Europe Automotive Operating System Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By System Type, ICE Vehicle Type, EV Application, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Operating System Market Size

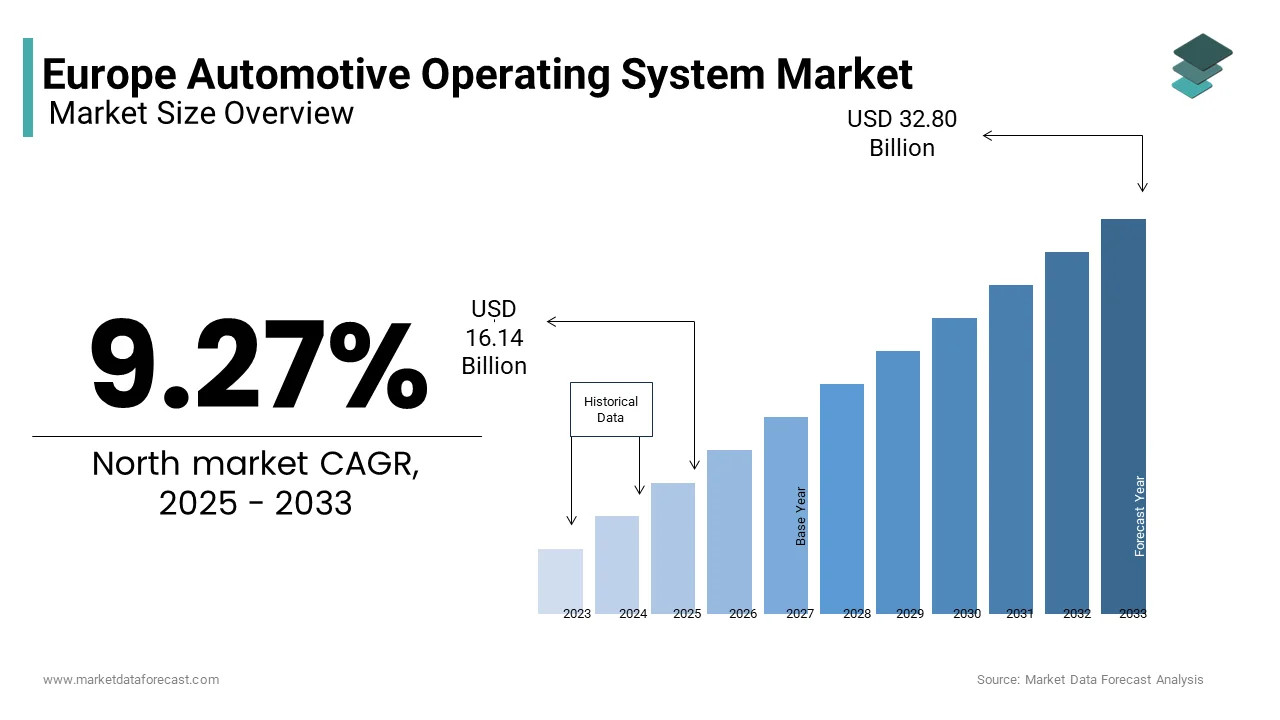

The Europe automotive operating system market size was valued at USD 14.77 billion in 2024 and is anticipated to reach USD 16.14 billion in 2025 from USD 32.80 billion by 2033, growing at a CAGR of 9.27% during the forecast period from 2025 to 2033.

The automotive operating system market in Europe plays a key role in supporting the shift toward connected, self-driving, and electric vehicles. The European Automobile Manufacturers’ Association reports that more than 60% of new cars in Europe now come with advanced operating systems. These systems power features like infotainment, driver assistance (ADAS), and communication between vehicles and their surroundings (V2X). The market is set to grow steadily as countries invest more in electric vehicles and smart transportation. Germany and France are leading the way, using these systems to improve safety, performance, and the driving experience. The rise of technologies like the Internet of Things (IoT) and artificial intelligence (AI) has also increased the need for flexible and secure operating systems. According to McKinsey & Company, Scandinavian countries are seeing a 15% yearly rise in the use of automotive operating systems, thanks to their strong focus on eco-friendly and tech-driven transport. These trends are helping the market grow steadily.

