Europe outboard Engines Market Size, Share, Trends & Growth Forecast Report - Segmented By Type, System Type, Provider Type, End-User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe outboard Engines Market Size

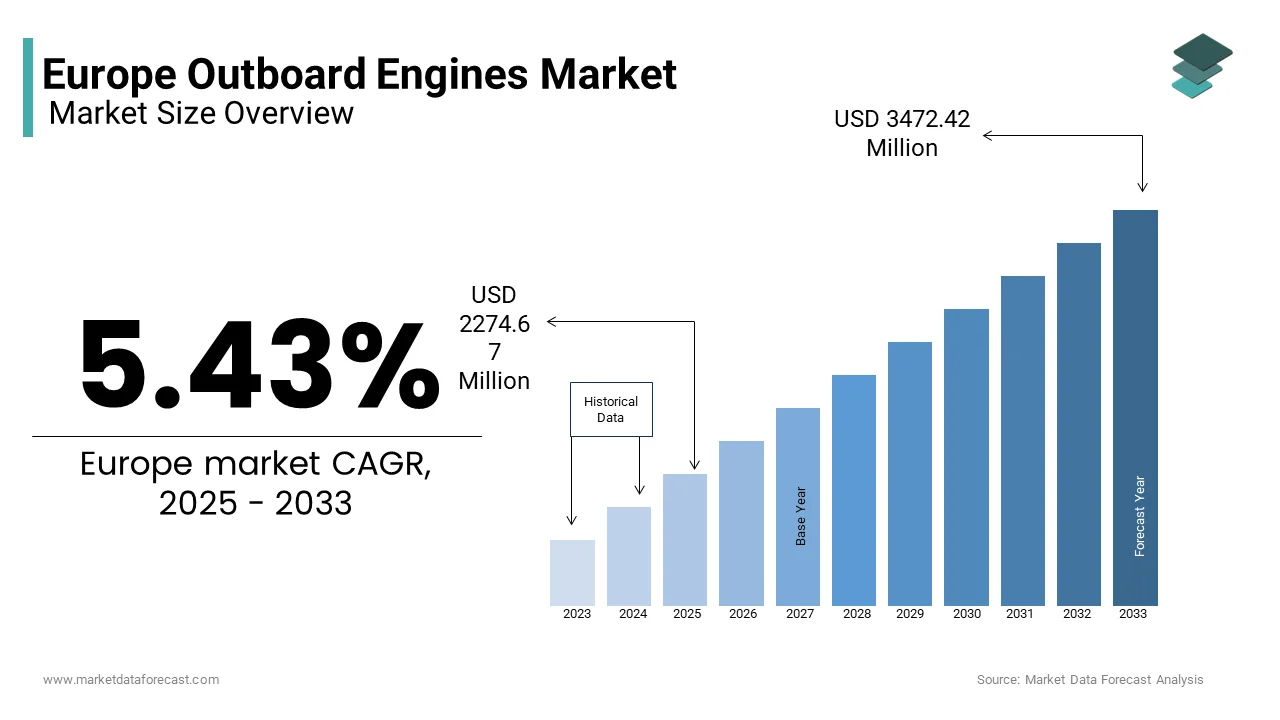

The Europe outboard engines market size was valued at USD 2157.52 million in 2024 and is anticipated to reach at USD 2274.67 million in 2025 from USD 3472.42 million by 2033, growing at a CAGR of 5.43% during the forecast period from 2025 to 2033.

The outboard engines are self-contained units mounted on the transom of boats, providing both propulsion and steering capabilities. These engines are favored for their portability, ease of maintenance, and versatility across various vessel sizes. As of 2023, the European market has demonstrated steady growth driven by increasing consumer interest in leisure activities such as yachting, fishing, and coastal tourism.

