Europe Oncology Market Size, Share, Trends & Growth Forecast Report By Cancer Type (Breast Cancer, Skin Cancer), Drug Class Type, Distribution Channel, Route Of Administration, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Oncology Market Size

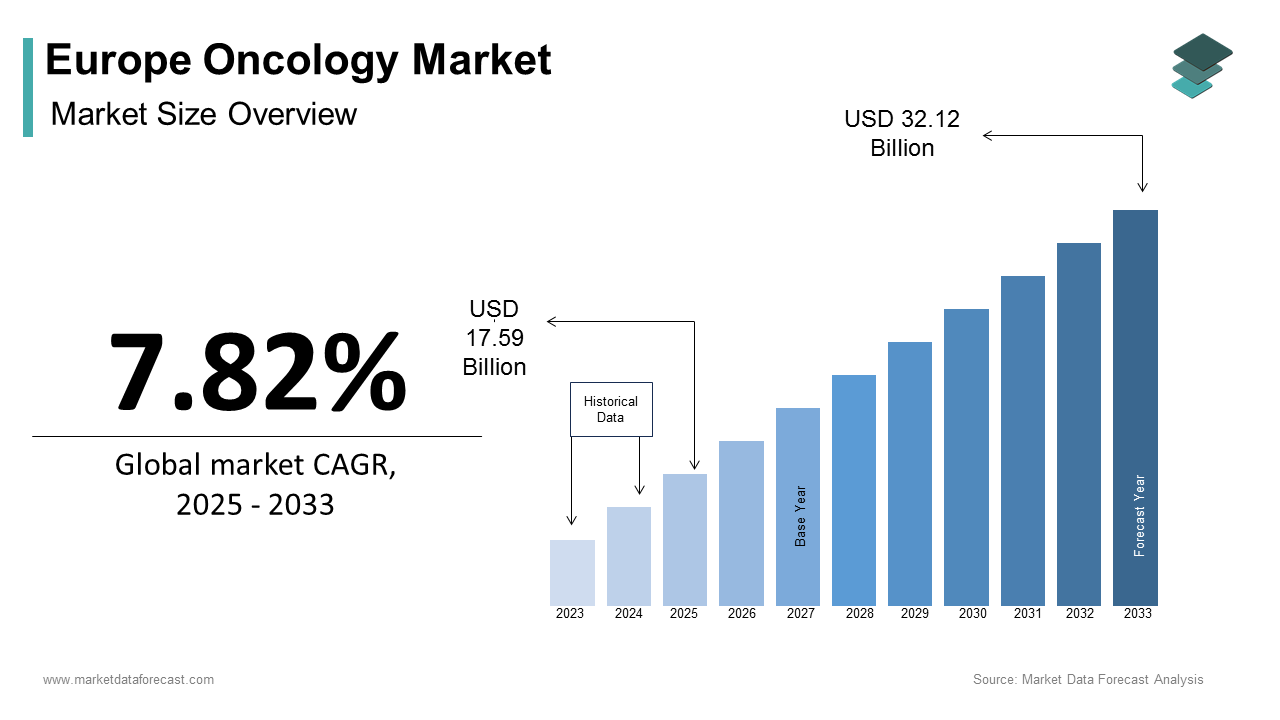

The Europe Oncology Market size was calculated to be USD 16.31 billion in 2024 and is anticipated to be worth USD 32.12 billion by 2033, from USD 17.59 billion in 2025, growing at a CAGR of 7.82% during the forecast period.

