Europe Natural Food Additives Market Size, Share, Trends & Growth Forecast Report By Type (Emulsifiers, Food Flavors and Enhancers), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Natural Food Additives Market Size

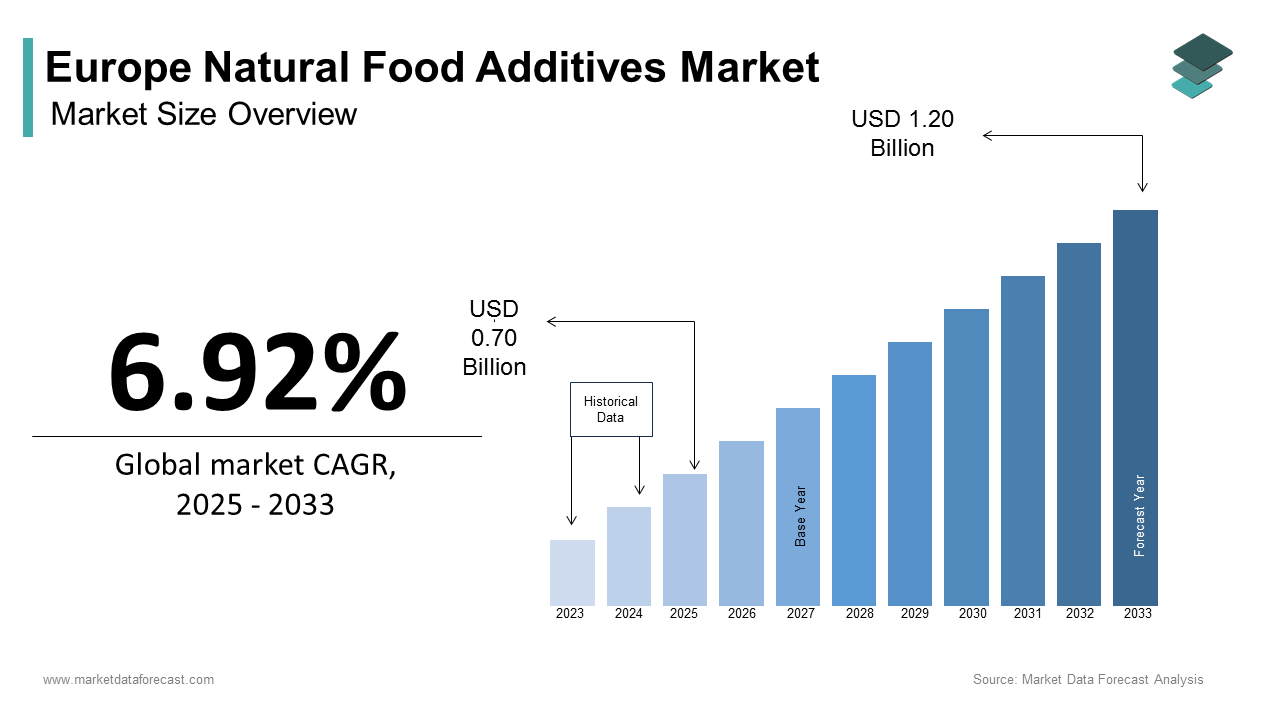

The Europe Natural Food Additives Market size was calculated to be USD 0.66 billion in 2024 and is anticipated to be worth USD 1.20 billion by 2033, from USD 0.70 billion in 2025, growing at a CAGR of 6.92% during the forecast period.

The European natural food additives market focuses on plant-based, animal-derived, or mineral-origin substances used to enhance the flavor, texture, appearance, or shelf life of food products without compromising safety or nutritional value. These additives include natural preservatives like rosemary extract, emulsifiers such as lecithin from sunflower or soy, coloring agents derived from beetroot or turmeric, and functional fibers extracted from fruits and vegetables.

With rising consumer awareness about health and wellness, there has been a marked shift away from synthetic additives toward clean-label alternatives across the region. This trend is further reinforced by regulatory support from the European Food Safety Authority (EFSA), which encourages transparency in labeling and promotes the use of safe, naturally sourced food additives. Moreover, the European Union's Farm to Fork Strategy under the Green Deal emphasizes sustainable sourcing and reduction of chemical inputs in food production, aligning with the growing demand for natural additives.

