Europe Parkinson’s Disease Treatment Market Size, Share, Trends & Growth Forecast Report By Drug Class, Distribution Channel, Patient Care Setting and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Parkinson’s Disease Treatment Market Size

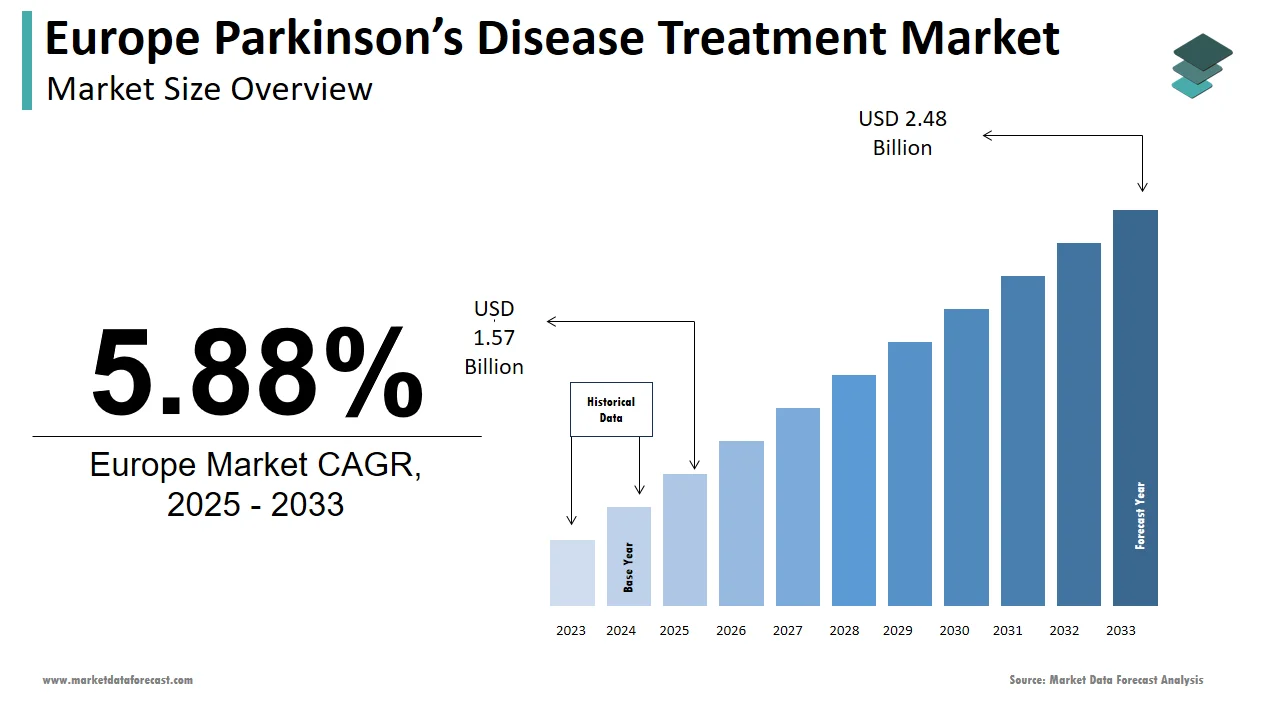

The size of the Europe parkinson’s disease treatment market was worth USD 1.48 billion in 2024. The European market is further estimated to be growing at a CAGR of 5.88% from 2025 to 2033 and be worth USD 2.48 billion by 2033 from USD 1.57 billion in 2025.

MARKET DRIVERS

Increasing Incidence of Parkinson’s Disease in Developed Countries

Europe's Parkinson's Disease Treatment Market is growing at a high pace as the incidence of Parkinson's disease is increasing in developed countries. The value of the European Parkinson's disease treatment market in 2021 was $ 2.94 billion, and it is likely to register a CAGR above 11% in the coming years. Europe's Parkinson's Disease Treatment market propels a growing public understanding of this disease, the multiplying elderly population, the prospect of launching pipeline drugs and new products, and relatively high growth in the therapeutic market.

Parkinson’s Disease as a Progressive Neurodegenerative Disorder

Parkinson's disease is termed a progressive neurodegenerative disorder that affects dopaminergic neurons in the brain. Parkinson's disease mainly causes tremors, muscle stiffness, abnormal movement, walking, and balance problems. Secondary symptoms of this ailment include anxiety, depression, and dementia. The exact etiology of Parkinson's disease is unknown and mainly affects older people over the age of 50, but men suffer half of the women's illnesses. According to estimates by the United States Parkinson's Foundation, the disease affects about 70 to 10 million people worldwide, and about 60,000 Americans are diagnosed with the disease each year. In developed regions like Europe, the high prevalence and risk of this disease are driving the growth of the Parkinson's disease treatment market.

MARKET RESTRAINTS

Patent Expiry and Side Effects

However, it is expected that the patent expiry of crucial drugs and side effects related to therapeutic medicines will limit the growth of Europe's Parkinson's disease treatment market over the forecast period. The government and non-profit organizations' understanding of Parkinson's disease and higher clinical research and development budgets are expected to drive the growth of the Parkinson's treatment market over the forecast period. Promising product channels represent potential business development opportunities over the projection period. In the United States, in a phase III clinical study, about ten drugs are used to treat different symptoms of Parkinson's disease. The availability of alternative therapies limits the market with advanced technology.

COUNTRY LEVEL ANALYSIS

Regionally, Europe is supposed to gain the largest share of the global Parkinson's disease treatment market, and its market share is also considerable. Understanding of treatment, increased expenditure on research and development, favorable drug reimbursement regulations and policies, high incidence of Parkinson's disease, the rapid increase in the elderly population, and potential medical pipeline products may account for a significant share of the Europe Parkinson's disease treatment market. The regional market is foreseen to grow at a reasonable rate.

The most critical market share in the European Parkinson's disease treatment market may be occupied by nations like the UK, Germany, France, etc., mainly due to a large number of patients with Parkinson's disease in these countries.

KEY MARKET PLAYERS

Leading companies dominating the European Parkinson’s Disease Treatment Market profiled in this report are Teva (Israel), Novartis AG (Switzerland), GSK (UK), AbbVie (US), Merck (US), Boehringer Ingelheim (Germany), Impax Laboratories (US), Lundbeck (Denmark), Sun Pharma (India), Wockhardt (India), UCB (Belgium), Valeant Pharmaceuticals (Canada), and Acadia (US).

MARKET SEGMENTATION

This Europe parkinson’s disease treatment market research report is segmented and sub-segmented into the following categories.

By Drug Class

- Dopamine Receptor Antagonists

- Pramipexole

- Ropinirole

- Apomorphine

- Rotigotine

- Mono Amine Oxidase Inhibitors

- Selegiline

- Rasagiline

- Carbidopa

- Anticholinergics

- Other Drug Classes

By Distribution Channels

- Retailer Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Patient Care Setting

- Clinics

- Hospitals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com