Europe MRO Distribution Market Size, Share, Trends & Growth Forecast Report By Distribution Channel (Distributors, E-Commerce), Product Type, End Use, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe MRO Distribution Market Size

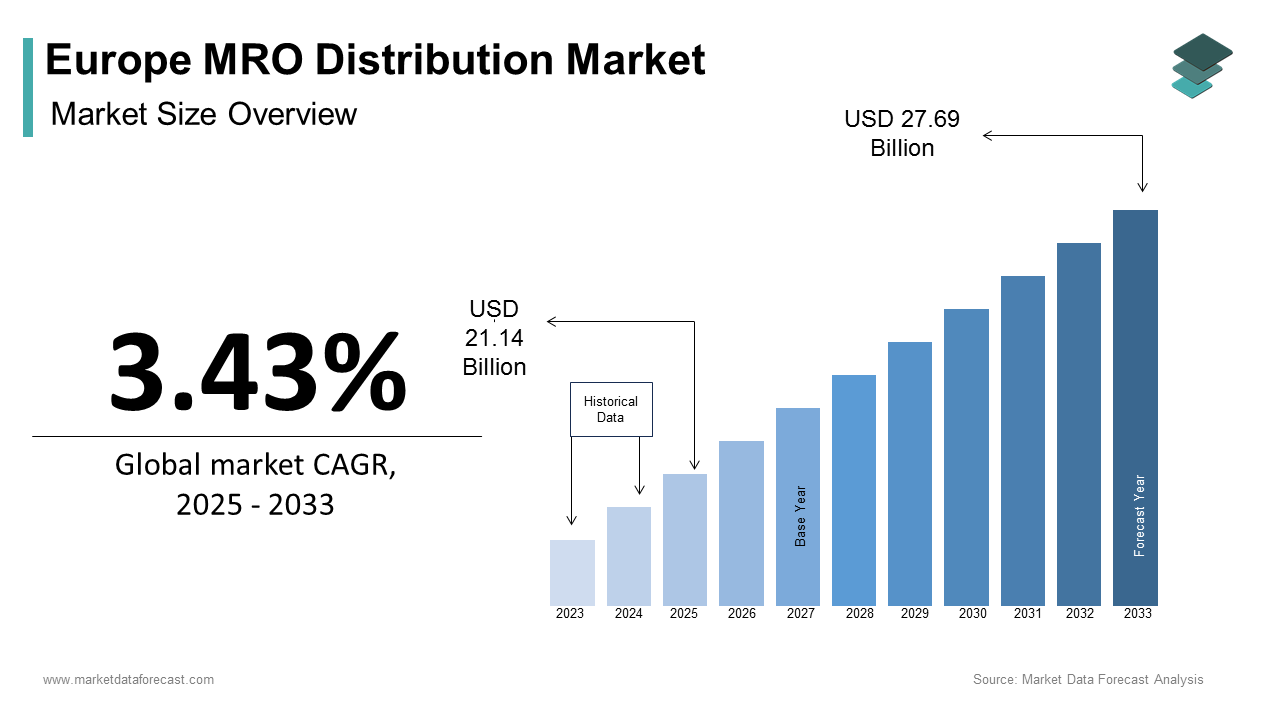

The Europe MRO Distribution Market size was calculated to be USD 20.44 billion in 2024 and is anticipated to be worth USD 27.69 billion by 2033, from USD 21.14 billion in 2025, growing at a CAGR of 3.43% during the forecast period.

The MRO (Maintenance, Repair, and Operations) distribution market in Europe has a large spectrum of products and services used across industrial, manufacturing, energy, transportation, and commercial sectors to maintain operational efficiency. These include tools, equipment, safety gear, electrical components, and consumables that are essential for ongoing operations but not directly part of end-products. The market serves as a critical enabler for industries aiming to reduce downtime, enhance productivity, and ensure compliance with stringent health and safety standards.