MARKET DRIVERS

Increasing Consumer Preference for Clean-Label and Health-Conscious Products

A major driver fueling the European natural food additives market is the growing consumer inclination toward clean-label, minimally processed foods perceived as healthier and safer. Modern European consumers, particularly in urban centers like London, Paris, and Berlin, are increasingly scrutinizing ingredient lists and opting for products free from synthetic preservatives, artificial colors, and chemical stabilizers. This shift is especially pronounced among millennials and Gen Z, who prioritize transparency and sustainability in their food choices. In addition, public health campaigns across the EU have raised concerns about the potential adverse effects of synthetic additives, linking them to conditions like hyperactivity in children and allergic reactions. The European Food Safety Authority (EFSA) has issued multiple assessments highlighting the risks associated with certain artificial preservatives, prompting food manufacturers to reformulate products using natural alternatives. As a result, companies are replacing synthetic options with natural extracts like green tea antioxidants, citrus bioflavonoids, and seaweed-based thickeners.

Expansion of Plant-Based and Functional Food Segments Across Europe

Another key driver of the European natural food additives market is the rapid expansion of plant-based and functional food categories, which rely heavily on natural additives to maintain sensory attributes and deliver enhanced nutritional benefits. The rise in veganism, flexitarian diets, and health-focused eating habits has led to increased demand for meat substitutes, dairy-free beverages, and fortified snacks—all of which require natural ingredients to ensure texture, stability, and nutrient retention. These products often incorporate natural emulsifiers like sunflower lecithin, gelling agents such as pectin, and plant-derived colorants to mimic the properties of traditional animal-based foods. Furthermore, functional foods enriched with probiotics, fiber, and omega fatty acids are gaining traction due to heightened health consciousness. To meet these expectations, manufacturers are leveraging natural additives not only for formulation purposes but also for their inherent health benefits—such as antioxidant-rich rosemary extract or prebiotic inulin.

MARKET RESTRAINTS

High Cost of Sourcing and Production Compared to Synthetic Alternatives

One of the primary restraints affecting the European natural food additives market is the relatively high cost of sourcing and producing natural ingredients compared to their synthetic counterparts. Unlike synthetic additives, which can be manufactured at scale with predictable consistency, natural additives often depend on agricultural yields, seasonal availability, and complex extraction processes, all of which contribute to elevated production costs. For instance, natural colors derived from sources like spirulina, beetroot, and paprika require extensive processing to isolate pigments while maintaining stability and vibrancy. Moreover, supply chain disruptions—particularly those caused by climate variability—can significantly impact the availability and pricing of raw materials. A report by the European Environment Agency noted that erratic weather patterns in 2023 affected crop yields of carotenoid-rich plants in Southern Europe, leading to temporary shortages and price hikes for natural coloring agents. These economic pressures make natural additives less attractive to budget-conscious food manufacturers, especially in price-sensitive markets such as Eastern Europe.

Limited Shelf Life and Stability of Certain Natural Additives

Another significant constraint in the European natural food additives market is the limited shelf life and lower stability of many natural compounds when exposed to heat, light, or oxygen. Unlike synthetic additives, which are engineered for durability and resistance to degradation, natural alternatives can lose potency or functionality over time, posing challenges for food manufacturers seeking consistent product quality. For example, natural antimicrobials like rosemary extract and grape seed oil are effective in delaying spoilage but may degrade faster than synthetic preservatives such as potassium sorbate. Additionally, natural emulsifiers and texturizing agents may struggle to maintain uniformity in processed foods subjected to high-temperature treatments. The Institute of Food Technologists (IFT-Europe) highlighted that some plant-based gums and starches exhibited inconsistent performance in baked goods and ready-to-eat meals, requiring frequent reformulations. These technical limitations necessitate advanced packaging solutions and controlled storage environments, adding complexity and cost.