Environmental concerns have also shaped this market, with stringent emissions regulations introduced by the European Union pushing manufacturers to innovate in fuel efficiency and alternative energy solutions. According to a report by Marine Industry News, electric and hybrid outboard engines are gaining traction by accounting for nearly 10% of new unit sales in 2023. Furthermore, key countries like Germany, France, Italy, and Scandinavia dominate demand due to their extensive coastlines and inland waterways. Despite global supply chain disruptions affecting production timelines, the market remains resilient, supported by robust aftermarket services and replacement cycles.

Market Drivers

Stringent Environmental Regulations and the Shift Toward Sustainable Propulsion Systems

The increasing focus on sustainability with stringent environmental regulations and growing consumer awareness are primary driving factors for the Europe outboard engines market to grow. According to the European Maritime Safety Agency, maritime activities contribute nearly 15% of the EU's total transportation-related emissions by prompting stricter emission standards under the Recreational Craft Directive. According to the European Environment Agency, over 30% of new outboard engine sales in Europe are now compliant with Tier III emission norms, reflecting a shift toward cleaner technologies. Governments across Europe have introduced subsidies for electric and hybrid marine engines, further accelerating adoption. For instance, Norway’s Zero Emission Vessels initiative offers tax exemptions for eco-friendly boats by boosting sales by 20% in 2022. This regulatory push, combined with consumer preference for sustainable options, has positioned energy-efficient outboard engines as a key growth area in the region.

Expansion of Coastal Tourism and Recreational Water Activities

The expansion of coastal tourism and recreational water activities, which significantly boosts demand for small and medium-sized boats equipped with outboard engines is another factor that is bolstering the growth rate of the Europe outboard engines market. According to the European Commission, coastal and maritime tourism generates €60 billion annually by accounting for over 40% of Europe’s total tourism revenue. Countries like France, Italy, and Croatia have seen a 12% annual increase in boat rentals and water sports participation, according to Eurostat. According to the United Nations World Tourism Organization, post-pandemic recovery has led to a 25% rise in domestic nautical tourism in 2023. This surge in recreational boating directly fuels demand for durable, high-performance outboard engines. Manufacturers are capitalizing on this trend by offering innovative and reliable engine solutions tailored to diverse consumer needs.

Supply Chain Disruptions and Rising Raw Material Costs

A significant restraint affecting the European outboard engines market is the ongoing challenge of supply chain disruptions and escalating raw material costs. According to the European Commission’s Directorate-General for Industry, the marine industry has faced a 20% increase in production delays due to shortages of critical components like semiconductors and aluminum, which are essential for engine manufacturing. As per the International Monetary Fund, global raw material prices surged by 30% in 2022 with growing geopolitical tensions and inflationary pressures. These factors have led to a 15% rise in production costs for outboard engines, as per Eurostat. Manufacturers are grappling with reduced profit margins and increased pricing for end consumers, which could dampen demand. The inability to secure timely deliveries of parts further exacerbates production bottlenecks, hindering market growth and innovation in the sector.

Stringent Environmental Compliance Costs and Technological Transition Challenges

The high cost associated with meeting stringent environmental regulations and transitioning to advanced technologies is hampering the growth rate of the Europe outboard engines market. According to the European Environment Agency, compliance with the Recreational Craft Directive and other emissions standards requires significant investment in research and development with estimation of €500 million annually for the marine industry. Small and medium-sized enterprises (SMEs), which dominate the European outboard engine market, face challenges in adopting expensive electric or hybrid propulsion systems. According to the European Investment Bank, only 30% of SMEs in the marine sector have successfully transitioned to low-emission technologies due to financial constraints. According to the United Nations Industrial Development Organization, the lack of standardized infrastructure for alternative fuels, such as hydrogen or biofuel is limiting the scalability of these solutions. These barriers slow down technological adoption and restrict market expansion.

