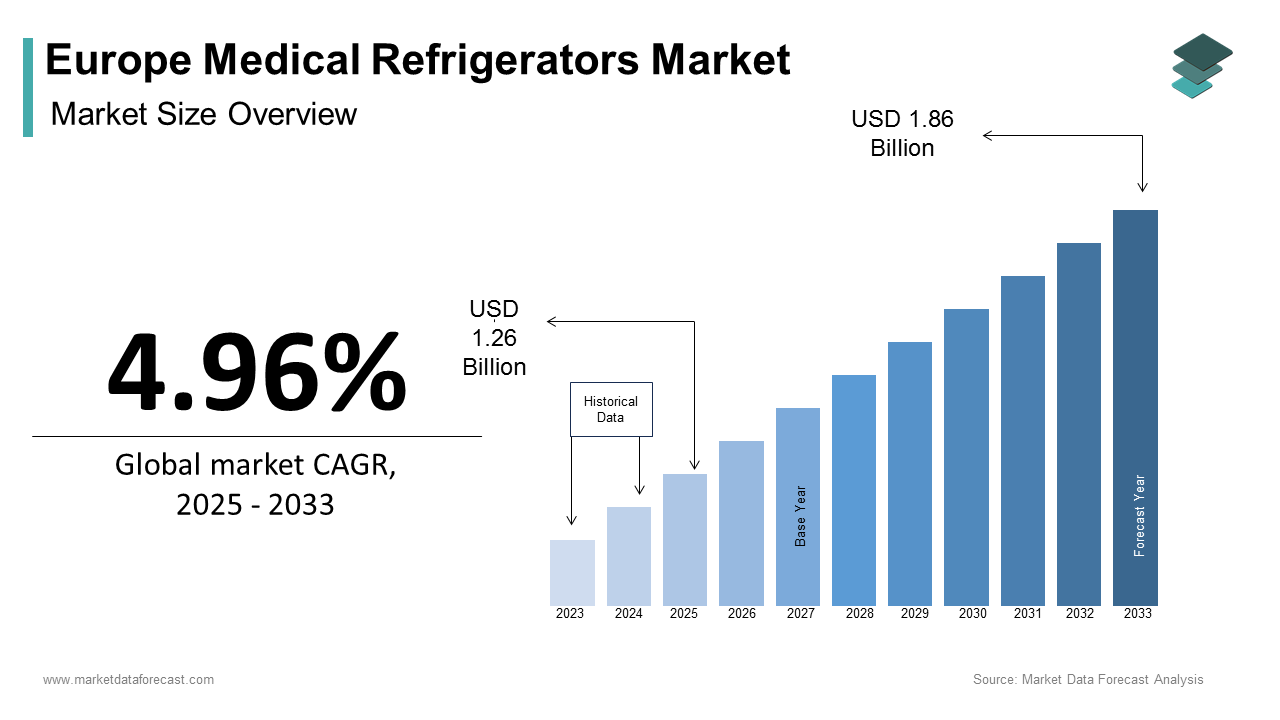

Europe Medical Refrigerators Market Size, Share, Trends & Growth Forecast Report By Product Type (Laboratory Refrigerators, Ultra-Low-Temperature (ULT) Refrigerators), End User, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Medical Refrigerators Market Size

The Europe medical refrigerators market size was calculated to be USD 1.20 billion in 2024 and is anticipated to be worth USD 1.86 billion by 2033, from USD 1.26 billion in 2025, growing at a CAGR of 4.96% during the forecast period.

The European medical refrigerators market encompasses a specialized segment of healthcare infrastructure, dedicated to preserving temperature-sensitive biological materials such as vaccines, blood samples, medications, and diagnostic reagents. These refrigeration units maintain precise temperature ranges—typically between 2°C and 8°C for general storage or ultra-low temperatures down to -86°C for advanced applications—ensuring the integrity and efficacy of stored substances. With increasing emphasis on cold chain logistics in healthcare systems, the demand for reliable and technologically advanced medical refrigeration solutions has surged across hospitals, research laboratories, blood banks, and pharmaceutical companies.