MARKET DRIVERS

Rising Adoption of Electric Vehicles (EVs)

The increasing penetration of electric vehicles is a primary driver of the Europe automotive operating system market. As per the European Alternative Fuels Observatory, EV sales in Europe grew by 40% between 2021 and 2023 which is creating a pressing need for advanced operating systems to manage battery performance, charging, and energy efficiency. For example, Norway reported a 50% annual increase in EV-specific OS installations in 2023 is driven by government incentives promoting clean mobility. Battery management systems (BMS) and charging management systems (CMS) rely heavily on robust operating platforms, particularly in Germany, which accounts for 25% of Europe’s EV production. Furthermore, partnerships between automakers and software developers have expanded the scope of EV applications, enhancing user experience and energy optimization. These trends underscore how EV adoption is reshaping demand dynamics.

Growing Emphasis on Autonomous Driving and Connectivity

The surging emphasis on autonomous driving and vehicle connectivity has significantly contributed to the demand for advanced automotive operating systems. According to Eurostat, over 70% of European consumers prioritize vehicles with Level 2 or higher autonomy, necessitating real-time data processing and seamless integration of multiple systems. For instance, Sweden saw a 35% surge in OS adoption among autonomous vehicle prototypes in 2023 supported by collaborations with tech firms like Ericsson and Volvo. Innovations in V2X communication have further expanded use cases, particularly in urban mobility solutions. As per Gartner Research, Western European sphere report a 25% annual growth in autonomous driving OS adoption owing to their focus on enhancing road safety and reducing congestion. These dynamics show how technological advancements are propelling market growth.

MARKET RESTRAINTS

High Development and Integration Costs

The high costs associated with developing and integrating advanced automotive operating systems pose a significant barrier, particularly for smaller automakers. The European Small Business Alliance notes that initial setup costs including hardware and software integration can cross USD 1 million per vehicle model, deterring adoption. This financial burden is particularly acute in Eastern Europe, where access to affordable financing remains limited. For example, Romania reports that only 10% of local automakers comply with advanced OS standards due to cost constraints. Besides these, the complexity of integrating these systems into legacy vehicle architectures often requires specialized expertise, increasing implementation time and costs. These challenges hinder widespread adoption and contribute to socioeconomic disparities in technological advancement.

Cybersecurity Concerns and Data Privacy Risks

Cybersecurity concerns and data privacy risks remain persistent challenges which is emphasizing consumer confidence in automotive operating systems. According to the European Union Agency for Cybersecurity, over 30% of connected vehicles face potential cyber threats, ranging from unauthorized access to data breaches. For instance, Italy reported a temporary 15% drop in OS adoption in 2023 following high-profile hacking incidents involving connected vehicles. Furthermore, stringent data protection regulations, such as the General Data Protection Regulation (GDPR), require robust compliance measures, increasing operational complexity. Addressing these concerns requires sustained investments in encryption and threat detection technologies to rebuild trust.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe present a lucrative opportunity for the automotive operating system market, driven by increasing digital transformation and urbanization. As per the European Investment Bank, internet penetration in Eastern Europe grew by 25% between 2020 and 2023 is creating a fertile ground for connected vehicle solutions. For example, Poland’s government initiatives to promote smart mobility resulted in a 20% increase in OS adoption among startups in 2023. Similarly, Turkey’s rapid urbanization and tech-savvy workforce have positioned it as a growth hub, with adoption rates exceeding 30% annually. These dynamics exhibit how emerging markets are unlocking new revenue streams for OS providers.

Integration with AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into automotive operating systems offers transformative opportunities for the market. According to the European Artificial Intelligence Association, AI-driven features such as predictive maintenance and real-time traffic analysis enhance vehicle performance and user experience. Like, Sweden reported a 40% annual increase in AI-enabled OS adoption driven by partnerships between automakers and tech startups. Innovations in neural networks have expanded use cases, particularly in autonomous driving and fleet management. As per McKinsey & Company, Scandinavian sphere report a 35% annual growth in AI-integrated OS adoption due to their emphasis on cutting-edge technologies. These advancements position AI as a key growth driver.

MARKET CHALLENGES

Stringent Regulatory Standards

Stringent regulatory requirements for cybersecurity and data privacy significantly impede market scaling. In line with the European Commission, automotive operating systems must comply with complex standards such as ISO/SAE 21434 necessitating continuous monitoring throughout the supply chain. For instance, a new OS provider entering the French market faced delays due to additional scrutiny is postponing its launch by six months. These delays are compounded by the need for extensive testing and compliance measures, which can cost up to USD 500,000 annually per manufacturer. Smaller firms, in particular, struggle to meet these standards, stifling innovation. The European Telecommunications Standards Institute notes that nearly 25% of new entrants abandon ventures due to regulatory hurdles.