The European oncology market covers a wide range of therapeutic solutions, diagnostic tools, and supportive care products aimed at the prevention, detection, and treatment of various forms of cancer. As one of the most advanced healthcare regions globally, Europe has witnessed a significant rise in cancer incidence rates over the past decade. According to the European Cancer Information System (ECIS), nearly 2.7 million new cancer cases were diagnosed across the EU in 2022, with mortality figures surpassing 1.3 million annually. This growing disease burden has intensified the demand for innovative therapies, including immunotherapies, targeted treatments, and precision medicine approaches. Moreover, the region benefits from universal healthcare systems in several countries that ensure broad patient access to cancer treatments. The European Society for Medical Oncology (ESMO) reports that more than 50% of cancer patients in Western Europe receive treatment within multidisciplinary care settings. These factors collectively contribute to a dynamic and evolving oncology landscape across the continent.

MARKET DRIVERS

Rising Incidence of Cancer Across Europe

One of the primary drivers of the Europe oncology market is the increasing prevalence of cancer among the population. According to the World Health Organization’s International Agency for Research on Cancer (IARC), Europe accounts for a significant portion of global cancer cases despite representing only 9% of the world's population. This surge in cancer incidence is primarily attributed to aging demographics, lifestyle changes, and environmental risk factors such as tobacco use and poor dietary habits. Moreover, many reports indicate that by 2030, a major percentage of the EU population will be aged 65 or older, a demographic segment particularly susceptible to oncological diseases. As cancer risk increases with age, this demographic shift directly fuels demand for advanced diagnostics, therapeutics, and personalized treatment strategies. Additionally, early diagnosis initiatives supported by national health authorities have led to higher detection rates, further stimulating market growth. For instance, the European Commission’s Beating Cancer Plan launched in 2021 aims to enhance screening programs and improve access to innovative therapies. As per the European Cancer Information System (ECIS), breast, colorectal, lung, and prostate cancers remain the most commonly diagnosed malignancies, reinforcing the urgent need for expanded oncology services across the region.

Expansion of Precision Medicine and Targeted Therapies

Another key driver of the Europe oncology market is the rapid adoption of precision medicine and targeted therapies in cancer treatment. Unlike traditional chemotherapy, these advanced modalities focus on genetic markers and molecular profiles unique to individual tumors, offering more effective and less toxic alternatives. According to the European Society for Medical Oncology (ESMO), over 40% of cancer patients in Western Europe now receive some form of biomarker testing before initiating therapy, a significant increase from a decade ago. This shift is largely driven by increased government funding and private-sector investment in genomic research. For example, the UK’s Genomics England program, part of the National Health Service (NHS), has sequenced over 100,000 whole genomes to support personalized cancer care. Similarly, Germany’s National Decade Against Cancer initiative allocates substantial resources toward integrating precision oncology into standard clinical practice. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), more than 30 novel oncology drugs based on molecular targeting mechanisms received regulatory approval in the EU between 2020 and 2023. Furthermore, reimbursement policies in several European countries are increasingly accommodating high-cost precision therapies, encouraging their uptake. The European Medicines Agency (EMA) has also expedited approvals for breakthrough oncology treatments, fostering innovation and market expansion.

MARKET RESTRAINTS

High Cost of Advanced Cancer Therapies

A major restraint impeding the growth of the Europe oncology market is the exorbitant cost associated with advanced cancer therapies, including immunotherapy, gene therapy, and CAR-T cell treatments. Despite their efficacy, these cutting-edge interventions often come with price tags notably high per patient per year. For instance, a 2023 report by the Organisation for Economic Co-operation and Development (OECD) revealed that while Germany and the United Kingdom have relatively flexible reimbursement pathways for high-cost oncology drugs, countries like Greece, Bulgaria, and Romania face significant delays in drug availability due to financial limitations. Additionally, only a limited portion of newly approved oncology drugs receive positive reimbursement recommendations across the EU, leading to disparities in patient access. Moreover, health technology assessment (HTA) bodies in several European nations impose stringent cost-effectiveness criteria, which can delay market entry. These financial and regulatory barriers hinder equitable access to life-saving treatments and constrain overall market expansion.