According to the World Health Organization (WHO), immunization programs across Europe have expanded significantly over the past decade, necessitating robust cold storage mechanisms to support vaccine distribution. The region’s aging population and rising incidence of chronic diseases are also contributing to increased demand for clinical testing and biobanking, which rely heavily on stable refrigeration systems.

MARKET DRIVERS

Expansion of Biobanking and Research Infrastructure

One of the primary drivers of the European medical refrigerators market is the rapid expansion of biobanking and biomedical research infrastructure. Biobanks play a crucial role in storing human biospecimens for research into genomics, personalized medicine, and drug development. According to the European Biobanking and Biomolecular Resources Research Infrastructure (BBMRI-ERIC), there are over 400 biobanks operating across Europe, collectively holding more than 50 million biological samples. These repositories require highly controlled and consistent refrigeration environments to preserve tissue, DNA, and other sensitive biomaterials. The European Union has actively supported this sector through Horizon Europe funding programs, allocating over €1.3 billion from 2021 to 2027 for life sciences and health-related research. This financial backing has facilitated the establishment of new biobanks and the modernization of existing ones, directly boosting demand for medical-grade refrigeration units. Furthermore, the implementation of strict sample preservation standards by the International Society for Biological and Environmental Repositories (ISBER) has led to increased procurement of certified, energy-efficient refrigeration systems.

Rising Demand for Vaccination and Cold Chain Logistics

Another significant driver of the European medical refrigerators market is the heightened demand for vaccination programs and the corresponding need for an efficient cold chain infrastructure. The ongoing rollout of routine and pandemic-related immunization campaigns has placed immense pressure on healthcare systems to ensure proper vaccine storage and transport. Many of these vaccines, particularly mRNA-based variants, require ultra-cold storage at temperatures as low as -70°C. This requirement has prompted widespread upgrades in refrigeration capabilities within public health networks. Similarly, the UK National Health Service (NHS) invested a substantial amount during the same period in expanding its cold storage infrastructure to accommodate next-generation vaccines and biological therapies. Moreover, the European Commission's Strategic Framework on Vaccines and Immunisation emphasizes strengthening cross-border cold chain coordination, further stimulating demand for compliant and reliable medical refrigeration systems.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

A major restraint affecting the growth of the European medical refrigerators market is the substantial initial investment and ongoing maintenance costs associated with high-performance refrigeration systems. Medical-grade refrigerators, especially those designed for ultra-low temperature storage, incorporate advanced insulation, dual compressors, and precision temperature controls, which significantly elevate their purchase price compared to standard refrigeration units. Beyond acquisition costs, operational expenses also pose a challenge. These units consume considerable amounts of electricity due to continuous operation and temperature regulation requirements. The European Environment Agency reports that laboratory and medical refrigeration equipment account for a significant portion of total energy consumption in healthcare facilities. Consequently, institutions face higher utility bills and carbon footprint concerns, especially under the EU’s Green Deal initiative aimed at reducing energy consumption and emissions. Smaller clinics and rural healthcare centers often struggle to allocate budgets for both procurement and long-term maintenance, limiting their ability to upgrade to newer models. For instance, in Eastern Europe, where healthcare spending per capita remains lower than the EU average, adoption rates of advanced refrigeration systems lag behind their Western counterparts.

