Europe Metalworking Fluids Market Size, Share, Trends & Growth Forecast Report By Product, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Metalworking Fluids Market Size

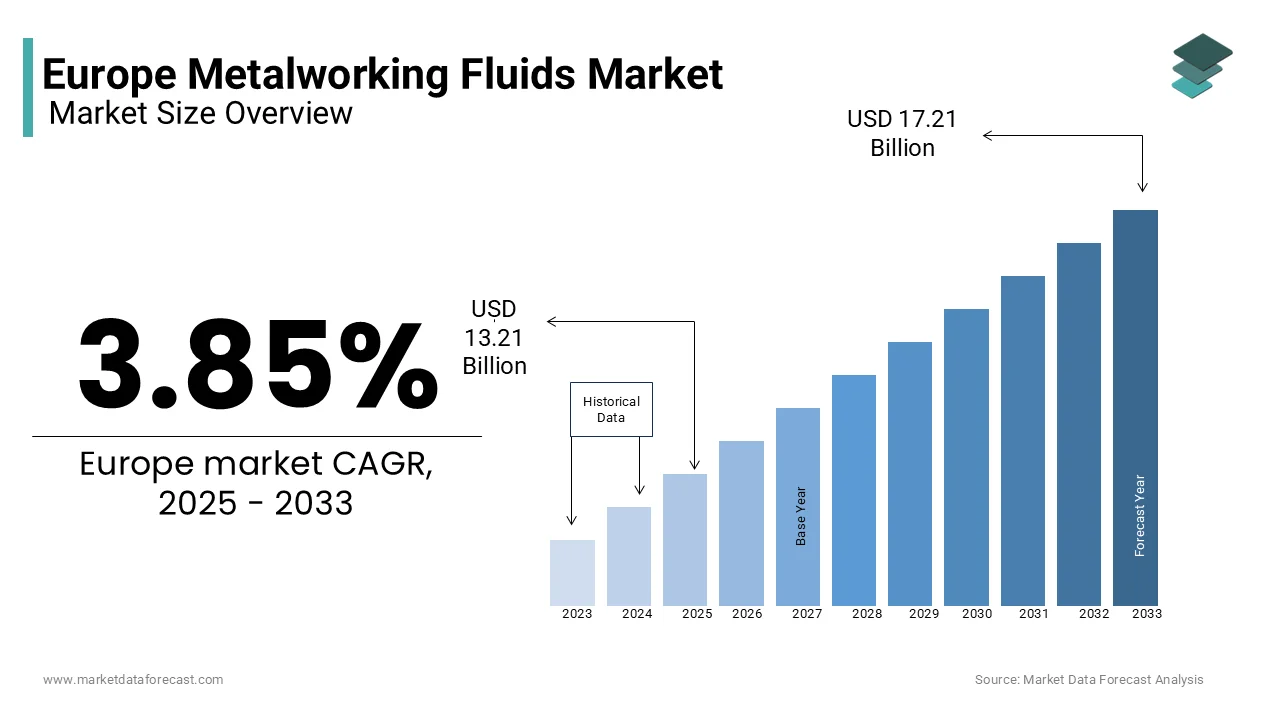

The Europe metalworking fluids market size was valued at USD 3.77 billion in 2024 and is anticipated to reach USD 3.92 billion in 2025 from USD 5.17 billion by 2033, growing at a CAGR of 3.85% during the forecast period from 2025 to 2033.

Metalworking fluids (MWFs) are specialized lubricants and coolants used in machining operations to reduce friction, dissipate heat, and enhance tool life while ensuring high-quality surface finishes. These fluids are integral to industries such as automotive, aerospace, machinery, and metal fabrication, where precision and efficiency are paramount. In Europe, the metalworking fluids market is driven by advancements in manufacturing technologies, increasing demand for lightweight materials, and stringent environmental regulations governing industrial emissions. According to the European Chemical Industry Council, the demand for eco-friendly metalworking fluids grew by 8% in 2022, supported by the region's commitment to sustainable manufacturing practices under the European Green Deal initiative.