Europe’s industrial base remains robust, particularly in countries like Germany, France, and Italy, where advanced manufacturing and infrastructure development continue to drive demand for reliable MRO supplies. According to the European Commission, the industrial sector accounted for a significant portion of the EU's GDP in 2023, underscoring its economic significance and reinforcing the need for efficient MRO supply chains.

Moreover, sustainability initiatives and digital transformation efforts have reshaped procurement strategies, with companies increasingly adopting integrated platforms and predictive maintenance technologies.

MARKET DRIVERS

Industrial Automation and Smart Manufacturing Adoption

One of the key drivers propelling the Europe MRO distribution market is the rapid adoption of industrial automation and smart manufacturing practices. As industries shift toward digitized production environments, the need for precision-engineered MRO components—such as sensors, actuators, control systems, and preventive maintenance tools—has surged significantly. According to the International Federation of Robotics, Europe contributed approximately 30% of global industrial robot installations in 2023, with Germany alone representing over a third of this share. With increased automation comes greater dependency on continuous machine performance, necessitating frequent maintenance interventions and timely replacement of parts. Additionally, Industry 4.0 initiatives backed by the European Union have incentivized manufacturers to invest in predictive maintenance solutions, which rely heavily on high-quality MRO products. The Fraunhofer Institute reported that nearly 60% of surveyed German manufacturing firms were using condition-monitoring technologies that require regular calibration and component servicing.

Increasing Focus on Operational Efficiency and Downtime Reduction

Another significant driver influencing the growth of the Europe MRO distribution market is the growing emphasis on operational efficiency and minimizing unplanned downtime across industrial and commercial sectors. Companies are increasingly prioritizing proactive maintenance strategies to avoid costly production halts and ensure regulatory compliance. This trend is particularly evident in energy-intensive sectors such as automotive, aerospace, and chemical processing. Furthermore, the European Agency for Safety and Health at Work highlighted that equipment failure was responsible for a major share of workplace accidents in 2023, reinforcing the importance of regular maintenance. In response, many firms are entering long-term contracts with MRO suppliers to ensure consistent availability of critical components.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

A major restraint affecting the European MRO distribution market is the persistent impact of global supply chain disruptions and component shortages, which have significantly slowed down procurement cycles and increased lead times. The semiconductor shortage, logistical bottlenecks, and geopolitical tensions have all contributed to delays in sourcing critical industrial parts. Like, in 2023, over 40% of industrial firms in the EU reported supply delays exceeding six weeks for key MRO components, particularly those sourced from Asia. This has led to higher inventory holding costs and increased pressure on distributors to maintain localized stockpiles. Moreover, the ongoing effects of Brexit have introduced additional customs checks and documentation requirements between the UK and mainland Europe, complicating cross-border MRO logistics. The Confederation of British Industry noted that UK-based manufacturers faced a 15–20% increase in import-related administrative costs in 2023.

Rising Raw Material and Logistics Costs

Another pressing challenge restraining the Europe MRO distribution market is the rising cost of raw materials and logistics, which has placed financial pressure on both suppliers and end-users. Steel, copper, aluminum, and plastics—all essential inputs for MRO products—have seen sharp price increases due to inflationary pressures and energy market volatility. As reported by the European Central Bank, industrial input prices in the EU rose notably in 2023 compared to the previous year, with energy costs contributing significantly to this increase. This has resulted in higher pricing for MRO goods, making budget planning more complex for industrial buyers. In addition, transportation costs have escalated due to fuel price surges and stricter emissions regulations. The European Transport Federation indicated that freight transport costs increased in 2023, impacting just-in-time delivery models that many MRO distributors rely upon.