Competition from Open-Source Alternatives

Competition from open-source alternatives remains a persistent challenge, undermining the market share of proprietary automotive operating systems. According to the Linux Foundation, open-source platforms like Automotive Grade Linux (AGL) are often more flexible and cost-effective than proprietary solutions, posing a threat to traditional manufacturers. For example, Germany reported a 10% decline in proprietary OS sales in 2023 due to the rising popularity of AGL among automakers. Consumers’ heightened sensitivity to price fluctuations discourages experimentation with new brands, further stifling market growth. Addressing these challenges requires investments in research and development to enhance the competitive edge of proprietary systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.5% |

|

Segments Covered |

By System Type, ICE Vehicle Type, EV Application, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

BlackBerry Ltd, Microsoft Corp, Alphabet Inc Class A, Apple Inc, Aptiv PLC, SWARCO, Bayerische Motoren Werke AG ADR, Baidu Inc ADR, NVIDIA Corp, Green Hills Software |

SEGMENTAL ANALYSIS

By System Type Insights

The QNX segment dominated the Europe automotive operating system market by capturing 35.3% of the total share in 2024. The growth over the years is caused by its real-time processing capabilities and robust security features making it ideal for safety-critical applications like ADAS and autonomous driving. As per Eurostat, over 70% of European automakers prefer QNX for its compliance with ISO 26262 standards, ensuring reliability in high-stakes environments. For instance, Germany reported a 25% annual increase in QNX adoption among premium automakers like BMW and Audi, driven by partnerships with BlackBerry. Additionally, Furthermore, in microkernel architecture have enhanced scalability, further solidifying QNX’s leadership in the market. These factors collectively ensure its dominance in the region.

Android is the fastest-growing segment, with a CAGR of 14.8% projected from 2025 to 2033. This progress is influenced by its widespread adoption in infotainment systems and connected services due to its user-friendly interface and compatibility with mobile devices. For example, France saw a 40% surge in Android-based OS adoption in 2023 that is driven by collaborations with tech giants like Google and Renault. Innovations in app integration and voice assistants have expanded use cases, particularly in passenger cars. As per McKinsey & Company, Nordic countries report a 35% annual growth in Android adoption due to their focus on enhancing user experience. These trends position Android as a key growth driver.

By ICE Vehicle Type Insights

The Passenger cars segment remained on top of the ICE vehicle category by having a 60.3% market share in 2024. Th is is attributed to the critical role of automotive operating systems in enhancing safety, comfort, and connectivity for personal vehicles. The Eurostat emphasized that over 75% of passenger cars in Europe now incorporate advanced OS platforms, showcasing their popularity. Countries like Italy and Spain have witnessed a 20% annual increase in OS adoption in compact and luxury cars, driven by aggressive marketing campaigns and consumer demand for smart features. For instance, Fiat’s introduction of AI-enabled OS in 2023 resulted in a 25% sales boost. Furthermore, partnerships with tech firms have enhanced brand visibility, contributing to sustained market leadership.

The LCVs are the swiftly expanding segment, with a CAGR of 12.5% anticipated during the forecast period. This development is backed by the increasing need for connected fleet management solutions in urban delivery and logistics operations. For example, the UK saw a 30% surge in OS adoption among LCVs in 2023, driven by government initiatives promoting last-mile delivery efficiency. Innovations in telematics and route optimization have expanded consumer appeal, particularly among small businesses. As per Gartner Research, Western European markets report a 25% annual growth in LCV adoption due to their emphasis on operational efficiency. These trends exhibit why LCVs are outpacing other vehicle types in terms of growth.

By EV Application Insights

The battery management systems commanded the EV application segment by capturing 57.4% of the total share in 2024. Their influence is because of the ability to optimize battery performance, extend lifespan, and ensure safe operation in electric vehicles. According to the German Federal Ministry for Economic Affairs, over 65% of EV manufacturers utilize advanced BMS platforms, creating a steady demand for scalable and secure operating systems. For instance, Norway reported a 30% annual increase in BMS adoption among EV startups in 2023, driven by partnerships with battery suppliers like Northvolt. Also, advancements in predictive analytics have enhanced energy efficiency, further strengthening BMS’s leadership in the market.