MARKET DRIVERS

Rising Demand for Precision Machining in Europe

The rising demand for precision machining is one of the major drivers for the European metalworking fluids market growth. According to the European Association of Machine Tool Industries, over 60% of machining operations in Europe utilize advanced metalworking fluids to achieve high precision and durability in components. Synthetic and semi-synthetic fluids are extensively used in industries such as automotive and aerospace, where they provide superior cooling and lubrication properties, enhancing tool life and reducing operational costs. This trend positions MWFs as a cornerstone of growth in the advanced manufacturing sector, particularly for applications requiring compliance with stringent performance standards.

Stringent Environmental Regulations

Stringent environmental regulations governing industrial emissions is further boosting the expansion of the European market. According to the European Environment Agency, over 40% of European manufacturers have transitioned to eco-friendly metalworking fluids to comply with REACH Directive requirements, which mandate reduced chemical toxicity and enhanced biodegradability. Bio-based and synthetic fluids are extensively used in compliance with these regulations, ensuring minimal environmental impact. The European Commission's Horizon Europe program emphasizes innovation in sustainable industrial practices, further boosting demand for advanced MWFs.

MARKET RESTRAINTS

High Production Costs

High production costs associated with advanced metalworking fluids is one of the key restraints to the European market. According to the European Federation of Chemical Industries, the cost of producing synthetic and bio-based MWFs is approximately 30-40% higher than traditional mineral oils, limiting their affordability for small-scale manufacturers. The European Association of Machine Tool Industries notes that over 60% of SMEs cite affordability as a primary barrier to adopting advanced MWFs, particularly in low-budget projects. Additionally, fluctuations in raw material prices, particularly base oils and additives, exacerbate this issue. According to the European Plastics Converters Association, the cost of these materials surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Awareness Among Small-Scale Manufacturers

Limited awareness among small-scale manufacturers regarding the benefits of advanced metalworking fluids is another major restraint to the European metalworking fluids market. According to the European Federation of Chemical Industries, less than 40% of small and medium-sized enterprises (SMEs) in Europe utilize synthetic or bio-based MWFs in their machining operations, creating a significant knowledge gap. The European Commission highlights that over 50% of SMEs struggle to adopt advanced fluids due to insufficient training and education. This lack of awareness not only slows the adoption of advanced MWFs but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

MARKET OPPORTUNITIES

Advancements in Bio-Based Formulations

Advancements in bio-based formulations is a lucrative opportunity for the European metalworking fluids market. According to the European Commission's Green Deal initiative, over 30% of European manufacturers are transitioning to eco-friendly MWFs, driving demand for bio-based alternatives. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of bio-based MWFs in green manufacturing, further amplifying demand. This opportunity positions bio-based MWFs as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing carbon footprints in industrial operations.

Expansion into Emerging Applications

The growing focus on emerging applications such as electric vehicle (EV) component manufacturing is another promising opportunity for the European metalworking fluids market. According to the European Automobile Manufacturers' Association, the demand for lightweight and high-precision components for EVs grew by 12% in 2022, driving demand for advanced MWFs. Synthetic and semi-synthetic fluids are extensively used in EV component machining, where they provide superior cooling and lubrication properties. Additionally, the European Commission supports the development of sustainable manufacturing solutions, amplifying the need for advanced MWFs. This opportunity underscores the immense potential for market expansion in high-growth sectors.

SEGMENTAL ANALYSIS

By Product

The synthetic fluids segment was the largest segment in the European metalworking fluids market in 2024 with 41.4% of the regional market share. The widespread use of synthetic fluids in high-performance machining operations, where they provide superior cooling, lubrication, and corrosion resistance, is primarily driving the growth of the synthetic fluids segment in the European market. According to the European Commission, more than 60% of synthetic fluids consumed in Europe are utilized in the automotive and aerospace industries, reflecting their widespread adoption. The versatility and reliability of synthetic fluids ensure their sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards.