MARKET OPPORTUNITIES

Growth of Predictive Maintenance and Digital Procurement Platforms

One of the most promising opportunities for the Europe MRO distribution market lies in the rapid adoption of predictive maintenance technologies and digital procurement platforms. As industries transition toward data-driven maintenance strategies, the demand for intelligent MRO components—such as IoT-enabled sensors, vibration analyzers, and real-time monitoring devices—is increasing. This shift is also driving the use of digital procurement platforms that streamline ordering, inventory tracking, and supplier coordination. Furthermore, cloud-based MRO software solutions are gaining traction, allowing companies to manage their spare parts inventory more efficiently. These advancements present a substantial opportunity for distributors to expand their service offerings beyond physical products.

Expansion of Renewable Energy and Green Infrastructure Projects

Another significant opportunity for the Europe MRO distribution market is the accelerating development of renewable energy and green infrastructure projects across the region. As governments commit to net-zero targets, investments in wind farms, solar power plants, hydrogen facilities, and electric vehicle charging stations are generating new demand for specialized MRO supplies. These projects require extensive maintenance support to ensure uninterrupted operation, creating a steady stream of demand for MRO products such as high-voltage connectors, insulation materials, and mechanical components. Additionally, the European Green Deal and national-level sustainability incentives are pushing industries to upgrade aging equipment with energy-efficient alternatives. The European Investment Bank reported that EUR 150 billion was allocated to sustainable infrastructure projects in 2023 alone. This investment trajectory presents a strong growth avenue for MRO distributors catering to clean energy and environmental technology sectors.

MARKET CHALLENGES

Intensifying Competition and Margin Pressure

One of the foremost challenges facing the Europe MRO distribution market is the intensifying competition among domestic and international suppliers, leading to margin compression and pricing pressures. As the market becomes increasingly consolidated, larger players leverage economies of scale and digital capabilities to undercut smaller distributors, squeezing profitability. This trend is especially pronounced in commodity product segments, where differentiation is difficult and buyers often prioritize cost over brand loyalty. Moreover, the rise of e-commerce platforms offering direct-to-consumer and business-to-business MRO sales has disrupted traditional distribution channels. Amazon Business and other B2B marketplaces have expanded their industrial product catalogs, capturing market share with competitive pricing and streamlined logistics.

Regulatory Complexity and Compliance Burdens

Another pressing challenge impacting the Europe MRO distribution market is the complexity of regulatory frameworks and compliance requirements that vary across EU member states and extended markets. Distributors must navigate a vast array of directives related to product safety, environmental standards, labor laws, and digital data handling, which can be resource-intensive. According to the European Committee for Standardization (CEN), over 200 new technical regulations affecting industrial products were introduced in 2023 alone, requiring MRO suppliers to continuously update their product portfolios and documentation. Non-compliance risks penalties, reputational damage, and supply chain disruptions, adding layers of complexity to operations. In addition, the implementation of the EU’s Sustainable Products Initiative and Ecodesign for Sustainable Circularity Regulation mandates stricter environmental performance criteria for industrial goods, including MRO items.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.43% |

|

Segments Covered |

By Distribution Channel, Product Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Rubix, RS Group, Sonepar, Würth Group, Eriks, Descours & Cabaud, Brammer Buck & Hickman, Grainger, Rexel, Cromwell Tools |

SEGMENTAL ANALYSIS

By Distribution Channel Insights

The distributors segment spearheaded the Europe MRO distribution market by accounting for 42.1% of total revenue in 2024. This dominance is primarily due to the long-standing reliance on specialized industrial supply chains that offer tailored product selection, technical support, and just-in-time delivery services. One key driver behind this segment’s leadership is the need for expert guidance in sourcing complex MRO products. Besides, the fragmented nature of the MRO market across Europe necessitates regionalized distribution networks that can respond swiftly to localized demand fluctuations. The European Association of Industrial Distributors (EUID) noted that in 2023, a large share of large manufacturers had formal partnerships with multi-line distributors to ensure consistent supply chain performance.