Regulatory Complexity and Delayed Approvals

Regulatory complexity and prolonged approval timelines pose another significant challenge to the European oncology market. While the European Medicines Agency (EMA) ensures rigorous evaluation of oncology drugs, the process often results in delayed patient access compared to other global markets. This delay is further compounded by divergent national pricing and reimbursement procedures across EU member states. A study published by the European Journal of Health Economics found that after EMA approval, it takes an additional 18–24 months on average for a new oncology drug to reach patients in certain EU countries due to separate national HTA processes. Also, post-marketing requirements imposed by the EMA, including real-world evidence generation and risk management plans, add administrative burdens for manufacturers. The European Confederation of Pharmaceutical Entrepreneurs (EUCOPE) estimates that compliance costs for small biotech firms developing oncology treatments can exceed €5 million annually.

MARKET OPPORTUNITIES

Integration of Digital Health Technologies in Oncology Care

The integration of digital health technologies presents a transformative opportunity for the European oncology market. With advancements in artificial intelligence (AI), telemedicine, and electronic health records (EHRs), healthcare providers are increasingly leveraging digital tools to enhance cancer diagnosis, treatment planning, and patient monitoring. In particular, AI-driven platforms are being deployed for early cancer detection through medical imaging analysis. Furthermore, remote patient monitoring systems are enabling oncologists to track treatment responses and manage side effects without requiring frequent hospital visits. The European Institute for Innovation through Health Data (i~HD) estimates that digital health implementation could reduce oncology-related hospital readmissions, lowering healthcare costs and improving patient outcomes. Several governments and private entities are investing heavily in digital oncology infrastructure. As per the European Society for Medical Oncology (ESMO), the adoption of digital tools is expected to accelerate clinical trial recruitment and personalize treatment regimens, thereby driving innovation and efficiency across the oncology ecosystem in Europe.

Expansion of Biosimilars and Cost-Effective Treatment Alternatives

The rising adoption of biosimilars represents a significant opportunity for the Europe oncology market, offering cost-effective alternatives to expensive biologic cancer therapies. Biosimilars are highly similar versions of original biologics, providing comparable efficacy and safety at a reduced cost. According to the European Medicines Agency (EMA), numerous biosimilars have been approved in the EU since 2017, with several targeting key oncology indications such as breast cancer, leukemia, and lymphoma. Market dynamics are increasingly favoring biosimilars due to mounting pressure on healthcare budgets and the expiration of patents for blockbuster biologics. A 2023 report by Deloitte suggests that biosimilar uptake in oncology could save European healthcare systems more than €10 billion annually by 2027. Countries such as Germany, Norway, and the Netherlands have implemented proactive biosimilar substitution policies, leading to faster market penetration. According to the European Association of Hospital Pharmacists (EAHP), biosimilar utilization in hospital settings rose notably between 2020 and 2023. In addition, regulatory incentives and streamlined approval pathways from the EMA have encouraged pharmaceutical companies to invest in biosimilar development. As healthcare systems continue seeking sustainable solutions, the expansion of biosimilars is poised to reshape the competitive landscape and improve patient access to life-saving cancer treatments across Europe.

MARKET CHALLENGES

Disparities in Access to Oncology Treatments Across Europe

One of the most pressing challenges facing the Europe oncology market is the persistent disparity in access to cancer treatments across different regions. Despite the presence of well-developed healthcare systems in Western Europe, patients in Central and Eastern Europe often encounter significant delays in accessing novel therapies. According to the European Cancer Patient Coalition (ECPC), survival rates for certain cancers, such as breast and colorectal cancer, differ significantly between Western and Eastern European countries. These disparities stem from variations in healthcare funding, infrastructure, and regulatory efficiencies. Consequently, countries with constrained budgets struggle to afford high-cost oncology drugs, including immunotherapies and targeted therapies. The European Society for Medical Oncology (ESMO) notes that a significant share of approved oncology drugs take more than two years to become available in Eastern Europe after EMA approval. Furthermore, differences in national reimbursement policies create fragmented market conditions. As per the European Network for Health Technology Assessment (EUnetHTA), only a limited portion of newly launched oncology drugs receive full reimbursement in lower-income EU countries, compared to wealthier nations.