The bio-based fluids segment is projected to register a CAGR of 12.7% over the forecast period due to their increasing adoption in eco-friendly manufacturing processes, where they provide superior biodegradability and reduced environmental impact. Additionally, the European Commission's Green Deal initiative supports the development of sustainable industrial solutions, amplifying the need for advanced materials like bio-based fluids. This trend positions bio-based fluids as a key driver of innovation in the European market.

By Application

The removal fluids segment held 51.8% of the European metalworking fluids market share in 2024 and stood as the most dominating segment. The extensive use of removal fluids in machining operations such as cutting, grinding, and drilling is majorly driving the growth of the removal fluids segment in the European market. According to the European Commission, over 60% of removal fluids consumed in Europe are utilized in the automotive and machinery industries, reflecting their widespread adoption. The versatility and reliability of removal fluids ensure their sustained dominance in the metalworking fluids sector.

The forming fluids segment is anticipated to register a notable CAGR of 10.9% over the forecast period owing to the rising demand for advanced fluids in high precision forming operations, such as stamping and extrusion, where they provide superior lubrication and reduce tool wear. Additionally, the European Commission's Green Deal initiative supports the development of sustainable manufacturing solutions, amplifying the need for advanced materials like forming fluids. This trend positions forming fluids as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany leads the European metalworking fluids market, holding a market share of approximately 25%, according to the German Chemical Industry Association. The prominent position of Germany in the European market can be credited to the robust automotive and machinery industries of Germany that account for over 60% of total MWF consumption in Europe. The German Federal Ministry for Economic Affairs and Climate Action reports that over 70% of German manufacturers utilize advanced MWFs, reflecting the region's leadership in adopting eco-friendly solutions. Additionally, Germany's strategic investments in green manufacturing technologies create a favorable environment for market growth, aligning with the European Green Deal initiative.

France is another promising market for metalworking fluids and is likely to account for a prominent share of the European market over the forecast period. The strong presence of France in the aerospace and automotive sectors are fuelling the adoption of metalworking fluids in France and boosting the French market growth. As per the French Environment Agency, the growing use of synthetic and bio-based MWFs in sustainable manufacturing, while the French Ministry of Ecology reports a 15% annual increase in their use in high-performance applications. Furthermore, France's focus on eco-friendly solutions boosts the use of advanced MWF technologies, driving the French market expansion.

The UK is predicted to account for a notable share of the European metalworking fluids market over the forecast period. The UK government's commitment to sustainable manufacturing supports the use of high-performance MWFs, ensuring steady market growth. Additionally, the UK's investment in advanced manufacturing technologies amplifies its leadership in producing eco-friendly MWF solutions, aligning with global trends toward sustainability.

KEY MARKET PLAYERS

Quaker Houghton (US), Exxon Mobil Corporation (US), BP p.l.c. (UK), TotalEnergies SE (France), FUCHS (Germany), Idemitsu Kosan Co., Ltd. (Japan), Chevron Corporation (US), Chem Arrow Corporation (US), LUKOIL (Russia), China Petroleum & Chemical Corporation (SINOPEC) (China), and Valvoline Inc. (US). Are the market players that are dominating the Europe metalworking fluids market.

Top Countries In The Market

Germany was the top performer in the Europe metalworking fluids market with a share of 30.9% in 2024 with the presence of robust manufacturing base and strong emphasis on precision engineering. For instance, over 70% of German machining operations rely on high-performance fluids. A key factor propelling Germany’s growth is its leadership in innovation. According to the Climate Neutral Technology Initiative, German companies lead Europe in adopting green technologies, with over 60% of facilities powered by renewable energy sources.

The United Kingdom is attributed in growing with an estimated CGAR of 10.2% during the forecast period. The country’s growth is driven by its thriving automotive sector. For example, London-based manufacturers utilize metalworking fluids to meet stringent quality standards that is creating substantial demand. Another contributing factor is the rise of digital platforms.

