Europe Oil Filled Distribution Transformer Market Research Report – Segmented By Voltage Rating ( Medium Voltage (1 kV – 36 kV) , High Voltage (36 kV – 150 kV), Cooling Method,Phase Type,Mounting Type & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Oil Filled Distribution Transformer Market Size

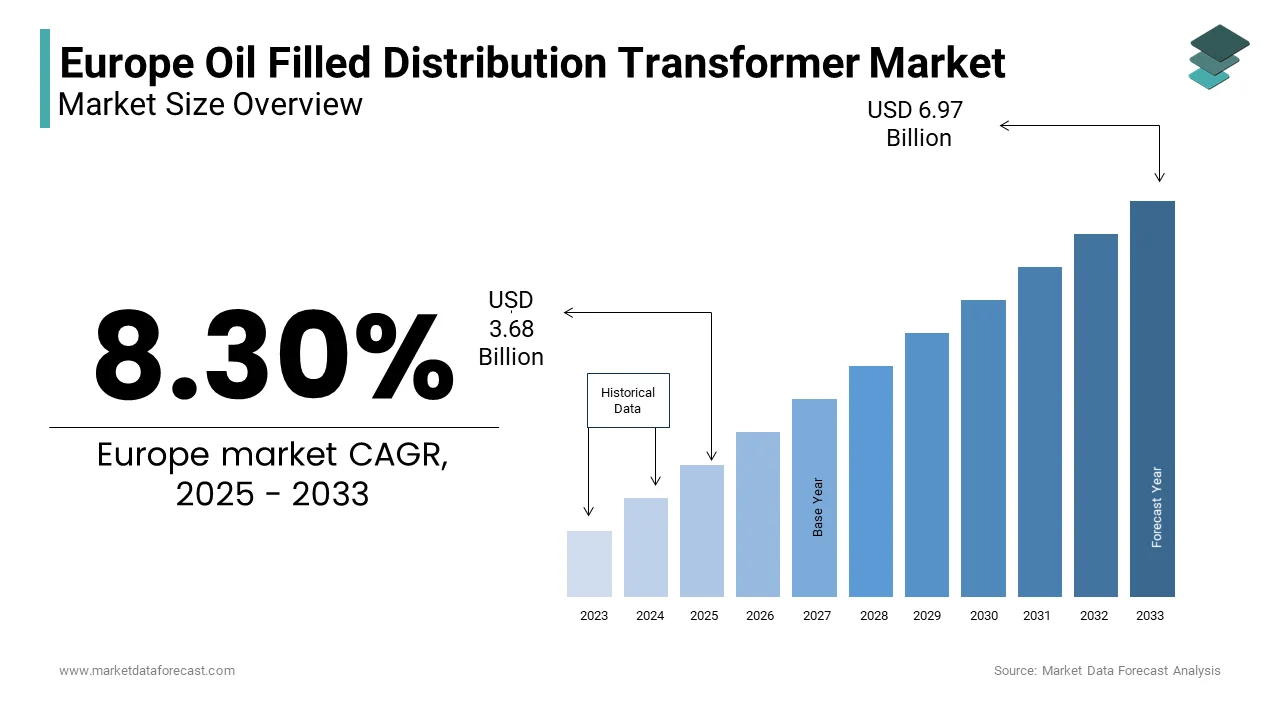

The Europe Oil Filled Distribution Transformer Market Size was valued at USD 3.4 billion in 2024. The Europe Oil Filled Distribution Transformer Market size is expected to have 8.30 % CAGR from 2025 to 2033 and be worth USD 6.97 billion by 2033 from USD 3.68 billion in 2025.

The Europe oil filled distribution transformer market refers to a critical component of the region’s electrical power infrastructure, facilitating the efficient and safe transformation of voltage levels for electricity distribution in urban, rural, and industrial settings. These transformers use mineral oil as an insulating and cooling medium, offering high thermal performance and reliability, which makes them particularly suitable for heavy-duty applications. Despite increasing interest in alternative technologies such as dry-type transformers, oil filled units remain widely used due to their superior efficiency, cost-effectiveness, and long service life.