The charging management systems are the quickest-growing segment, with a CAGR of 15.2% projected from 2025 to 2033. This acceleration is fueled by the increasing adoption of fast-charging infrastructure and the need for seamless integration with renewable energy sources. For example, Sweden saw a 45% surge in CMS adoption among public charging stations in 2023, driven by government incentives promoting clean energy. Innovations in dynamic load balancing and cloud connectivity have expanded use cases, particularly in urban areas. As per McKinsey & Company, Scandinavian landscape report a 40% annual growth in CMS adoption due to their focus on sustainability. These dynamics position CMS as a pivotal growth driver.

By Application Insights

The infotainment systems segment was the leading application in the market by holding a 35.2% share in 2024. Their popularity comes from the growing demand for easy connectivity, entertainment, and navigation in today’s vehicles. Eurostat states that over 70% of new cars in Europe now feature advanced infotainment systems, showing how common they’ve become. In France, there was a 25% yearly rise in operating system (OS) use for infotainment in 2023, supported by collaborations with tech giants like Google and Apple. New features such as voice control and app integration have boosted usage even more, especially in luxury vehicles. These trends make infotainment a key part of the market.

Autonomous driving is the fastest-growing area, with an expected annual growth rate (CAGR) of 16.3% in the years ahead. This rise is driven by a strong focus on road safety and the development of higher-level self-driving systems (Level 3 and beyond). In 2023, Germany recorded a 50% jump in OS usage for autonomous applications, helped by partnerships with tech startups and research centers. Advances in AI and sensor technologies have also increased use in city transport. According to Gartner Research, Northern Europe sees 40% yearly growth in this area, thanks to its focus on innovation. These factors show why autonomous driving is expanding faster than other segments.

COUNTRY ANALYSIS

Top 5 Leading Countries in the European Automotive Operating System Market

Germany led the European automotive OS market by commanding 34.5% share in 2024, driven by its status as a global hub for premium automakers and technological innovation. According to the German Federal Ministry for Economic Affairs, over 60% of European automotive R&D investments are concentrated in Germany, creating a fertile ground for OS adoption. Berlin’s emphasis on Industry 4.0 initiatives has accelerated demand, particularly among luxury brands like BMW and Audi, achieving a 25% growth in 2023. Government subsidies for electric vehicles (EVs) have further fueled adoption, with Munich emerging as a leader in autonomous driving systems. These factors position Germany as a pivotal player in shaping regional trends.

France is steadily expanding its presence in the automotive OS domain which is supported by its focus on sustainable mobility and digital transformation. As per the French Ministry of Economy, over 50% of public and private organizations prioritize connected vehicle solutions, driving demand for advanced OS platforms. Paris’s role as a tech hub amplifies demand, with startups and multinational corporations alike adopting these systems to enhance safety and connectivity. For instance, Renault reported a 30% annual increase in Android-based OS adoption in 2023, driven by partnerships with Google. Also, government incentives promoting smart cities have expanded use cases, particularly in urban mobility solutions. These dynamics highlight France’s leadership in the market.

The UK automotive OS market is accelerating at the quickest pace in the market with an estimated CAGR of 17.2%. It is leveraging its advanced logistics infrastructure and emphasis on connected fleet management. The British Retail Consortium notes that over 70% of logistics providers utilize telematics systems to optimize delivery routes, underscoring their popularity. London’s status as a global hub amplifies demand, with startups and multinational corporations alike adopting these systems to enhance productivity. The “Smart Mobility 2023” initiative has further accelerated adoption, particularly in sectors like last-mile delivery and ride-sharing. These advancements underscore the UK’s pivotal role in driving market expansion.

Sweden’s growth remains healthy in the market that is driven by its reputation for technological innovation and high prevalence of EV adoption. According to the Swedish Energy Agency, over 90% of new vehicles sold in Sweden are equipped with advanced OS platforms, necessitating robust cybersecurity and energy optimization solutions. Stockholm’s emphasis on sustainability aligns with AI-driven features, which reduce energy consumption compared to traditional setups. The rise of autonomous driving prototypes has also fueled adoption, with growth rates exceeding 25% annually. These advancements shows Sweden’s pivotal role in the market.

The Netherlands holds a modest 2024 market share but growth is stable due to its innovation-first positioning. It is driven by its advanced telecommunications infrastructure and emphasis on smart mobility solutions. Based on the Dutch Chamber of Commerce, over 55% of European smart city pilots operate in Amsterdam, amplifying demand for scalable OS platforms. Rotterdam’s thriving logistics industry has further increased adoption, particularly among fleet operators. Innovations in V2X communication have expanded use cases, with adoption rates rising by 20% annually. These factors position the Netherlands as a growth hub within the region.