MARKET OPPORTUNITIES

Rising Demand for Organic and Non-GMO Certified Ingredients

An emerging opportunity for the European natural food additives market is the increasing demand for organic and non-GMO certified ingredients, driven by consumer trust in ethical sourcing and transparent labeling. As awareness of environmental sustainability and food integrity grows, more consumers are seeking assurance that the additives in their food come from verified, non-genetically modified sources. According to the Federation of Organic Product Organisations and Initiatives of Europe (FOPI Europe), the number of organic-certified food products launched in the EU increased notably in 2023, with a strong emphasis on additive transparency. Countries like Denmark and Switzerland lead in organic product consumption, where labels such as “clean label” and “non-GMO project verified” hold significant influence over purchasing decisions. This trend is encouraging suppliers to invest in traceable sourcing networks and certification programs that meet stringent EU organic standards. For instance, natural sweeteners like stevia and monk fruit extracts are being cultivated under organic farming practices to cater to premium health-conscious brands. Furthermore, regulatory bodies such as the European Commission’s Directorate-General for Health and Food Safety are promoting stricter guidelines for non-GMO labeling, reinforcing consumer confidence.

Innovation in Fermentation-Based Natural Additive Production

Another promising opportunity for the European natural food additives market lies in the advancement of fermentation-based methods for producing natural ingredients. Traditional sourcing from plants and animals often faces constraints in scalability and consistency, making biotechnological approaches an attractive alternative. Companies are increasingly turning to microbial fermentation to generate natural flavors, proteins, and preservatives with enhanced functional properties. For example, precision fermentation techniques are being used to produce dairy-like proteins without animal involvement, while yeast-based systems are generating natural vanillin for flavor enhancement. A research paper published in Nature Food brought to attention that fermentation-derived natural additives offer superior purity and batch consistency compared to plant-extracted variants, reducing dependency on climate-sensitive crops. Additionally, the European Union has been supporting innovation in this space through funding initiatives such as Horizon Europe.

MARKET CHALLENGES

Regulatory Complexity and Divergent Approval Standards Across EU Member States

One of the most pressing challenges in the European natural food additives market is the fragmented regulatory landscape, where approval criteria and permitted usage levels vary significantly across EU member states. Although the European Food Safety Authority (EFSA) provides overarching guidance, national authorities retain discretion in interpreting and enforcing regulations, creating compliance difficulties for manufacturers and suppliers. For instance, while the EFSA has approved certain natural extracts as food additives, individual countries may impose additional restrictions based on local risk assessments or cultural preferences. A case in point is the differing treatment of curcumin, a natural yellow pigment derived from turmeric—permitted widely in Northern Europe but subject to tighter limits in France due to past concerns over heavy metal contamination. As outlined in a policy brief by the European Food Law Association, small and medium-sized enterprises (SMEs) often struggle to navigate this regulatory maze, limiting their ability to compete with larger firms.

Consumer Misunderstanding and Mislabeling of ‘Natural’ Ingredients

Another critical challenge facing the European natural food additives market is the lack of a universally accepted definition of “natural,” leading to confusion among consumers and inconsistencies in labeling practices. While the term implies purity and minimal processing, its interpretation varies across brands, regulators, and consumer groups, sometimes resulting in misleading marketing claims. This ambiguity has prompted calls for standardized definitions and clearer labeling requirements. In response, the European Commission has initiated consultations on defining natural food additives more precisely, aiming to prevent deceptive claims and build consumer trust. However, until such guidelines are formalized and enforced consistently, the credibility of natural food additives remains at risk, potentially undermining market growth and consumer confidence in clean-label products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.92% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

BASF SE, Evonik Industries AG, Tate & Lyle PLC, Döhler, Danisco A/S, Symrise AG, Firmenich SA, Chr. Hansen A/S, Cargill Inc., Kerry Group, Carbery Group Ltd., Ajinomoto Co. Inc., Kalsec Inc., Corbion, Givaudan, DSM, Sensient Technologies Corporation, Archer Daniels Midland Company, Associated British Foods plc, Robertet Group, Azelis Group, Auga Group |