The European Environment Agency notes that while mineral oil poses environmental risks if not properly managed, it remains the most technically viable option for high-capacity distribution due to its dielectric strength and heat dissipation properties.

MARKET DRIVERS

Aging Grid Infrastructure Requiring Replacement

One of the primary drivers of the Europe oil filled distribution transformer market is the urgent need to replace aging electrical infrastructure across multiple countries. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), nearly 45% of distribution transformers in service were installed before 1985, making them prone to inefficiencies, frequent failures, and compliance issues with modern safety and performance standards. This aging stock has prompted extensive investment in grid modernization programs aimed at enhancing reliability and reducing downtime. In France, the French Electricity Transmission Network Manager (RTE) reported that over 30% of the country’s distribution transformers are beyond their expected operational lifespan, leading to an accelerated replacement cycle supported by national funding initiatives. Moreover, Italy’s Terna SpA documented an increase in transformer replacements during the same period, citing improved grid stability and reduced losses as key motivators.

Expansion of Renewable Energy Integration

Another significant driver of the Europe oil filled distribution transformer market is the rapid expansion of renewable energy integration into the grid. As wind, solar, and hydroelectric power generation capacities grow, so does the need for stable and adaptable distribution infrastructure capable of managing intermittent power flows and ensuring grid compatibility. According to the International Renewable Energy Agency (IRENA), Europe added significant gigawatts of new renewable capacity, necessitating enhanced distribution-level equipment to handle fluctuating voltages and reverse power flows.

Denmark’s Energinet reported that the integration of offshore wind farms required extensive deployment of oil filled distribution transformers to manage step-down operations at regional substations. In Germany, the Federal Network Agency (Bundesnetzagentur) noted a surge in transformer installations near photovoltaic parks to accommodate bidirectional power flow and ensure voltage regulation under varying generation conditions.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Pressure

A major restraint affecting the Europe oil filled distribution transformer market is the growing environmental concerns associated with mineral oil leakage and fire hazards, prompting regulatory scrutiny and policy shifts favoring alternative insulation technologies. According to the European Environment Agency, mineral oil-based transformers pose a risk of soil and water contamination in case of leaks or ruptures, leading to stricter guidelines on oil containment and spill prevention. In response, several EU member states have introduced policies encouraging the adoption of dry-type or ester-based transformers in sensitive locations such as urban centers, nature reserves, and indoor facilities. Similarly, the Netherlands' Ministry of Infrastructure and Water Management launched a nationwide initiative in 2023 promoting eco-friendly alternatives for low- and medium-voltage distribution, limiting the procurement of conventional oil filled units in specific applications.

Supply Chain Disruptions and Component Shortages

Another critical constraint on the Europe oil filled distribution transformer market is the ongoing supply chain disruptions and shortages of key components such as copper, silicon steel, and insulating materials. According to the European Copper Institute, global copper prices surged between 2021 and 2023 due to mining bottlenecks and rising demand from electrification projects, significantly impacting transformer manufacturing costs. Apart from these, the war in Ukraine disrupted raw material supplies from Eastern Europe, particularly affecting production timelines for core laminations and bushings. The German Electrical and Electronic Manufacturers’ Association (ZVEI) reported that lead times for critical transformer components extended beyond six months in some cases, delaying utility procurement schedules. Furthermore, semiconductor shortages affected control and monitoring systems integrated into newer transformer models, complicating the rollout of smart grid-compatible oil filled units. Smaller manufacturers, particularly in Poland and Romania, faced production halts due to inconsistent availability of raw materials and logistics delays.

