Europe Paperboard Packaging Market Size, Share, Trends & Growth Forecast Report By Grade (Carton board, Containerboard, Other Grades), Product Type, End-User industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Paperboard Packaging Market Size

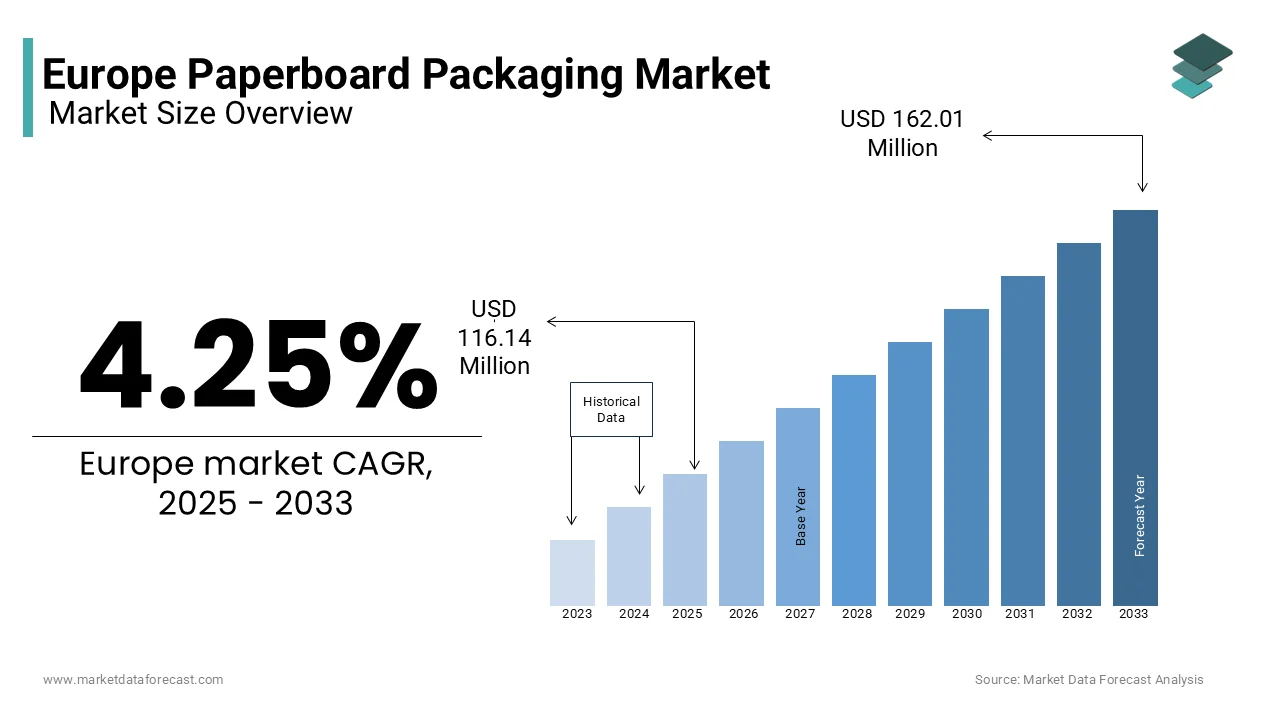

The paperboard packaging market size in Europe was valued at USD 111.41 million in 2024. The European market is estimated to be worth USD 162.01 million by 2033 from USD 116.14 million in 2025, growing at a CAGR of 4.25% from 2025 to 2033.

Paperboard, a versatile and renewable material derived from wood pulp or recycled fibers, is celebrated for its lightweight yet durable properties by making it an ideal choice for both primary and secondary packaging needs. In 2023, the market continues to thrive amidst growing consumer awareness about environmental sustainability and stringent regulations aimed at reducing plastic waste.

Europe’s in adopting circular economy principles has significantly bolstered the paperboard packaging market growth. The region recycles over 80% of its paper and board waste, as per the Confederation of European Paper Industries (CEPI). The material's recyclability and alignment with green initiatives is also to boost the growth of the market. Furthermore, innovations in barrier coatings and digital printing technologies have expanded the applications of paperboard by enabling brands to deliver visually appealing and functional packaging. Germany, France, and the United Kingdom are leading consumption patterns with robust industrial activity and heightened retail and online shopping trends. The European paperboard packaging landscape stands poised for transformative growth by balancing ecological responsibility with commercial viability.