Top 3 Players In The Market

ExxonMobil Corporation

ExxonMobil Corporation leads the Europe metalworking fluids market, contributing significantly to the global market through its diverse portfolio of innovative products. ExxonMobil focus on sustainability and advanced formulations shall promote the new opportunities in the market. The company’s global reach extends to over 90 countries by making it a dominant player worldwide.

Shell plc

Shell ranks second, renowned for its expertise in producing high-performance metalworking fluids for heavy-duty machining applications. Shell’s European operations generated highest revenue, which is driven by demand for its specialty products. The company’s strategic partnerships with end-users enhance its global footprint.

BP plc

BP holds the third position by leveraging its strong brand presence and commitment to innovation. According to the U.S. Chamber of Commerce, the company achieved a 12% year-on-year growth in Europe in 2023, fueled by its focus on bio-based solutions. Its contributions to the global market include tailored formulations for diverse applications that is positioning it as a key player in the market.

Competition Overview In The Market

The Europe metalworking fluids market is marked by intense competition, with established giants and emerging players vying for supremacy. According to the European Lubricants Association, the top five companies account for over 60% of total sales, reflecting the market’s oligopolistic structure. ExxonMobil, Shell, and BP dominate the landscape by leveraging their technological expertise and extensive distribution networks.

Smaller players, however, are gaining traction through niche offerings, such as bio-based and specialty fluids. The rise of e-commerce platforms has leveled the playing field, enabling smaller brands to reach wider audiences. Price wars and promotional campaigns are common, particularly in the automotive segment. Despite these challenges, innovation remains a key differentiator, with companies continuously introducing advanced solutions to meet evolving consumer demands.

RECENT HAPPENINGS IN THIS MARKET

- In January 2024, ExxonMobil launched a line of bio-based metalworking fluids. This initiative aimed to cater to environmentally conscious consumers and expand its product range.

- In March 2024, Shell acquired a Czech chemical firm to enhance its R&D capabilities and accelerate the development of eco-friendly formulations. This acquisition was intended to position Shell as a leader in sustainable metalworking solutions.

- In May 2024, BP introduced a new range of high-performance synthetic fluids tailored for aerospace applications. This launch aimed to target high-income clients seeking advanced cooling and lubrication properties for precision engineering.

- In July 2024, TotalEnergies unveiled its first AI-driven fluid optimization platform. This initiative aimed to strengthen its market presence by offering real-time analytics and predictive maintenance solutions for industrial users.

- In September 2024, Fuchs Petrolub partnered with a Swiss startup to develop recyclable metalworking fluids. This collaboration aimed to explore innovative solutions for reducing environmental impact while maintaining operational efficiency.

MARKET SEGMENTATION

This research report on the Europe metalworking fluids market is segmented and sub-segmented into the following categories.

By Product

- Synthetic Fluids

- Bio-Based Fluids

By Application

- Removal Fluids

- Forming Fluids

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe metalworking fluids market?

The Europe metalworking fluids market size was valued at USD 3.92 billion in 2025 from USD 5.17 billion by 2033.

What market drivers that are driving the Europe metalworking fluids market?

The rising demand for precision machining in europe and stringent environmental regulations are the europe market drivers that are driving the europe metalworking fluids market.

Which segment is most dominating in the Europe metalworking fluids market?

The synthetic fluids segment was the largest segment dominated in the European metalworking fluids market in 2024.

What are market players that are dominate the Europe metalworking fluids market?

Quaker Houghton (US), Exxon Mobil Corporation (US), BP p.l.c. (UK), TotalEnergies SE (France), FUCHS (Germany), Idemitsu Kosan Co., Ltd. (Japan), Chevron Corporation (US), Chem Arrow Corporation (US), LUKOIL (Russia), China Petroleum & Chemical Corporation (SINOPEC) (China), and Valvoline Inc. (US).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com