Shortage of Skilled Oncology Professionals and Workforce Constraints

A critical challenge confronting the Europe oncology market is the shortage of skilled healthcare professionals specializing in oncology, including medical oncologists, radiation therapists, and oncology nurses. This workforce deficit is exacerbated by the rising cancer burden and the increasing complexity of treatment protocols. According to a 2023 report by the European Society for Medical Oncology (ESMO), the EU faces a shortfall of nearly 20,000 oncology professionals, with certain specialties experiencing even greater gaps. Germany, France, and the UK have reported increasing demand for oncologists, yet training pipelines fail to keep pace. The European Oncology Nursing Society (EONS) highlights that nurse vacancy rates in oncology departments exceed 15% in several countries, contributing to burnout and reduced quality of care. Additionally, rural areas suffer disproportionately, as specialized oncology centers tend to be concentrated in urban hubs. Moreover, the integration of advanced therapies such as immunotherapy and CAR-T cell treatments requires highly trained personnel capable of managing complex administration and monitoring protocols. The European Federation of Pharmaceutical Industries and Associations (EFPIA) estimates that workforce limitations may delay the adoption of novel oncology treatments by up to 18 months in certain regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.82% |

|

Segments Covered |

By Cancer Type, Drug Class Type, Distribution Channel, Route of Administration, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

F. Hoffmann-La Roche Ltd, Novartis AG, Bristol-Myers Squibb, Pfizer Inc., Johnson & Johnson, AstraZeneca, Merck & Co., Amgen Inc., Eli Lilly and Company, Sanofi |

SEGMENTAL ANALYSIS

By Cancer Type Insights

Breast cancer stood as the largest segment in the Europe oncology market accounting for 18.8% of total market revenue in 2024. According to the European Cancer Information System (ECIS), breast cancer remains the most commonly diagnosed malignancy in Europe, with over 500,000 new cases reported in 2023 alone. This high incidence rate directly drives demand for diagnostic services, targeted therapies, and supportive care products. One key driver behind the dominance of this segment is the robust investment in early detection programs. The European Commission's Beating Cancer Plan has significantly expanded mammography screening initiatives across EU member states, resulting in increased diagnosis rates. Besides, the proliferation of HER2-positive and hormone receptor-targeted treatments has spurred pharmaceutical innovation. The European Society for Medical Oncology (ESMO) notes that over 40% of breast cancer patients now receive biomarker-driven therapy, supported by growing reimbursement coverage. Furthermore, patient advocacy groups such as Europa Donna have played a pivotal role in raising awareness and influencing policy changes, reinforcing sustained market expansion in this segment.

Skin cancer is currently the fastest-growing segment in the Europe oncology market, projected to expand at a CAGR of approximately 9.5%. According to the World Health Organization’s International Agency for Research on Cancer (IARC), melanoma incidence in Europe has seen a significant rise over the past two decades, with over 150,000 new cases diagnosed annually. A primary factor fueling this rapid growth is increasing UV exposure due to lifestyle changes and shifting travel patterns. The European Environment Agency reports that ozone depletion continues to impact UV radiation levels, particularly in Northern Europe, where fair-skinned populations are more vulnerable. Consequently, melanoma diagnosis rates have surged, especially among younger demographics. Moreover, advancements in immunotherapy and BRAF inhibitors have transformed skin cancer treatment paradigms. A 2023 study published by the European Journal of Cancer highlights that checkpoint inhibitors such as pembrolizumab and nivolumab have improved five-year survival rates for advanced melanoma patients by over 50%. These therapeutic breakthroughs, coupled with rising public health campaigns promoting sun protection and early diagnosis, are accelerating market growth in this segment.