MARKET DRIVERS

Regulatory Push Toward Sustainable Packaging

The escalating regulatory push toward reducing plastic usage and promoting sustainable packaging solutions is propelling the growth rate of the European paperboard packaging market. The European Union’s Single-Use Plastics Directive, implemented in 2021, has imposed strict bans on certain plastic products and mandated member states to achieve a 55% recycling target for plastic packaging by 2030. This has accelerated the shift toward paperboard as a viable alternative. According to Eurostat, the EU's statistical office, over 72% of paper and cardboard waste was recycled in 2020 by demonstrating the material's compatibility with circular economy goals. Paperboard's biodegradability and lower carbon footprint make it an attractive option for industries seeking compliance with environmental regulations. Businesses are increasingly adopting paperboard packaging to align with legislative frameworks and consumer expectations with governments actively incentivizing sustainable practices.

Growing Demand for Premium and Customizable Packaging

The rising demand for premium and customizable packaging in the e-commerce and luxury goods sectors is additionally to fuel the growth rate of the Europe paperboard packaging market. The surge in online shopping, fueled by the COVID-19 pandemic, has amplified the need for durable yet visually appealing packaging solutions. A report by the European Environment Agency revealed that e-commerce sales in Europe grew by 12.7% in 2022 by intensifying competition among brands to enhance product presentation. Paperboard packaging offers versatility through advanced printing technologies by enabling high-quality finishes and unique designs. According to the Confederation of European Paper Industries, the adoption of lightweight yet robust paperboard materials reduce shipping costs by up to 15%, further boosting its appeal. Paperboard emerges as a preferred choice for enhancing brand value while meeting functional requirements as consumers gravitate toward aesthetically pleasing and eco-conscious packaging.

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Shortages

The European paperboard packaging market is the ongoing challenge of supply chain disruptions and raw material shortages. According to the Confederation of European Paper Industries (CEPI), the availability of virgin pulp is a raw material for paperboard production that has been inconsistent due to global trade restrictions and logistical bottlenecks. In 2022, Europe faced a 15% increase in lead times for key raw materials, as per Eurostat, leading to higher production costs and delays in fulfilling customer orders. Additionally, energy-intensive manufacturing processes have been further strained by rising energy prices, with natural gas costs surging by over 200% in parts of Europe during 2022, according to the European Commission. These factors have constrained production capacities and increased operational expenses by posing significant challenges to market growth.

Environmental Concerns Over Recycling Limitations

Another restraint is the growing concern over the limitations of paperboard recycling systems, despite their perceived sustainability. Contamination from food residues, inks, or coatings often reduces its recyclability while paperboard is recyclable. According to the European Environment Agency, only 47% of paperboard waste collected is suitable for high-quality recycling, with the remainder downcycled or sent to landfills. Furthermore, the increasing demand for barrier-coated paperboard, which enhances functionality but complicates recycling, has raised questions about its long-term environmental impact. According to a report by the European Commission, less than 60% of coated paperboard products are effectively recycled due to technological constraints. This gap between consumer expectations for eco-friendly solutions and the practical limitations of recycling infrastructure poses a significant hurdle for the industry is requiring substantial investment in advanced recycling technologies.