MARKET OPPORTUNITIES

Digitalization and Smart Grid Integration

A compelling opportunity emerging in the Europe oil filled distribution transformer market is the integration of digital technologies and smart grid capabilities. As part of the European Union’s push toward intelligent power networks, utilities are increasingly deploying transformers equipped with real-time monitoring, predictive maintenance features, and remote diagnostics. According to McKinsey & Company, a high percentage of new transformer procurements in Germany and the Netherlands now include digital sensors and IoT-enabled condition monitoring systems. The European Commission’s Digital Grid Initiative also supports this trend by promoting interoperability and data-driven grid management strategies.

Demand from Decentralized Energy Systems

Another transformative opportunity for the Europe oil filled distribution transformer market lies in the expansion of decentralized energy systems, including microgrids, prosumer networks, and localized renewable integration. As cities and industries move toward distributed generation models, there is an increasing need for compact, high-efficiency transformers that can manage bi-directional power flows and maintain grid stability. Similarly, Finland’s Helen Ltd. expanded its use of oil filled units in neighborhood heating and power hubs that combine biomass and wind energy sources. The Italian National Agency for New Technologies, Energy and Sustainable Economic Development (ENEA) also emphasized the role of oil filled transformers in balancing decentralized grid segments without compromising reliability.

MARKET CHALLENGES

Rising Competition from Dry-Type Transformers

A pressing challenge confronting the Europe oil filled distribution transformer market is the rising competition from dry-type transformers, particularly in urban, commercial, and environmentally sensitive areas. Unlike oil filled units, dry-type transformers use solid insulation materials such as epoxy resin, eliminating the risk of oil leakage and fire hazards, making them preferable in densely populated zones and indoor installations. In the Netherlands, Amsterdam’s Smart City initiative mandated the use of dry-type transformers in all new residential developments to reduce environmental liability and improve public safety.

Increasing Cost Pressures and Raw Material Volatility

Another significant challenge for the Europe oil filled distribution transformer market is the escalating cost pressures and volatility in raw material pricing, which affect production economics and procurement strategies. Manufacturers in Italy and Spain reported production slowdowns and order backlogs as input costs made budget forecasting difficult. Smaller producers, in particular, struggled to absorb these fluctuations without passing them on to customers, affecting competitiveness. Moreover, inflation-linked interest rate hikes made financing large-scale transformer orders more expensive, discouraging bulk purchases from municipal utilities and independent power producers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.30 % |

|

Segments Covered |

By Voltage Rating , Cooling Method,Phase Type,Mounting Type and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

CG Power & Industrial Solutions, Eaton, Elsewedy Electric, General Electric |

SEGMENT ANALYSIS

By Voltage Rating Insights

The medium voltage segment dominated the Europe oil filled distribution transformer market by capturing a 48.5% of total revenue in 2024. This position is primarily attributed to its extensive use across urban and rural power distribution networks, particularly in secondary transmission lines that deliver electricity from substations to end consumers. Germany leads adoption. Similarly, the UK National Grid emphasized the importance of medium voltage transformers in maintaining stability in decentralized energy systems powered by wind and solar farms.

The high voltage segment is projected to grow at the highest compound annual growth rate (CAGR) of approximately 6.1% from 2025 to 2033 which is driven by increasing deployment in regional transmission hubs, industrial clusters, and large-scale renewable energy interconnection projects. These transformers are essential for stepping down voltages from high-voltage transmission lines to levels suitable for local distribution while ensuring grid resilience.

According to the European Network of Transmission System Operators for Electricity (ENTSO-E), cross-border electricity trade increased between 2021 and 2023, necessitating additional high-voltage distribution nodes at interconnection points. In Spain, Red Eléctrica de España reported a significant rise in 66 kV-rated oil filled transformers being deployed near photovoltaic farms to manage bulk power evacuation and grid synchronization.

By Cooling Method Insights

ONAN cooling method commanded the Europe oil filled distribution transformer market by accounting for a 52.8% of total revenue in 2024. This is caused by its simplicity, reliability, and widespread application in passive-cooled distribution transformers used in standard utility operations. Additionally, ONAN transformers are widely adopted in islanded microgrid applications due to their self-sufficient thermal management capabilities. With ongoing investments in passive-cooled infrastructure and minimal dependency on external cooling mechanisms, the ONAN segment continues to maintain its leading position across the continent.