By Drug Class Type Insights

Chemotherapy remained the top-performing drug class in the Europe oncology market by holding a market share of 35.3% in 2024. Despite the rise of newer modalities like immunotherapy and targeted therapy, chemotherapy continues to be the cornerstone of cancer treatment across various indications, including lung, colorectal, and blood cancers. The continued dominance of this segment is primarily attributed to its widespread applicability and affordability compared to emerging biologic therapies. The European Federation of Pharmaceutical Industries and Associations (EFPIA) reports that generic chemotherapy drugs account for nearly 75% of all cytotoxic prescriptions, making them accessible even in budget-constrained healthcare systems. Also, chemotherapy is often used in combination regimens to enhance treatment efficacy. For example, neoadjuvant and adjuvant chemotherapy protocols remain standard-of-care for early-stage breast and colorectal cancers.

Immunotherapy is the rapidly expanding segment within the Europe oncology market, expanding at a CAGR of approximately 12.5% between 2025 and 2033. According to the European Medicines Agency (EMA), over 20 new immunotherapeutic agents received regulatory approval in the EU since 2020, reflecting strong pipeline activity and commercial momentum. A major driver of this growth is the increasing adoption of immune checkpoint inhibitors, which have demonstrated significant survival benefits in melanoma, non-small cell lung cancer (NSCLC), and renal cell carcinoma. The European Journal of Cancer reports that PD-1/PD-L1 inhibitor usage has grown significantly in the past three years, with Germany and France leading in terms of prescription volumes. Furthermore, favorable reimbursement policies and accelerated HTA approvals in several countries have enhanced patient access. The European Observatory on Health Systems and Policies notes that six EU nations have implemented dedicated funding mechanisms to support high-cost immunotherapy treatments.

By Distribution Channel Insights

Hospital pharmacies dominated the distribution channel landscape in the Europe oncology market by commanding 60.1% of the total market share in 2024. This segment's pre-eminence is due to the highly specialized nature of oncology drugs, many of which require administration under medical supervision or intravenous infusion. According to the European Association of Hospital Pharmacists (EAHP), over 75% of oncology treatments in hospitals involve parenteral delivery methods, necessitating dispensing through hospital-based pharmacy units. Moreover, the centralized procurement and distribution model in public healthcare systems across Europe favors hospital pharmacies. In countries such as Germany, France, and Italy, hospital pharmacists play a crucial role in managing high-cost biologics and ensuring compliance with safety regulations. The European Federation of Pharmaceutical Industries and Associations (EFPIA) estimates that a substantial share of novel oncology drugs introduced between 2020 and 2023 were initially distributed exclusively through hospital channels. In addition, the integration of digital health systems in hospitals enhances medication tracking and inventory management. The European Commission’s Digital Economy and Society Index (DESI) indicates that over 60% of European hospitals now use electronic prescribing systems, improving efficiency and reducing dispensing errors.

Retail pharmacies and drug stores are emerging as the swiftly progressing distribution channel in the Europe oncology market, registering a projected CAGR of 7.5% through 2033. This growth trajectory is largely driven by the increasing availability of oral oncology medications, which can be safely dispensed outside hospital settings. Another contributing factor is the shift toward outpatient care models, particularly in countries with decentralized healthcare systems such as the Netherlands and Sweden. The European Observatory on Health Systems and Policies reports that outpatient oncology prescriptions have increased notably over the past five years, with retail pharmacies playing a pivotal role in medication accessibility. In addition, government initiatives aimed at expanding community pharmacy networks are supporting this trend. In the UK, the National Health Service (NHS) has launched pilot programs allowing selected community pharmacies to dispense oral cancer therapies under strict monitoring. As per the Royal Pharmaceutical Society, such initiatives are expected to enhance patient convenience while alleviating pressure on hospital infrastructure, thereby driving sustained growth in this segment.