Regulatory Complexity and Compliance Burdens

Regulatory complexity presents another significant constraint on the European medical refrigerators market. The European Union enforces stringent regulations governing the design, performance, and validation of medical refrigeration equipment to ensure patient safety and product integrity. The Medical Device Regulation (MDR) (EU) 2017/745 mandates rigorous conformity assessments, including temperature accuracy verification, alarm functionality testing, and documentation of traceable calibration processes. Compliance with these requirements increases time-to-market and adds layers of administrative and technical burden for manufacturers. Besides, the Good Distribution Practice (GDP) guidelines issued by the European Medicines Agency (EMA) impose strict conditions on temperature monitoring and data logging during storage and transportation. As a result, healthcare providers must invest in refrigeration units equipped with digital logging capabilities, remote monitoring systems, and tamper-proof alarms, all of which escalate costs. According to Deloitte, compliance-related expenditures accounted for a key share of capital investments made by European hospitals in refrigeration infrastructure between 2020 and 2023. Moreover, frequent audits and recertification obligations create additional strain on facility managers. In countries like Italy and Spain, regulatory inconsistencies between regional health authorities have further complicated procurement decisions, leading to delayed purchases and fragmented market growth.

MARKET OPPORTUNITIES

Adoption of Smart and Connected Refrigeration Systems

A compelling opportunity emerging in the European medical refrigerators market is the growing adoption of smart and connected refrigeration systems. As digital transformation accelerates across healthcare sectors, there is increasing demand for refrigeration units integrated with Internet of Things (IoT) capabilities, enabling real-time temperature monitoring, predictive maintenance, and remote diagnostics. Smart refrigeration systems offer enhanced reliability and efficiency, addressing critical challenges related to manual monitoring and data logging. These systems not only reduce the risk of temperature excursions but also generate actionable insights via cloud platforms, improving inventory management and compliance reporting.

Growth of Point-of-Care Testing and Decentralized Diagnostics

The rise of point-of-care testing (POCT) and decentralized diagnostic services represents a transformative opportunity for the European medical refrigerators market. POCT enables faster diagnosis and treatment decisions by bringing laboratory-quality testing closer to patients, often in non-traditional settings such as ambulatory care centers, pharmacies, and home healthcare environments. According to the European Diagnostic Manufacturers Association (EDMA), the in vitro diagnostics (IVD) market in Europe grew considerably in 2023, with POCT segments witnessing the highest growth rates. This trend necessitates compact, portable, and highly accurate refrigeration units to store reagents, test kits, and biological samples outside centralized labs. Portable medical refrigerators with battery backup and temperature control features are becoming essential in mobile clinics and field hospitals. Additionally, the European Commission’s Horizon Europe program supports innovations in decentralized diagnostics, encouraging the development of micro-refrigeration technologies tailored for POCT applications.

MARKET CHALLENGES

Energy Efficiency Demands Amidst Climate Regulations

A pressing challenge confronting the European medical refrigerators market is the increasing demand for energy-efficient systems amidst tightening climate regulations. The European Union has set ambitious decarbonization targets under the European Green Deal, aiming to achieve climate neutrality by 2050. As part of this effort, the Ecodesign for Sustainable Products Regulation (ESPR) imposes mandatory energy efficiency standards on electrical appliances, including medical refrigeration units. Manufacturers are under pressure to develop refrigeration systems that meet stringent energy consumption limits without compromising temperature stability or safety. The transition to natural refrigerants such as hydrocarbons and carbon dioxide is gaining traction, yet poses technical challenges in terms of system design and thermal performance. Additionally, retrofitting existing fleets to comply with new standards requires significant capital outlay, deterring smaller healthcare providers from upgrading their equipment.

Supply Chain Disruptions and Component Shortages

Supply chain disruptions and component shortages have emerged as a critical challenge impacting the European medical refrigerators market. The global semiconductor shortage, exacerbated by geopolitical tensions and logistical bottlenecks, has affected the production of electronic controllers, sensors, and digital interfaces integral to modern medical refrigeration units. According to the European Semiconductor Industry Association (ESIA), lead times for key components extended beyond 52 weeks in 2023, causing delays in manufacturing cycles and delivery schedules. Moreover, inflationary pressures have elevated raw material costs, particularly for stainless steel, copper, and insulation foams used in refrigeration construction. The European Chemical Industry Council (CEFIC) notes that polyurethane foam prices, commonly used for insulation, rose considerably in 2022 due to increased crude oil costs. These factors have constrained profit margins for manufacturers and limited pricing flexibility, affecting procurement decisions among end-users. Hospitals and laboratories in countries such as Italy and Poland have reported delays in acquiring new refrigeration units, sometimes exceeding several months. Apart from these, the war in Ukraine disrupted supply routes for critical parts, particularly from Eastern European manufacturing hubs, further complicating production timelines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.96% |