MARKET OPPORTUNITIES

Expansion of E-commerce and Retail Packaging Needs

The rapid expansion of e-commerce and retail sectors which are driving demand for sustainable and functional packaging solutions. According to the European Environment Agency, online retail sales in Europe grew by 12.7% in 2022, with projections indicating continued growth as consumer shopping habits shift toward digital platforms. This trend has created a surge in demand for durable yet lightweight packaging that ensures product safety during transit. According to the Confederation of European Paper Industries, paperboard packaging can reduce shipping-related carbon emissions by up to 20% due to its lightweight properties. Additionally, advancements in digital printing technologies allow brands to leverage paperboard for high-quality, customizable designs by enhancing brand visibility. The paperboard market is well-positioned to capitalize on this expanding segment as e-commerce giants increasingly prioritize eco-friendly packaging

Innovations in Barrier-Coated and Functional Paperboard

The innovations in barrier-coated and functional paperboard are addressing the limitations of traditional materials in sensitive applications such as food and pharmaceuticals. According to the European Commission, investments in research and development have led to breakthroughs in biodegradable coatings by enabling paperboard to compete with plastic in terms of moisture and grease resistance. By 2023, the adoption of these advanced materials has grown by 18% annually, as per data from Eurostat is driven by stricter regulations on single-use plastics. According to the Confederation of European Paper Industries, functional paperboard solutions can extend the shelf life of perishable goods by up to 30% by making them highly attractive to manufacturers. The development of innovative paperboard products presents a lucrative growth avenue for the European market.

MARKET CHALLENGES

Intense Competition from Alternative Sustainable Materials

The intense competition from alternative sustainable materials, such as bioplastics and molded fiber is ascribe to pose a challenge for the market key players. According to the European Bioplastics Association, the production capacity for bioplastics in Europe is expected to grow by 25% annually through 2025, driven by their versatility and ability to replace traditional plastics in various applications. While paperboard remains a popular choice, bioplastics offer advantages like transparency and higher barrier properties, which are critical for certain industries such as fresh produce and beverages. According to the European Environment Agency, nearly 30% of businesses are exploring alternatives to paperboard due to its limitations in moisture resistance and shelf-life extension. This competitive pressure forces paperboard manufacturers to invest heavily in innovation by potentially straining smaller players in the market who lack the resources to compete effectively.

High Energy Costs Impacting Production Efficiency

Another significant challenge is the rising energy costs affecting the production efficiency of paperboard packaging. As per the European Commission, energy prices in Europe surged by over 200% in 2022, primarily due to geopolitical tensions and supply chain disruptions. Paperboard manufacturing is an energy-intensive process, with energy accounting for approximately 15-20% of total production costs, as per Eurostat. These escalating costs have led to reduced profit margins for manufacturers, particularly small and medium-sized enterprises. According to the Confederation of European Paper Industries, high energy expenses hinder investments in sustainable technologies, which are crucial for meeting regulatory requirements and consumer expectations. As a result, the industry faces the dual challenge of maintaining cost competitiveness while transitioning to greener production methods by threatening long-term growth prospects.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.25% |

|

Segments Covered |

By Grade, Product Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Amcor plc, DS Smith, Fedrigoni S.P.A., Smurfit Kappa, Svenska Cellulosa Aktiebolaget SCA, Mondi, Stora Enso, METSÄ GROUP, Mayr-Melnhof Karton AG, and UPM, and others. |

SEGMENTAL ANALYSIS

By Grade Insights

The cartonboard segment was the largest and held 45.1% of the European paperboard packaging market share in 2024 due to its versatility, recyclability, and suitability for high-quality printing by making it ideal for consumer goods like food, cosmetics, and pharmaceuticals. As per Eurostat, over 70% of cartonboard is recycled in Europe by aligning with sustainability goals. Cartonboard's importance lies in its ability to meet stringent environmental regulations while offering excellent branding opportunities by ensuring the steady growth rate.

By Product Type Insights

The corrugated boxes segment is ascribed to witness a fastest CAGR of 6.2% during the forecast period. This growth is fueled by the e-commerce boom, with the European Environment Agency reporting a 12.7% annual increase in online retail sales in 2022. The corrugated boxes are preferred for their durability, lightweight nature, and cost-effectiveness by reducing shipping costs by up to 15%. Their recyclability also supports circular economy initiatives by making them crucial for sustainable logistics and packaging solutions in Europe’s rapidly expanding digital marketplace.