SEGMENTAL ANALYSIS

By Type Insights

The Emulsifiers segment held the largest market share accounting for 21.5% of the European natural food additives market in 2024. This dominance is primarily attributed to their widespread use across various food and beverage applications, particularly in bakery, dairy, and processed meat products, where they play a crucial role in maintaining texture, consistency, and shelf life. Also, emulsifiers like lecithin from sunflower and soy, mono- and diglycerides from plant oils, and stearoyl lactylates are among the most commonly used natural emulsifying agents. These ingredients help prevent phase separation, enhance mouthfeel, and improve product stability—making them indispensable in modern food formulations. Moreover, the increasing demand for clean-label alternatives to synthetic emulsifiers has accelerated the adoption of naturally derived options. Besides, regulatory support from the European Food Safety Authority (EFSA) encourages the use of safe and transparently sourced emulsifiers.

The Food Flavors and Enhancers segment is projected to grow at the fastest CAGR of 8.9% during the forecast period, outpacing other types of natural food additives. This rapid expansion is driven by shifting consumer preferences toward minimally processed foods with authentic taste profiles and the growing popularity of savory and umami-rich flavors in convenience foods. In addition, demand for natural flavoring agents such as yeast extracts, mushroom powders, seaweed-derived compounds, and fermented vegetable broths has surged due to their ability to enhance the depth of flavor without artificial chemicals. Furthermore, the rise of plant-based and alternative protein products has intensified the need for natural flavor boosters that mimic the taste of traditional meat and dairy. Moreover, regulatory agencies like EFSA have endorsed the safety of these flavoring agents, encouraging manufacturers to replace artificial counterparts.

By Application Insights

The Bakery and Confectionery application segment accounts for the majority of usage by contributing 27.6% of the total European natural food additives market in 2024. This rule over the market due to the extensive reliance on natural additives to enhance texture, extend shelf life, and improve visual appeal in breads, pastries, cookies, and desserts. Natural emulsifiers like sunflower lecithin and acacia gum are widely used in bread and cake formulations to improve dough elasticity and moisture retention. Apart from these, natural colorants such as beetroot extract, turmeric, and carotenoids are increasingly used in confectionery items to provide vibrant hues without synthetic dyes. A study by the British Confectionery Association found that more than half of new candy and chocolate launches in the UK featured natural coloring agents. Furthermore, functional fibers and plant-based sweeteners are being incorporated into reduced-sugar baked goods to maintain taste and structure.

The beverage application segment is emerging as the fastest-growing, registering a CAGR of 9.3% over the forecast period. This growth is largely fueled by the booming demand for functional drinks, plant-based beverages, and flavored waters that rely on natural additives to enhance taste, color, and stability. According to the European Beverage Association, sales of functional and fortified beverages—including immunity boosters, probiotic-infused drinks, and herbal tonics—grew in 2023 compared to the previous year. These products often incorporate natural sweeteners like stevia, monk fruit extract, and erythritol to cater to health-conscious consumers seeking sugar-free alternatives. Moreover, the rise of cold-pressed juices and plant-based milk alternatives has increased the need for natural stabilizers and emulsifiers such as pectin and carrageenan to prevent sedimentation and ensure uniform texture. Also, regulatory bodies such as the European Commission have encouraged the use of natural preservatives like rosemary extract to replace synthetic ones in bottled drinks.

REGIONAL ANALYSIS

Germany had the largest market share contributing 23.7% of the overall European natural food additives market in 2024. It maintains its position due to a strong presence of food manufacturing companies, advanced R&D infrastructure, and a highly regulated environment that supports clean-label product development. With one of the largest food and beverage industries in Europe, Germany serves a diverse consumer base that increasingly prioritizes health-conscious and transparently labeled products. In addition, Germany’s robust organic food sector and stringent food safety regulations encourage the adoption of natural alternatives to synthetic ingredients. The country is also home to several key ingredient suppliers and research institutions that collaborate on innovations in natural extraction and formulation technologies.