Growing Demand for Electric and Hybrid Outboard Engines

The increasing demand for electric and hybrid propulsion systems followed by environmental policies and consumer preferences is substantially to set huge opportunities for the Europe outboard engines market to grow. According to the European Environment Agency, the marine industry is projected to achieve a 25% reduction in carbon emissions by 2030 through the adoption of alternative technologies. According to Eurostat, sales of electric outboard engines grew by 18% in 2022, with Scandinavia leading the charge due to its strong focus on sustainability. Government incentives, such as Germany’s National Hydrogen Strategy, which allocates €9 billion for green technologies, further bolster this trend. Also, the European Investment Bank studies have shown that investments in sustainable marine technologies reached €2 billion in 2022 that created a fertile ground for innovation. Manufacturers capitalizing on this shift can tap into a rapidly expanding niche market while aligning with EU climate goals.

Expansion of Shared Ownership Models and Boating Accessibility

The rise of shared ownership models and increased accessibility to boating, which broadens the customer base for outboard engines is additionally to fuel the growth rate of the Europe outboard engines market. According to the European Boating Industry, shared ownership platforms have grown by 35% since 2020 by making recreational boating more affordable and appealing to younger demographics. A report by Eurostat indicates that over 2 million Europeans participated in shared boating activities in 2022 by reflecting a 12% annual increase. This trend is particularly prominent in urban areas with access to inland waterways, such as Amsterdam and Paris. According to the United Nations World Tourism Organization, nautical tourism initiatives, like Italy’s Blue Flag beaches program, have attracted 20% more first-time boaters in 2023. Manufacturers can target a growing segment of casual users seeking reliable, cost-effective outboard engines for shared vessels.

High Initial Costs of Advanced Technologies and Limited Consumer Adoption

A significant challenge for the European outboard engines market is the high initial cost of advanced technologies, which limits widespread consumer adoption. According to the European Investment Bank, the transition to electric and hybrid outboard engines requires an upfront investment 40% higher than traditional combustion engines, deterring price-sensitive buyers. According to Eurostat, only 8% of recreational boaters in Europe have upgraded to eco-friendly engines due to affordability concerns. As per the International Council on Clean Transportation, the lack of charging infrastructure for electric engines in coastal regions further hinders adoption, with less than 20% of marinas equipped with charging stations as of 2023. These financial and infrastructural barriers create a slow uptake of innovative solutions, particularly among small-scale boat owners, constraining market growth despite regulatory incentives.

Fluctuating Demand Due to Economic Uncertainty and Inflationary Pressures

The fluctuating demand caused by economic uncertainty and inflationary pressures across Europe is solely to decline the growth rate of the market in the coming years. According to a report by European Central Bank, inflation rates reached 8.5% in 2022 that significantly to impact discretionary spending on luxury items like recreational boats and their engines. A study by the European Commission’s Joint Research Centre shown that consumer spending on marine leisure activities declined by 12% during periods of economic instability. Furthermore, the United Nations Economic Commission for Europe warns that rising interest rates have made boat financing more expensive by reducing new purchases by 15% in 2023. This economic volatility creates unpredictability for manufacturers and suppliers, who must navigate reduced consumer confidence and shifting priorities is ultimately affecting long-term investments and market stability.

SEGMENTAL ANALYSIS

By Type

The Outboard Electric Propulsion Motor segment dominated the European market with 65.1% of share in 2024. Its versatility for primary propulsion in recreational and small commercial boats is levelling up the growth rate of the European outboard engines market. As per Eurostat, over 70% of new electric outboard engine sales are propulsion motors with EU emissions regulations and subsidies like Germany’s €500 million green boating fund. This segment's importance lies in its alignment with sustainability goals by reducing carbon emissions by 40% compared to traditional engines.

The Outboard Electric Trolling Motor segment is estimated to experience a fastest CAGR of 12.1% during the forecast period. Its rapid growth is fueled by demand from anglers and inland water enthusiasts in France and Germany, where sales rose by 25% in 2022. The United Nations Industrial Development Organization attributes this to advancements in lithium-ion batteries with improved efficiency by 30%. Enhancing user experience with quiet, precise control by making it indispensable for eco-friendly fishing and leisure activities is attributed in leveraging the growth of the market.