The OFAF cooling method is expected to grow at the fastest CAGR of a 7.2% and is fueled by rising demand in high-load industrial zones, urban substations, and renewable energy integration projects. Unlike natural air-cooled variants, OFAF transformers use pumps and fans to enhance heat dissipation, making them ideal for applications requiring continuous operation under heavy loads.

According to the International Energy Agency, industrial electricity consumption in Europe rose between 2021 and 2023, prompting greater adoption of forced-cooling technologies in manufacturing and data center power systems. Similarly, Norway’s Statnett implemented OFAF units in several upgraded grid stations to accommodate increased electric vehicle charging station demand and hydrogen production facilities.

By Phase Type Insights

Three-phase oil filled distribution transformers was the widely used type in 2024. This is primarily due to their widespread use in industrial, commercial, and large-scale public utility applications where balanced three-phase power supply is essential for efficient motor and equipment operation. According to the European Committee for Electrotechnical Standardization (CENELEC), a significantportion of new industrial buildings and commercial developments require three-phase power transformation to meet machinery and HVAC system demands. Similarly, in France, RTE (Réseau de Transport d'Électricité) emphasized the role of three-phase transformers in managing power flow from combined cycle gas plants and biomass facilities into the national grid. Additionally, the UK National Grid documented a key increase in three-phase transformer installations near EV fast-charging corridors to support stable and high-efficiency power delivery.

The single-phase oil filled distribution transformer segment is anticipated to grow at a CAGR of 5.3%. It is driven by increasing deployment in residential and small-scale commercial settings, particularly in rural and semi-urban regions. These transformers are commonly used in low-density consumer areas where three-phase power distribution is not economically viable. According to the European Rural Electrification Association, a notable percentage of new housing developments in Eastern Europe rely on single-phase transformers for localized power distribution. Additionally,

By Mounting Type Insights

Pole-mounted oil filled distribution transformers accounted for a 44.5% of the Europe market which is driven by their widespread use in overhead distribution networks, especially in rural and semi-urban areas. These transformers are typically installed on utility poles and serve smaller communities and individual households, offering cost-effective and easily accessible solutions for power distribution. According to the European Electricity Distribution Network Operators for Smart Grids Coordination Group, a large share of overhead distribution lines in Central and Eastern Europe still rely on pole-mounted transformers due to lower installation costs and ease of replacement. In Romania, Transelectrica reported a 20% increase in pole-mounted transformer installations as part of rural electrification and grid reinforcement programs between 2021 and 2023.

The substation mounted oil filled distribution transformer segment is predicted to accelerate at the highest CAGR of approximately 6.8%. This is propelled by increasing investments in centralized power distribution hubs and smart grid infrastructure. These transformers are typically housed within indoor or outdoor substations and serve high-demand zones such as cities, industrial parks, and data centers.

According to the European Network of Transmission System Operators for Electricity (ENTSO-E), substation capacity expansion plans across Germany, France, and the Benelux region have led to a surge in high-capacity oil filled unit installations. The European Commission’s Clean Energy Package further supports this trend by encouraging grid operators to adopt standardized, high-performance substation transformers capable of handling bidirectional power flows from distributed energy resources.

COUNTRY LEVEL ANALYSIS

Germany had the largest share of the Europe oil filled distribution transformer market by contributing a 20.8% of total regional revenues in 2024. This is attributed to the country’s robust industrial base, proactive grid modernization policies, and strong commitment to integrating renewable energy sources into the national grid. According to the German Federal Network Agency (Bundesnetzagentur), over €4.2 billion was invested in grid infrastructure upgrades between 2021 and 2023, including the replacement of outdated transformers with smart-enabled oil filled units. The German Electrical and Electronic Manufacturers’ Association (ZVEI) reported an increase in transformer orders from wind and solar park developers seeking reliable voltage regulation for decentralized power injection. Also, Germany's Energiewende policy has spurred demand for high-efficiency transformers in regional substations, particularly in Schleswig-Holstein and Bavaria, where renewable penetration is highest.