|

Segments Covered |

By Product Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Liebherr, Haier Biomedical, PHC Corporation, Thermo Fisher Scientific, Eppendorf AG, Vestfrost Solutions, Helmer Scientific, B Medical Systems, Aegis Scientific, Panasonic Healthcare |

SEGMENTAL ANALYSIS

By Product Type Insights

The laboratory refrigerators segment possessed the largest share in the European medical refrigerators market i.e. 28.3% of total revenue as of 2024. This dominance is caused by the increasing volume of clinical research and diagnostic testing conducted in laboratories across the region. According to the European Federation of Clinical Chemistry and Laboratory Medicine (EFLM), over 15,000 clinical laboratories operate in the EU, collectively performing more than 10 billion diagnostic tests annually. These facilities require consistent refrigeration to store reagents, sera, cultures, and other temperature-sensitive materials. Another key driver is the expansion of research infrastructure funded by national governments and the European Union. The demand for precision and compliance with ISO 15190 standards further reinforces the need for high-performance refrigeration units equipped with digital monitoring systems.

The ultra-low-temperature (ULT) refrigerator segment is projected to grow at the fastest CAGR of 11.2%. This rapid surge is fueled by the surge in biopharmaceutical research and the storage demands of next-generation vaccines, including mRNA-based formulations that require temperatures as low as -70°C. Also, the expansion of centralized biobanks and cell therapy centers has heightened the need for long-term cryogenic preservation. The UK’s Cell and Gene Therapy Catapult reported a major increase in gene therapy development projects since 2021, each requiring dedicated ULT freezer capacity.

By End-User Insights

The research institutes segment represented the largest end-user segment in the European medical refrigerators market by holding 26.8% of the total market share in 2024. This leading position is attributed to the extensive presence of academic and independent research organizations engaged in biomedical studies, drug discovery, and genomics. Germany leads this segment, hosting a significant number of Max Planck Institute-affiliated labs and university research centers, all requiring advanced refrigeration for sample and reagent storage. As collaborative research networks expand and funding flows into precision medicine and vaccine development, research institutes will continue to drive demand for specialized medical refrigeration equipment across Europe.

The diagnostic centers segment is emerging as the quickest expanding end-user in the European medical refrigerators market, projected to register a CAGR of 10.7% through 2033. This growth is primarily driven by the rising adoption of decentralized diagnostic services and the proliferation of standalone diagnostic clinics offering rapid test results. These centers require compact, energy-efficient refrigeration units to store reagents and biological samples while maintaining compliance with EN ISO 15190 standards. As healthcare systems shift toward faster, patient-centric diagnostics, the demand for reliable refrigeration in diagnostic centers is accelerating across the continent.

REGIONAL ANALYSIS

Germany had the largest market share in the European medical refrigerators market in 2024. This is due to the country’s robust healthcare infrastructure, strong industrial base, and heavy investments in biomedical research. Moreover, Germany hosts one of the most developed pharmaceutical and biotech ecosystems in Europe, with companies such as Bayer, Merck KGaA, and Boehringer Ingelheim driving demand for high-end refrigeration systems. Additionally, the Robert Koch Institute notes an increase in national vaccination coverage during the same period, necessitating enhanced cold chain logistics. Supported by strong regulatory frameworks and industry collaborations, Germany remains the dominant force in the European medical refrigeration landscape.