Also, e-commerce is projected to grow at the fastest CAGR of 9.8% through 2033. This rapid expansion is driven by digital transformation initiatives and shifting buyer preferences toward streamlined procurement experiences. A primary contributing factor is the increasing adoption of B2B digital platforms that enable real-time ordering, automated reordering, and integrated supplier analytics. Moreover, major players like RS Components, Misumi, and Amazon Business have expanded their industrial product catalogs, offering competitive pricing and next-day delivery options. These developments note the strong momentum behind the e-commerce channel in the European MRO distribution landscape.

By Product Type Insights

The electrical components segment had the largest share of the Europe MRO distribution market i.e. 35.5% of total sales in 2024. This influence is attributed to the widespread use of electrical parts—such as circuit breakers, switches, relays, and control panels—in manufacturing, energy, and automation sectors. One major driver is the ongoing modernization of industrial infrastructure, particularly in Germany, France, and Italy, where smart factories and Industry 4.0 initiatives are accelerating. Furthermore, the transition toward renewable energy sources has increased the need for electrical components used in wind turbines, solar inverters, and grid stabilization systems. These trends underscore the critical role of electrical components in sustaining industrial operations across Europe.

Industrial safety equipment is emerging as the fastest-growing product segment in the Europe MRO distribution market by registering a CAGR of 10.3% between 2025 and 2033. This rise is fueled by stringent health and safety regulations and heightened awareness regarding workplace risk mitigation. A key factor contributing to this trend is the enforcement of updated EU occupational safety directives. Additionally, labor unions and corporate sustainability programs are pushing for higher safety standards. As a result, industries such as construction, mining, and chemical processing are expanding their procurement of personal protective equipment (PPE), fire suppression systems, and ergonomic support tools, driving sustained demand in this segment.

By End-User Industry Insights

The manufacturing sector accounted for the biggest share of the Europe MRO distribution market in 2024. This is driven by the sector’s extensive reliance on continuous production lines, automated machinery, and preventive maintenance strategies. One key driver is the high level of capital investment in industrial automation across countries like Germany, Sweden, and the Netherlands. Moreover, the implementation of predictive maintenance technologies has increased the frequency of component replacements and system upgrades. The Fraunhofer Institute reported that in 2023, a major portion of German manufacturing firms had adopted condition-monitoring systems that require regular calibration and spare part replacements. These developments highlight the manufacturing industry’s central role in shaping the dynamics of the European MRO distribution market.

The transportation and logistics industry is experiencing the highest growth in MRO distribution demand, with a projected CAGR of approximately 9.6% during the forecast period. This surge is primarily driven by the expansion of freight networks, electric vehicle adoption, and infrastructure modernization efforts. A major contributing factor is the European Green Deal’s push for sustainable mobility, which has led to a sharp increase in electric buses, trains, and cargo vehicles requiring specialized maintenance components. According to the International Energy Agency, electric commercial vehicle registrations in Europe grew in 2023 compared to the previous year. In addition, rail and port infrastructure projects under the Trans-European Transport Network (TEN-T) initiative have boosted demand for MRO products such as bearings, lubricants, and signaling equipment.

REGIONAL ANALYSIS

Germany was at the forefront of the European MRO distribution market by accounting for 22.2% of total regional revenue in 2024. The country’s position is primarily attributed to its highly developed industrial base, technological innovation, and strong presence of global manufacturing hubs. A key driver behind Germany’s dominant position is the country’s status as Europe’s largest manufacturing economy. According to the Federal Statistical Office of Germany, the industrial sector contributed majorly to the national GDP in 2023, with automotive, mechanical engineering, and chemicals being the most MRO-intensive industries. Additionally, Germany is at the forefront of Industry 4.0 adoption, which has significantly increased demand for predictive maintenance tools and digital MRO procurement platforms.