By Route of Administration Insights

The parenteral administration dominated the route of administration segment in the Europe oncology market by capturing 55.8% of the total market share in 2024. This mode of drug delivery, which includes intravenous, subcutaneous, and intramuscular routes, is essential for administering chemotherapeutic agents, monoclonal antibodies, and immunotherapies that cannot be effectively absorbed through oral ingestion. According to the European Society for Medical Oncology (ESMO), a large share of biologic and targeted therapies currently in clinical use require parenteral administration. Intravenous infusion remains the gold standard for delivering high-dose chemotherapy and immunotherapy regimens, particularly for hematological malignancies and solid tumors such as lung and breast cancer. Moreover, the well-established infrastructure of hospital-based infusion centers supports the continued reliance on parenteral delivery. Additionally, regulatory agencies such as the European Medicines Agency (EMA) continue to approve new injectable formulations, reinforcing the dominance of parenteral administration in the European oncology landscape.

Oral administration is the fastest-growing route of drug delivery in the Europe oncology market, projected to grow at a CAGR of approximately 9.1%. This upward trajectory is primarily driven by the development of small-molecule tyrosine kinase inhibitors (TKIs), hormonal therapies, and oral chemotherapeutics that offer greater patient convenience and reduced need for hospital visits. Notably, therapies targeting chronic myeloid leukemia (imatinib), breast cancer (palbociclib), and lung cancer (osimertinib) have gained widespread adoption due to their oral formulation. Also, healthcare systems are increasingly favoring oral oncology drugs as part of cost-containment strategies. The European Observatory on Health Systems and Policies notes that oral therapies reduce the burden on infusion centers and inpatient facilities, lowering overall healthcare expenditures. As per the European Cancer Patient Coalition (ECPC), patient adherence to treatment regimens also improves with oral therapies, further supporting their adoption across the region.

REGIONAL ANALYSIS

Germany held the top position in the Europe oncology market, accounting for 22.1% of total regional revenue. As one of the continent’s largest economies and a hub for pharmaceutical innovation, Germany benefits from a well-developed healthcare system, high per capita healthcare expenditure, and a strong emphasis on research and development. According to the Robert Koch Institute, Germany records over 500,000 new cancer diagnoses annually, with lung, colorectal, and breast cancers being the most prevalent. This high disease burden fuels the demand for advanced diagnostics and treatment solutions. Moreover, the country’s robust reimbursement framework ensures timely patient access to novel therapies, including immunotherapy and biosimilars. The German Federal Ministry of Health has actively supported oncology innovation through initiatives such as the National Decade Against Cancer, which allocates substantial funding for personalized medicine and early detection technologies. Also, the presence of global pharmaceutical companies like Bayer and Merck KGaA fosters a conducive environment for clinical trials and drug development. These factors collectively reinforce Germany’s leadership in the European oncology landscape.

The United Kingdom captured a notable share of regional revenue. The National Health Service (NHS) plays a central role in shaping oncology care delivery, with a focus on early diagnosis, precision medicine, and equitable access to innovative treatments. According to Cancer Research UK, the country recorded over 360,000 new cancer cases in 2023, with breast, prostate, and lung cancers dominating the incidence statistics. Additionally, the UK’s post-Brexit regulatory reforms have expedited drug approvals, enabling faster patient access to novel oncology therapies. The Medicines and Healthcare Products Regulatory Agency (MHRA) has streamlined pathways for accelerated assessments, encouraging pharmaceutical companies to prioritize UK launches. Furthermore, academic institutions such as the Francis Crick Institute and University College London contribute extensively to oncology research, reinforcing the UK’s competitive standing in the European market.

France is driven by a combination of strong government funding, a mature healthcare system, and a thriving biotech sector. The French National Cancer Institute (INCa) plays a pivotal role in coordinating cancer prevention, treatment, and research efforts across the country. According to Santé Publique France, over 400,000 new cancer cases were diagnosed in 2023, with colorectal, breast, and prostate cancers representing the highest incidence rates. The French healthcare system offers broad reimbursement coverage for oncology treatments, including immunotherapy and targeted therapies, facilitating patient access. Moreover, France has emerged as a leader in digital oncology and AI-driven diagnostics. The Paris Biotech Santé cluster, one of Europe’s largest life sciences hubs, fosters collaboration between academia, startups, and multinational firms.