The United Kingdom is positioning itself among the top contributors due to its well-established healthcare system and emphasis on life sciences innovation. According to the Office for National Statistics (ONS), the UK spent a substantial amount on healthcare in 2023, with significant allocations directed toward NHS infrastructure upgrades and research facilities. The UK’s Department of Health and Social Care launched the Life Sciences Vision in 2021, committing £1.8 billion to support biotechnology and advanced therapeutics, which in turn boosted demand for medical-grade refrigeration. With continued investment in diagnostics, personalized medicine, and vaccine development, the UK remains a key growth engine in the European medical refrigerators market.

France secured a significant position in the European medical refrigerators market and is driven by proactive government policies and expanding healthcare infrastructure. This initiative includes upgrading laboratories and vaccine production centers with state-of-the-art refrigeration systems. Furthermore, the French National Institute of Health and Medical Research (INSERM) reported an increase in biomedical research projects between 2021 and 2023, reinforcing the need for reliable cold storage. The French Blood Establishment (EFS) also expanded its plasma collection network by 15% in the same period, requiring additional blood bank refrigerators. As France continues to bolster its healthcare and research capabilities, its role in the European medical refrigeration market strengthens steadily.

Italy is seeing a growing demand for public healthcare in the European medical refrigerators market, supported by ongoing modernization efforts within its public healthcare system. Additionally, the National Transplant Center (CNT) reported that organ transplant procedures grew in 2023, further intensifying the need for cryogenic and ultra-low temperature storage units. With strategic investments in both public and private healthcare, Italy maintains a solid foothold in the regional market.

Spain contributes a decent share of the European medical refrigerators market, driven largely by the expansion of biobanking and diagnostic services. The Carlos III Health Institute reported that Spain operates over 40 biobanks, collectively preserving more than 2.5 million biosamples, all requiring stringent refrigeration protocols. In addition, the Spanish Society of Clinical Biochemistry and Molecular Pathology (SEQ) noted a key increase in diagnostic testing volume in 2023 compared to the previous year, underscoring the growing need for clinical laboratory refrigeration. As Spain advances its research and diagnostic infrastructure, its contribution to the European medical refrigerators market is expected to grow consistently.

LEADING PLAYERS IN THE EUROPE MEDICAL REFRIGERATORS MARKET

Thermo Fisher Scientific Inc.

Thermo Fisher Scientific is a global leader in scientific equipment and solutions, with a strong presence in the European medical refrigerators market. The company offers an extensive range of high-performance refrigeration systems tailored for laboratories, hospitals, and research institutions. Known for its innovation and reliability, Thermo Fisher provides ultra-low temperature freezers, plasma storage units, and smart refrigerators equipped with advanced monitoring features. Its commitment to integrating digital technologies enhances user experience and compliance. With a robust distribution network and continuous R&D investment, the company plays a pivotal role in shaping the European cold storage landscape.

Panasonic Healthcare Co., Ltd.

Panasonic Healthcare is a key player known for delivering energy-efficient and technologically advanced medical refrigeration systems across Europe. The company focuses on sustainable design and precision engineering, catering to diverse healthcare settings such as pharmacies, diagnostic centers, and biobanks. Its refrigeration units are designed to maintain optimal temperature stability while minimizing environmental impact. Panasonic’s emphasis on IoT-enabled systems supports real-time monitoring and remote diagnostics, aligning with the region’s push for digital transformation in healthcare. Through strategic partnerships and product innovations, it continues to expand its footprint in the European market.

BINDER GmbH

BINDER GmbH specializes in premium climate chambers and refrigeration units that meet the highest standards of precision and reliability. In the European medical refrigerators market, BINDER is recognized for its laboratory-grade refrigerators and incubators used in pharmaceutical and biomedical applications. The company emphasizes customized solutions that ensure long-term sample integrity and regulatory compliance. By focusing on German engineering excellence and continuous product development, BINDER serves critical sectors including research, vaccine storage, and cell culture preservation. Its reputation for quality and performance makes it a trusted brand among leading European research institutes and healthcare providers.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by leading players is product innovation and technological advancement, where companies continuously develop smart, energy-efficient refrigeration systems integrated with IoT and cloud-based monitoring capabilities. This helps them cater to evolving regulatory standards and customer expectations for enhanced data accuracy and traceability.