France oil filled distribution transformer market is driven by strategic investments in grid modernization and the expansion of nuclear and renewable power generation. Moreover, the French Ministry of Ecological Transition documented a rise in transformer installations near wind and solar farms to facilitate smoother grid integration. Paris-based research institutions also collaborated with manufacturers to develop fire-safe mineral oil alternatives for use in sensitive environments. With continued policy backing and a focus on energy efficiency, France maintains a key position in the European oil filled distribution transformer market.

The United Kingdom focuses on decentralized power systems and is supported by strong investments in decentralized power systems and grid resilience. According to the UK Department for Business, Energy & Industrial Strategy (BEIS), the nation spent £3.1 billion on grid upgrades in 2023, with a particular focus on replacing aging transformers in both urban and rural locations. The UK National Grid reported a increase in transformer procurement for solar and wind farm interconnection projects, reinforcing the need for oil filled units capable of managing variable load conditions. Additionally, ScottishPower Renewables noted a rise in oil filled transformer deployments in Scotland’s wind-dense regions to ensure voltage stability and long-term reliability.

Italy market is propelled by expanding renewable integration and infrastructure renewal programs. The Italian Ministry of Economic Development launched the "Grid Resilience Fund" to support upgrades in Sicily and Sardinia, where islanded power systems require robust and adaptive distribution assets.

Spain is seeing rising demand in solar energy projects that is driven by increasing demand in solar energy projects and rural electrification initiatives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe oil filled distribution transformer market are CG Power & Industrial Solutions, Eaton, Elsewedy Electric, General Electric, Hitachi Energy, HYOSUNG HEAVY INDUSTRIES, IEO Transformers, IMEFY GROUP, Koncar, Mitsubishi Electric, ORMAZABAL, Schneider Electric, SGB SMIT, Siemens

The competition in the Europe oil filled distribution transformer market is characterized by a blend of established multinational corporations, regional manufacturers, and specialized engineering firms vying for contracts across utility, industrial, and renewable energy sectors. Leading players such as ABB, Siemens, and Schneider Electric dominate due to their technological leadership, broad product portfolios, and extensive service networks. However, mid-sized firms are gaining traction by focusing on cost-effective alternatives, localized sourcing, and niche applications in rural and decentralized power systems.

A defining feature of the competitive landscape is the increasing emphasis on digitalization, with companies racing to introduce smart transformers that provide real-time diagnostics, enhanced load management, and predictive maintenance capabilities. Additionally, shifting regulatory frameworks aimed at reducing fire hazards and environmental impact are influencing material selection and insulation technology adoption across different regions.

Brand differentiation is increasingly tied to technical certification, environmental credentials, and customer-centric service delivery. As electrification accelerates and grid complexity increases, the ability to deliver compliant, high-performance, and digitally enabled oil filled distribution transformers will determine long-term success in this critical infrastructure sector.

Top Players in the Market

ABB Ltd.

ABB is a global leader in power technologies and holds a strong position in the Europe oil filled distribution transformer market. The company offers a comprehensive range of high-efficiency, smart-enabled transformers tailored for utility, industrial, and renewable energy applications. ABB’s oil filled distribution transformers are known for their reliability, durability, and integration with digital monitoring systems.

The company contributes significantly to the global market by setting benchmarks in transformer innovation and sustainability. Its solutions support grid modernization, decentralized energy models, and predictive maintenance capabilities. Through its Grid Automation and Power Systems divisions, ABB continues to shape future trends in electrical infrastructure across Europe and beyond.

Siemens AG – Energy Sector

Siemens is a key player in the European oil filled distribution transformer market, delivering advanced transformers designed for urban substations, industrial complexes, and renewable energy interconnection points. The company emphasizes digitalization, asset monitoring, and energy efficiency in its product portfolio, ensuring compatibility with evolving smart grid requirements.

