portable medical devices.

Italy captures key position in the Europe medical products market in 2024, driven by its aging population, expanding home healthcare infrastructure, and growing focus on cost-effective treatment alternatives. The Italian healthcare system, which is regionally managed, has seen a surge in home-based care services, particularly in Lombardy and Lazio. Moreover, Italy’s participation in the European Reference Networks (ERNs) has facilitated cross-border collaboration in rare diseases, enhancing the adoption of specialized medical products. With continued investment in public-private partnerships and regional health digitization projects, Italy remains a dynamic market for medical products in Southern Europe.

Spain is seeing a rising demand for preventive and diagnostic devices with growth driven by increasing investments in preventive healthcare and diagnostic technologies. Urbanization and lifestyle-related illnesses such as diabetes and hypertension are fueling demand for glucose monitors, blood pressure cuffs, and ECG machines. Also, Spain’s growing biotech and medtech startup ecosystem is attracting venture capital investment, fostering innovation in niche medical products. With government-backed initiatives promoting regional manufacturing and export capabilities, Spain is steadily reinforcing its position as a key market for medical products in Western Europe.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key players in the Europe medical products market include Medtronic plc, Siemens Healthineers AG, Koninklijke Philips N.V., Fresenius Medical Care AG & Co. KGaA, B. Braun SE, GE Healthcare, Stryker Corporation, Johnson & Johnson Services, Inc., Abbott Laboratories, and Boston Scientific Corporation.

The competition in the Europe medical products market is marked by a dynamic mix of multinational corporations, regional leaders, and emerging startups striving to capture market share through innovation, regulatory expertise, and customer-centric solutions. Established players dominate due to their vast R&D resources, strong brand recognition, and established distribution networks, enabling them to maintain long-term contracts with healthcare institutions. However, smaller firms are increasingly gaining traction by focusing on niche segments, cost-effective alternatives, and agile product development cycles. The regulatory environment remains a key differentiator, as companies must navigate stringent EU medical device regulations that impact approval timelines and market entry strategies. Additionally, the shift toward value-based healthcare is pushing manufacturers to demonstrate clinical efficacy and cost-efficiency more rigorously than ever before. As digitalization reshapes the industry, companies that successfully integrate smart technologies into their offerings are likely to lead the next phase of market evolution.

TOP PLAYERS IN THIS MARKET

Siemens Healthineers AG

Siemens Healthineers is a leading force in the European medical products market, specializing in diagnostic imaging, laboratory diagnostics, and digital health solutions. The company plays a pivotal role in advancing precision medicine and AI-driven diagnostics, supporting healthcare providers in improving patient outcomes. With a strong presence across Germany and expanding influence in Eastern Europe, Siemens Healthineers continuously invests in innovation and strategic partnerships to enhance its product portfolio and service offerings.

Fresenius SE & Co. KGaA

Fresenius is a major player in clinical healthcare products, particularly in dialysis equipment, infusion therapy, and hospital nutrition. The company’s extensive reach in both public and private healthcare sectors across Europe underscores its significance in the medical products landscape. Fresenius emphasizes patient-centric solutions and integrated care models, making it a trusted name among hospitals and homecare providers throughout the region.

B. Braun Melsungen AG

B. Braun is a globally recognized manufacturer of medical devices, disposable products, and pharmaceuticals. Known for its commitment to infection control, patient safety, and surgical technologies, B. Braun has a substantial footprint in European hospitals and clinics. The company actively supports sustainable healthcare practices and collaborates with healthcare institutions to develop tailored medical solutions that meet evolving clinical needs.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Expansion Through Strategic Mergers and Acquisitions

Leading companies are leveraging mergers and acquisitions to broaden their geographic reach, diversify product portfolios, and gain access to cutting-edge technologies. This approach allows firms to integrate complementary capabilities and accelerate time-to-market for innovative medical solutions.

Investment in Digital Health and Connected Devices

To stay competitive, key players are heavily investing in digital transformation by developing connected medical devices, cloud-based diagnostics, and AI-powered analytics. These advancements enhance clinical decision-making and support remote monitoring, aligning with the growing trend of decentralized healthcare delivery in Europe.

Strengthening Local Manufacturing and Supply Chain Resilience

Amid global supply chain disruptions, manufacturers are reinforcing their local production facilities and sourcing networks within Europe. This strategy not only mitigates risks but also ensures faster response times, compliance with regional regulations, and better alignment with national healthcare procurement frameworks.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Siemens Healthineers launched a new AI-enabled radiology platform designed specifically for European healthcare systems, enhancing diagnostic accuracy and workflow efficiency across multiple hospital networks.

- In June 2023, Fresenius announced the expansion of its dialysis treatment centers in Poland, aiming to improve patient access to renal care and reinforce its leadership in chronic disease management across Central Europe.

- In October 2023, B. Braun introduced a new line of single-use endoscopic devices tailored for minimally invasive surgeries, addressing rising demand for infection prevention and outpatient procedures in German and French hospitals.

- In March 2024, Getinge AB opened a state-of-the-art manufacturing facility in Sweden focused on producing critical care and ICU equipment, strengthening its supply chain resilience and responsiveness to Nordic healthcare demands.

- In August 2023, BD (Becton, Dickinson and Company) partnered with a leading European telehealth provider to integrate its point-of-care diagnostic tools with remote patient monitoring platforms, supporting the growth of decentralized healthcare services.

MARKET SEGMENTATION

This research report on the Europe medical products market is segmented and sub-segmented into the following categories.

By Medical Beds

- Patient Beds

- Examination Beds

- Massage Beds

- Gurney Beds

- Other Medical Beds

By Walkers

- Double-Handed Walkers

- Single-Handed Walkers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving growth in the Europe medical products market?

Key growth drivers include rising healthcare expenditure, technological advancements in medical devices, an aging population, and increased demand for diagnostic and therapeutic products.

2. Which countries in Europe are contributing the most to market growth?

Major contributors include Germany, France, the UK, and Italy due to their advanced healthcare systems and high adoption of medical technologies.

3. Who are the key players in the Europe medical products market?

Leading companies include Medtronic plc, Siemens Healthineers AG, Koninklijke Philips N.V., Fresenius Medical Care, B. Braun SE, GE Healthcare, Stryker, Johnson & Johnson, Abbott Laboratories, and Boston Scientific.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com