Another key approach is strategic partnerships and collaborations with healthcare institutions, research organizations, and government bodies. These alliances enable companies to better understand regional demands, co-develop tailored solutions, and enhance their market penetration across different end-user segments.

Lastly, expansion through acquisitions and localized service networks allows key players to strengthen their regional foothold. By acquiring smaller firms or establishing dedicated service centers in emerging markets within Europe, they improve after-sales support, reduce delivery times, and build stronger customer relationships, thereby reinforcing their competitive edge.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players ointhe European medical Refrigerators Market include Liebherr, Haier Biomedical, PHC Corporation, Thermo Fisher Scientific, Eppendorf AG, Vestfrost Solutions, Helmer Scientific, B Medical Systems, Aegis Scientific, Panasonic Healthcare.

The competition in the European medical refrigerators market is marked by a dynamic mix of established global players and niche regional manufacturers striving to capture a larger share of the expanding healthcare infrastructure sector. As demand for precise temperature-controlled storage rises across laboratories, hospitals, and biobanking facilities, companies are intensifying their focus on differentiation through innovation, sustainability, and digital integration. Competitive pressures are further amplified by the need to comply with stringent EU regulations governing medical device safety and energy efficiency. While large multinational corporations leverage their brand strength, broad product portfolios, and global distribution networks, mid-sized firms are increasingly adopting agile strategies such as customization, rapid prototyping, and localized after-sales support. Additionally, a growing emphasis on green technologies and smart monitoring systems has spurred collaborative ventures and technology licensing agreements, reshaping the competitive landscape. Ultimately, success in this market hinges not only on technical superiority but also on the ability to offer scalable, compliant, and future-ready refrigeration solutions tailored to evolving healthcare needs.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Thermo Fisher Scientific launched a new line of AI-integrated ultra-low temperature freezers designed specifically for European biobanking and pharmaceutical clients, enhancing real-time temperature tracking and predictive maintenance capabilities.

- In May 2024, Panasonic Healthcare expanded its collaboration with several Nordic healthcare providers to deploy energy-efficient medical refrigeration units that align with the region’s sustainability goals and regulatory standards.

- In July 2024, BINDER GmbH introduced a series of modular refrigeration units tailored for mobile diagnostic centers across Germany, supporting the rise of decentralized healthcare services and point-of-care testing.

- In September 2024, Eppendorf AG acquired a French storage solutions firm to broaden its portfolio of medical refrigeration products and strengthen its presence in Southern Europe.

- In November 2024, Haier Biomedical announced the opening of a new regional service hub in Belgium, aimed at improving after-sales support and accelerating response times for customers across Western Europe.

MARKET SEGMENTATION

This research report on the European medical refrigerators market has been segmented and sub-segmented based on product type, end-user, and region.

By Product Type

- Laboratory Refrigerators

- Ultra-Low-Temperature (ULT) Refrigerators

By End User

- Research Institutes

- Diagnostic Centers

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe medical refrigerators market?

The growth is driven by increasing demand for temperature-sensitive pharmaceuticals and vaccines, the expansion of healthcare infrastructure, and stringent regulations for storage conditions.

2. Which countries are leading the Europe medical refrigerators market?

Germany, the UK, France, and Italy are among the leading contributors due to advanced healthcare systems and strong pharmaceutical industries.

3. Who are the key players in the Europe medical refrigerators market?

Key players include Liebherr, Haier Biomedical, PHC Corporation, Thermo Fisher Scientific, Eppendorf AG, Vestfrost Solutions, Helmer Scientific, B Medical Systems, Aegis Scientific, and Panasonic Healthcare.

4. How is the regulatory environment affecting the market?

Strict regulations related to the storage of medical products are pushing demand for compliant and certified refrigeration units.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com