The United Kingdom is a key player in the market and is driven by a combination of proactive regulatory oversight and strong consumer demand for clean-label products. The UK Food Standards Agency (FSA) has played a pivotal role in advocating for the removal of artificial additives from mainstream food products. Supermarkets like Tesco and Waitrose have led reformulation efforts, removing synthetic additives from own-brand lines. Additionally, the post-Brexit regulatory environment has allowed the UK to adopt more flexible yet rigorous standards for natural additive approvals, facilitating faster market entry for innovative ingredients. Research institutions such as the University of Reading are also engaged in studies evaluating the efficacy and safety of natural preservatives and flavor enhancers.

France is supported by its progressive approach to integrating organic and sustainable ingredients into mainstream food production. The French government has implemented policies under the "Farm to Fork" strategy to promote the use of natural additives in processed foods. Companies like Roquette and Solabiol are leading domestic innovations in natural ingredient sourcing and formulation. Moreover, France's strong gourmet and artisanal food culture has created a favorable environment for premium natural additives. The National Institute for Agricultural Research (INRAE) has been actively involved in validating the functionality and health benefits of natural extracts used in food processing.

Spain contributes majorly to the European natural food additives market, with a growing focus on enhancing food quality standards and promoting healthier dietary choices. The Spanish Ministry of Agriculture has introduced several initiatives aimed at supporting the transition from synthetic to natural additives in both local and export-oriented food products. This shift is particularly evident in the dairy and beverage sectors, where natural alternatives are gaining traction. Additionally, Spain has seen an increase in the cultivation of native plants such as saffron and carob, which serve as sources of natural colorants and texturizing agents. Universities like the Autonomous University of Barcelona are cresearchingoptimizing the extraction and application of these natural compounds.

Italy has an expanding consumer base and improved ingredient transparency which is driven by an expanding consumer base and improved ingredient transparency across the food industry. With a rich culinary tradition, Italian consumers place a high value on authenticity and naturalness in food products, making it a fertile ground for clean-label ingredient adoption. Traditional food categories such as pasta, sauces, and cured meats are undergoing reformulation to meet evolving consumer expectations. Private-label brands and independent retailers are playing a key role in driving this shift, offering products that emphasize natural preservation methods and plant-based ingredients. In addition, the Italian government has supported small-scale producers in transitioning to natural additives through funding and technical assistance programs.

LEADING PLAYERS IN THE EUROPE NATURAL FOOD ADDITIVES MARKET

Cargill Incorporated

Cargill is a global leader in food ingredient innovation and plays a pivotal role in the European natural food additives market through its diverse portfolio of plant-based emulsifiers, sweeteners, and texturizing agents. The company emphasizes sustainable sourcing, offering natural alternatives derived from non-GMO crops and fermentation processes. With extensive R&D capabilities and strategic partnerships across European food manufacturers, Cargill contributes significantly to the development of clean-label products that meet evolving consumer expectations while supporting industry-wide sustainability goals.

Roquette Frères

Roquette is a prominent French company specializing in plant-based ingredients, particularly natural sweeteners, and functional starches used in a wide range of food applications. As a key player in the European market, Roquette focuses on extracting high-quality additives from peas, potatoes, and other natural sources to replace synthetic compounds. The company’s investment in biotechnological research and green processing techniques has positioned it as a preferred supplier for health-conscious brands seeking innovative, eco-friendly food solutions tailored to European dietary trends and regulatory standards.

DuPont de Nemours, Inc. (now Corteva Agriscience and NutriAddo)

DuPont, through its former Nutrition & Biosciences division now partially under NutriAddo and related entities, remains a major force in the European natural food additives space. Known for its expertise in enzymes, microbial fermentation, and bio-preservation technologies, the company offers advanced natural preservatives and flavor enhancers that support product stability and taste without artificial inputs. Its strong presence in the dairy, bakery, and beverage sectors, along with continuous innovation, reinforces its leadership in promoting cleaner, more transparent food formulations across Europe.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One major strategy employed by key players in the Europe natural food additives market is product innovation and diversification , focusing on developing novel ingredients that align with emerging consumer preferences and regulatory guidelines. Companies are investing heavily in R&D to create functional, multi-purpose additives derived from organic and sustainable sources, enhancing their competitive edge.