Italy is seeing a high prevalence and aging demographics and is driven by a rapidly aging population and a high prevalence of cancer-related diseases. Its universal healthcare system ensures broad patient access to oncology treatments; however, regional disparities persist. Despite these gaps, Italy maintains a strong foothold in clinical research and pharmaceutical manufacturing. Companies such as Menarini Group and Angelini Pharma contribute significantly to oncology drug development. Also, the Italian Medicines Agency (AIFA) has implemented flexible pricing and reimbursement models to facilitate patient access to high-cost biologics.

Spain is supported by a well-organized public healthcare system and increasing investment in cancer research. The aging demographic exacerbates the cancer burden, prompting government initiatives aimed at enhancing early diagnosis and treatment access. Additionally, Spain participates in cross-border health technology assessment (HTA) collaborations through the EUnetHTA network, expediting access to innovative therapies.

LEADING PLAYERS IN THE EUROPE ONCOLOGY MARKET

Roche Holding AG

Roche is a dominant force in the European oncology market, known for its extensive portfolio of targeted therapies and diagnostic solutions. The company's oncology division focuses on developing innovative treatments across various cancer types, including breast, lung, and hematological malignancies. Roche has pioneered personalized medicine by integrating diagnostics with therapeutics, enabling tailored treatment approaches based on biomarker testing. Its commitment to research and development has led to breakthrough therapies that have redefined cancer care standards globally. In Europe, Roche collaborates closely with regulatory bodies, healthcare institutions, and patient advocacy groups to enhance treatment accessibility and improve clinical outcomes.

AstraZeneca plc

AstraZeneca plays a pivotal role in shaping the oncology landscape in Europe through its robust pipeline of novel therapies and strategic partnerships. The company has made significant strides in immuno-oncology, particularly with the development of checkpoint inhibitors that have transformed lung and bladder cancer treatment paradigms. AstraZeneca emphasizes early-stage intervention and precision medicine, investing heavily in biomarker research and companion diagnostics. In Europe, the company works alongside national health systems to streamline drug approvals and expand patient access. Its long-term vision includes leveraging digital health technologies to optimize treatment monitoring and improve therapeutic efficacy across diverse cancer indications.

Merck KGaA (EMD Serono in North America)

Merck KGaA is a key player in the European oncology sector, with a strong focus on innovation in oncology therapeutics and diagnostics. The company contributes significantly to advancements in targeted therapies and immunotherapies, particularly in areas such as melanoma and ovarian cancer. Merck KGaA actively engages in collaborative research initiatives with academic institutions and biotech firms across Europe, fostering an ecosystem of innovation. It also invests in patient support programs and digital health platforms to enhance treatment adherence and outcome tracking. By aligning with evolving regulatory frameworks, Merck strengthens its position in the region while advancing the global standard of cancer care.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS IN THE EUROPE ONCOLOGY MARKET

One of the primary strategies employed by leading players in the Europe oncology market is expanding their biosimilar and generic oncology portfolios. As healthcare systems seek cost-effective treatment alternatives, pharmaceutical companies are prioritizing the development and commercialization of biosimilars to maintain competitiveness while addressing affordability concerns. This approach allows them to offer high-quality therapies at reduced costs without compromising efficacy.

Another major strategy involves forging strategic collaborations and licensing agreements with biotechnology firms and academic research institutions. These partnerships enable pharmaceutical giants to gain early access to innovative drug candidates, accelerate clinical trials, and enhance their R&D pipelines. By leveraging external expertise and cutting-edge technologies, companies can bring differentiated therapies to market more efficiently.