France is progressively moving ahead in the market. The country benefits from a diversified industrial landscape, government-backed infrastructure development programs, and a growing emphasis on sustainable manufacturing practices. A major growth catalyst is the French government’s commitment to revitalizing its energy and transport sectors. According to the Ministry of Economy, France allocated EUR 54 billion under its “France 2030” plan to modernize industrial infrastructure, including nuclear power plants, hydrogen production facilities, and high-speed rail networks. These initiatives have generated significant demand for specialized MRO components. Additionally, the country’s automotive and aerospace industries remain key contributors to MRO spending.

The United Kingdom holds a notable share of the European MRO distribution market and is positioning it as a moderate yet influential player in the region. Despite Brexit-related disruptions, the UK maintains a robust industrial and energy infrastructure that continues to drive demand for maintenance and repair services. A significant factor influencing market growth is the country’s offshore energy sector, particularly in North Sea oil and gas and expanding offshore wind farms. According to the Department for Business, Energy & Industrial Strategy, the UK commissioned over 2 GW of new offshore wind capacity in 2023, requiring extensive maintenance support for turbines and transmission systems. Also, the logistics and transportation sectors remain key contributors to MRO demand.

Italy captures a key portion of the European MRO distribution market, supported by its strong presence in the manufacturing, fashion, and food processing industries. The country remains a key market due to its extensive small and medium enterprise (SME) network and strategic location within the Mediterranean trade corridor. One of the primary drivers is the textile and apparel sector, which relies heavily on specialized machinery requiring frequent maintenance. Additionally, the country is investing in green industrial transitions. These initiatives are reinforcing Italy’s relevance in the European MRO distribution landscape.

Spain's MRO distribution market is benefiting from its expanding renewable energy sector, automotive industry, and tourism-linked infrastructure development. The country’s strategic location also makes it a gateway for MRO supply chains serving both Europe and Latin America. A key growth factor is Spain’s leadership in concentrated solar power and wind energy installations. Additionally, the automotive manufacturing sector remains a strong contributor to MRO demand. The Spanish Automotive Industry Association (ANFAC) reported that over 2.45 million vehicles were produced in Spain in 2023, with many plants adopting predictive maintenance models to optimize uptime. These developments highlight Spain’s growing influence in the European MRO distribution ecosystem.

LEADING PLAYERS IN THE EUROPEAN MRO DISTRIBUTION MARKET

RS Components

RS Components is a leading player in the European MRO distribution market, offering an extensive portfolio of industrial and electronic components, tools, and maintenance supplies. The company operates across multiple sectors including manufacturing, energy, and automation, providing tailored solutions to meet complex industry demands. Its strong digital platform enables customers to access real-time inventory, technical datasheets, and rapid delivery services, enhancing procurement efficiency. RS Components plays a critical role in supporting predictive maintenance strategies by supplying high-quality, reliable parts that ensure operational continuity.

Sonepar

Sonepar is a global leader in electrical product distribution and holds a significant presence in the European MRO market. The company specializes in distributing electrical equipment, lighting, and control systems through its vast network of subsidiaries and partnerships. In Europe, Sonepar serves diverse industries including infrastructure, renewable energy, and industrial manufacturing, offering customized support and technical expertise. Its focus on digital transformation and sustainability aligns with evolving industrial needs, reinforcing its competitive edge in the region’s MRO supply chain ecosystem.

Rexon Components (A Rexon Components Company)

Rexon Components is a key player in the European MRO distribution landscape, specializing in motion control and power transmission products. With a strong emphasis on engineering excellence, the company provides bearings, gears, motors, and automation components essential for industrial maintenance and repair operations. Rexon supports a wide range of sectors such as aerospace, defense, rail, and precision manufacturing, delivering specialized MRO solutions tailored to mission-critical applications. Its commitment to technical service and long-term client relationships strengthens its position in the European industrial supply chain.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the Europe MRO distribution market is digital transformation and e-commerce expansion. Leading distributors are investing heavily in online platforms that offer real-time inventory tracking, automated reordering, and integrated supplier analytics to streamline procurement processes and improve customer experience.