Another critical approach is strategic partnerships and collaborations with food manufacturers, academic institutions, and agricultural suppliers. These alliances help companies stay ahead of formulation challenges, optimize supply chain efficiency, and accelerate the commercialization of new additive solutions tailored to specific food categories.

Lastly, expanding regional presence through acquisitions and localized production facilities is a growing trend among leading firms. By establishing manufacturing units closer to key markets and acquiring niche ingredient developers, companies can better respond to regional demand dynamics, reduce costs, and strengthen their foothold in the European natural food additives landscape.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE OVERVIEW

Major Players in the European natural food additives market include BASF SE, Evonik Industries AG, Tate & Lyle PLC, Döhler, Danisco A/S, Symrise AG, Firmenich SA, Chr. Hansen A/S, Cargill Inc., Kerry Group, Carbery Group Ltd., Ajinomoto Co. Inc., Kalsec Inc., Corbion, Givaudan, DSM, Sensient Technologies Corporation, Archer Daniels Midland Company, Associated British Foods plc, Robertet Group, Azelis Group, Auga Group

The competition in the European natural food additives market is highly dynamic, characterized by the presence of both global giants and specialized regional players striving to capture market share through innovation, sustainability, and regulatory alignment. Established multinational corporations leverage their extensive R&D capabilities, broad product portfolios, and well-established distribution networks to maintain dominance, particularly in Western Europe. At the same time, smaller, agile companies are gaining traction by focusing on niche segments such as plant-based flavors, fermented extracts, and functional fibers tailored to specific dietary trends.

Strategic differentiation is increasingly being driven by transparency in sourcing, traceability of raw materials, and certifications such as organic, non-GMO, and vegan compliance. Additionally, the push toward carbon-neutral production practices is shaping competitive strategies, with many firms investing in green technologies and circular economy models. Regulatory responsiveness also plays a crucial role, as companies must navigate evolving EU food safety standards and labeling requirements. In this environment, only those who can combine scientific excellence with consumer insight and environmental responsibility will be able to sustain long-term growth and leadership in the rapidly evolving European natural food additives sector.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Cargill announced the launch of a new line of plant-based emulsifiers derived from upcycled sunflower oil residues, aiming to enhance texture and shelf life in bakery and confectionery products while reducing environmental impact.

- In May 2024, Roquette expanded its production capacity at its Lestrem facility in France to meet rising demand for natural sweeteners, particularly erythritol and maltitol, used in low-sugar and diabetic-friendly food formulations across Europe.

- In July 2024, a subsidiary of NutriAddo entered into a strategic partnership with a leading European dairy cooperative to co-develop natural microbial-based preservatives that extend shelf life without compromising taste or nutritional value.

- In September 2024, Tate & Lyle introduced a new clean-label fiber blend designed to improve gut health benefits in processed foods, positioning itself as a key player in functional ingredient innovation within the European market.

- In November 2024, Givaudan, a global flavor and fragrance leader, acquired a German startup specializing in fermentation-derived natural flavor enhancers.

MARKET SEGMENTATION

This research report on the Europe Natural Food Additives Market has been segmented and sub-segmented based on type, application, and region.

By Type

- Emulsifiers

- Food Flavors and Enhancers

By Application

- Bakery and Confectionery

- Beverages

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe Natural Food Additives Market?

The market is being driven by increasing consumer demand for clean-label products, rising health consciousness, and stricter regulations on synthetic additives.

2. Which countries in Europe are leading in the consumption of natural food additives?

Major countries include the United Kingdom, Germany, France, Italy, and Spain due to high demand for organic and processed natural food products.

3. How are natural food additives regulated in Europe?

Natural food additives are regulated by the European Food Safety Authority (EFSA) to ensure safety, quality, and compliance with food standards.

4. Who are the key players in the Europe Natural Food Additives Market?

Key players include Cargill, Archer Daniels Midland Company, DuPont, Kerry Group, Ingredion Incorporated, and Chr. Hansen.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com