By End-User Industry Insights

The food industry dominated the market and held 35.3% of the European paperboard packaging market share in 2024. The growing demand for sustainable, recyclable packaging solutions that comply with EU regulations on plastic reduction is driving the growth of the market. According to the Eurostat, over 70% of paperboard used in the food sector is recycled by supporting circular economy goals. Cartonboard is widely used for frozen foods, snacks, and ready-to-eat meals, with its ability to extend shelf life and ensure hygiene driving adoption. The segment's importance lies in its alignment with consumer preferences for eco-friendly packaging and regulatory mandates, ensuring sustained dominance.

The personal care industry is the fastest-growing segment with a CAGR of 7.8% in the foreseen years. This growth is fueled by the rise of e-commerce and premiumization trends, with consumers demanding visually appealing and sustainable packaging. According to the CEPI, a 20% annual increase in paperboard adoption for luxury skincare and cosmetics, which is driven by innovations in barrier coatings and digital printing. The shift toward refillable and reusable packaging further boosts demand. The segment’s importance lies in its ability to cater to both sustainability goals and the booming global beauty market by making it a critical driver of innovation and market expansion.

REGIONAL ANALYSIS

Germany dominated the European paperboard packaging market with 23.3% share in 2024. Its robust manufacturing base, stringent environmental regulations, and high demand for sustainable packaging in industries like automotive, food, and pharmaceuticals are attributed in leveraging the growth rate of the market. According to the German Environment Agency, over 80% of paper and board waste is recycled in the country, underscoring its commitment to circular economy principles. Germany’s advanced recycling infrastructure and technological innovations in barrier coatings have positioned it as a hub for premium paperboard solutions. Additionally, the country’s strong export-oriented economy drives demand for durable and eco-friendly packaging by reinforcing its dominance in the regional market.

France paperboard packaging market is likely to experience a CAGR of 3.9% during the forecast period. The country’s market growth is driven by its proactive stance on sustainability by including the Anti-Waste Law for a Circular Economy, which bans single-use plastics and promotes recyclable alternatives like paperboard. According to the French Ministry of Ecological Transition, paperboard usage in the food and beverage sector has surged by 25% since 2020. France’s thriving luxury goods industry, particularly cosmetics and wine, also fuels demand for high-quality folding cartons and specialty boards. France’s emphasis on innovation and regulatory compliance solidifies its position as a key player in the European market.

The United Kingdom is likely to showcase a significant growth rate in the next coming years. The rapid expansion of e-commerce, with online retail sales growing by 14% annually, has significantly boosted demand for corrugated boxes and lightweight paperboard packaging. According to the Confederation of Paper Industries, the UK recycles over 70% of its paper and board waste, aligning with consumer preferences for sustainable solutions. Additionally, the country’s strong presence in the pharmaceutical and personal care sectors drives demand for functional and customizable packaging. The UK’s strategic investments in digital printing technologies further enhance its competitive edge by making it a leading contributor to the European paperboard packaging market.

KEY MARKET PLAYERS

The major key players in Europe paperboard packaging market include Amcor plc, DS Smith, Fedrigoni S.P.A., Smurfit Kappa, Svenska Cellulosa Aktiebolaget SCA, Mondi, Stora Enso, METSÄ GROUP, Mayr-Melnhof Karton AG, and UPM, all of which focus on sustainable and innovative packaging solutions

MARKET SEGMENTATION

This research report on the Europe paperboard packaging market is segmented and sub-segmented into the following categories.

By Grade

- Carton board

- Containerboard

- Other Grades

By Product Type

- Folding Cartons

- Corrugated Boxes

- Other Types

By End-User Industry

- Food

- Beverage

- Healthcare

- Personal Care

- Household Care

- Electrical Products

- Other End-User Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth rate of the paperboard packaging market in Europe?

The paperboard packaging market is anticipated to grow at a CAGR of 4.25% from 2025 to 2033.

2. What challenges does the European paperboard packaging market face from alternative sustainable materials?

The European paperboard packaging market faces challenges from alternative sustainable materials like bioplastics and molded fiber, which offer advantages such as transparency and higher barrier properties, appealing to industries like fresh produce and beverages.

3. How significant is recycling in Germany's paperboard packaging industry?

Germany has a well-established recycling system, with over 80% of paper and board waste being recycled, reflecting its commitment to circular economy principles.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]