Siemens plays a pivotal role in advancing grid resilience through its integration of intelligent sensors and condition-based diagnostics into oil filled units. By collaborating with national utilities and research institutions, Siemens supports large-scale electrification projects and low-carbon transition strategies. Its commitment to system interoperability and modular design has reinforced its influence across both public and private sector power networks in Europe.

Schneider Electric SE

Schneider Electric is a major contributor to the Europe oil filled distribution transformer market, offering energy-efficient and digitally integrated transformer solutions suited for commercial, residential, and industrial applications. The company focuses on compact, eco-conscious designs that align with EU directives on energy performance and environmental safety.

Schneider Electric enhances the global market by promoting sustainable electrification and digital transformation through its EcoStruxure platform, which includes real-time monitoring and analytics for transformer health management. Its focus on plug-and-play modularity and lifecycle optimization makes it a preferred partner for utilities and independent power producers seeking scalable and secure distribution solutions across Europe.

Top strategies used by the key market participants

One major strategy employed by leading players in the Europe oil filled distribution transformer market is product innovation and digital integration , where companies develop smart transformers equipped with IoT-enabled monitoring systems, predictive maintenance features, and remote diagnostics to enhance operational efficiency and compliance with grid modernization goals.

Another key strategy is strategic partnerships and collaborations , particularly with grid operators, renewable energy developers, and automation solution providers to ensure seamless integration of transformers into next-generation power networks and improve after-sales service offerings.

Lastly, localized production and supply chain optimization allow companies to reduce lead times, comply with regional standards, and offer customized solutions that meet specific country-level grid requirements, reinforcing their competitive positioning in a highly regulated and technically demanding market.

RECENT HAPPENINGS IN THE MARKET

In February 2024, ABB launched a new line of digitally integrated oil filled distribution transformers in Germany, featuring embedded condition-monitoring sensors designed to predict failures and optimize maintenance schedules for urban grid operators.

In May 2024, Siemens partnered with a French grid analytics firm to deploy smart oil filled transformers equipped with AI-driven diagnostics, enabling real-time thermal and insulation analysis for enhanced grid reliability in high-demand zones.

In July 2024, Schneider Electric expanded its transformer manufacturing facility in Spain, increasing capacity to meet rising demand from solar farms and decentralized energy hubs requiring robust voltage regulation and bi-directional power flow control.

In September 2024, General Electric's Energy Connections division introduced an ultra-compact oil filled transformer series in Italy, specifically engineered for retrofitting aging substations without requiring structural modifications or extended downtime.

In November 2024, Efacec, a Portuguese energy equipment manufacturer, acquired a German transformer testing laboratory to enhance its R&D capabilities and accelerate product certifications, strengthening its foothold in Western Europe’s smart grid upgrade programs.

MARKET SEGMENTATION

This research report on the europe oil filled distribution transformer market has been segmented and sub-segmented into the following categories.

By Voltage Rating

- Medium Voltage (1 kV – 36 kV)

- High Voltage (36 kV – 150 kV)

By Cooling Method

- ONAN (Oil Natural Air Natural)

- OFAF (Oil Forced Air Forced)

By Phase Type

- Three Phase

- Single Phase

By Mounting Type

- Pole-mounted oil filled distribution transformers

- substation mounted oil filled distribution transformer

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is driving the growth of the oil-filled distribution transformer market in Europe?

The market is primarily driven by the rapid expansion of renewable energy projects, grid modernization efforts, and the rising demand for electricity in residential and industrial sectors.

Which countries are the major markets for oil-filled distribution transformers in Europe?

Key markets include Germany, the United Kingdom, France, Italy, and Spain, driven by strong industrial bases and robust power infrastructure.

How is the market impacted by regulatory standards and policies in Europe?

Strict regulations around efficiency, emissions, and safety, like the EU's EcoDesign directive, significantly impact transformer design and manufacturing processes.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com