Another major strategy is strategic acquisitions and regional expansion. Companies are acquiring niche distributors and logistics providers to strengthen their geographical reach, enhance product portfolios, and gain access to specialized industry segments such as renewable energy or advanced manufacturing.

Lastly, firms are focusing on value-added services and technical support to differentiate themselves in a highly competitive environment. By offering expert consultation, predictive maintenance tools, and customized packaging solutions, they help clients reduce downtime and optimize supply chain performance. These strategic initiatives enable MRO distributors to maintain a strong foothold in the evolving European industrial landscape.

KEY MARKET PLAYERS AND COMPETITIVE OVERVIEW

Major Players of the Europe MRO distribution market include Rubix, RS Group, Sonepar, Würth Group, Eriks, Descours & Cabaud, Brammer Buck & Hickman, Grainger, Rexel, Cromwell Tools.

The European MRO distribution market is marked by intense competition among a mix of global giants, regional specialists, and emerging digital-first suppliers. While multinational players like RS Components, Sonepar, and Rexon Components dominate due to their extensive product catalogs and well-established distribution networks, mid-sized regional firms are leveraging localized knowledge and agility to carve out niche markets. This dynamic has led to a fragmented yet highly responsive industry structure where differentiation increasingly comes from service quality, digital capabilities, and sector-specific expertise.

Market participants are under growing pressure to modernize their offerings and align with Industry 4.0 trends such as predictive maintenance, smart inventory management, and digital procurement platforms. As companies shift toward data-driven decision-making, MRO distributors must evolve beyond traditional transactional roles to become strategic partners in asset lifecycle management.

Additionally, sustainability mandates and regulatory compliance requirements are reshaping sourcing strategies, compelling distributors to ensure product traceability and environmental conformity. In this evolving landscape, success hinges not only on product availability but also on value-added services, customer engagement, and technological integration across the supply chain.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, RS Components launched a new AI-powered procurement assistant designed to automate part selection and streamline bulk ordering for industrial clients, aiming to enhance user experience and increase customer retention across key European markets.

- In June 2023, Sonepar acquired a French-based distributor specializing in smart building automation components, expanding its footprint in the energy-efficient infrastructure segment and strengthening its ability to serve commercial and industrial clients seeking integrated electrical solutions.

- In November 2024, Rexon Components opened a dedicated technical support center in Germany to provide real-time engineering assistance and customized product recommendations, reinforcing its commitment to industrial customers requiring high-precision motion control and power transmission solutions.

- In March 2023, a leading pan-European industrial distributor formed a strategic alliance with a predictive maintenance software provider to integrate condition-monitoring tools into its service offerings, enabling clients to anticipate equipment failures and optimize spare parts procurement.

- In September 2024, RS Components introduced a carbon-neutral logistics program across Western Europe, partnering with green freight providers to reduce emissions associated with last-mile deliveries, positioning itself as a sustainability-focused choice for environmentally conscious businesses.

MARKET SEGMENTATION

This research report on the Europe MRO Distribution Market has been segmented and sub-segmented based on distribution channel, product type, end use, and region.

By Distribution Channel

- Distributors

- E-commerce

By Product Type

- Electrical Components

- Industrial Safety Equipment

By End Use

- Manufacturing

- Transportation and Logistics

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe MRO distribution market?

Growth is driven by industrial automation, aging infrastructure, the need for operational efficiency, and increased outsourcing of MRO services.

2. Which industries are major consumers of MRO products in Europe?

Key industries include manufacturing, automotive, aerospace, energy & utilities, and food & beverage.

3. Who are the key players in the Europe MRO distribution market?

Major players include Rubix, RS Group, Sonepar, Würth Group, Eriks, Descours & Cabaud, Brammer Buck & Hickman, Grainger, Rexel, and Cromwell Tools.

4. How is technology impacting the MRO distribution market?

Digital platforms, e-commerce, predictive maintenance tools, and IoT-based inventory tracking are transforming the MRO landscape.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com