By Application

The Civil Entertainment segment led the European outboard engines market by occupying 41.2% share in 2024 owing to the rising popularity of recreational boating, with over 7 million registered boats in Europe, as reported by Eurostat. The segment benefits from increased coastal tourism, which contributes €40 billion annually to the economy. Post-pandemic trends show a 15% rise in leisure boating activities in France and Italy. Its importance lies in driving innovation, such as quieter and eco-friendly engines, while supporting local economies through tourism.

The Municipal segment is anticipated to witness a CAGR of 9.5% from 2025 to 2033. The growth is driven by municipalities adopting electric outboard engines for waterway maintenance and environmental monitoring with a 25% increase in fleet upgrades in 2022. According to the United Nations Economic Commission for Europe, smart city initiatives and sustainability goals are propelling this trend. The municipalities prioritize low-emission engines by reducing carbon footprints by 30%. This segment's importance lies in enhancing public services like flood control and rescue operations while promoting eco-friendly urban water management by making it a critical area for future investment.

COUNTRY ANALYSIS

Germany

Germany tops the European outboard engines market by capturing 25.1% of share in 2024 due to its extensive inland waterways, which span over 7,500 kilometers by making it a hub for recreational boating and fishing activities. According to the German Federal Ministry for Economic Affairs, domestic tourism, including nautical leisure, grew by 18% in 2022 with growing demand for eco-friendly outboard engines. Additionally, government incentives like subsidies for electric propulsion systems have accelerated adoption, with Eurostat reporting a 30% increase in sales of low-emission engines. Germany's robust manufacturing base and focus on innovation further solidify its position by making it a key driver of market growth.

France

France is predicted to register a lucrative CAGR of 6.8% during the forecast period with its vast coastline and popularity as a global tourist destination by attracting over 10 million nautical tourists annually, as per United Nations World Tourism Organization. The French government’s Blue Economy initiative promotes sustainable marine technologies by boosting sales of hybrid and electric engines by 25% in 2022. France’s strong boating culture, with over 1.5 million registered vessels, drives consistent demand. Moreover, investments in marina infrastructure is posing huge opportunities to enhance accessibility that accelerates France’s role as a pivotal market for outboard engine manufacturers.

Italy

Italy is more likely to have prominent growth rate in the next coming years driven by its Mediterranean coastline and thriving yacht manufacturing industry. The country’s emphasis on luxury boating and water sports fuels demand for high-performance outboard engines. Additionally, initiatives like the National Recovery and Resilience Plan allocate €2 billion to green marine technologies by encouraging the adoption of electric engines. Italy’s strategic location also makes it a gateway for exports to neighboring regions by amplifying its market influence. These factors, combined with a rich maritime heritage to ensure Italy remains a dominant force in the European outboard engines market.

KEY MARKET PLAYERS

SECO GmbH, Yamaha Motor Co., Ltd., Suzuki Motor Corporation, Torqeedo GmbH, Honda Motor Co., Ltd., DEUTZ AG, E.P. Barrus Ltd., Marine Tech, Vector Outboards, and Selva S.p.A. These are the market players that are dominating the Europe outboard engines market.

MARKET SEGMENTATION

This research report on the Europe outboard Engines Market is segmented and sub-segmented into the following categories.

By Type

- Outboard Electric Propulsion Motor

- Outboard Electric Trolling Motor

By Application

- Civil Entertainment

- Municipal

- Commercial

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe outboard engines market?

The current market size of the Europe outboard engines market was valued at USD 2274.67 Mn by 2033.

How big was the Europe outboard engines market?

The Europe outboard engines market size was valued at USD 2157.52 million in 2024 and is anticipated to reach at USD 2274.67 million in 2025 from USD 3472.42 million by 2033, growing at a CAGR of 5.43% during the forecast period from 2025 to 2033.

Who are the market players that are dominated the Europe outboard engines market?

SECO GmbH, Yamaha Motor Co., Ltd., Suzuki Motor Corporation, Torqeedo GmbH, Honda Motor Co., Ltd., DEUTZ AG, E.P. Barrus Ltd., Marine Tech, Vector Outboards, and Selva S.p.A. These are the market players that are dominating the Europe outboard engines market.

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com