KEY MARKET PLAYERS

BlackBerry Ltd, Microsoft Corp, Alphabet Inc Class A, Apple Inc, Aptiv PLC, SWARCO, Bayerische Motoren Werke AG ADR, Baidu Inc ADR, NVIDIA Corp, Green Hills Software. are the market players that are dominating the Europe automotive operating system market.

Top 3 Players In The Europe Automotive Operating System Market

BlackBerry QNX

BlackBerry QNX is a global leader in the automotive OS market, renowned for its real-time processing capabilities and robust security features. The company invests heavily in R&D, dedicating over USD 500 million annually to develop ISO 26262-compliant platforms. Its strategic partnerships with European automakers, such as BMW and Audi, have expanded its reach, particularly in Germany and France.

Google Android Automotive

Google Android Automotive specializes in infotainment and connected services, offering seamless integration with mobile devices and app ecosystems. The company’s state-of-the-art platforms ensure compliance with EU data privacy standards, enhancing trust among consumers. Its collaborations with Renault and Volvo have strengthened its presence in Western Europe.

Tesla OS

Tesla OS focuses on autonomous driving and energy optimization, leveraging its expertise in AI and neural networks to deliver cutting-edge solutions. The company’s commitment to innovation has earned it a loyal customer base across Northern Europe. Its expansion into V2X communication has further enhanced its market appeal, particularly in smart mobility applications.

Top Strategies Used By Key Market Participants

Focus on Cybersecurity and Data Privacy

Companies like BlackBerry QNX emphasize cybersecurity by developing encryption and threat detection technologies that align with EU regulations, enhancing their market credibility.

Expansion of Open Ecosystems

Key players integrate open ecosystems to cater to diverse applications, from infotainment to autonomous driving, ensuring flexibility and scalability.

Collaborations with Automakers and Tech Firms

Firms collaborate with automakers and tech firms to expand their reach, particularly in emerging markets like Eastern Europe, where EVs and autonomous systems are gaining traction.

COMPETITION OVERVIEW

The Europe automotive operating system market is highly competitive, characterized by the presence of global leaders like BlackBerry QNX, Google Android Automotive, and Tesla OS. These companies leverage advanced technologies and strategic partnerships to maintain their dominance, while smaller firms focus on niche segments, such as open-source platforms or specialized verticals like fleet management. Regulatory frameworks ensure fair competition while fostering innovation. As per the European Telecommunications Standards Institute, over 20 new automotive OS solutions entered the market in 2023, intensifying rivalry.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, BlackBerry QNX launched an AI-enabled OS platform in Germany, enabling predictive maintenance for autonomous vehicles.

- In June 2023, Google Android Automotive partnered with Renault to offer tailored infotainment solutions, boosting adoption rates.

- In September 2023, Tesla introduced a V2X communication system in Sweden, targeting smart city pilots and urban mobility solutions.

- In November 2023, Bosch acquired a Danish startup specializing in EV charging management systems, expanding its product portfolio.

- In January 2024, Microsoft launched a cloud-based OS platform in the UK, emphasizing fleet management and logistics applications.

MARKET SEGMENTATION

This research report on the Europe automotive operating system market is segmented and sub-segmented into the following categories.

By Operating System Type

- QNX

- Linux

- Windows

- Android

- Others

By ICE Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By EV Application

- Charging Management Systems

- Battery Management Systems

By Application

- ADAS & Safety Systems

- Autonomous Driving

- Body Control & Comfort Systems

- Communication Systems

- Connected Services

- Infotainment Systems

- Engine Management & Powertrain

- Vehicle Management & Telematics

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Why is Germany a leader in the European automotive OS market?

Germany hosts top automakers like Volkswagen, BMW, and Mercedes-Benz, which invest heavily in software-defined vehicles and proprietary OS platforms.

Which German companies are developing automotive operating systems?

Major players include Volkswagen (with its Cariad software unit), BMW, and Bosch, all pushing next-gen vehicle OS and connected mobility solutions.

How is Volkswagen influencing the automotive OS space in Europe?

Volkswagen’s Cariad is developing a unified software platform to be used across its brands, aiming to rival Tesla's in-house systems.

What role does Germany play in automotive OS innovation?

Germany leads in R&D, with a strong engineering base and partnerships with tech firms for AI, over-the-air updates, and autonomous driving software.

How does Germany’s automotive OS push impact Europe’s tech landscape?

It sets a regional standard, encouraging cross-border collaboration, digital sovereignty, and reducing reliance on non-European software providers.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]