Lastly, investing in digital health integration and real-world evidence generation has become crucial for maintaining a competitive edge. Companies are incorporating AI-driven diagnostics, remote monitoring tools, and data analytics into clinical workflows to support personalized treatment decisions and demonstrate therapeutic value to payers and regulators across Europe.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe Oncology market include F. Hoffmann-La Roche Ltd, Novartis AG, Bristol-Myers Squibb, Pfizer Inc., Johnson & Johnson, AstraZeneca, Merck & Co., Amgen Inc., Eli Lilly and Company, Sanofi.

The competition in the European oncology market is characterized by a dynamic mix of multinational pharmaceutical companies, emerging biotech firms, and publicly funded research institutions striving to advance cancer care. Established players dominate due to their extensive resources, mature product portfolios, and well-established distribution networks across the region. However, smaller biotech companies are increasingly influencing the market by introducing novel therapies and forming strategic alliances with larger entities. The rapid pace of innovation in immunotherapy, targeted therapy, and precision medicine has intensified rivalry, with companies continuously seeking differentiation through clinical superiority and improved patient outcomes. Regulatory complexity and reimbursement constraints further shape competitive behavior, prompting manufacturers to adopt localized strategies that align with national healthcare policies. Additionally, the growing emphasis on biosimilars and cost-effective treatment options has led to pricing pressures, compelling companies to balance profitability with accessibility. Digital transformation is also playing a critical role, with competitors investing in AI-driven diagnostics, telemedicine platforms, and patient-centric services to enhance engagement and treatment adherence. Overall, the market remains highly fragmented yet highly innovative, driven by both scientific advancements and evolving healthcare demands.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, Roche announced a new partnership with a leading European genomics institute to integrate next-generation sequencing into routine clinical practice for oncology patients. This initiative aimed to support personalized treatment strategies by expanding biomarker testing capabilities across multiple countries.

- In May 2024, AstraZeneca launched a regional hub in Sweden focused on accelerating oncology drug development through collaboration with local universities and biotech startups, reinforcing its commitment to innovation in the Nordic oncology landscape.

- In September 2024, Merck KGaA expanded its manufacturing facility in Germany to increase production capacity for oncology biologics, ensuring a stable supply chain for key therapies used in treating advanced cancers across Europe.

- In November 2024, Novartis entered into a cross-border agreement with several European health technology assessment bodies to expedite market access for newly approved oncology drugs, reducing time-to-market and improving patient availability.

- In January 2025, Bristol-Myers Squibb initiated a pan-European digital health program designed to monitor patient responses to immunotherapy treatments in real time, enhancing treatment personalization and supporting value-based reimbursement models.

MARKET SEGMENTATION

This research report on the Europe Oncology Market has been segmented and sub-segmented based on cancer type, drug class type, distribution channel, route of administration, and region.

By Cancer Type

- Breast Cancer

- Skin Cancer

By Drug Class Type

- Chemotherapy

- Immunotherapy (Biologic Therapy)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies/Drug Stores

By Route of Administration

- Parenteral

- Oral

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the oncology market in Europe?

Key drivers include rising cancer incidence, advancements in targeted therapies and immunotherapy, supportive government initiatives, and increasing healthcare spending.

2. Which types of cancer are most prevalent in Europe?

The most common types include breast cancer, lung cancer, prostate cancer, colorectal cancer, and skin cancer.

3. Who are the major players in the Europe Oncology Market?

Key players include F. Hoffmann-La Roche Ltd, Novartis AG, Bristol-Myers Squibb, Pfizer Inc., Johnson & Johnson, AstraZeneca, Merck & Co., Amgen Inc., Eli Lilly and Company, and Sanofi.

4. How is technology influencing the oncology market in Europe?

Technologies such as AI-based diagnostics, molecular profiling, and next-generation sequencing are enhancing cancer detection and treatment accuracy.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com